My thoughts on Bitcoin long-term, as well as mid- to short-termLONG-TERM / THE BIG PICTURE:

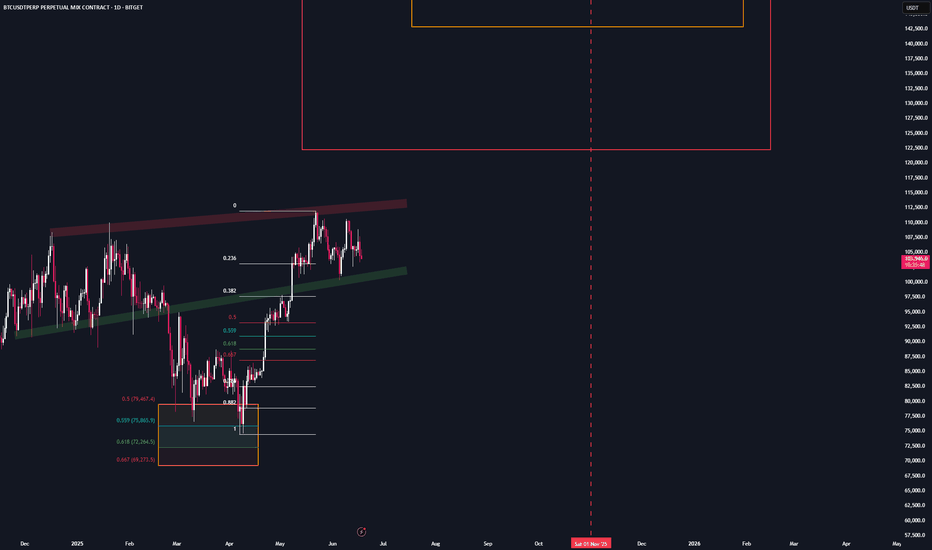

Regarding the big picture, we couldn’t be more bullish. We’re currently fighting our way through the cycle as usual—despite the fact that this cycle has had way too many chop phases, flushing out far too many participants.

Just a few weeks ago, we got our bullish crossover on the weekly MACD—a signal that has triggered a major BTC rally every single time this cycle.

At no point in this cycle has #BTC been overheated. The blow-off top is still coming.

LOCAL PRICE ACTION:

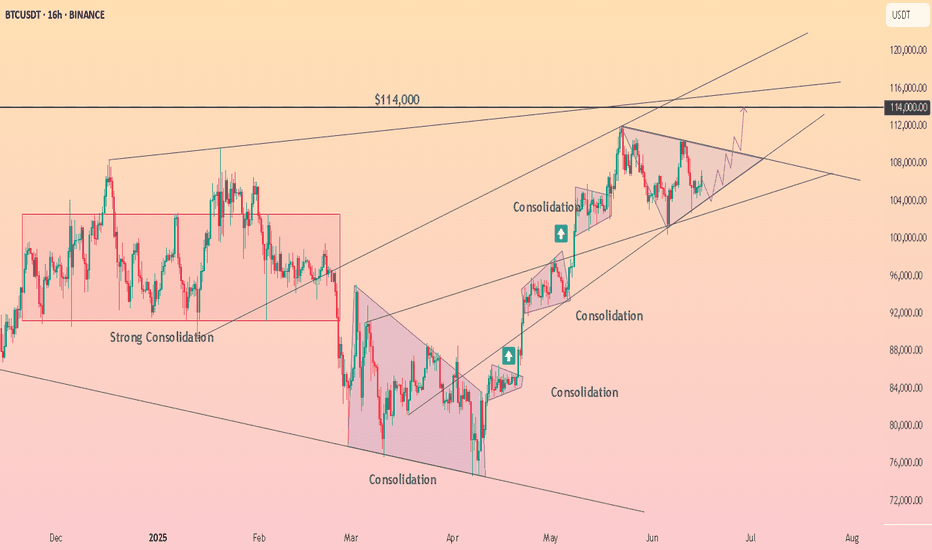

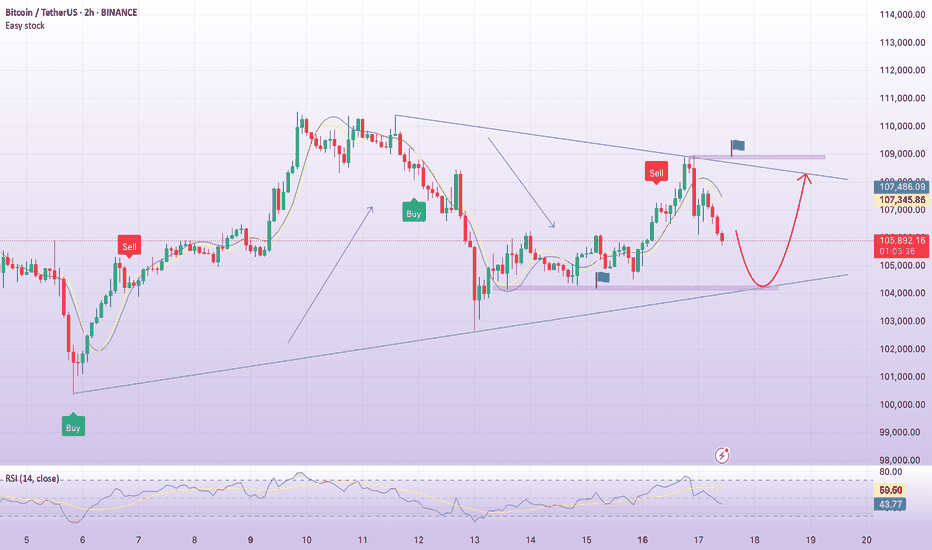

CRYPTOCAP:BTC remains in this vertical ascending channel and remains macro bullish what imo is another huge re-accumulation range lasting more than 200 days since November, that will lead to an impulsive breakout TO THE UPSIDE in the weeks to come

MACRO LANDSCAPE:

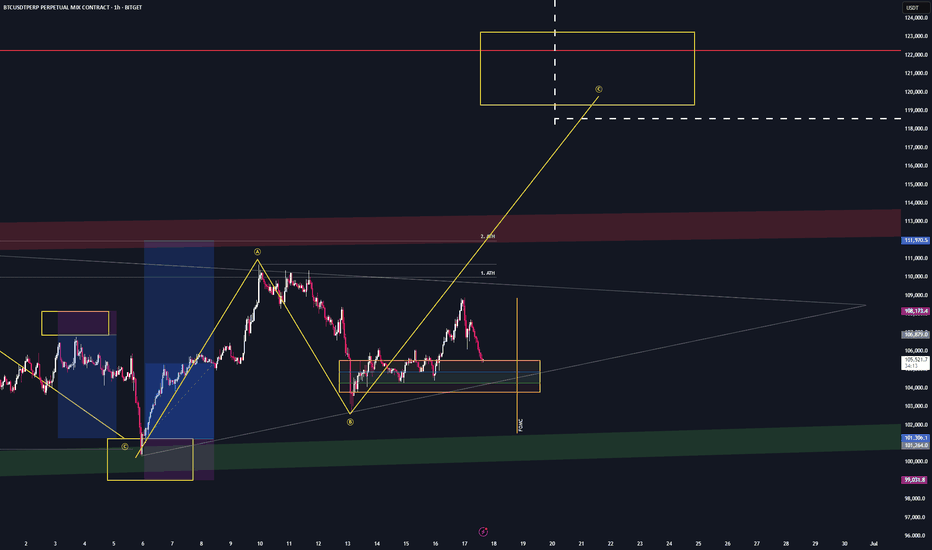

Due the last crash we potentially got an bulllish structure, wich if the price breaks the high at $110.000 is confiraed and can bring us to 120k on #Bitcoin

On the lower TF we currently see an oversold RSI + a bounce from the 0.667 level

RECOMMENDATION:

Watch the high at 110k and the low at 100k, we have to break either one of these 2 levels.

Have an eye on the current conflict with israel & iran and dont forget the FOMC meeting tmwr, where we can expect some important news due the current situation

Either way, I'm long and mid-term bullish despite the current accumulation by long-term holders (which just peaked)...

Always watch the big picture from above - maintain perspective and don't focus too much on smaller timeframes...

But most importantly: Survive.

Thanks for reading, let me know your thoughts about the current market situation & price action👇

BTCUSDT.3L trade ideas

Technical Analysis of Bitcoin

From a market analysis perspective, the daily chart of the large cycle has closed with consecutive declines, the price is below the moving averages, and the indicator is in a death cross, indicating a bearish trend. However, it is necessary to be wary of the stimulation from the news and data caused by the current unstable national situation. In operation, risk control should be paid attention to, and the moving average pressure level near 106,000 on the daily chart should be focused on.

In the hourly chart of the short cycle, the decline continued in the European session after the morning decline yesterday, the U.S. session broke the low of the previous day, and the price rebounded and corrected at the support in the early morning. Currently, it is still in a corrective trend. Today, focus on the high pressure level in the 106,000 area, as well as the impact of the strength of the European session and the unemployment benefit data in the evening on the trend.

you are currently struggling with losses,or are unsure which of the numerous trading strategies to follow,You have the option to join our VIP program. I will assist you and provide you with accurate trading signals, enabling you to navigate the financial markets with greater confidence and potentially achieve optimal trading results.

HTF Consolidation: Key Alerts, Vital Supports, FOMC & Geopolitic__________________________________________________________________________________

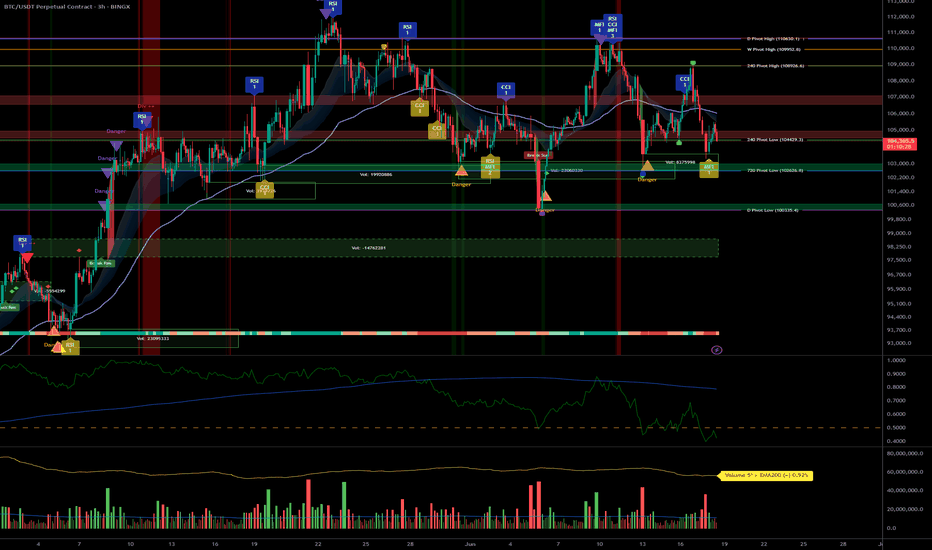

Technical Overview – Summary Points

__________________________________________________________________________________

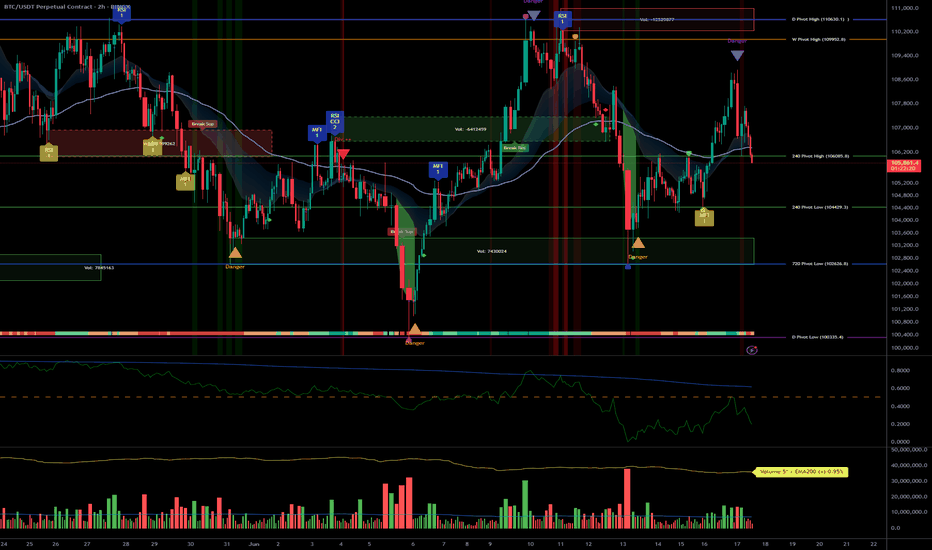

Momentum: Strong bullish signal across sector indicators (Risk On / Risk Off Indicator), especially on daily and 12H. Momentum remains robust within consolidation.

Support/Resistance : Key zone at 104429–102600 (short- and long-term pivots); major resistance at 106000–109950.

Volume : Normal to high, with peaks at major supports on 1H/2H (potential sign of absorption/defensive buying).

Behavior across timeframes :

ISPD neutral on most TFs, only 2H gives a buy signal (possible tactical bounce).

All LTFs (≤1H) are down, HTFs (≥1D) are up → corrective structure, awaiting catalyst.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Overall bias : Underlying bullish, but market consolidates on key technical zones.

Opportunities : Swing buy at 104429/102600, tight stop below 100k, take profit 109950+.

Risk zones : Clear break below 100350/100000 invalidates the setup (risk-off or tactical short).

Macro catalysts : FOMC, Iran–Israel tensions, economic calendar (monitor Jobless Claims, Crude, Fed statement).

Action plan :

Capital preservation before FOMC.

Tactical entries only on key support; tight stops, prudent sizing.

No breakout chasing without macro/fundamental validation.

Hedge/volatility play via options possible (IV low, caution for post-event spike).

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D/12H/6H :

Supports: 104429, 102626, 100353.

Resistances: 106000–109952.

Risk On / Risk Off Indicator = Strong Buy.

No extreme volume, ISPD neutral; mature range.

HTF consolidation, bullish underlying momentum.

4H/2H :

Key zone at 104429–102600 (technical defense); 2H is the first true behavioral buy signal.

Very high volume at support, favoring a "spike bounce" scenario.

“Up” confluence on Risk On / Risk Off Indicator, volume, and ISPD for short-term bounce.

MTFTI: 2H is one of the “Up” TFs; LTFs remain Down.

1H/30min/15min :

Structurally bearish, elevated volume (absorption/protection) on 1H.

No behavioral excesses.

Intraday weakness but supports tested and defended.

__________________________________________________________________________________

Macro / Fundamental analysis

__________________________________________________________________________________

Market in wait-and-see mode : FOMC upcoming, no hike expected but high impact from tone/forward guidance (increased volatility risk).

Geopolitics : Iran–Israel escalation, risk-off climate, nervous risk assets.

On-chain : Supports tested (STH ~97.6k). Persistent LTH accumulation. Low option IV → underpriced volatility risk.

Risk/Reward swing : 2:1/3:1 buying 104429–102600, stop < 100k, take profit 109950+.

__________________________________________________________________________________

Final synthesis: Bias, Opportunities, Risks

__________________________________________________________________________________

Directional bias : Bullish on HTF, neutral/undecided on short-term. Wait-and-see until strong catalyst confirmed (FOMC, geopolitical de-escalation).

Opportunities : Tactical buy on supports, profit-taking on resistance or confirmed breakout.

Risks : Invalidation below 100k; sudden spike in FOMC/Israel–Iran escalation = risk-off or selloff.

Recommended action : Protect capital before FOMC. Swing tactical entry only on confirmed support. No breakout chasing without macro validation. Leverage potential post-FOMC vol spike via options.

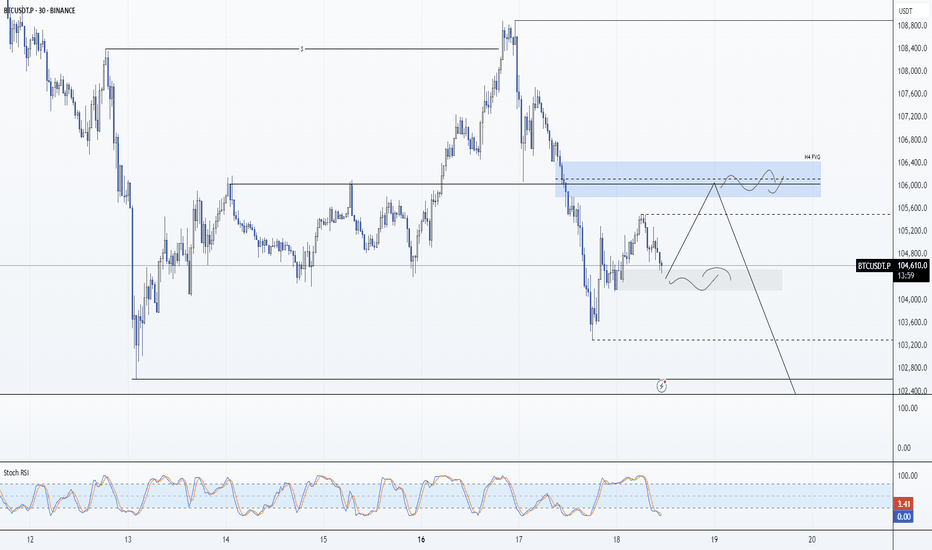

BTC: Bias Map 18/06/25Daily Bias Map:

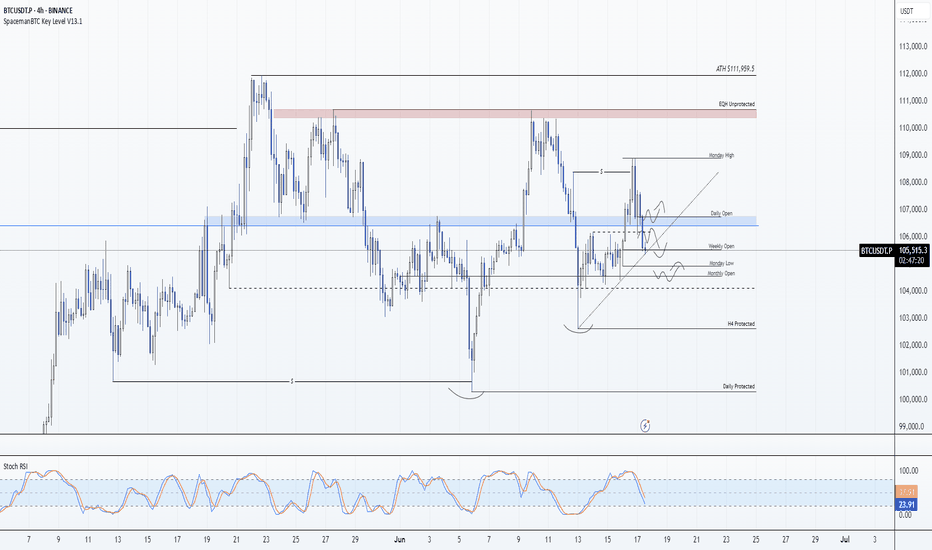

- Bitcoin is trading within a HTF range between 110,700 and 100,700.

- Mid range sits around 105,700 aligning with a 4H bearish fair value gap.

- Higher timeframes are trending down no justification for looking at longs here. Especially after losing 106,500

- FOMC today at 7PM UK time

- Expecting major volatility looking to short any spike into resistance or inefficiencies.

- A scalp long might be valid around 104,115 (demand zone + 30min SFP), but that’s tactical only.

- No reason to flip bullish geopolitical tension (Israel/Iran) adds further downside risk.

- Main plan: scalp long if triggered early, then look to short FOMC-driven upside move.

- Risk is tight. If setups aren’t clean, I’ll sit out and wait for the FOMC dust to settle.

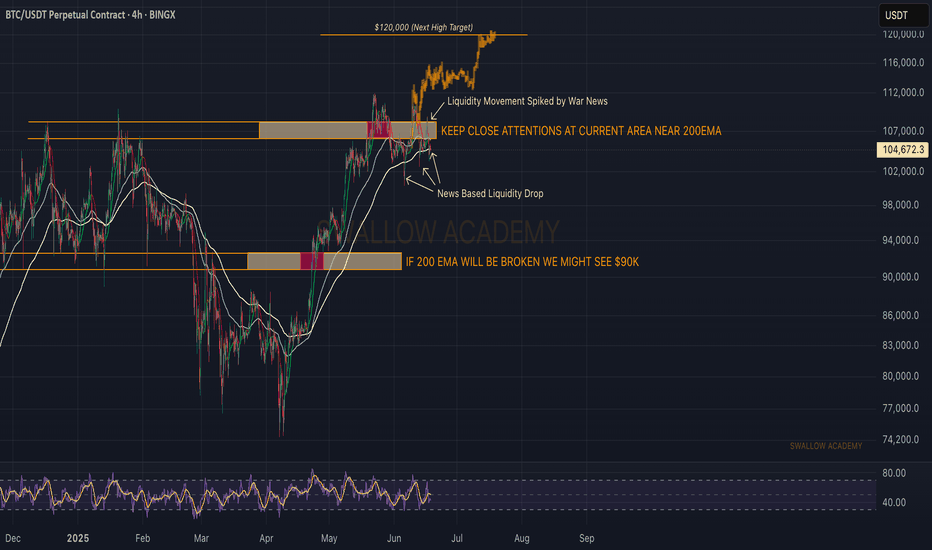

Bitcoin (BTC): Important Area of 200 EMA | Volatility IncomingWhat's happening in the world is having a huge impact on Bitcoin, but the worst is to come...

Price is hovering near the 200EMA, where neither buyers nor sellers can establish proper dominance near that area so our "wait" game continues. We wait for proper confirmations of which side will take control of the 200EMA and once we see it, we will be trading according to that.

Overall, as long as we are above the 200EMA, we are still looking for the $120K area, but once there, we will be looking for a BIG dump.

Swallow Academy

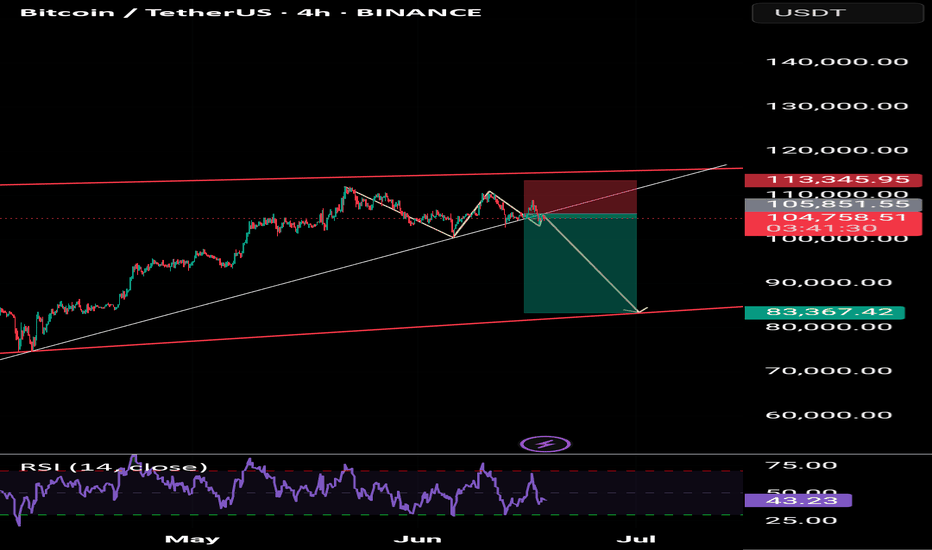

BTCUSDT – Price Poised to Break Descending ChannelBTCUSDT has been maintaining a series of higher lows since early May, consistently rebounding from its dynamic support trendline. Currently, the price is consolidating just below the descending channel resistance around the 108,000 USDT level. A clear double-bottom pattern accompanied by solid recovery momentum suggests a potential breakout from the prolonged correction phase that has persisted throughout June.

If BTC breaks above the descending trendline, the next target could be the major resistance zone near 113,000 USDT.

On the news front, the market is reacting positively to BlackRock’s announcement of expanding investment in crypto ETF products. At the same time, recent soft U.S. inflation data has strengthened expectations that the Fed may halt its tightening cycle. This combination is improving investor sentiment and driving renewed interest in risk assets like Bitcoin.

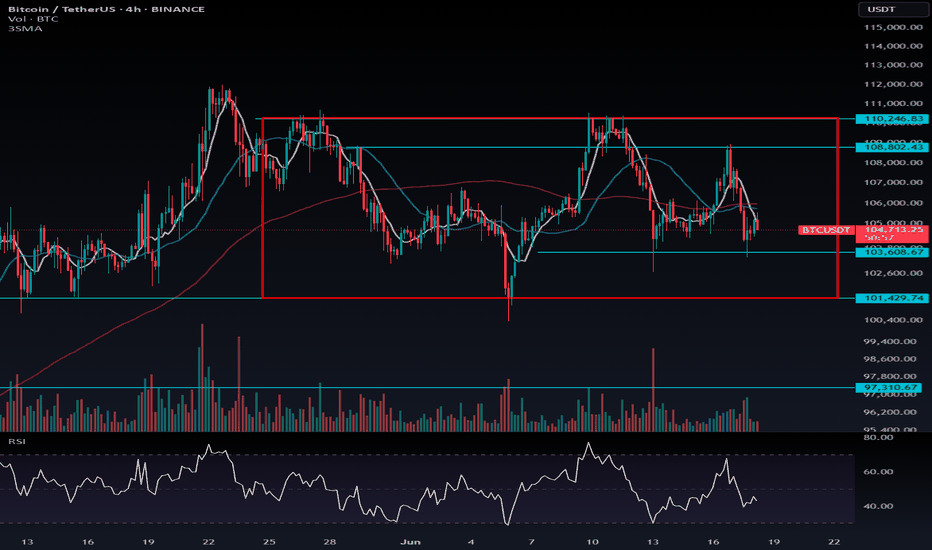

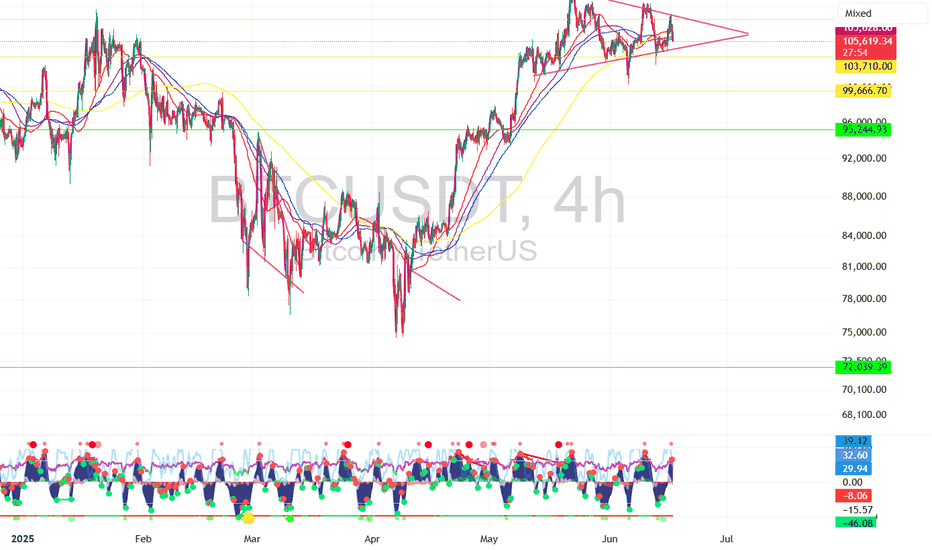

BTC at Risk Amid Technical Weakness and Geopolitical TensionsBitcoin has failed to break above the previous high of $110,264, and instead formed a lower high at $108,802, signaling potential weakness in the current structure. From a technical standpoint, this breakdown increases the likelihood of a bearish move — especially with today’s FOMC interest rate decision on the horizon and escalating geopolitical tensions, including the risk of U.S. involvement in the Middle East conflict.

We're also seeing increased volatility and market sensitivity to news, which can make short-term trading riskier than usual. Bitcoin remains inside the red consolidation box — and as previously mentioned, any breakout from this range is likely to be sharp and aggressive (whale-driven). That’s why positioning ahead of the breakout is crucial.

If BTC breaks below $103,608.67 and at the same time Bitcoin Dominance rises above 64.90%, it could be a strong signal that capital is exiting altcoins. In that case, short opportunities in altcoins may offer better setups, as they could drop more significantly than BTC.

🛑 Due to the high volatility and macro uncertainty, keep your risk low, use tight stop-losses, and don’t forget to secure profits quickly.

💬 What’s your take on BTC’s next move? Drop a comment below — let’s discuss! 👇

Bitcoin (BTCUSDT) 4H AnalysisBitcoin is currently consolidating around $105,523 after a strong rally and forming a short-term sideways structure. It is still unable to break the immediate resistance of $ 111 K.

Key Technical Observations:

BTC has been ranging between $101,409 and $105,523

RSI at ~51.38 indicates a neutral zone, signaling indecision in momentum

Support holding at $105,396, but price action is flat

Bulls need to reclaim $111,633 to regain momentum

Major Levels to Watch:

Resistance: $111,633 → $122,318

Support: $105,396 → $101,409 → $97,340 → $93,343

A break above $111,633 could trigger bullish continuation, while a fall below $101,409 might open the path to deeper support zones.

Patience is key — wait for breakout confirmation before making moves.

This is not financial advice. Always DYOR and manage risk.

Like, share & comment if you find this analysis helpful!

#Bitcoin #BTC #BTCUSDT

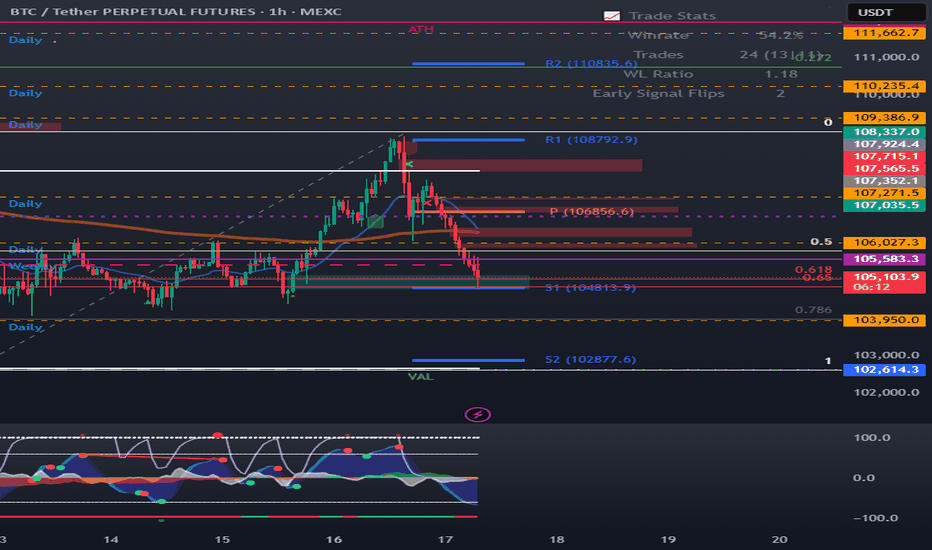

BTC/USDT Long Trade Setup – 1H Chart AnalysisBTC/USDT Long Trade Setup – 1H Chart Analysis

BINANCE:BTCUSDT

Hello traders! Sharing a recent long entry I took on Bitcoin (BTC/USDT) based on price action and liquidity concepts. This trade is taken on the 1-hour timeframe and aligns with my strategy of combining liquidity sweeps, support zones, and market structure shifts.

---

🔍 Trade Overview:

Entry Price: 104,704 USDT

Stop Loss: 103,660 USDT

Take Profit (Target): 108,349 USDT

Risk-to-Reward Ratio (RRR): Approximately 1:3

---

🧠 Trade Idea Behind the Entry:

As you can see on the chart, BTC had been in a downtrend and recently made a strong move into a key liquidity zone. This zone had previously seen multiple touches and rejections, making it an area of interest for both buyers and sellers.

The price swept liquidity below the previous low (labelled as “Liquidity Sweep $$$”), grabbing stop losses of early buyers and triggering limit orders of smart money. This move into the liquidity zone was followed by a strong bullish reaction – a signal that buyers may be stepping in.

Additionally, the "Break of Structure" (BOS) confirms a potential shift in market direction. The reaction from the liquidity zone indicates that this level is holding as new support.

---

🛠️ Why I Took the Trade:

1. Liquidity Sweep: The wick that pierced the liquidity zone signals stop-hunting and accumulation. These moves often precede a strong reversal.

2. Demand Zone Reaction: After the sweep, the candle closed bullish inside the demand box. This shows buyer strength.

3. Risk Management: The stop loss is set just below the liquidity zone to protect from deeper sweeps while keeping the RR healthy.

4. High Probability Target: The target is placed near the next resistance level around 108,349, which also aligns with a clean imbalance that price may want to fill.

---

📊 Technical Confidence:

Confluence Factors:

✅ Liquidity sweep

✅ Demand zone reaction

✅ Market structure shift

✅ High RR

✅ No immediate resistance till target

This type of setup reflects smart money behavior – first pushing price below structure to grab liquidity and then reversing sharply. The bullish momentum after the sweep gave extra confirmation.

---

🧭 What I’m Watching Now:

I will continue monitoring how price reacts around the 105,500–106,000 range. If momentum continues with higher highs and higher lows, I may trail my stop loss to lock in profits.

---

Let me know what you think of this setup! Have you taken a similar trade or are you waiting for confirmation? Drop your thoughts or charts below 👇

Stay disciplined, manage your risk, and trust the process. 🚀

#Bitcoin #BTCUSD #PriceAction #LiquiditySweep #SmartMoney #CryptoTrading #TradingSetup #TechnicalAnalysis #TradeJournal

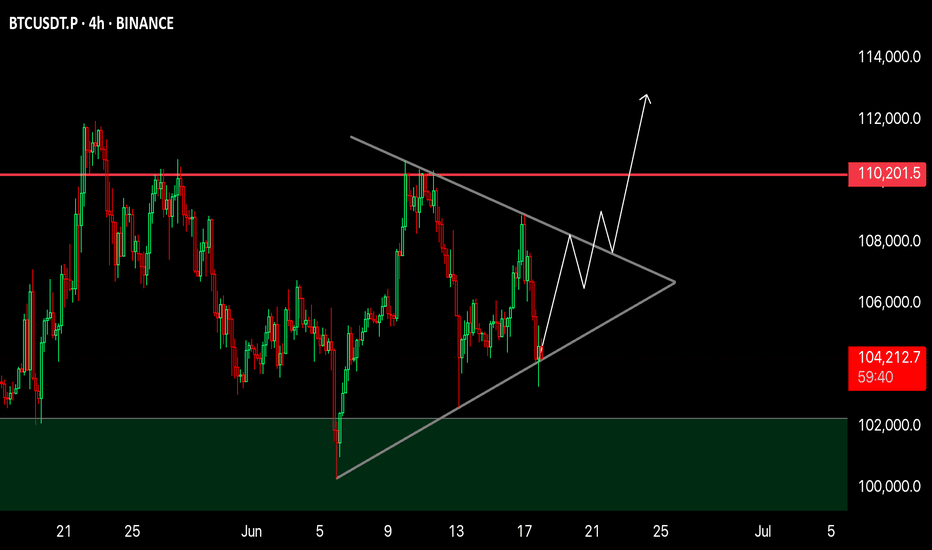

BTC 4H Analysis📈 BTC 4H Analysis – Symmetrical Triangle Breakout Loading

Bitcoin is currently consolidating inside a Symmetrical Triangle, forming higher lows and lower highs – a classic sign of volatility compression.

🔹 Structure: Symmetrical Triangle

🔹 Support Holding Strong – bulls defending the zone

🔹 Breakout Expected Soon

🔹 Major Resistance: $110,200

🔹 Breakout Target: $112,000+

Price is coiling up. Break above the triangle = strong bullish continuation likely.

🚀 Eyes on breakout — next move could be explosive!

NFA | DYOR

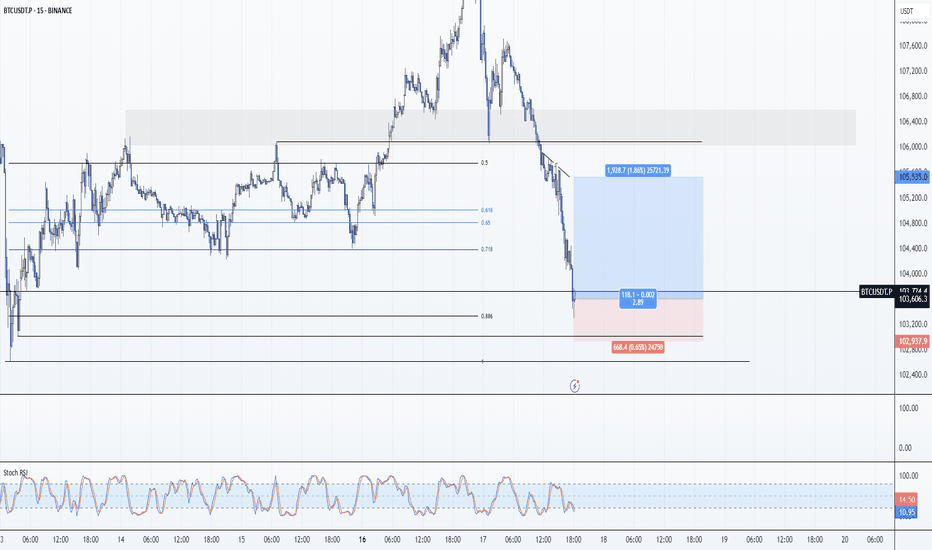

BTC: Scalp Long 17/06/25Trade Direction:

BTC Scalp Long

Risk Management:

- 0.25% Risk

- High risk knife catch trade

Reason for Entry:

- 0.886 Retrace

- Weekly Open ideal area for short entries also lines up with a 0.5 corrective move for this leg.

- Oversold on 4 Macro TFs (M15,M30,H1,H2)

Additional Notes:

- Target Weekly Open

- High High Risk which = A very tiny risk on SL. My only trade of the day.

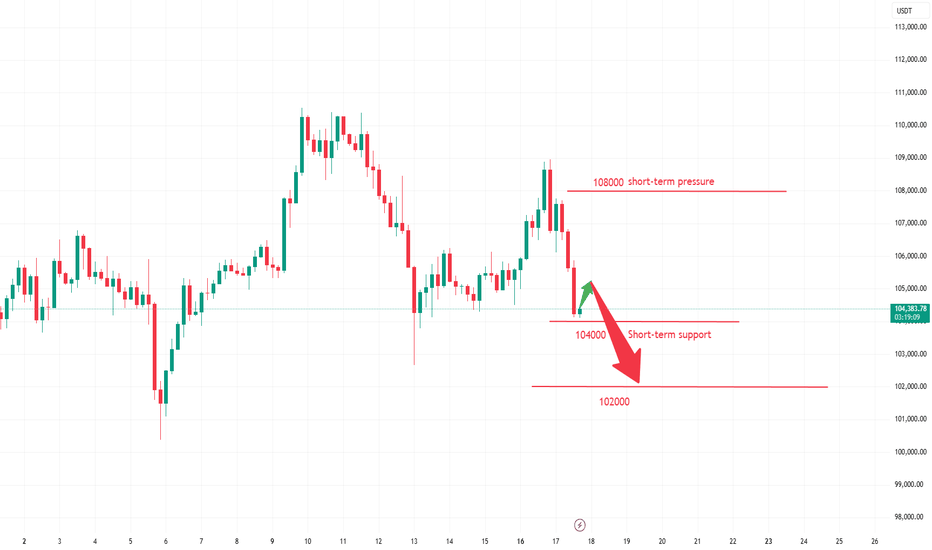

Test the crucial round-number threshold of $100,000.Affected by sudden news factors, the Bitcoin market has seen sharp fluctuations. The price started a significant downward trend from the $108,900 level and has dropped to around $104,000 as of now. This decline has caused Bitcoin to break through multiple key support levels.

On the daily timeframe, the originally important support range of $106,000 - $107,000 was easily breached, with market bearish forces gaining absolute dominance. Bitcoin is facing significant downward risks and is highly likely to continue falling to test the crucial psychological level of $100,000.

you are currently struggling with losses,or are unsure which of the numerous trading strategies to follow,You have the option to join our VIP program. I will assist you and provide you with accurate trading signals, enabling you to navigate the financial markets with greater confidence and potentially achieve optimal trading results.

Trading Strategy:

sell@104000-104500

TP:102000-1025000

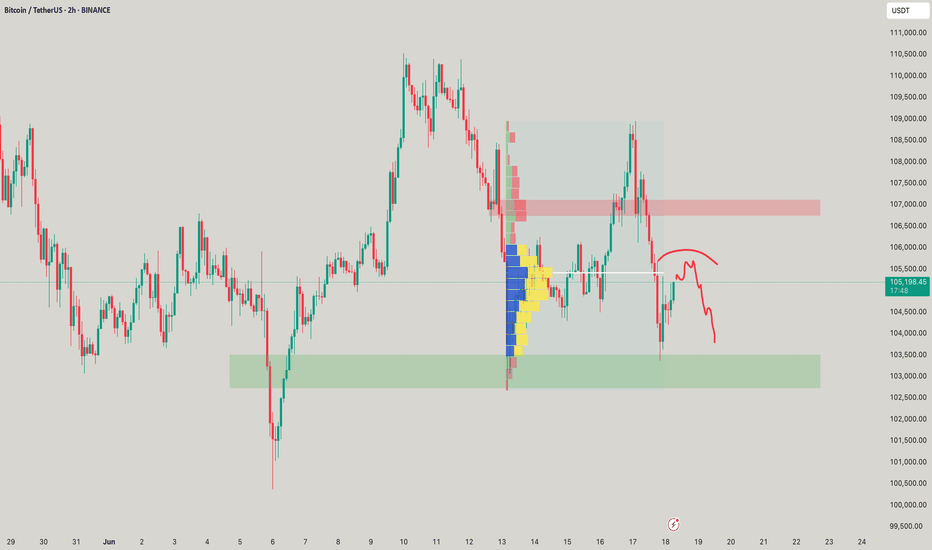

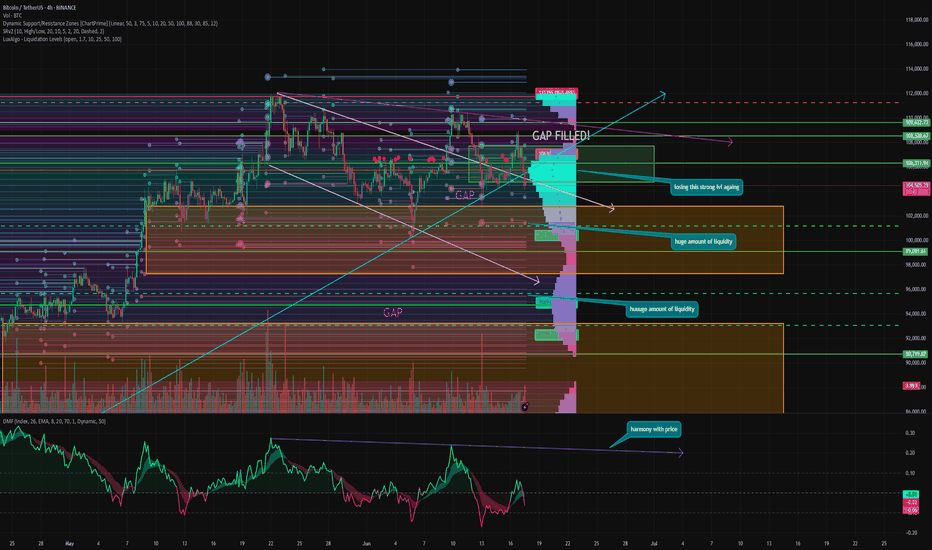

As I said earlier, the real correction is STARTING right now!Hello, everyone! I started writing this review when Bitcoin was at $105,200, and I'm finishing it at $104,150.

⚡️ So far, my thesis is completely correct — we filled the GAP at $104,763 and are going lower to collect liquidity and close the GAPs.

But let's take a look at where and when something might change:

➡️ Today, there is a vote on the stablecoin bill. It is being hyped up a lot and in the short term, it could be a catalyst for a small rebound. But in reality, it has no global value right now. And it will take a very long time to truly feel its impact. But this law is definitely a breakthrough.

➡️ June 18 — the Fed's interest rate decision. The market expects the rate to remain at 4.5%. But in a bearish momentum, anything other than a rate cut (and even that is not always the case) is a bearish catalyst. Remember April, when positive news came out in droves, but Bitcoin at $75,000 didn't care.

However, if the rate is lowered, we can definitely expect a rebound. But I don't think it will be very high.

⚙️ Metrics and indicators:

Money flow - in complete harmony with the price. Position closing and liquidity outflow continue. It is clear that most of it has flowed into ETH and altcoins. But don't forget that if Bitcoin goes down, this liquidity from altcoins will evaporate even faster.

Support/Resistance Zones - as we can see, the level of 105,500 - 106,000 is still key, and without consolidating above it, we are going down. As long as the price is below this level, it is a bearish signal.

Liquidation Levels - just look at the amount of liquidity from below. As we know, the price moves from one liquidity to another; it is literally its fuel. And now, there is simply no liquidity from above, but there is plenty of it from below.

📌 Conclusion:

So far, everything is quite predictable for me and my subscribers. So, leaning back in our chairs, we continue to enjoy the show and wait for real discounts!

Have a great week, everyone!

BTC - AnalysisWe’re currently back at the short-term trend reversal zone,

which has been reactivated after price moved 3% away from it.

The zone itself spans 1.6%, so a new reaction from this level is likely.

If the bottom at $102,500 holds,

we’ve activated a valid bullish structure that could take us up to the $119,000 target zone —

which also overlaps with a weekly target region.

We’ll see what the next few days bring...

Key events to watch right now:

1️⃣ Israel & Iran – Will the conflict escalate or calm down?

2️⃣ Tomorrow’s FOMC meeting – Will QT be addressed?

Feel free to drop any questions or feedback —

I’ll read and respond to everything.

LFG 🚀

BTC Bias Map: 17/06/25Daily Bias Map:

- Bitcoin lost key support at 106,500

- I am leaning more bearish now that this key support is lost.

- Market is heavily driven by news and uncertainty.

- Key levels like Monday low and monthly low cluster in the same region — likely last bastions of support.

- Expecting a possible larger shakeout toward weak lows nearby, which don’t look appealing for entries.

- Will watch for potential long scalp triggers around monthly open or Monday low but will likely stay side-lined. Unless I see a potential good short setup form.

- With FOMC news tomorrow I’m avoiding heavy involvement the risk is not worth it in this volatile environment.

Discipline means knowing when to step back. In all likelihood I'll let the market develop today unless a extremely clean trade develops.

$BTC 4hr - The Calm Before Bitcoin’s Next Move💡 In bull markets, triangles break UP more often than down.

But volume + macro + ETF flows > patterns.

Set alerts, manage risk, stay nimble.

#BTC #CryptoAlpha #RiskManagement

🎯 Key Levels Analysis:

✅ Resistance: 106.3K

→ This level matches the upper bound of the symmetrical triangle and is reinforced by multiple recent rejections. Also aligns with previous highs.

✅ Support: 103.7K

→ Mid-range horizontal support. Price reacted here multiple times. It's also near the triangle base.

✅ Support: 99.6K

→ Clean psychological + technical level. A previous consolidation zone. Would likely trigger a strong reaction.

✅ Last Line of Bull Defense: 95.2K

→ Major horizontal support from the April/May breakout structure. Losing this would likely invalidate the bullish structure.

BTC accumulates above 104,300 zonePlan BTC today: 17 June 2025

Related Information:!!!

Bitcoin (BTC) price falls to around $106,000 at the time of writing on Tuesday following a mild recovery the previous day. The decline comes as investors continue to digest the escalation of the Iran-Israel conflict and after US President Donald Trump highlighted concerns and asked his security advisors to meet in the Situation Room. While institutional interest in Bitcoin remains robust, any further escalation in the Middle East could impact global risk assets.

The US steps in to resolve the Iran-Israel war

Bitcoin price action remained broadly resilient on Monday despite escalating tensions in the Middle East. The four-day-old war between Israel and Iran, which began on Friday, has so far failed to trigger a sharp correction. The largest cryptocurrency by market capitalization held above its key psychological threshold of 100,000 despite the initial shock — a contrast to April last year, when BTC fell more than 8% amid similar Iran-Israel turmoil.

The New York Times reported on Monday that US President Donald Trump has encouraged Vice President JD Vance and his Middle East envoy, Steve Witkoff, to offer to meet with the Iranians this week.

personal opinion:!!!

Gold price continues sideways and accumulates in 2 trend lines, support 104,300

Important price zone to consider :!!!

support zone : 104.300 - 104.100

Sustainable trading to beat the market

Bitcoin Multiframe: Key clusters to watch before FOMC__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Momentum: Dominant bullish structure across all major timeframes (MTFTI = Up).

Supports/Resistances: No HTF pivot engaged; key on-chain support at $97.6k, resistance at $115.4k.

Volume: Central oscillation within range; no major surges observed, consolidation on micro-TF.

Multi-timeframe behaviors: Bullish structure dominates, technical pullback on 4H-1H-15min without major breaks.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Overall Bias: Structurally bullish as long as key supports hold (97.6k–104.5k zone).

Opportunities: Buy confirmed dips on on-chain cluster/H4-H2 area, target 110–115k extension post-FOMC positive catalyst.

Risk zones: Extreme volatility expected around FOMC (June 17–18); strict risk management, avoid overexposure.

Macro catalysts: FOMC (rate decision, dot plot), Fed leadership stability, Israel-Iran geopolitical tensions.

Action plan: Patience until FOMC; favor setups on clear price reaction, tight stops below 97.5k (on-chain support).

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D: Bullish momentum, price at range center ($106k). Watch for pivot break.

12H: Persistent bullish bias, confluence with 1D.

6H: Expected consolidation, bullish structure.

4H: Technical pullback, bullish structure remains. Key anticipated support 105k–104.5k.

2H: Likely move towards lower range. Up bias confirmed.

1H: Technical correction within overall Up trend.

30min/15min: Seller sequence, trend intact, no major break.

Risk On / Risk Off Indicator remains “Up” across all frames, boosting the positive view despite short-term correction.

Executive summary:

Strong bullish convergence from Daily → 15min timeframes.

Ongoing short-term pullback, no HTF pivot breaks.

Any break below $97.6k would invalidate the swing bullish scenario.

__________________________________________________________________________________

Macro, Economic Calendar, On-chain & Risk Management

__________________________________________________________________________________

Macro:

FOMC imminent (June 17–18): waiting – volatility on rate/dot plot.

Geopolitical risk (Iran-Israel): sustained global risk-off may escalate.

BTC shows strong resilience at 106k.

Economic calendar (key points):

June 17–18: FOMC — maximum impact (stocks, FX, crypto)

June 17: Fed leadership rumors — potential volatility, BTC stable

June 17, 08:30 UTC: USA — retail sales (May/core)

On-chain:

Key support at $97.6k (STH cost basis), resistance at $115.4k.

Long-term holders are distributing, but bullish accumulation pressure intact.

Clustering may amplify short-term directional moves.

Key scenarios:

Bullish: Extension to 110–115k if FOMC positive, stop below 97.6k.

Bearish: Break of 97.6k = risk of drop towards 92.9–95.4k.

Management: Avoid exposure pre-FOMC, active monitoring, strict stops.

Patience & discipline: Only size up with post-FOMC validated reaction or confirmed breakout. On-chain cluster = invalidation radar for bullish bias.

__________________________________________________________________________________