BTCUSDT.3S trade ideas

BTCUSDT: Sharing of the Latest Trading StrategyAll the trading signals today have resulted in profits!!! Check it!!!👉👉👉

Fundamental Analysis:

Expectations of potential regulatory easing by the U.S. Securities and Exchange Commission (SEC) on cryptocurrencies, coupled with rising interest from global institutional investors in crypto-asset allocation, have positively impacted the Bitcoin market.

Sustained net inflows into Bitcoin ETFs in recent days reflect market optimism about its long-term prospects.

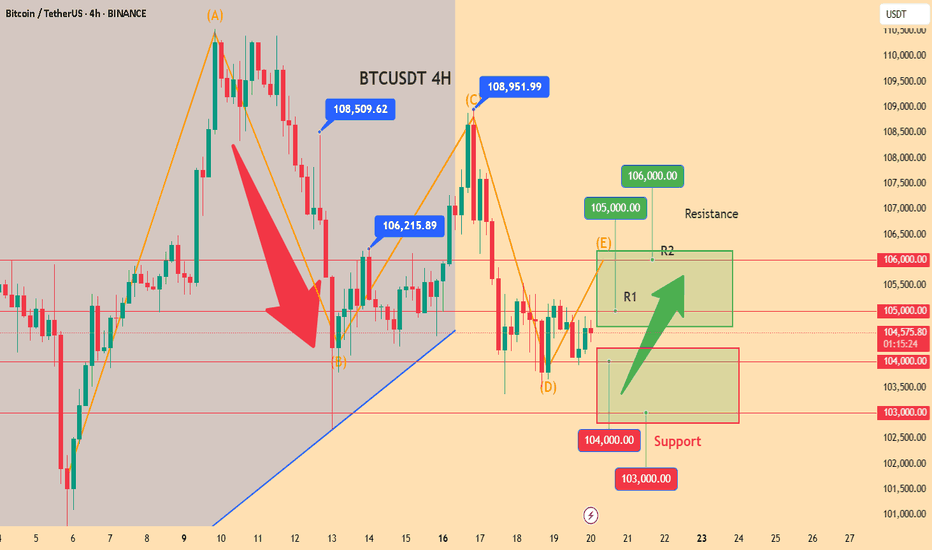

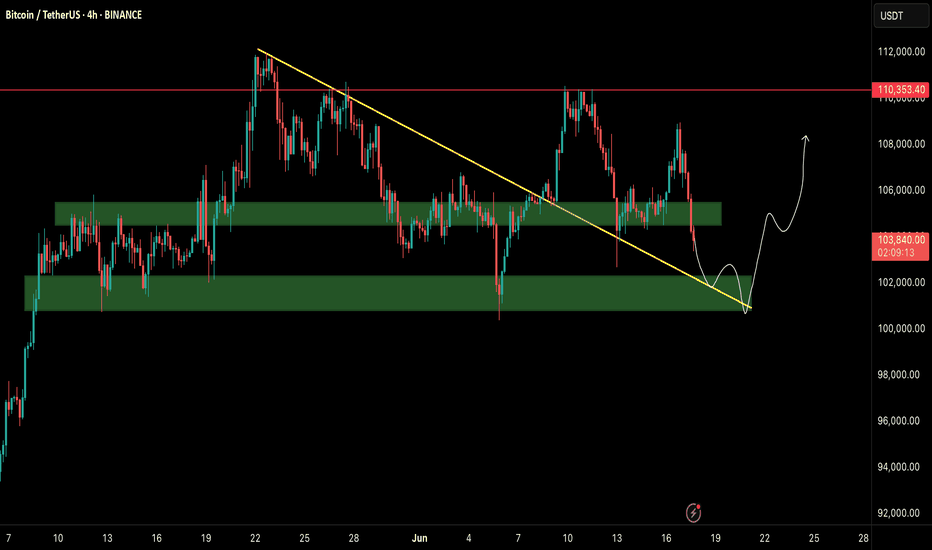

Technical Analysis:

On the 4-hour chart, Bitcoin prices have found support multiple times within the $102,000–$104,000 range, forming a strong support level.

The MACD indicator remains above the zero line, with histograms contracting but still positive, indicating lingering bullish momentum. The DIF and DEA lines maintain a bullish configuration.

In the Bollinger Bands, price is trading near the middle band (currently at $104,700), which acts as support. A valid break above the middle band could unlock upward potential, with overhead resistance at $108,000.

Long Strategy:

Aggressive traders may initiate light long positions as price pulls back to the $104,700–$105,000 zone, setting a stop-loss below $104,000 and targeting $108,000.

Trading Strategy:

buy@ 104700–105000

TP:106000-108000

Share accurate trading signals daily—transform your life starting now!

👇 👇 👇 Obtain signals👉👉👉

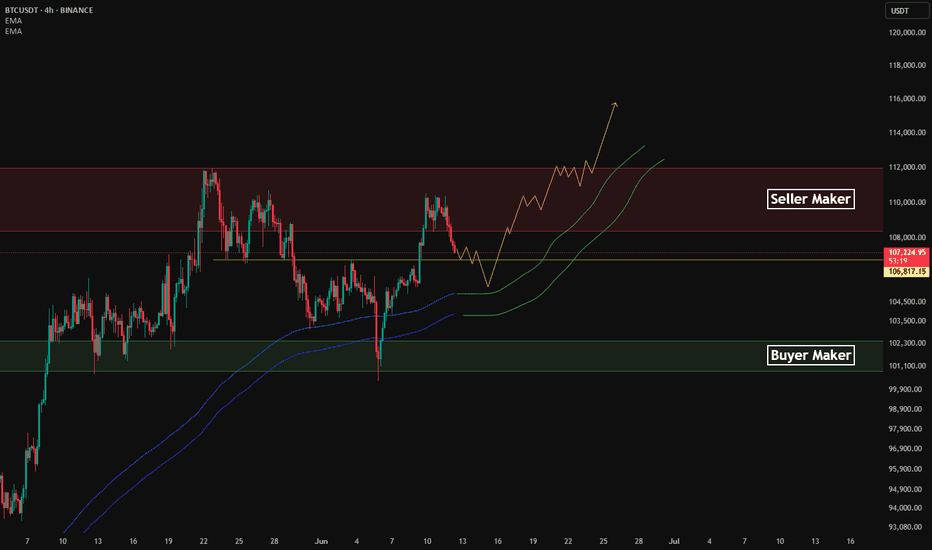

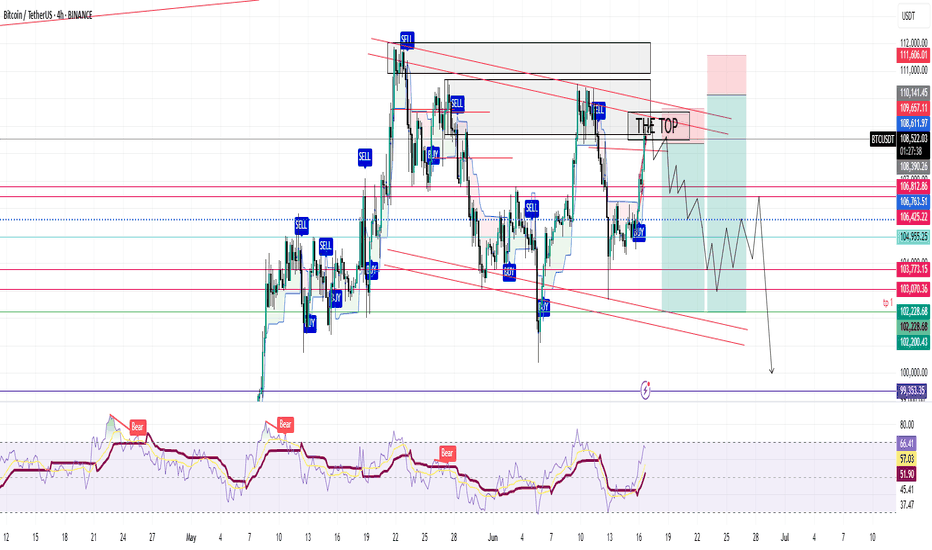

Accumulate, BTC back above 110K💎 BTC PLAN UPDATE (June 16)

NOTABLE BITCOIN (BTC) NEWS:

Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) are showing signs of stabilization around key support levels following last week’s correction. BTC is attempting to regain momentum after closing below a critical support zone, while ETH and XRP are hovering near technical thresholds that could determine their next directional move.

TECHNICAL ANALYSIS OUTLOOK:

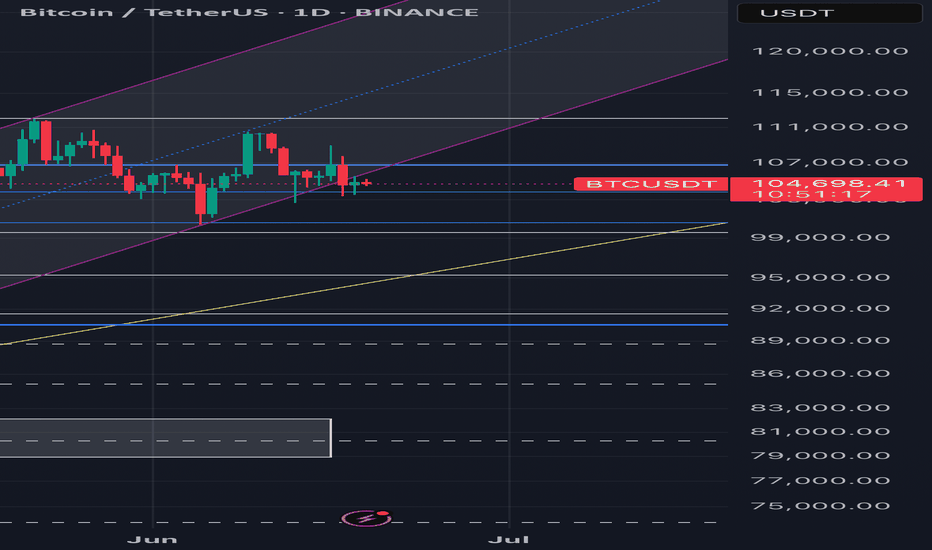

Bitcoin could decline further if it closes below the 50-day EMA

Bitcoin closed below its daily support at $106,406 on Thursday, then bounced back after retesting the 50-day Exponential Moving Average (EMA) at $102,893 on Friday. BTC has since stabilized around the $105,000 level over the weekend. As of Monday, it continues to consolidate, trading near $105,788.

If BTC fails to close above the $106,406 resistance level and heads lower, it may extend its decline toward the psychologically significant $100,000 level.

The Relative Strength Index (RSI) on the daily chart is hovering around the neutral 50 mark, signaling indecision among traders. Meanwhile, the Moving Average Convergence Divergence (MACD) indicator shows a bearish crossover on the daily chart, indicating selling pressure and a possible downtrend continuation.

At this stage, whether you're new or experienced, it's wise to spend more time practicing, deepening your technical analysis knowledge, and exploring educational content shared on the channel. Strengthening your foundation will help you protect your capital in this volatile environment.

==> This analysis is for trend reference only. Wishing all investors successful trades!

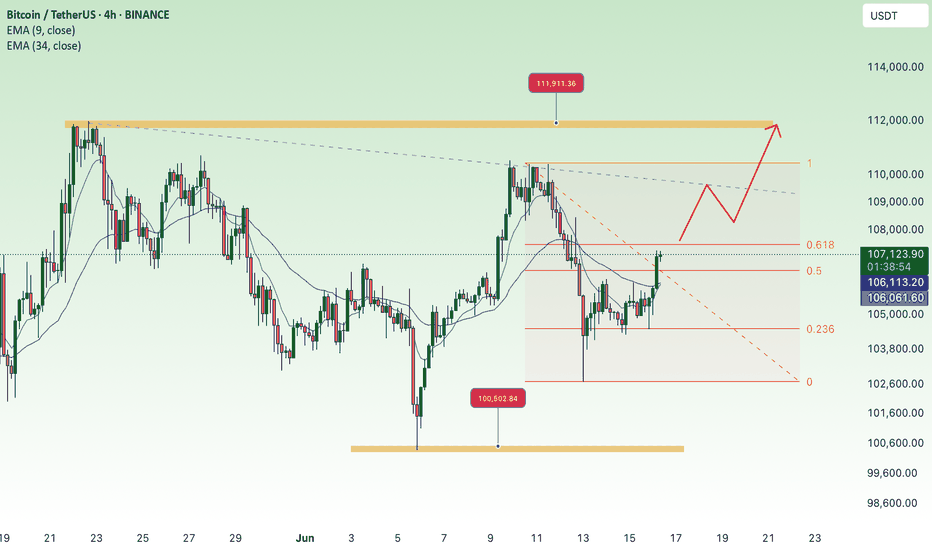

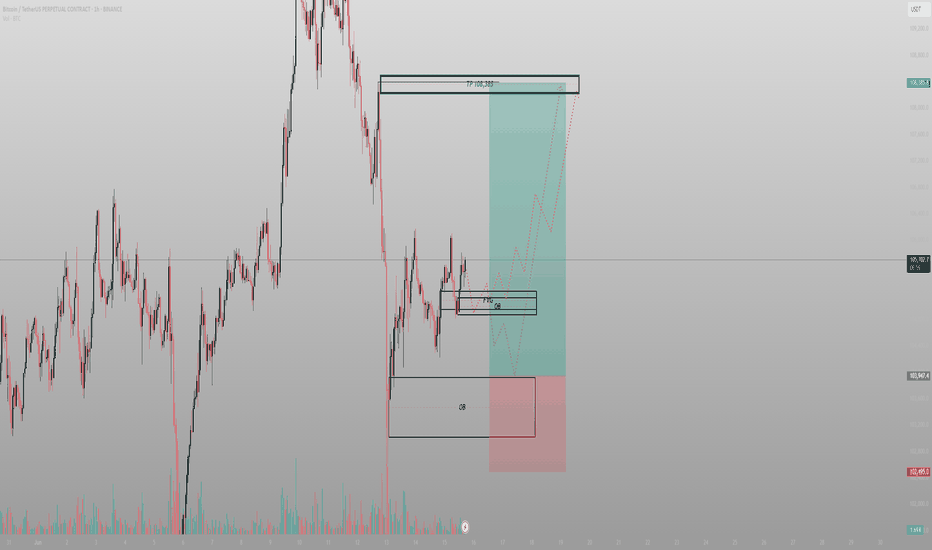

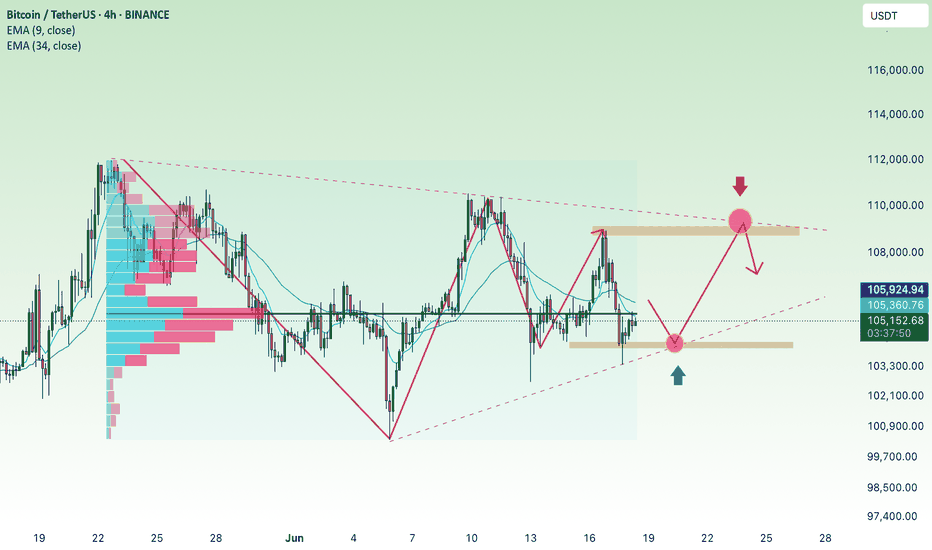

The FVG was the invitation. The OB was the entryBTC delivered exactly where it needed to. It didn’t break down. It rebalanced. The chart isn’t noisy — it’s speaking. And it’s pointing to 108.3k.

The logic:

Price printed clean displacement, returned to mitigate a 1H FVG stacked on top of a refined Order Block, then paused. That pause is structure — not indecision. Volume compression confirms it: absorption, not rejection.

A deeper OB sits below at 102.5k. If we tap it, it’s not invalidation — it’s refinement. But the primary play is already in motion.

The path:

Reclaim 105.7k range high

Break above intraday liquidity

Deliver to 108.3k inefficiency fill

Execution:

Entry: 104.8k–105.1k (current OB zone)

SL: Below 103.9k

TP: 108.3k

Don’t react to the candles. React to what they represent — engineered displacement followed by precision mitigation.

Final thought:

“This isn’t a trade setup. It’s a delivery route — and I’m already onboard.”

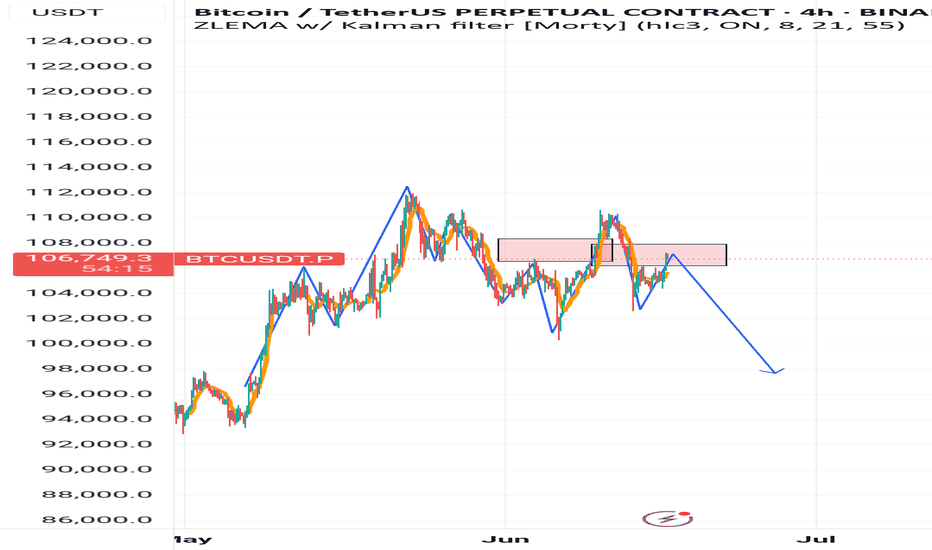

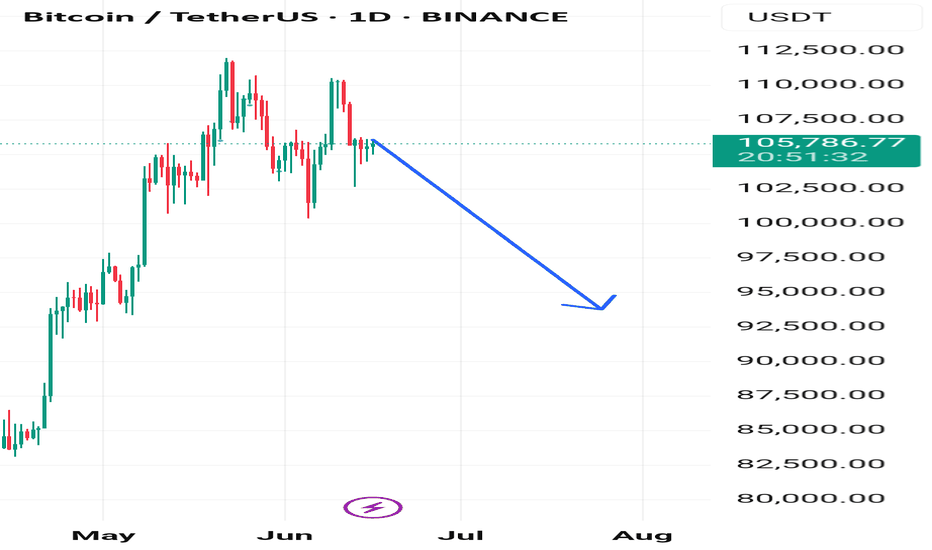

Crypto Crash Is Coming! Time to sell everythingThe war is escalating every day, major hits in Tel Aviv , Haifa and big cities. US will get involved wether they want it or not, since Israel doesnt want to stop the war without fully destroying all threats and leaders, and it can't finish the war alone.

Btc have to fill the monthly gap, crash is coming.

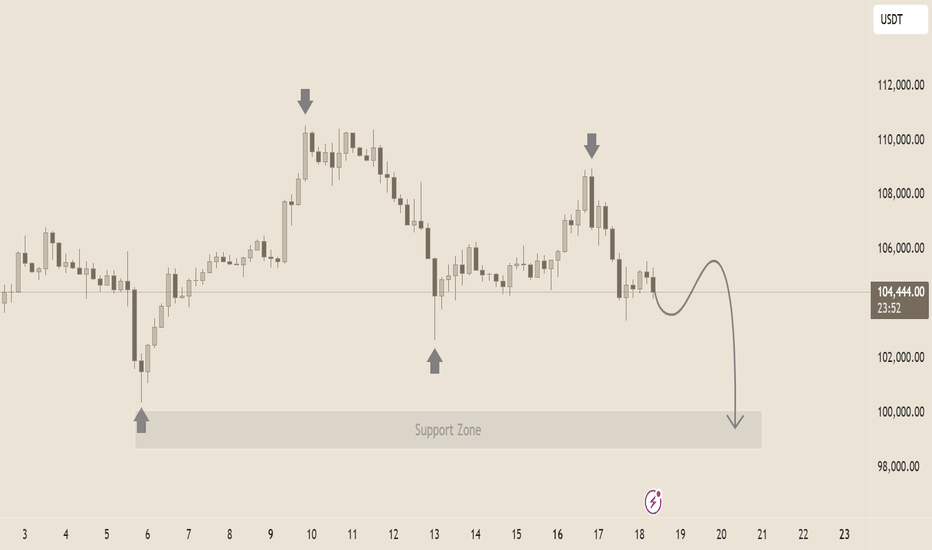

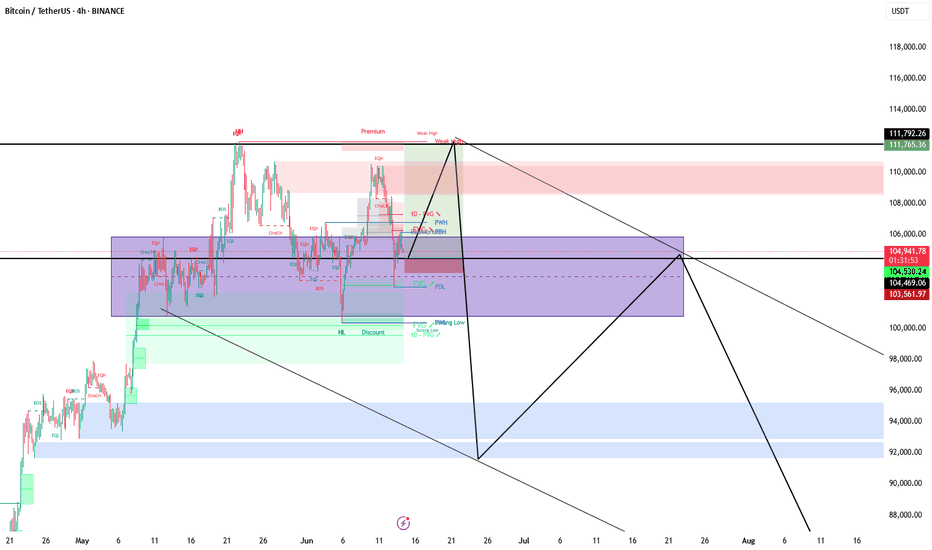

BTC/USDT Technical Analysis🔍 BTC/USDT Technical Analysis

📆 Chart Context:

Published on: June 18, 2025

Instrument: Bitcoin (BTC) vs Tether (USDT)

Timeframe: Appears to be 4H or 1H based on candle width and structure

🧠 Market Structure

🔸 Lower Highs Forming

Clear rejection from around 110,000–112,000 USDT

A sequence of lower highs suggests bearish momentum

Market is failing to break previous highs, signaling potential reversal

🔸 Strong Support Zone

Marked between $99,000 – $100,000

This level has previously caused price reversals (see June 6 and 13 wicks)

Currently being tested again — buyers have defended this area twice

🔁 Price Action & Candlestick Behavior

Recent candles show indecision and weakness after a mild bounce

Wick rejections near $106,000–$107,000 point to supply zone

Projected path (gray curve) implies a small pullback, then a breakdown into the support zone

📉 Prediction: Price Outlook

✴️ Short-Term (1–3 Days):

A likely pullback to $106,000, then a drop toward $100,000–$99,000

If support fails to hold, next target is $96,000–$94,500

✴️ Bearish Breakdown Confirmation:

Candle close below $99,000 with high volume = clear sell signal

In this case, bears may aim for $92,000–$90,000 next

✴️ Bullish Scenario (Less Likely):

If price holds above $104,000 and breaks $108,000, next resistance: $110,500–$112,000

📊 Key Technical Zones

Zone Type Price Level (USDT) Note

Resistance $110,000–$112,000 Previous top, major supply zone

Short-Term Resistance $106,000–$107,000 Weak bounce, possible entry area for shorts

Current Price ~$104,376 Weak consolidation

Support Zone $99,000–$100,000 Key demand area

Breakdown Target $96,000–$94,000 If support fails

✅ Professional Outlook Summary

Market Bias: 📉 Bearish

Action Zone: 🔍 Watching $106K as potential short entry

Support Critical: $99K must hold, or deeper drop

Risk Level: ⚠️ High volatility likely

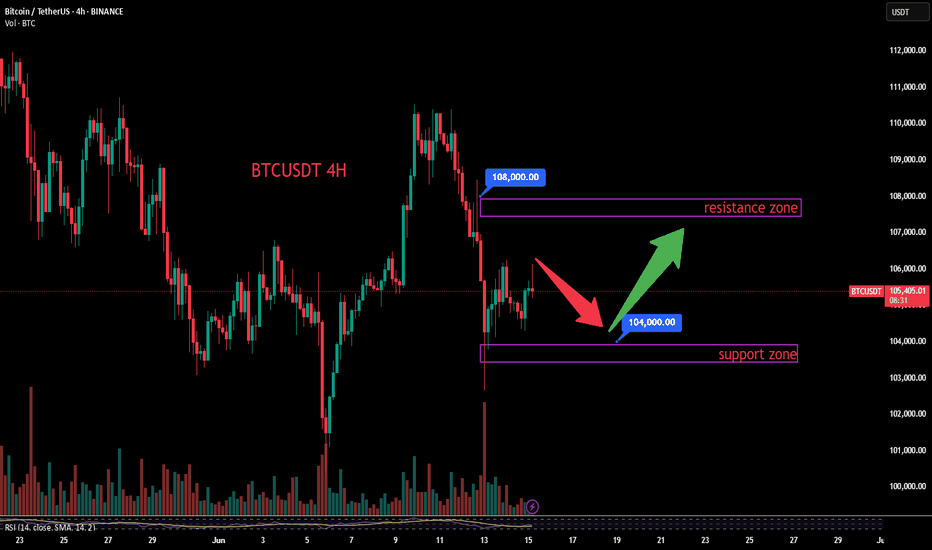

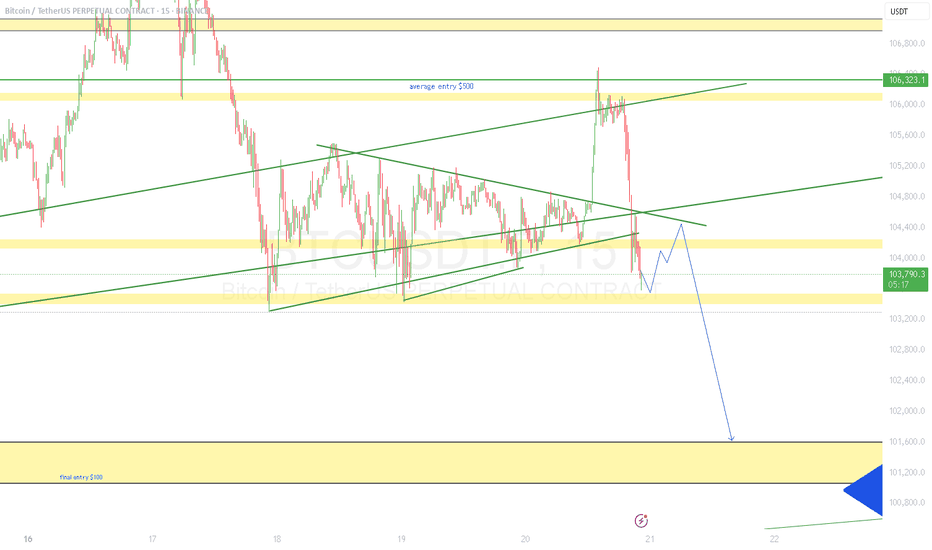

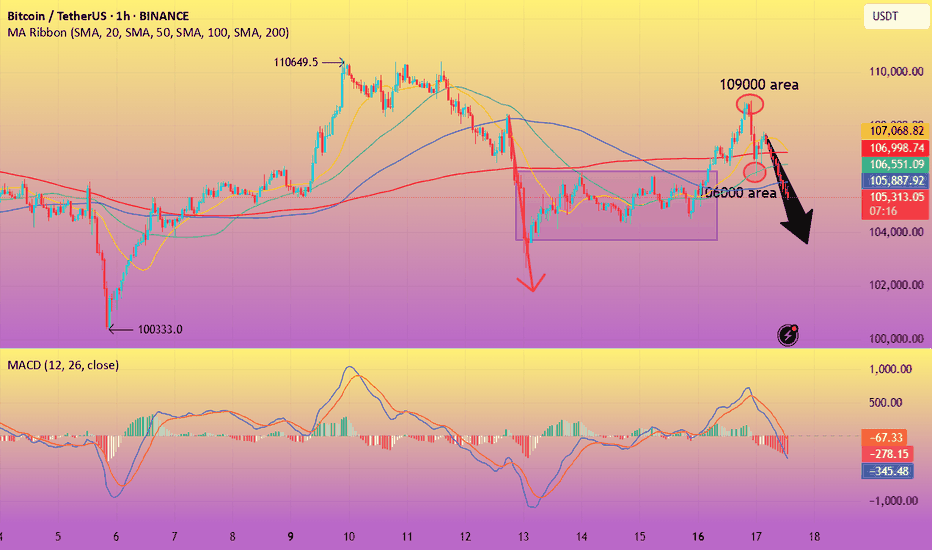

BTC-----Sell around 105500, target 104000 areaTechnical analysis of BTC contract on June 17:

Today, the large-cycle daily level closed with a small positive line yesterday, and the K-line pattern was a single positive line with continuous negative lines. The price was consolidating at a high level, but the attached indicator was dead cross, and the closing line yesterday was a long upper lead, and the high point was near the 109,000 area. Why is it difficult to continue the rise? The price did not break the previous high point, the continuity was poor, the technical indicators were not obvious, etc., which are all reference data; the short-cycle hourly chart showed that the European session rose yesterday, and the US session continued to break the weekend correction high position. The price fell under pressure, the intraday high was 109,000 area, and the intraday retracement low was 106,000 area. There is no obvious direction at present, so the European and American sessions are the focus, so pay attention to the strength and weakness of the European and American sessions and the breakout situation, and then we will layout according to the real-time trend. The European and American sessions are currently showing a downward trend.

Today's BTC short-term trading contract strategy:

The current price is 105,500 and directly short, stop loss in the 106,000 area; the target is the 104,000 area;

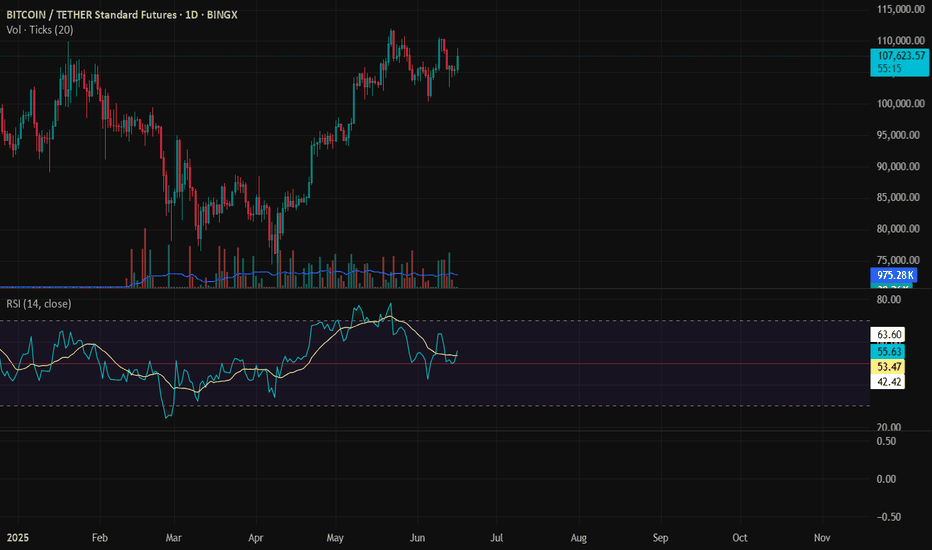

Today's BTC trading strategy, I hope it will be helpful to youBitcoin prices have fluctuated frequently in recent days, presenting a complex landscape. Looking at price data from the past week, Bitcoin has seen significant volatility. On June 13, triggered by Israel's airstrikes on Iran that escalated tensions in the Middle East, Bitcoin hit a low of $102,614 per coin—edging close to the $100,000 threshold. As of June 20, Bitcoin hovered around $104,500. While this represents a rebound from the recent low, prices remain relatively unstable, reflecting intense battles between bulls and bears with no clear trend established.

Reviewing this year's price trajectory, Bitcoin fell below $40,000 per coin at the start of 2025 before launching a robust rally. In less than a year, prices more than doubled, briefly hitting $99,000 per coin to set a new all-time high. Recent volatility can be seen as a correction after the prior surge—a common occurrence in crypto markets, typically a process where the market digests earlier gains and seeks a new price equilibrium.

Global macroeconomic conditions and shifts in crypto regulatory policies significantly impact Bitcoin prices. Continuously monitor the Federal Reserve's monetary policy stance: if the Fed signals rate cuts or implements easing, increased market liquidity may fuel Bitcoin's rally, warranting appropriate long position additions. Conversely, if the Fed hikes rates or maintains a hawkish stance, exercise caution and consider reducing positions. Meanwhile, track global crypto regulatory dynamics: positive policies from more countries can strengthen long positions, while signals of regulatory tightening require prompt strategy adjustments and position reductions to mitigate risks. Additionally, stay attuned to market sentiment and investor psychology to avoid herd behavior.

In Bitcoin's complex and volatile environment, long strategies must be flexibly adjusted. Investors should align with their risk tolerance and investment objectives, strictly implement strategies, and strive to maximize returns while minimizing risks.

Today's BTC trading strategy, I hope it will be helpful to you

BTCUSDT BUY@103000~104000

SL:102000

TP:105000~106000

BTC Accumulated Over 104K💎 BTC PLAN UPDATE (June 16)

NOTABLE BITCOIN (BTC) NEWS:

At least four publicly listed U.S. companies announced plans on Tuesday to significantly increase their cryptocurrency exposure, committing a combined $844 million in new investments. The move reflects a growing corporate appetite for Bitcoin and other digital assets as alternative stores of value and growth opportunities.

The most substantial commitment came from Hong Kong-based ready-meal provider DDC Enterprise Ltd, which disclosed three separate purchase agreements totaling $528 million. The entire sum is earmarked for expanding the company’s Bitcoin reserves.

Technical analysis angle

DAY DAY: Bitcoin is united when uncertainty takes root

Bitcoin price moves widely at about $ 106,300 at the time of writing the article after failing to reach the $ 107,000 resistance threshold on Monday. Its technical structure, as observed from the daily chart below, shows the trend of price increases.

The dynamic convergence indicator (MACD) has maintained the signal to be confirmed on Thursday when the blue MACD line cut under the red signal line. This signal often encourages traders to consider reducing exposure to Bitcoin, thereby creating a dynamic motivation.

The relative power index (RSI) highlights the discount trend when it is sloping, approaching the middle line 50. The movement is below this important neutral level that can catalyze the downtrend, bringing the average exponent dynamic line of 50 days (EMA) at $ 103,064, the 100 -day EMA road at $ 98,783 and the 200 -day EMA road at $ 93,083 to become expected targets.

==> Comments for trend reference. Wishing investors successfully trading

BTCUSDT Update — Big Macro Forces In Play!!Hey Traders!

If you’re finding value in this analysis, smash that 👍 and hit Follow for high-accuracy trade setups that actually deliver!

Bitcoin once again testing key support levels as global tensions continue to fuel uncertainty in the markets.

Chart Overview:

BTC broke down from short-term resistance and is now retesting the major support zone between $102K–$103K. The structure still remains within a broader consolidation range, but this support zone is absolutely critical for bulls to defend.

Immediate Resistance: $106K → $110K

Immediate Support: $102K → $100K

A breakdown below $100K could trigger deeper liquidations towards $95K–$98K, while a successful defense here could push BTC back toward previous highs.

Geopolitical Impact:

Global headlines are heavily influencing risk assets right now:

🇮🇱 Israel-Iran tensions are escalating.

🇺🇸 The US is signaling stronger involvement diplomatically, adding more fear to markets.

📉 Traditional markets have already started to show signs of caution.

Bitcoin, as a risk asset, remains vulnerable to these global macro shocks in the short term.

The Game Plan Right Now:

If we see sustained support at $102K–$103K, there’s still room for a relief bounce towards $106K–$110K in the near term.

However, if global tensions escalate further, expect increased volatility with downside liquidity grabs.

Stay cautious with tight risk management. Macro headlines are still driving sudden sentiment shifts.

📊 My Bias:

Watching for potential sweep of $102K with possible reversal structure forming. Any clear reclaim of $105K may signal a local bottom.

📝 Key Takeaway:

Global narratives are bigger than technicals right now. The next few days could dictate whether BTC holds or faces another sharp liquidation event.

Stay patient. Stay disciplined. And most importantly: manage your risk.

👉 Follow for more real-time updates as we track both price action and macro headlines impacting crypto.

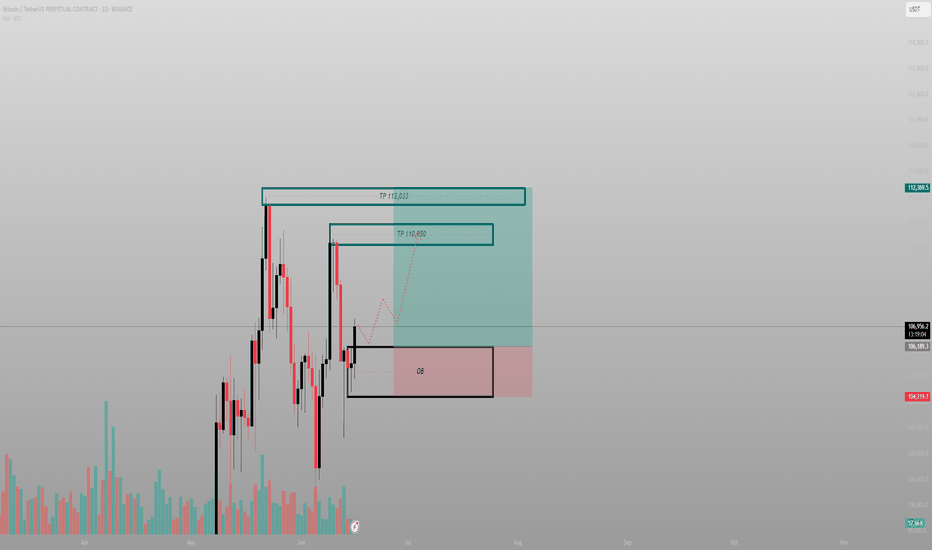

This isn’t a breakout. It’s a return to senderPrice didn’t rally from randomness — it tapped directly into a daily OB, respected it, and is now marching toward unfulfilled inefficiency above. What looks like recovery is really just Smart Money closing the loop.

The logic:

Price swept sell-side liquidity into a deep daily OB and rebounded sharply — not passively. The response wasn’t a bounce. It was intention.

Above? Two clean destinations:

TP1: 110,950 — inefficiency fill and EQ of prior supply

TP2: 112,033 — full delivery into unmitigated structure

No overlapping zones, no chaos — just precise levels that haven’t yet been claimed.

Execution:

Entry: 104,200–105,000 range

SL: Below 103,800

TP1: 110,950

TP2: 112,033

The risk is defined. The reward is prewritten.

Final thought:

“This move wasn’t built to excite you. It was built to deliver.”

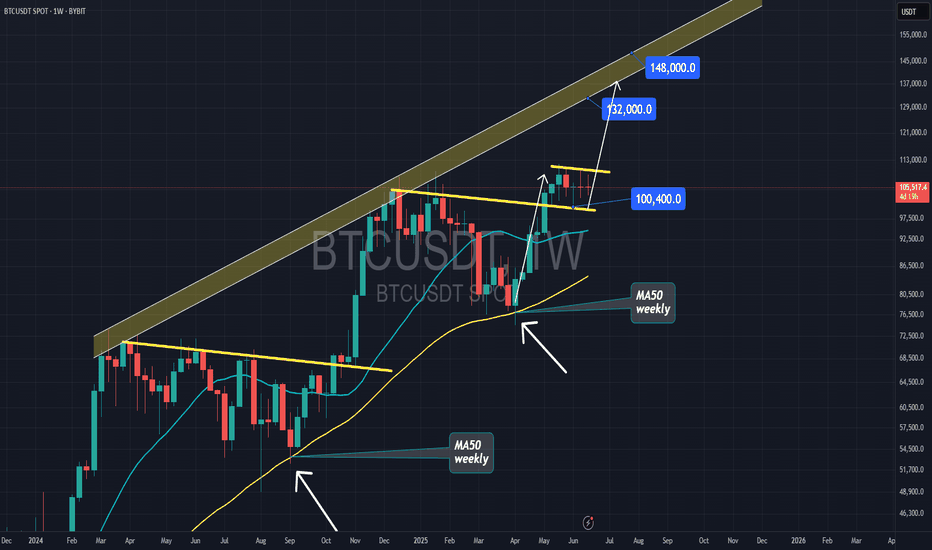

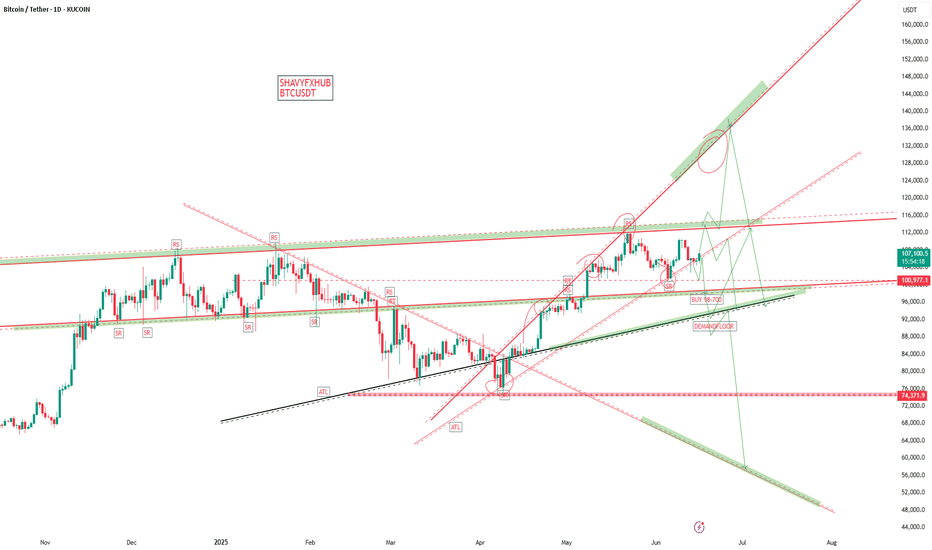

BITCOIN BITCOIN weekly candle closed respecting the demand ascending trendline and we have seen buyers return against speculation from elite traders,

the retest of daily roof will be watched for potential rejection at 111-117k, and i will be watching 125k-136k ascending trendline roof should we have a daily break of structure above the current ALTH.

keep eyes on break of the current floor break out on daily, close below will be a a new week rejection ,where we will likely hold sell into 98-97k zone .

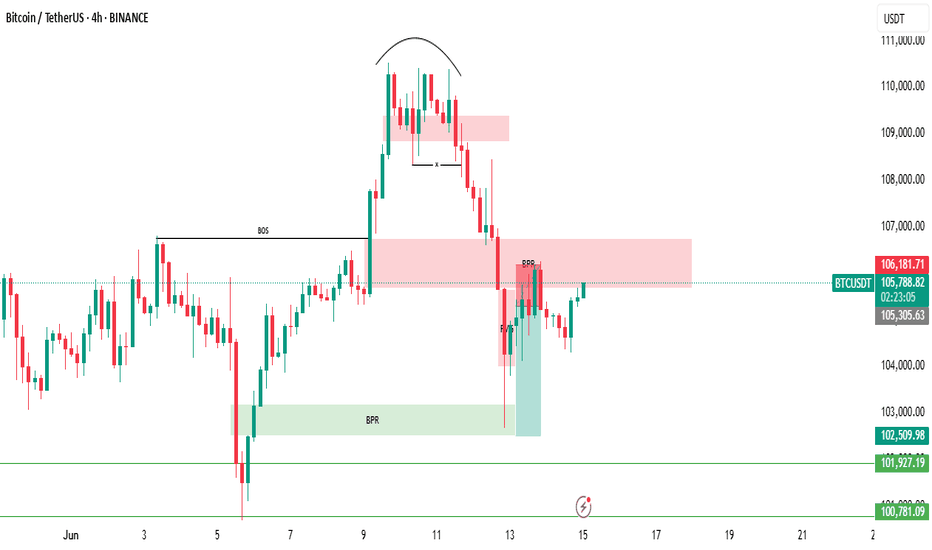

There is another Bearish BPR zone below the current price.BTC/USDT Market Update – Clear, Detailed, and Easy to Understand (Even for Beginners)

Let’s take a look at what’s happening with Bitcoin (BTC/USDT) right now explained in a way that even someone new to trading can follow along and understand.

Recently, Bitcoin hit a new high it was climbing up steadily. But then, due to negative global news related to war, the market took a hit and started dropping sharply.

Currently, BTC is trading at a (BPR) this is a technical area that often acts as a strong resistance zone, where the price tends to face rejection and reverse.

👉 Right now, Bitcoin is struggling to move higher and appears to be getting rejected from this BPR level.

But here’s where it gets more interesting:

🔻 There is another Bearish BPR zone below the current price, and the market has already touched that zone once before bouncing upward.

So what's the current situation?

📍 If Bitcoin is able to break above the current Bearish BPR (the level where it’s trading now) — it would be a bullish sign, and the market may start rising again.

📍 However, if BTC fails to break this resistance level, then we could see another strong move to the downside, possibly heading back to lower support zones.

🚨 Key Takeaway:

This level — the one BTC is currently interacting with — is very important.

📌 Traders should keep a close eye on it.

📌 Let the market reveal its direction before making any decisions.

Remember:

⚠️ This is not financial advice. Always Do Your Own Research (DYOR).

Technical Analysis of Bitcoin

From a market analysis perspective, the daily chart of the large cycle has closed with consecutive declines, the price is below the moving averages, and the indicator is in a death cross, indicating a bearish trend. However, it is necessary to be wary of the stimulation from the news and data caused by the current unstable national situation. In operation, risk control should be paid attention to, and the moving average pressure level near 106,000 on the daily chart should be focused on.

In the hourly chart of the short cycle, the decline continued in the European session after the morning decline yesterday, the U.S. session broke the low of the previous day, and the price rebounded and corrected at the support in the early morning. Currently, it is still in a corrective trend. Today, focus on the high pressure level in the 106,000 area, as well as the impact of the strength of the European session and the unemployment benefit data in the evening on the trend.

you are currently struggling with losses,or are unsure which of the numerous trading strategies to follow,You have the option to join our VIP program. I will assist you and provide you with accurate trading signals, enabling you to navigate the financial markets with greater confidence and potentially achieve optimal trading results.