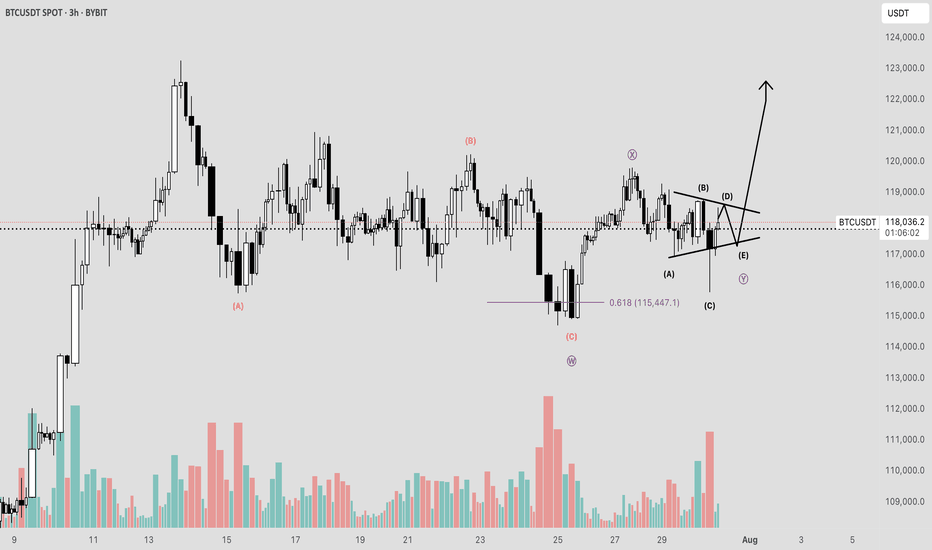

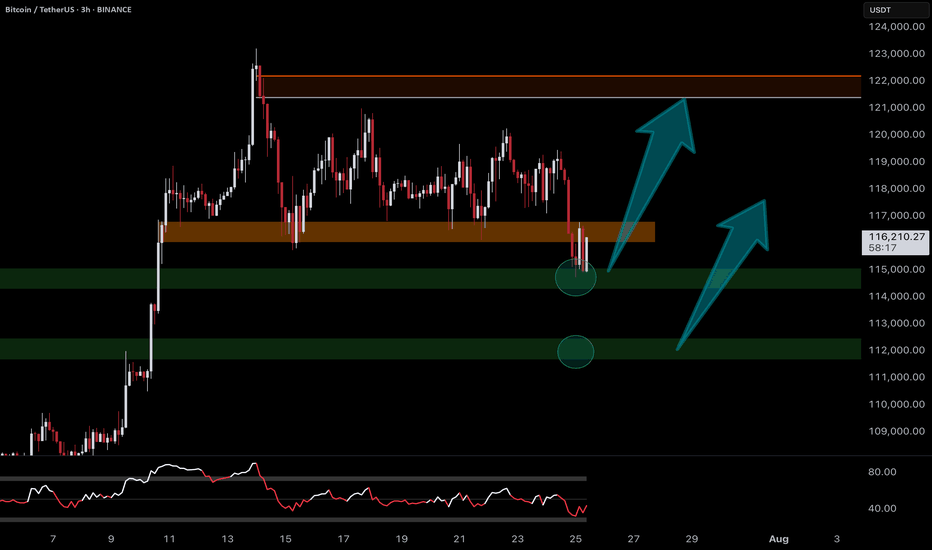

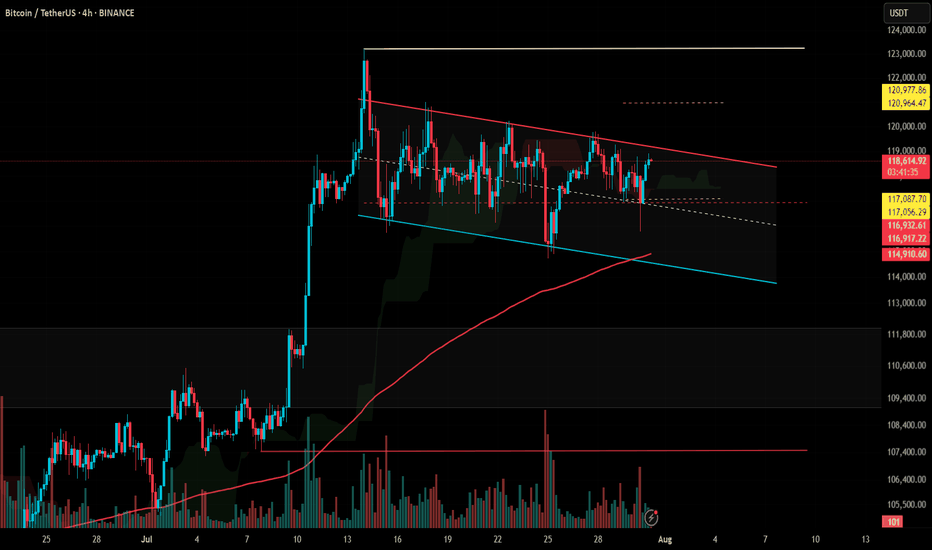

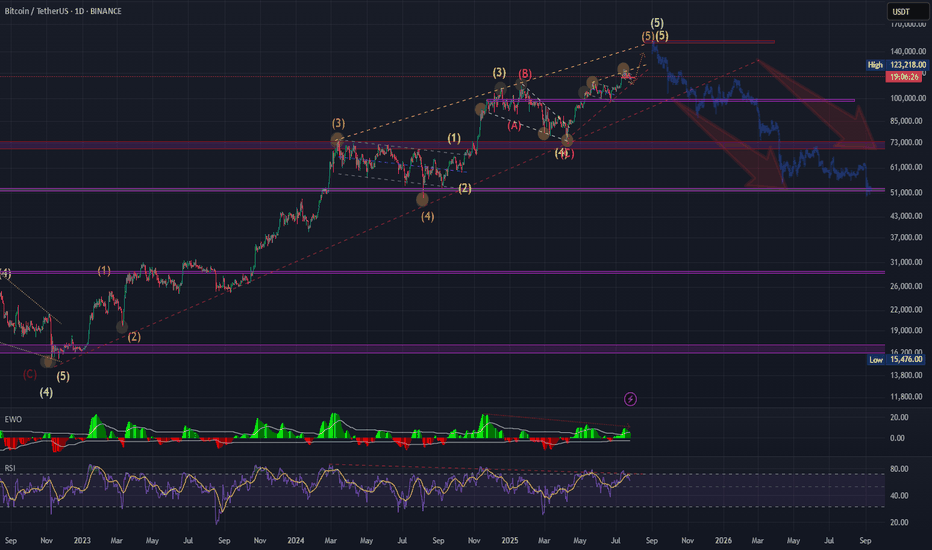

BTC Elliot Wave Double Combo CorrectionToday, I observed that Bitcoin may be unfolding within a complex double corrective wave structure—specifically a WXY pattern—potentially culminating in a contracting triangle.

Such corrective formations represent a temporal pullback, wherein the market undergoes a period of consolidation following an impulsive advance, also referred to as a pullback in time. This phase often serves as a mechanism for establishing structural support within a defined range prior to a continuation move.

A key point of uncertainty lies in whether the integrity of the triangle has been compromised by the recent, pronounced liquidity sweep. From the perspective of both the daily and 4-hour charts, this move resembles a classic deviation or "fake-out" rather than a legitimate breakout.

Nonetheless, the market may remain in a state of indecision for a few more sessions, characterized by erratic or range-bound price action, before committing to a more definitive trend.

A sustained break and successful retest above the 120K level would serve as a strong technical confirmation that Bitcoin intends to pursue higher valuations.

BTCUSDT trade ideas

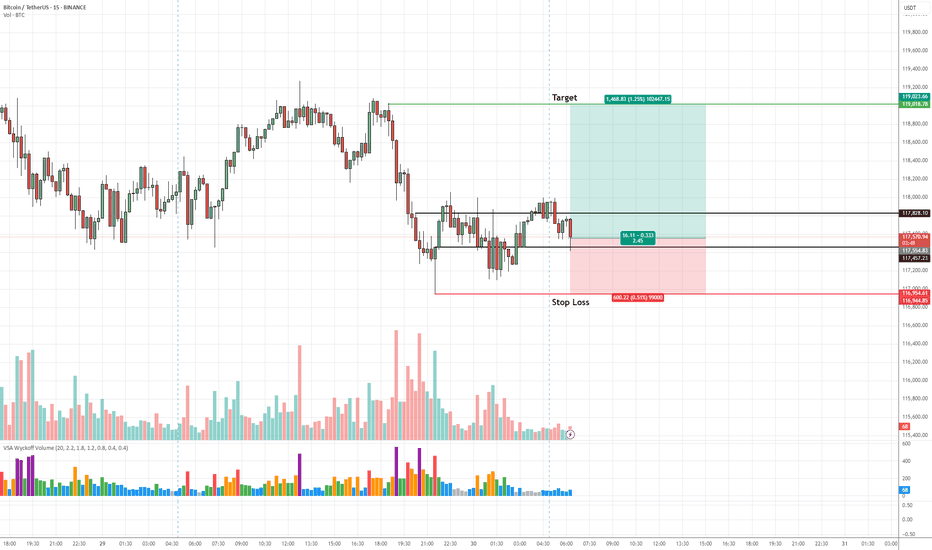

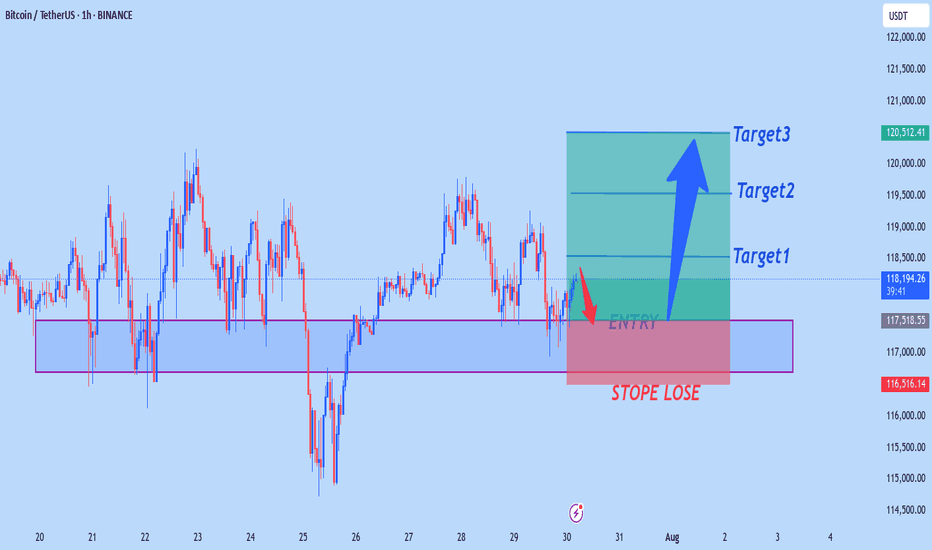

BTC/USDT Buy Setup – VSA & Demand Zone Reaction✅ Entry: Current price action near 117,297

🎯 Target: 119,078 (+1.22%)

🛑 Stop Loss (SL): 116,944 (below demand zone)

📊 Technical Insight (Volume Spread Analysis):

Stopping Volume at Lows:

The recent down move halted with a wide spread down-bar on high volume, followed by an immediate rejection. This indicates potential professional buying absorbing supply.

No Supply Confirmation:

After the stopping volume, several narrow spread candles on low volume formed, suggesting weak selling pressure and a lack of commitment from bears.

Bullish Reaction:

Price rebounded from the demand zone with increasing volume on up-bars, showing early signs of demand dominance.

The current consolidation just above the support is typical of absorption before a markup phase.

Risk-Reward Structure:

The setup offers a favorable 2.2:1 R:R ratio, with the stop placed just below the zone to avoid false breakouts while allowing the trade room to breathe.

📌 Trade Plan:

Bias remains bullish as long as price holds above 116,944.

A breakout above the minor resistance (117,828) with volume expansion would confirm the next leg up toward the 119,078 target.

If volume fails to support the move, reassess before committing additional capital.

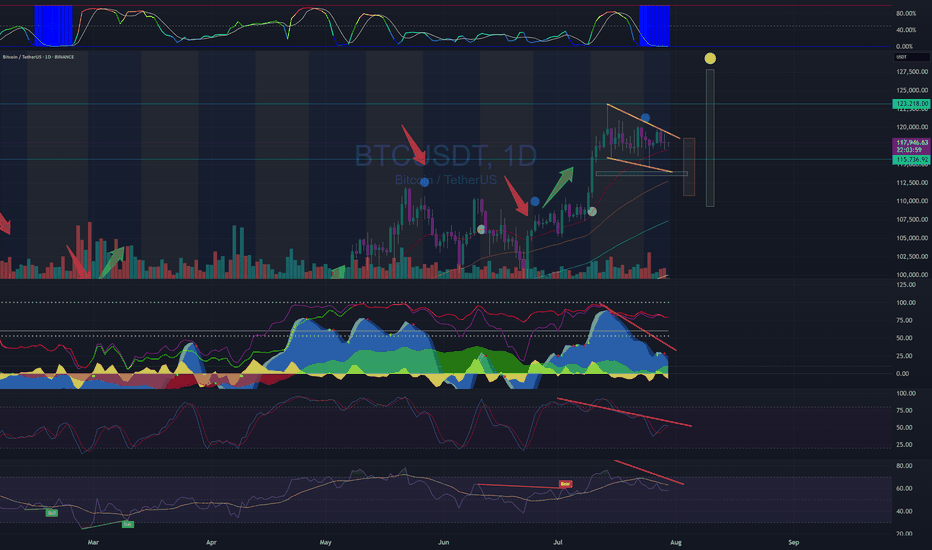

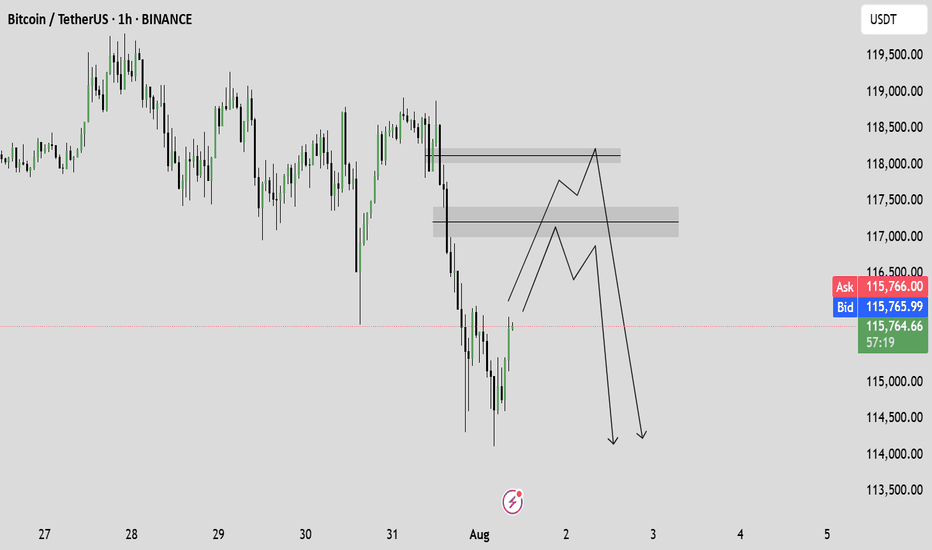

BTC Moon Phase, Dominance % and BBWP resolutionBTC, D. Moon Phase. I see bearish scenario for the next days, until 4-5th of August. After reviewing Moon Phase chart for last year+, I see same scenario is happening most of the times. During the First Quarter ( Aug. 1) of the phase, price is dropping and start to recover about 4-5 days prior Full Moon. This is exactly when energy of the Full Moon starting to amplify. Current BBWP is contracted for 8 days, making the next move very rapid, I would not set any long/short trades, untill the volume start to expand. Its the mid summer - always slow and August is the month it start to accelerate towards the Fall, with all financial/political tricks happening in September and later in Q4. We already had one bear trap fakeout, but price didnt anticipate to go higher and got rejected by falling wedge upper like ( or bull flag, in this case).I would expect that high volume green candle will be either fully recovered to $110-111K , or 75% recovery, where the CME gap is $113500 - 1-2% lower, making it $113,000. The cascade liquidation will happen very fast, I expect the whole move down and up will take around 24 hours, with the bottom time 5-15 minutes. Need to be ready, that all alts will crash as well, Im expecting BTC %dominance to bounce here , after 8.4% drop to weekly 50EMA. I would like to see BTC, D% at 70% by Christmas and new ATH, what ever it is 160K or 200K what ever it is, for bitcoin to make ATH, it must grab dominance.

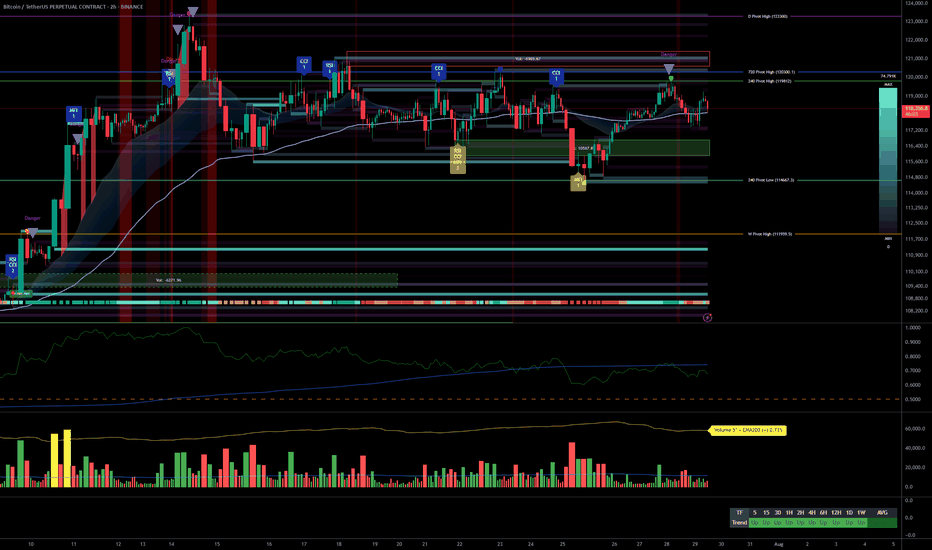

Multi-timeframe analysis, strong momentum, FOMC risk/reward plan__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Strong momentum and bullish consensus confirmed across all timeframes.

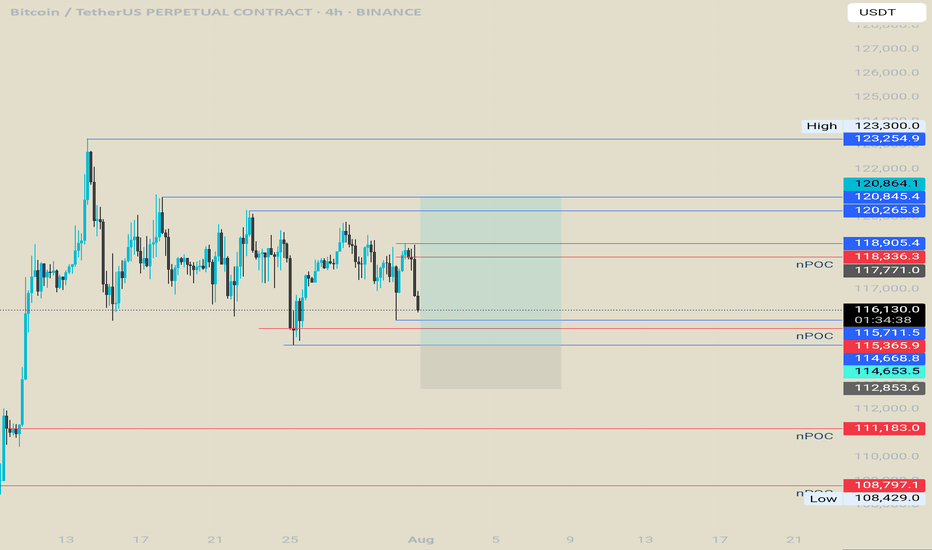

Key support/resistance : 114k–116k (critical support), 123k (major pivot).

Healthy organic volume , no extreme peaks except isolated moments (30min/15min).

Risk On / Risk Off Indicator : Dominant bullish signal, neutral only on 15min.

Multi-timeframe structure : Perfect alignment daily/4H/2H/1H, caution on 15/30min (slight inflection but no abnormal divergence).

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Global bias : Structural bull market, intact dynamic.

Opportunities : Tactical buys on pullbacks (114–116k), swing on breakout 123k.

Risk areas : Below 114k = risk of invalidation, targets 111k–105k.

Macro catalysts : FOMC imminent (high volatility expected), watch geopolitical tensions.

Action plan : Favor swing/cautious trading ahead of FOMC, dynamic stops, act on first post-Powell trigger.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D : Active range 114k–123k; strong supports, momentum maintained; Risk On / Risk Off Indicator strongly bullish.

12H/6H/4H : Clean bullish structure, no excesses or divergence; price sits within major horizontal clusters.

2H/1H : Healthy impulse/correction phases; key intermediate supports 114.6k, 117.5k to watch.

30min/15min : Slightly weaker momentum but constructive microstructure, no immediate sell threat; localized volume spikes on support reactions.

ISPD DIV : No behavioral stress observed throughout.

Cross-timeframe summary : Bullish confluence dominant; caution on short-term reversals tied to FOMC and on-chain volatility spikes.

__________________________________________________________________________________

Multi-timeframe Cross Analysis & Decisional Rationale

__________________________________________________________________________________

As long as BTC > 114k = bullish bias, buying pullbacks, swing target 123k.

Active management post-FOMC strongly advised (enter/reduce after first H4 close).

Increased volatility risk in case of Fed/geopolitical shock; mandatory stops.

Sector momentum (Risk On / Risk Off Indicator) and volume underpin the bullish case unless exogenous alert.

Invalidation below 114k = prudent, neutral, or tactical shorts towards 111k–105k.

__________________________________________________________________________________

Macro, On-chain & Economic Calendar

__________________________________________________________________________________

FOMC July 29th : pivotal event, any surprise = strong intraday move (BTC sensitive to Powell speech).

US Macro: strong fundamentals but caution on trade war, inflation "contained."

On-chain : realized cap BTC >$1T, high open interest in derivatives = leveraged risk, beware speculative altcoin excess.

Global risk : market remains buyer until bearish Fed/geopolitical shock; swing trading favored, tight stops recommended.

__________________________________________________________________________________

Action plan

__________________________________________________________________________________

Favor buying/reloading on pullbacks to 114.6k–116k (stop <114k).

Break above 123k = bull confirmation, further extension likely to 126–128k depending on FOMC outcome.

Prioritize strict risk management; monitor liquidity/supports on macro/on-chain volatility peaks.

__________________________________________________________________________________

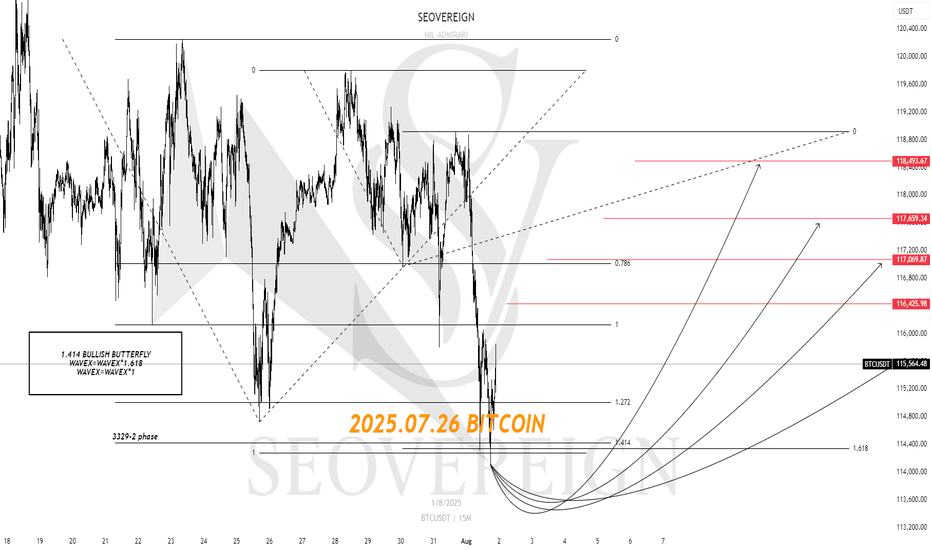

[SeoVereign] BITCOIN BULLISH Outlook – August 1, 2025We are the SeoVereign Trading Team.

With sharp insight and precise analysis, we regularly share trading ideas on Bitcoin and other major assets—always guided by structure, sentiment, and momentum.

🔔 Follow us to never miss a market update.

🚀 Boosts provide strong motivation and drive to the SeoVereign team.

--------------------------------------------------------------------------------------------------------

Hello.

This is SeoVereign.

My fundamental view on Bitcoin, as mentioned in the previous idea, is that I am anticipating an overall downward trend. In the mid- to long-term, I believe the downward pressure will gradually increase, and this is partially confirmed by various indicators and the overall market sentiment.

However, before we fully enter this downward phase, I have been judging that one more upward wave is likely to remain. I have focused my strategy on capturing this upward segment, and I have recently reached a point where I can specifically predict the development of that particular wave.

If this upward move unfolds successfully, I plan to set my take-profit range conservatively. The reason is simple: I still believe there is a high possibility that the market will shift back into a downtrend afterward. The core of this strategy is to minimize risk while realizing profits as efficiently as possible toward the tail end of the wave.

The relevant pattern and structure have been marked in detail on the chart, so please refer to it for a clearer understanding.

In summary, I view this rise as a limited rebound that could represent the last opportunity before a downturn, and I believe this idea marks the beginning of that move.

I will continue to monitor the movement and update this idea with additional evidence. Thank you.

BTC: Calm before the storm on market, or where we go?Sometimes the market is straightforward: there’s momentum, a trend, a clear direction. But other times—like now—there’s complete uncertainty. Over the past few days, Bitcoin has been trading in a tight range, lacking any pronounced momentum. The price moves back and forth, bouncing off local levels but not breaking out in any meaningful way.

📉 This is especially clear on the 4-hour chart: neither bulls nor bears can take control. Every move upward is quickly met with selling pressure, and attempts to drop are countered by buying. It’s like a “ping-pong” match in a sideways market.

📊 Indicators show low volatility and declining volumes, confirming that market participants are simply waiting. Likely, they’re anticipating an external trigger: news, macroeconomic events, interest rate decisions, ETF developments, or something else.

What could this mean?

Such conditions often precede a strong move. The question is—where to? Honestly, there’s no clear signal yet. Personally, I try not to rush in moments like these: if the market isn’t giving a clear direction, it’s better to take a pause.

That’s the essence of a professional approach: don’t trade just for the sake of trading, but wait until the market speaks more confidently.

What can you do now?

– Watch the range boundaries and wait for a breakout or trade bounces.

– Avoid entering positions based on emotions—pullbacks can be sharp and unexpected.

– Reduce trade sizes if you do enter, and set tight stops.

– Keep an eye on the news—sometimes even neutral news can spark a move.

Sometimes the best decision is to do nothing. This might be one of those times. In a sideways market, you’re more likely to lose than gain. But clarity almost always follows a consolidation.

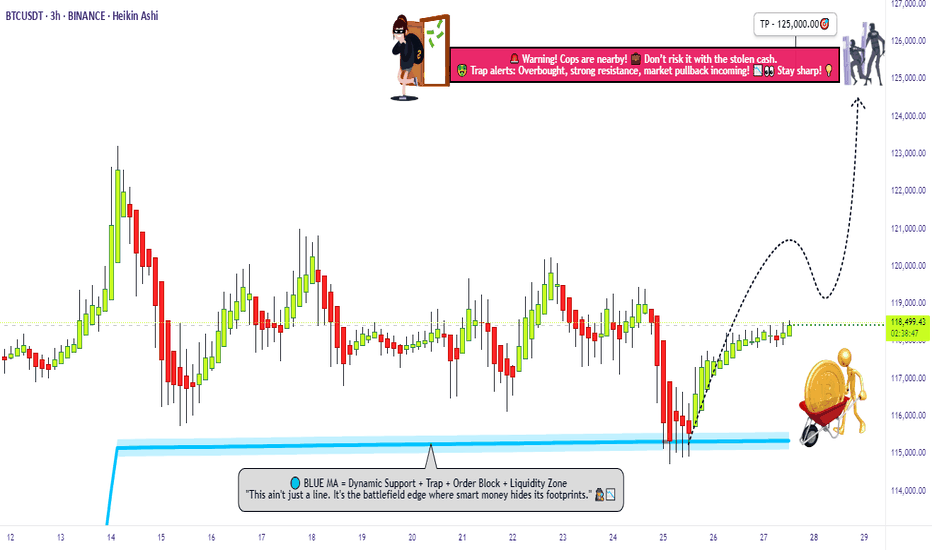

"Bitcoin’s Big Heist – Are You In or Out?"🚨 BTC/USDT HEIST MISSION – SWIPE THE BULL RUN BEFORE THE BEARS WAKE UP 💰💣

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Money Makers & Robbers, assemble! 🤑💰✈️💸

Here’s your decoded BTC/USDT “Bitcoin vs Tether” Crypto Market Heist Plan, fully loaded with Thief Trading Style 🔥 TA + FA combo. We’re prepping for a bullish breakout loot – eyes on the vault, ignore the noise.

🎯 PLAN OF ATTACK:

🎯 ENTRY (BUY ZONE):

💥 “The vault’s open—time to sweep!”

DCA/Layer your buy limit orders near the 15–30 min swing lows/highs for sniper pullback entries.

Use multi-entry method to stack positions (layering / DCA) as per your ammo (capital 💵).

🛑 STOP LOSS:

Set SL at the nearest swing low wick (4H TF) — around 115000.00, adjust based on your risk/load.

SL = insurance. Not optional.

🏁 TARGET:

Lock sights on 125000.00

🎉 Or… vanish with profits before the bear cops arrive.

🔎 MARKET BACKDROP & ANALYSIS:

📈 BTC/USDT currently signals bullish vibes on the swing/day horizon — fueled by:

Macro Fuel & Fundamentals

Sentiment Radar

COT Reports

On-Chain Pulse

Intermarket Clues

🚀 Connect the dots. The smart money's already prepping a breakout move.

🧲 Scalpers Note:

Stick to the long side only. No shorting the beast — unless you’re made of diamonds.

Secure your bag with trailing SLs.

⚠️ NEWS TRIGGER ZONE – TRADE WITH TACT:

📢 Upcoming high-volatility news events can spike charts.

Avoid new entries during releases and guard open trades with trailing SLs.

Protect the loot. Always.

💖 SUPPORT THE HEIST GANG: BOOST IT!

Smash that ❤️ to boost our thief squad’s momentum!

Every click powers this underground mission – making money with style, one pip at a time. 🎯💣💵

🚀 See you in the next heist drop.

Until then – Stay stealthy. Stay profitable. Stay legendary. 🐱👤💸🏆

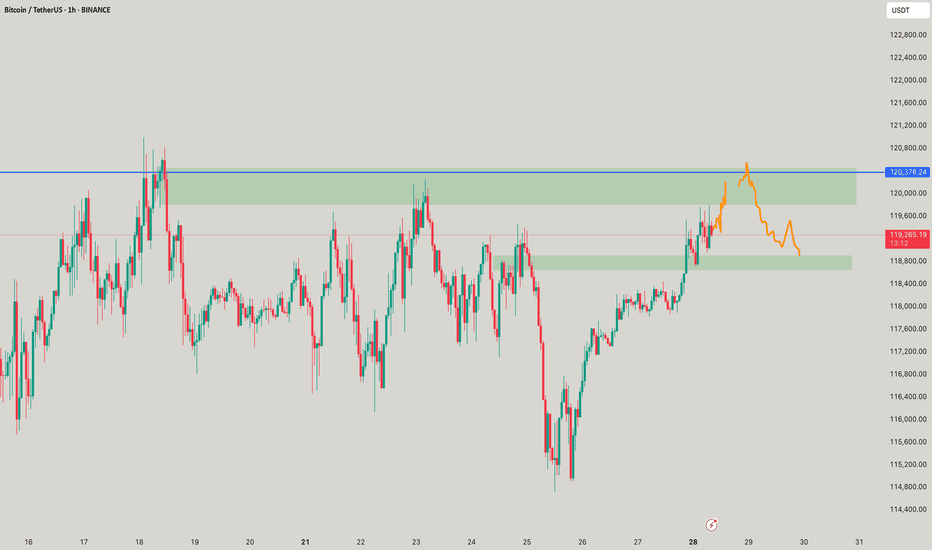

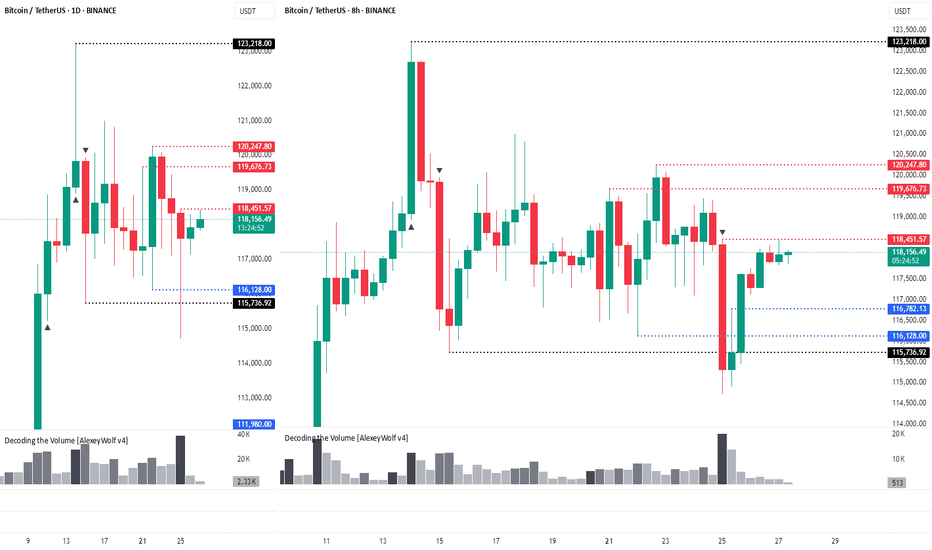

The move is up to the buyersHi traders and investors!

The price has already played out the upper boundary of the scenario, rising above 120,500. Then it also reached the lower boundary by dropping below 115,222.

Now we are at an interest moment: will the price continue to move upward or not?

This situation is clearly visible on the 8-hour timeframe.

On the 8H chart, we see a sideways range, similar to the 1D timeframe. The lower boundary is 115,736 and the upper boundary is 123,218. The active initiative is currently with the buyers, and their target is 120,998 и 123,218.

There is a notable bar attacking the lower boundary (115,736) with very high volume. The high of that bar is 118,451. We’re watching to see whether buyers absorb this bar — that will determine how the next move plays out.

There are three key levels where buyers may step in: 116,782, 116,128, and 115,736. If the price drops to any of these, we can look for a long setup.

Above, we also have three resistance levels from the sellers: 118,451, 119,676, and 120,247. We’ll be watching how sellers react if the price tests these zones.

This analysis is based on the Initiative Analysis concept (IA).

Wishing you profitable trades!

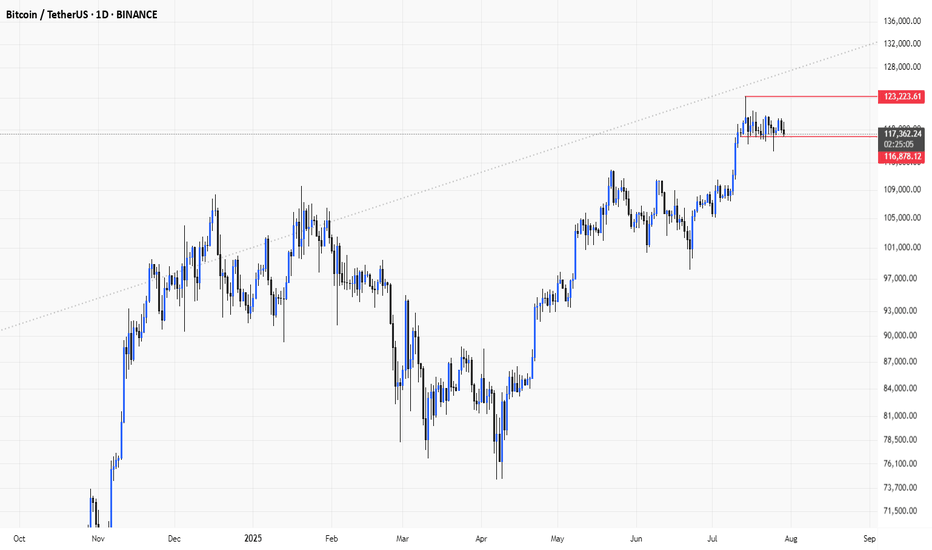

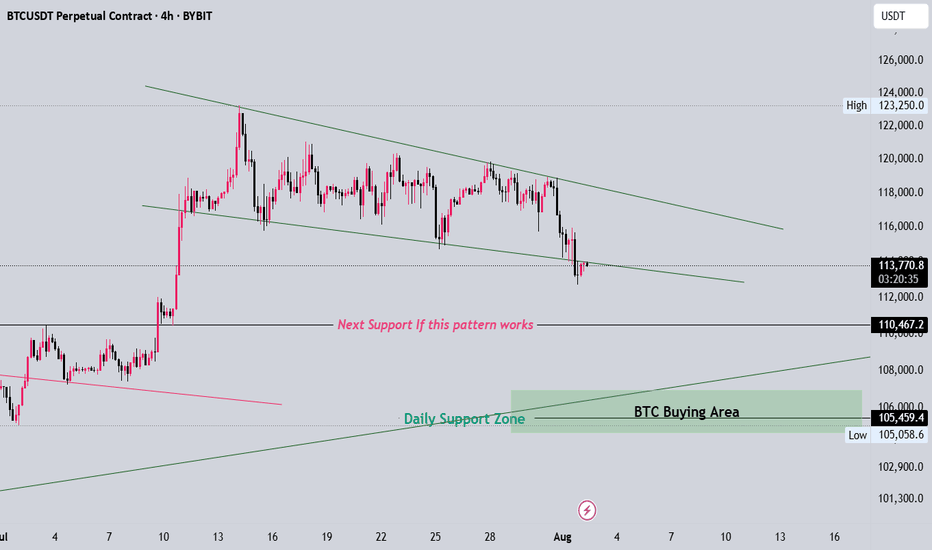

#BTC Update #12 – July 31, 2025#BTC Update #12 – July 31, 2025

Bitcoin is currently at the upper boundary of the channel it has been following. It may experience a pullback from this upper boundary. This pullback is estimated to reach the $116,800 level. If it wants to go lower, it could drop as far as the $114,500 level.

There is a significant amount of liquidity between $121,000 and $117,000. Bitcoin may also try to sweep this area. However, despite 4 or 5 attempts, it still hasn’t managed to break above the upper resistance zone. Therefore, a pullback should always be taken into account.

Overall, Bitcoin is still in a correction within a correction. That means no impulsive move has occurred yet. It’s not at a suitable point for either long or short positions. You may choose to trade within this range, but keep in mind that it's quite risky.

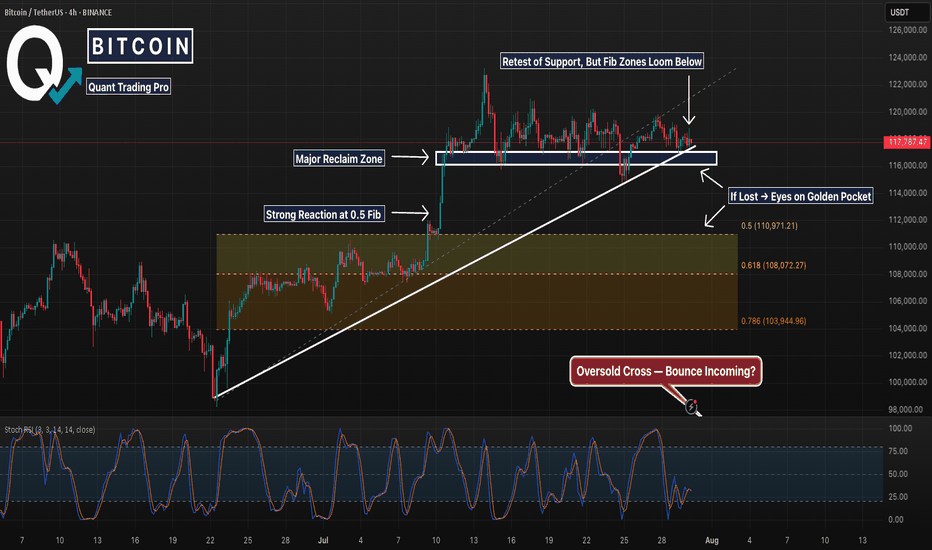

BTC 4H – Retest Holding, But Golden Pocket BelowBitcoin’s 4H chart is at a key decision point. After a strong breakout in early July, price has been consolidating just above the prior resistance zone — now acting as support. This white box represents a major reclaim level that has held multiple times, but buyers are starting to look fatigued.

Below this support lies a clean Fibonacci retracement zone:

0.5 at 110,971

0.618 (Golden Pocket) at 108,072

0.786 deeper pullback at 103,945

The structure remains intact for now, but a loss of the current level could trigger a deeper sweep into one of these fib levels — especially with momentum (Stoch RSI) resetting from oversold.

A potential bounce here keeps the uptrend alive. However, if the zone breaks, the .618 area may be the magnet.

📊 Watching for:

Strong reaction or absorption at this support

Bullish divergence forming

Sweep into golden pocket followed by reversal structure

This setup blends price action, key S/R levels, and Fib confluence — a great chart for anticipating the next move, not reacting to the last one.

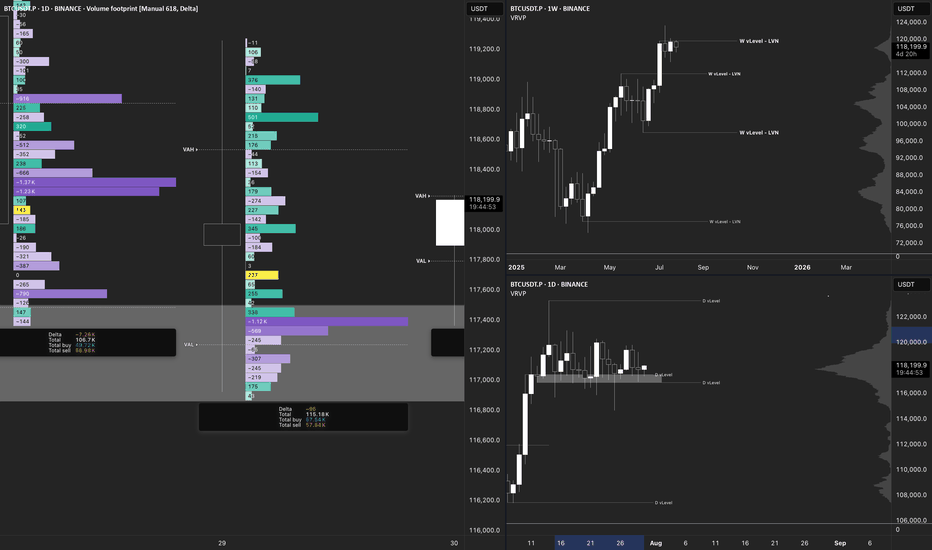

$BTC Daily OutlookDaily Chart

Today’s close printed a small bearish doji; visually bearish but still another inside-day that keeps BTC boxed between the High-Volume Node / v-Level cluster at $116 860-$123 300.

Holding $116 860 remains critical; lose it on a daily close and price can easily slide to the weekly breakout shelf near $111 960. We are now 16 days inside this balance. Per Auction-Market-Theory rule #5, the longer price churns at the edge, the more resting liquidity is absorbed, eventually a decisive push will follow. If buyers defend $116 860 again, the path opens toward range high $123 300 and the prior ATH; if they fail, expect a fast flush to the weekly V-Level.

Footprint Read

Value Area High and Low span the full candle, with the POC parked mid-range, classic two-sided trade. Delta finished negative and the heaviest prints sit at session lows: sellers hit the bid hard, yet could not follow through. That absorption leaves shorts vulnerable to a squeeze if new selling momentum doesn’t appear quickly.

Fundamental Pulse – Week Ahead

ETF Flows: Spot-Bitcoin ETFs booked three consecutive inflow days to close last week (+$180 M net). Sustained demand under the range supports the bullish case.

Macro Data: U.S. FOMC & Federal Fund Rates prints for this week; expect more volatility starting from tomorrow.

Game Plan

Primary bias stays long while daily candles close above $116 860; upside trigger is a clean for now or shorts squeeze toward $123 300.

If $116 860 breaks with volume, prepare for a quick liquidity hunt into the weekly shelf at $111 960, where we reassess for swing longs.

Intraday: I’ll monitor the Intraday Chart on tomorrow's High impact events and look for best opportunities across the board. Alt window: a fresh downtick in BTC Dominance could spark rotation; watch high-Open Interest majors if BTC ranges.

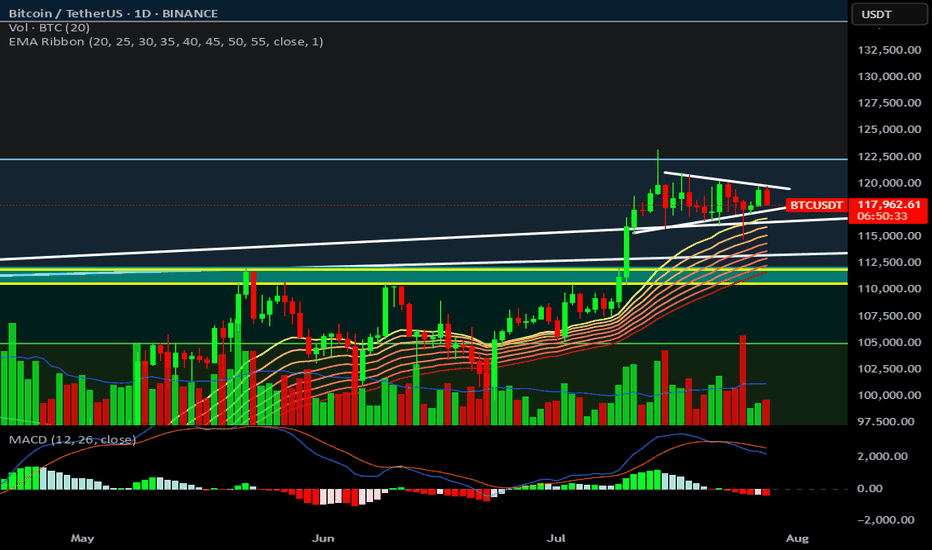

Bitcoin & Altcoins: Technical Analysis and Market OutlookBitcoin (BTC) Analysis

Bitcoin is currently forming a short-term bullish pennant within a larger long-term pattern, projecting a potential target around $135K.

Key Levels: BTC is consolidating between the lower zone at $117.3K and the upper zone at $119.7K.

Breakout Potential: A break above this pattern could propel BTC toward a new all-time high (ATH), surpassing the current ATH at $123K.

Macro Events This Week:

Wednesday: The Federal Reserve will announce its interest rate decision, with no changes expected.

Wednesday: ADP Employment Report, providing insights into potential future rate cuts.

Friday: Non-Farm Payrolls (NFP) data release, which could further influence market sentiment.

Ethereum (ETH) Breakout

Ethereum has decisively broken through its 4-year historical resistance around $3,725, closing the week above this level. This breakout signals a strong bullish outlook for ETH, with potential for further upside.

Altcoin Highlights

BNB: Has shattered its previous all-time highs, showcasing significant bullish momentum.

XRP: Reached approximately $3.64, reflecting strong gains and market interest.

Market Context

The crypto market is showing robust activity, with altcoins following Bitcoin and Ethereum's lead. Key macroeconomic events this week could introduce volatility, so traders should stay vigilant.

Disclaimer: This is not financial advice. Every trader is responsible for their own strategy and risk management.

Happy trading and good profits! 🚀

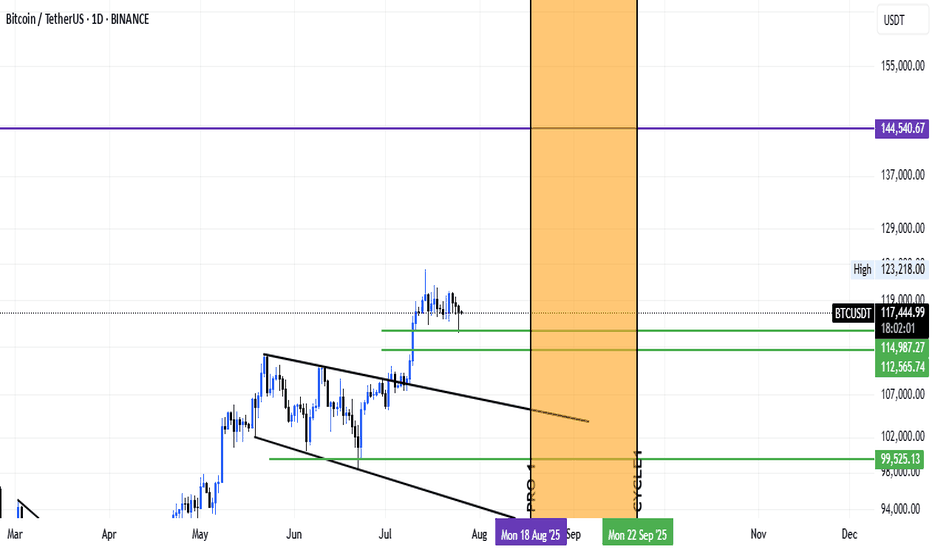

BTCUSDTAccording to previous analysis and its short-term target, Bitcoin has made a correction, and the correction areas, namely $114,000 and $112,000, were the important support areas it saw. However, considering the time, it can be said that the next Bitcoin ceiling will be reached in the period from August 18 to September 22, approximately 35 days.This is a medium-term timeframe on a weekly basis and Bitcoin is expected to reach $144,000 to $148,000 in price. Good luck and be victorious.

BTC should have one more leg upAccording to Elliot waves BTC should have one more impulse leg up to complete final wave of this cycle. Both daily and weekly RSI charts show bearish divergence, suggesting momentum is weakening even as price attempts to climb. A drop below $110000 would invalidate the current wave count and suggest a shift in market structure.

. Need to watch out reactions at target levels 136-150.

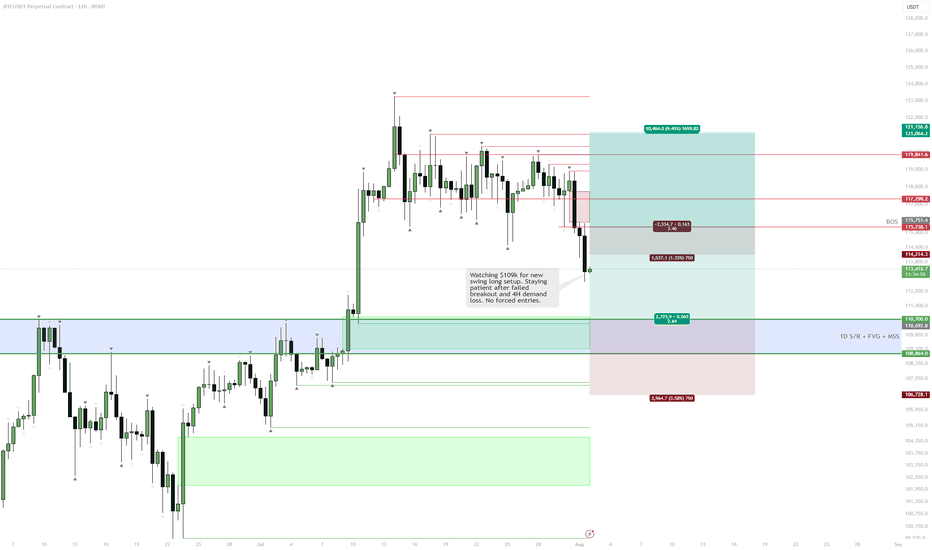

BTC | Swing Plan UpdatePrice failed to break out above 1D supply and sharply rejected, losing key 4H demand at $117,300.

HTF demand at $109,000 (1D FVG + BOS + S/R) is the next major area of interest—this is where I’ll look for fresh swing setups if the market flushes further.

No need to rush new positions until a clean setup prints or levels are reclaimed.

Plan:

Wait for price to test $109,000 zone before considering a swing long.

Only consider LTF scalp longs if we reclaim the 4H BOS at $118,300.

Stay flat until high-probability entry, let the market show its hand.

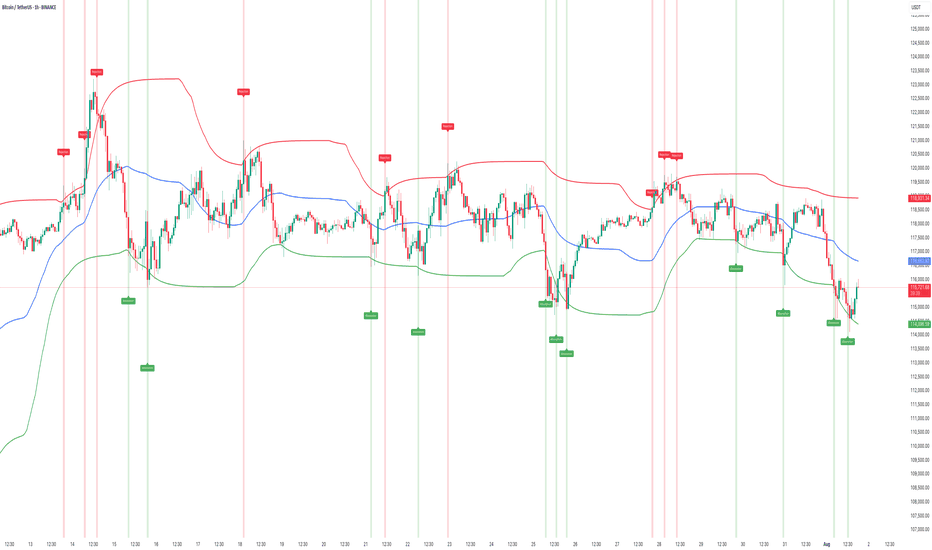

HOW TO Spot Liquidity-Driven Reversals & Market TrapsAdaptive Liquidity Pulse

🎯 Spot Liquidity-Driven Reversals & Market Traps

The Adaptive Liquidity Pulse is designed to help traders detect high-volume rejections and absorptions, revealing where big players are likely defending or accumulating positions. This indicator is especially useful for spotting market traps, liquidity sweeps, and swing reversals.

⸻

🧠 How It Works

1. Dynamic Liquidity Zones

• Red Band (High EMA) → Potential supply/rejection zone

• Blue Band (Mid EMA) → Equilibrium / magnet zone

• Green Band (Low EMA) → Potential demand/absorption zone

2. Signal Labels

• 🔴 Rejection → Price spikes into high liquidity with volume → Bearish bias

• 🟢 Absorption → Price flushes into low liquidity with volume → Bullish bias

3. Volume-Weighted Detection

• Only triggers signals when volume exceeds a configurable threshold

• Filters out weak moves, highlighting true liquidity events

⸻

📊 Best Use Cases

• Scalping & Intraday Trading: Identify early reversal points

• Swing Trading: Track absorption/rejection cycles to time entries/exits

• Liquidity Sweep Detection: Spot where false breakouts occur with volume confirmation

⸻

⚡ Trading Tips

• Use Rejection (Red) for short entries or take-profits near highs

• Use Absorption (Green) for long entries or short exits near lows

• Combine with support/resistance zones or trend structure for higher accuracy

• Midline (Blue) often acts as a mean-reversion magnet in ranging markets

⸻

📢 Alerts

• 🔴 Rejection Alert → Strong selling pressure at liquidity zone

• 🟢 Absorption Alert → Heavy buying at demand zone

⸻

🧠 Why Traders Love It

• ✅ Visualizes hidden liquidity interactions

• ✅ Highlights trap zones before reversals occur

• ✅ Works across crypto, indices, forex, and commodities

• ✅ Designed for confluence with other strategies

⸻

This script gives you a real-time pulse of liquidity shifts, allowing you to trade like institutions and avoid falling into retail traps.

⸻