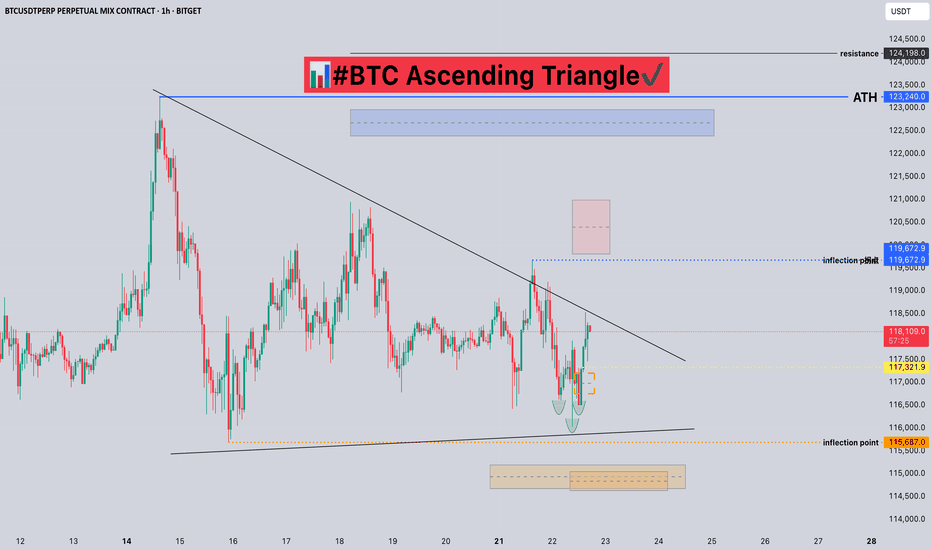

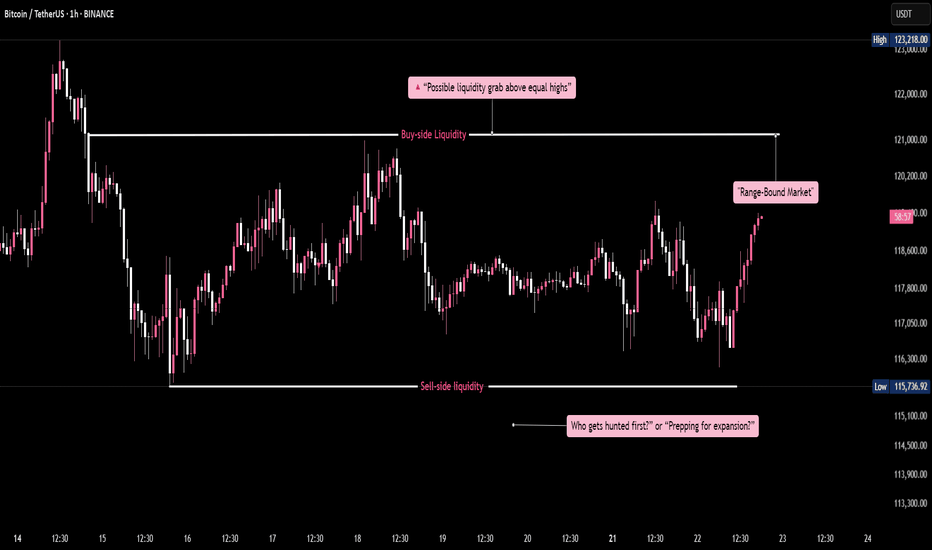

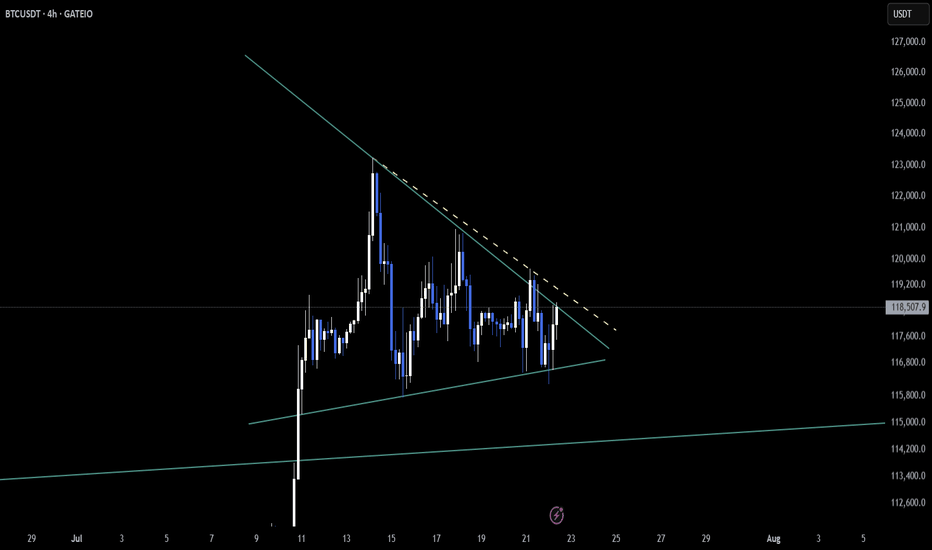

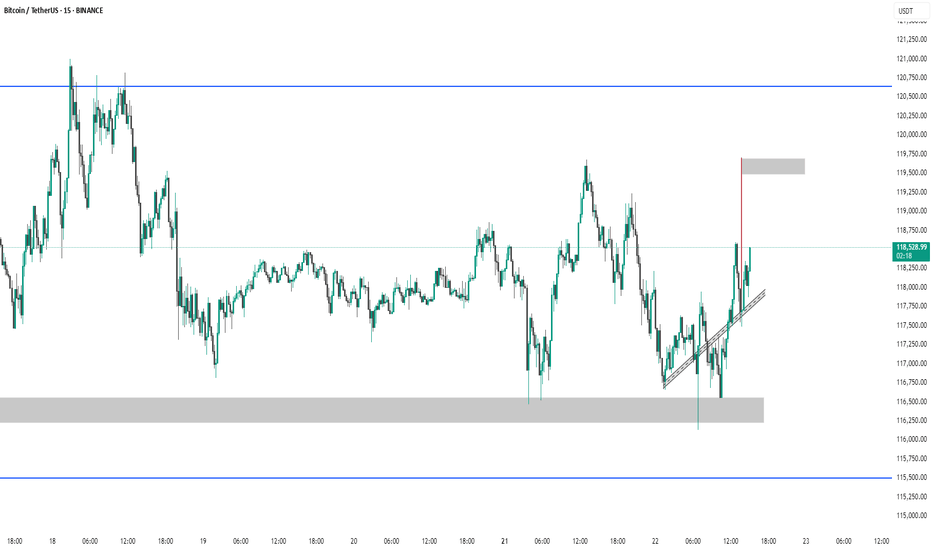

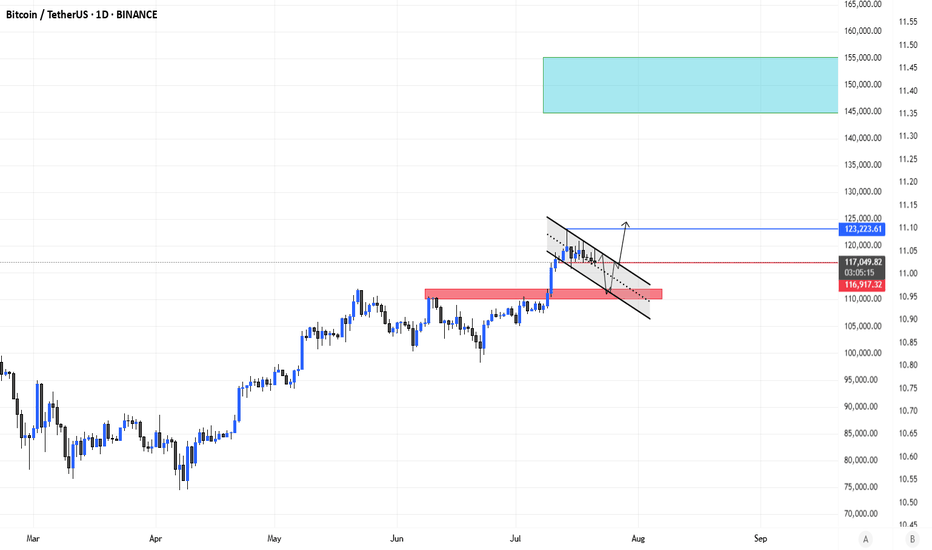

#BTC Ascending Triangle📊#BTC Ascending Triangle✔️

🧠From a structural point of view, we are still in a long-term bullish trend, and the short-term short structure of the small cycle is difficult to change the trend force of the large cycle. And we have been sideways here for a long time, digesting the selling pressure here, and it seems difficult to pull back. And the 15m level has built a bullish head and shoulders structure, so please be cautious about shorting!

➡️From a morphological point of view, the price is gradually compressed and formed into an ascending triangle. Generally, we will use this model to continue the original trend force.

⚠️Note that if we fall below the inflection point of 115687, it means a short structure at the 4h level. We need to be alert to further pullbacks. At that time, if we want to participate in long transactions, we need to find a lower support level to participate, such as around 112000.

Let's take a look👀

🤜If you like my analysis, please like💖 and share💬 BITGET:BTCUSDT.P

BTCUSDT trade ideas

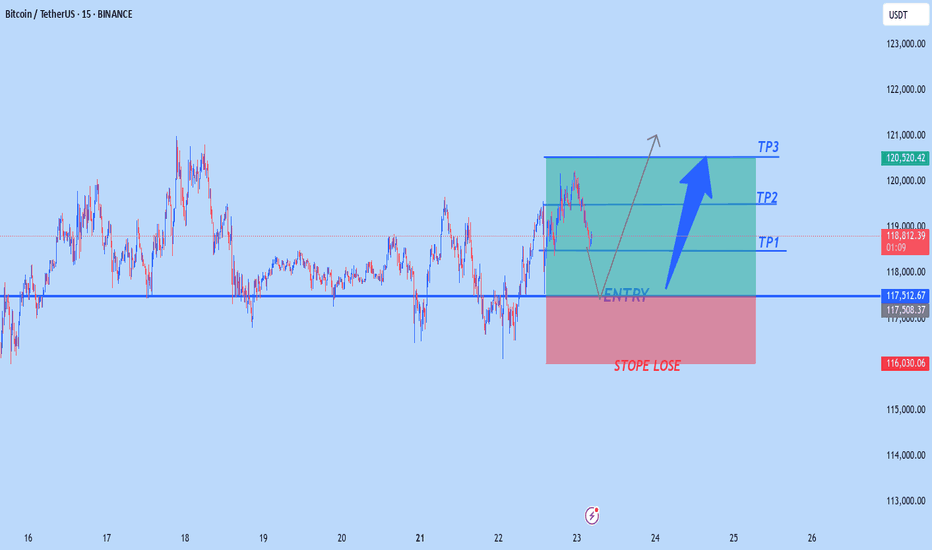

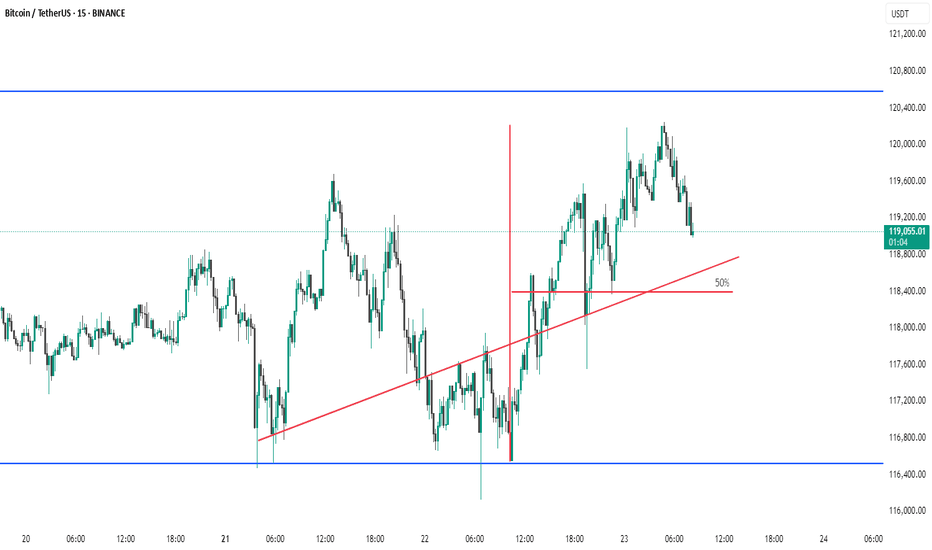

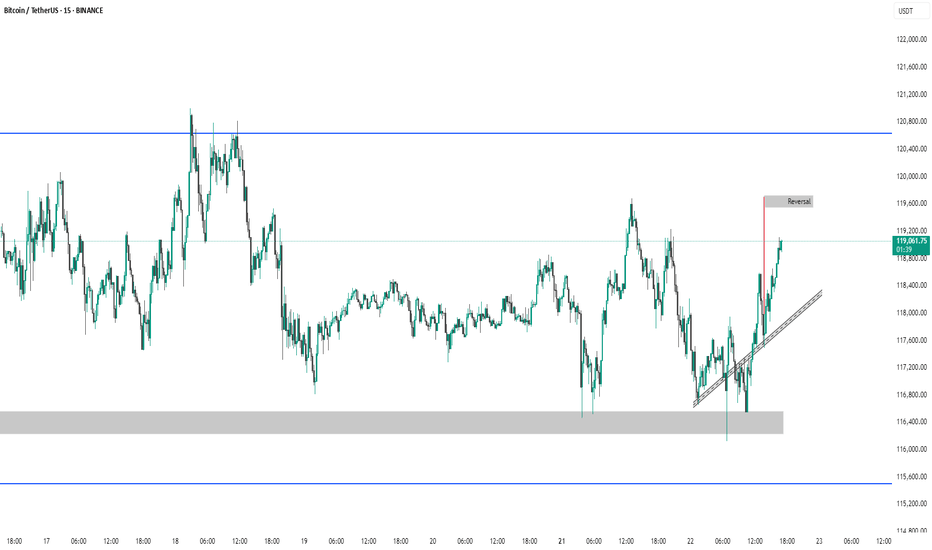

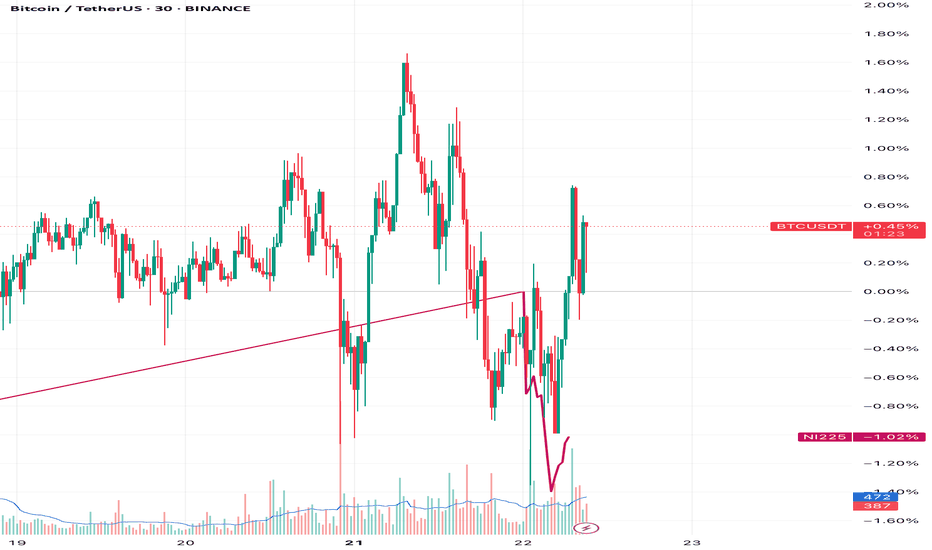

BTC # 15-minute BTC/USDT chart This 15-minute BTC/USDT chart shows a key breakout structure:

Ascending trendline (red) supported price before a breakout.

Horizontal line marks a previous resistance turned support post-breakout.

Vertical red line represents the breakout height.

50% retracement level of the breakout move is highlighted — a critical area for potential price reaction.

Price is currently pulling back after a recent high near $120,400, trading around $119,059, nearing the breakout support zone.

This setup suggests a possible bullish retest scenario if support holds near the 50% level

thanking you

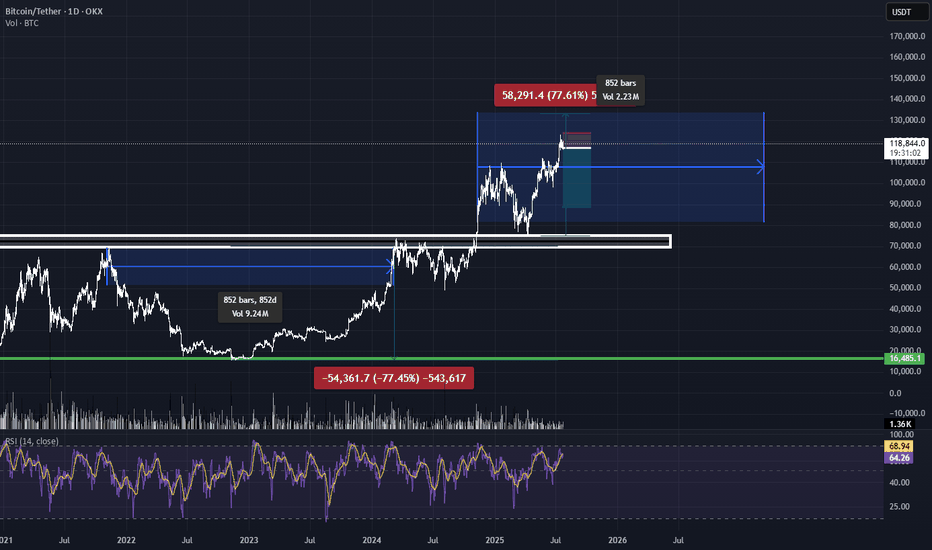

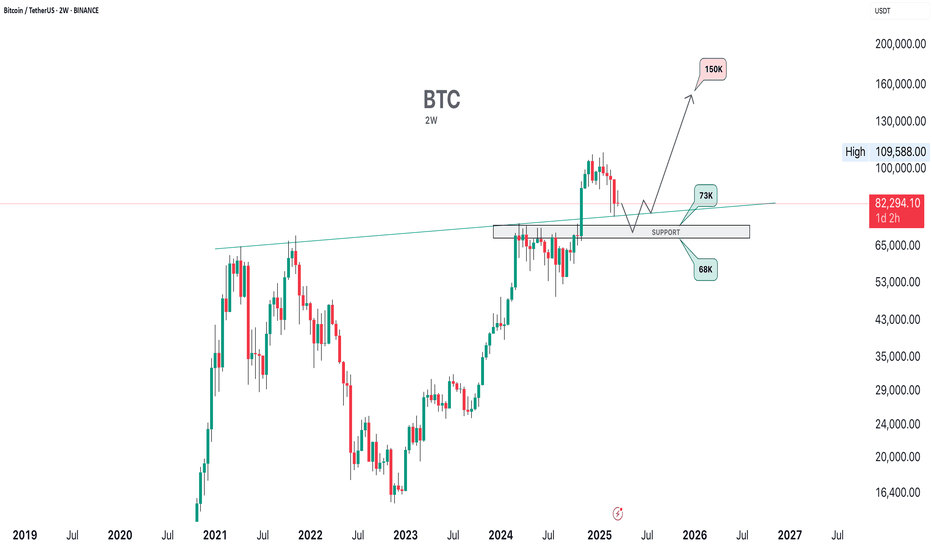

BTC - A POSSIBLE SCENARIO (MARCH 2025)BTC - A POSSIBLE SCENARIO (MARCH 2025)

BTC is still showing weakness. Overall, I remain bullish, but it may dip to $68K–$73K.

Alts are a real bargain now in March 2025. They won’t stay like this forever—soon, they’ll surprise everyone. But obviously they are extremely risky assets.

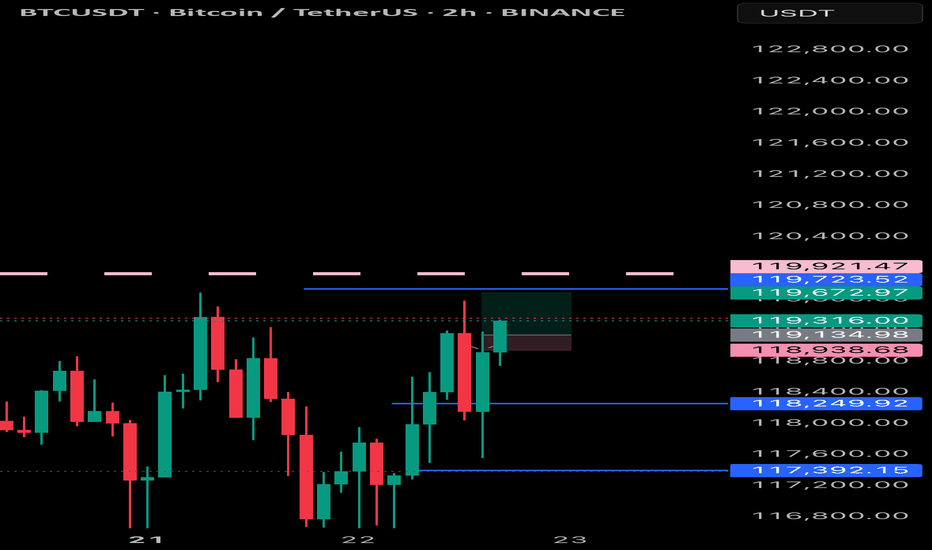

BTC/USDT - Liquidity Loading Zone

Bitcoin is trading within a well-defined range, building liquidity on both sides. Equal highs near 121K signal buy-side liquidity, while equal lows around 115.7K mark the sell-side liquidity. This setup is a classic smart money trap—engineered to gather orders before a major move. The longer the range holds, the more explosive the breakout is likely to be. Watch for a sweep of either side as a potential trigger for expansion.

Whether it’s a fakeout or breakout, liquidity will decide the next move.

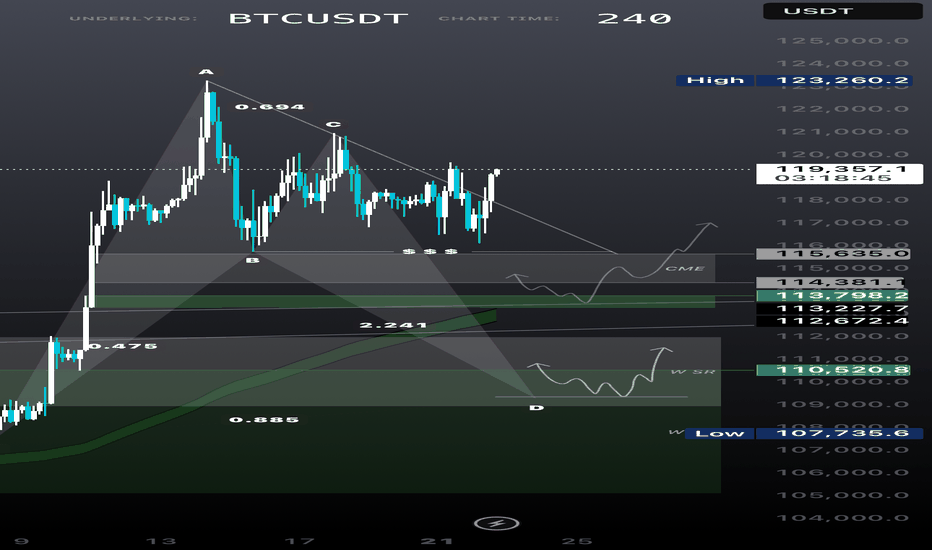

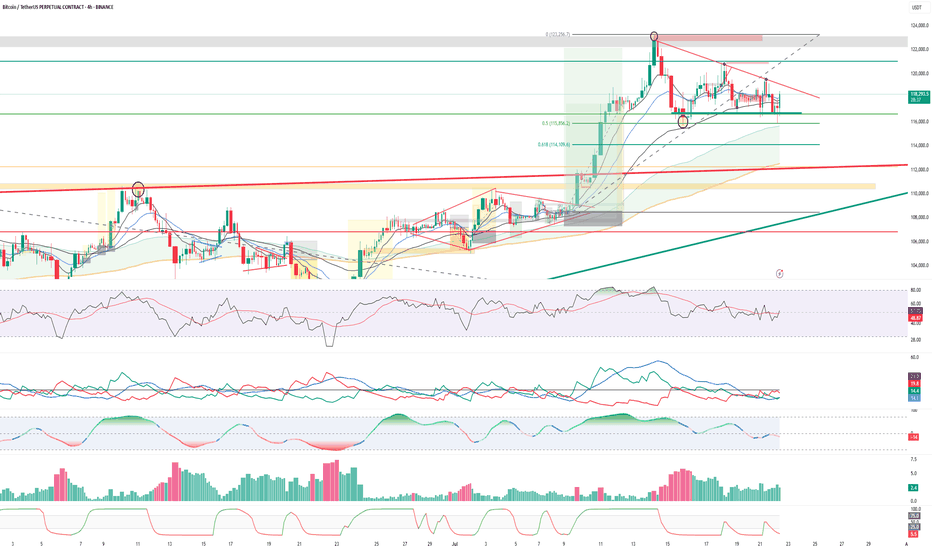

BTC Top-Down Analysis (Weekly, Daily, 4H)Weekly, Daily, and overall trend is bullish only 4H internal structure is short-term bearish with price trading inside a 4H demand zone.

From weekly timeframe:

- Inverse head & shoulders is forming showing trend continuation.

- ATH trendline (Nov 2021) has flipped from resistance to support — not retested yet.

- Major supports all align between 113K–109K including:

- CME Gap: 114380–115635

- Trendline: 113798

- Neckline: 112800

- Weekly Bullish OB: 110520

- Harmonic Bat PRZ: 109350

My Thoughts:

This 113K–109K zone is a high-confluence support area I’ll only consider buying BTC within this range.

This analysis remains valid as long as the weekly candle doesn’t close below the Bullish OB (105K) or above the ATH.

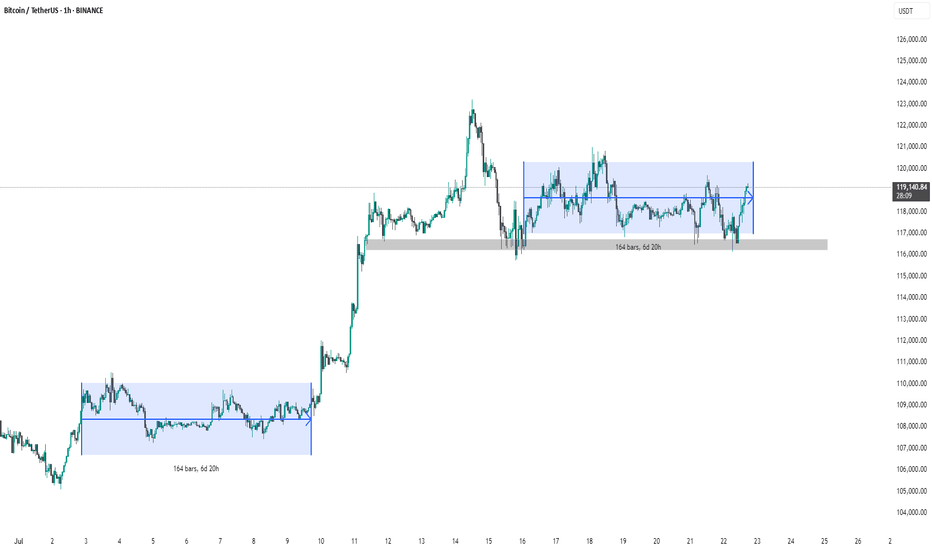

BTC #Bitcoin (BTC/USDT) 1-hour chartThis Bitcoin (BTC/USDT) 1-hour chart shows two clear consolidation phases marked by blue rectangles. Each consolidation lasted 164 bars (~6 days 20 hours). After the first range, Bitcoin broke out upwards, leading to a strong rally. The current price action is again testing the upper boundary of the second consolidation range ($119,200), indicating a possible breakout. The gray zone ($116,500) highlights a key support level. A breakout above the range could signal another bullish continuation.

thanking you

BTC #Bitcoin 15-minute BTC/USDT chart (Updated ChartThis 15-minute BTC/USDT chart (Binance) shows Bitcoin rebounding from a demand zone near 116,000–116,750 USDT and forming higher lows along a short-term ascending trendline. Price is currently around 118,446 USDT, aiming toward a marked supply zone near 119,500 USDT, suggesting a potential short-term bullish move. A rejection at this supply zone could signal a pullback, while a breakout may indicate continued upward momentum. Key support and resistance zones are clearly defined.

thanking you

BTC – Tightening Structure, Big Move Loading?CRYPTOCAP:BTC is currently bouncing off the lower trendline of the symmetrical triangle on the 4-hour chart 📊. The structure remains intact, with neither a breakout nor a breakdown confirmed yet.

This kind of compression often leads to expansion—either a bullish surge or a sharp dip depending on who takes control next ⚡️.

All eyes are on this zone 👀. The next few candles could decide the market’s short-term direction, so stay sharp and watch the reaction closely!

BTC #Bitcoin 15-minute BTC/USDT chart This 15-minute BTC/USDT chart (Binance) shows Bitcoin rebounding from a demand zone near 116,000–116,750 USDT and forming higher lows along a short-term ascending trendline. Price is currently around 118,446 USDT, aiming toward a marked supply zone near 119,500 USDT, suggesting a potential short-term bullish move. A rejection at this supply zone could signal a pullback, while a breakout may indicate continued upward momentum. Key support and resistance zones are clearly defined.

I’m just trying my luck with this and it doesn’t look too great The only only way way I could find find out if they they are are in in a a little little while I was was if if I could get them them in in a a week week and and I I could could find find a couple couple days days in the next month month or two two days days and and I I can can I have have them them out out in a a week and and I have a lot more time

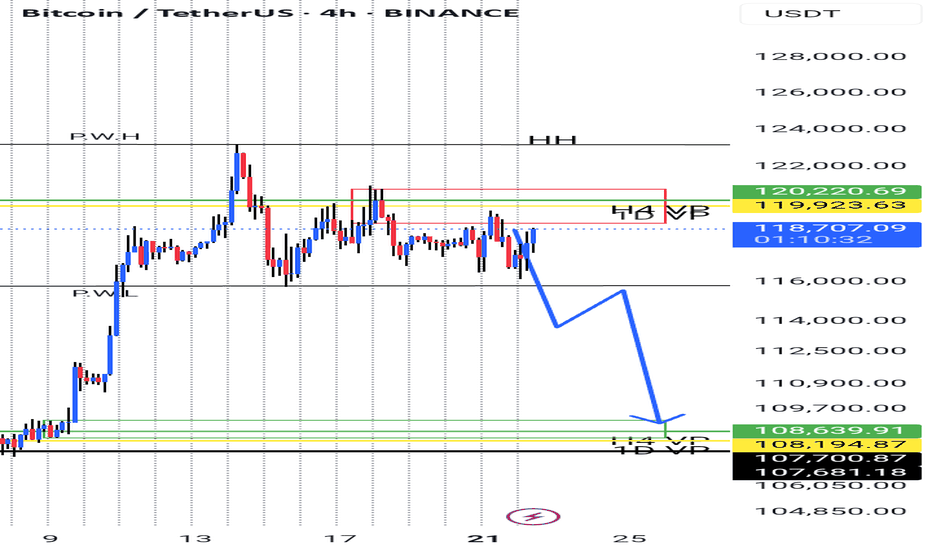

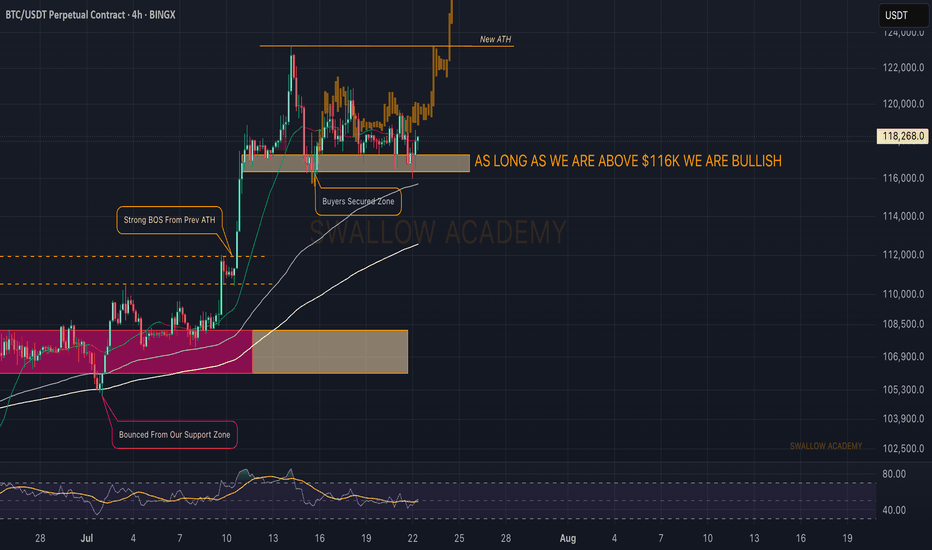

Bitcoin (BTC): 90% Of Traders Will Be Wiped Soon | Be Careful!Still bullish on Bitcoin, while we are seeing accumulation movement happening, we are still above the local neckline zone of $116K, which means as long as we are above that zone, we are going to look for buy entries.

We are expecting one more push to happen before we enter a proper correction, which will wipe out 90% of traders!

Swallow Academy

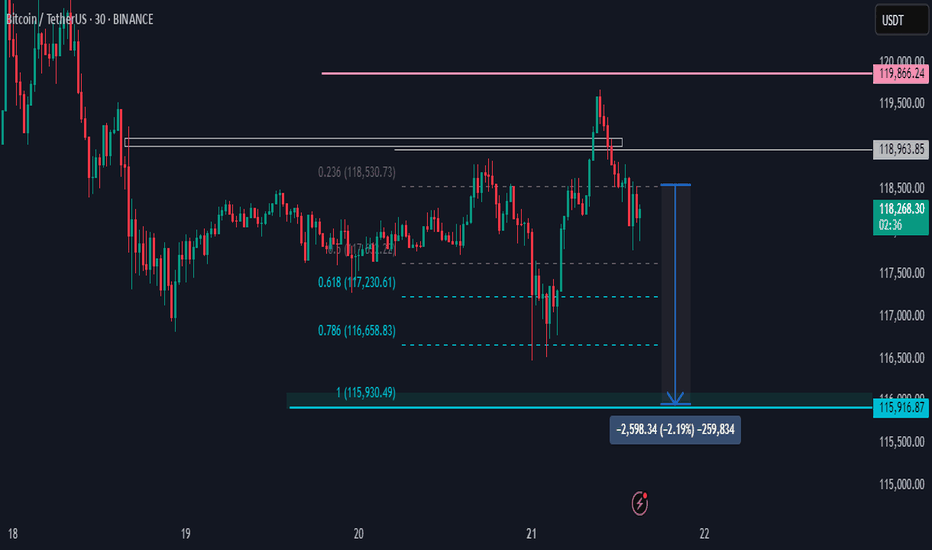

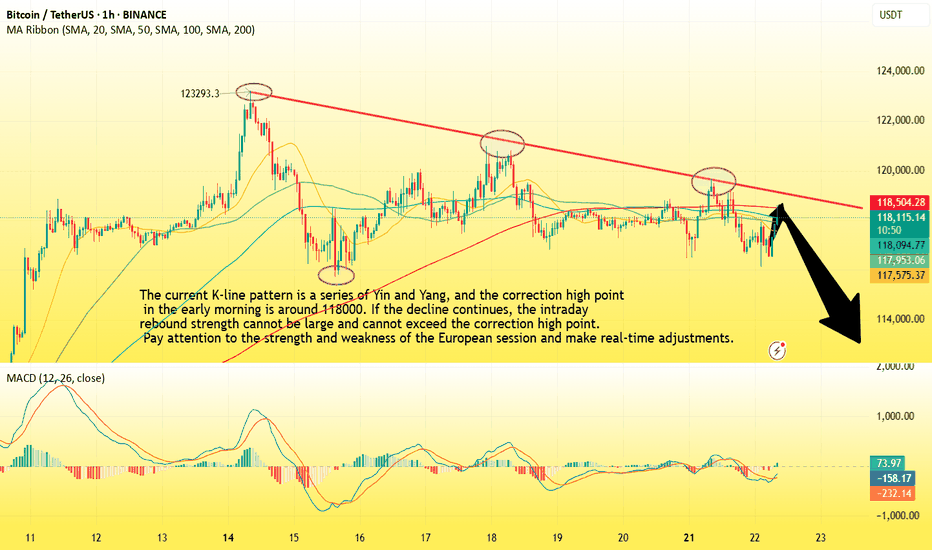

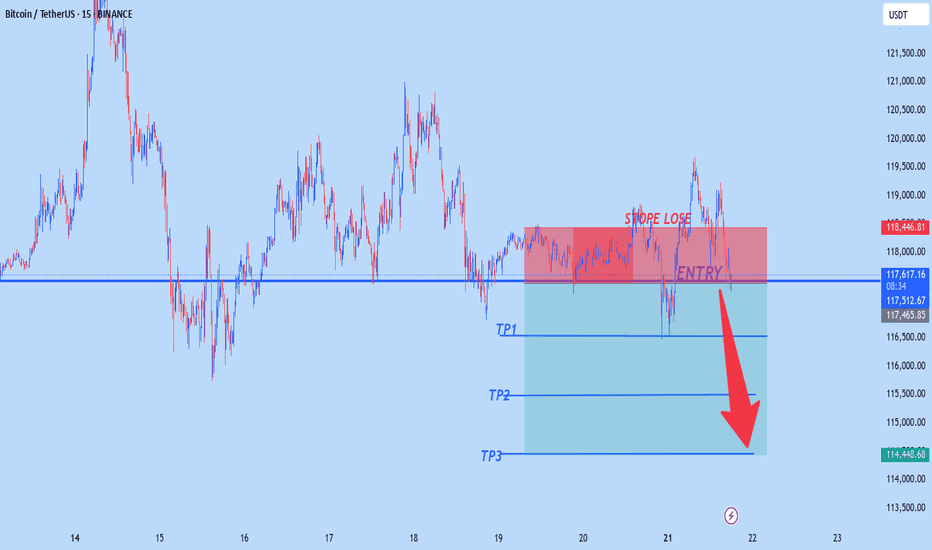

BTC-----Sell around 118100, target 116500 areaTechnical analysis of BTC contract on July 22:

Today, the large-cycle daily level closed with a small positive cross yesterday, and the price was below the moving average. The attached indicator was dead cross. The general trend is currently biased towards a downward trend. From the overall trend, we can see that the current trend is consistent and strong, but there is no room for rebound, and the continuous sluggish trend is also quite obvious, so the idea of selling down in the future market has become the main idea; the short-cycle hourly chart showed that the US market fell and rebounded yesterday, and the pressure continued to fall and broke down in the morning, and the correction high was near the 118000 area. The current K-line pattern is a single positive line. According to the trend rule, if the decline continues today, the rebound strength cannot be large, and the high point of the US market correction is resistance.

Today's BTC short-term contract trading strategy:

Sell at the current price of 118100, stop loss at 118500, and target 116500;

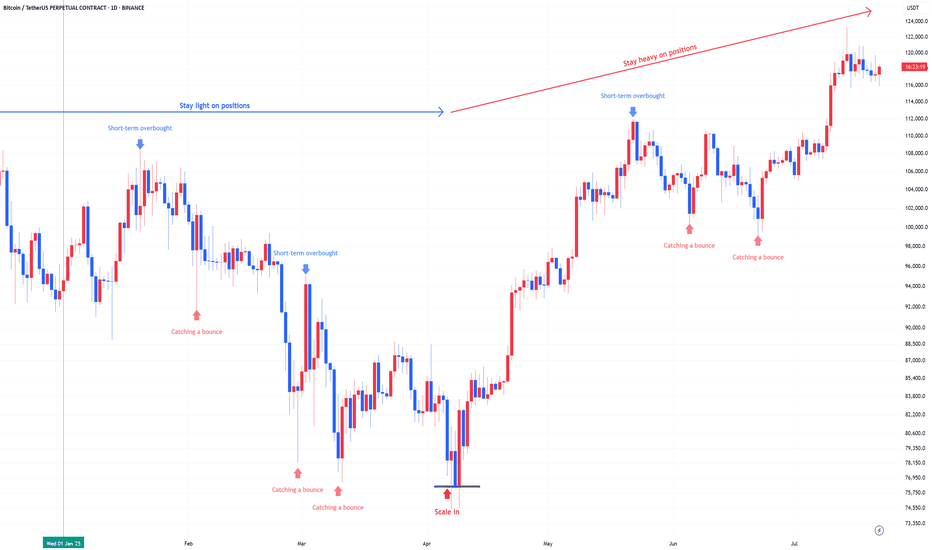

Bitcoin : Stay heavy on positionsApril was the scale-in zone:

Back in April, the US stock market flashed a split-entry buy signal—a classic zone for gradual accumulation.

That same setup applied to Bitcoin. Buying the fear worked again.

We’ve moved out of the fear zone:

Both Bitcoin and equities have left the extreme fear territory behind. Sentiment has shifted.

Short-term overbought now:

Bitcoin is currently in a short-term overbought phase. Some consolidation or cooling off is natural here, but no major trend reversal signs yet.

Stay heavy on positions:

I’m maintaining an overweight position in Bitcoin as long as the US stock market stays intact. The Nasdaq is holding up, so Bitcoin likely stays in risk-on mode.

Warning:

If US equities take a hit, expect Bitcoin to follow.

Negative moves in the stock market will likely translate directly into crypto weakness.

BTC/USDT – Breakout Watch🔹 Price rebounded strongly from key support at $116,400

🔹 Approaching breakout zone near $119,500

🔹 Descending trendline and multiple rejection wicks being tested

🔹 Bullish momentum building — RSI rising, MACD stabilizing, volume uptick visible

🔹 ADX shows trend strength picking up

📈 If breakout confirmed above $119,500:

🎯 TP1: $122,000

🎯 TP2: $127,000

🎯 TP3: $135,000

📉 Below $116,400 = invalidation

Bias: Bullish above $119,500, cautious until breakout confirms.

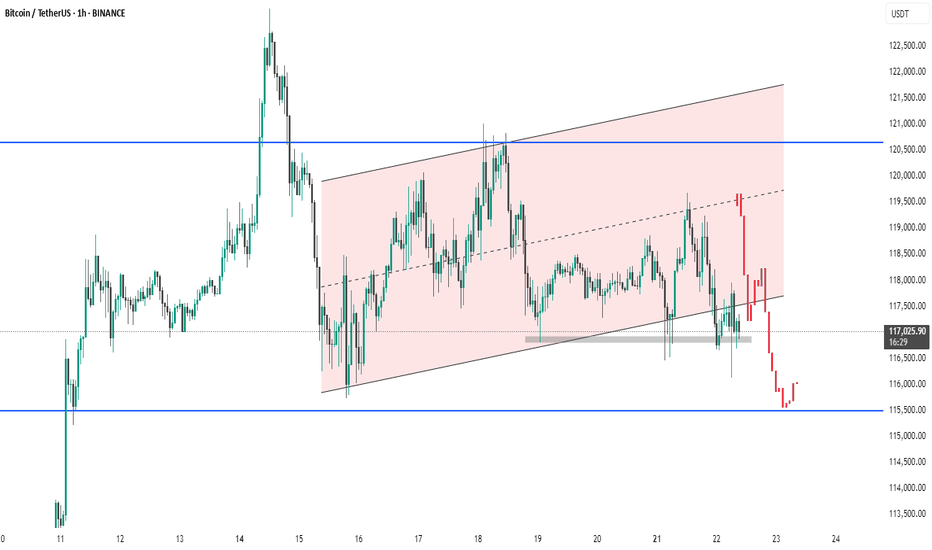

BTC # 1-hour Bitcoin/USDT chart This 1-hour Bitcoin/USDT chart from Binance shows a recent breakdown from a rising parallel channel (highlighted in pink). Price action broke below the lower trendline and a key support zone (grey area), indicating a bearish shift. The strong red candles signify increased selling pressure. The next major support lies near 115,500 USDT (blue horizontal line), which could act as a potential bounce zone.

thanking you