BTCUST trade ideas

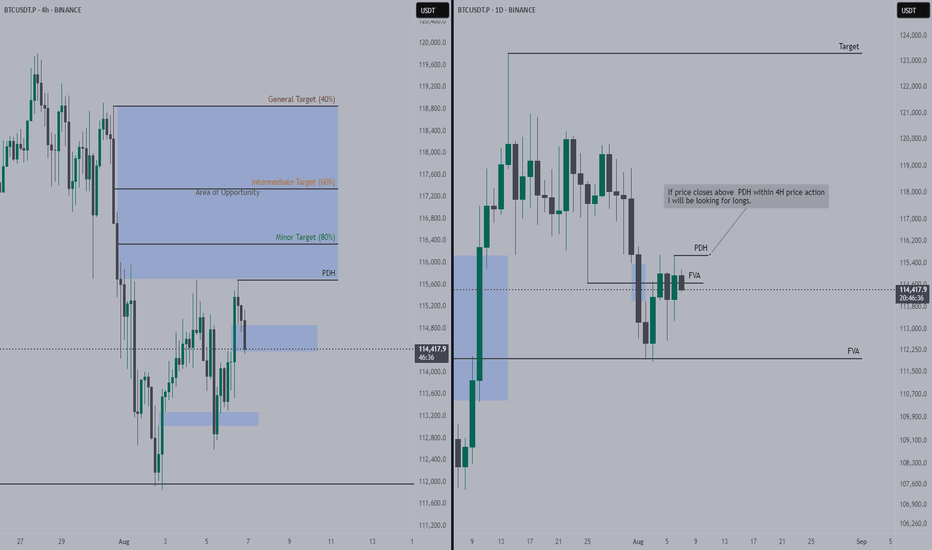

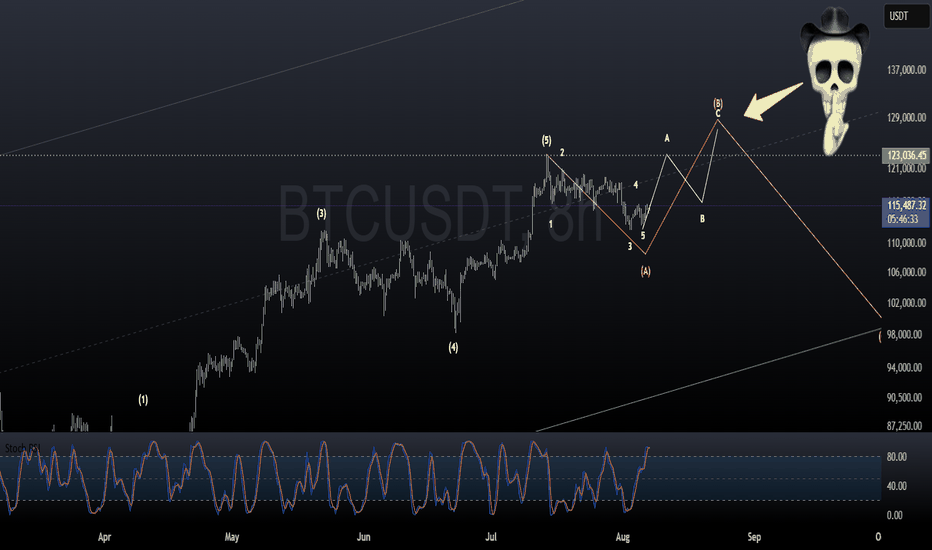

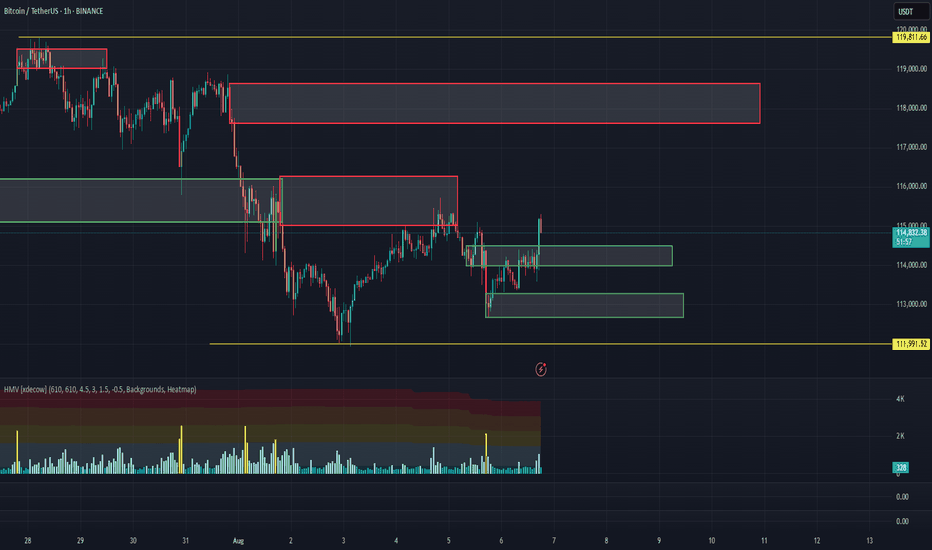

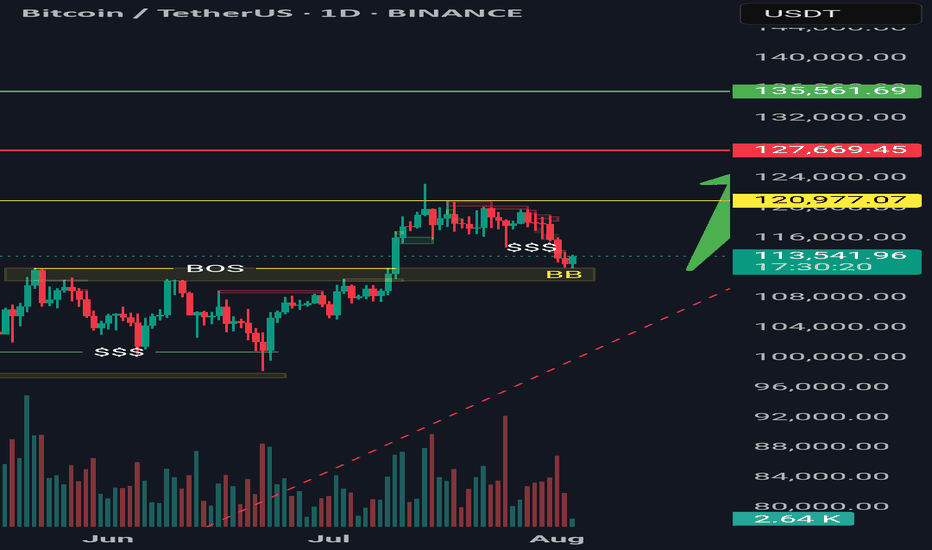

BTC – Summer chop arrived?Some rotations I'm looking for BTC.

Volatility is slowly cooling off, also noticeable in options premiums so I'm not expecting any big moves and mostly focussing on intraday moves.

That doesn't mean we can't mark more htf POIs of course.

1. Clean up the bad lows we left yesterday, but protect the low from CME open this week. Gives a really nice setup and RR

2. Take a stab lower into 110-111k. I think the sweep can be frontran here, so it's possible we have to stay alert and enter a bit sooner.

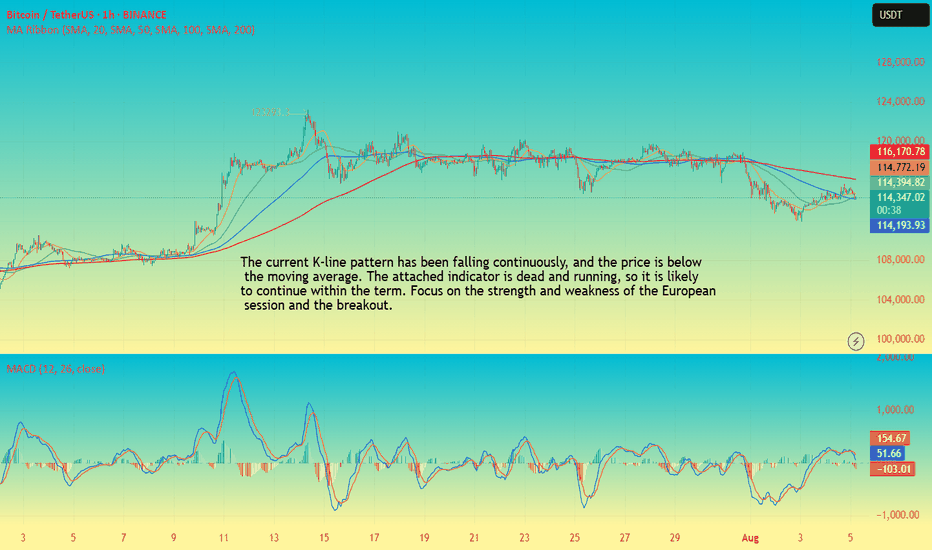

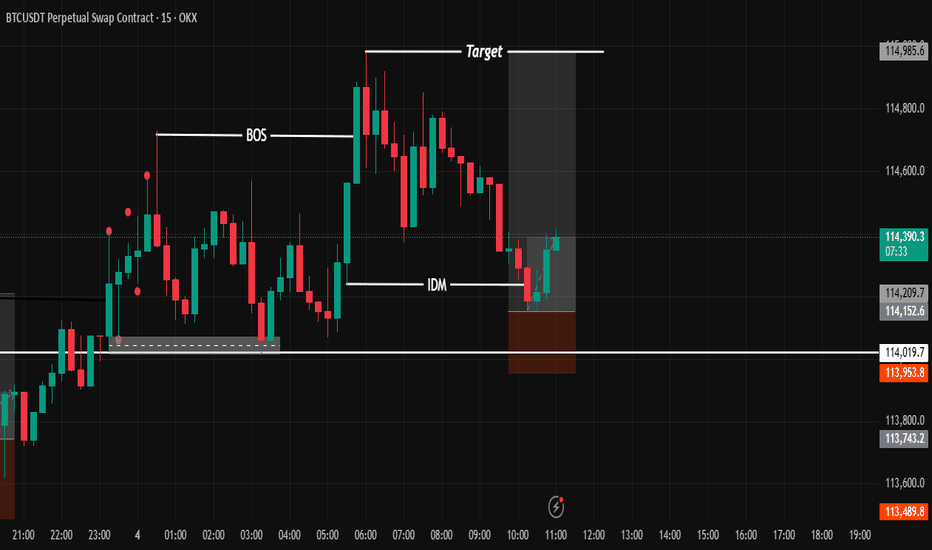

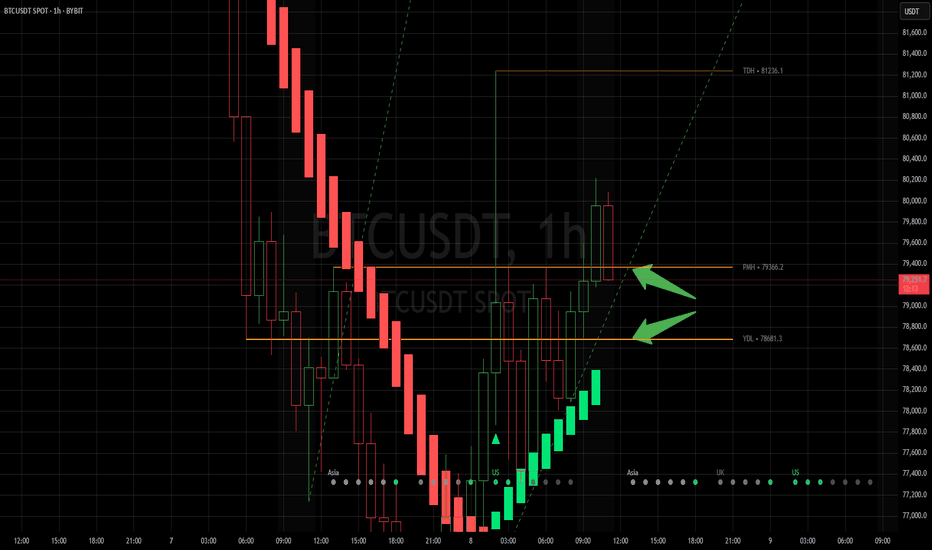

BTC-----Sell around 114500, target 113500-113000 areaAugust 5th BTC Contract Technical Analysis:

Today, the daily chart closed with a small bullish candlestick pattern, with prices remaining high. However, the accompanying indicator forms a death cross. While the broader trend remains bearish, the market is still trending downwards. However, yesterday's significant upward trend suggests a range-bound trend in the short term. Without a continuation of the trend, a significant unilateral move is unlikely. On the hourly chart, yesterday's intraday gains continued in the European and American sessions, but prices failed to break above the previous high. The current candlestick pattern shows consecutive bearish candlesticks, with prices trading below the moving average and the accompanying indicator forming a death cross. Therefore, continued support is crucial for the day, with the strength and potential breakouts of the European session also key.

Today's BTC Short-Term Contract Trading Strategy:

Sell on pullbacks to the 114,500 area, with a stop-loss at 115,000, and a target of 113,500-113,000.

Important Volatility Period: August 2nd - 5th

Hello, fellow traders!

Follow us for quick updates.

Have a great day!

-------------------------------------

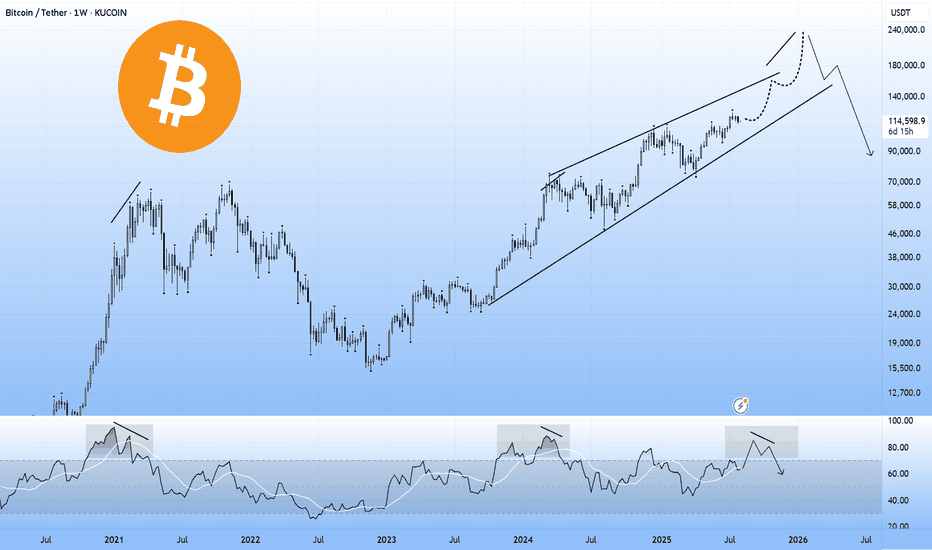

(BTCUSDT 1M Chart)

Let's take a moment to check the trend before the new month begins.

There have been two major declines so far, and a third major decline is expected next year.

For the reason, please refer to the "3-Year Bull Market, 1-Year Bear Market Pattern" section below.

-

My target point for 2025 is around the Fibonacci ratio of 2.618 (133889.92).

However, if the price surges further, it could touch the Fibonacci range of 3 (151018.77) to 3.14 (157296.36).

If it rises above 133K, it's expected that prices will never fall below 43823.59 again.

Since the HA-Low indicator hasn't yet been created on the 1M chart, we need to monitor whether it appears when a downtrend begins.

Based on the current trend, the HA-Low indicator is expected to form around 73499.86.

More details will likely be available once the movement begins.

-

The basic trading strategy involves buying in the DOM(-60) ~ HA-Low range and selling in the HA-High ~ DOM(60) range.

However, if the price rises above the HA-High ~ DOM(60) range, a step-up trend is likely, while if the price falls below the DOM(-60) ~ HA-Low range, a step-down trend is likely.

Therefore, the basic trading strategy should be a segmented trading approach.

The further away from the HA-High indicator, the more likely it is that the DOM(60) indicator will act as a strong resistance when it forms.

Therefore, if the current price and the HA-High indicator are trading far apart, and the DOM(60) indicator forms, it is expected to face significant resistance.

-

Looking at the current trend formation, the high trend line is drawn correctly, but the low trend line is not.

This is because the StochRSI indicator failed to enter the oversold zone.

Therefore, the low trend line is marked with a dotted line, not a solid line.

Therefore, what we should pay attention to is the high trend line.

We need to see if the uptrend can continue along the high trend line.

-

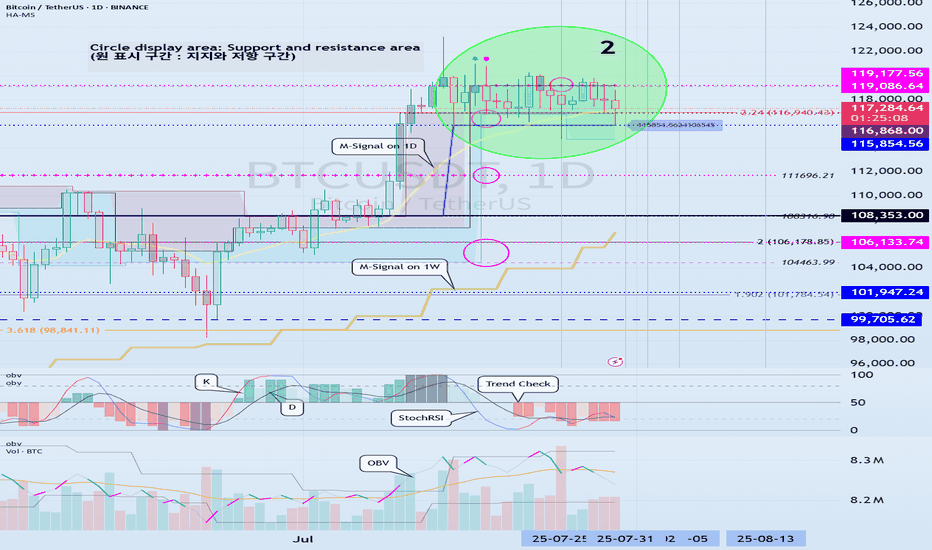

(1D chart)

If we use the trend lines drawn on the 1M, 1W, and 1D charts to predict periods of volatility, the periods around August 5th and August 13th are significant periods of volatility.

By breaking this down further, the volatility periods are around July 31st, August 2nd-5th, and August 13th.

Therefore, trading strategies should be developed based on the assumption that the volatility period extends from July 30th to August 14th.

The current price is moving sideways in the 115,854.56-119,177.56 range.

This range, the HA-High ~ DOM (60), is a crucial area to consider for support.

This will determine whether the price will continue its upward trend by rising above 119,177.56, or whether it will turn downward by falling below 115,854.56.

If the price falls below 115854.56, it is expected to meet the M-Signal indicator on the 1W chart and reestablish the trend.

The HA-High indicator on the 1W chart is forming at 99705.62, and the DOM (60) indicator on the 1W chart is forming at 119086.64.

Therefore, when the price declines, it is important to check where the HA-High indicator on the 1W chart forms and determine whether there is support near that point.

-

The On-Board Value (OBV) indicator within the Low Line ~ High Line channel is showing a downward trend.

If the OBV falls below the Low Line, the price is expected to plummet.

Therefore, it is necessary to closely monitor the movements of the OBV indicator.

The Trend Check indicator is a comprehensive evaluation of the StochRSI, PVT-MACD Oscillator, and On-Board Value (OBV) indicator.

The TC (Trend Check) indicator interprets a rise from the 0 point as a buying trend, while a decline indicates a selling trend.

In other words, a rise from the 0 point is likely to indicate an uptrend, while a decline is likely to indicate a downtrend.

Currently, the TC (Trend Check) indicator is below the 0 point, suggesting a high probability of a downtrend.

However, if the TC (Trend Check) indicator touches a high or low, the trend may reverse.

In other words, touching a high increases the likelihood of a reversal from an uptrend to a downtrend, while touching a low increases the likelihood of a reversal from a downtrend to an uptrend.

When such movements occur, it's important to consider the support and resistance levels formed around the price level to determine a response.

In other words, consider the support and resistance levels formed at the current price level.

As a significant period of volatility approaches, prepare to transition from box trading to trend trading.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

- Here's an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I'll explain more in detail when the bear market begins.

------------------------------------------------------

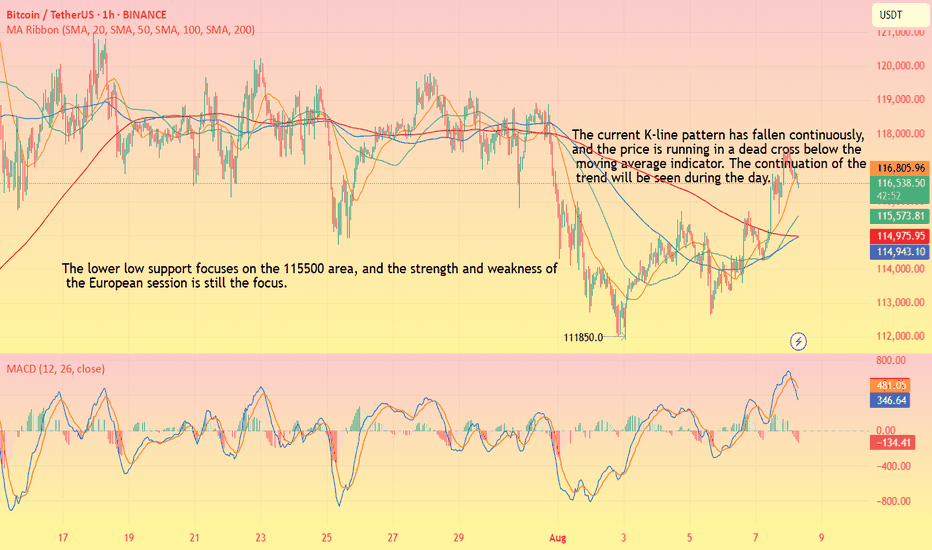

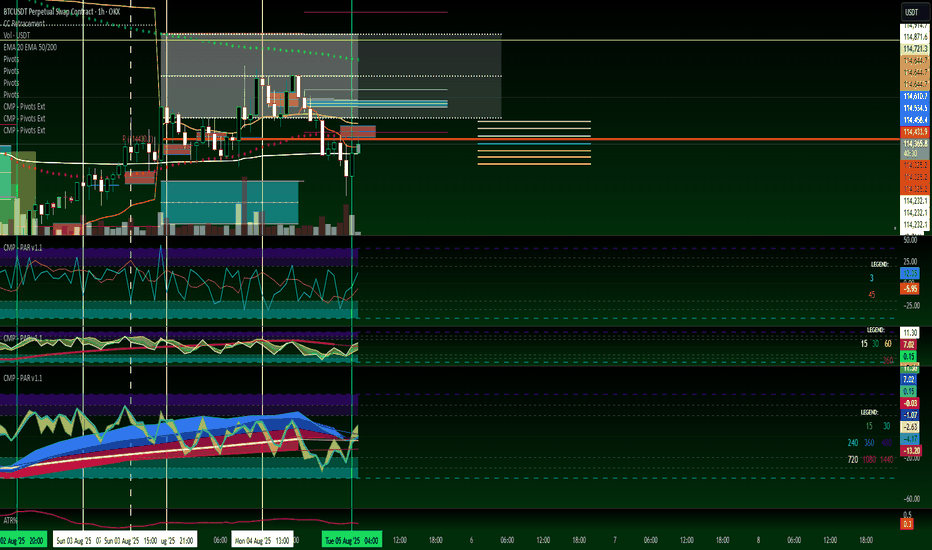

BTC(20250808) market analysis and operationAugust 8th BTC Contract Technical Analysis:

Today, the daily chart closed with a small bullish candlestick pattern, with prices rising above the moving average. The accompanying indicator formed a death cross and showed shrinking volume. The overall upward trend is currently dominant. Although there was a significant pullback at the beginning of this week, it has not continued. However, the upward trend continues, with consecutive highs broken. Positive news and data are driving prices higher. The short-term hourly chart currently shows a series of bearish candlestick patterns and a death cross. This suggests a strong intraday pullback, with support at the 115,500 area. This is a level to watch during the European session. Furthermore, today, Friday, is a cautious market.

Today's BTC Short-Term Contract Trading Strategy:

Sell at the current price of 116,500, with a stop loss at 117,300 and a target of 115,500. Buy if the price does not break below 115,500, with a stop loss at 115,000 and a target of 117,000.

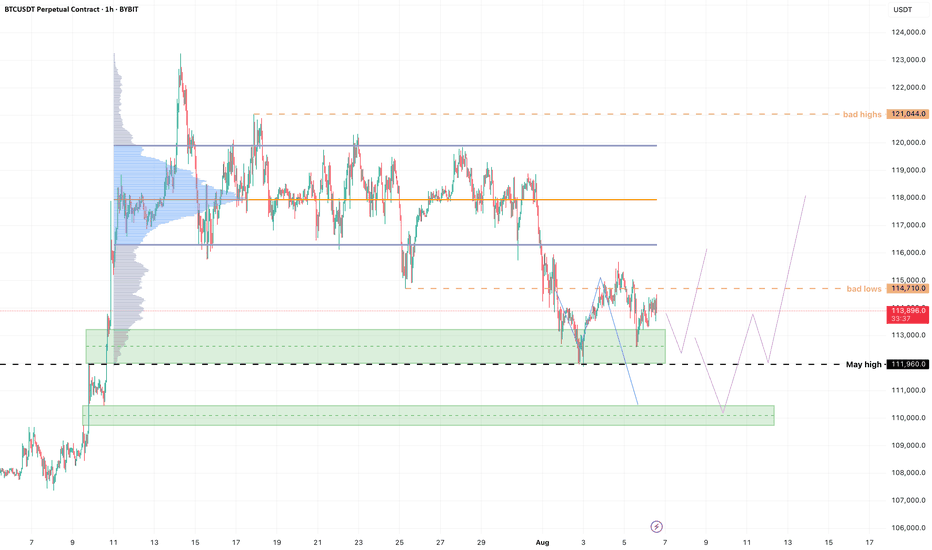

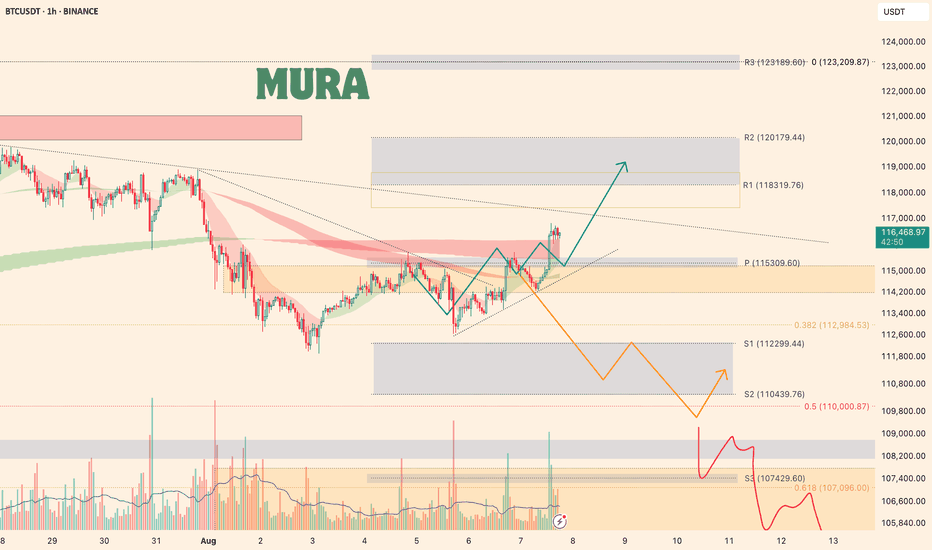

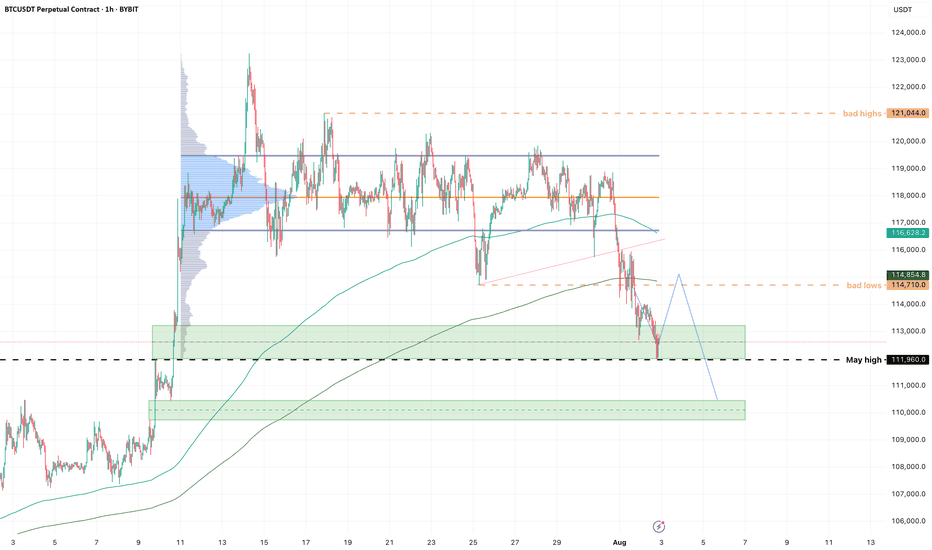

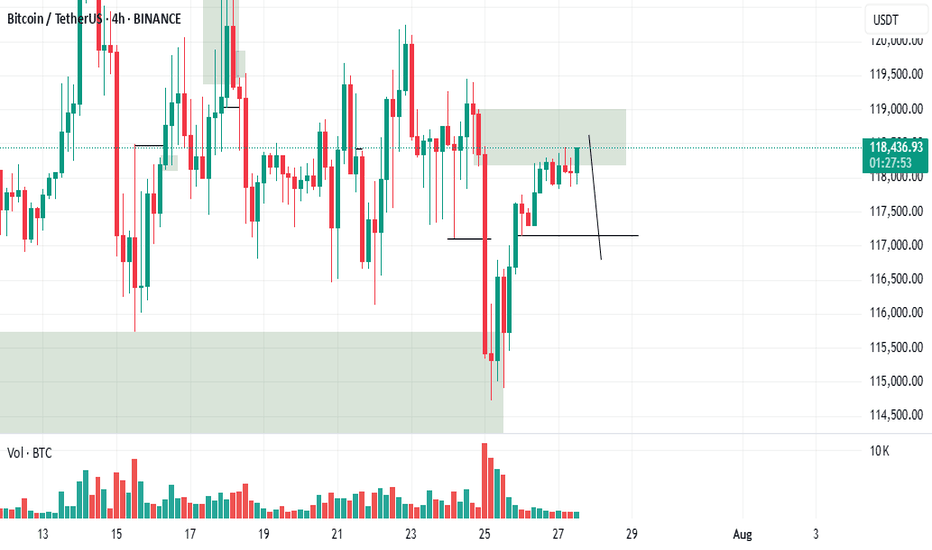

Bitcoin Market OverviewBitcoin is currently following the bullish (green) scenario. The 1H RSI is overbought, and the 4H RSI is already above 70, so I'm closely watching the price action. A local correction would be logical before a potential move up toward the resistance zone at $118,319–$120,179 .

If the price drops back below the $115,000 level, I’ll be looking for a decline toward the support zone at $112,300–$110,400 .

BTC/USDT Analysis — First Signs of Buyer Support

Hello everyone! This is the daily market analysis from the CryptoRobotics trading analyst.

Yesterday, Bitcoin experienced another wave of decline but failed to reach the local low. A strong absorption of sell orders occurred, and a local support zone formed at $113,300–$112,700. We currently interpret the resulting volume as being positioned for buying.

We are now waiting for a retest of two local support zones:

$114,500–$114,000 (mirror volume zone)

$113,300–$112,700 (local absorption of selling pressure)

From there, we consider local long entries.

The movement potential is aimed at the next sell zone.

If price drops further and shows no reaction within these zones, it's important to closely monitor the price reaction near the $112,000 level.

Buy Zones:

$114,500–$114,000 (mirror volume zone)

$113,300–$112,700 (local absorption of selling pressure)

$110,000–$107,000 (accumulated volume)

Sell Zones:

$115,000–$116,300 (mirror volume zone)

$117,600–$118,600 (accumulated volume)

This publication is not financial advice.

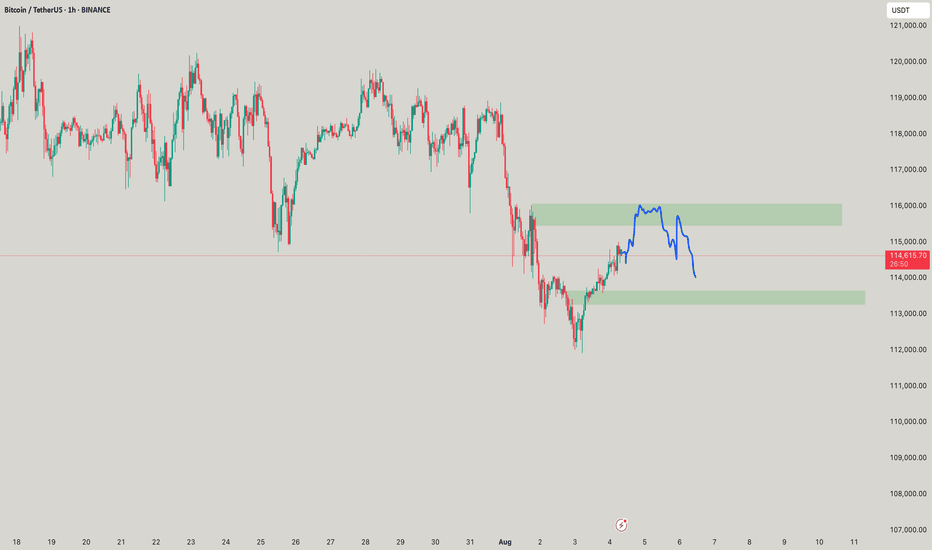

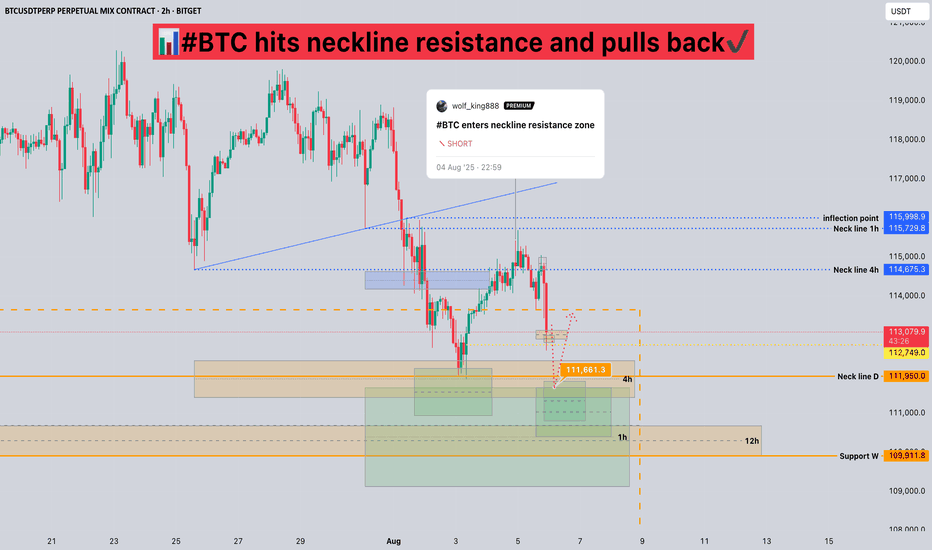

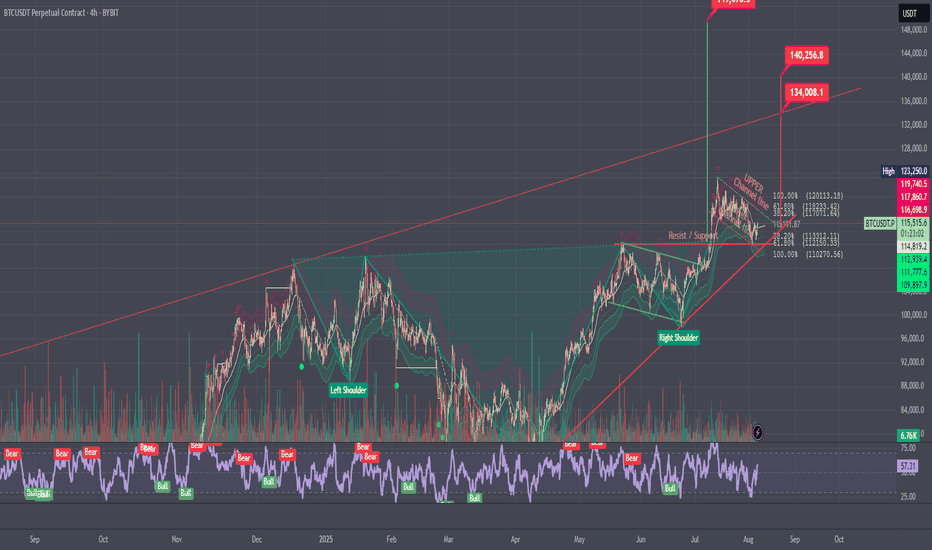

#BTC hits neckline resistance and pulls back📊#BTC hits neckline resistance and pulls back✔️

🧠From a structural perspective, we've retreated after hitting resistance at the neckline, as expected. If the current structure continues to decline rapidly, we could potentially retest support near 112,000, or perhaps break below the previous low to sweep liquidity before rebounding.

➡️The resistance zone remains clear. Only if the neckline resistance zone is broken and stabilizes for a day or so can we maintain a positive bullish stance.

Let's see 👀

🤜If you like my analysis, please like 💖 and share 💬 BITGET:BTCUSDT.P

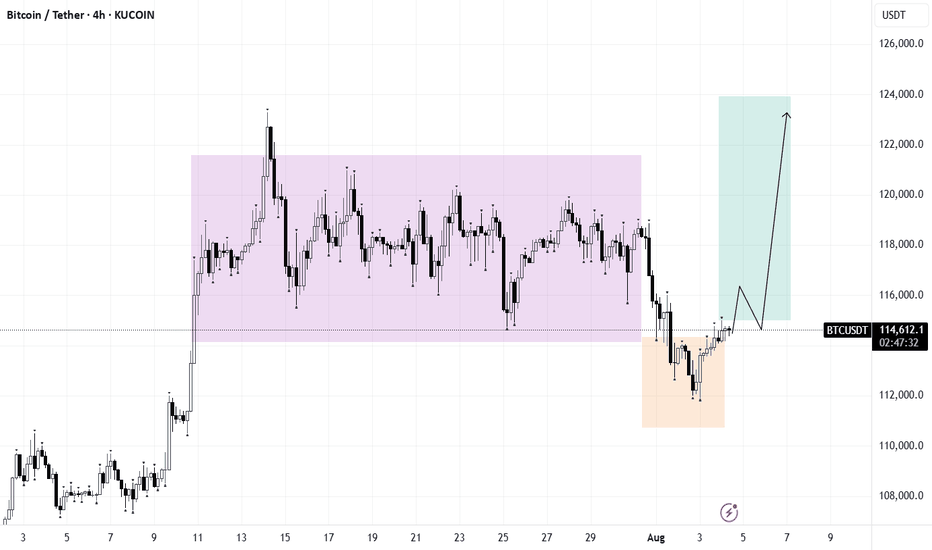

Bitcoin at Key Support - Watching for Bullish ShiftHello everybody!

Bitcoin has reached a very important demand/support zone between 110,000–112,000.

If this area holds, we could see bullish momentum building on the chart.

Currently, we are waiting for confirmations.

We're watching closely for any change in market structure or a trend shift.

If it happens, we can expect the price to move up to around 118,000.

Manage your risk and trade safe!

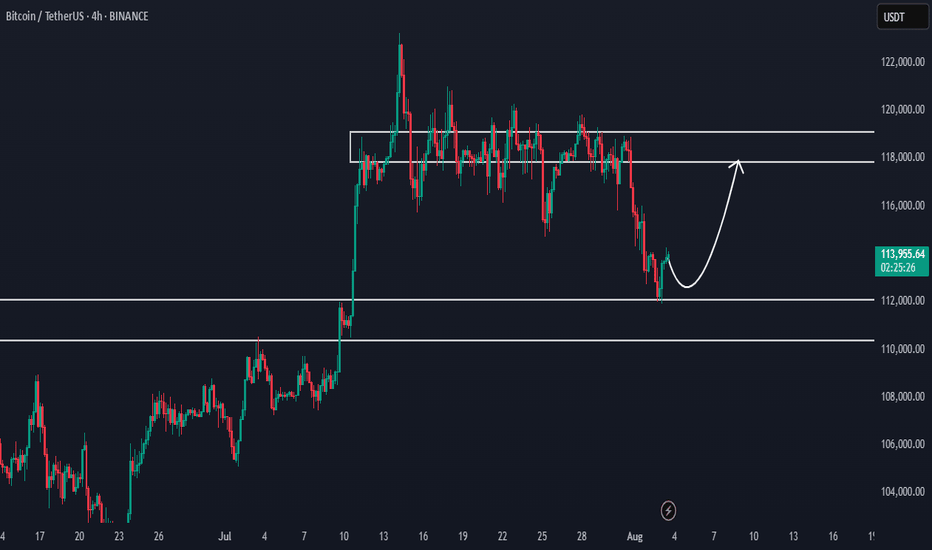

BTC - HOOOLLDDD!!!!Looks like we got our downside first.

Short update, but important level to watch is that 112k high from May this year. I longed on a ltf low hold, looking for a bounce into the highs of this sell-off cluster, then see what's what.

Flow is still very heavy; I expect to get stopped on this but it's one of those setups I just have to take, or I kick myself tomorrow.

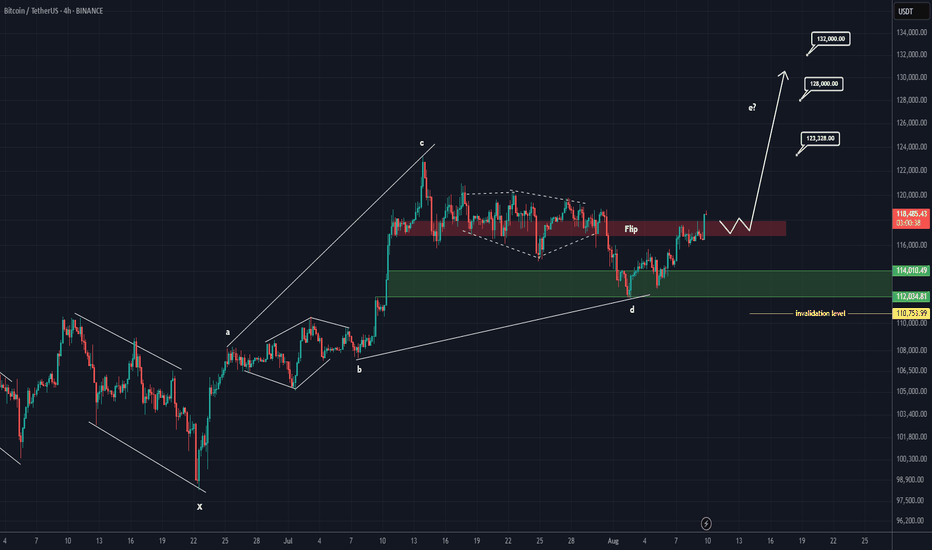

Bitcoin is super bullish (4H)This analysis is an update of the analysis you see in the "Related publications" section

If you’ve been following our previous analyses, we had a bullish outlook on Bitcoin from the lower green zone.

An important level on the Bitcoin chart has been reclaimed, and it is expected to move toward the next targets if it consolidates above the red box.

The targets are marked on the chart.

A daily candle closing below the invalidation level will nullify this analysis.

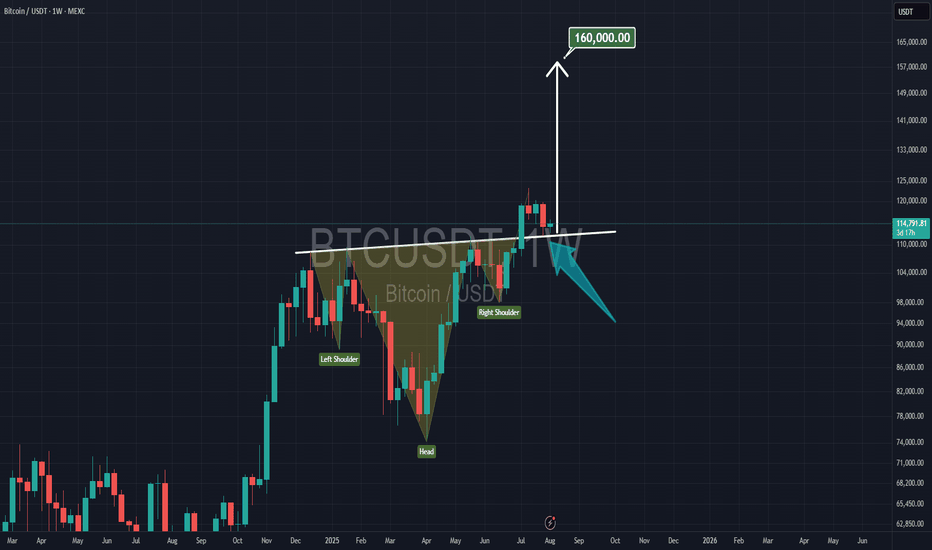

Why I'm bullish on Bitcoin!While everyone starts questioning if its over for Bitcoin, I'm bullish

Inverse head and shoulder going into 2 bull flags so far. Target is 149k'ish.

Unless I see some movements that cancel out these patterns I'm forever bullish.

Support on 112k is important to stay above if we break below and close below forget about this idea.

I just got filled for a long hereAs an alert I just got filled with a small limit order long and intend to add to it within this range with more frequency in the bottom half with (again) very small orders as I want to average down my entry price before we ideally pump up next if it works out that way. And if not (so in the case we gradually keep grinding down in price) I can continue to add longs until we get a bounce which may provide the opportunity to get out at break even or a small profit. But I am happy with the value of the areas I have focused on and not chasing pumps. Enjoy!