BTCUSD trade ideas

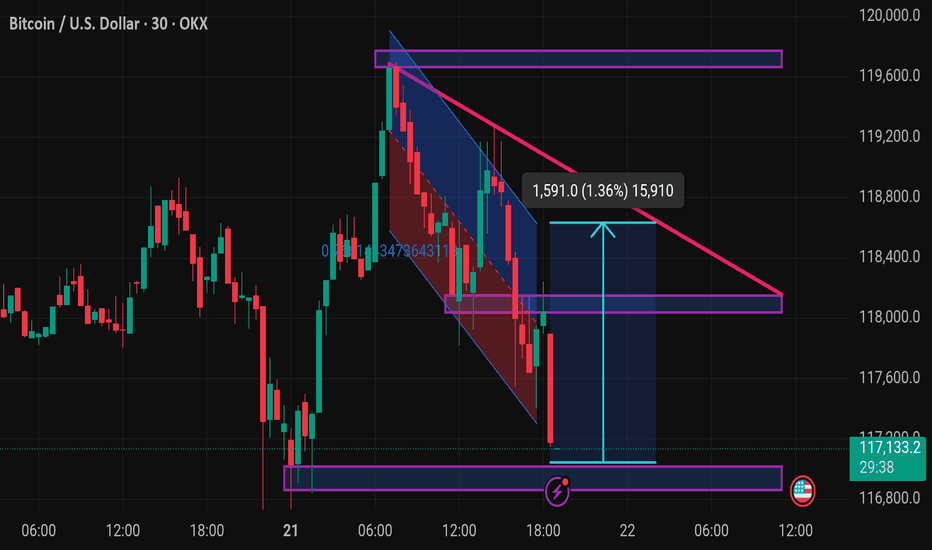

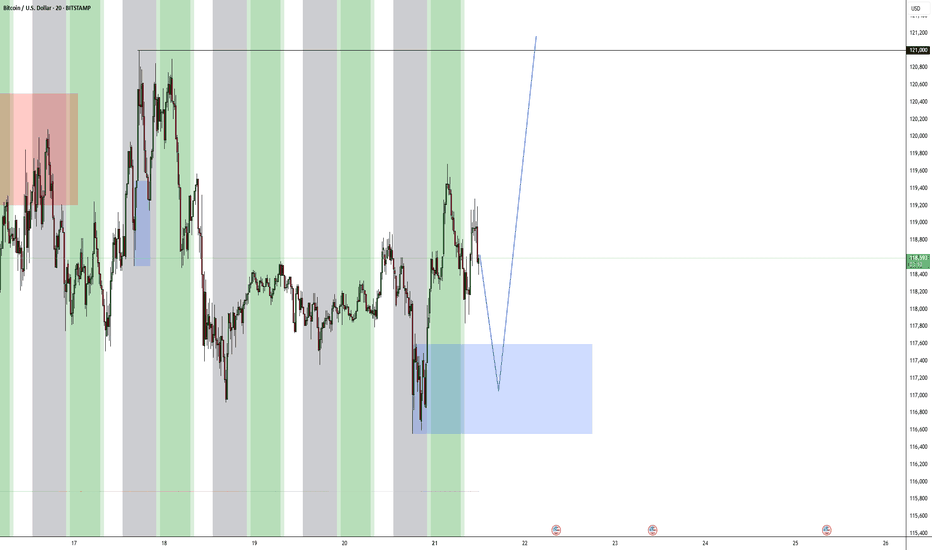

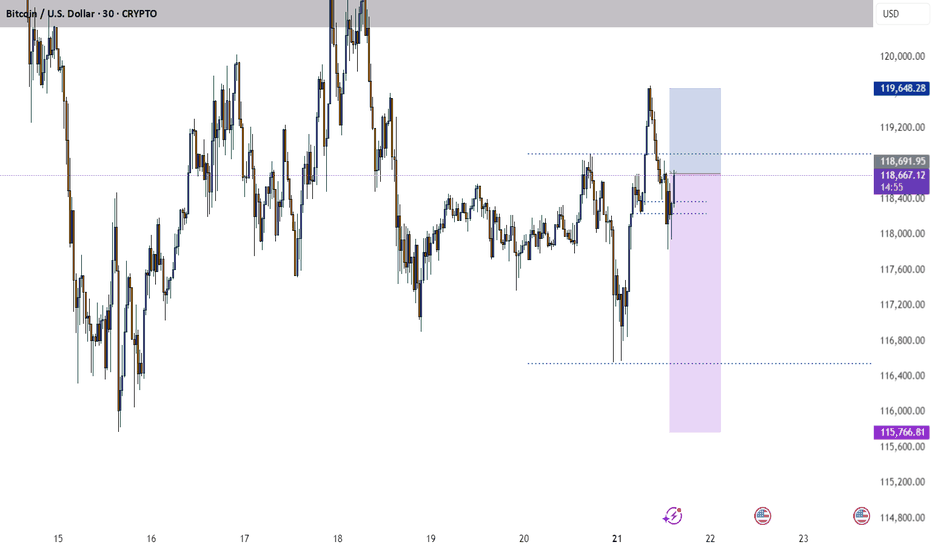

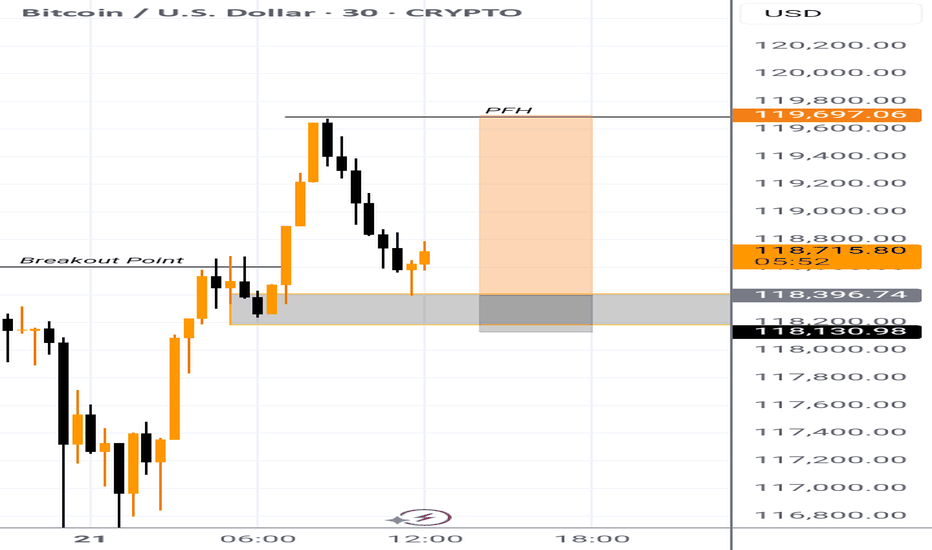

Btusdt techinical analysisThis chart shows a BTC/USD (Bitcoin to US Dollar) 30-minute time frame with a falling wedge pattern and potential bullish breakout setup. Here’s a breakdown of the key technical elements:

---

🔍 Chart Analysis Summary:

1. Pattern:

Falling wedge (highlighted by the converging pink trendlines): typically a bullish reversal pattern, especially after a downtrend.

Price has broken above the wedge, indicating a possible breakout.

2. Price Action:

BTC found strong support near $116,800.

After the breakout, the expected upward move is projected by the blue measured move box, targeting around $118,400–$118,800, a 1.36% gain (~$1,591).

3. Resistance & Target Zones:

First resistance zone: $118,400–$118,800 (wedge top and measured move target).

Next major resistance: $119,600–$120,000 area.

4. Support:

Strong support marked around $116,800 (purple zone at the bottom).

If BTC breaks below this, the bearish scenario could resume.

---

📈 Potential Trade Setup:

Bullish bias above wedge breakout.

Entry: Current level (if breakout holds).

Target: $118,400–$118,800.

Stop loss: Below $116,800 support zone.

---

Let me know if you'd like a bearish scenario, RSI/volume analysis, or a follow-up chart.

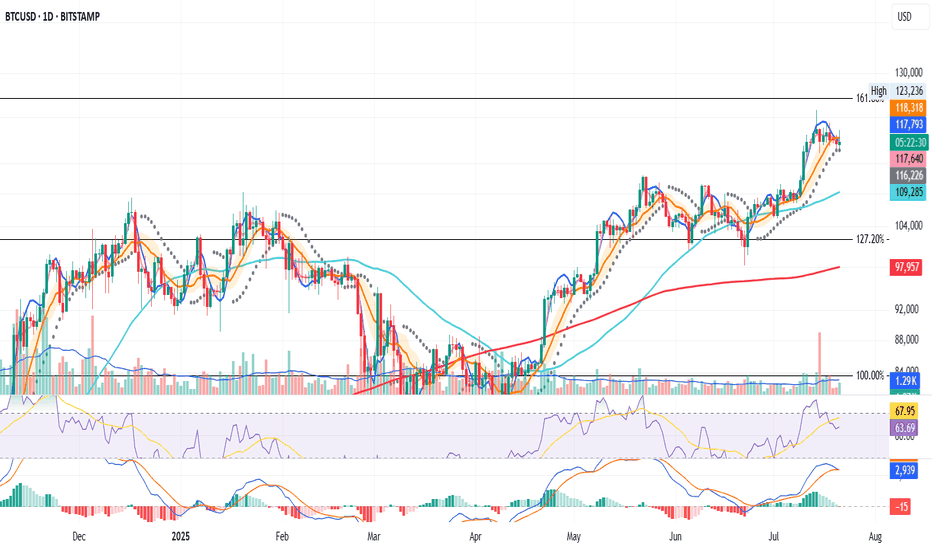

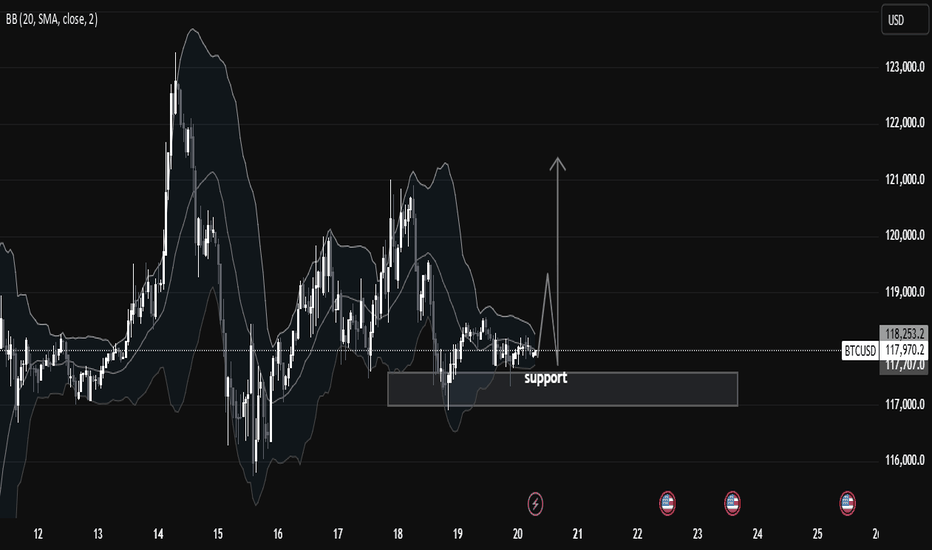

BTC Update – Short-Term Pressure Building

Bitcoin is still being pushed down below the BB center.

RSI is trending lower, and MACD is nearing a bearish crossover.

PSAR is hovering close to price, a warning sign.

This could still be a pause before the next leg up — but don’t ignore the signs.

And just a thought: Trump Media buying $2B in BTC might’ve marked a local top.

Prepare in advance.

Always take profits and manage risk.

Interaction is welcome.

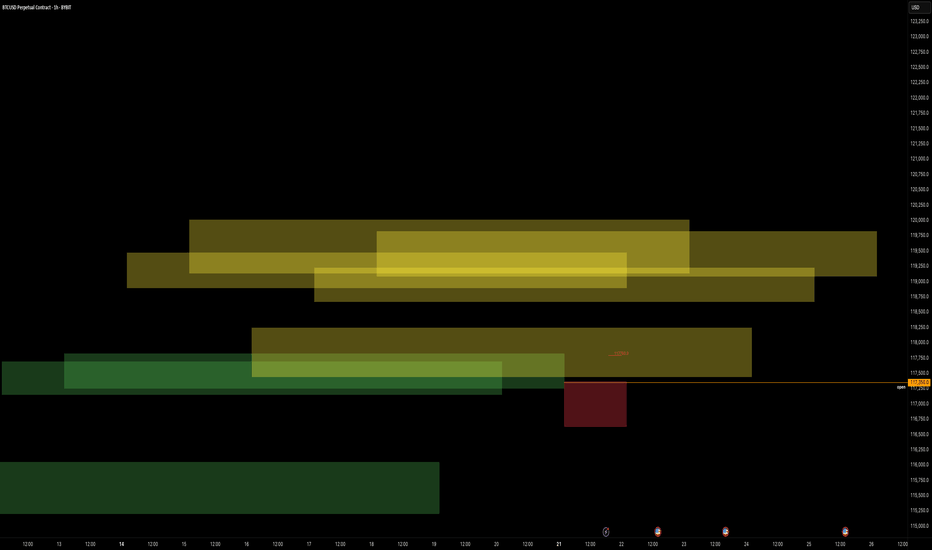

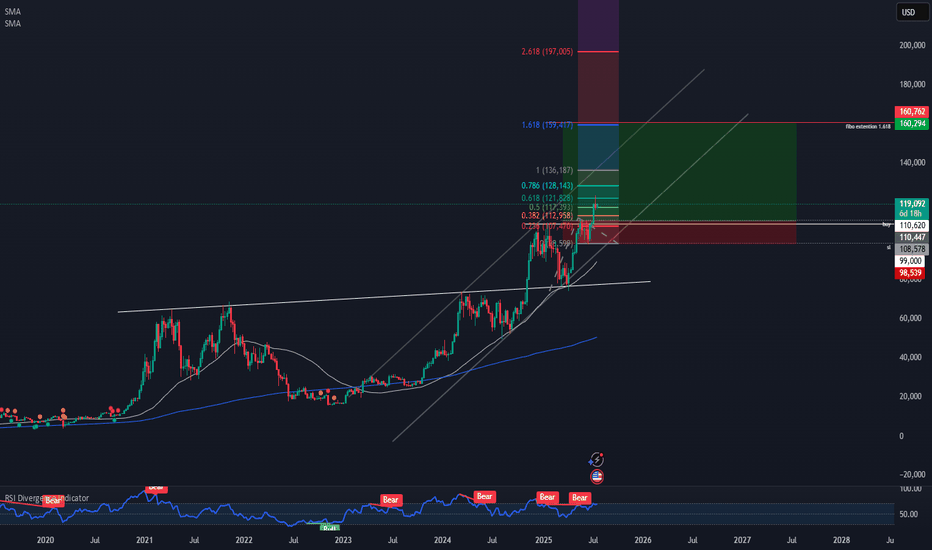

vision paintingthis is sort of a game, i would like to play with anyone interested in chart riddles. i'm being very specific with my inputs, and coloring, painting a picture of what i need to see and when. painting whats there, guiding to where itll be. wondering if i could actually create art pieces here. hypothetically the 'paintings' would need to be back checked, to artificialy create any worth to it. market involvement is day/week trades. *no advice whatsoever. so, i think ill give it a go. from here onwards, these posts are the only ill post, with updates, within the comments of such post. happy trading

ballino

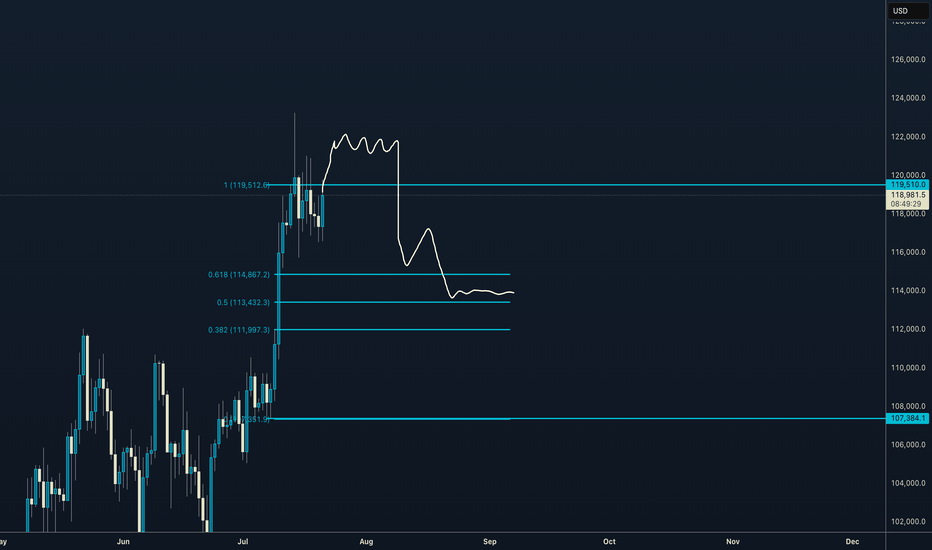

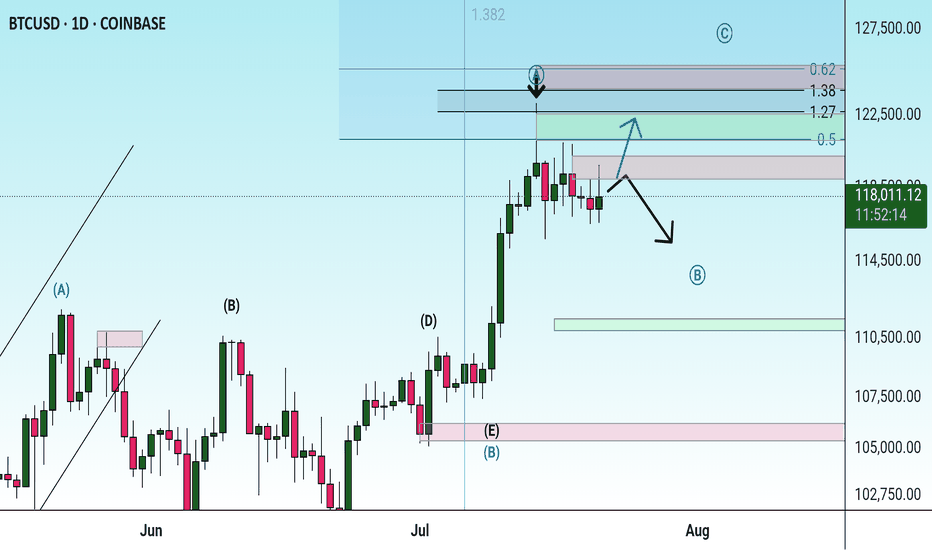

WEEKLY CLSBTC has formed a generous weekly range, I can already see a few candles closing inside of the range signaling a further downside to the 114K range where I will take most profit.

I will look for manipulation tommorow on wednesday and see if I can find more precise entries, if anything ask me in the comments and I will happily reply!

Good luck and do not over-leverage and remember be PATIENT!

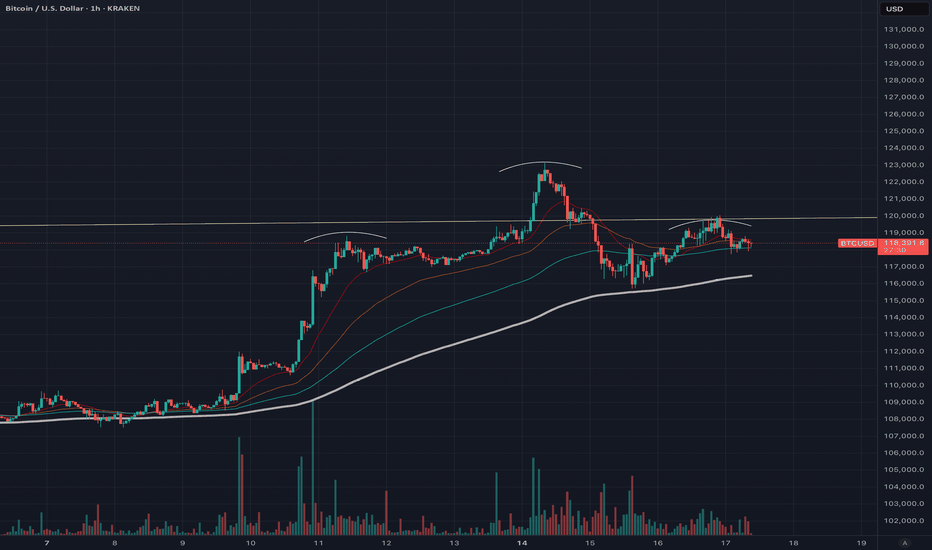

Head and shoulder pattern on hourly.

A reversal seems likely, so we should anticipate a pullback. The trading volume is decreasing while exchange volume is increasing, which suggests a potential market top based on previous trends. Greed is also on the rise. Although history doesn’t repeat itself, it certainly shows similarities. The BTC/GBP chart is indicating a double top pattern on the daily timeframe. An altcoin season may be approaching based on the ETH/BTC pair, signaling that the end of Bitcoin’s dominance could be near.

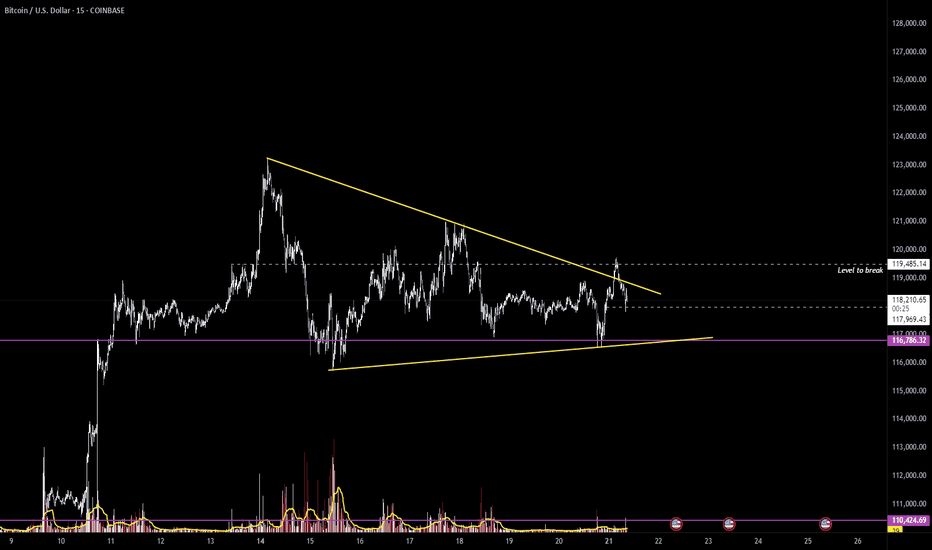

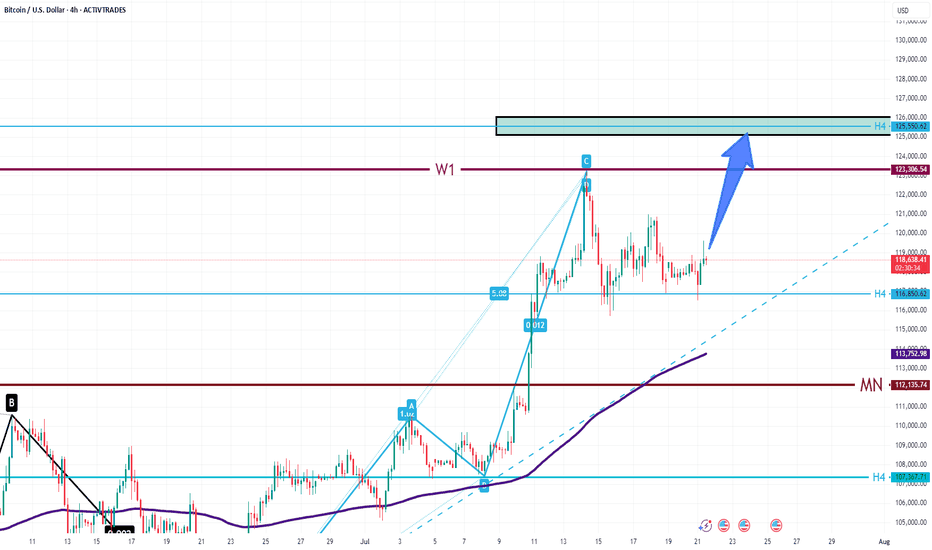

$BTC / Bitcoin Elliot Wave Analysis Update - 7/21Hello fellow degenerates,

Price reached our Wave 3 target and is now inside a consolidation pattern, wave 4. If we have a break above the pattern, my next target is at 126k - 132k range.

- We need price to stay above 116k for a bullish continuation

- A break below 116k could take us towards 110k

- Key levels to watch: 116k, 110k

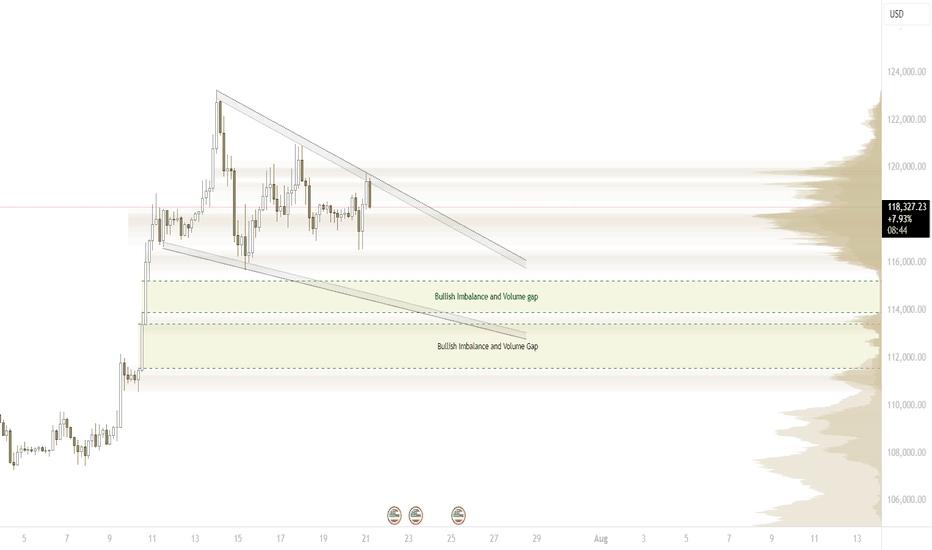

Where is the discount?In the wake of the past two week's impulsive price action, imbalances have emerged on multiple time frames. With these imbalances leaving volume gaps behind, if 116 doesn't hold, 110-112 is likely the discount zone, where institutions step up their buying. I'm inclined to believe that, with the lower highs, we're headed there. COINBASE:BTCUSD

BTC/USD 21.07.25Targeting the $125,500 Resistance

Market Overview:

After a correction down to $116,850, Bitcoin held above the 144 EMA and is recovering toward the key resistance zone around $125,500. A bullish continuation pattern is forming.

Technical Signals & Formations:

— Strong support reaction from $116,850

— 144 EMA on 4H holding as dynamic support

— ABCD harmonic structure supports upside

— Break above $120,000 will confirm bullish momentum

Key Levels:

Support: $116,850, $113,700

Resistance: $123,300, $125,500–$126,000

Scenario:

Primary: continuation upward toward $125,500 with potential breakout

Alternative: minor pullback to $116,850 before next leg up

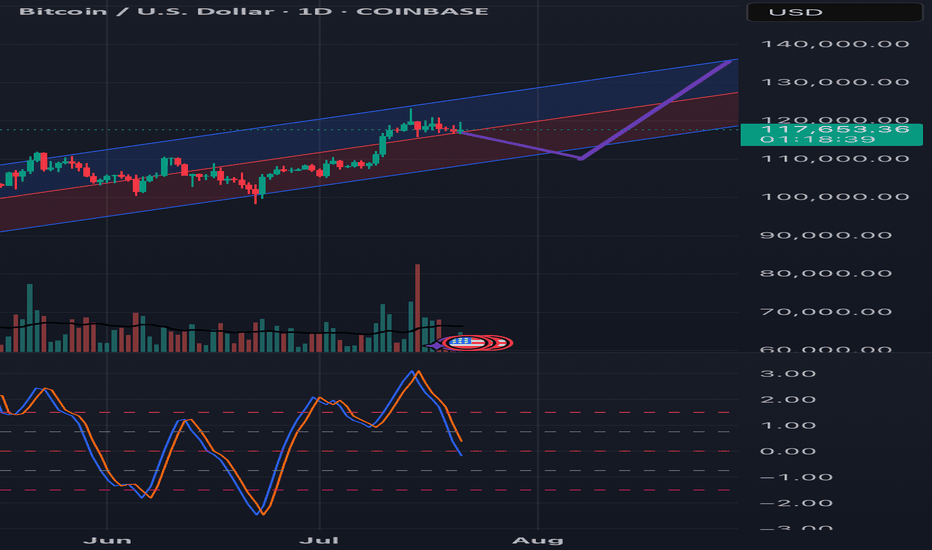

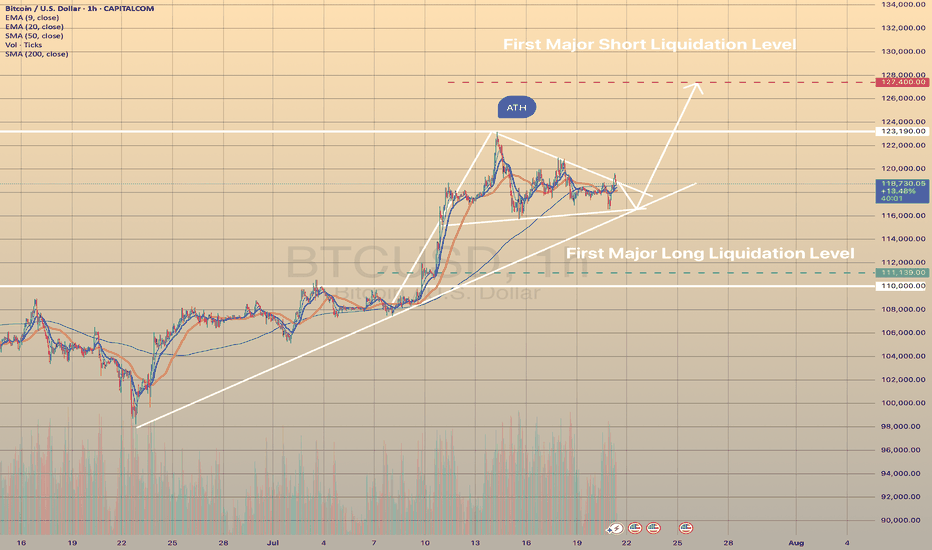

BTCUSD CONSOLIDATES BEFORE NEXT HIKE

BTCUSD CONSOLIDATES BEFORE NEXT HIKE📈

Bitcoin has been under buying pressure since the beginning of July 9. Since July 14 the price has been consolidating. Now the graph represents the bullish pennant.

I expect the price to continue trading sideways for some time, then rebound from the trendline and move towards first major liquidation level at 127,400.00.

What is a liquidation Level?

The price at which a crypto exchange forcibly closes a leveraged position when margin falls below the required level, recovering borrowed funds.

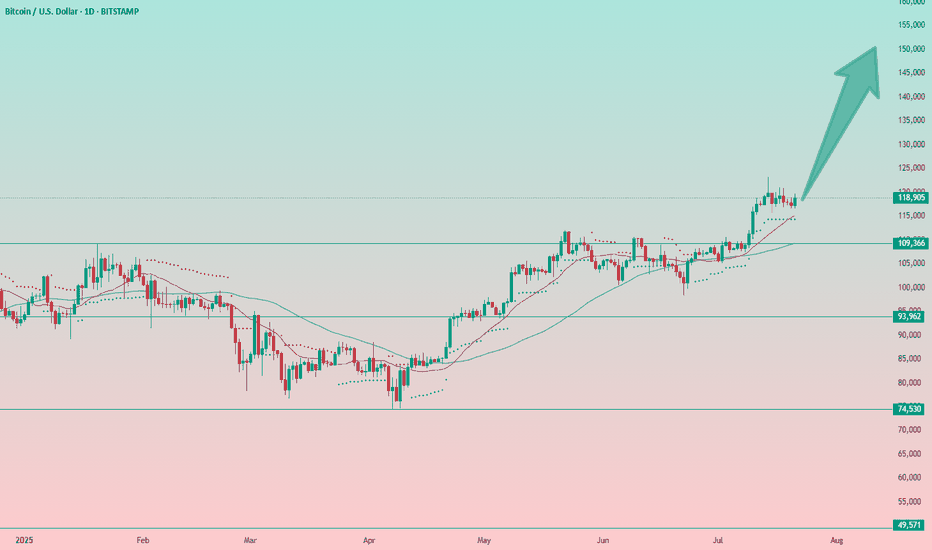

Bitcoin Keeps Charging AheadBitcoin doesn't seem to be slowing down and continues its bullish momentum.

Overall, I believe the chart shows a solid setup for further growth. I'm not exactly sure how high we’ll go, so in this case, I’ll be trading with a clear stop-loss strategy.

📝Trading Plan

Entry: I’m building a position from current levels.

Stop Loss: Stop-loss set at $115,000 (4%).

Target: Target is around $150.000. I'll be trailing stop-loss as price moves higher.

One more thought on Bitcoin:

I don’t expect to see crypto winters like we had in the past. Liquidity in the system has increased significantly, and institutional players are now involved. As a result, we should see fewer long, painful drawdowns and overall reduced volatility.

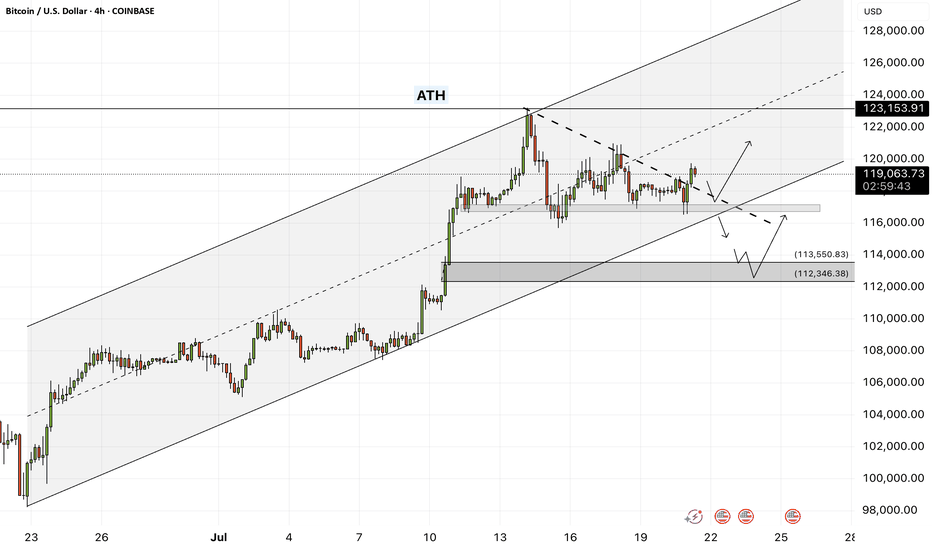

Bitcoin - Will Bitcoin reach its previous ATH?!Bitcoin is above the EMA50 and EMA200 on the four-hour timeframe and is in its ascending channel. Bitcoin’s current upward momentum has the potential to reach its previous ATH. If it corrects, we can look for Bitcoin buying positions from the specified support area, which is also at the intersection of the bottom of the ascending channel.

If this support is lost, the decline will continue to around $113,000, where we can again buy Bitcoin with a better risk-reward ratio.

It should be noted that there is a possibility of heavy fluctuations and shadows due to the movement of whales in the market, and capital management in the cryptocurrency market will be more important. If the downward trend continues, we can buy within the demand area.

Last week, the U.S. House of Representatives passed the CLARITY Act (Crypto-Asset National Regulatory Transparency for Investors and Consumers Act) with 294 votes in favor and 134 against, including support from 78 Democrats. The bill represents the first comprehensive legislative effort to regulate the cryptocurrency industry and is considered a major regulatory win for digital asset proponents.

Key features of the legislation include:

• Clearly defining the regulatory roles of agencies like the SEC and CFTC

• Establishing a new category for registered digital assets

• Facilitating broader integration of cryptocurrencies into traditional financial systems

Status in the Senate: Despite bipartisan approval in the House, the bill’s future in the Senate remains uncertain. Senators are still in the early stages of drafting their own version, and significant revisions are expected. Some Senate Democrats insist that the bill must explicitly address President Trump’s and his family’s cryptocurrency holdings.

The CLARITY Act is part of a broader Republican-led legislative initiative dubbed “Crypto Week,” which includes two additional major digital asset bills aimed at modernizing blockchain regulation and the broader digital finance ecosystem.

Meanwhile, Donald Trump is preparing to issue an executive order that would open up U.S. retirement markets to cryptocurrencies, gold, and private equity. This order would allow 401(k) fund managers to incorporate alternative assets into retirement portfolios.

The move follows the rollback of Biden-era restrictions and the recent passage of three crypto-related bills in the House. While major investment firms have welcomed the proposal, critics warn that alternative assets may expose retail investors to greater financial risks.

Also last week, Bitcoin reached a new all-time high, pushing its market capitalization to $2.43 trillion. It has now surpassed Amazon, Google, and even silver, becoming the fifth-largest asset globally by market value.

Looking ahead, one of the key events on the economic calendar is Federal Reserve Chair Jerome Powell’s upcoming speech at an official central bank-hosted conference on Tuesday. This event comes just before the release of the preliminary S&P Global Purchasing Managers’ Indexes (PMIs) on Thursday. Given Trump’s escalating verbal attacks on Powell, a central question is whether this political pressure has influenced the Fed Chair’s stance.

Trump has repeatedly urged Powell to lower interest rates. This week, reports emerged suggesting that the President had discussed with some Republicans the possibility of removing Powell from his position. However, Trump was quick to downplay the reports, stating that the likelihood of Powell being dismissed was “very low.”

In this context, if Powell uses his speech to reassert the Fed’s independence and calls for patience to assess the impact of tariffs more thoroughly, the U.S. dollar may continue its recent upward trend. Still, it’s too early to confirm a definitive bullish reversal for the dollar. While the global reserve currency has responded positively to headlines fueling tariff concerns, markets could mirror April’s behavior—when fears of recession led investors to sell the dollar instead of buying it—should those concerns intensify again.

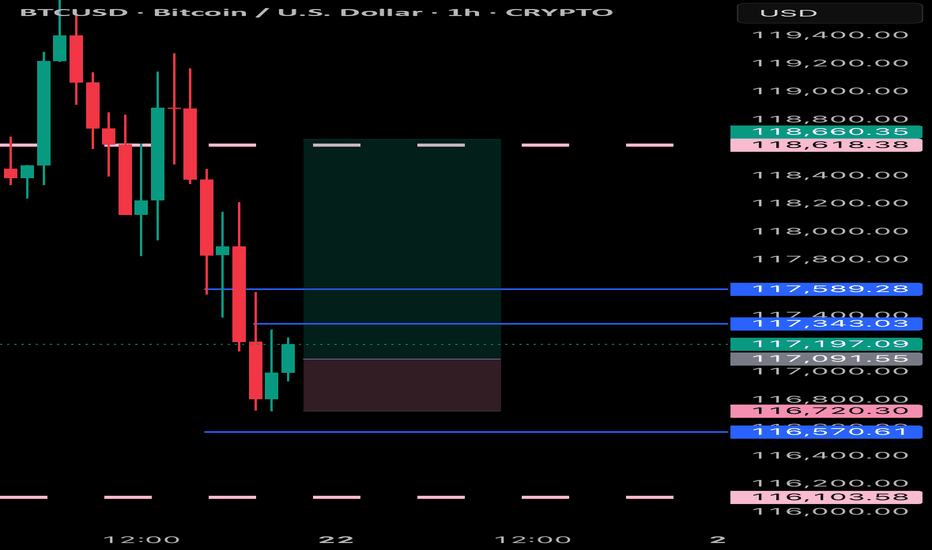

Chart Analysis: BTCUSD Consolidating at Key Support LevelIn this 1-hour BTCUSD chart, we observe that price is currently respecting a key support zone between $117,500 and $118,000, which has held strongly over the past few sessions. This region has acted as a strong demand zone, with visible buying pressure every time the price dips into it. The chart clearly shows multiple rejections from this zone, indicating that smart money participants are accumulating here.

We also see the Bollinger Bands (20 SMA) tightening around the price. This narrowing of the bands signifies low volatility and a potential expansion move. Such squeezes are often followed by impulsive breakouts or breakdowns, and traders should be alert for a decisive candle close above or below the range to confirm direction.

🧠 Market Structure & Technical Insights:

Support Holding: Price is consolidating above a major support level at $117,500–$118,000, which has been tested multiple times but not broken.

Accumulation Phase: The sideways structure after a previous impulsive move suggests that price is possibly in a re-accumulation phase before another leg up.

Liquidity Above Range: There's a visible liquidity pool above recent highs (~$118,600–$119,000), which could be targeted if bulls take control.

Volatility Squeeze: Bollinger Bands are compressing, showing signs of accumulation. Such patterns typically lead to a breakout move, especially if paired with volume.

Candle Behavior: Long wicks from below the support show aggressive buying interest, rejecting lower prices. This is a bullish signal.

🎯 Potential Scenarios:

1. Bullish Breakout:

If BTCUSD breaks and closes above the mini resistance near $118,600–$119,000, we may see a quick move toward $120,500 and $122,000.

A breakout backed by volume and momentum would confirm strength and trend continuation.

2. Bearish Breakdown:

A break below $117,500 with a strong bearish candle and increased volume would invalidate the bullish bias and may open the downside toward $116,000 and possibly $114,500.

This would indicate failure to hold support, transitioning into a distribution phase.

3. Range-Bound:

Until we get a clear break in either direction, price may continue to range between $117,500 and $118,600. Best approach is to remain patient and wait for breakout confirmation.

📚 Educational Note:

This is a textbook setup for many smart money traders—a compression near a strong support level with low volatility. Such patterns reflect market indecision, but also the potential energy build-up for a significant move. Traders should focus on risk management and confirmation instead of predicting direction blindly.

✅ Key Levels to Watch:

Support: $117,500

Resistance: $118,600 – $119,000

Breakout Target: $120,500 – $122,000

Breakdown Target: $116,000 – $114,500

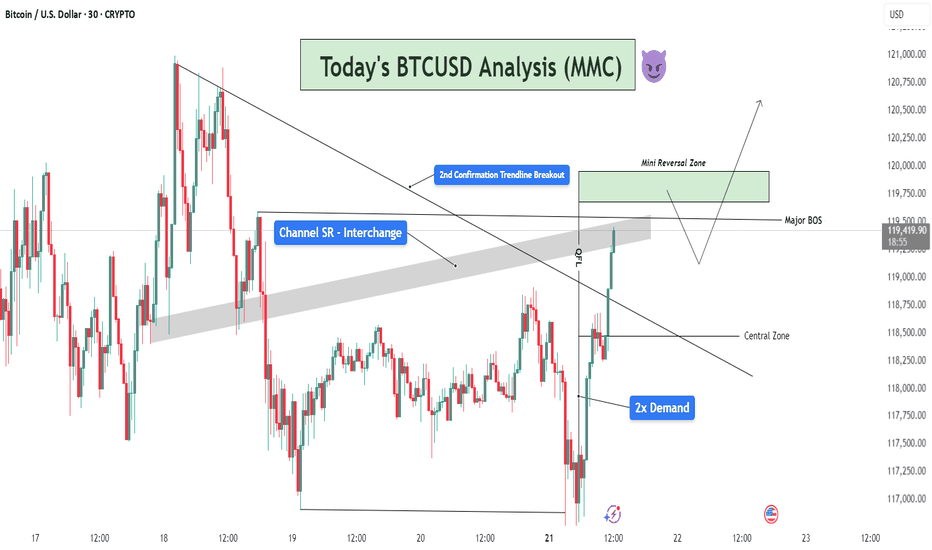

BTCUSD MMC Analysis - Breakout Confirmation + Reversal + TargetWelcome back to another deep-dive analysis powered by MMC (Mirror Market Concepts), where precision meets market psychology. In today’s BTCUSD setup, we’re observing a textbook confluence of structural breakouts, demand rejections, and liquidity zone engagements. Let’s break it down step by step.

📊 1. Market Context & Background

The market recently showed a prolonged bearish trendline structure, with lower highs compressing price into a wedge. The prior days have been consolidative, hinting at an accumulation phase. This forms the foundation for reversal setups we often identify in MMC-style analysis — where liquidity, not just structure, determines the next move.

🔍 2. Demand Zone Dominance – 2x Tap Confirmation

At the bottom of the chart, BTC created a strong 2x Demand Zone (117,250–118,000 area), a region where buyers aggressively stepped in. This zone had already been tested once, and the second tap confirmed demand strength — a key MMC signal.

This dual-tap created a spring effect, launching price upward and rejecting all downside liquidity grabs. It also showed clear absorption of sell-side volume.

📈 3. QFL Behavior + Break of Structure

We see a QFL (Quick Flip Liquidity) reaction just after price bounced from demand — this is a behavior unique to MMC models. Here, price flipped structure rapidly after breaking a local high near 118,500, suggesting aggressive buyer entry.

This QFL event served as the first warning for a major trend shift.

Right after that, we got a major BOS (Break of Structure) above 119,250, further confirming the bullish transition.

🪜 4. Trendline Breakout – Second Confirmation

The descending trendline — connecting several swing highs — was breached with strong bullish momentum. Importantly, this was the second confirmation breakout, not just a fakeout spike.

The breakout candle closed strongly above the trendline and above the SR channel zone (gray area), confirming trend reversal intent.

This aligns with MMC's multi-stage breakout logic, where price gives one trap, pulls back, and then breaks cleanly with intent.

🛡 5. Channel SR Interchange Zone (Support-Resistance Flip)

The gray horizontal SR Channel played a crucial role. Initially acting as resistance, it became support once the breakout was confirmed.

This interchange behavior — a principle where support turns into resistance or vice versa — is critical in MMC. Price flipping this zone and holding above is a strong continuation signal.

🧠 6. Targeting & Forward Outlook

Price is now approaching the Mini Reversal Zone (119,750–120,250). This is a low-timeframe liquidity zone where short-term traders may take profits or where institutional orders may reverse temporarily.

Here are two potential scenarios:

Bullish Continuation: If price pulls back slightly and holds the channel SR as support, we may see a continued leg upward, breaking above 120,250.

Temporary Rejection: A sharp reaction from the Mini Reversal Zone could lead to a retracement into the Central Zone (~118,800), where buyers might reload.

📌 Key MMC Takeaways:

✅ 2x Demand Zone reaction confirmed bullish interest.

✅ QFL + BOS + Trendline Break = High-conviction reversal signal.

✅ SR Flip adds MMC-style structural layering.

✅ Price is now navigating final supply zones before expansion.

👑 Join the Candle King Community

If you find value in these advanced MMC analyses, join the Candle King server — a professional community focused on refining trading journeys through advanced market theory like Mirror Market Concepts, QFL, and real-time price logic.

📢 We don’t just trade levels — we trade behavior.

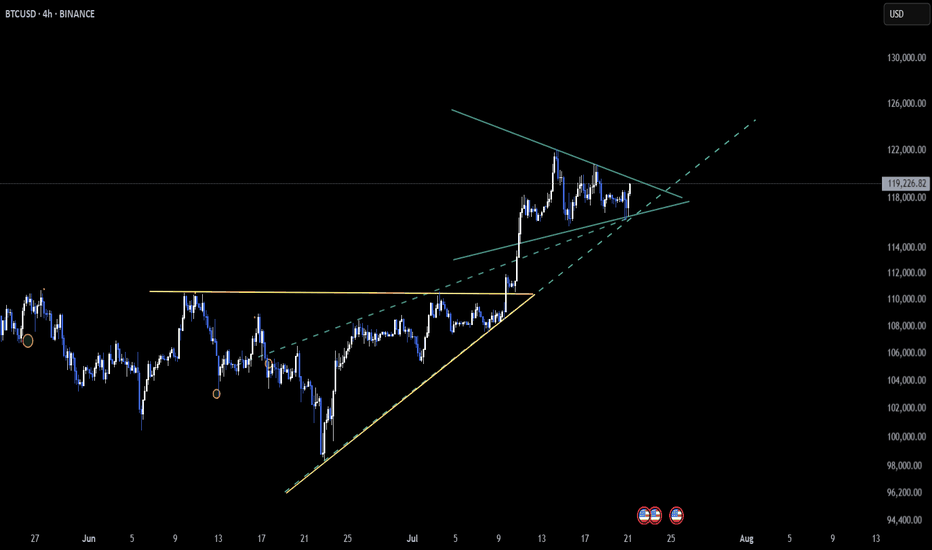

BTC – Symmetrical Triangle Tightens the Market CoilCRYPTOCAP:BTC is navigating a symmetrical triangle on the 4-hour timeframe 📊. This pattern typically signals a build-up of pressure before a decisive move.

As price action compresses toward the apex, the market is setting the stage for either a breakout surge or a breakdown slip ⚡️.

Patience is key here—traders are watching closely to catch the next wave of momentum.

Eyes on the chart 👀