BTCUSDLONGS trade ideas

Game Over...First of all, I want you to think about these sentences:

A: Anything can happen in the market at any time.

B: If something happened once, it is more probable to happen in the future..!

If you think the above sentences are wrong don't bother yourself to read the next paragraphs.

What Is a Bubble?

Bubbles are the suspension of disbelief by most participants when the speculative price surge is occurring!

In the case of Bitcoin, it is a 3 million percent (3,000,000 %) gain matured in the last 11 years..!

5 Stages of A Bubble

1. Displacement:

A displacement occurs when investors get enamored by a new paradigm, such as an innovative new technology!

The cryptocurrency, Bitcoin was born 21st May 2011: When a risk-taker accepted to give 2 pizzas (something with intrinsic value) to someone and received a token (10000 Bitcoin with 0 intrinsic value) that had no idea about it.

All the Currencies from the beginning of history were born whenever two parties accept using them to finalize a transaction.

2. Boom

Prices rise slowly at first, following a displacement, but then gain momentum as more and more participants enter the market, setting the stage for the boom phase.

During this phase, the asset in question attracts widespread media coverage. Fear of missing out on what could be a once-in-a-lifetime opportunity spurs more speculation, drawing an increasing number of investors and traders into the fold.

3. Euphoria

During this phase, caution is thrown to the wind, as asset prices skyrocket. Valuations reach extreme levels during this phase as new valuation measures and metrics are touted to justify the relentless rise, and the "greater fool" theory—the idea that no matter how prices go, there will always be a market of buyers willing to pay more—plays out everywhere.

4. Profit-Taking

In this phase, the smart money—heeding the warning signs that the bubble is about at its bursting point—starts selling positions and taking profits.

5. Panic

It only takes a relatively minor event to prick a bubble, but once it is pricked, the bubble cannot inflate again. In the panic stage, asset prices reverse course and descend as rapidly as they had ascended. Investors and speculators, faced with margin calls and plunging values of their holdings, now want to liquidate at any price. As supply overwhelms demand, asset prices slide sharply.

I believe in the next 10-11 years it would be hard to find another risk-taker who is willing to give you 2 pizzas for 10000 Bitcoin.

Don't Forget I did the hardest Job and find the exact day..!

Moshkelgosha

Educational Article:

www.investopedia.com

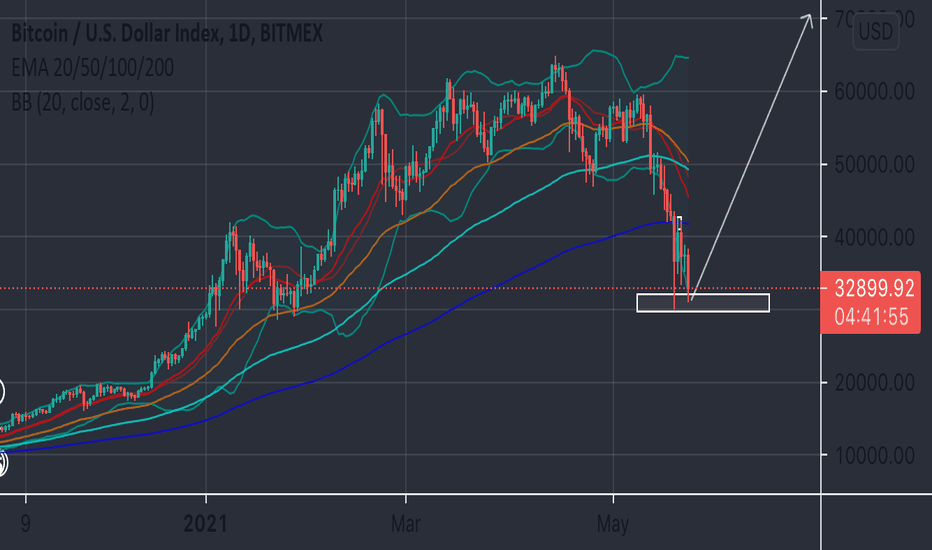

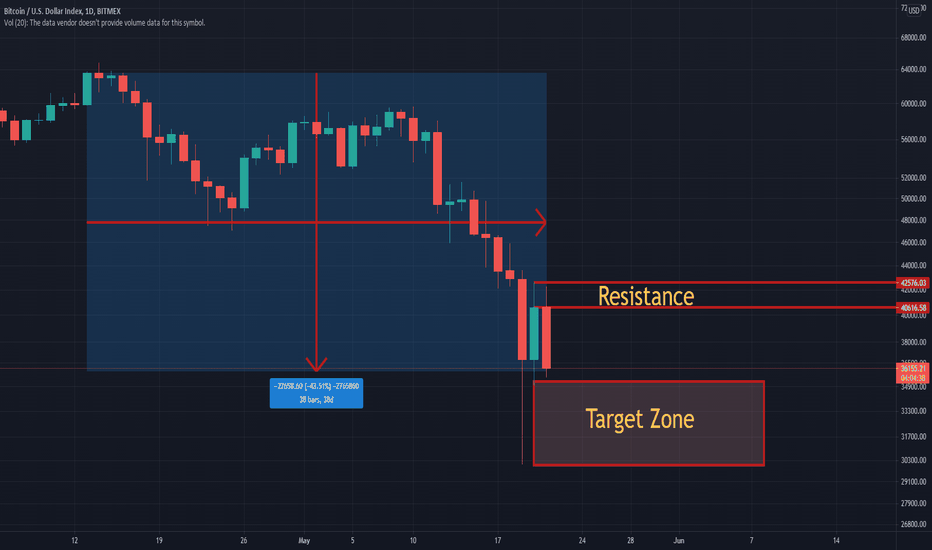

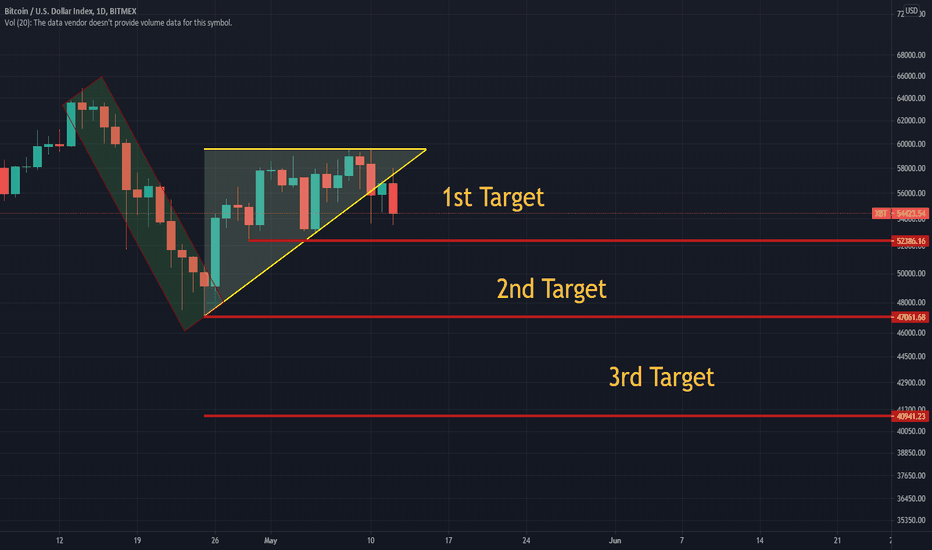

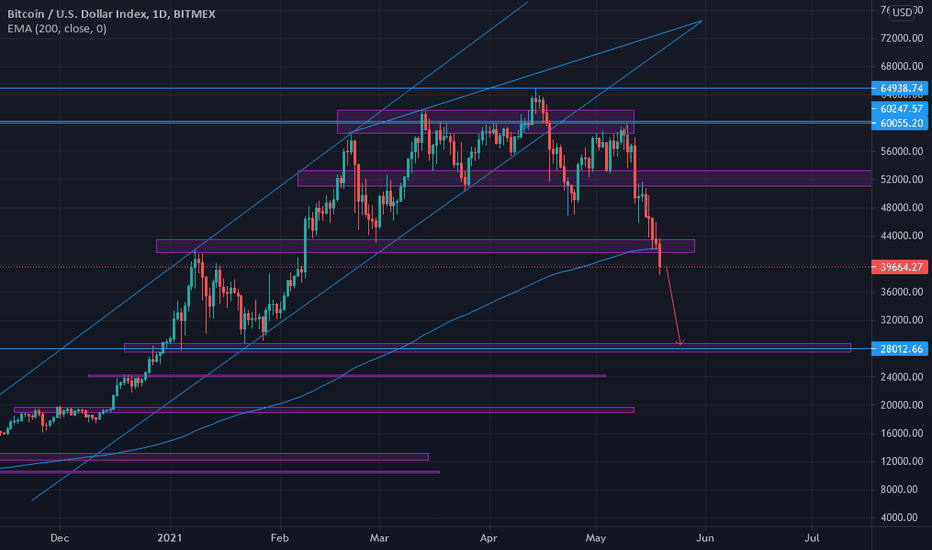

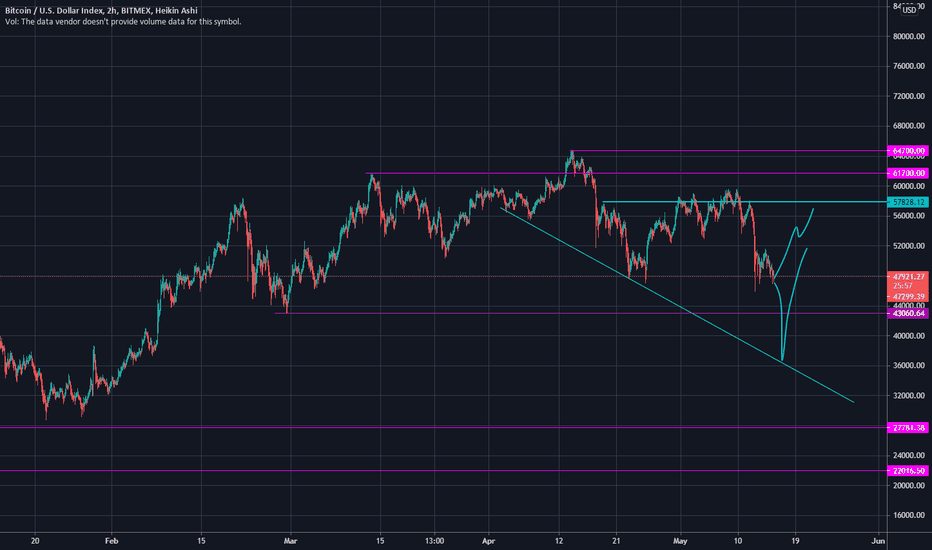

Next 2 wksThis is the most probable scenario for Bitcoin!

Buy position is not recommended, bitcoin could experience another crash at any minute!

Assume there will be no bullish run and 64862.90 is all time high!

I think it will remain intact in the history books, at least at this point I believe so!

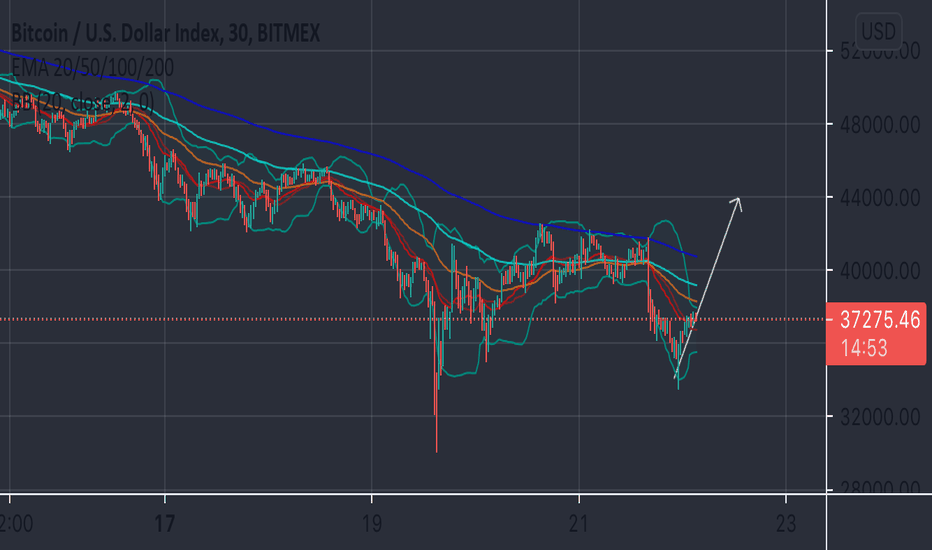

Faster than expacted!Faster than expacted the courses drops down very fast. The alternate side (GOLD) seems to start a upswing, so may attract some investors to switch? (Belive me, there are enough possible Gold/Bitcoin switchers)

Because of the fast breakdown, it maybe that 28k will not hold!

If the bitcoin trends longer sidewards on 28k... A buy is possible, but now? No recommendation to go in this value.

Bearish. I am still hold a little bit, but may reduce soon?! We will see!

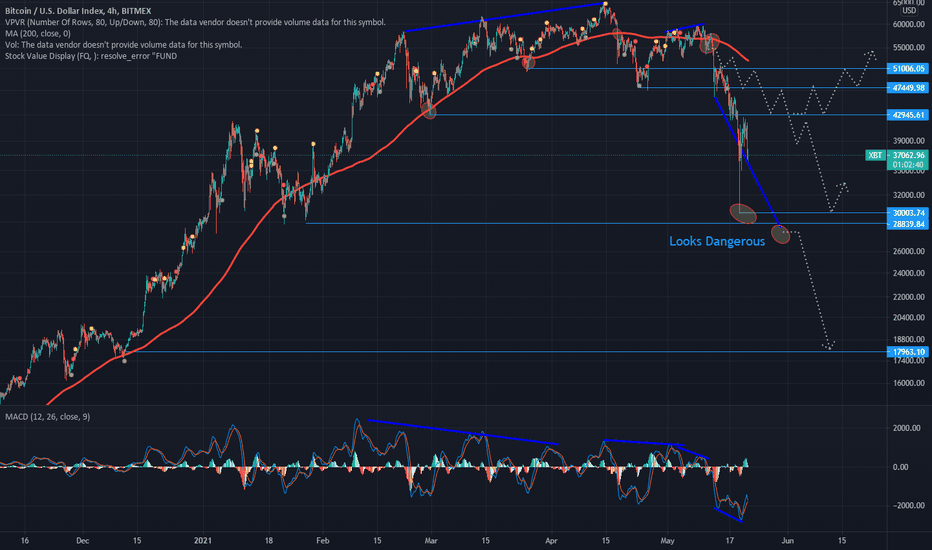

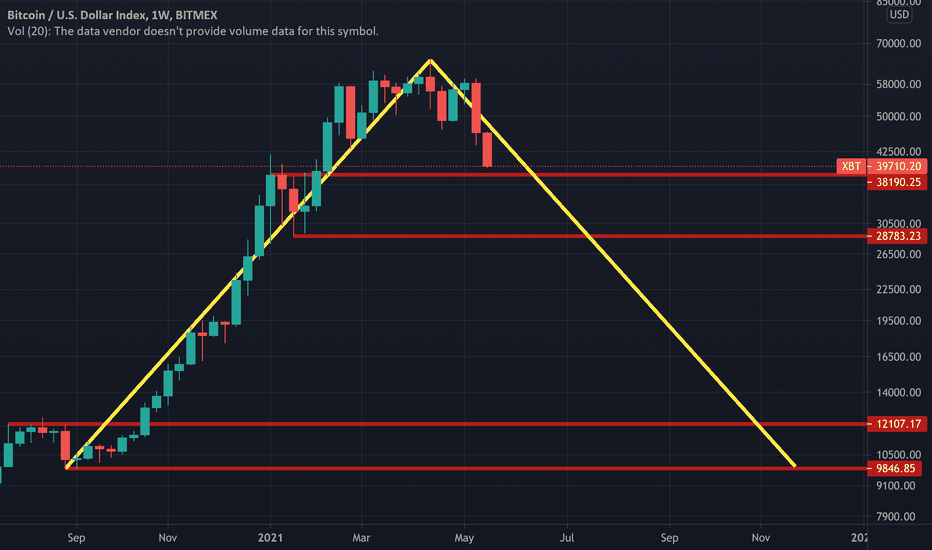

This is not a correction, this is a Bearish trend!While many people still believe in bitcoin, I believe the bullish rally has ended on April 13, 2021.

Many of you may heard the historical transaction of Laszlo Hanyecz, who infamously traded 10,000 BTC for two Papa John’s pizzas on May 22, 2010. While many consider those pizza as the most expensive pizza ever, I believe they were actually the cheapest pizza ever! Because the person who ate them, pay for them by creating 10000 bitcoin just by clicking!

Who knows maybe in the next 11 years you can buy only 2 slices of a pizza with 10000 bitcoins!

Sound ridiculous today, but if it happened once it could happen once again! Don’t forget, Bitcoin or any other cryptocurrencies have ZERO intrinsic value!

400 years ago, people had Tulip mania, at the beginning of the 19th century they had Hyacinth, and today they have cryptocurrency mania!

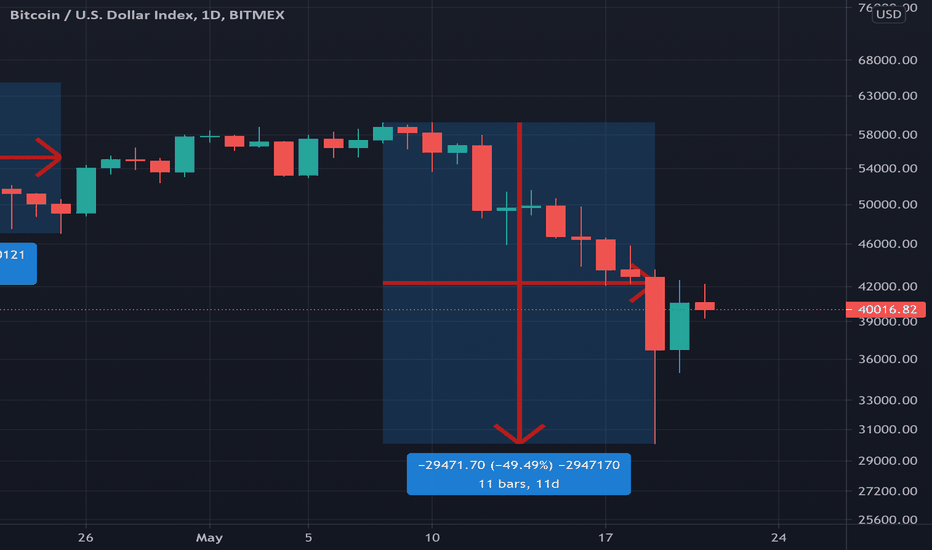

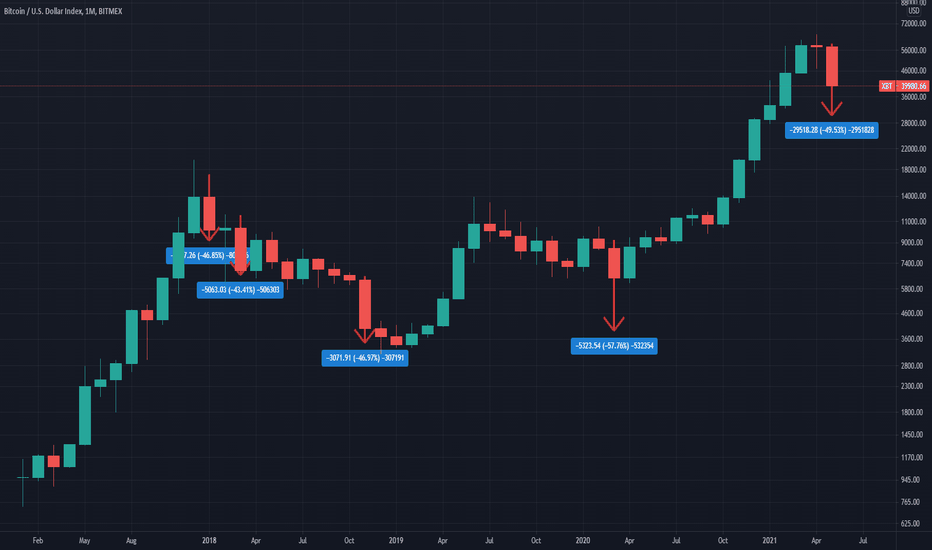

Bitcoin went down 27% in 11 days in April, in May it has lost 49% of its value in 11 days, which means the going down process is accelerating!

If you think I’m insane, review these:

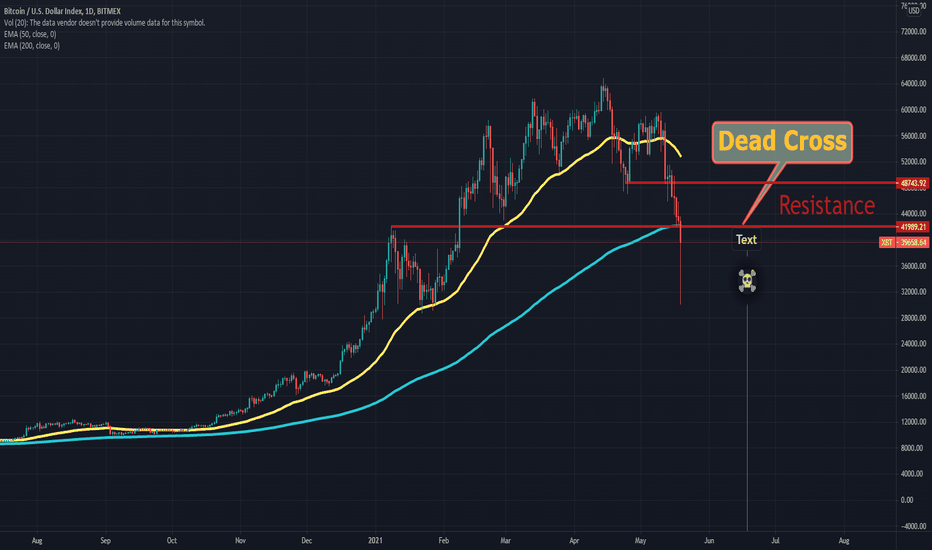

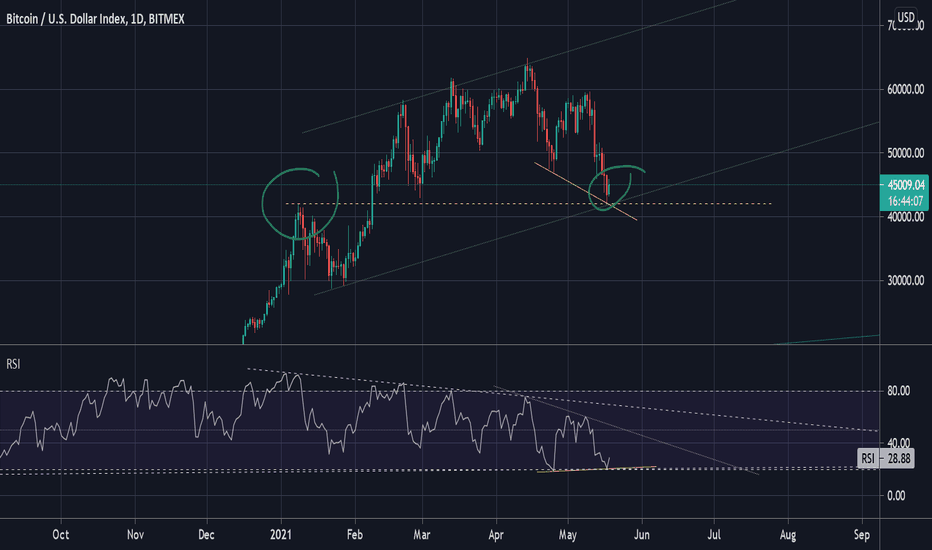

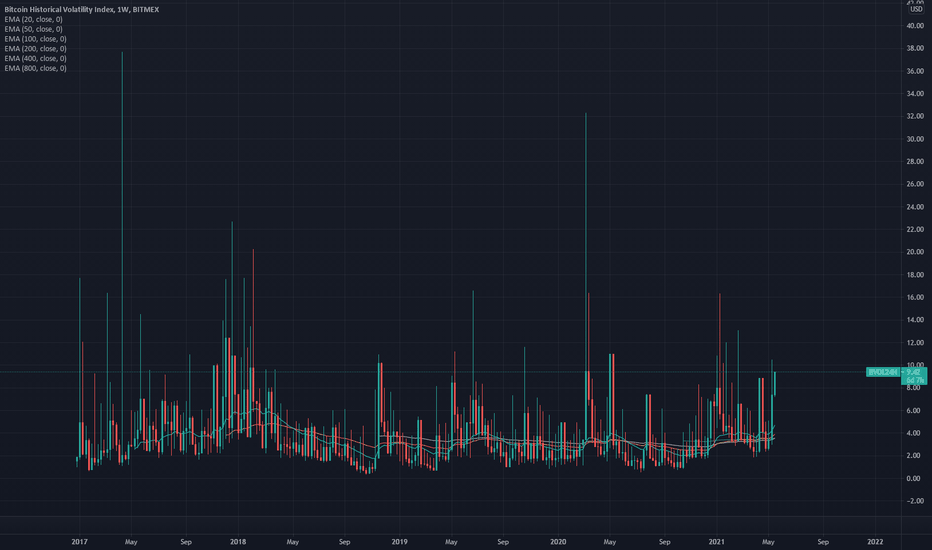

Bitcoin Crossed Below 200 EMAI can not convince you that Bullish run for bitcoin has Gone!

Atleast check all my previous Bitcoin analyses!

I did whatever could do..! decision is yours to make!

I asked short Bitcoin on April 13, 2021, when it was 62-64K

I predicted NIO top on January 11th, 2021 (2 weeks before it happen).

Tesla Top on February 17:

NYSE:GME

when it was 325 on January 30th, 2021

NASDAQ:TLRY Top on February 11th, when it was 63!

Whole EV maker sector on February 18:

NASDAQ:RIOT top on Feb 18, 2021 when it was 62

I asked everyone to buy Gold when it was 1700 on March 6th,

Many people called me stupid, scammer, ...etc, but at least I know I started this to help others!

I know I had mistakes but review my works and judge yourself..!

Moshkelgosha

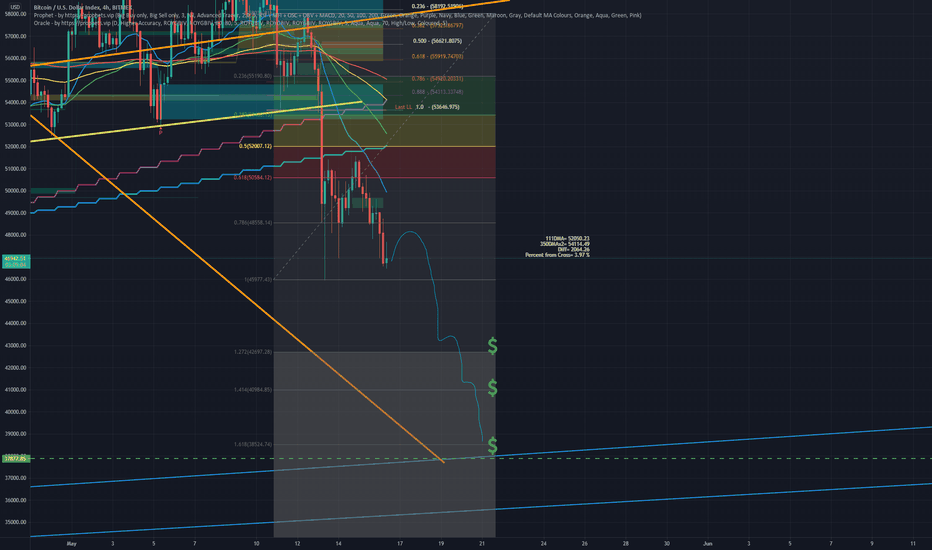

The Next 12 days..! Bitcoin made the second biggest negative monthly candle in the past 5 years, with -49.53% in April and we have 12 days ahead to finish May 2021.

based on the last 24 hours move, Bitcoin has shown it has the potential to make this candle bigger..!

I'm the Bubbelogist..!

It is not related to Elon Musk or any other tweet..!

If you don't want to get stuck into these scenarios, Study the Bubbles through history, they all work the same, with few differences.

Educational Articles:

www.investopedia.com

www.investopedia.com

www.investopedia.com

www.investopedia.com

www.investopedia.com

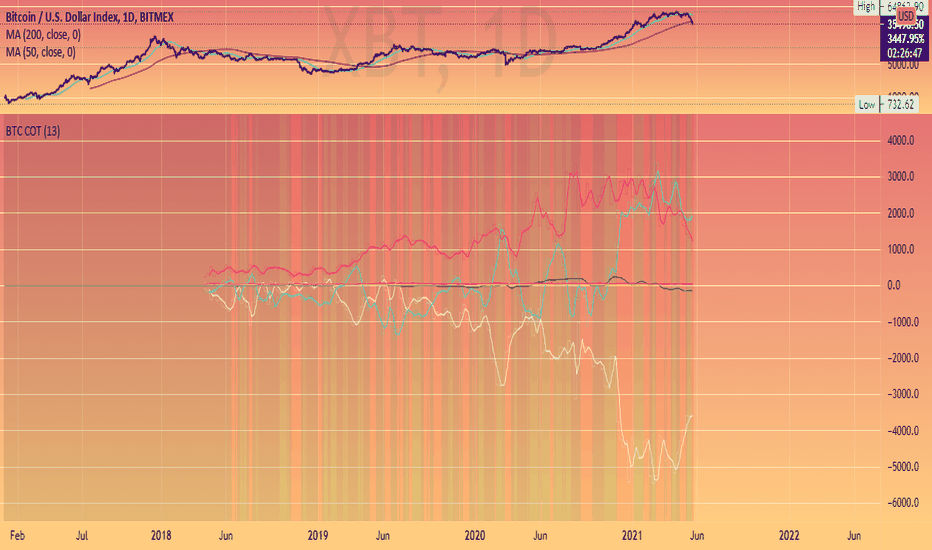

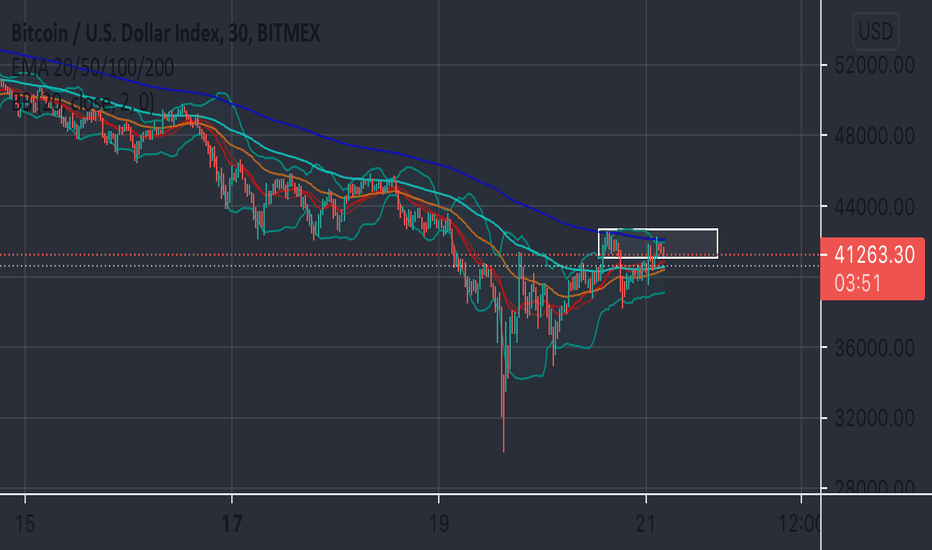

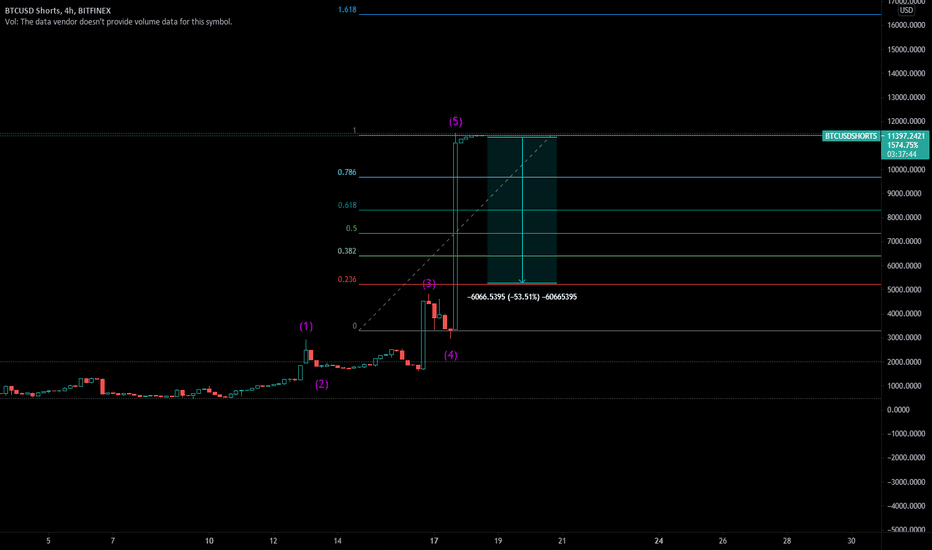

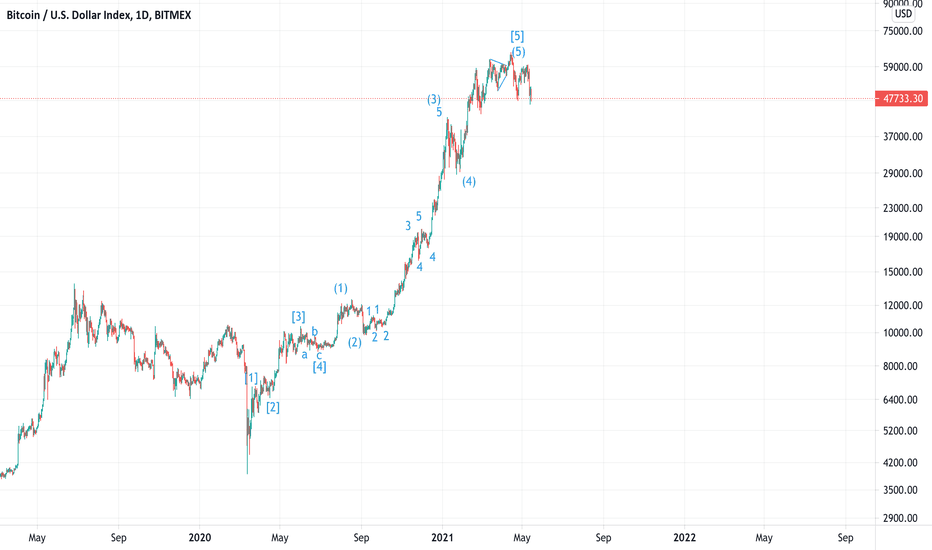

Crypto - BTCUSD Short CapitulationIdea for Bitcoin:

- I am shorting Bitcoin shorts.

- BTC shorts have clearly made 5 impulse waves and momentum has faded.

- BTC longs are rising after major stopping volume on BTCUSD at 43k.

- Bottom shorters are trapped and their liquidations begin at 52k.

- Bitcoin will continue the down trend as fast as the short squeezing will allow!

BTC longs:

GLHF

- DPT

How far Bitcoin Could slips???I think the only one who is eligible to answer this question is the man who asked his followers to sell their bitcoin one day before Coinbase IPO. when the price was 63800 at the all-time high! the man who made the call to buy bitcoin when it was 10k and put the target at 100k, but updated his view based on new information..! the very same man who said RIOT and MARA will perform better than bitcoin in bullish rallies when RIOT was 3.47 and MARA was 2.31..! the very same man who asked his followers to sell RIOt when it was 67 and Mara when it was above 53..!

Those who have early access to my trading ideas have the chance to perform better.

Don't you believe it?

Check my recently private post:

If you are interested to have early access to my trading ideas, check the signature box below the post for more information.

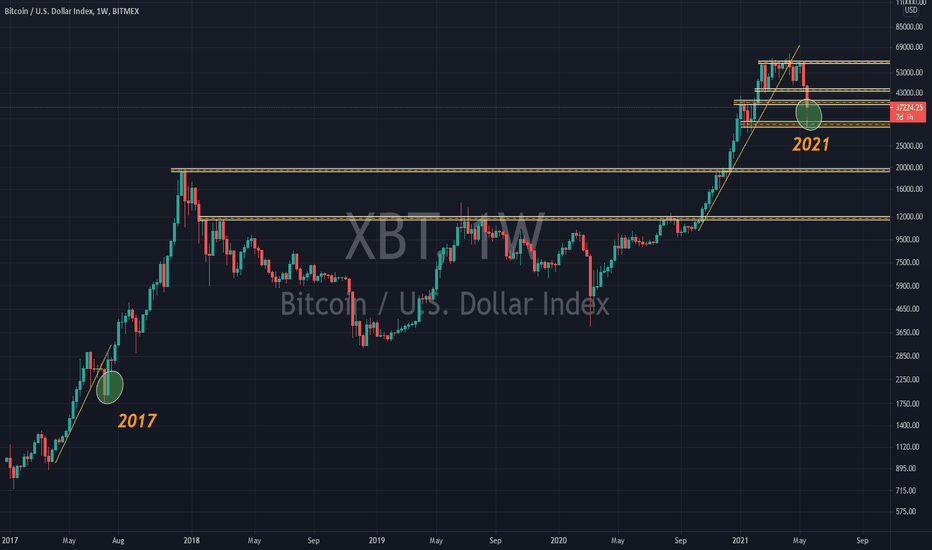

This is not the beginning nor the EndIn September 2020, when bitcoin was 10400 I published an analysis with a 100k price target in the next 2 years, why I changed my target and duration of the bullish rally on April 13, 2021, just one day before Coinbase IPO. and on April 29, I updated my target to 42-46k between May 10-20th.

Why did I change my target?

The best answer to this question will receive 1500 TradingView coins (1 month Free Pro subscription).

Write your answer below the TradingView post as a comment.

1-Sep 12, 2020: Bitcoin could technically soar to 100 Thousand, what next?

2- Oct 21, 2020: Do Not Trade Bitcoin, Invest in Bitcoin for The next 2 years!

3-Apr 13: History tends to repeats itself..!

4-Apr 29: An updated target for Bitcoin

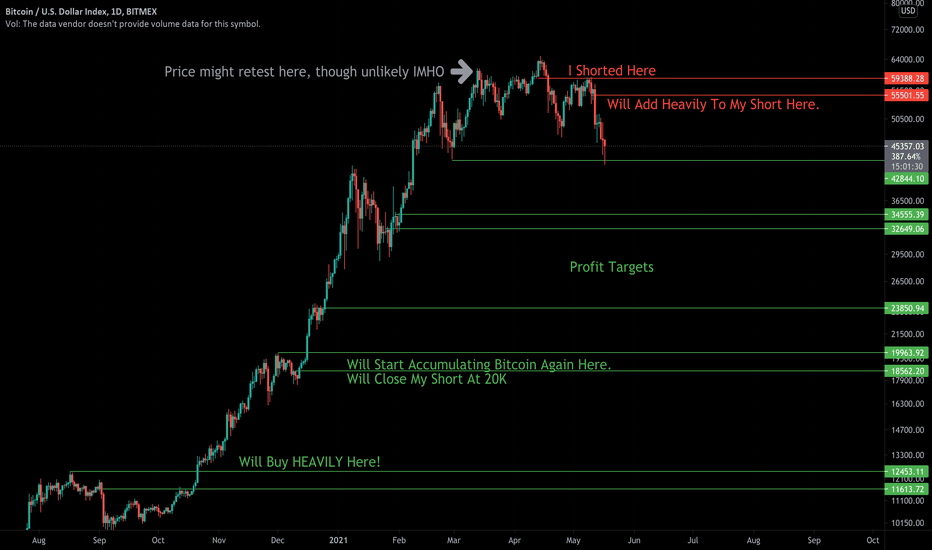

Bitcoin Trading Plan For The Next 12-24 MonthsMy Bitcoin Trading Plan For The Next Year. I Posted The $59,384 Short Level Weeks Ago And It Touched It Perfectly. Does Anyone Else Here Trade Price Action? Hoping That BTC Pops Soon To $56K For A Short Re-Add. See You Guys At $20K Where I'll Begin Accumulating Again, Just Like $3400. Not Financial Advice.