BTCUSDT.PS trade ideas

Bitcoin Update 25.06.2025 —Altcoins, Top Altcoins Choice & MoreGood morning my fellow Cryptocurrency trader, I hope you are having a nice week and a wonderful day.

We have good news to start today and it is all based on Bitcoin's price action. This is going a bit deep on the daily noise, price swings.

Price action analysis

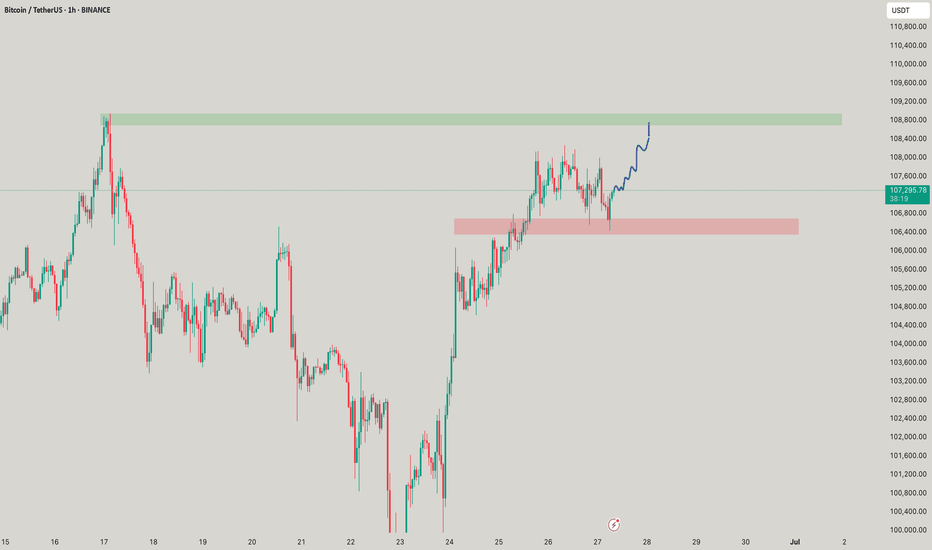

Bitcoin went deep on its sideways range and tested below 100K. This is normal for a sideways market. The positive news comes from the fact that Bitcoin is once more trading above $106,000 and already hit above $107,000. This type of action reveals a bullish bias.

If the market was mainly bearish with a major drop on the deck, say going below 90K or 80K even, then Bitcoin would not be allowed to go beyond $105,000. In fact, any bounce or small recovery would be quickly sold as bear would be active, waiting and selling each time prices move up.

The fact that Bitcoin can grow day after day and consume all selling pressure while doing so, reveals a strong presence from buyers. We know this to be true because Bitcoin is now in a new phase in its evolution and growth cycle. It is truly a young technology that only now is being fully accepted with plenty of room available for growth.

We have three instances where Bitcoin moved above 110K. The selling that happened afterward is not filled with pressure, instead you can see some standard candles as prices continue to consolidate.

On the other hand, notice the last session from 21-June (21-24 June —3D candles). You can see a long lower shadow, a bullish hammer; there was definitely strong buying pressure as soon as Bitcoin reached below support.

Altcoins market action

Some altcoins continue to produce multi-months high. The highest price since January 2025. These altcoins recovered, started to rise and continue rising in clear, standard bull market fashion. Literally straight up.

Some altcoins did even better and grew as high as December or November 2021. The highest price in almost four years. This is very important when we go deep into the chart and price action because it is the main revealing signal. The altcoins simply do not go on a major bull market before a market crash. If the altcoins are recovering or rallying, it is because the market is set to "buy." The Cryptocurrency market is in bullish mode.

If the market was set to drop long-term then we would be experiencing a rise that is running out of momentum. This rise would later peak and a surprise sudden flash crash would signal the start of a major downturn. This is not what we see.

Inversely, if prices are going to rise strongly we start by seeing some form of retrace or correction, this event losing momentum and volume and then finally a strong bullish jump as soon as support is confirmed. This bullish jump would signal the start of a major market move. This is what we are experiencing today.

Bitcoin & Altcoins

Bitcoin and the altcoins move together. Bitcoin leads the altcoins, the altcoins reveal what Bitcoin will do when the action is sideways.

We can always say that Bitcoin is leading the altcoins of course because Bitcoin has been growing non-stop since November 2022. The major trend being bullish the altcoins are set to follow at some point.

Now, when Bitcoin goes sideways, by definition, anything goes. The market can break-down just as it can break-up. This is where the altcoins become useful.

If smaller Cryptocurrency projects are moving ahead, strongly and even producing 3-4 multi-year highs, it reveals what Bitcoin will do once its consolidation period ends.

Buying Bitcoin

In short, Bitcoin is going up. The next major market move is a rise and we have proof coming from the signals, the altcoins and the charts.

Never again in its history Bitcoin will trade below 80K. 90K soon to be gone... Once the action starts, you will look like a genius for buying below $110,000.

What to choose: Bitcoin or altcoins?

Now, my personal suggestion is different. If you are not a whale, the way to go are the altcoins. Why? Because there is more room for these to grow. We can say that the altcoins are riskier, but risk is almost non-existent with spot. We can simply focus on the pairs that have been filtered by the major exchanges. Reputable pairs with a long track record and plenty of room available for growth. You can't go wrong with those.

If you are ready for the 2025 bull market, leave a comment below.

Altcoins analysis by request

I think it is time for a new Your Top Altcoins Choice, session. It is always wise to do these when the market hits bottom or before a major bullish wave, that's exactly where we are now. If you agree and would like to see a new session, leave a comment saying "Yes! Top Altcoins Choice." If there is enough interest we can work together and find many hidden gems. It can be done with your support.

Namaste.

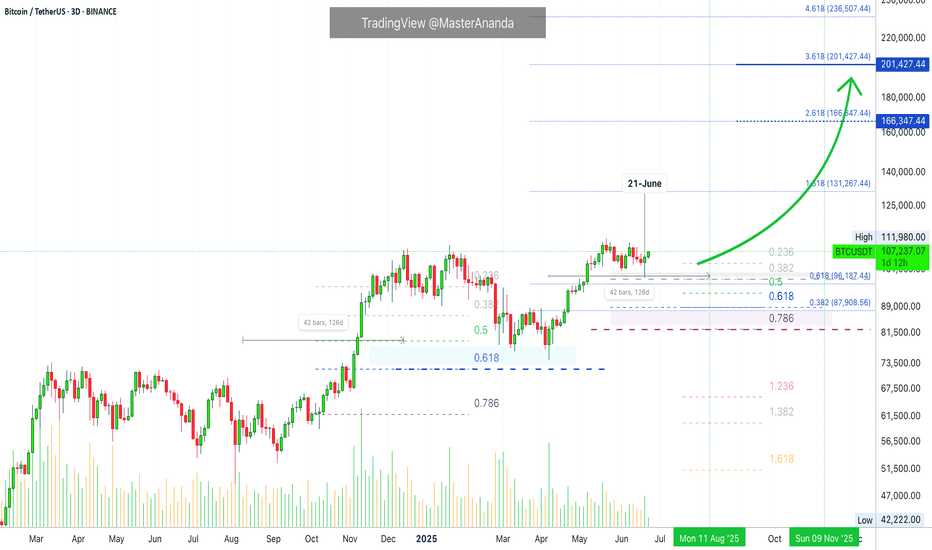

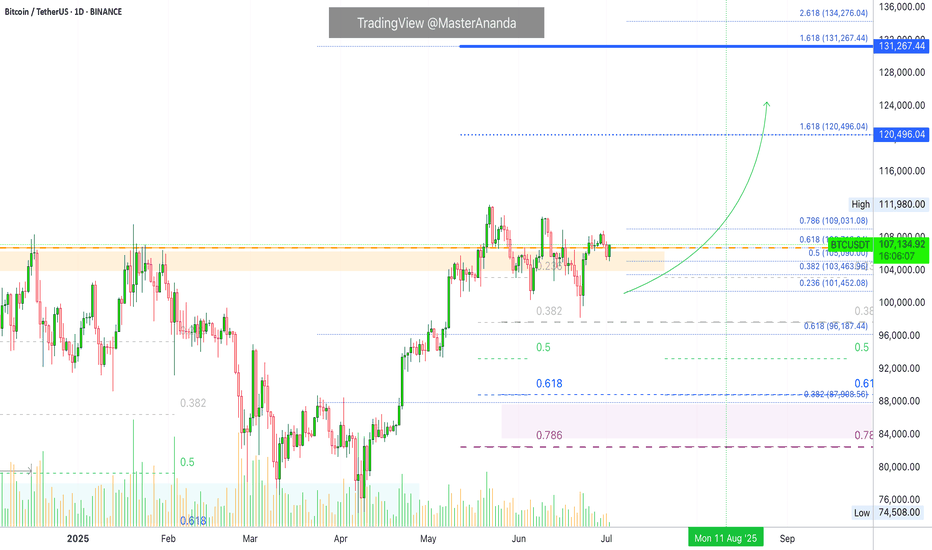

Bitcoin Weekly & $120,000This weekly Bitcoin chart says it all... Please, allow me to reveal to you what the future holds!

Good evening my fellow Cryptocurrency trader, what a wonderful day.

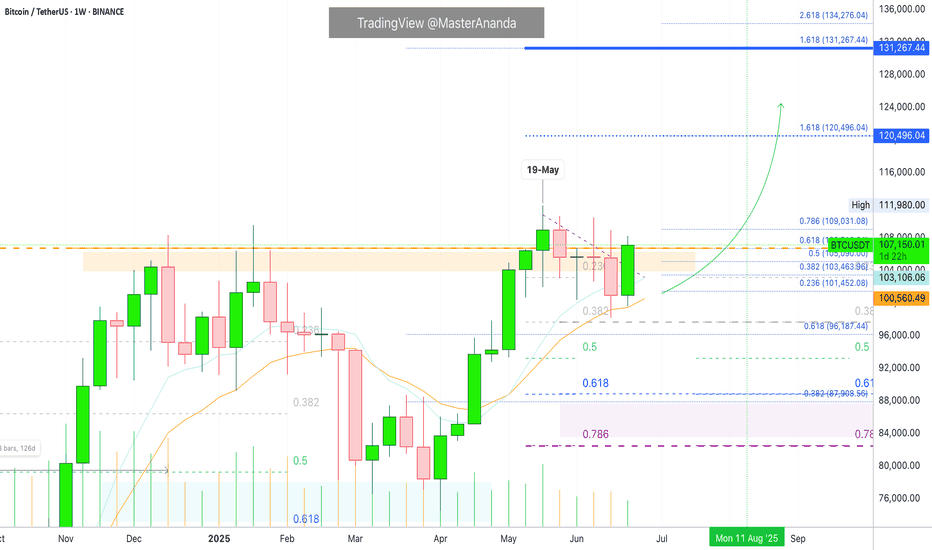

Only one week ever produced a higher close than the current price. Only once, 19-May, Bitcoin managed to close above $107,000... What happens if Bitcoin closes above $107,000? New all-time high confirmed.

Two days remain for the week to close and we—the bulls—only need to maintain a price of $107,000 or higher to send such a strong bullish signal that everybody will come out and start buying.

The next target on this timeframe is $120,000.

Bitcoin is using EMA13 as support. This level was tested and holds, the same for EMA8. When Bitcoin moved above these levels in April, it produced an advance from $83,000 to $112,000, more than 33%. The price now is $107,000 but instead of recovering from below EMA8/13, BTCUSDT is trading above; this means that the bullish bias is fully confirmed.

The weekly timeframe looks great. We can expect higher prices soon, with growth happening for an extended period of time. Bitcoin is very strong now and this is only the start.

I will continue to share proof that shows the entire Cryptocurrency market going up.

Thank you for reading.

Leave a comment with your questions.

Thanks a lot for your support.

Namaste.

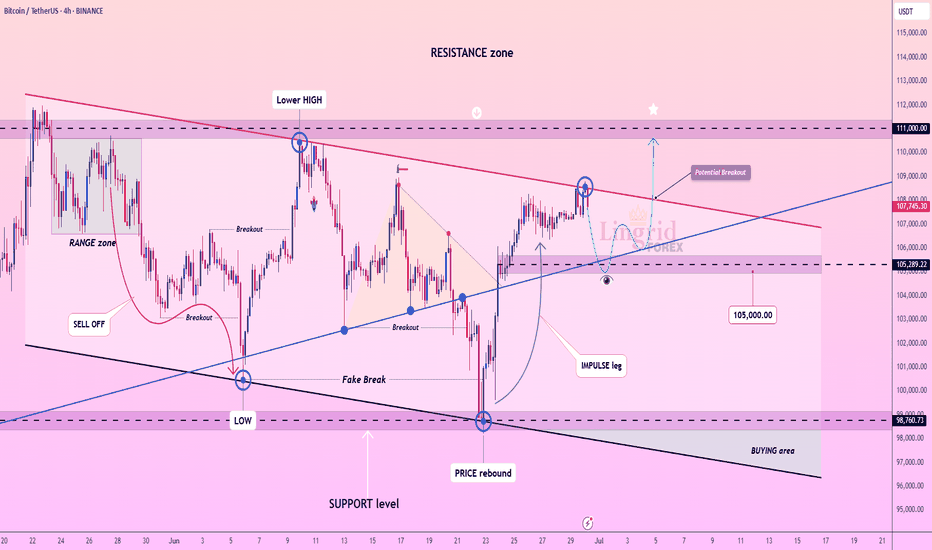

do not SHORT Bitcoin with 20XA consolidation range happens when the market trades sideways, in a neutral capacity. This sideways trading is neither bearish nor bullish, thus neutral. The bearish or bullish tendencies can only be defined based on the broader market structure.

If the consolidation range develops coming from a major drop, you can say that the market is bearish and the consolidation a bearish consolidation even if the breakout happens to the upside. Once it happens to the upside we can say that a reversal developed but the tendencies were bearish nonetheless.

If the consolidation range develops coming from a major rise, you can easy say while being correct that the market is bullish and the consolidation phase a bullish one, because of the bigger structure, previous price action and the chart.

Bitcoin is consolidating with bullish tendencies but there is a boundary which we call resistance and another boundary which we call support, this is the trading range. When the market is ranging, this is when margin traders lose the most because the trend remains hidden and money tends to be made when the market is in a clear trend.

Whenever the upper boundary gets challenged we get a retrace and a test of support. Whenever the lower boundary gets tested prices recover and move back up. This process gets repeated for as long as it is needed to remove all the weak hands, most of the signals are pure noise.

This is the situation in which we find Bitcoin today. Ultra-bullish but sideways and anything can happen short-term. Do not SHORT Bitcoin with 20X. You might end up with some fast and easy profits.

Thank you for reading.

Namaste.

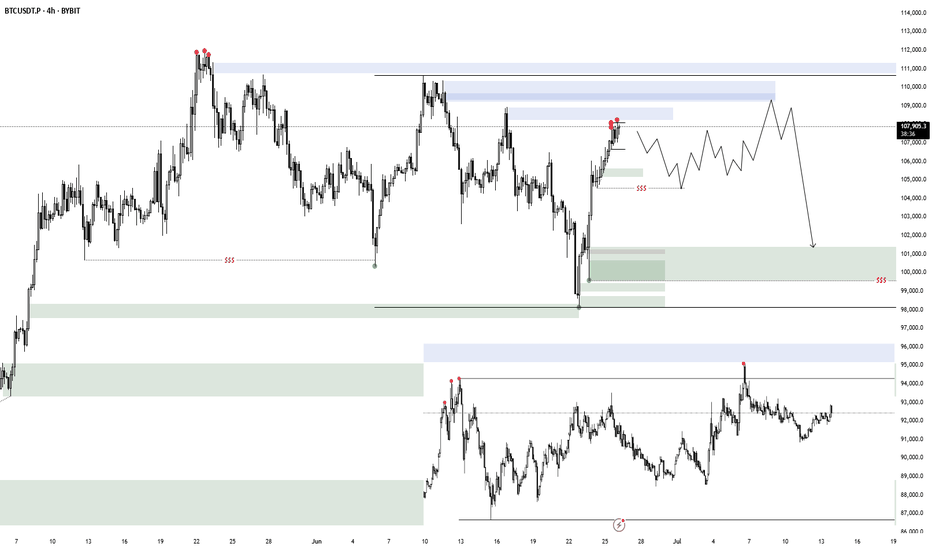

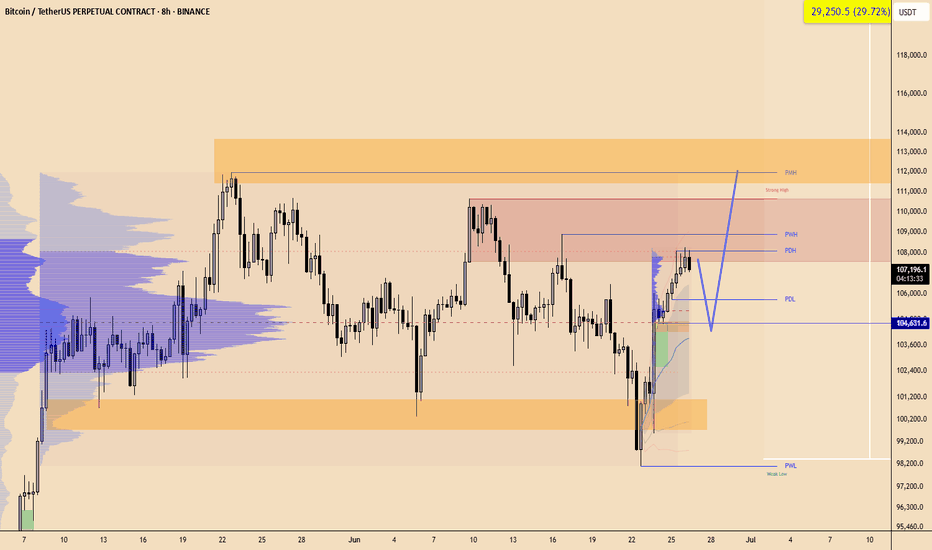

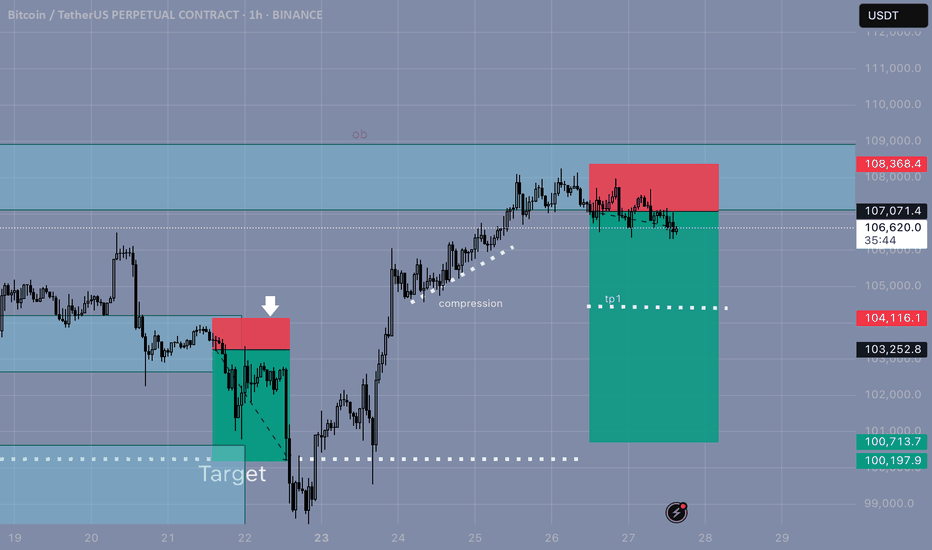

BTC 26.06.25This could be the range i was waiting for to create the 3rd tap of the accumulation model later. Yesterday we had a mini model 1 at NY open which could have had the intention to be the starting point of the new range. I am now watching for new deviations which then would form a bigger range. There is nothing but liquidity until 104.536$ which would be a perfect target for a range low, but until there are no confirmations this only is an expectation. If the accumulation model is already complete, like i mentioned in my last post, then the target becomes the range high (110.652$).

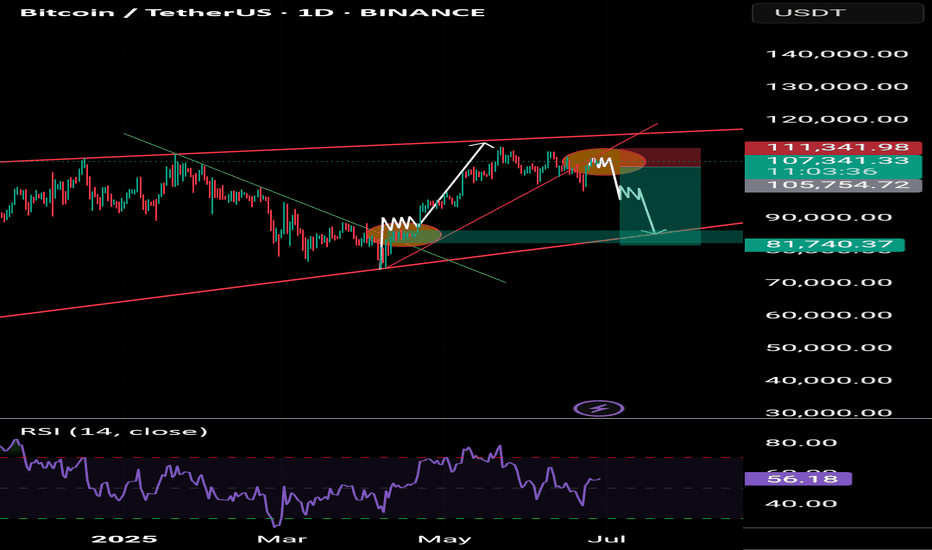

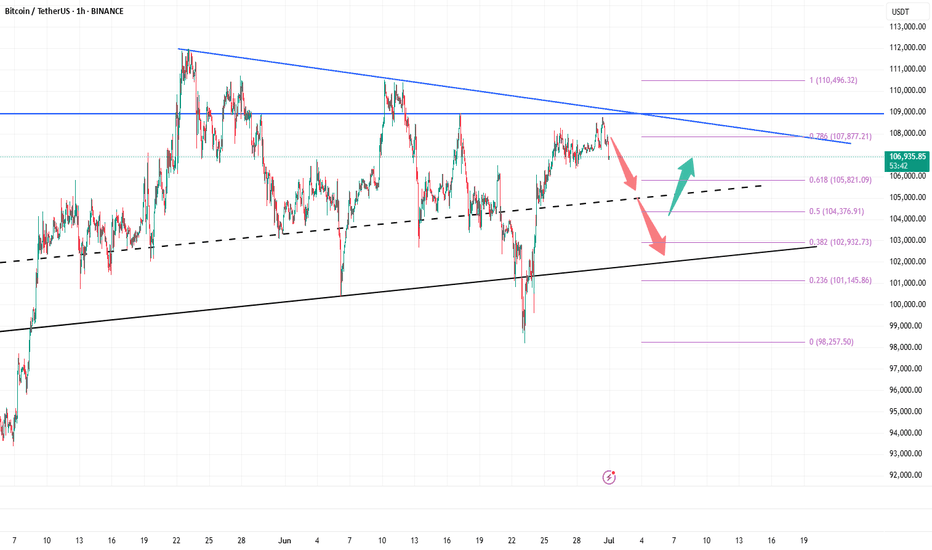

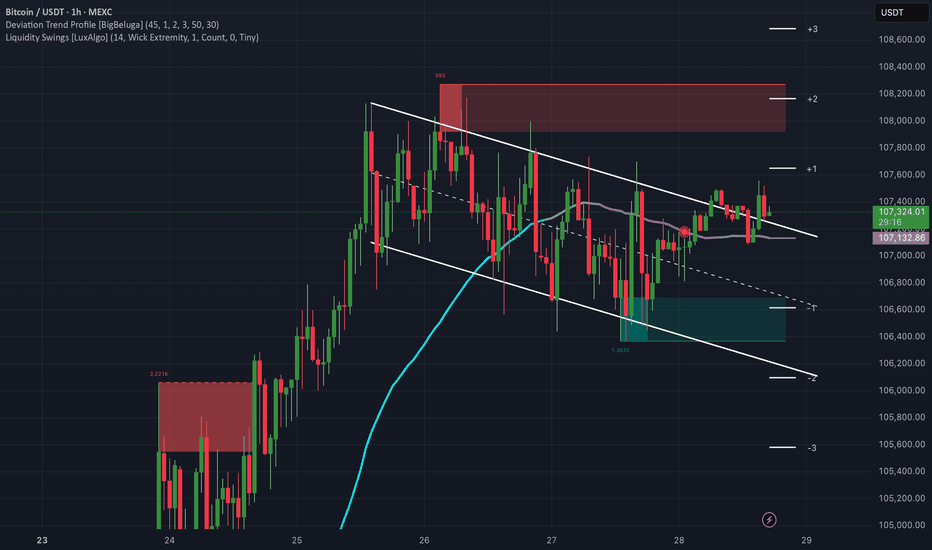

Lingrid | BTCUSDT possible Channel Break - Upside Surge The price perfectly fulfilled my last idea . BINANCE:BTCUSDT is pulling back slightly after rejecting the descending red trendline near the 108,000 level, while remaining above the breakout zone around 105,000. The structure suggests a potential bullish continuation if the price holds this level and forms a higher low. A successful breakout above 108,000 could ignite a move toward the 111,000 resistance band.

📈 Key Levels

Buy zone: 105,000–105,300

Sell trigger: breakdown below 105,000

Target: 111,000

Buy trigger: breakout and retest above 108,000 with strong momentum

💡 Risks

Failure to hold 105,000 reopens path to 98,700

Bearish rejection at 108,000 could maintain lower high structure

Weak volume breakout may lead to a bull trap under 111,000

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

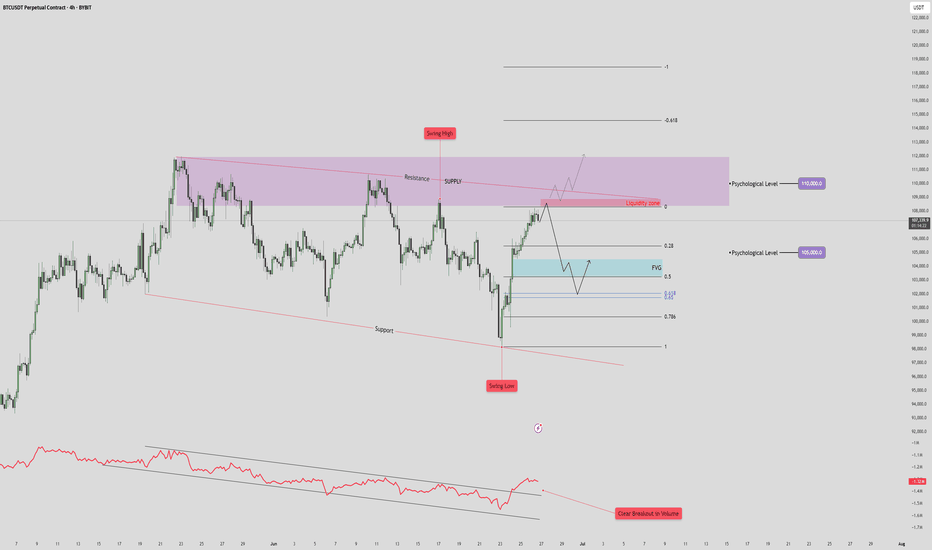

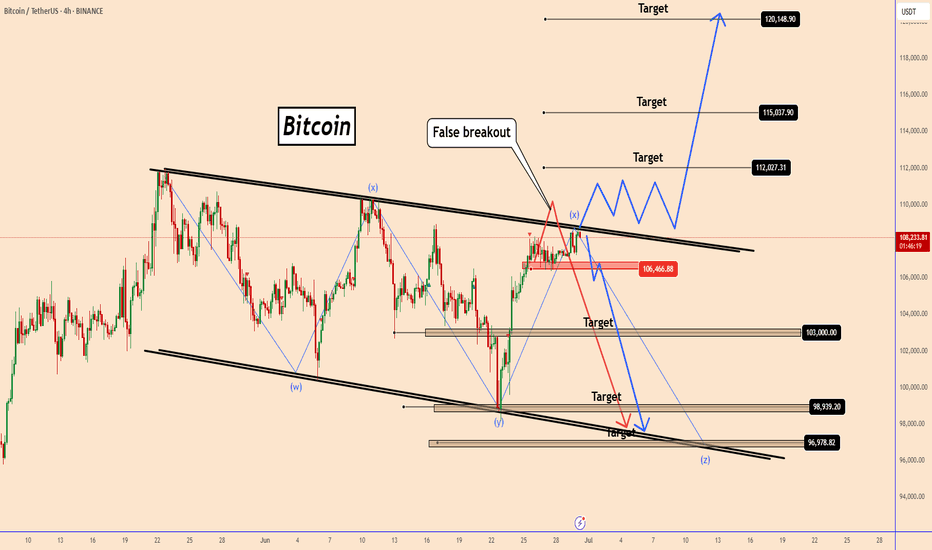

BTC/USDT Drop to 101k?🧠 High Time Frame Context

Trend: Consolidation within a broad range (support and resistance clearly defined).

Key Psychological Levels:

105,000 USDT – minor level, acting as a magnet in short-term PA.

110,000 USDT – major supply confluence and liquidity target.

🟪 Supply & Resistance Zone

Zone: Marked in purple (108.5k-112k).

Key Observation:

Swing high formed inside this zone, indicating liquidity trap.

Potential fake-out or strong rejection from this area.

Strong confluence with a descending resistance trendline, adding to the selling pressure.

🔵 Fair Value Gap (FVG) & Retracement Targets

FVG identified just below the current price (~103.5k-104.5k).

Price is projected to:

Reject from the current high.

Drop to fill the FVG zone.

Possibly bounce between FVG and Fibonacci retracement levels:

0.5

0.618

0.786

🔴 Volume & RSI Divergence

Volume breakout is noted on the last push down (bottom red annotation), followed by a retrace.

OBV shows bullish divergence with price:

🔻 Support Structure

Lower red trendline is a key long-term support.

Previous swing low aligns with this trendline – buyers showed strong interest here.

If FVG fails to hold, expect a retest of this trendline near 97,000–98,000.

📈 Likely Scenarios

Base Case (Neutral-Bearish):

Price rejects current zone (~107,000).

Pullback into FVG (101–104K).

Bounce to 105K (minor resistance), then decide next direction.

Bullish Breakout:

If price breaks and closes above 110K, it invalidates supply zone.

Opens door to 115–118K range.

Bearish Breakdown:

Fails FVG zone.

Tests previous swing low and support (~97K).

Below that, structure becomes macro bearish.

🧩 Summary

Short-Term: Retracement into FVG likely. Monitor reaction.

Medium-Term: Bearish bias while price is below 110K.

Invalidation for bears: Clean break and hold above 110K.

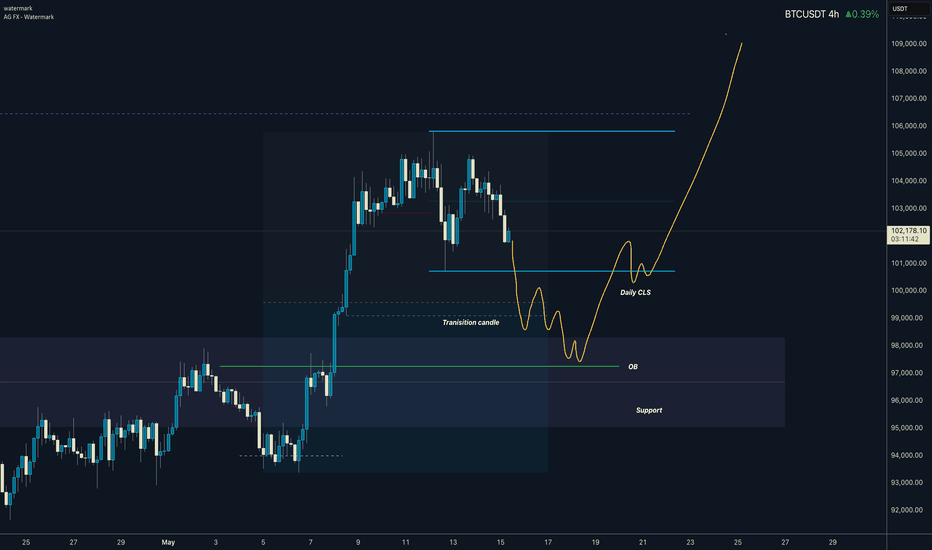

Bitcoin BTC price analysis BTC.D and events calendar for JulyToday is the last day of the month and the last day of the second quarter, so there may be some volatility in the markets between 🐂 VS 🐻

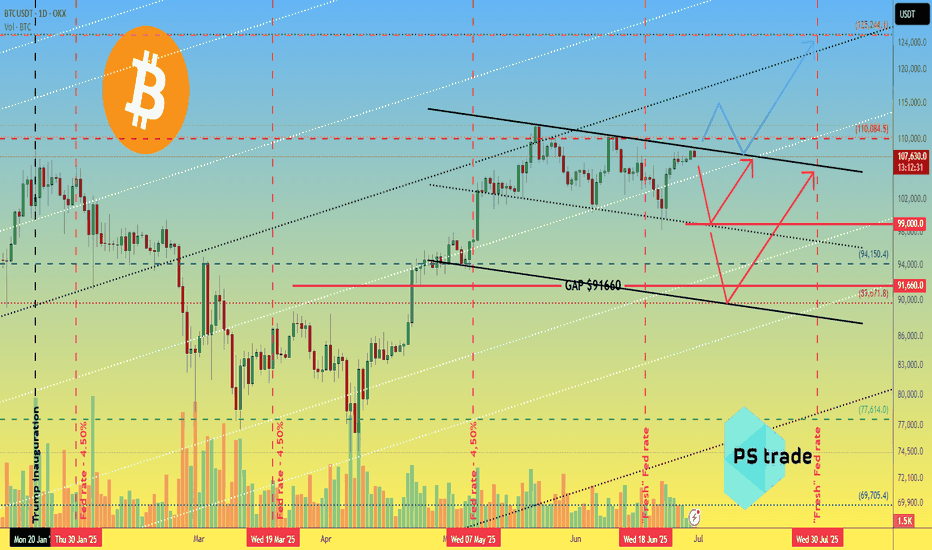

💰 The CRYPTOCAP:BTC chart shows an interesting picture — the price has reached the upper limit of the consolidation channel, and now:

1️⃣ The scenario with an upward breakout is quite clear: a breakout from the channel upward and consolidation above $108-110k= a move to $125k during July.

2️⃣ A correction to $99k will mean that buyers have taken control of the OKX:BTCUSDT price, preventing it from updating its lows. This will be a clear signal to buy, because further growth is inevitable.

3️⃣ A deep correction to $91,660 (filling the GAP that formed on the CME BTC chart) or slightly lower. This is the last “unclosed” GAP, which, according to TA rules, should be filled for a full-fledged growth trend to begin.

So which scenario is closer to your heart, which one do you believe in?

Or write your version of events in the comments.

Interesting observations to think about:

◆ Over the past two weeks, the inflow of funds to #BTCETF has exceeded $5 billion, but the price of #BTCUSD on CEX exchanges has not been able to “break out” upward. Is this just ETF "property of numbers", or are spot #Bitcoin sales that strong?

◆ The BTC.D indicator has reached a critical level of 66%, and it will be interesting to see whether it will give altcoins some breathing room next month.

(If there are a lot of likes and comments under the idea, we will additionally describe our thoughts on BTC.D and USDT.D.)

◆ SP 500, by the way, has updated its highs, and the last few months on the stock market are very similar to the beginning and middle of the COVID-19 pandemic in 2020.

◆ And in principle, July promises to be very eventful:

👉 By July 9, Trump is expected to make a statement regarding the tariff wars with the rest of the world, which he has put on hold.

👉 July 18 marks the beginning of Mercury retrograde, which “influences” people's behavior and ‘superstitions’ and forces them to be “more cautious” when making trading decisions (and trading bots don't care about emotions and beliefs)

👉 And on July 30, there will be a FOMC meeting, where Mr. Powell may announce a rate cut, as the US is in a recession, which is time to acknowledge.

If we have forgotten anything, please add it in the comments!

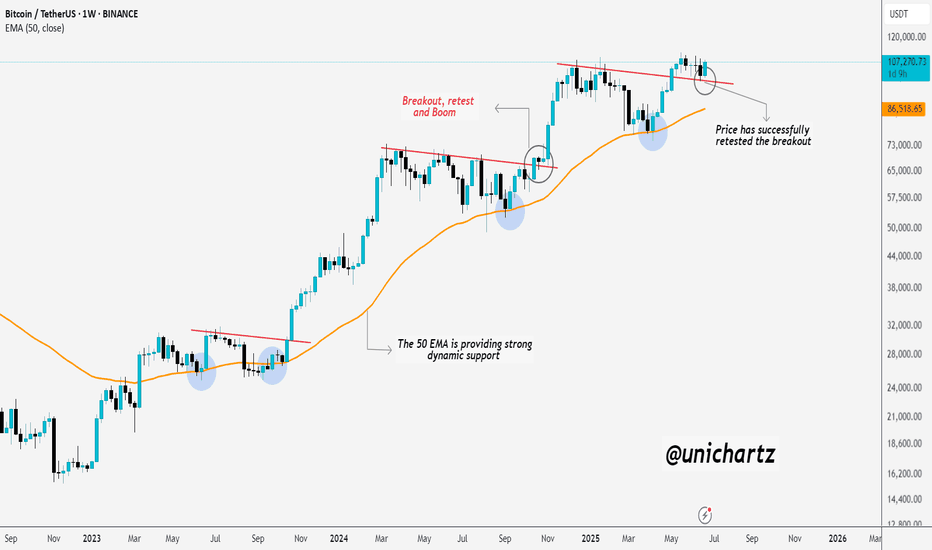

Bitcoin Bounced Right Where It ShouldBitcoin continues to respect the script — breakout, clean retest, and now holding strong.

The 50 EMA has been a reliable dynamic support throughout the entire uptrend, and once again, it helped catch the recent dip. Price has now successfully retested the breakout zone and is starting to bounce.

Structure looks healthy, momentum is building, and unless the support fails, the next leg up could be just around the corner.

Simple setups. No noise. Just trend.

DYOR, NFA

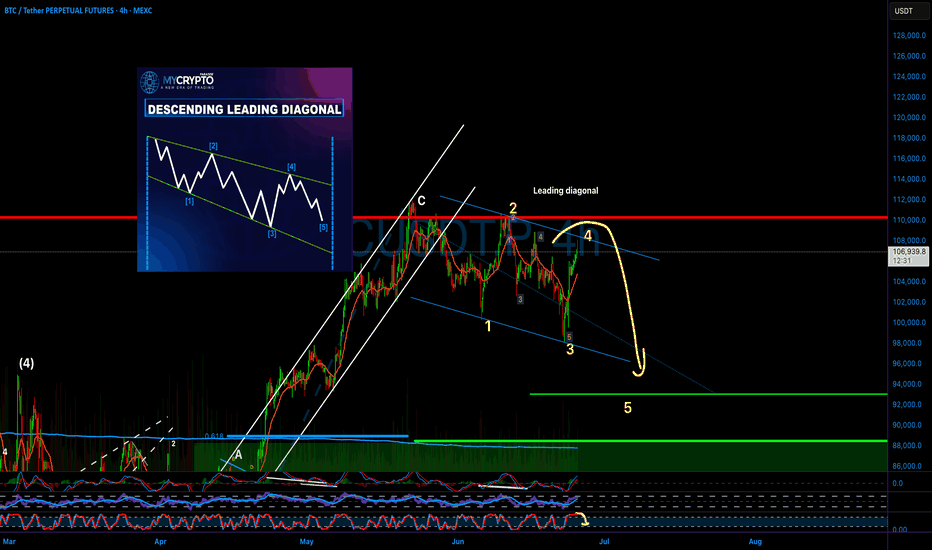

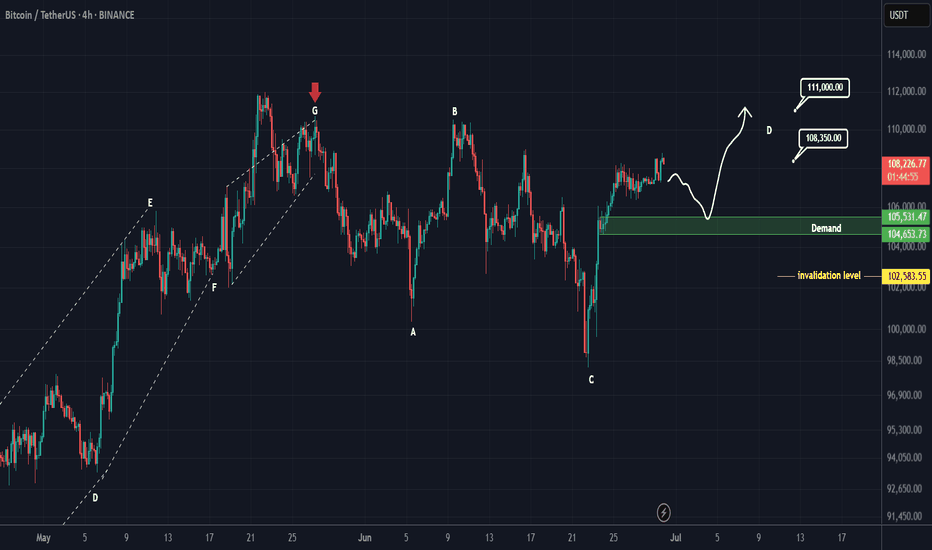

BTC AnalysisSince the red arrow was placed on the chart, Bitcoin's bullish phase has ended and it has entered a corrective phase. This correction appears to be forming a Diametric pattern, and we are currently in the middle of wave E.

After interacting with the demand zone, the price may move toward the specified targets.

A daily candle closing below the invalidation level will invalidate this analysis.

Bitcoin Recovers Above 105,000, Extremely Bullish +AltcoinsBitcoin produced only two days red, a bear-trap, and is now trading daily back above $107,000, an extremely bullish development.

Good morning my fellow Cryptocurrency trader, I hope you are having wonderful day.

The altcoins market bull market is confirmed and what Bitcoin is currently doing gives further strength to the bullish case and bias. It will be only a matter of days before the entire altcoins market turns strongly bullish with major momentum.

The range is still valid though, $100,000 - $110,000. But this time around the upper-boundary is likely to break and the last ATH tested, a new all-time high is even possible and also highly probable which is what will propelled the altcoins to hit multi-year highs and some even new all-time highs. Many pairs will move ahead.

With each passing day, the Cryptocurrency market will continue to heat up. We can expect growth long-term.

The 2025 bullish cycle started with the 7-April market low. The start of the third wave started 22-June and should go for 2-3 months. Then we will have a correction, the fourth wave followed by one final jump, the fifth wave.

We can expect growth now and all through late 2025. The entire period will be bullish. Only when the marketwide correction comes there will be a pause but many pairs will grow even at this point.

Choose wisely. Low risk vs high potential for reward.

Aim high. Focus on the long-term.

Thanks a lot for your continued support.

Namaste.

Bitcoin Price Analysis! What's Next?Bitcoin Price Analysis! What's Next?

From our last analysis, Bitcoin increased from 107K to 108.5K

The price reached the limits of the pattern so far making everything more difficult because it increased, but with very low volume.

This time, BTC added some more data.

You may watch the analysis for further details

Thank you!

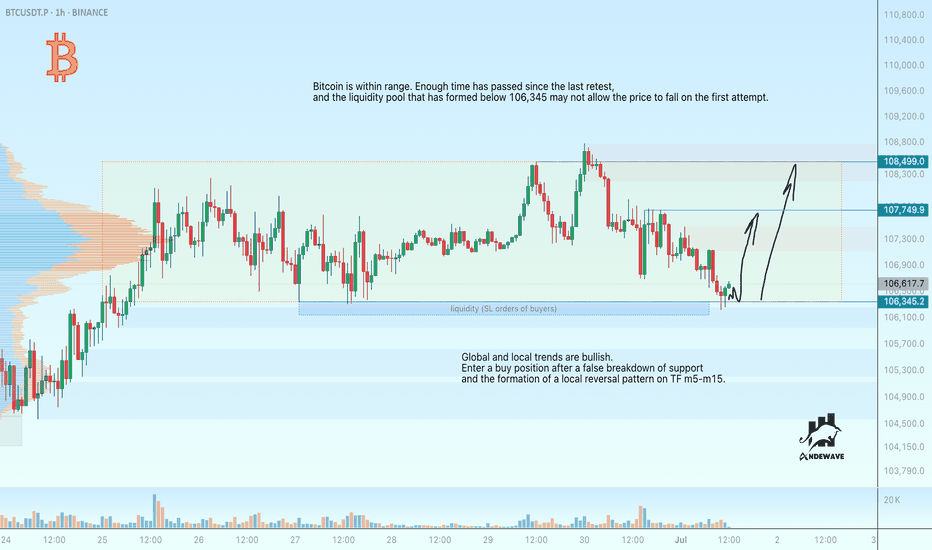

Bitcoin has dropped for profitable purchasesBitcoin is within the range. Quite a bit of time has passed since the last retest, and the liquidity pool that has formed below 106345 may not allow the price to fall on the first attempt.

Global and local trends are bullish. Enter a buy position after a false breakout of support and the formation of a local reversal pattern on TF m5-m15

Scenario: if, after a false breakout, price consolidation forms above 106500, then the entry point could be a breakout of local highs (breakout of the structure - ‘bos’).

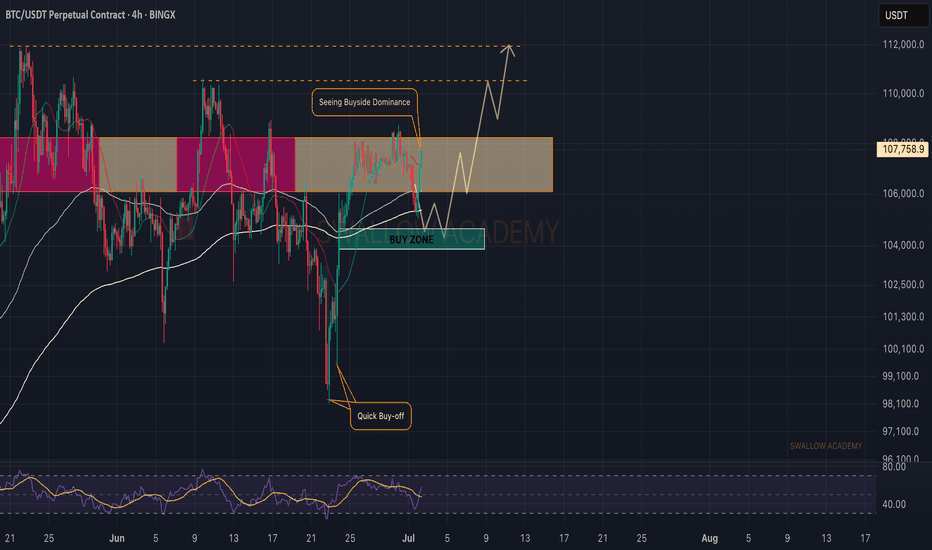

Bitcoin (BTC): Buyers Are Back in Control | New ATH Incoming?Buyers have taken full control once again where we had a good bounce near our buy zone. As we approach the local resistance zone, we are expecting to see a proper breakout from here, which would then lead us to a new ATH (around $120,000).

Swallow Academy

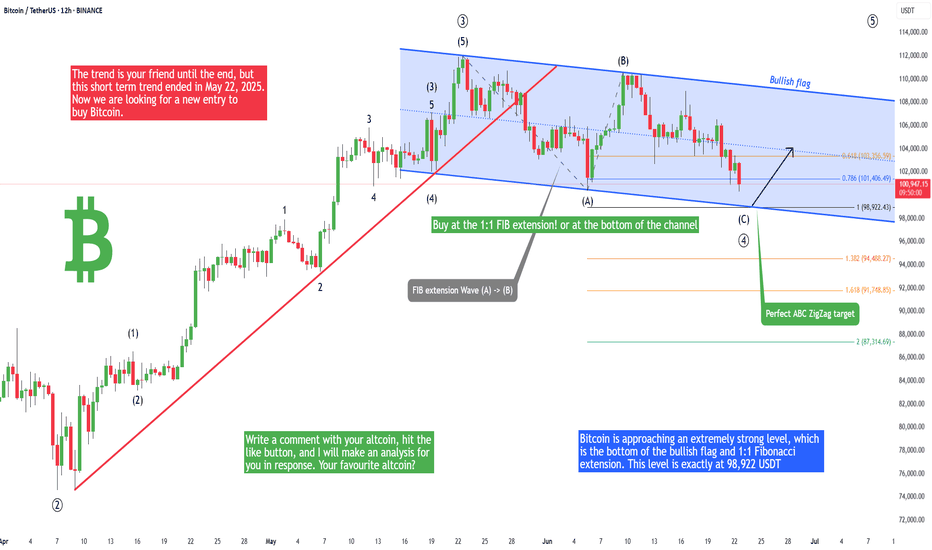

Bitcoin - Drop to 98,922 then a big pump! (Buy here)Bitcoin is falling again mostly because of Trump's aggressive attack on Iran. But technical analysis in general is very strong, and we can find strong levels where smart money has their buy orders. You, as a fish, always want to trade with big whales. Bitcoin is approaching an extremely strong level, which is the bottom of the bullish flag and 1:1 Fibonacci extension. This level is exactly at 98,922 USDT and this is where you definitely want to put your buy orders. I am confident we will see a significant pump from this level.

From the Elliott Wave point of view, Bitcoin is finishing a major ABC ZigZag correction. A classic textbook ZigZag pattern has a 1:1 fib extension between its waves. At this point we don't know if this is going to be the bottom on Bitcoin or not, because ZigZag can transform into a complex WXYXZ Triple three corrective pattern. Of course there are no patterns with 100% probability of success, but this ABC seems to be very probable, at least for a short-term bounce.

Now the most important question - where to take profit? If we buy at 98,922 we definitely want to take profit at a strong resistance on the way up. In the next analysis I will share with you the best levels to sell and potentially short Bitcoin, so this will be very exciting, do not forget to hit the boost button and follow me! But I can already see a strong level around 104,500.

Trading tip at the end: Before entering a trade, you must know where your profit target is and where your stop loss is. Write a comment with your altcoin + hit the like button, and I will make an analysis for you in response. Trading is not hard if you have a good coach! This is not a trade setup, as there is no stop-loss or profit target. I share my trades privately. Thank you, and I wish you successful trades!

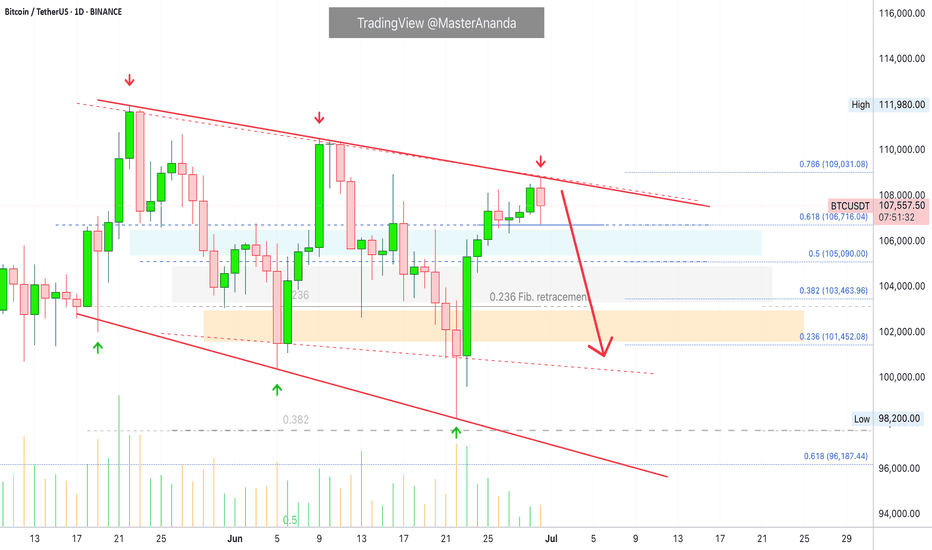

Short BTC, it is about to retrace and test 100000 again!As BTC gradually fell back, the rebound did not stand above 110,000 in the short term, proving that there is strong selling pressure above, and the trend line formed by the technical high point 111,000 and the second high point 110,000 formed an important resistance area, which limited the rebound space of BTC and strengthened the demand for BTC's short-term retracement.

According to the current trend, the short-term oscillation bottom area of 106,000 may be broken at any time. Once it falls below the oscillation area, it may arouse a certain degree of profit-taking chips and stimulate BTC to accelerate its decline. I think BTC will at least test the 105,000-104,000 area again during the retracement, and may even test the 100,000 integer mark again.

Therefore, shorting BTC is still the preferred option for current short-term trading.

Consider shorting BTC in the 108,000-109,000 area, and the target area in the short term is 104,500-103,500. After breaking this area, the target can be extended to 101,000-100,000.

BINANCE:BTCUSDT BINANCE:BTCUSDT BITSTAMP:BTCUSD

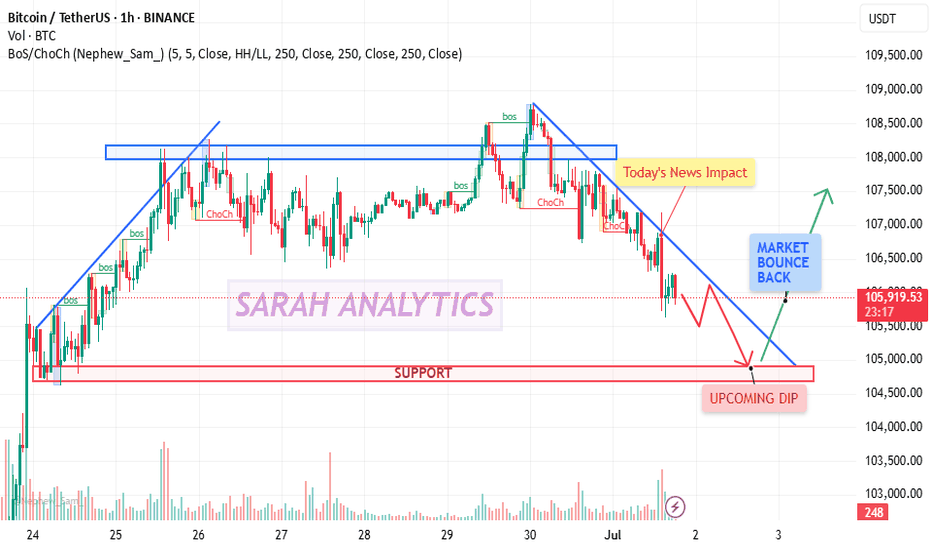

Bitcoin Major Dip Upcoming | Next Move BEARISH ?Bitcoin experienced a sharp intraday pullback from ~$107.6K down to ~$105.8K, influenced by new U.S. Senate legislation discussions targeting crypto taxation and exchange regulation. This news injected short-term volatility and prompted a minor sell-off.

However, BTC closed June at its highest monthly level ever (~$107.1K), maintaining a strong macro uptrend. Institutional interest remains robust, with over $4.5B in inflows into BTC ETFs over the past two weeks. On-chain data shows ~98% of BTC supply is in profit, reflecting underlying strength—though short-term caution is warranted due to possible profit-taking.

📉 Technical Analysis (Chart Reference)

🔹 Key Levels:

• Resistance: $107,500 / $112,000

• Support: $105,000 / $103,000 / $100,000

🧠 Observations from the Chart:

• Resistance Zone: Price struggled to break and sustain above $107,500 despite multiple Break of Structure (BoS) attempts.

• Support Zone: Strong horizontal support is established around the $105,000 level—price is currently testing this.

• Market Structure: Multiple Change of Character (ChoCh) patterns suggest a short-term bearish trend, likely driven by macro news impact.

• Upcoming Dip: Chart annotations highlight an expected pullback into the $104K–$105K region before a potential bounce.

• Trendlines: The downward-sloping trendline indicates corrective pressure, but the broader ascending channel remains intact.

📈 Technical Outlook

• Trend: BTC is consolidating within a broad ascending structure on higher timeframes. The current dip aligns with a healthy retest.

• Momentum: 4H RSI and MACD show cooling, signaling temporary bearish momentum.

• Watch Zone: $103K–$105K is key for potential bounce. Losing $100K would invalidate short-term bullish structure.

Next Move Prediction

Short-Term (1–5 Days):

🔻 Expect continued downside/consolidation toward $103K–$105K. High chance of buyer re-entry around support.

Medium-Term (2–4 Weeks):

📈 Bullish continuation toward $112K–$115K if ETF inflows remain steady and no major regulatory shocks occur.

💼 Trading Plan

• Buy Zone: $103,000–$105,000 (scale in during dips)

• Target 1: $112,000

• Target 2: $115,000

• Stop Loss: Below $100,000 (daily close)

Despite short-term news-driven volatility, Bitcoin’s macro trend remains bullish. As long as the $100K support holds, this is likely a dip-buying opportunity. July often brings strong seasonal performance, and ETF demand may act as a major bullish catalyst. Stay alert for news and volume confirmation before committing to entries.

Waiting for the Liquidity Flush – Will We Get That Drop or a StoCurrently holding a short position and have been waiting for a decent liquidity flush towards my TP zone for almost a day now. The thing that bothers me is how slow the price action is—it's grinding lower, but at the same time, building up a new liquidity shelf just above my entry.

This makes me concerned that we might see a quick liquidity sweep to the upside (taking out stops, possibly including mine) before any real move down happens. The area around my TP is loaded with liquidity, but the market seems hesitant to make that push.

What’s your opinion—are we likely to get that clean drop soon, or should we brace for a fake-out and stop hunt first?

BITCOIN I Daily CLS I KL - OB I Target ATHHey, Market Warriors, here is another outlook on this instrument

If you’ve been following me, you already know every setup you see is built around a CLS range, a Key Level, Liquidity and a specific execution model.

If you haven't followed me yet, start now.

My trading system is completely mechanical — designed to remove emotions, opinions, and impulsive decisions. No messy diagonal lines. No random drawings. Just clarity, structure, and execution.

🧩 What is CLS?

CLS is real smart money — the combined power of major investment banks and central banks moving over 6.5 trillion dollars a day. Understanding their operations is key to markets.

✅ Understanding the behaviour of CLS allows you to position yourself with the giants during the market manipulations — leading to buying lows and selling highs - cleaner entries, clearer exits, and consistent profits.

🛡️ Models 1 and 2:

From my posts, you can learn two core execution models.

They are the backbone of how I trade and how my students are trained.

📍 Model 1

is right after the manipulation of the CLS candle when CIOD occurs, and we are targeting 50% of the CLS range. H4 CLS ranges supported by HTF go straight to the opposing range.

📍 Model 2

occurs in the specific market sequence when CLS smart money needs to re-accumulate more positions, and we are looking to find a key level around 61.8 fib retracement and target the opposing side of the range.

👍 Hit like if you find this analysis helpful, and don't hesitate to comment with your opinions, charts or any questions.

⚔️ Listen Carefully:

Analysis is not trading. Right now, this platform is full of gurus" trying to sell you dreams based on analysis with arrows while they don't even have the skill to trade themselves.

If you’re ever thinking about buying a Trading Course or Signals from anyone. Always demand a verified track record. It takes less than five minutes to connect 3rd third-party verification tool and link to the widget to his signature.

"Adapt what is useful, reject what is useless, and add what is specifically your own."

— David Perk aka Dave FX Hunter ⚔️