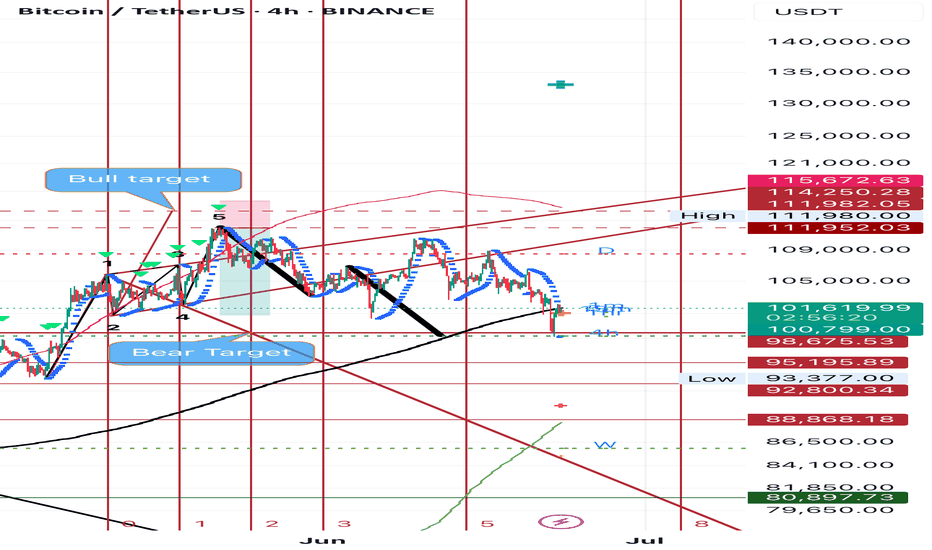

Bitcoin### Bitcoin Price Analysis (June 21, 2025)

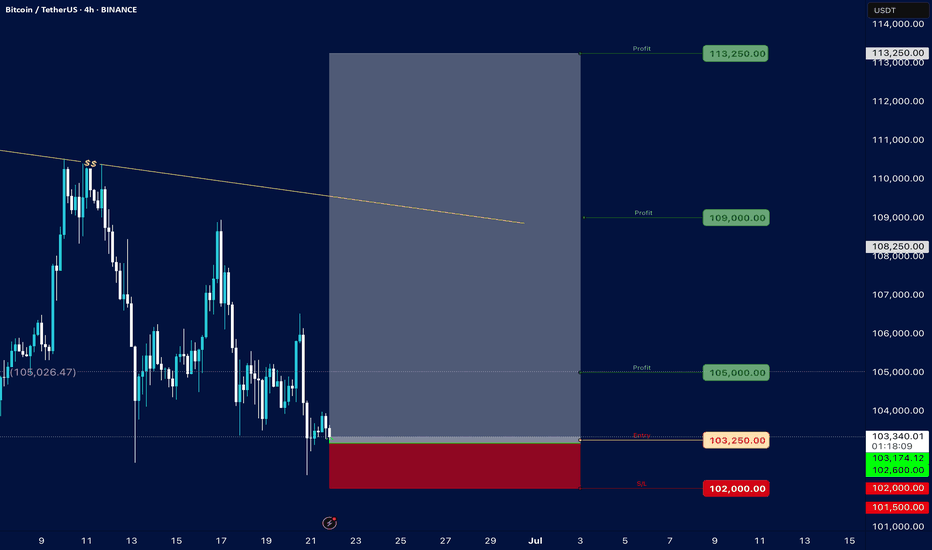

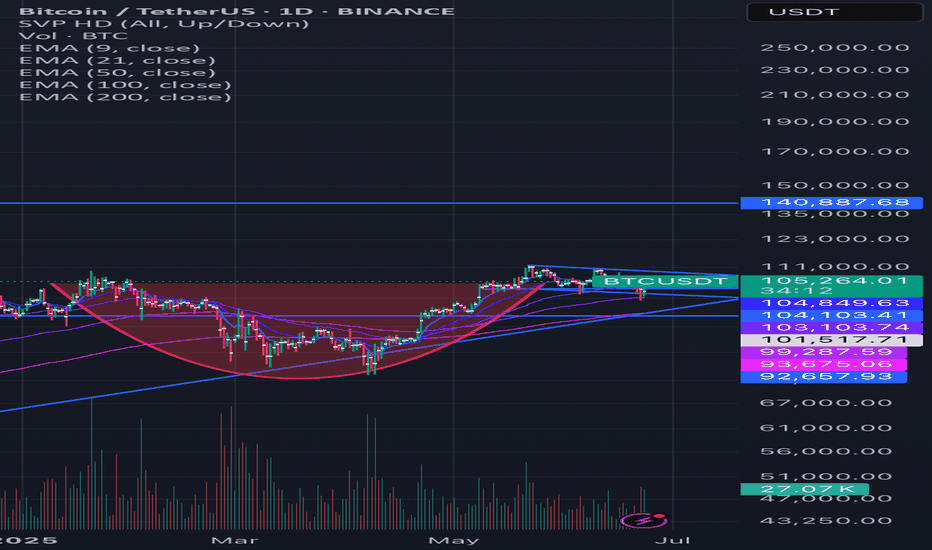

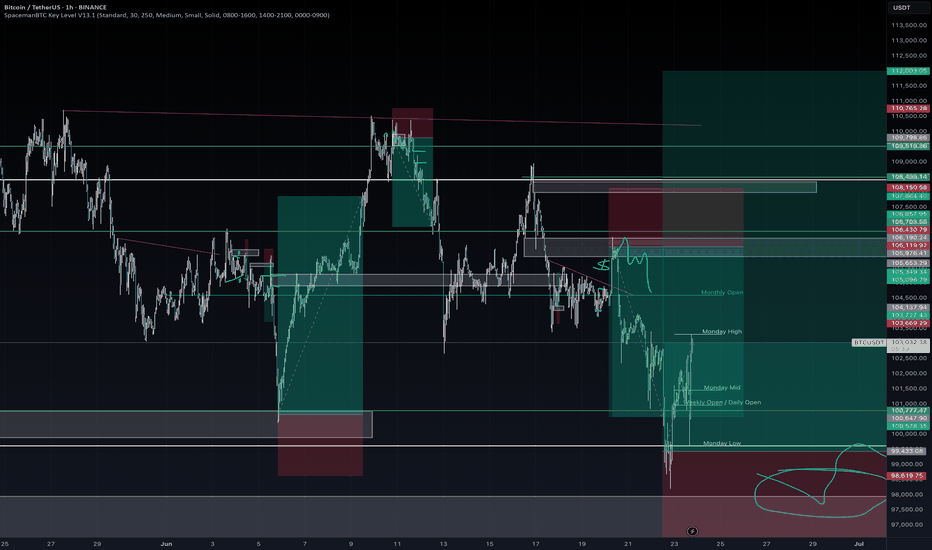

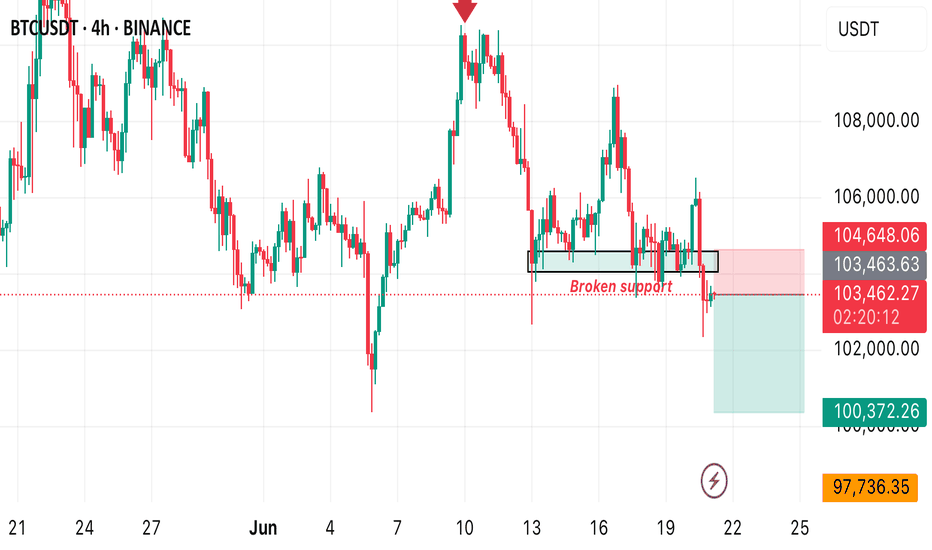

#### **Current Price**: $103,236.15 (as of the snapshot)

- The price is hovering near the lower end of the recent range, with key support at **$102,000** (marked as "S/s" on the chart).

- Resistance levels are visible at **$105,000**, **$107,000**, and **$110,000–$114,000**.

#### **Key Observations**:

1. **Support and Resistance**:

- **Strong Support**: $102,000 (critical level; break below could signal further downside).

- **Immediate Resistance**: $105,000 (previous entry point and psychological level).

- **Higher Targets**: $110,000–$114,000 (if bullish momentum returns).

2. **Price Action Context**:

- The price recently rejected the $105,250 level ("Entry") and is now testing lower support.

- The "Profit" markers at $105,000 and $105,026 suggest these were take-profit zones for traders.

3. **Trend and Sentiment**:

- The chart shows consolidation between $102,000–$110,000, with no clear breakout yet.

- A hold above $102,000 could lead to a retest of $105,000, while a break below may target $100,000 or lower.

4. **Volume and Timeframe**:

- The snapshot lacks volume data, but the date range (June–July) suggests a medium-term view.

- Key dates to watch: June 25–28 and early July for potential volatility.

#### **Conclusion**:

- **Bullish Case**: Hold above $102,000 and reclaim $105,000 to aim for $110,000+.

- **Bearish Risk**: Break below $102,000 could accelerate selling toward $100,000 or $99,000.

**Actionable Insight**: Watch the $102,000–$105,000 range for a breakout or breakdown. A rebound from support with volume could signal a buying opportunity, while a drop below $102,000 may indicate further downside.

*(Note: The analysis is based on limited data from the snapshot. For a full assessment, additional indicators like RSI, MACD, and volume would be needed.)*

BTCUSDT.PS trade ideas

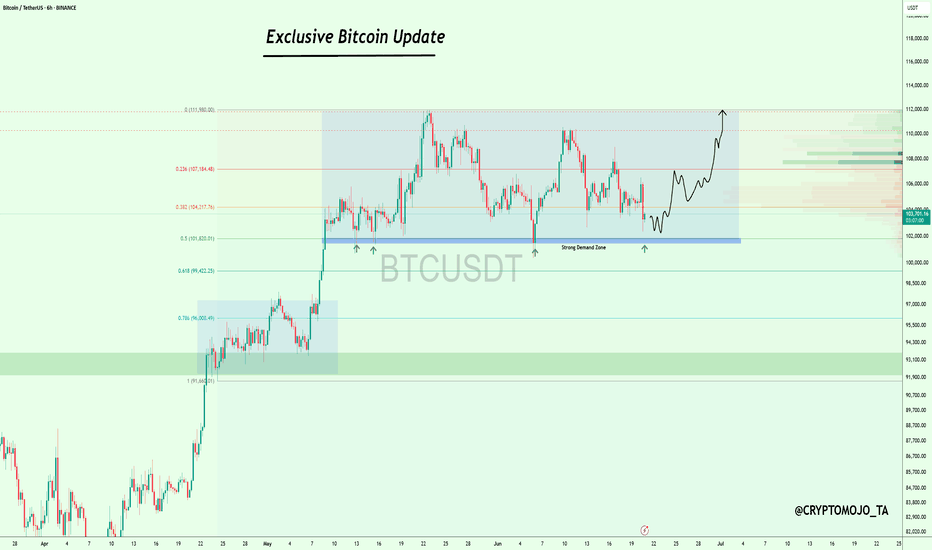

DeGRAM | BTCUSD rebound from the demand zone📊 Technical Analysis

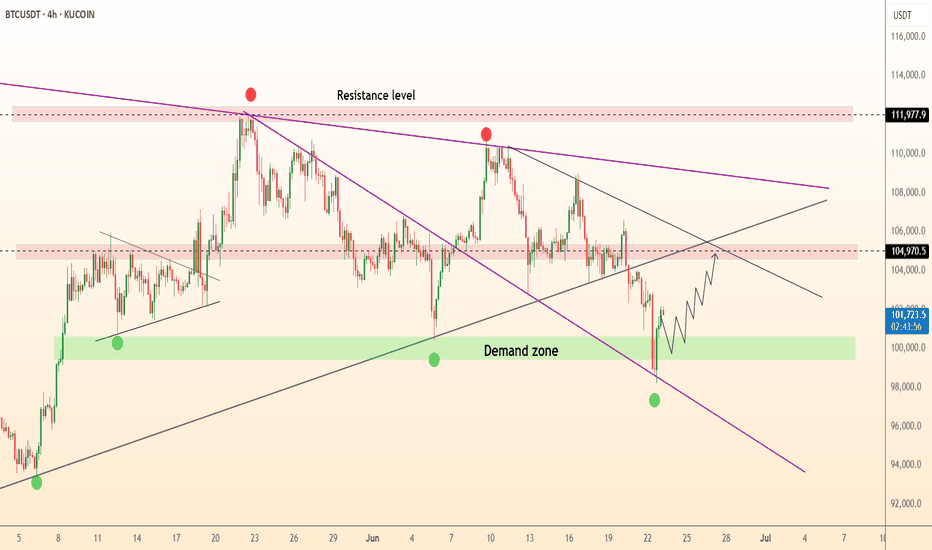

● The BTCUSDT 4-hour chart on KUCOIN highlights a pronounced descending channel, with price action recently rebounding from a well-defined demand zone between 98,000 and 100,000. This green-shaded area has repeatedly acted as a springboard for bullish reversals, as evidenced by the strong wick and immediate recovery after the latest test. The chart also marks a series of lower highs and lower lows, but the most recent price action shows a break in bearish momentum, with a projected zigzag path indicating a potential move toward the 104,970 resistance. The confluence of the lower channel boundary and the demand zone suggests that buyers are stepping in aggressively at these levels, aiming for a retest of the upper resistance band.

● The technical setup is further reinforced by the presence of a major resistance level at 111,977, which has capped previous rallies. The chart’s structure, with its clear trendlines and highlighted resistance and support zones, points to a tactical opportunity for bulls to capitalize on the oversold conditions. The anticipated path, as drawn on the chart, suggests a gradual recovery with intermittent pullbacks, targeting the 104,970 area as the next significant hurdle. The overall pattern indicates that while the broader trend remains bearish, the immediate outlook favors a corrective rally from the current demand zone.

💡 Fundamental Analysis

● Recent fundamentals support the technical case for a short-term recovery. Over the past two days, Bitcoin has experienced heightened volatility due to escalating geopolitical tensions, notably US military action in the Middle East, which triggered a sharp sell-off and flushed out leveraged positions. Despite this, institutional accumulation remains robust, with over $1.2 billion in Bitcoin added to corporate treasuries in the last week, and Texas officially establishing a state-managed Bitcoin reserve. On-chain data shows sustained negative netflows from exchanges, indicating that large holders are moving coins to cold storage, a historically bullish signal. Meanwhile, derivatives data reveals a cautious market, with open interest skewed toward protective puts, but spot ETF inflows and long-term adoption trends continue to underpin the market.

✨ Summary

● BTCUSDT is rebounding from a key demand zone, with technicals pointing to a corrective move toward 104,970. The bullish scenario is supported by strong institutional accumulation and strategic adoption, even as short-term volatility persists. A sustained close above 104,970 would open the path to the 111,977 resistance, while a drop below 98,000 would invalidate the recovery thesis.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

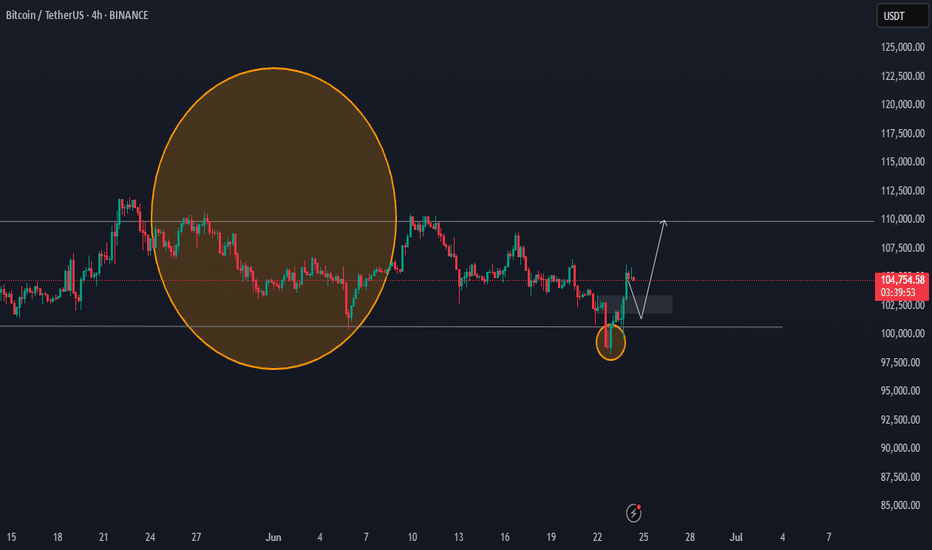

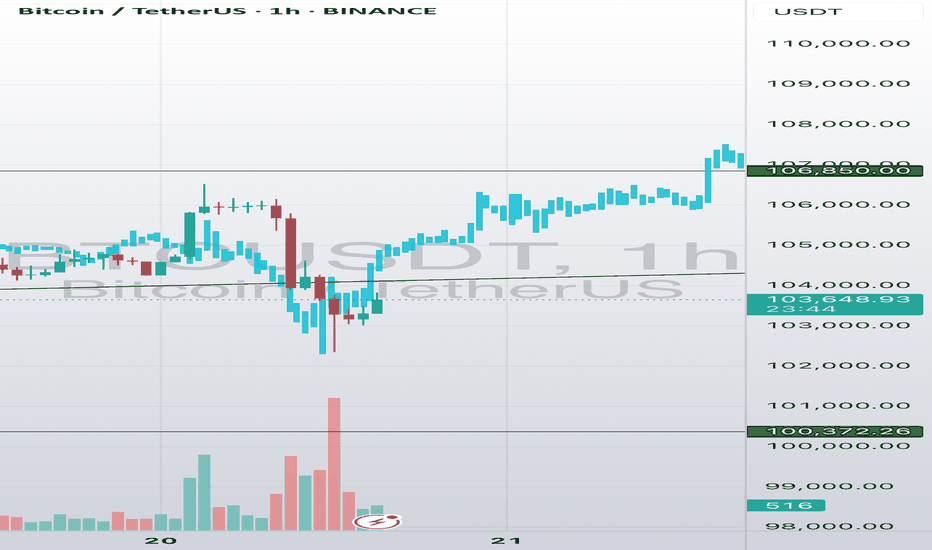

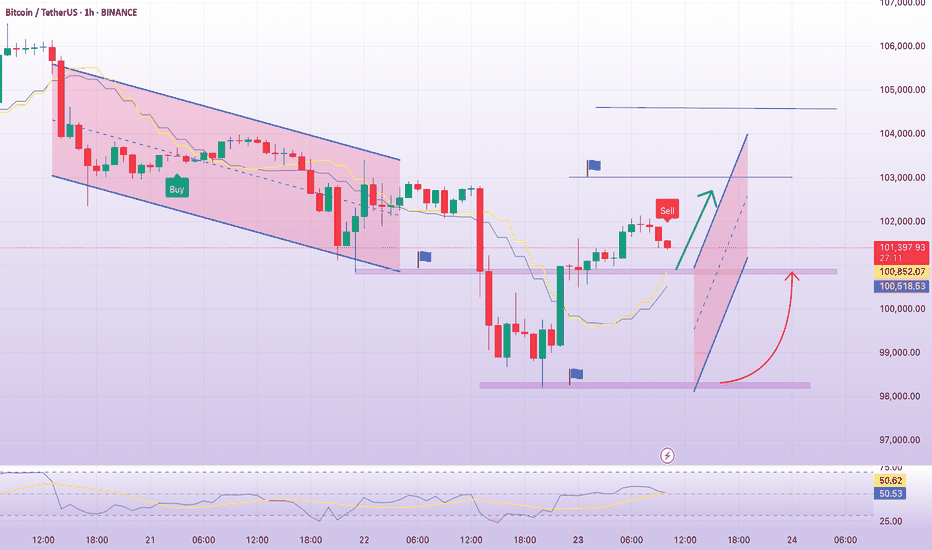

Bitcoin Holding Above $100K – Bullish Bias IntactIn my previous analysis, I mentioned that a daily close below $100K would trigger a short bias. However, price closed above the $100K level, sweeping liquidity and rejecting the downside.

This move invalidates the bearish setup and confirms a bullish continuation. Market structure remains intact, and we're now looking for potential long setups on retests or pullbacks.

Key Points:

Liquidity sweep below $100K

Daily close above key support

Bullish structure remains valid

Watching for continuation targets and retests

📍 Stay patient and follow price action. Structure never lies.

#BTCUSD #Bitcoin #CryptoAnalysis #LiquiditySweep #BullishContinuation #PriceAction #TechnicalAnalysis #TradingView #CryptoTA

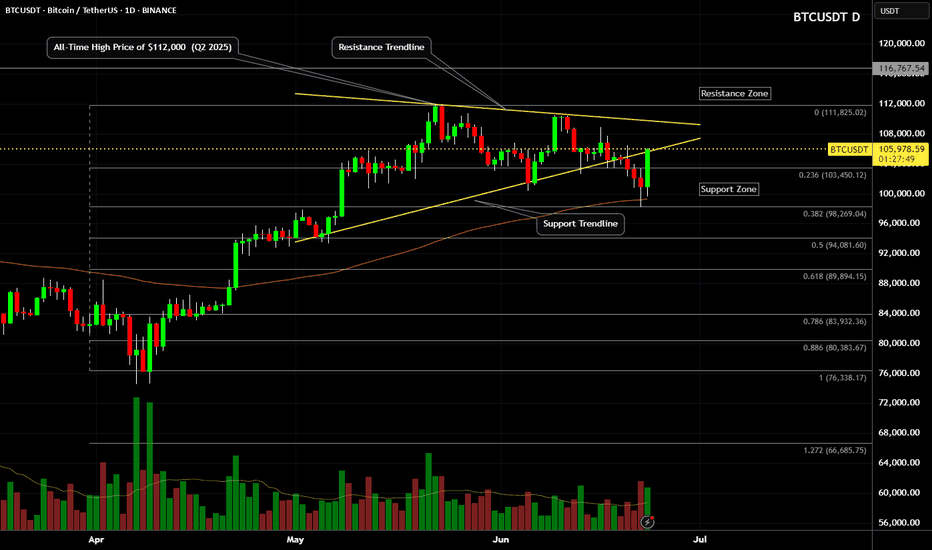

#Bitcoin is approaching a strong demand zone!#Bitcoin is approaching a strong demand zone!

This level has acted as solid support several times in the past.

According to the Fibonacci levels, we’re currently at the 0.5 level, which makes this area even more significant.

In my opinion, we’re likely to see a bounce from here.

However, if the price fails to hold this level, there’s a good chance we’ll retest the $92K zone.

But for that to happen, we need a daily close below $100K.

Until then, we’re still in a safe zone.

I’ll keep you updated as things develop.

If you find my updates helpful, don’t forget to like and follow for more!

DYOR, NFA

btc chipping down de road This is de rasshole fractal—the fractal from the future, the one whispered through the blockchain by quantum echoes of bull runs past, the one that knows, that sees, that is. It bends time, folds sentiment, loops liquidity through dimensions you haven’t even leveraged yet. It doesn’t care about your indicators, your trendlines, your cousin’s TA on Reddit—it just exists, pulsing with the inevitable. You can squint at it, laugh at it, ignore it—but it’s already printed, already fulfilled, already written in the candlesticks of destiny. Don’t try to understand it. Just feel it. Because the fractal knows: the price is going up. Did you buy the dip, or are you still refreshing?

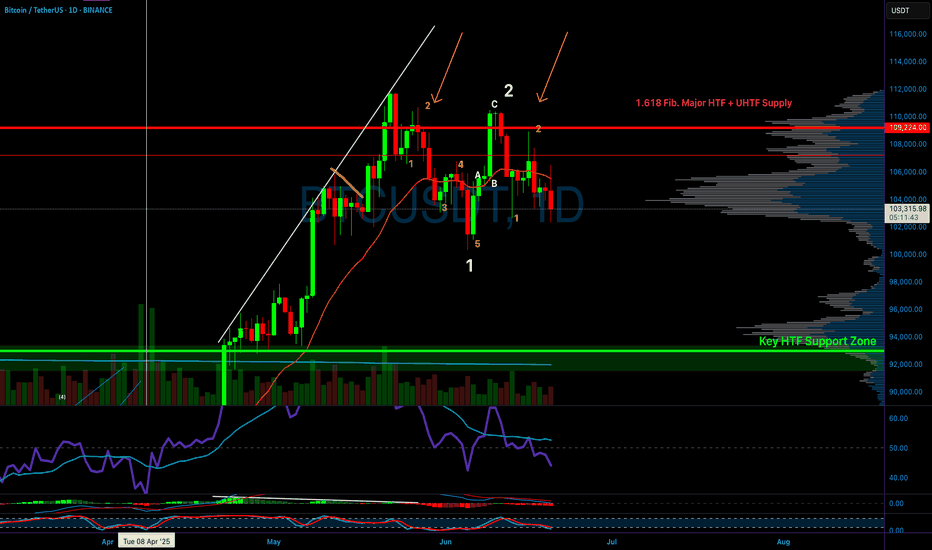

Is Bitcoin Signaling Risk-Off? Structure Breakdown Explained💥 BTC/USD Outlook – Is Bitcoin Losing Steam? 🧠📉

I'm keeping a close watch on Bitcoin (BTC/USD) this week, and the current price action is flashing some key signals.

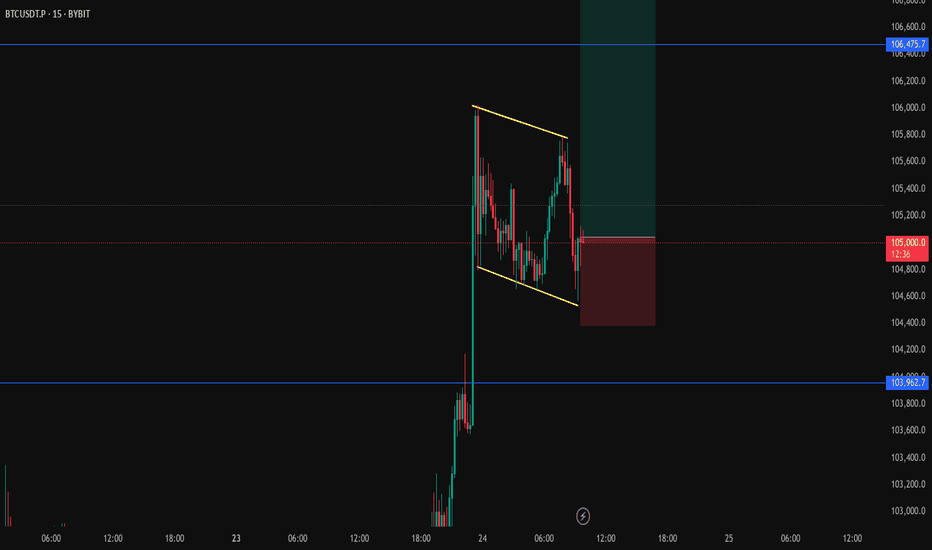

🔍 Over the past several sessions, BTC has struggled to hold momentum, and we’re now seeing a shift in tone. On the 4-hour timeframe, the market structure is tilting bearish, with a pattern of lower highs and lower lows developing — a classic sign of weakness ⚠️📉.

📐 The most recent downside leg has caused a clear break in structure, and BTC is now retracing back into a potential supply zone, hovering around equilibrium of the recent move. This zone will be critical to watch for signs of seller re-entry.

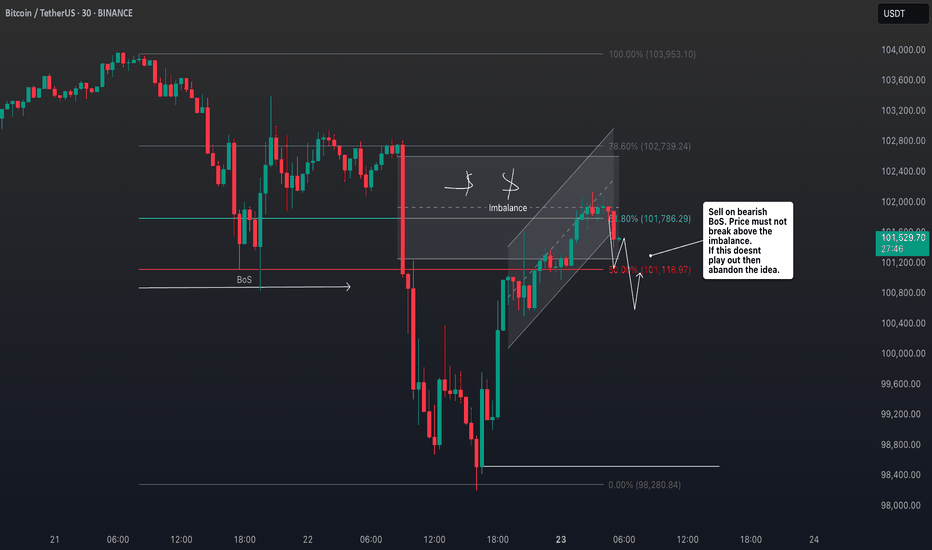

⏳ On the 30-minute chart, I’m waiting for a decisive shift in structure — a break of local support or a failed rally that confirms bearish continuation. Should that play out, it could signal a high-probability short setup.

🪙 A breakdown in BTC often has broader implications — especially in the risk asset space. If we see weakness here, JPY pairs may strengthen as capital rotates into safer assets 💴🌐.

⚠️ Disclaimer:

This is not financial advice. The information provided is for educational purposes only. Please conduct your own analysis and consult a licensed professional before making any investment decisions. 📚💼

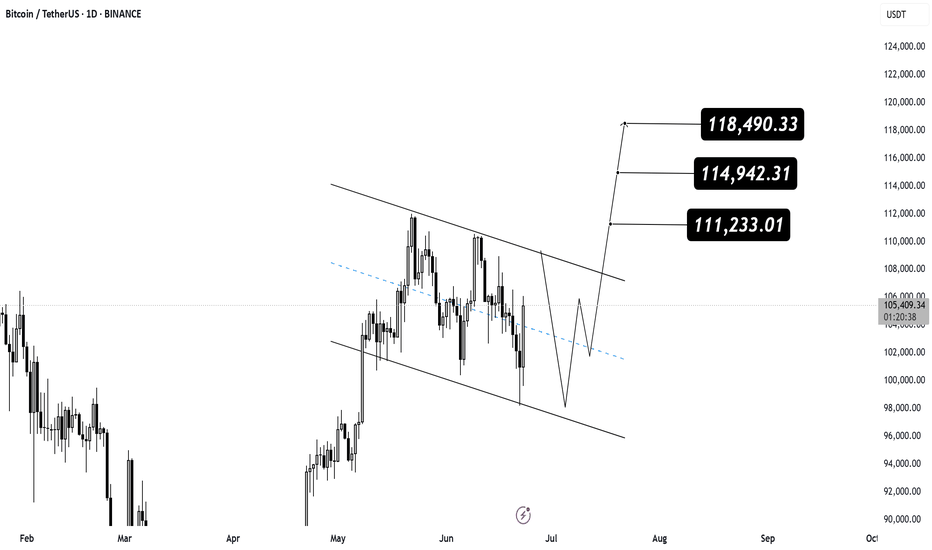

BTC is breaking out of a falling channel 🚀

Bitcoin has pushed strongly off the lower boundary and is approaching the top of a descending parallel channel on the daily chart 📈

A confirmed breakout could lead to a continuation rally toward key upside targets ✈️

🎯 Targets:

1️⃣ $111,233.01

2️⃣ $114,942.31

3️⃣ $118,490.33

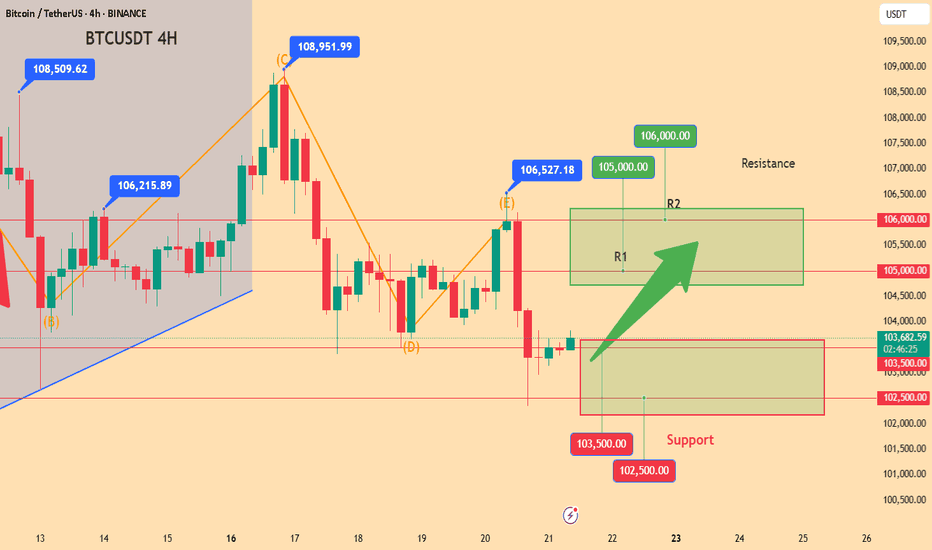

Bitcoin (BTCUSDT) - Price Testing Resistance after Morning StarBitcoin (BTCUSDT) price is currently testing the resistance zone of $105,000 to $110,000 (yellow lines).

A morning star candle pattern has formed above the 100 ema (orange line), which is also $100,000 price support.

Some bullish momentum is forming on the MACD Histogram, however, Bitcoin is still technically in a short-term downtrend for the past 30 days.

Bitcoin price needs to create a new uptrend on the daily chart, a series of higher-highs and higher-lows in the price, which could take several months.

At this time, Bitcoin is still reacting to global news and stock market correlations.

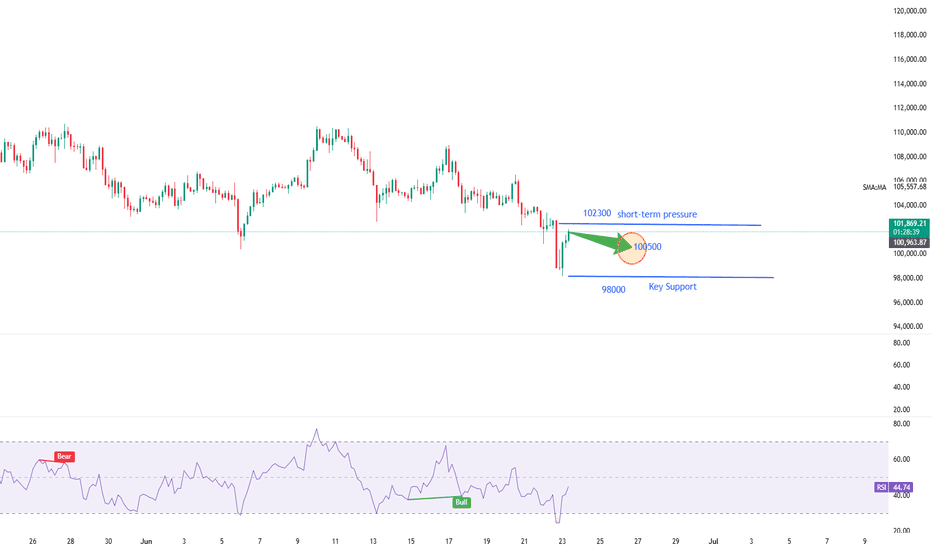

Today's BTC trading strategy, I hope it will be helpful to youBitcoin prices hovered around $103,300, retreating from the $104,000 threshold seen in previous days and showing an overall volatile adjustment trend. The market has experienced a notable correction recently, with prices dropping significantly from earlier highs, but currently stabilizing around $103,000. Such fluctuations have left many investors confused about the price trend ahead.

Support and Resistance Levels

Technically, Bitcoin is facing key support and resistance levels. The lower support at $102,300 is critical: if prices hold above this level, the short-term decline may halt or even rebound. However, a break below this support could lead to further declines to test lower levels.

The upper resistance lies in the $107,000–$108,000 range, acting as a "wall" where prices have repeatedly stalled due to trapped positions and profit-taking pressure. For prices to continue rising, a successful breakout of this resistance zone is essential.

Technical Indicator Performance

Multiple technical indicators show bearish dominance in the market. Both MACD and RSI indicators signal bearish sentiment, implying short-term weakness may persist. Notably, prices are approaching oversold territory—similar to a spring compressed too far, Bitcoin may experience a technical rebound if the decline continues.

Today's BTC trading strategy, I hope it will be helpful to you

BTCUSDT BUY@102000~103000

SL:101000

TP:105000~106000

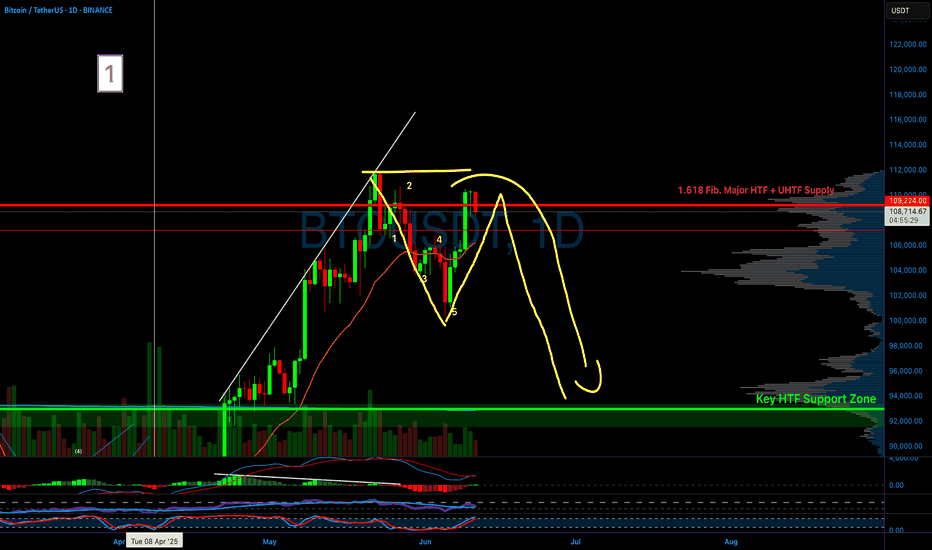

bitcoin update btc struggling to hold the 100k position market is choppy in lower tf but on higher tf its clearly shows sign of tapping below. with a double top on 3d tf, and breaking down of it will push long term holder book profits and with increasing tension in iran and usa 90k looks good support and as i mentioned previously about the cme gap in that area which works asa magnet for btc.

thanks

Measured move target madePrice bounced near the target and has been confirmed by the 4 hour SAR.

The 4 hour SAR is currently on a bearish retrace relative to the daily SAR.

As long as the Daily SAR is above price, the bearish Wolfewave is still in play.

Price is anticipated to go lower than what the 4 hour SAR has established as support.

To see more details and for faster movement, we look to the shorter intervals.

Shorter interval price action could invalidate longer interval patterns.

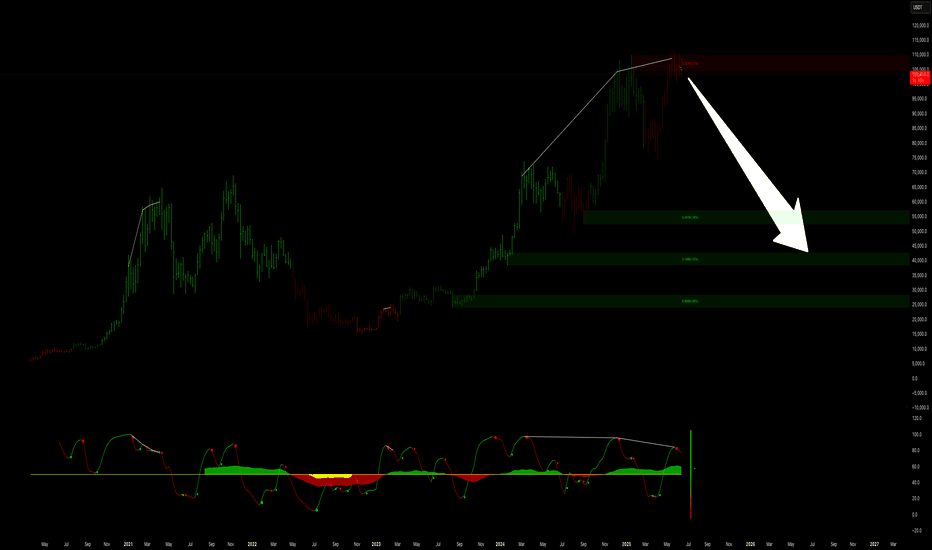

BTC slowly getting bearmarket vibes.Given the current macroeconomic and geopolitical landscape, there is a growing risk of a renewed downward move in the market. Should we not see a rate cut materialize as early as June, Bitcoin could begin a gradual decline, potentially retracing toward the $50,000–$40,000 range.

This slow grind lower may persist unless there is a sharp and meaningful shift in the key macro or geopolitical variables. While a reversal of this trend remains possible under improved conditions, current indicators suggest a steady move toward lower levels in the absence of a clear catalyst.

BTC, Selling pressure below 100K, 23 JunePlan BTC today: 23 June 2025

Related Information:!!!

Market capitalisation fell to $3.03 trillion over the weekend, likely due to speculators expecting a sell-off in response to US strikes on targets in Iran. However, the limited reaction from traditional financial markets brought buyers back to the crypto space, showing their willingness to buy at a discount and pushing market capitalisation back up to $3.12 trillion.

The cryptocurrency sentiment index dropped to 42 on Sunday, its lowest level in two months, but rebounded to 47 at the start of the new week, moving from the fear zone into neutral territory.

Bitcoin slipped to $98K over the weekend, briefly touching the classic support level at 61.8% of the April–May rally. However, by the start of the European trading session, it had already recovered to around $102K, compared to $102.7K at the beginning of Sunday. Still, last week’s sell-off broke the 50-day moving average support, weighed down by external factors. A breakout from the $96K–$105K range will likely determine the direction of the next major move

personal opinion:!!!

Selling pressure caused gold price to drop below 100k yesterday, macro economy has not changed much. Gold price continues to suffer selling pressure

Important price zone to consider :!!!

support zone : 100.800 ; 98.200

Sustainable trading to beat the market

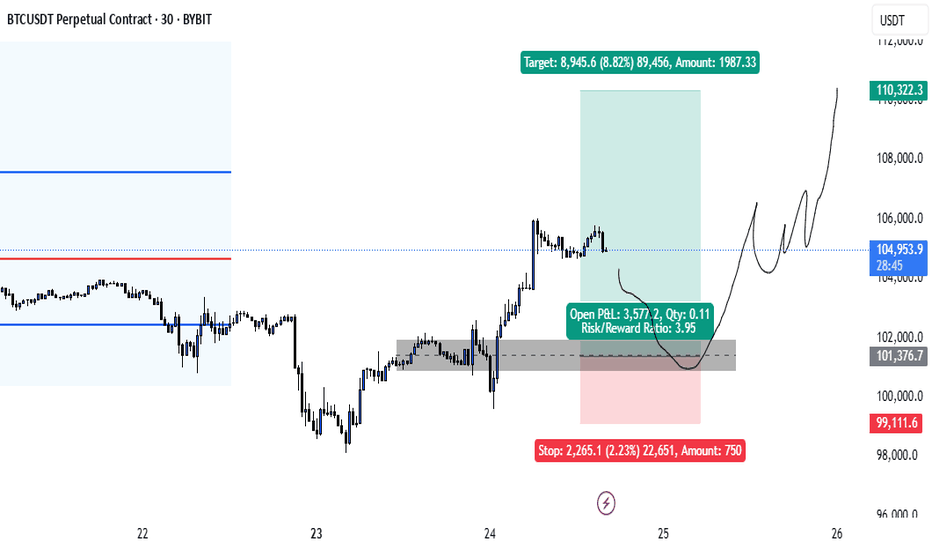

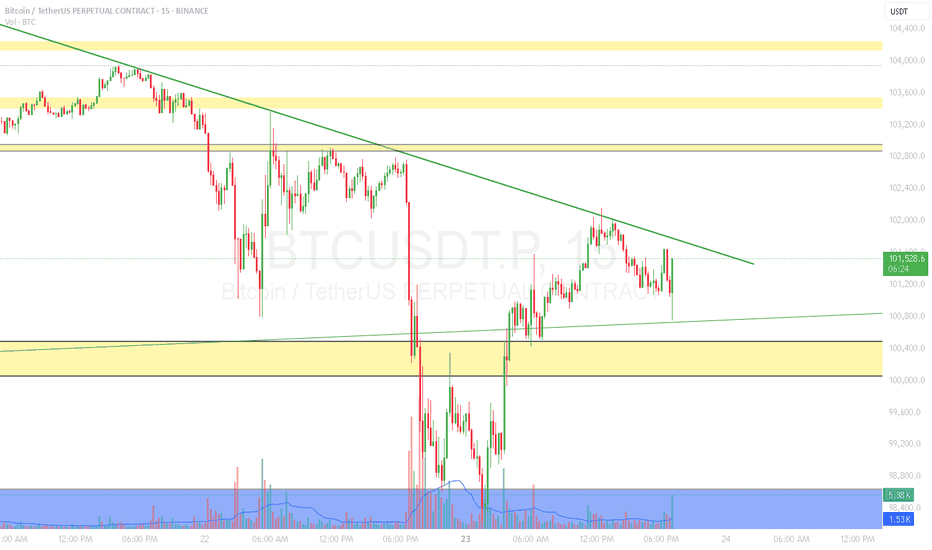

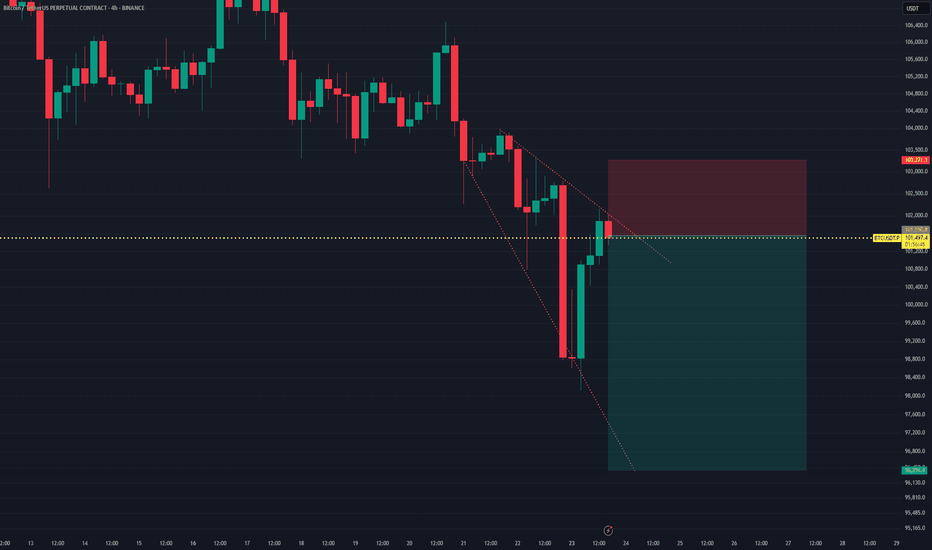

BTCUSDT Short Setup after Weak BreakoutThe BTCUSDT perpetual chart displays a bearish setup following a false breakout or weak retest of a descending wedge structure. After a strong bounce from the recent low, price surged but is now showing rejection at the $101,500 resistance level, marked by a key horizontal zone.

This area coincides with:

- The upper boundary of the falling wedge pattern.

- A former support zone now acting as resistance.

- A red candle signaling exhaustion from buyers.

A short position is initiated with:

- Entry: ~$101,500

- Stop Loss: ~$103,271

- Take Profit: ~$95,400

- Risk:Reward Ratio: ~1:3+

Unless price reclaims and holds above $103,271, this setup suggests a short-term bearish reversal is likely to unfold.

Pullback Correction after a Sharp DeclineTechnical Analysis of BTC Contracts: As of today, on the daily timeframe (major cycle), yesterday closed with a small bearish candle, showing consecutive bearish declines. The price remains below moving averages, and attached indicators are in a death cross, clearly indicating a downward trend. With the trend being evident, two key points should be noted: First, guard against significant pullback corrections; Second, risk control must be prioritized under any circumstances, which is of utmost importance.

On the hourly timeframe (short cycle), the price fell under pressure during the US session yesterday, breaking below the 100,000 level. It rebounded after hitting the intraday low in the morning. The breakdown level is near the 102,700 area. Currently, the K-line shows a large bullish rebound, and attached indicators form a golden cross, suggesting that corrective movements will prevail today. However, the breakdown level (102,700) must not be breached; otherwise, the corrective trend may fail to sustain, which aligns with typical price movement patterns.

you are currently struggling with losses,or are unsure which of the numerous trading strategies to follow,You have the option to join our VIP program. I will assist you and provide you with accurate trading signals, enabling you to navigate the financial markets with greater confidence and potentially achieve optimal trading results.

Trading Strategy:

sell@102300-102800

TP:100000-100500