BTCUSDT.3S trade ideas

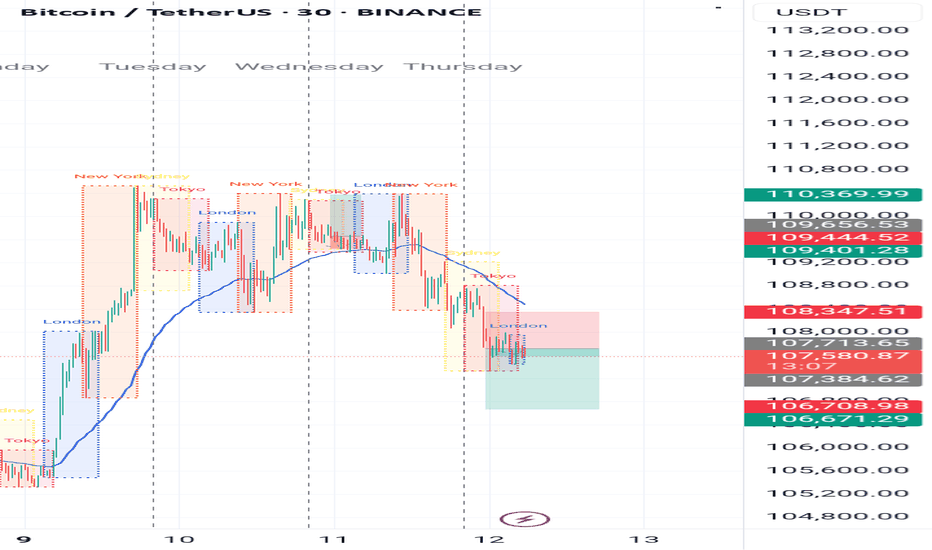

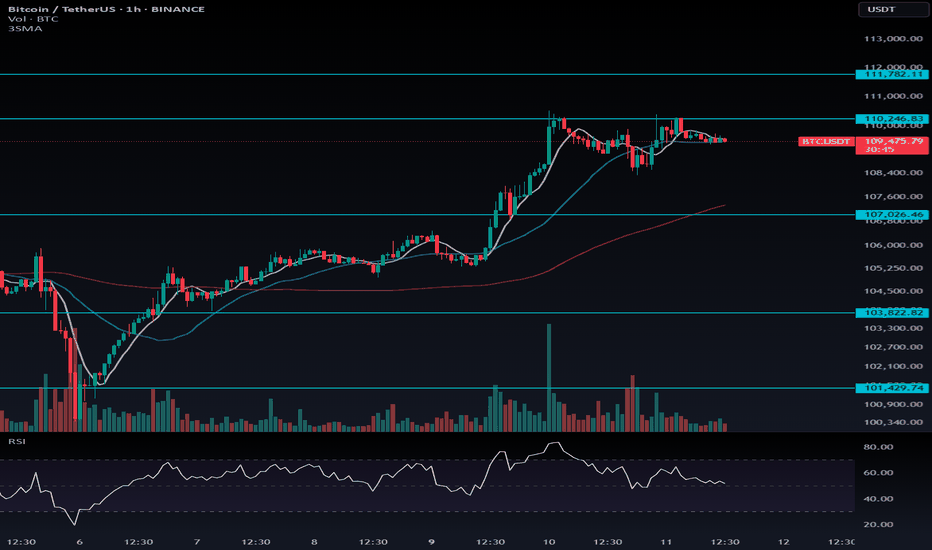

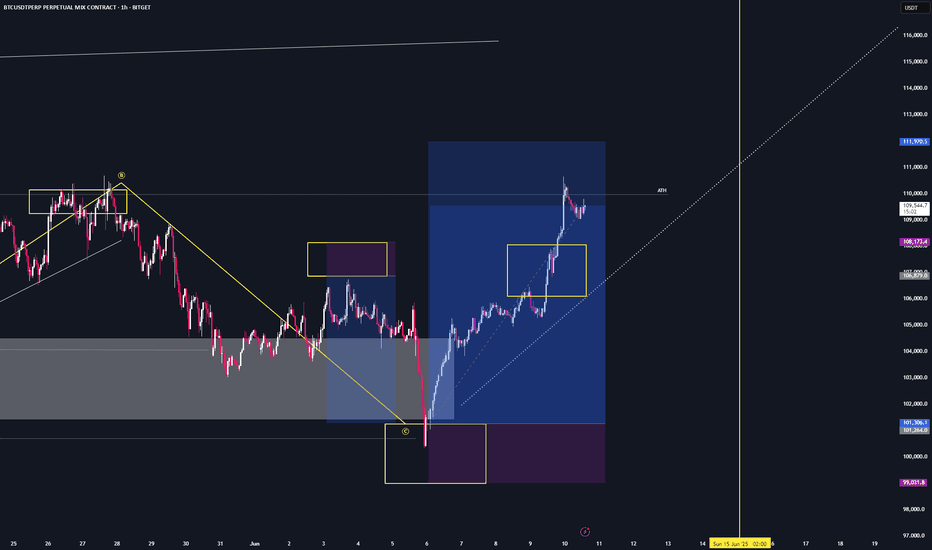

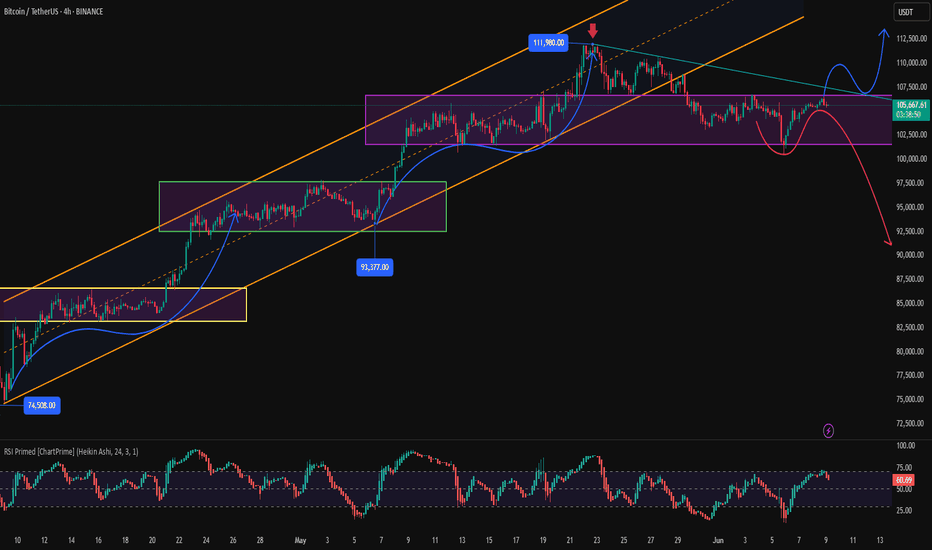

BTC CAN PUMP AGAIN AFTER A SHORT REST Bitcoin had a very strong pump from the 101 to 110k range. In my opinion, the third wave that I identified on the chart is complete and now the price can start pumping again by returning to 107k. The 107k range is an important range because the bottom of the main channel is at this price and it is also a good range for the fourth Elliott wave.

Bitcoin's Support in Focus: Stay Alert for Candle Closes

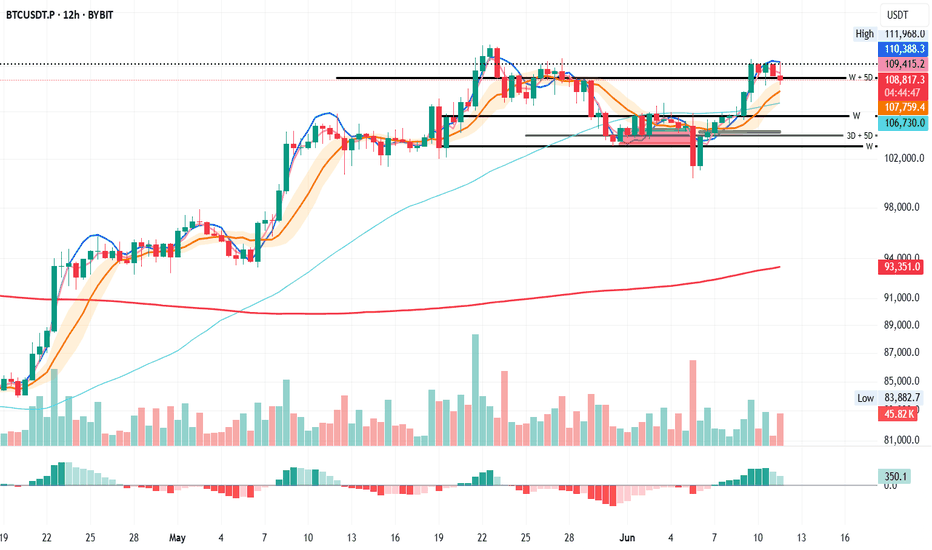

BTC on the 12H looks ready to close below the recently claimed W + 5D support.

It’s a signal to stay sharp and stick to a solid plan: but not a call to action just yet.

Let’s see how the next 3 to 5 candle closes unfold.

Always take profits and manage risk.

Interaction is welcome.

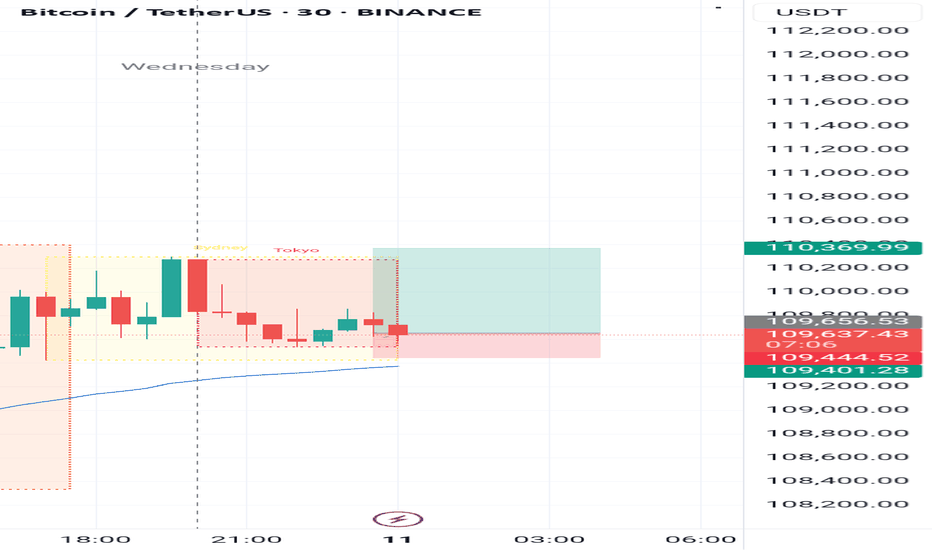

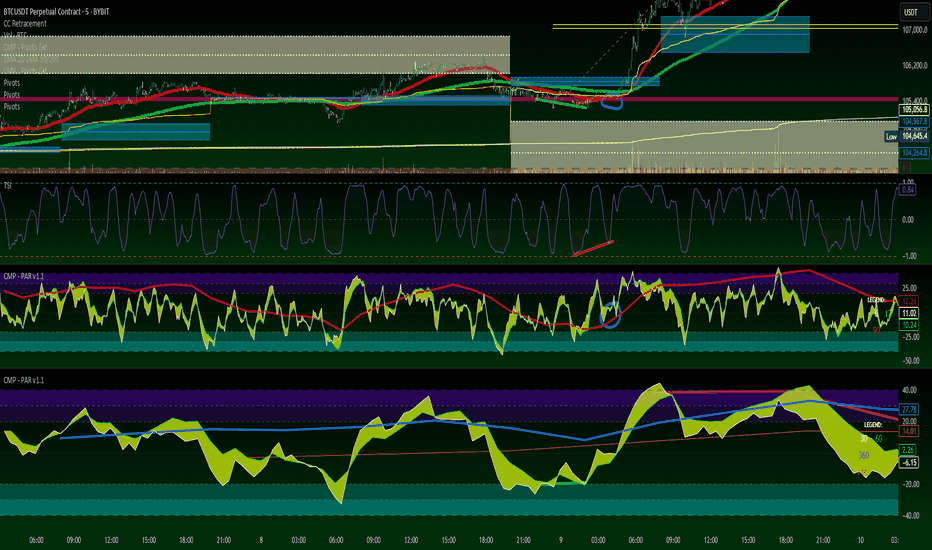

BTC/USDT Analysis: Unproductive Selling Pressure

Hello everyone! This is a daily analysis from a trader-analyst at CryptoRobotics.

Yesterday, Bitcoin once again tested the sell zone at $110,000–$110,600 (profit-taking by a large player) and moved into another correction.

Looking at the current accumulation, we’ve noticed strong market selling pressure that so far hasn't led to any significant result. The seller’s momentum is weak, so most likely we’ll see another upward impulse and a test of the all-time high (ATH).

Buy Zones:

$105,800–$104,500 (accumulated volumes),

$101,600–$100,000 (zone of previous pushing volumes + current buyer defense),

$98,000–$97,200 (local support),

Level at $93,000,

$91,500–$90,000 (strong buying imbalance).

This publication is not financial advice.

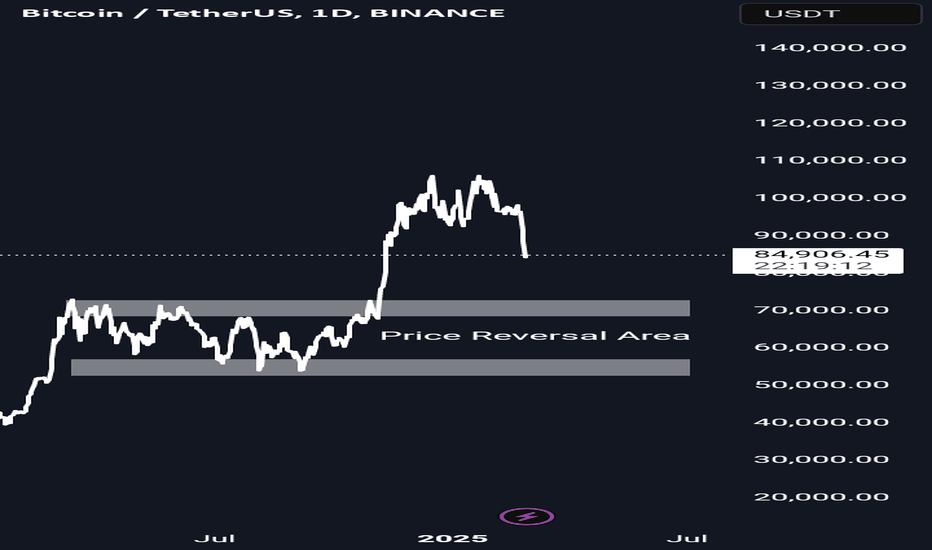

Bitcoin - Price Reversal AreaAny price increase in the market must be accompanied by a price correction and a temporary decrease, and only in the currency markets of countries with weak economies can currencies be found that always move in the same direction against strong currencies. This rule is the same in digital currencies and the crypto market. Supply and demand, fear and greed, cause increases and decreases. These drops are not a reason for a permanent decrease, and increases will definitely begin in the next few days. If the price of Bitcoin decreases again, you can use the specified support area to enter a new purchase.

Sasha Charkhchian

BTC:Range Likely Ahead of FOMC — Altcoin Strength Emerging📊 Bitcoin Price Update: Key Resistance Ahead – Range Likely Before FOMC

As previously discussed, Bitcoin may be entering a short-term consolidation phase. The current candlestick structure suggests that recent price action is driven by profit-taking from long positions, not aggressive selling. If bears were in control, we would have seen a deeper retracement by now — a positive sign for bulls.

Bitcoin is approaching a critical resistance zone between $110,264 and $111,782. If the price enters this range, some supply pressure is expected. However, as long as BTC holds above $107,000, the bullish market structure remains intact.

---

🔍 Key Technical Observations:

Recent candles show profit-taking, not distribution

Sellers are not yet active — indicating continued bullish sentiment

Bitcoin dominance is pulling back slightly while BTC ranges — this has led to stronger moves in altcoins

If BTC dips while dominance continues to fall, it could set the stage for an early altcoin rally (altseason)

---

🕰️ Macro Events on the Radar:

Key upcoming news:

U.S. CPI Data

FOMC Rate Decision – Wednesday next week

Until then, the market may remain range-bound as it awaits clarity

Recommendation: lower risk exposure, reduce position size, and stay selective with trades

---

⚠️ Altcoin Strategy:

If you're already in altcoin long positions, consider partial profit-taking

Watch Bitcoin dominance closely: continued downside could fuel a broader altseason

Keep an eye on BTC’s $107K support and its reaction near $111.7K resistance

---

📈 Summary:

Critical Resistance Zone: $110,264 – $111,782

Key Support: $107,000

Market Bias: Cautiously bullish

FOMC Outlook: Sideways movement likely until Wednesday

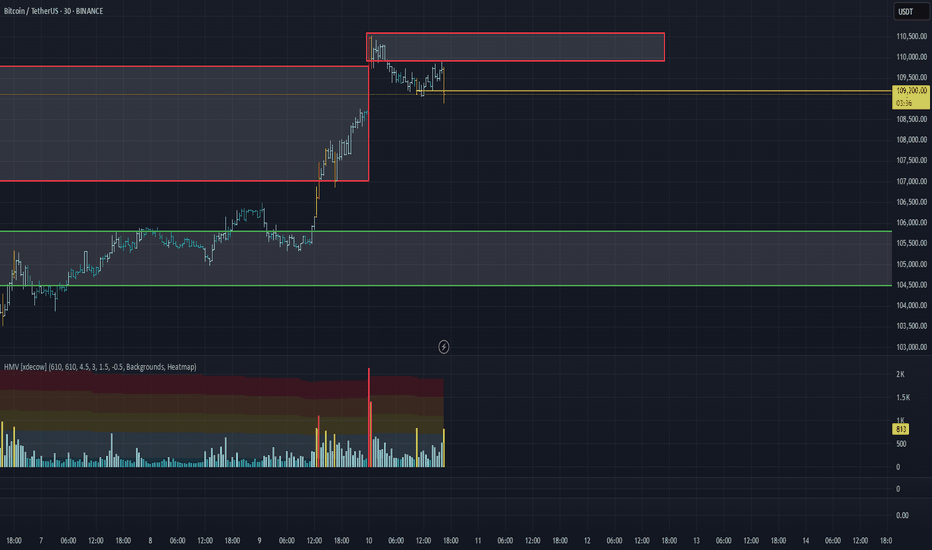

btcusdt 4h

Bitcoin is also expected to test the previous bottom price of 100,500-101,000. It may even reach the 98,000-97,000 range with the needle share. Be careful if you have positions in altcoins. Daily closings above 106,500 are required for this scenario to be canceled. We are moving towards the days when price volatility will increase, do not forget to take profit from your positions.

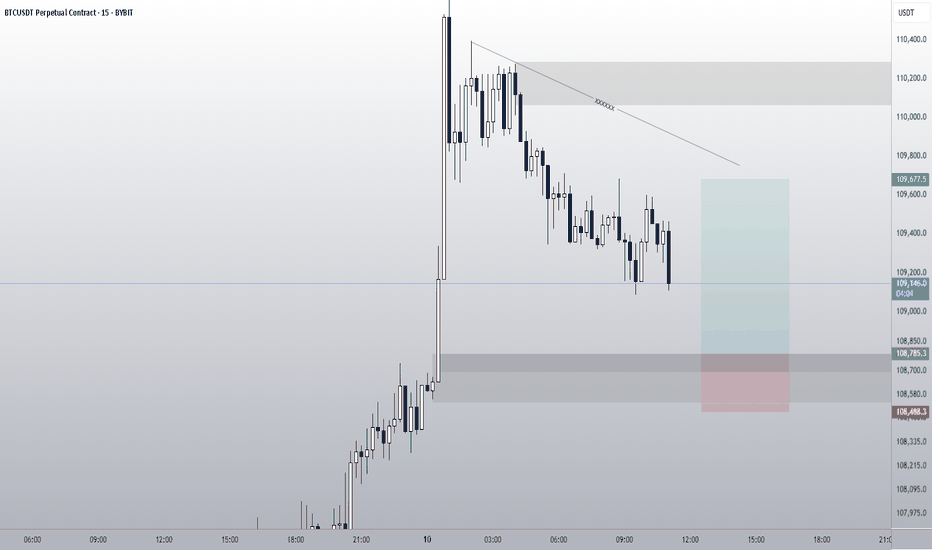

BTC/USDT Analysis: Best Long Entry Zones

Hello everyone! This is a daily analysis from a trader-analyst at CryptoRobotics.

After a strong breakout through the high-volume zone of $104,500–$105,800 and a full trend reversal to the upside, Bitcoin has reached its resistance zone at $107,000–$109,800 (accumulated volumes). At the upper boundary of this range, strong volume anomalies and profit-taking were recorded. The global trend remains bullish, but currently, there is a possibility of a strong correction down to the $105,800–$104,500 zone (accumulated volumes), which also roughly coincides with predictive liquidations that act as a magnet for the price.

An initial correction has already begun, but strong absorption of selling pressure has appeared around ~$109,200. If this level is breached without a renewed defense, the likelihood of further decline increases.

Sell Zone:

$110,000–$110,600 (profit-taking by large players).

Buy Zones:

$105,800–$104,500 (accumulated volumes),

$101,600–$100,000 (zone of previous pushing volumes + current buyer defense),

$98,000–$97,200 (local support),

Level at $93,000,

$91,500–$90,000 (strong buying imbalance).

This publication is not financial advice.

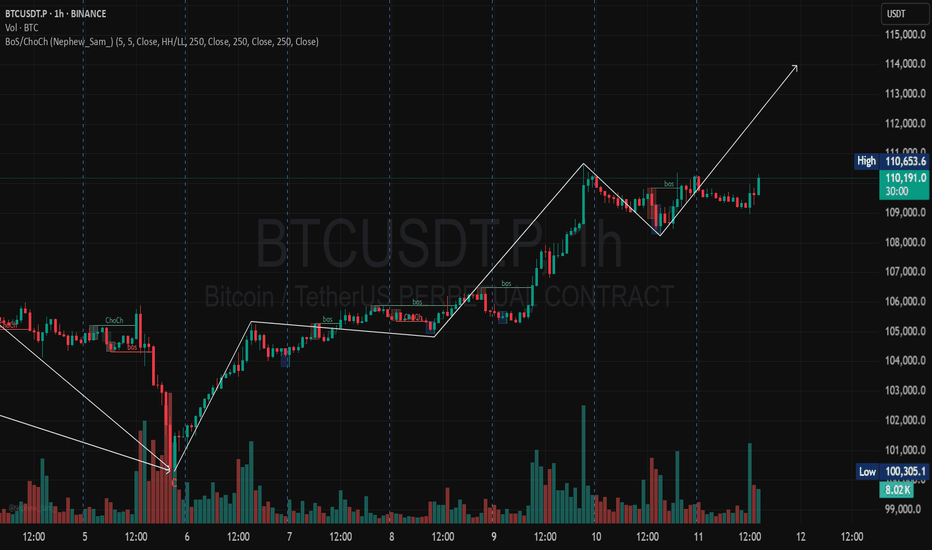

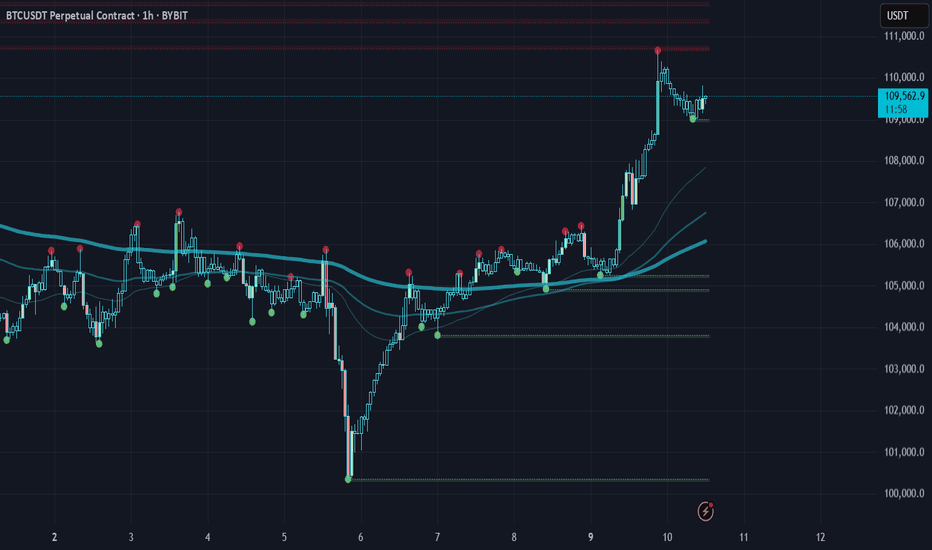

Bitcoin H1: Effort vs Result Breakdown!Massive selling volume spikes near the last swing low, but price reversal came in strong! 📉➡️📈

The law of Effort vs Result at play:

Effort: Sellers dumped hard, but the result? A bullish reversal 🚀

Result: Price back above key levels and closing near $109.5K. 💥

🔮 Price Target:

→ Immediate Resistance: $110K

→ Next Extension: $112K

This move shows that even with high volume sell-offs, buyers are in control. 🚀💰

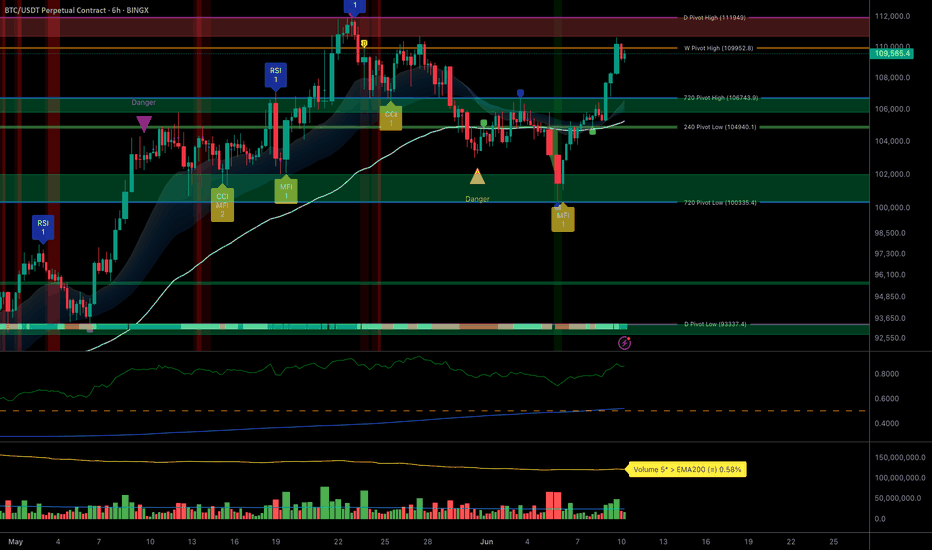

BTC: Strong bullish trend, key resistance 111–112k in focus__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Strong bullish momentum across all timeframes (1D to 15min).

Major supports: 100335, 104940, 106743 – multi-timeframe confluence, natural risk management levels.

Key resistances: 109952 – 111949 (historical pivot zones).

Risk On / Risk Off Indicator clearly favoring "Risk On" (strong buy). Tech sector in leadership mode, favorable context.

Volumes normal to moderately elevated, no major behavioral anomalies (ISPD DIV neutral).

No significant divergence between technical and behavioral indicators detected.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Overall bias : firmly bullish, but tactical caution just below 111,000–112,000.

Opportunities : prioritize buys/reloads on pullbacks to 104,900–100,300.

Risk zones : clean break below 103.7k ⇒ risk of acceleration to 95.6k; invalidation if daily close <103,700$ or >2 sessions <97,100$.

Macro catalysts : Fed decision (06/18), US CPI (06/12), Trump speech (06/10); anticipate higher volatility.

Action plan : engage tactically below resistance; recommended swing stop-loss at $97,000; active management after each catalyst event.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D : Massive support 100k-103k, critical resistance 111–112k. Robust momentum and context, no behavioral overheating.

12H : Steady staircase progression, intermediate supports respected (104940–106743), healthy volumes, ongoing up-trend.

6H : Bullish background, no excessive flow or defensive behavioral signals.

4H : Resistance zone test (111949–109952), structure remains solidly up, no reversal detected.

2H : Slightly rising volumes on resistance test, no behavioral excess. Positive momentum.

1H : Active resistance test, moderate volumes. Bullish structure intact.

30min : Micro-consolidation below resistance, no excessive volume/behavior. Trend up.

15min : Volume spike on last upward move, rapid normalization. Reload possible if breakout above 110k is confirmed.

Multi-timeframe summary : Bullish confluence, no strong reversal signal as long as support at 103.7k holds.

Risk On / Risk Off Indicator : Strong buy, tech sector leading, no structural risk detected in capital rotation.

__________________________________________________________________________________

Synthesis & Decision-Making

__________________________________________________________________________________

Dominant structure : BTC market structurally bullish, supported by multi-timeframe converging supports and solid tech sector.

No behavioral anomaly (ISPD DIV neutral); volumes under control; only vigilance below 111–112k due to matured seller pressure.

Macro context : Fed’s rates unchanged expected, major catalysts nearing with potential for significant volatility.

On-chain analysis : active distribution from long-term holders, critical area 103.7k–97.1k, demand must absorb “long-duration” supply.

Trading recommendation : favor buys/reloads on pullback (104,900–100,300); tactical caution under 111–112k; swing stop-loss at $97,000 advised.

BTC structurally bullish, but approaches a critical phase: robust multi-timeframe supports, positive macro momentum, no excessive behavioral exuberance. Heightened vigilance required below 111–112k due to pressure from long-term holders; dynamic risk management needed around major macro events.

__________________________________________________________________________________

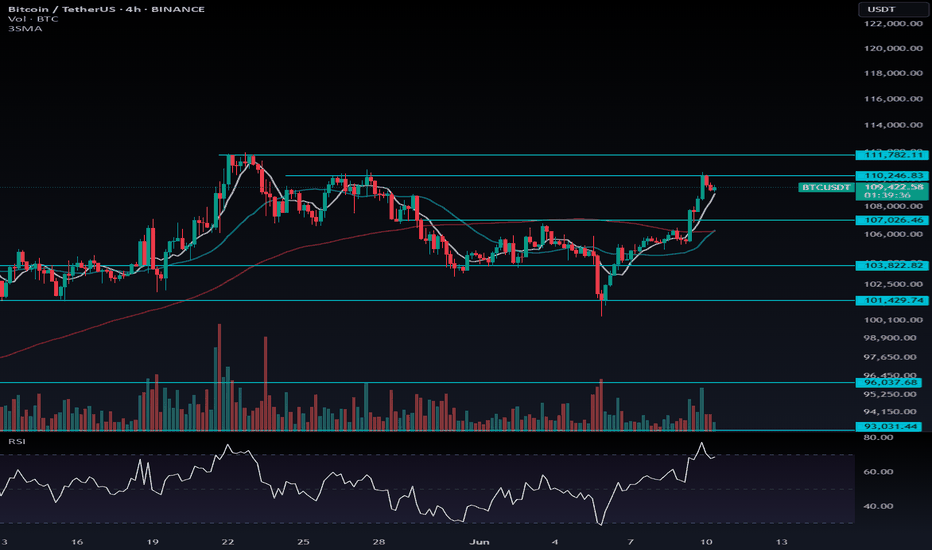

Bitcoin Price Update📊 Bitcoin Price Update: Key Resistance Zone Between $110K and $111.7K — Range-Bound Potential Ahead

As previously mentioned, Bitcoin's price action suggests that a break above $106,355 would signal the start of a bullish trend, and so far, we've seen upward momentum maintained while staying above $107K.

Now, Bitcoin has reached a critical resistance zone between $110,246.83 and $111,782.11. This area presents a potential for market hesitation, as it aligns with a strong resistance level. Given the significant movement over the past few days, it’s possible the market may enter a range-bound phase as it consolidates and structures itself for the next move.

---

📉 Possible Short-Term Range:

Range Between: $110,246.83 to $111,782.11

Expect possible sideways consolidation before continuing the trend

---

📈 Bullish Continuation:

As long as Bitcoin remains above $107K, the bullish trend remains intact

Break above $111,782.11 may signal continuation toward higher targets

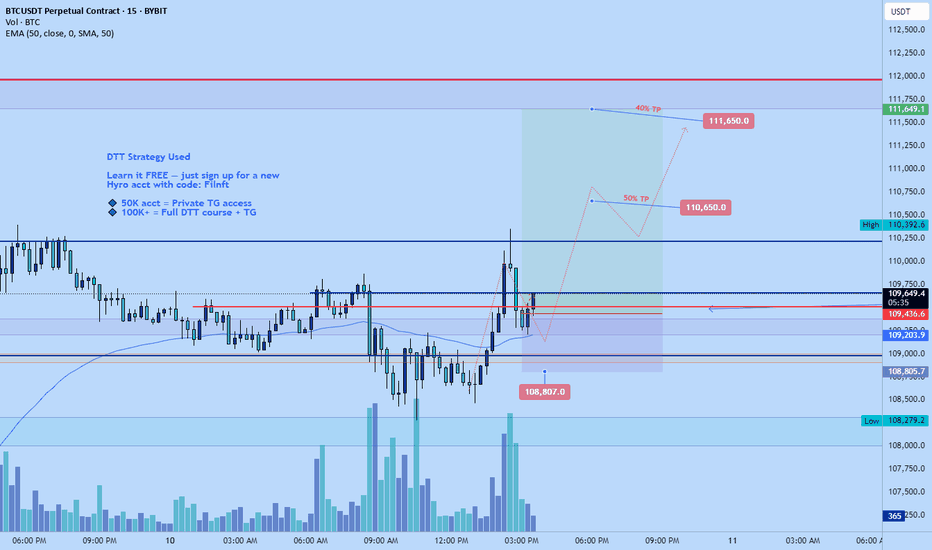

BTC/USDT Long PositionAfter a strong bullish impulse, price pulled back and formed a clear demand zone (OB) near the origin of the move.

The market is now retesting this zone after breaking short-term structure to the upside.

Entry:

Long from demand zone (OB) at the base of the bullish impulse.

Confluences:

✔️ Clean bullish BOS (Break of Structure)

✔️ Strong rejection wick from demand

✔️ Lower time frame liquidity grab

✔️ Favorable R:R setup

SL: Below the OB

TP: Targeting previous supply zone above

Bias: Bullish until structure shifts again

FOLLOW ME FOR MORE SIGNAL

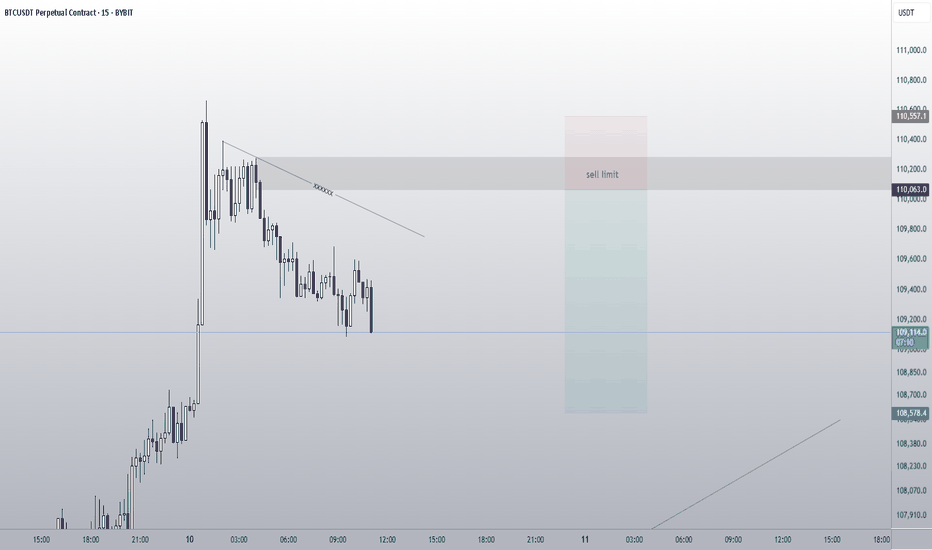

BTC/USDT Analysis (15m) – Short Position Setup📌 BTC/USDT Analysis (15m) – Short Position Setup

🔍 After a sharp rally, the market started a corrective phase and formed a bearish structure with lower highs.

A sell limit order is placed at the 110063 supply zone, targeting potential continuation to the downside.

🎯 Target: 108578

⛔️ Stop Loss: 110557

⚠️ Risk/Reward: Favorable and aligned with current market structure.

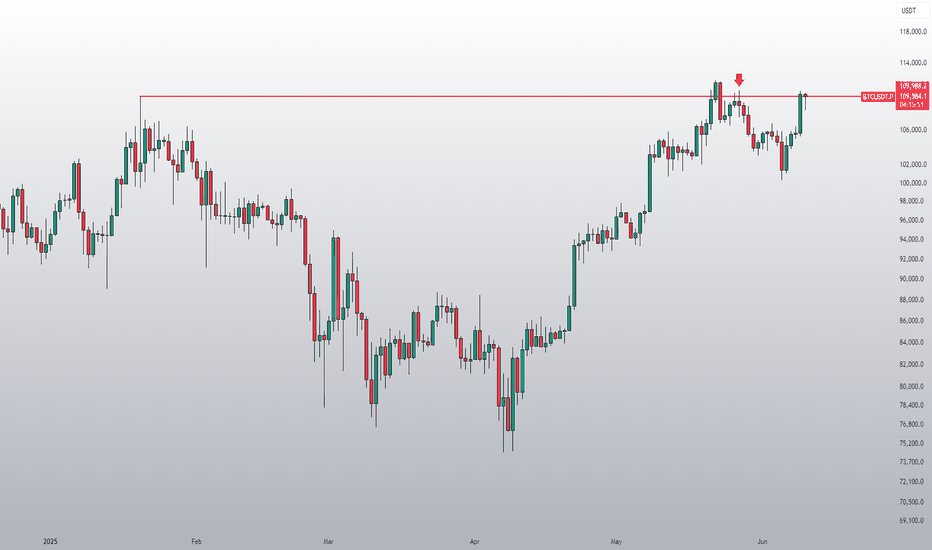

Bitcoin (BTC) Technical Analysis and Trading Strategy

Daily Level

Price Structure: Last week, it fell to 100,000 points and did not break the support. Then it returned to the horizontal adjustment range, but it was still suppressed by the downward trend line above, and the overall high-level decline structure was maintained.

K-line pattern: The two consecutive days of closing cross stars showed that the long-short game intensified, but there was no clear direction.

Momentum indicator: RSI continued to shrink, indicating that short-term momentum weakened, and attention should be paid to breakthrough signals.

4-hour level

Key resistance: 106,700 (horizontal channel top + downward trend line bonding pressure), breaking through is expected to test the 110,000 mark.

Key support: 103,500 (range bottom), 101,000 (strong support), if it falls below, it may form a head and shoulders top structure, and further look down to 97,600 (previous step support).

Short-term trading strategy

Short order opportunity

Entry area: 106,000-106,700

Stop loss: 108,000 (short order invalidated after trend line breakthrough)

Target: 103,500 → 101,000

Long order observation point

If the price stabilizes above 106,700, you can wait for confirmation of the retracement before arranging long orders, with a target of 110,000.

If it stabilizes at 101,000-103,500, you can consider short-term rebound trading.

Key trend judgment

Break above 106,700 → Continue to adjust upward and test 110,000.

Break below 103,500 → Confirm the head and shoulders top, target 97,600.

Range oscillation (103,500-106,700) → Wait for a breakthrough signal.

(Risk warning: Pay attention to changes in market liquidity and the impact of macro data, and strictly stop loss.)