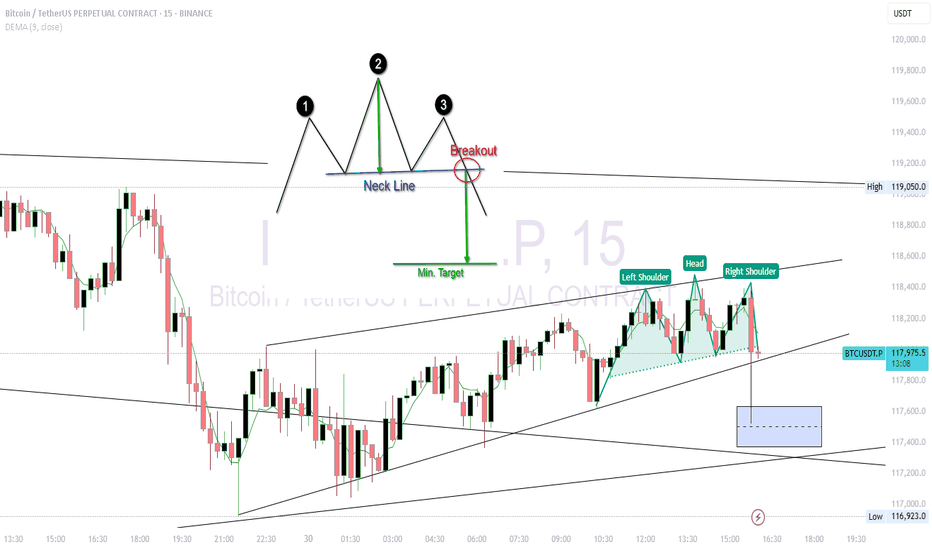

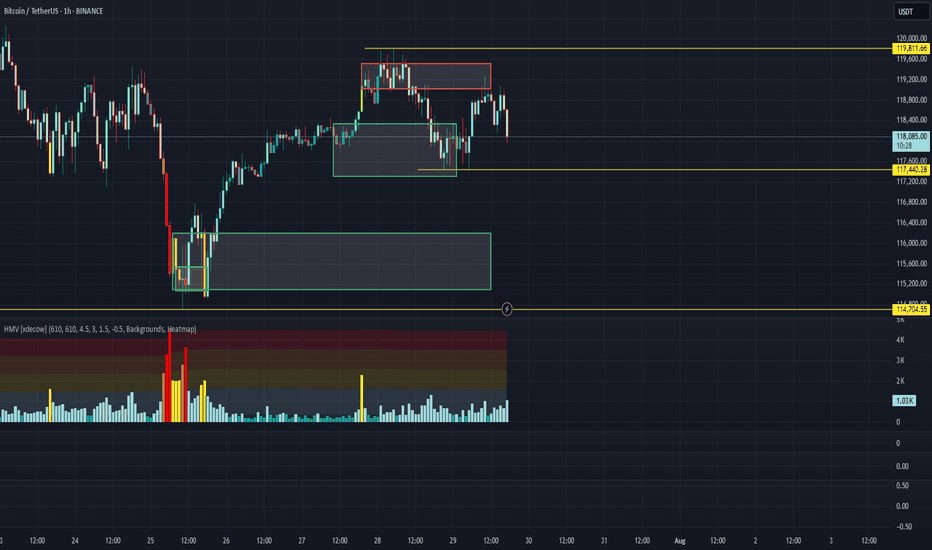

BTC USDT Forming Head and shoulder in 5 MinChart Breakdown

🟢 Pattern:

Left Shoulder: 118,450

Head: ~118,600

Right Shoulder: ~118,400

Neckline: Sloping slightly upward, around 118,050

📌 Bearish Breakdown Scenario

If BTC breaks below the neckline (~118,000) with volume, the expected drop (measured move) is:

Height of pattern:

Head (118,600) – Neckline (118,000) = 600 pts

Target on breakdown:

118,000 – 600 = ~117,400

🔻 Target: 117,400–117,300

🔒 Invalidation: Price closes above 118,300 with strong volume.

BTCUSDT.5S trade ideas

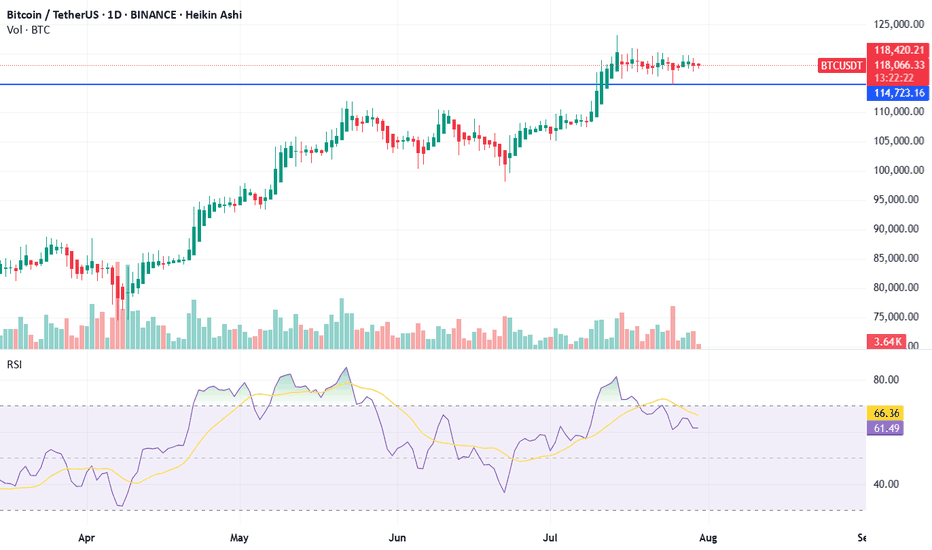

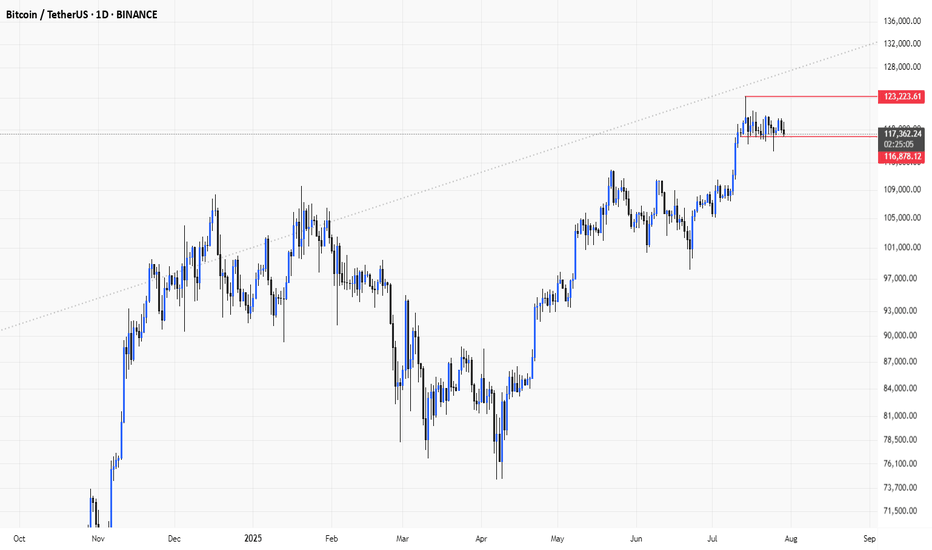

$BTC Daily OutlookDaily Chart

Today’s close printed a small bearish doji; visually bearish but still another inside-day that keeps BTC boxed between the High-Volume Node / v-Level cluster at $116 860-$123 300.

Holding $116 860 remains critical; lose it on a daily close and price can easily slide to the weekly breakout shelf near $111 960. We are now 16 days inside this balance. Per Auction-Market-Theory rule #5, the longer price churns at the edge, the more resting liquidity is absorbed, eventually a decisive push will follow. If buyers defend $116 860 again, the path opens toward range high $123 300 and the prior ATH; if they fail, expect a fast flush to the weekly V-Level.

Footprint Read

Value Area High and Low span the full candle, with the POC parked mid-range, classic two-sided trade. Delta finished negative and the heaviest prints sit at session lows: sellers hit the bid hard, yet could not follow through. That absorption leaves shorts vulnerable to a squeeze if new selling momentum doesn’t appear quickly.

Fundamental Pulse – Week Ahead

ETF Flows: Spot-Bitcoin ETFs booked three consecutive inflow days to close last week (+$180 M net). Sustained demand under the range supports the bullish case.

Macro Data: U.S. FOMC & Federal Fund Rates prints for this week; expect more volatility starting from tomorrow.

Game Plan

Primary bias stays long while daily candles close above $116 860; upside trigger is a clean for now or shorts squeeze toward $123 300.

If $116 860 breaks with volume, prepare for a quick liquidity hunt into the weekly shelf at $111 960, where we reassess for swing longs.

Intraday: I’ll monitor the Intraday Chart on tomorrow's High impact events and look for best opportunities across the board. Alt window: a fresh downtick in BTC Dominance could spark rotation; watch high-Open Interest majors if BTC ranges.

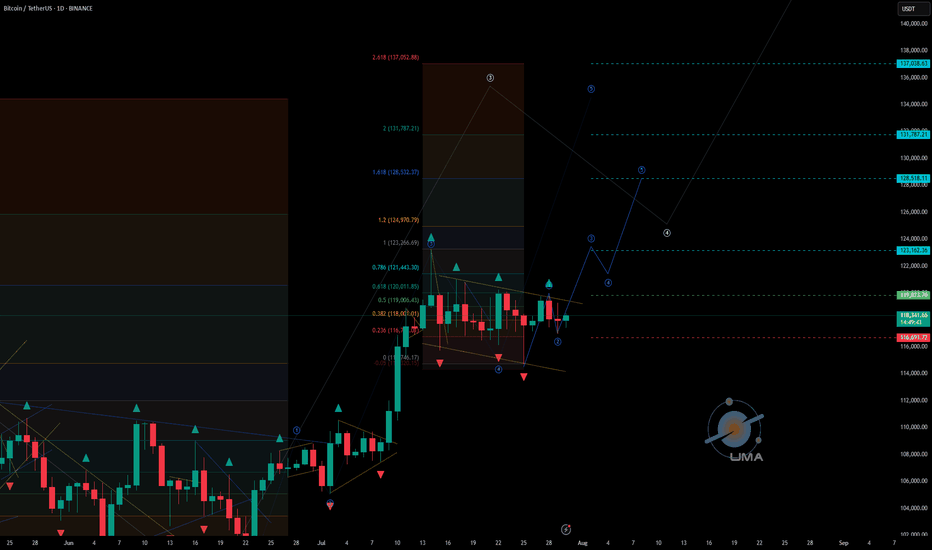

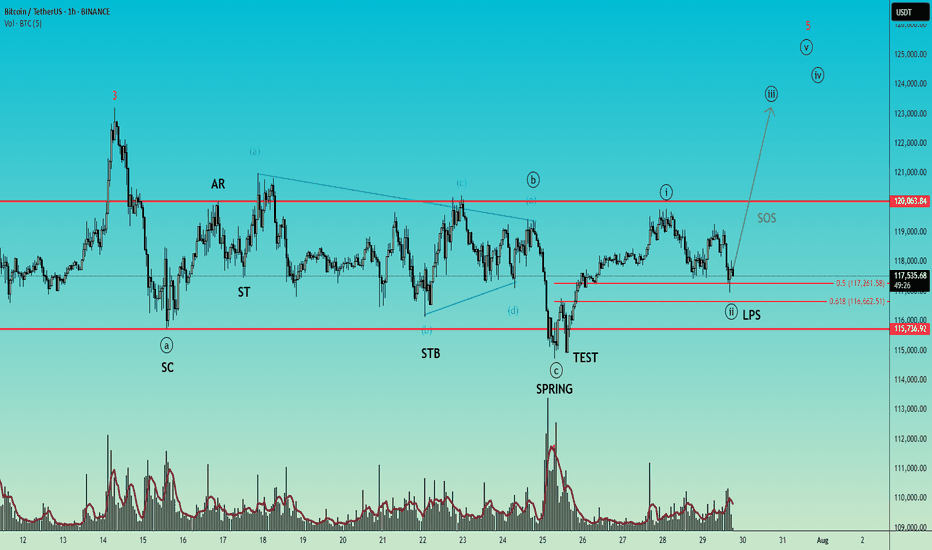

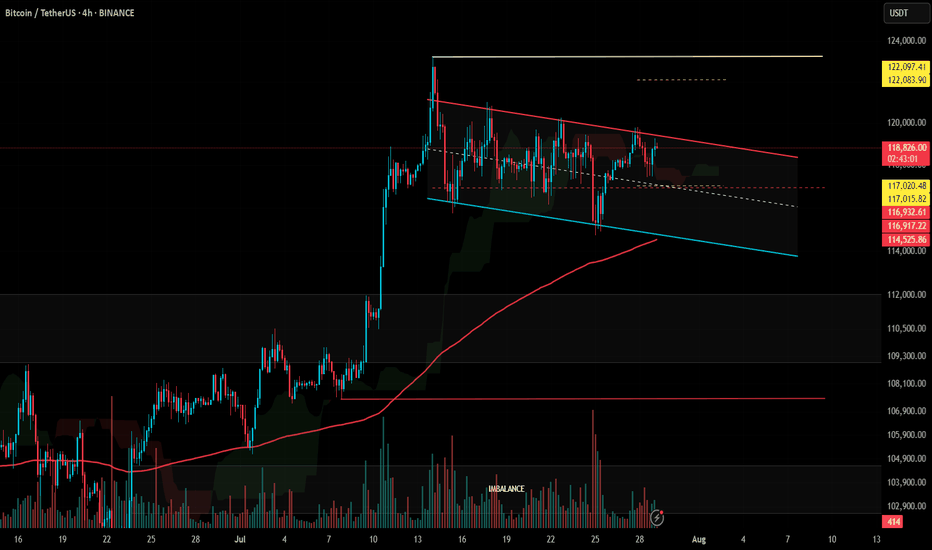

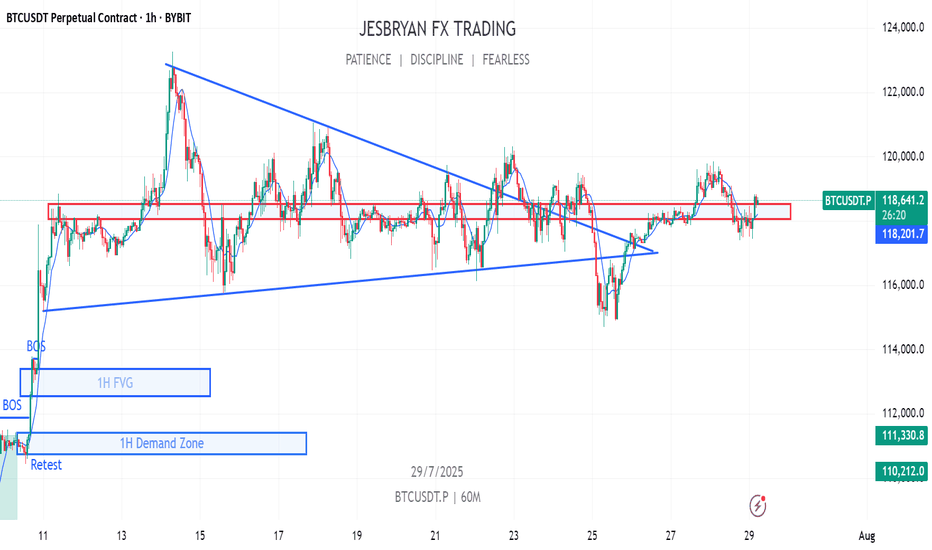

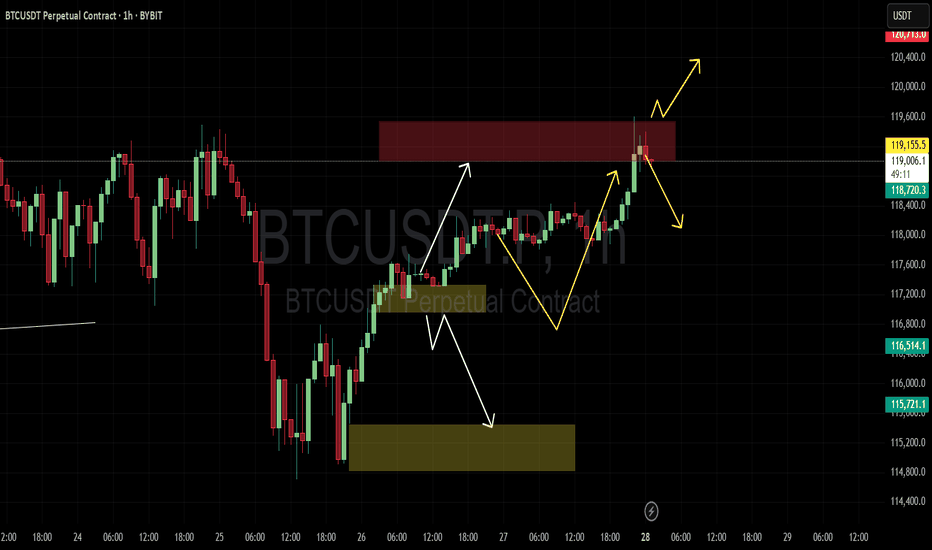

BTCUSD – Wyckoff Accumulation + Elliott Wave SynergyTimeframe: 1H

Title: "A textbook Wyckoff Accumulation with Elliott Wave Confirmation – Sign of Strength Next?"

This chart presents a textbook Wyckoff Accumulation structure seamlessly combined with Elliott Wave Theory, highlighting how the two methodologies can complement each other in timing and structural validation.

🔍 Wyckoff Accumulation Phases:

SC (Selling Climax) and AR (Automatic Rally) define the range.

ST (Secondary Test) and STB (Secondary Test in Phase B) confirm horizontal support.

A classic Spring and Test pattern occurs in Phase C, marked by a sharp downward probe below support (Spring), followed by a successful retest with no new low (Test).

The LPS (Last Point of Support) is forming above the Spring low and near the 61.8% Fibonacci retracement level, showing bullish absorption of supply.

The recent rally and pullback suggest we're entering Phase D, with the Sign of Strength (SOS) expected next.

🌀 Elliott Wave Alignment:

The Spring aligns with the end of wave (iv) of a larger impulse, and the structure unfolding from the Spring appears to be the start of wave (v).

The move from Spring to SOS shows impulsive qualities, labeled as wave (i), with the corrective pullback forming wave (ii), ending near the golden Fibonacci ratio (61.8%).

This alignment of wave (ii) with the LPS further validates the accumulation and sets the stage for a strong wave (iii) within wave (v), likely to coincide with a Sign of Strength breakout.

💡 Key Takeaways:

This is a classic Wyckoff Accumulation with all major phases visible: A to D.

Elliott Wave counts confirm the internal structure and suggest bullish continuation.

Watch for the SOS rally above resistance at ~120k to confirm the transition into Phase D/E and a potential trending move.

🔔 Conclusion:

Combining Wyckoff and Elliott Wave provides a high-probability setup. A successful break above resistance will signal the start of a trend phase. LPS offers a favorable risk-reward area, especially with wave (ii) possibly completing soon with a test of Fibonacci ratio (61.8%).

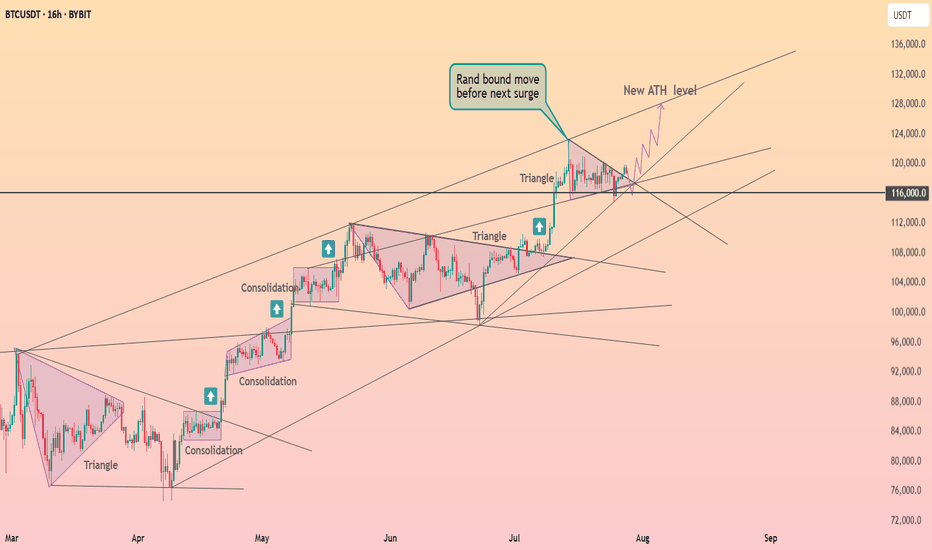

Bitcoin is testing the boundaries of the triangle ┆ HolderStatBINANCE:BTCUSDT is printing higher lows along trendline support near $67,800. The price is compressing into a wedge below $69,000 resistance. A breakout would confirm continuation toward $71,000–$72,000. Momentum remains intact unless $67.5k is broken. The market is building pressure for the next impulsive move.

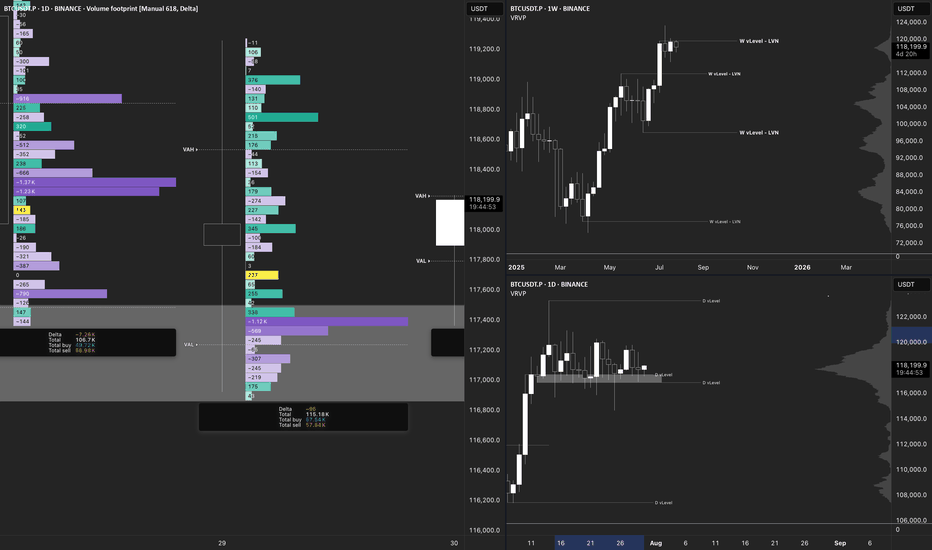

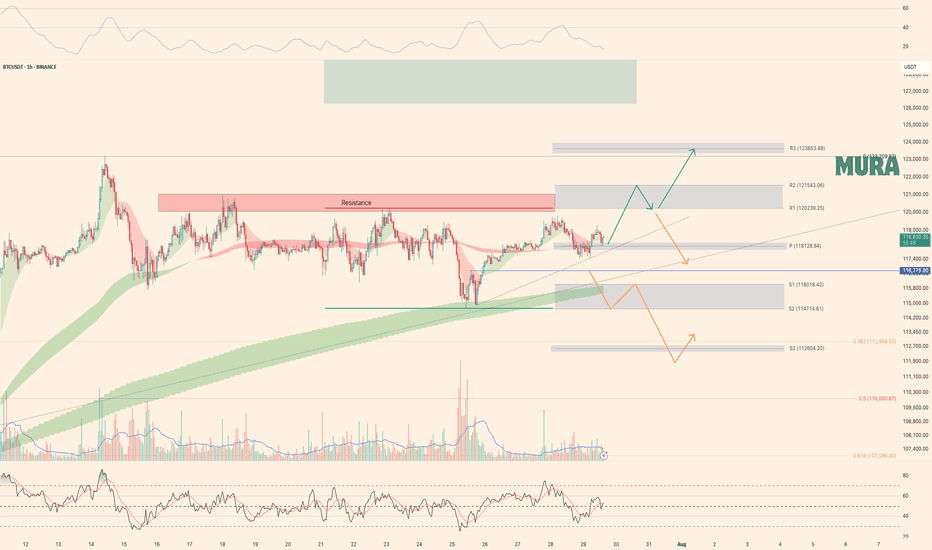

BTC/USDT Analysis — Potential Sideways Range

Hello everyone! This is the daily analysis from the CryptoRobotics trading analyst.

Yesterday, Bitcoin experienced a local reversal. At this point, two zones previously marked by us have been worked out:

Buy zone — $118,300–$117,300

Sell zone — $119,500–$119,000

We now expect continued rotation within the $117,400–$119,800 range, with potential expansion in both directions. The overall context remains positive, so a full breakout to the upside could occur in the near future.

Buy zones:

$116,200–$115,000 (volume anomalies)

$110,000–$107,000 (accumulated volume)

This publication is not financial advice.

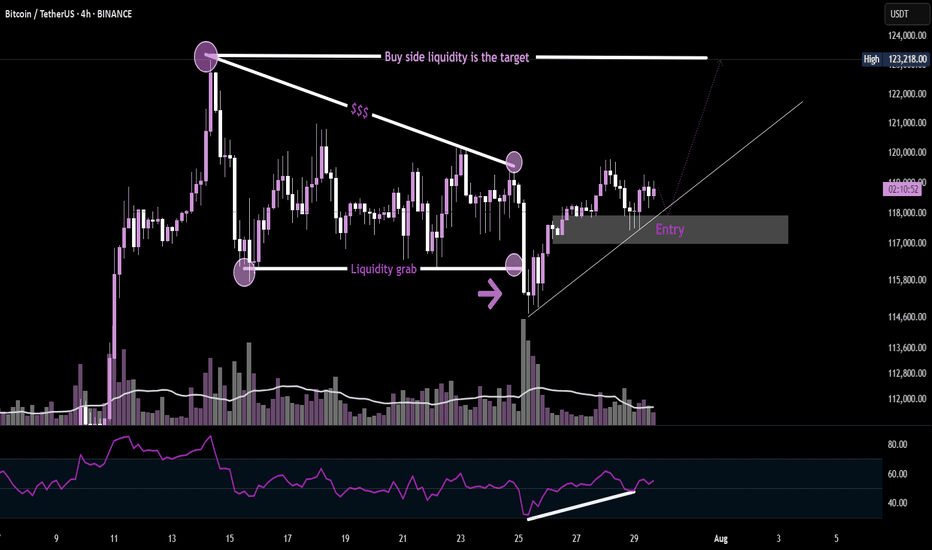

BTCUSDT-4H {Now Eyes on the Buy-Side Sweep}BTC on the 4H chart just executed a classic liquidity grab at support, followed by a strong bullish push.

🔹 Descending trendline tapped multiple times (indicating compression)

🔹 Entry zone forming on retest of previous demand

🔹 Target: Buy-side liquidity above $123K

🔹 Volume + RSI divergence supports the bullish bias

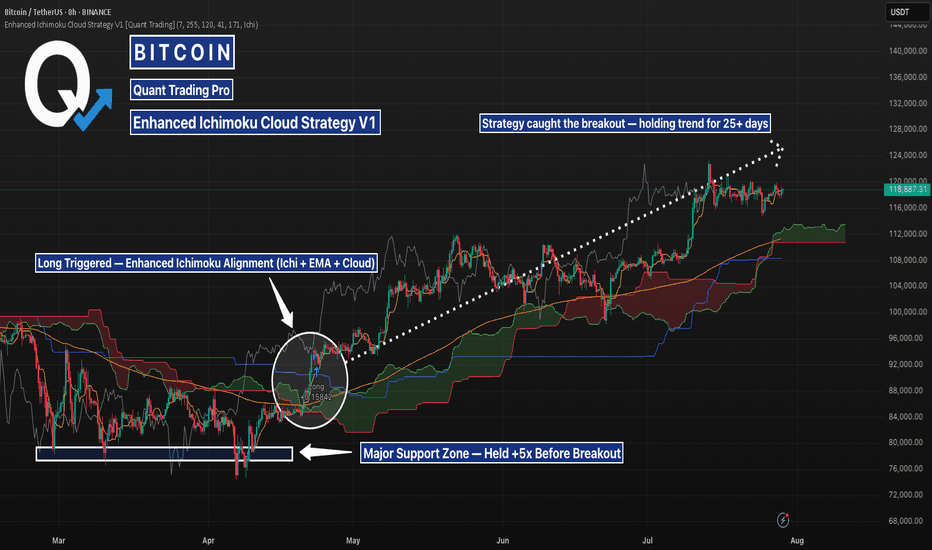

BTCUSD 8H – Long Triggered on Cloud Flip, Can This Trend Keep?This BTC 8H setup highlights how the Enhanced Ichimoku Cloud Strategy V1 caught a +27% move using clean trend confirmation and a low-noise entry.

📊 Setup Breakdown:

Major Support Zone held 5+ times between March and April — confirming buyer interest.

Entry triggered once:

Ichimoku Cloud flipped bullish

Price crossed the 171 EMA

Strategy alignment confirmed by Ichi + EMA + Cloud filters

Entry candle: ~$93,400

Current price: ~$119,000 → +27% trend continuation.

📈 Strategy Logic:

This system combines:

Custom Ichimoku (7 / 255 / 120 / 41) for cloud confirmation

A 171 EMA filter to block noise

A trend-following “state memory” logic to avoid premature reversals

This BTC move is a textbook example of how the strategy avoids second-guessing and holds strong trends without constant recalibration.

⚠️ What to Watch Next:

Price is currently ranging near prior highs

Cloud remains bullish, but RSI and momentum divergence should be monitored

If support holds above ~112K, continuation is likely — break below could shift structure

✅ Backtest this strategy on your charts to see how it handles your favorite assets.

It’s best used on high-timeframe trends where precision and conviction matter most.

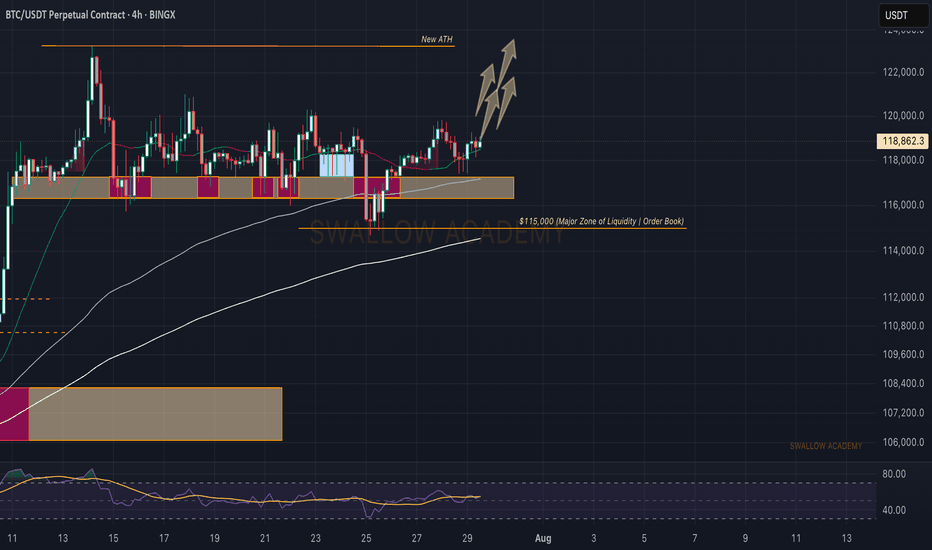

Bitcoin (BTC): Aiming For Re-Test of ATH | $123KBitcoin is back in the bullish zone, where we had a good bounce from $115K, where we had a huge order sitting and since then we have been seeing continuous movement to upper zones.

We are looking for further movement from here towards the ATH zone, where we then expect some huge volatility to occur!

Swallow Academy

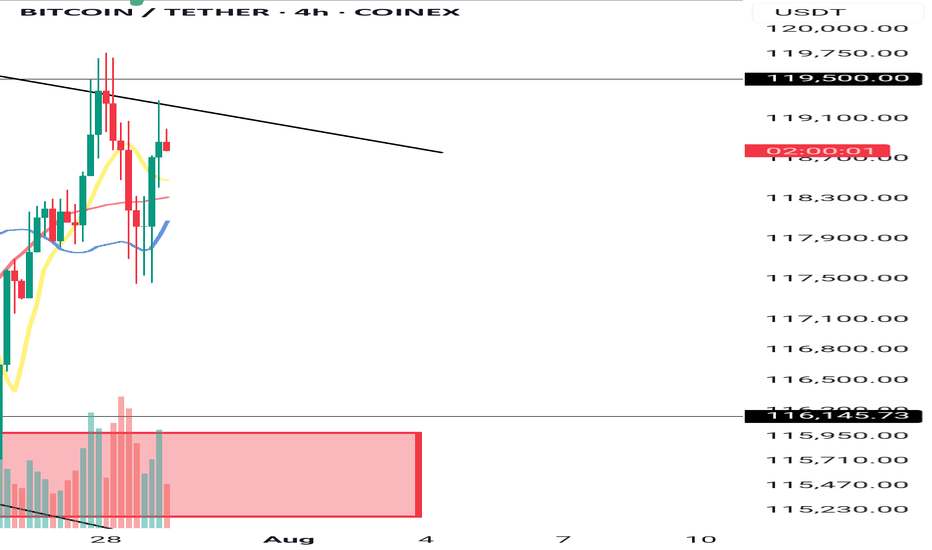

Weekly trading plan for BitcoinLast week price followed our orange scenario. Right now, we're stuck in a sideways correction, and here's what matters:

1. $118K is the big level this week

Stay above it? Good chance we retest ATH

Break below with no recovery? That's trouble

2. If we lose $116,780 next → $112K becomes the target

I've got all the charts and details covered in this video idea—check it out for the full picture!

Daily BTC, ETH & Market Index Analysis💎🔥 Daily BTC, ETH & Market Index Analysis & What Comes Next? 🔥💎

Smash the 🚀, FOLLOW for daily updates, and drop your thoughts in the comments!📈💬

♦️ Hello everyone!

Here’s what you can expect from this page:

🟡 Every Day: BTC & ETH analysis + complete market index overview

🟡 Every Sunday: Top 10 Altcoin breakdown (excluding BTC & ETH)

🟡 🆕 Coming soon: Weekly Watchlist every Sunday!

💛Your likes and follows are what keep this crypto routine going 💛

⭕️ 24-Hour Market Crash – Summary for Crypto Traders

Let’s break down what happened 👇

1️⃣ A massive wave of liquidations in futures and derivatives triggered heavy selling pressure.

2️⃣ BTC Dominance dropped, but capital also exited altcoins and flowed into BTC – a clear fear response and move toward safer assets.

3️⃣ Institutional players reduced exposure to altcoins to limit risk, causing deeper price drops.

4️⃣ On Ethereum, over $2.3B ETH is queued for unstaking, raising the chance of near-term sell pressure.

5️⃣ Ongoing pressure from investor sentiment shifts and global uncertainty is pushing money out of high-risk assets like crypto.

6️⃣ ⚠️ But this is a technical correction, not a fundamental collapse. For long-term thinkers, this could be a buy-the-dip opportunity.

🔥❗️Heavy Crypto Sentiment Week Ahead

As mentioned yesterday, we’re at a critical point across key crypto indexes:

♦️ BTC, ETH, major altcoins, and indexes like BTC.D, USDT.D, TOTAL, TOTAL2, TOTAL3.

🚨 Tomorrow brings a major crypto-impacting event — the Fed interest rate decision.

Most forecasts suggest no change. However, with rising stock indexes, there’s no clear pressure to cut inflation.

Any unexpected comments or decisions by Powell may drive new waves in the crypto space.

♦️ BTC

🗓 Monthly candle closes in 2 days — be cautious around this point.

🔑 $120,300 is still the main breakout level.

If it breaks with BTC Dominance rising, altcoins may stall (unless paired bullishly with BTC).

If it breaks while BTC.D drops, expect strong altcoin momentum.

⚔️ Two scenarios for entries:

1️⃣ Entry at $119,500 – higher risk of getting stopped out but tighter SL.

2️⃣ Entry above $120,300 – more reliable but wider stop due to breakout wick.

🟡 Key Support: $115K–$117.3K – still valid, but repeated testing weakens the zone.

❗️❓️Why does it get weaker?

Because each test drains buy orders. Sellers eventually overwhelm this level as buyers lose firepower.

♦️ BTC Dominance (BTC.D)

Trend isn't clearly bullish yet, but the recent drop has slowed down.

Structure is shifting – two key levels to watch:

1️⃣ 60.83 – rejected yesterday.

2️⃣ 60.42 – if this breaks down, alts may push higher.

♦️ TOTAL (Crypto Market Cap)

Stuck at the $3.91T resistance.

💥 Breakout = strong volume and momentum injection. Be positioned accordingly.

♦️ TOTAL2 (Altcoins excl. BTC)

At the $1.53T key level – breakout or rejection will shape altcoin direction.

♦️ TOTAL3 (Altcoins excl. BTC & ETH)

Still eyeing the $1.08T resistance zone.

♦️ USDT Dominance (USDT.D)

If 4.44% breaks and holds – bullish structure in BTC & alts will be in danger.

Until then, focus on long setups.

📌 Make sure you’re positioned before 4.13% breaks — alts typically begin moving before that confirmation.

♦️ ETH/USDT

If ETH closes below $3,480, expect extended correction or range.

♦️ Trading Outlook

1️⃣ Today may be quiet – market awaits reaction to tomorrow’s index events (Fed, BOJ, Powell).

2️⃣ These updates can create new moves or shift bias toward short setups.

💎 If this helped your crypto planning, hit the 🚀, FOLLOW for more daily setups, and share your thoughts in the comments! 🔥📊

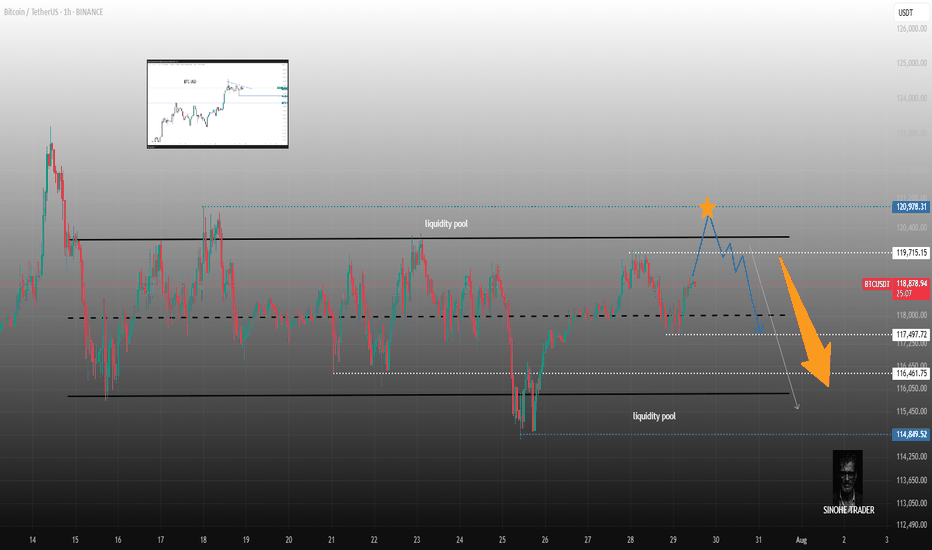

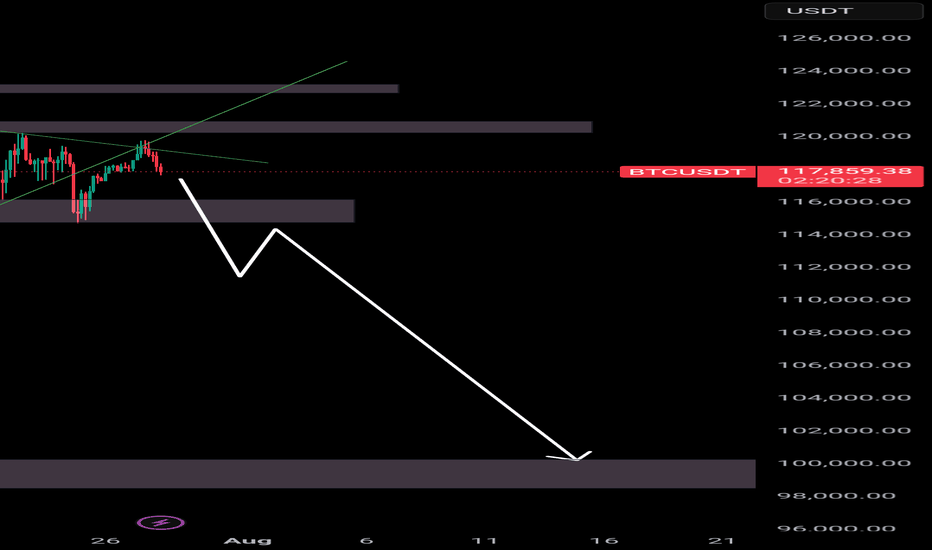

Hunting for liquidity. Retest resistance before a fallBitcoin is still in correction, but is rebounding from the local low of 117.4, formed during the pullback, and is heading back up towards the zone of interest at 119.8-120.1, which it did not reach during the main upward movement. I see no fundamental or technical reasons for the correction to end and for growth beyond 121K. I expect a rebound from the resistance zone towards 115-114K. However, in the medium term, I expect the market to attempt to close half or all of the gap between 112K and 114.8K, thereby expanding the key trading range.

Resistance levels: 119.77, 120.1K, 120.8K

Support levels: 117.4, 116.37, 115.68

Technically, a false breakout (liquidity capture) of key resistance and price consolidation in the selling zone could trigger bearish pressure on the market, which in turn would lead to a correction.

#BTC Update #11 – July 29, 2025#BTC Update #11 – July 29, 2025

Bitcoin continues to move within the channel and has completed several corrections of its last impulsive move. It is currently undergoing a correction within a correction. There was a liquidation zone around the $117,000 level, which was mostly filled, triggering a reaction.

From what we can observe now, Bitcoin is facing rejection from the upper boundary of the channel. If it manages to break out of the channel and continue its climb, I believe it will target the high liquidity zone near $122,000.

At this stage, Bitcoin is not in a suitable position for either long or short trades.

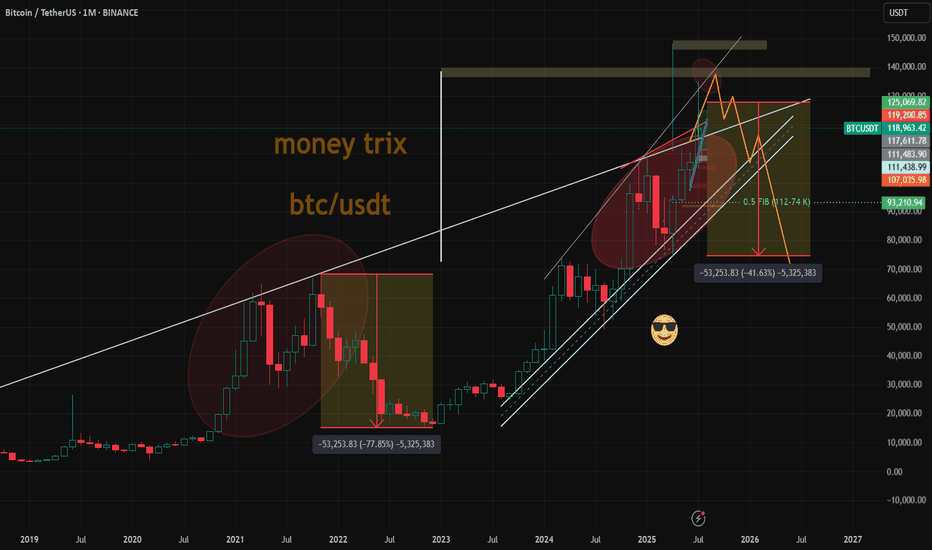

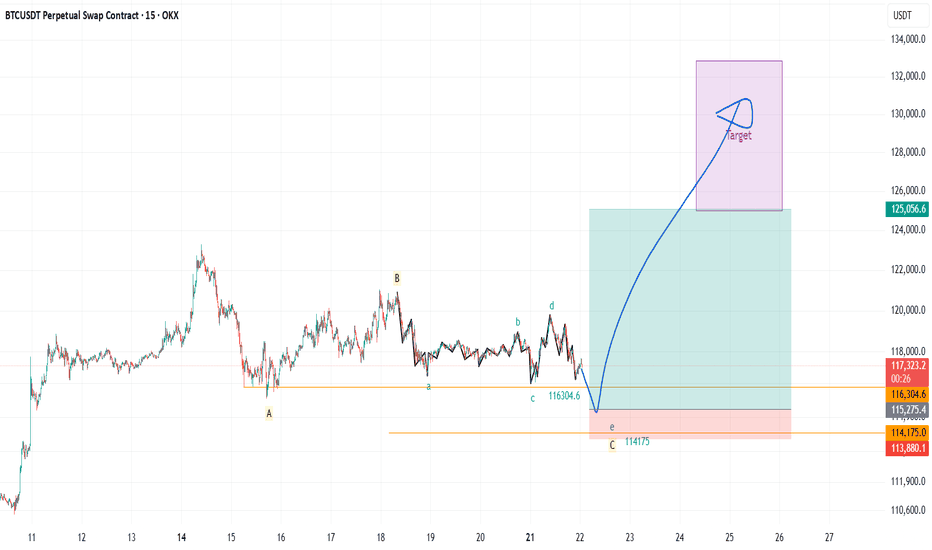

EP 01: BTC correction near completionAfter the impulse to last ATH we got a 3 wave correction, last wave being formed by 5 waves, so all together coming to completion. We should visit the liquidation area under last low and swipe that liquidity and aim closer to last ATH if not exceeding it. When the market gives us more information we will go for episode 02.

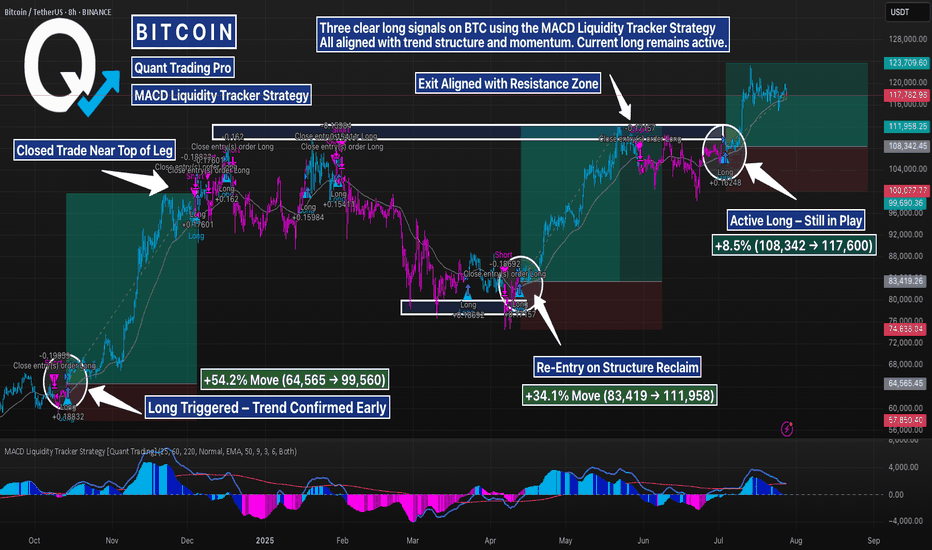

BTC MACD Liquidity Tracker Strategy – High Timeframe Long CallsThis BTC 8H chart shows how the MACD Liquidity Tracker Strategy has tracked trend structure cleanly across multiple long signals — each aligning momentum and EMA bias on the mid-to-high timeframe.

First long: Triggered at ~64,565 and exited near 99,560 as momentum peaked

Second long: Re-entry at 83,419 after reclaiming structure, closed near 111,958

Third long (active): Triggered at 108,342 and currently holding above 117,000 with trend still intact

Color-coded bias (blue/pink) helps confirm context at a glance. The combination of MACD momentum shifts + 60/220 EMA filters prevents early entries and helps capture large legs without excessive noise.

Want to explore or customize the strategy?

Search “MACD Liquidity Tracker Strategy ” and run your own backtests to refine parameters per asset.