Market - BTC - ETH Analysis

💎 Market - BTC - ETH Analysis💎

🟠 Current Market Status: ⚠️ / Low Risk-Reward ❗️ / Avoid Overtrading 🚫

🔷 BTC/USDT (Multi-Timeframe Analysis)

• Weekly (HWC): Last week’s red candle tapped into a buyer zone. A balance or sideways movement is likely this week.

• Daily (MWC): Minor retracement in a downtrend. No clear bullish reversal yet.

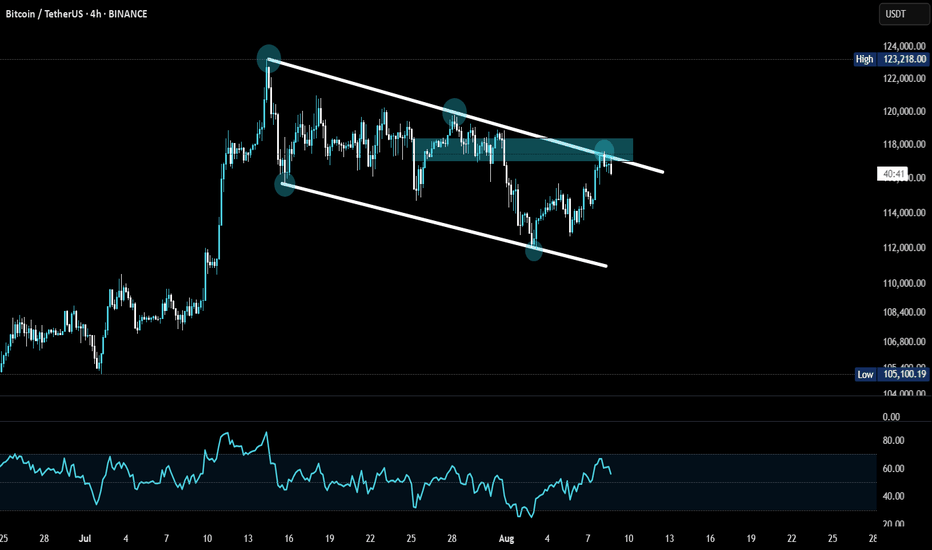

• 4H (LWC): Still in a downtrend. For a bullish reversal, we need a Higher Low (HL) followed by a break of the previous High.

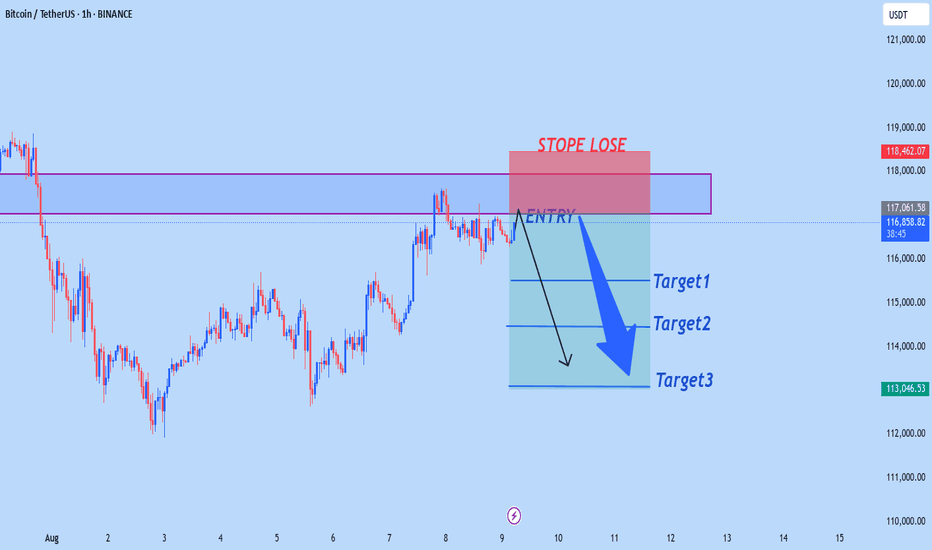

• 1H: Breakout above level 116 would signal a short-term trend reversal. Breaking the upper channel confirms bullish continuation in the lower timeframe.

✅ Strategy Outlook:

• HWC: Bullish

• MWC: Bullish

• LWC: Bearish

→ We're not shorting based on LWC unless it turns bullish or MWC flips bearish.

🕒 Conclusion: Stay on the sidelines until the structure shifts clearly.

🔶 BTC Dominance (BTC.D)

• Currently rejected in the 4H chart, but not yet a confirmed bearish structure.

🧭 Two setups to watch before rotating into altcoins:

1. Clear lower highs and lower lows in 1H and 4H

2. Box formation and breakdown in lower timeframes

🚨 Key Level: A break below 60.40 may trigger sharp altcoin rallies.

🌐 TOTAL / TOTAL2 / TOTAL3

• All three charts share a similar structure.

• 1H TOTAL: Break of 4.72 confirms a V-pattern and may trigger upside momentum.

• TOTAL2: Watch 1.42 as a critical level.

→ Until then: No action – Wait for breakout confirmation.

💵 USDT Dominance (USDT.D)

• Ideally should not retrace beyond 4.64 – if it forms a top here, that’s a bullish sign for the market.

• Level 4.44 is less relevant for now.

• Failure to reclaim 4.53 increases the importance of 4.64.

• If it starts dropping, enter before a breakdown of 4.13 to stay ahead of bearish pressure.

🟠 ETH/BTC

• Consolidating in a 4H box.

• Break of 0.03278 is a trigger for long ETH exposure — ideally hold post-breakout.

• Wait for SMA7 on the Daily to turn upward for stronger confirmation.

• Break of 0.03288 on ETH/BTC likely aligns with $3850–$4000 breakout on ETH/USDT.

→ Position should be taken before this breakout to catch the move early.

📌 Final Note:

We are in a low momentum, low R/R environment.

Only trade confirmed breakouts and structural shifts.

Avoid overtrading, keep risk exposure limited, and rely on higher-timeframe confluences for clearer direction.

BTCUSDT.5S trade ideas

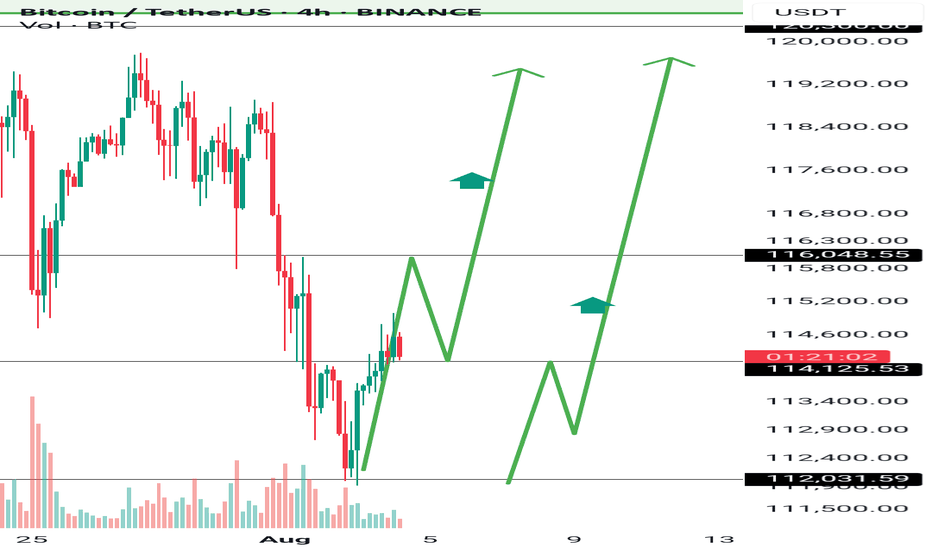

Don’t Panic Yet… BTC Might Just Be ReloadingBitcoin is doing something it’s done before.

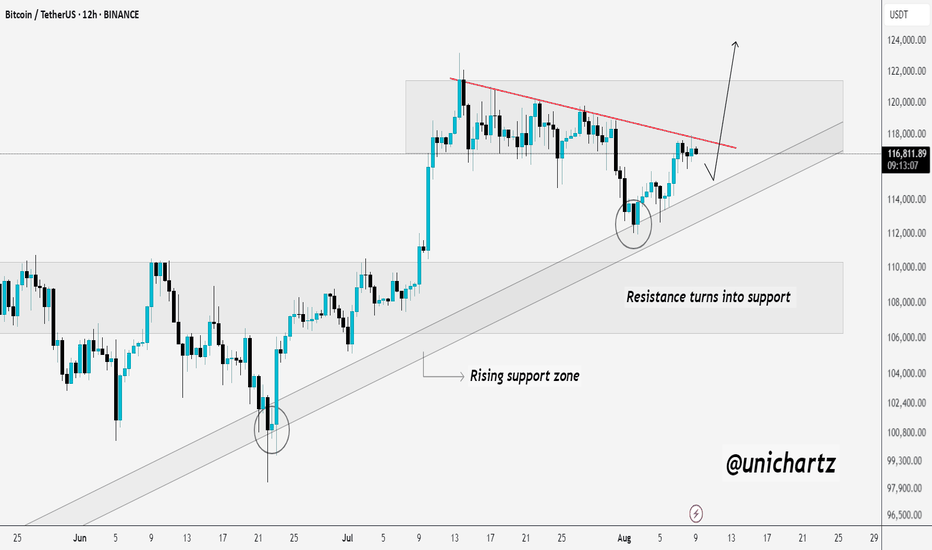

Every time CRYPTOCAP:BTC has pulled back into this key rising zone, it’s bounced back stronger. The last few dips got absorbed right at this level, and we’re seeing the same setup again now.

Price recently flipped a major resistance into new support, and that level is being tested again. If it holds, we’re likely looking at another leg up possibly towards $124K.

Nothing is broken. Just a typical retest in an uptrend.

DYOR, NFA

Thanks for the reading

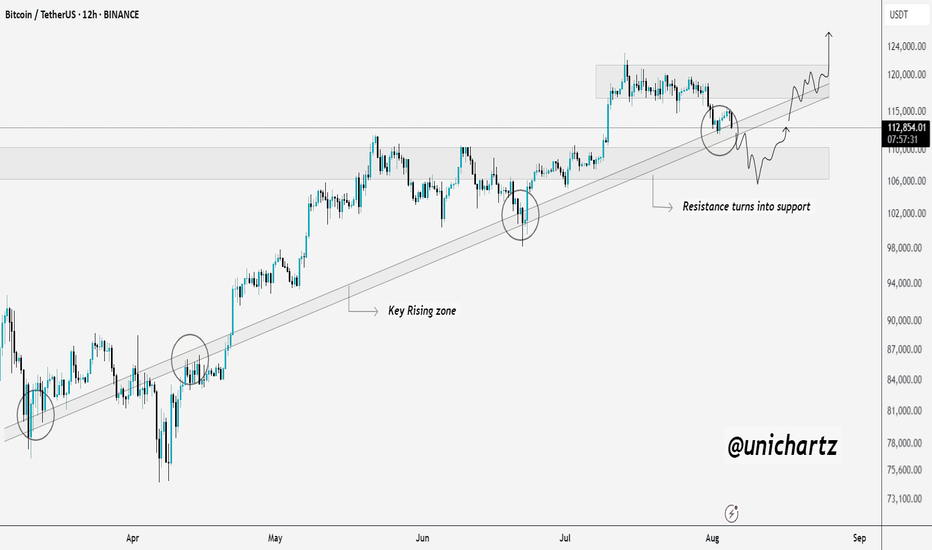

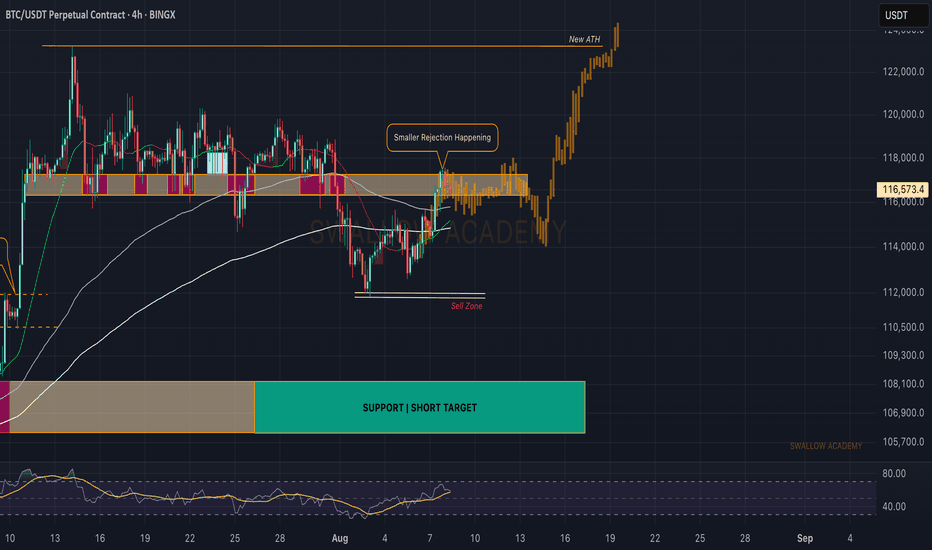

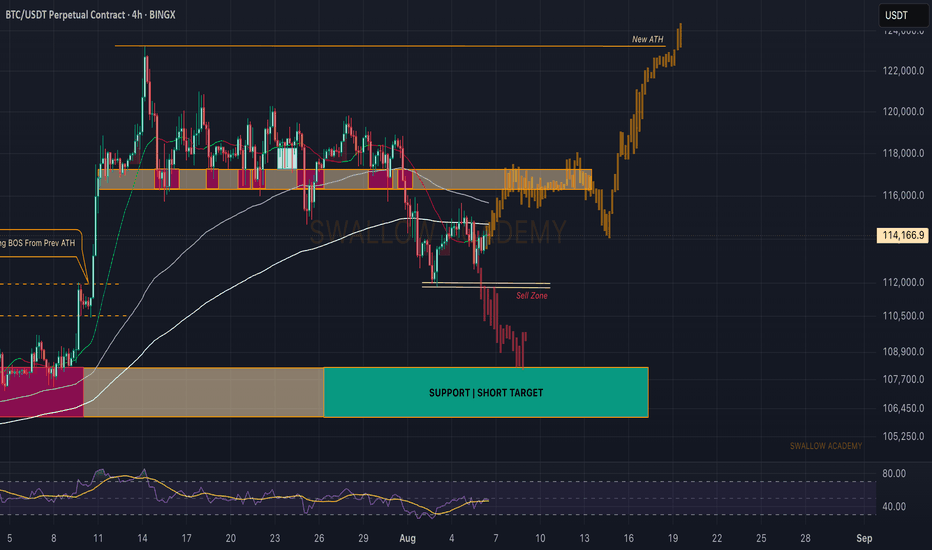

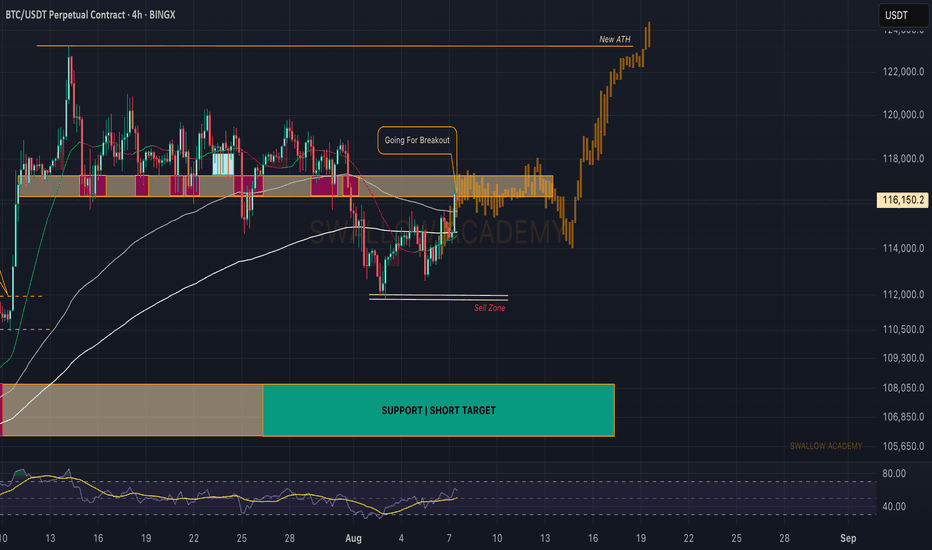

Bitcoin (BTC): Seeing Resistance At $116K, Waiting For BreakoutBitcoin had a good rally, where after reaching the local resistance zone, we had the rejection, a smaller pullback.

The plan has not changed; we are looking for that breakout, which would lead us back into the sideways channel and potentially give us the retest of ATH!

Swallow Academy

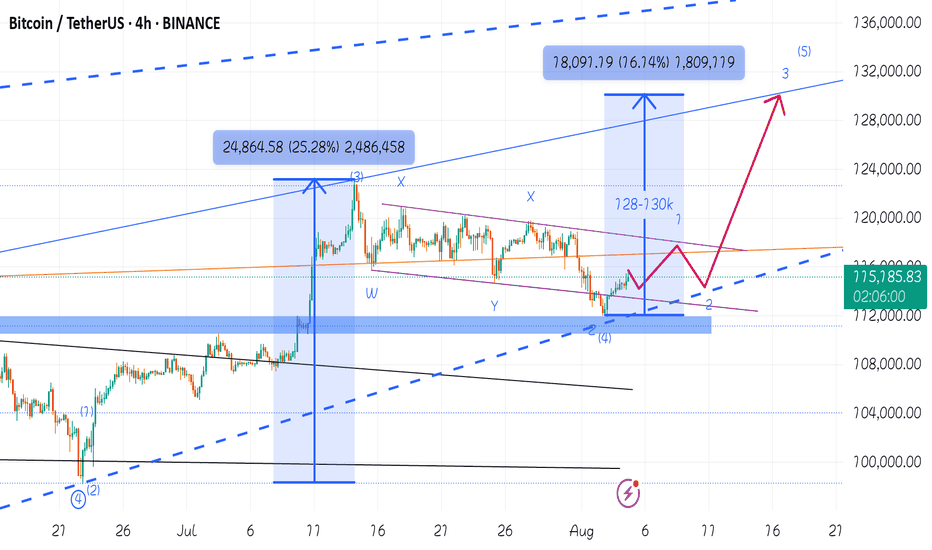

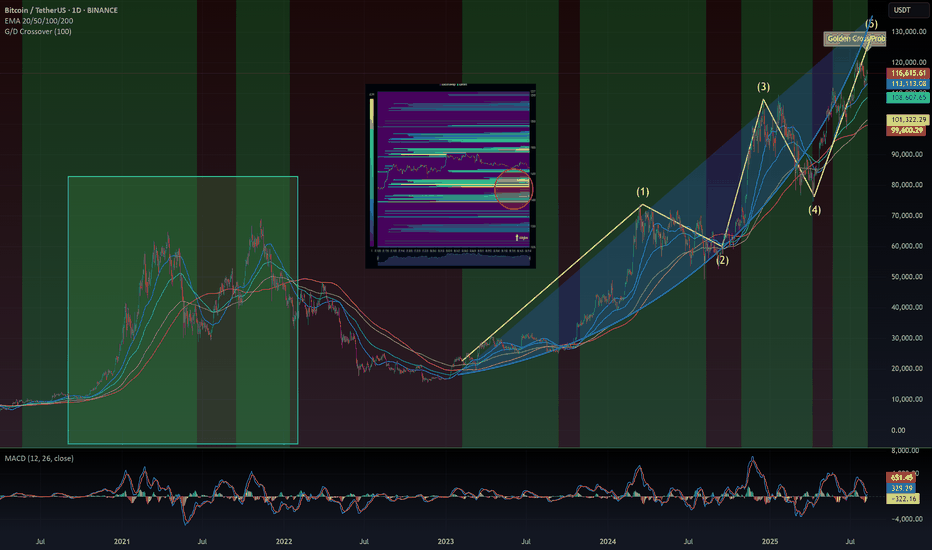

You don't know what's going on , 130K waiting for youI have shown in my previous post that Bitcoin is looking for a correction of wave 4 from wave 5 of the main wave 3 of Elliott waves, I said wait for 112k and then buy altcoins. It seems that the Elliott wave 4 micro-wave has completed its correction with the 50% Fibonacci percentage, I predict Bitcoin will touch the 128-130k levels at the end of Elliott wave 5. as I said before altcoins season is in the midway

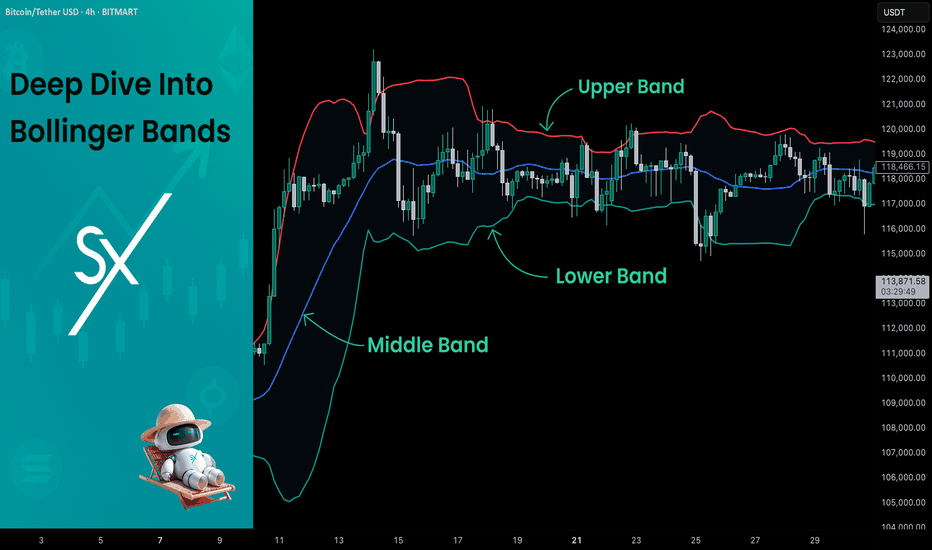

Deep Dive Into Bollinger Bands 🗓This article explores the Bollinger Bands indicator—a powerful volatility tool used by traders worldwide. You'll learn how it works, how to calculate it, and how to use it to detect potential breakouts, trend reversals, and overbought or oversold conditions in the market.

📚 Introduction to Bollinger Bands

In the fast-paced world of trading, understanding market volatility is key to making informed decisions. Bollinger Bands, developed by John Bollinger in the 1980s, offer a visual and statistical method to measure this volatility. Unlike simple moving averages, which only tell you the trend, Bollinger Bands expand and contract based on recent price action, helping traders spot overbought, oversold, or consolidation phases.

These bands dynamically adjust to market conditions, making them one of the most popular indicators for trend-following, mean-reversion, and breakout strategies. Whether you’re trading crypto, stocks, or forex, Bollinger Bands can help you identify high-probability setups by combining trend direction with volatility.

📚 How Bollinger Bands Are Calculated

Bollinger Bands consist of three lines:

Middle Band – This is a simple moving average (SMA) of the price, typically over 20 periods.

Upper Band – The middle band plus two standard deviations.

Lower Band – The middle band minus two standard deviations.

Middle Band = SMA(n)

Upper Band = SMA(n) + (k × σₙ)

Lower Band = SMA(n) - (k × σₙ)

Where σₙ is the standard deviation of the price for n periods and k is the multiplier, typically set to 2, which captures ~95% of price action under normal distribution. The middle band shows the average price over the last 20 candles. The upper and lower bands adjust based on how volatile the price has been — expanding in high volatility and contracting in low volatility.

🤖 For those traders who want to implement Bollinger Bands into algorithmic strategy we provide formula it's calculation in Pine Script:

basis = ta.sma(src, length) // Middle Band (SMA)

dev = mult * ta.stdev(src, length) // Standard Deviation × Multiplier

upper = basis + dev // Upper Band

lower = basis - dev // Lower Band

📚 How to Use MACD in Trading Strategies

⚡️Bollinger Band Squeeze (Volatility Contraction and Expansion)

The idea is pretty simple, а squeeze indicates low volatility and often precedes a breakout. The squeeze is the situation when the Upper Band and Lower Band contract, and BB width is at a local minimum. In this case you shall be prepared for the high volatility after the period of low volatility. This strategy doesn’t predict direction — it prepares you for volatility.

Long setup:

Price is in long-term uptrend, you can use 200 EMA as a major trend approximation - price shall be above it.

Bollinger Bands is narrow in comparison to the previous period. Price usually is in sideways.

Open long trade when candle shows a breakout and closes above the Upper Band.

Set a trailing stop-loss at the Middle Band.

Short setup:

Price is in long-term downtrend, you can use 200 EMA as a major trend approximation - price shall be below it.

Bollinger Bands is narrow in comparison to the previous period. Price usually is in sideways.

Open short trade when candle shows a breakdown and closes below the Lower Band.

Set a trailing stop-loss at the Middle Band

📈Long Trading Strategy Example

1. Price candle shall be closed above 200-period EMA. In our example we have BITMART:BTCUSDT.P 4h time frame.

2. Bollinger Bands shall be narrow in comparison with the previous periods.

3. Open long trade when candle closes above the Upper Band.

4. Close trade when price touched the Middle Band.

📉Short trading strategy example

1. Price candle shall be closed below 200-period EMA. In our example we have BITMART:BTCUSDT.P 4h time frame.

2. Bollinger Bands shall be narrow in comparison with the previous periods.

3. Open short trade when candle closes below the Lower Band.

4. Close trade when price touched the Middle Band.

⚡️Mean Reversion (Rebound from the Bands)

This is the most common approach to use Bollinger Bands. The idea is also very simple, we just want to open long if price touches Lower Band and short if price reaches Upper Band. Price tends to revert to the mean (Middle Band), especially in range-bound markets. It's very important to trade in the direction of the major trend to reduce the probability of the large move against you.

Long setup:

Price is in long-term uptrend, you can use 200 EMA as a major trend approximation - price shall be above it.

Open long trade when price touches the Lower Band.

Set the initial stop-loss at the fixed percentage below entry price. Choose this percentage number with your personal risk/money management, you shall be comfortable to lose this amount of money in case of stop-loss hit.

If price reached Middle Band set stop-loss at breakeven.

Close trade when price reached the Upper Band.

Short setup:

Price is in long-term downtrend, you can use 200 EMA as a major trend approximation - price shall be below it.

Open short trade when price touches the Upper Band.

Set the initial stop-loss at the fixed percentage above entry price. Choose this percentage number with your personal risk/money management, you shall be comfortable to lose this amount of money in case of stop-loss hit.

If price reached Middle Band set stop-loss at breakeven.

Close trade when price reached the Lower Band.

🧪 Important: the most common approach to close trades is the Middle Band touch, this is classic mean reversion. We experimented multiple times with different approached and revealed that usually it's better to take profit at the Upper/Lower band for long/short trades and use Middle Band only for setting stop-loss at breakeven. This approach provides better risk to reward ratio.

📈Long Trading Strategy Example

1. Price candle shall be closed above 200-period EMA. In our example we have BITMART:BTCUSDT.P 4h time frame.

2. Open long trade the Lower Band.

3. Put Initial stop-loss 2% below the entry price.

4. When price reached Middle band place stop-loss at the breakeven.

5. Close long trade at the Upper Band.

📉Short trading strategy example

1. Price candle shall be closed below 200-period EMA. In our example we have BITMART:BTCUSDT.P 4h time frame.

2. Open short trade the Upper Band.

3. Put Initial stop-loss 2% above the entry price.

4. When price reached Middle band place stop-loss at the breakeven.

5. Close short trade at the Lower Band.

🧪 Important tip: notice that initial stop-loss is needed only to avoid disaster in case of price moves strongly against you. This percentage shall give enough space to avoid its reaching too often. Mean reversion strategy provides fast trades with the small average gain, so you shall maintain the high win rate (perfectly above 70%). You have to choose stop-loss based on particular asset volatility.

⚡️Combined Approach: Mean Reversion + Trend Following

Skyrexio made multiple researches about Bollinger Bands strategies and we found that we can receive better gains in combination of different approaches. Mean reversion gives you great entry with discount but you don't need to exit that early. Use the trading stop and allow to gain profit while market is moving in your direction.

This approach you can find in our advanced strategy Bollinger Bands Enhanced Strategy which we shared in 2024. Click on the link to read about it and understand how you can combine best features of this popular indicator.

📚 Conclusion

Bollinger Bands are more than just a volatility indicator — they provide a flexible framework for understanding price dynamics and market conditions. By visualizing the relationship between price and standard deviation around a moving average, traders can gain valuable insights into whether an asset is consolidating, trending, or preparing for a breakout.

The real strength of Bollinger Bands lies in their versatility. They can adapt to different trading styles — whether you’re a short-term scalper, a swing trader, or a long-term position holder. From identifying squeeze setups to riding strong trends or capturing mean reversion moves, BBs offer a strategic edge when used correctly.

However, Bollinger Bands should never be used in isolation. Like any technical tool, they work best when combined with momentum indicators like RSI or MACD, volume analysis, and price action signals. Context is key: a signal that works well in a ranging market may fail during high momentum trends.

Ultimately, Bollinger Bands help traders make more informed, disciplined decisions by clarifying where price stands relative to recent history. When paired with sound risk management and broader market awareness, they become a powerful ally in navigating market uncertainty.

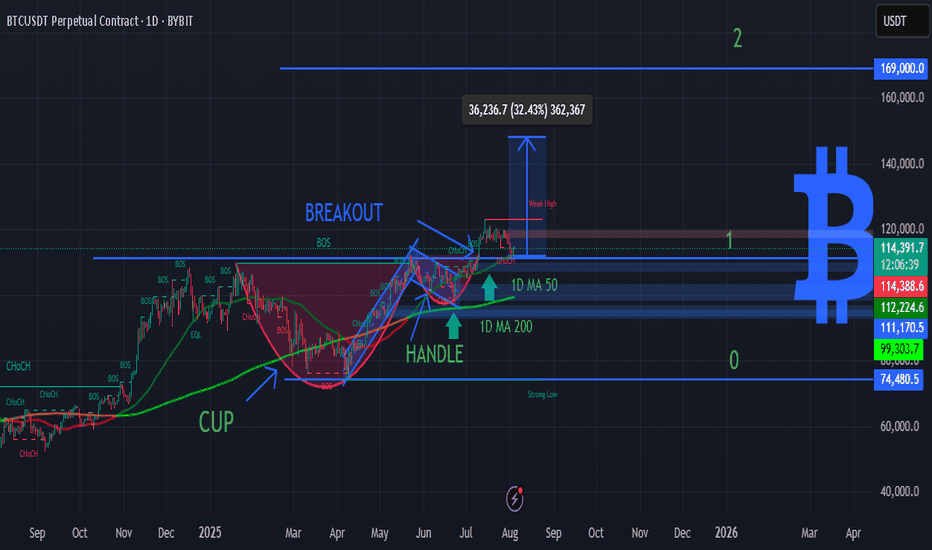

BTC DAILY - CUP & HANDLE BREAKOUT TARGETING $169KBitcoin just confirmed a macro Cup & Handle breakout with a strong push above the $112K neckline. The price is now consolidating above key moving averages – setting up for a potential explosive continuation. 🔥

🟢 Technical Highlights:

📈 Cup & Handle pattern – classic bullish continuation

💥 Breakout target: +32% move → $169,000

🟩 1D MA 50 / MA 200 acting as dynamic support

🔄 MACD bullish cross confirming momentum

🟦 Breakout above major resistance = new market structure zone

🧲 Psychological support near $99K and $112K

***********************************

🎯 Buy Signal Details:

Entry Zone (Pullback Valid): $112,000–$114,000

Take Profit: $169,000 🎯

Stop Loss: $99,000 🛡️

Buy Confidence: 95% ✅

📌 Not financial advice. This is pure chart-based technical analysis.

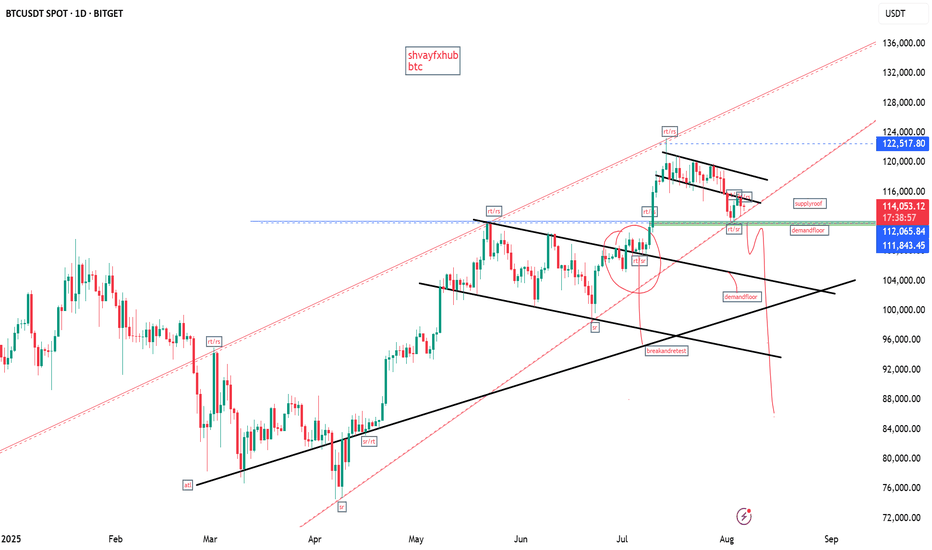

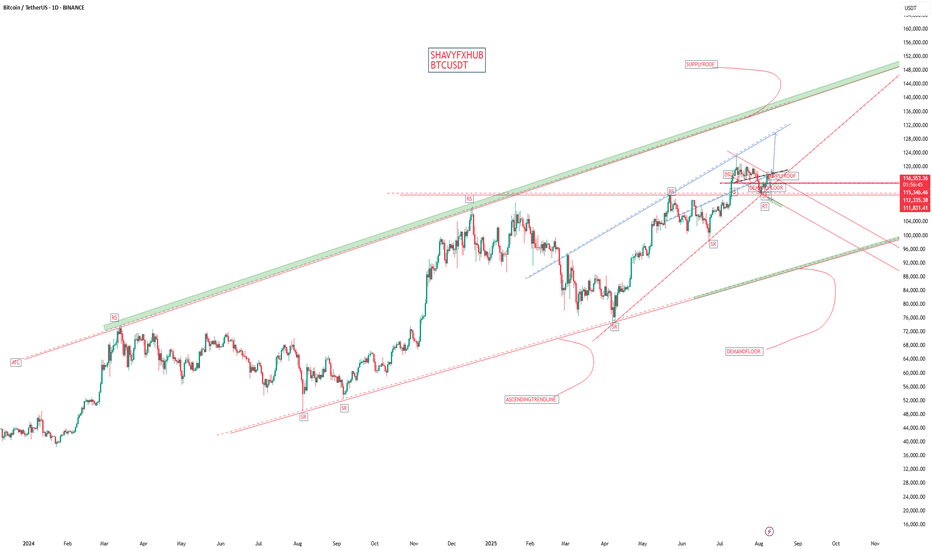

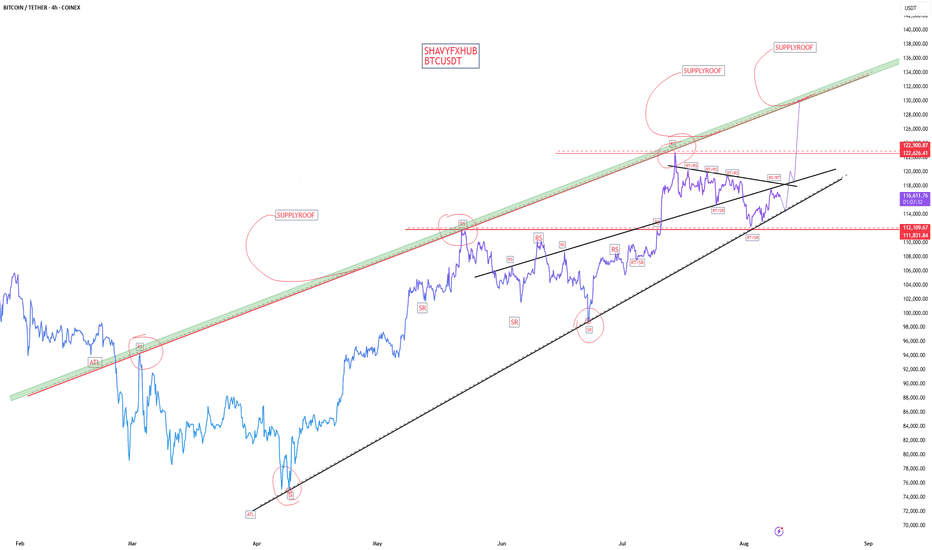

BITCOIN BITCOIN is cooling off from last attempted all time high at 123k 122k zone .the daily ascending trend and 4hr is giving a demand floor which will be watched on possible breakout from the structure ON 4HRS

On 4hrs we have a break out of a descending trendline and followed by two successful sell off connecting us from our current all time high. if we dont reclaim that supply roof by returning to buying floor ,then sellers will push to break the daily ascending trendline acting as dynamic support and our target from our EMA+SMA STRATEGUY IS 99-100 ZONE and on a flip side if we see buying liquidity from cooperate buying ,then we will hope for retest if 123k and extend the greed buying 128k-130k-135k will be targeted.

trading is 100% probability and any key level can fail, pls manage your risk

A trader without capital is a demo trader.

As a trader, your biggest weapon in the financial market is your capital,dont play or gamble with it.

GOODLUCK,PLS LIKE AND SHARE IF YOU LIKE THE IDEA AND INSIGHT.

Bitcoin (BTC): Filled Bearish CME Gap | Still Bullish Bitcoin had a smaller correction, which filled the local CME gap; after that, we are seeing a good chance for upside movement to happen.

Now we are keeping the same bullish game plan as we had before, as we are still far from the sell zone and as long as we are above the sell we are l are looking for a re-tet of upper resistance zone and ATH area.

Swallow Academy

BTCUSDT 111k first then UPHi fellow traders,

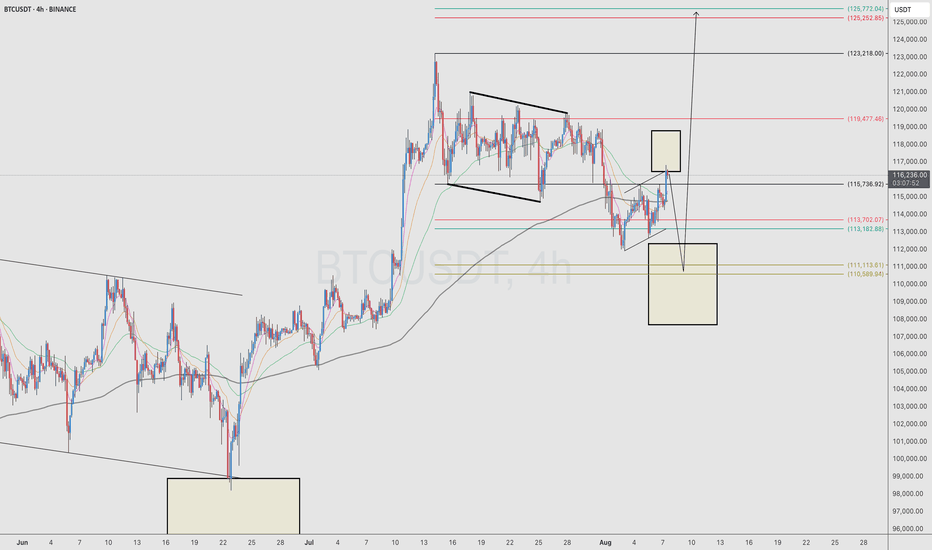

Here’s my current BTCUSDT view on the 4H chart, based on Elliott Wave principles.

After a corrective structure, we’ve seen a strong bounce, and price is now approaching a key area of interest. I’ve marked the zones I’m watching for potential buys and sells:

🟨 Lower box: Potential buy zone if price pulls back with a corrective structure.

🟨 Upper box: Area of interest for taking partials or looking for potential short setups, depending on how price reacts.

If momentum continues, we could see BTC pushing into the 125K region, which aligns with fib extensions from previous swings.

As always, I’m waiting for confirmation before making any entries.

Let me know what you see on your end!

Bitcoin (BTC): Buyers Are Accumulating | Going For Breakout Bitcoin looks good; after some struggle, the price is now pressuring the local resistance area. What we are looking for here is the breakout from the $116K zone, which then would open for us an opportunity to long the coin until the ATH zone of $123K.

Swallow Academy

BITCOIN DAILY/4HR THE daily trendline and 4hr trendline break out will be watched for forward guidance.

if we break the top layer resistance we buy and target 123k current all time and high and factor the possibility of 135-130k-128k zone for next sell.

And our sell will be on break of steep ascending trendline acting as dynamic support and we will watch 114k and 111.78k zone and further downslide wiill be 90k-100k zone.

zone by zone layer by layer.

the structure of the market is clear ,it will never lie.

trading is 100% probability and you need the mindset of a hunter, dont buy because others are buying.

your risk to reward ratio should be your trade reason.

GOODLUCK

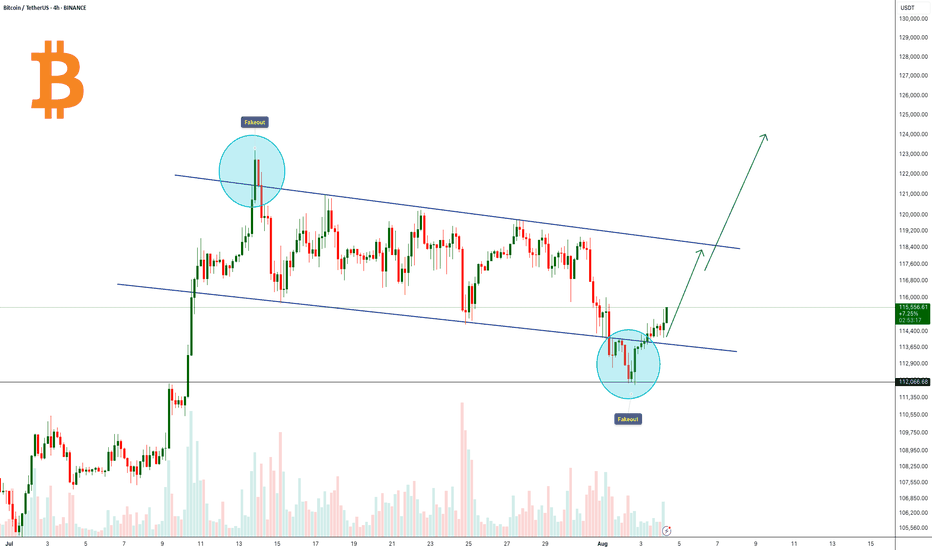

Bitcoin Traps Bulls and Bears – Real Move Next?Bitcoin is trading in a descending channel on the 4H chart, with two recent fakeouts — one above resistance and one below support — trapping traders on both sides. After reclaiming support, BTC is pushing toward the upper boundary with rising volume, hinting at strong demand. A breakout above $119K could drive a rally toward $125K–$135K.

Cheers

Hexa

BINANCE:BTCUSDT BITSTAMP:BTCUSD

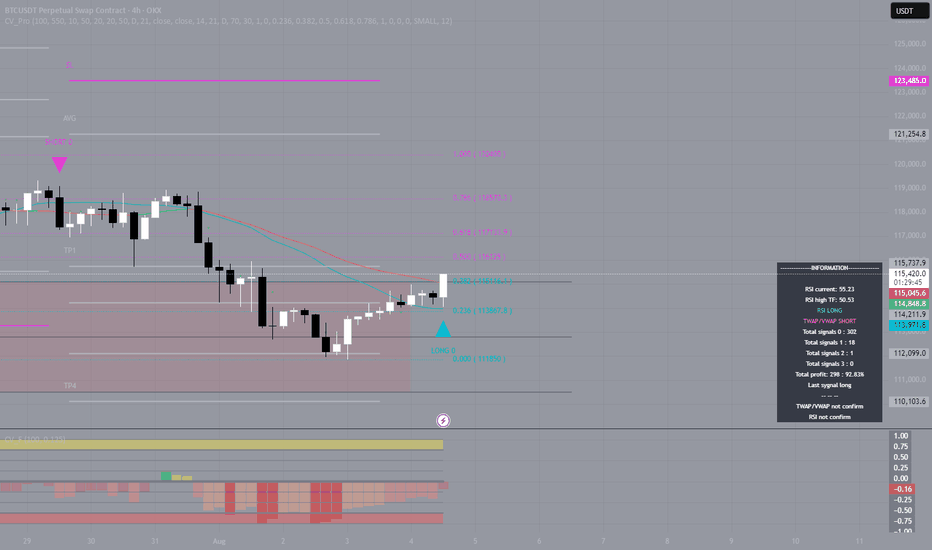

"BTC Moves Down — Scenario Confirmed"As expected, the market couldn’t sustain the overheating.

Over the past few days, Bitcoin has shown clear signs of weakness. The rally from $105K to $118K happened too quickly, without proper correction, and with noticeably declining volume toward the end of the move. In such situations, the market often loses footing — and that’s exactly what we’re seeing now: BTC has corrected down to $114,000.

If you've been following my analysis, you know I pointed out signs of overheating earlier: strong deviation from moving averages, weak reaction at key resistance levels, and upward wicks without volume confirmation. My indicator gave an early warning of trend weakening around the $117–$118K zone. That’s when it became clear momentum was fading.

This isn’t a crash or panic — it’s a normal, healthy market correction. Overleveraged long positions are getting flushed out, and late entries at the top are being shaken off. In such phases, it’s crucial not to react emotionally but to follow a clear system.

The key point: markets don’t reverse “suddenly.”

Everything happening now was visible in advance — if you were looking not just at price, but at the structure of the movement.

BITCOIN the rejection around $117,576 fits into the current volatile but evolving Bitcoin market, where prices near these peaks face resistance amid institutional inflows, ETF impacts, and changing cycle patterns. Ongoing market sentiment, regulatory developments, and macroeconomic factors will continue to influence whether these resistance levels are eventually broken or retested further.

its critical to know that further capital inflow could see 130K-135K and we will see massive correction.

and on a flip side a break out of the 4hr ascending trendline will be looking at 99k-100k zone .

#btc #bitcoin

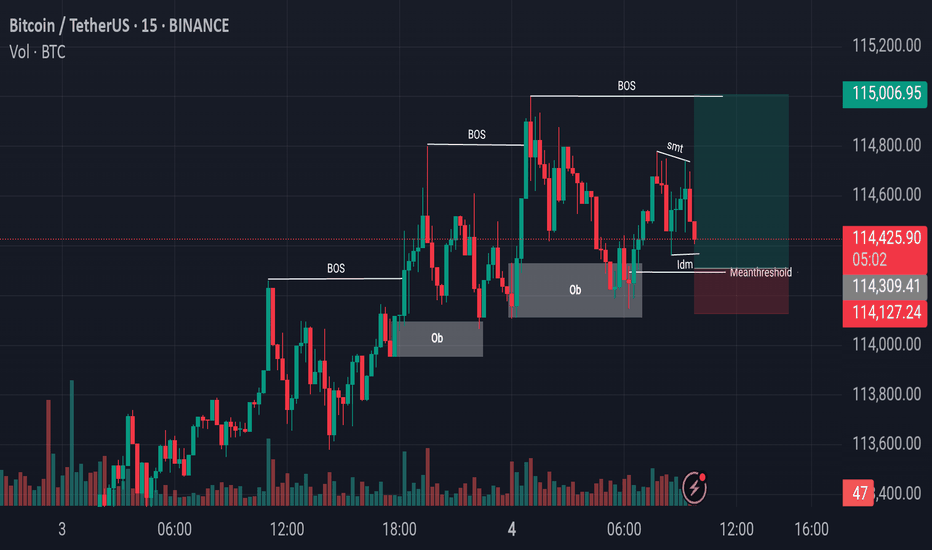

Bitcoin Price Flow From Liquidity Grabs to Structural BreakoutsBitcoin Price Action Analysis:

In recent sessions, Bitcoin has been consistently making Breaks of Structure (BoS) to the upside, indicating a strong bullish trend. Most recently, after forming another BoS, the market retraced downward and precisely tapped into a previously established Bullish Order Block (OB). This reaction led to a temporary upward movement; however, during this process, the market also created a zone of internal liquidity.

Currently, Bitcoin is showing signs of a downward move again, potentially aiming to capture Internal Drawdown Market (IDM) liquidity. Just below this level lies another key Order Block, which could serve as a strong support zone. If the price reacts positively from this region, we might see the market initiate another upward leg, potentially forming the next Break of Structure to continue the bullish narrative.

Note: Always perform your own research (DYOR) before making any trading decisions.

BTC Riding the Trend — $120K Target on RadarBitcoin is riding a rising support zone, showing steady bullish momentum despite recent pullbacks.

We’ve seen a key resistance level flip into support, and price is now holding firmly above it. As long as CRYPTOCAP:BTC respects this trendline, bulls have a strong chance to push higher.

The immediate test is the downtrend resistance — a clean breakout here could open the path toward the $120K–$122K zone.

If rejected, price may retest the rising support before making its next move.

DYOR, NFA

Thanks for the reading

$BTC Eliot Wave last step + Golden cross.The entire crypto market is on fire — Golden Crosses everywhere across altcoins. 🔥

BTC looks to be in the 5th wave of an Elliott Wave pattern and has just printed its own Golden Cross. Bullish momentum is clear in the price action.

But how long can this run last?

We may be in a parabolic phase, yet there’s heavy liquidity sitting around $115k.

The logical play: a drop to grab that liquidity, then a push to $120k+.

In the end… only the market makers know. 🎯

DYOR

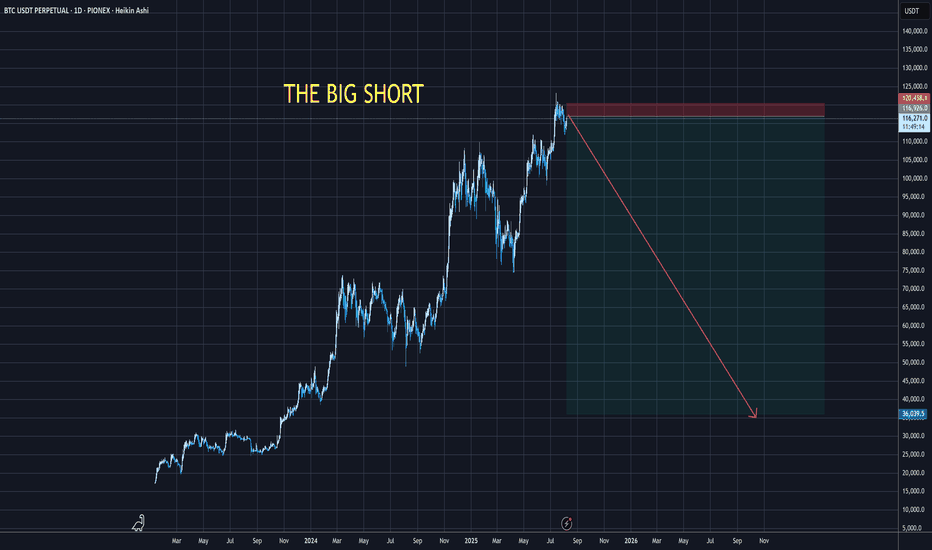

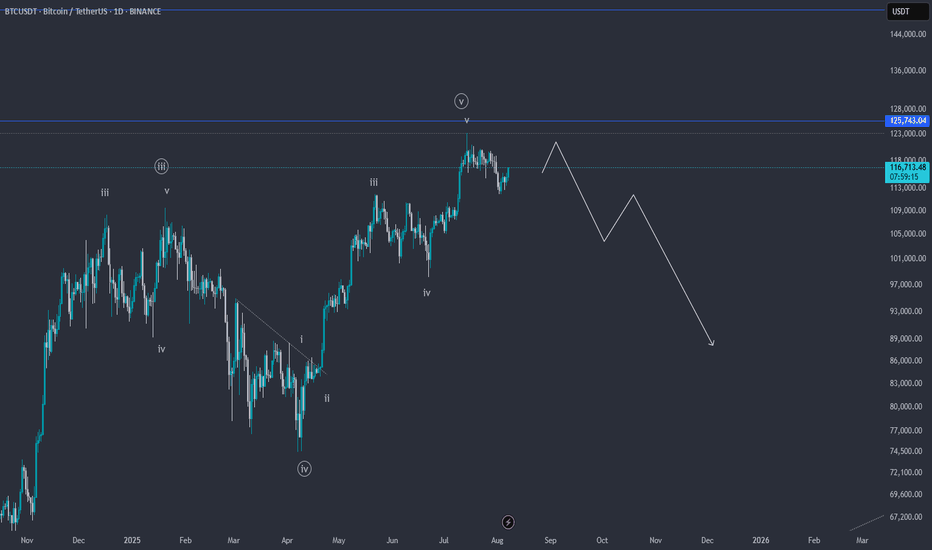

BTCUSDT Elliott Wave – End of the Rally or Start of a Crash?📉 BTCUSDT Elliott Wave Analysis – End of the Rally or Start of a Crash? ⚠️

On the BTCUSDT chart, it appears that the fifth wave of the impulsive structure is nearing completion. The wave count clearly shows a full five-wave sequence, suggesting that Bitcoin may be forming a major top around the $119,000–$125,000 resistance zone.

🔻 If price action confirms a reversal and breaks key support levels, we could see a deep correction potentially taking BTC below $90,000.

📌 Keep in mind this is a scenario based on wave structure and requires confirmation via breakdowns and price action.

💬 What do you think? Is Bitcoin ready for a major correction, or will it break into new all-time highs?

✅ Save this idea & follow for updates!

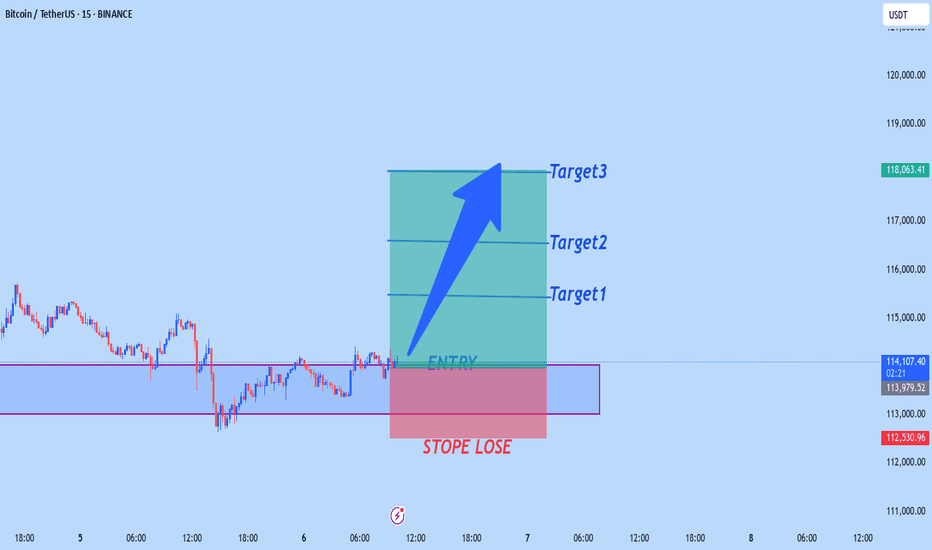

Bitcoin Long Position: Strong Trendline Support! Looking to take a long position on Bitcoin (BTC/USDT) as it bounces off the ascending trendline 🚀. The trendline has historically shown strong support levels, and it’s currently retesting it for a potential reversal.

Key Points:

Current Price: 112,580 USDT 💰

Support Zone: Trendline support is around 112,000 – 111,800 ⬇️

Target: Higher Highs near 116,322 (EMA 20 resistance level) 📈

Stop Loss: Set just below the trendline at 111,500 🔒

Trade Setup:

Entry: At 112,580 USDT

Stop Loss: 111,500 USDT

Target 1: 114,800 – 115,500 USDT

Target 2: 116,322 USDT (potential breakout)

Reasoning:

Trendline Rebound: BTC is testing a major trendline support.

Short-Term Momentum: Expecting a continuation after this test.

Risk Management: Tight stop below the trendline for safety.

🔔 Stay updated: Follow for more setups and updates! Happy trading!