GE trade ideas

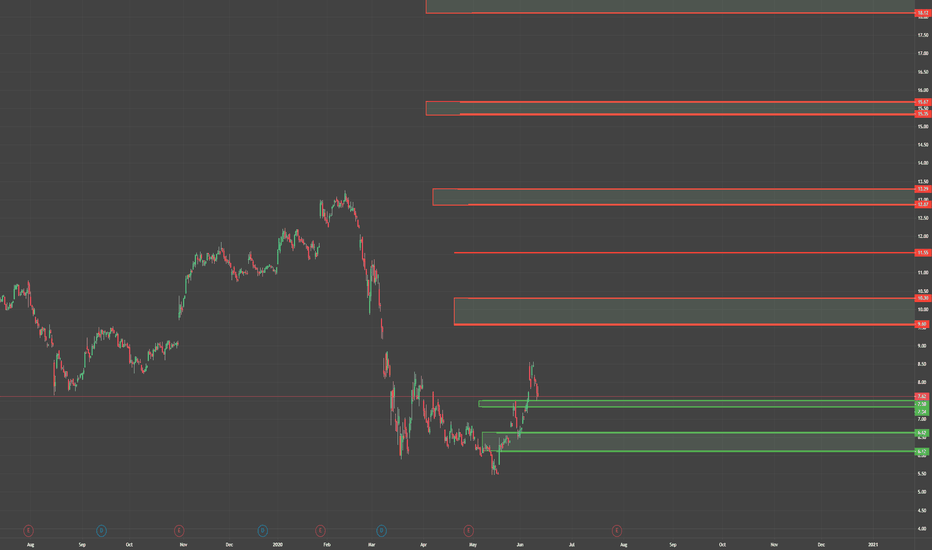

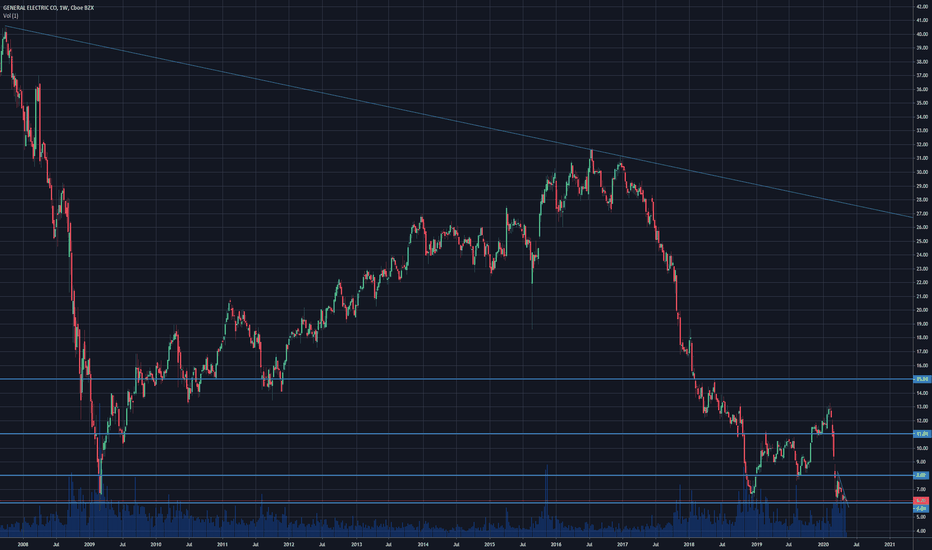

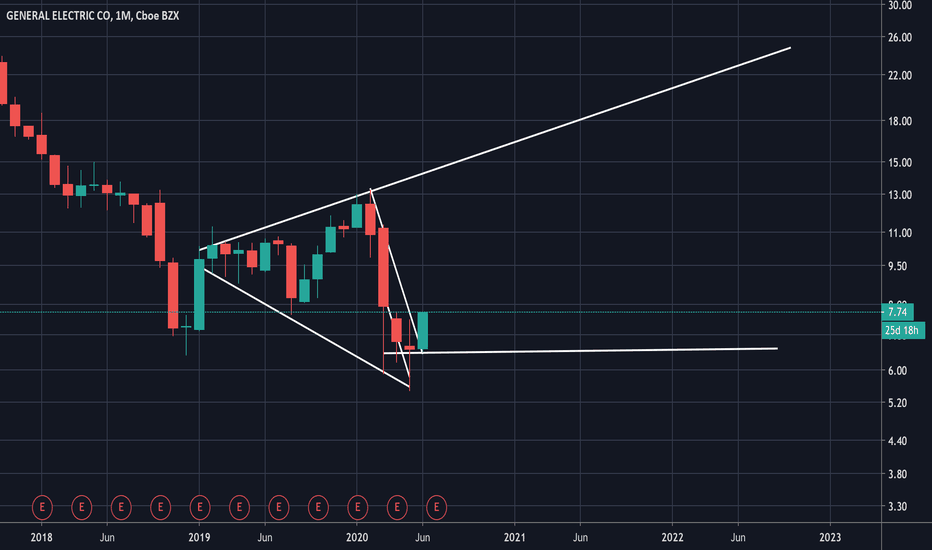

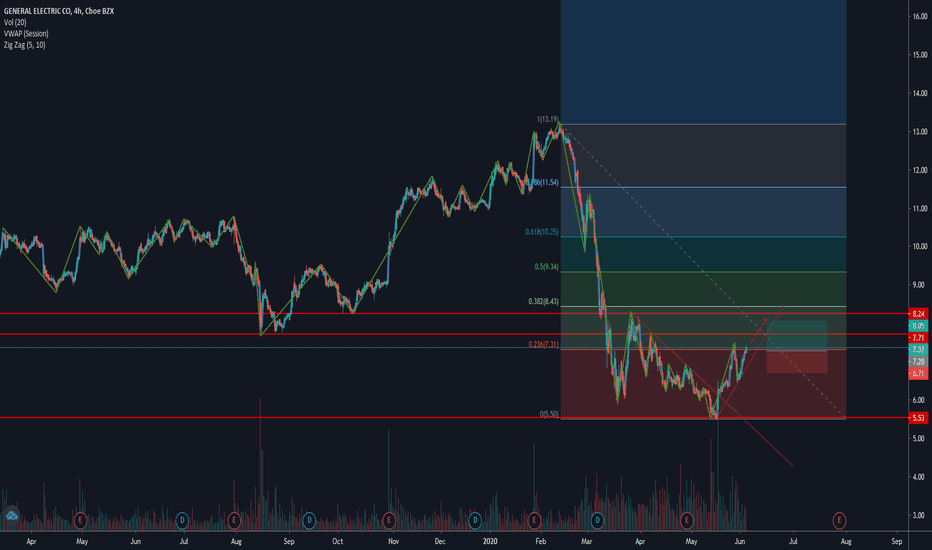

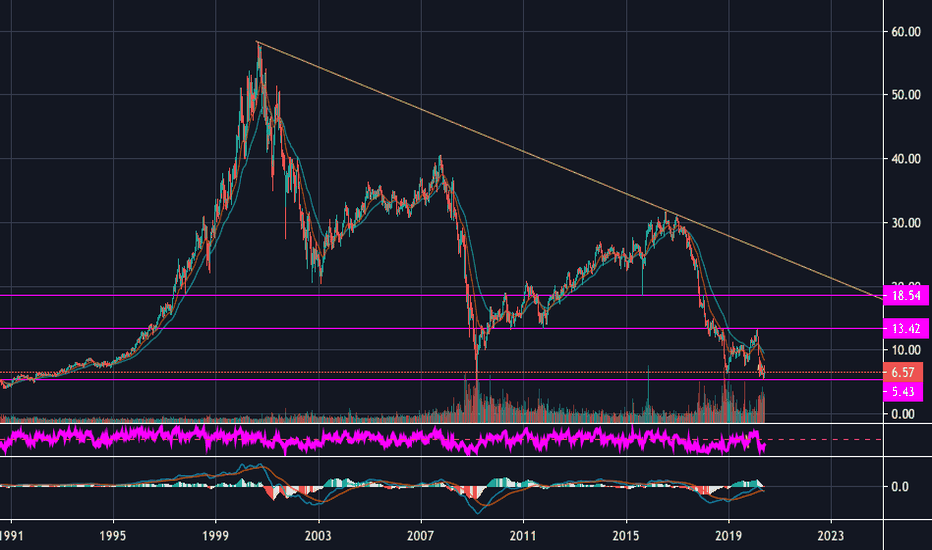

My GENERAL ELECTRIC Analysis on 4H, A Big bullish move is comingHi Traders, I'm sharing with you my vision concerning GE, the downtrend has come to an end, now place for a big uptrend move , It's the start of a bullish big move because the price is at a very strong level if it doesn't get throgh it will directly go up, waiting for your comments and remarks guys, good luck for you all :)

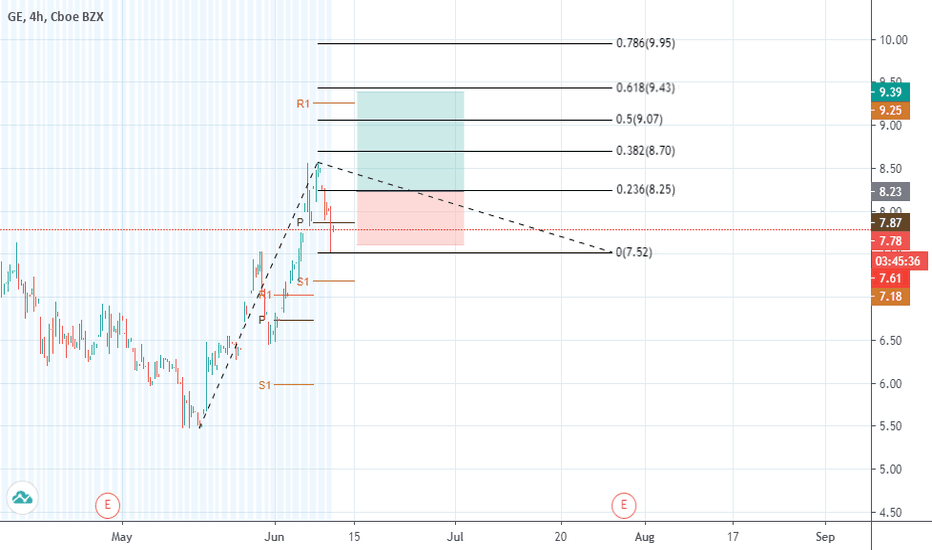

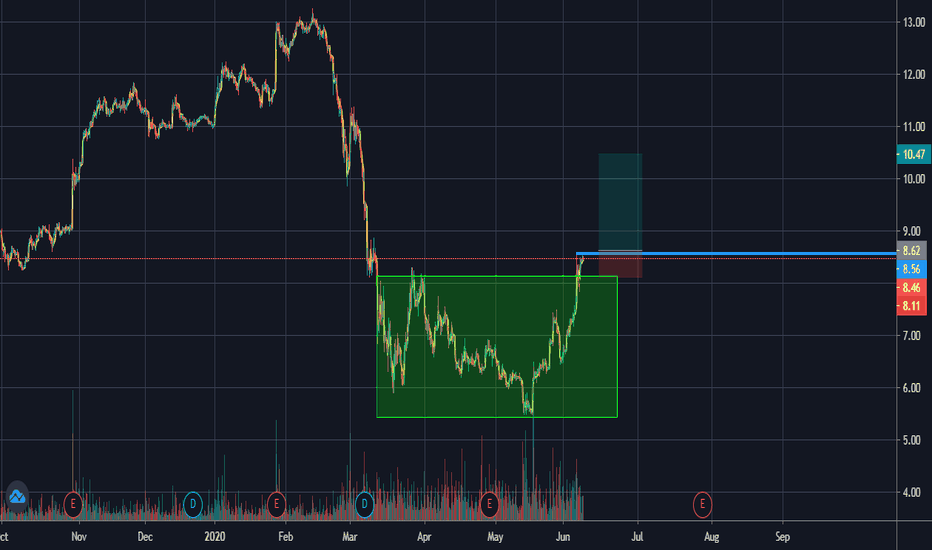

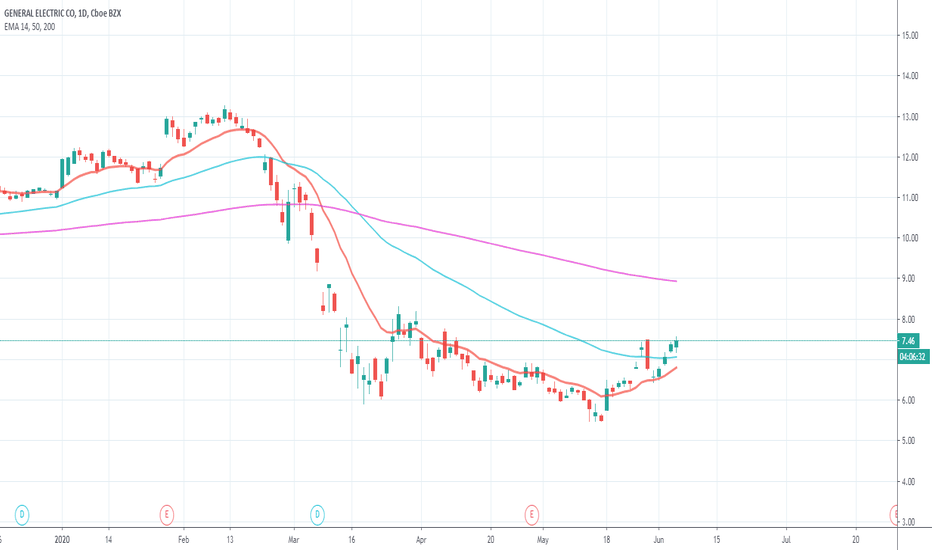

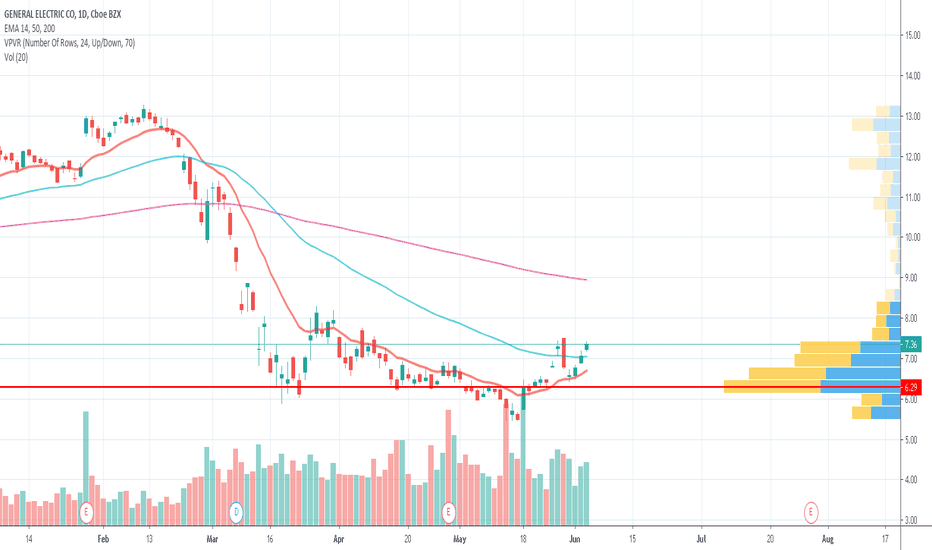

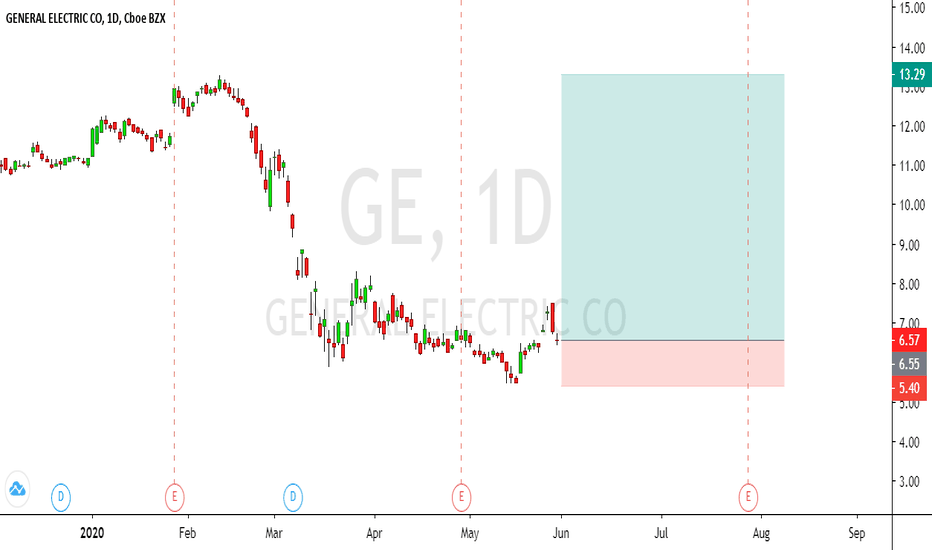

Can Mostly Bearish GE be finally on a Positive Streak? $8 Soon?First off, please don't take anything I say seriously or as financial advice. As always, this is on an opinion based basis. That being said, I have a few key insights. General Electric seems to be on a small bullish wave, and looks like core resistance targets are about to be broken. Given how ridiculously cheap it seems as a stock, past wave correlation and where it is trending at, an $8 price as a short could actually be reasonable if it pushed its momentum further.

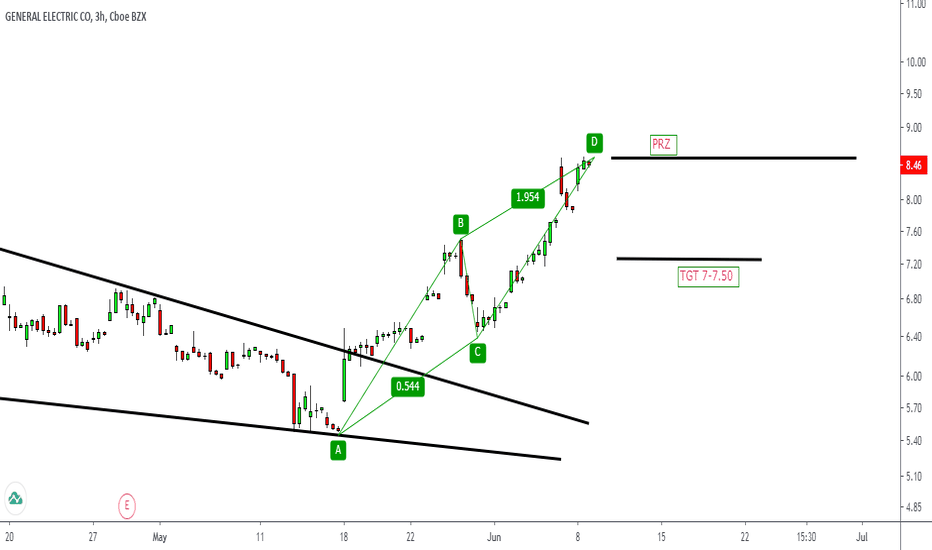

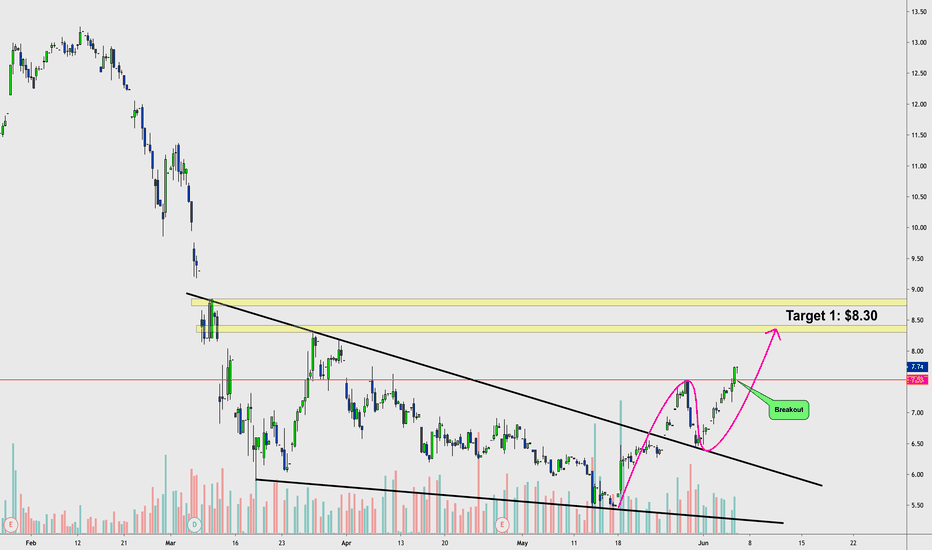

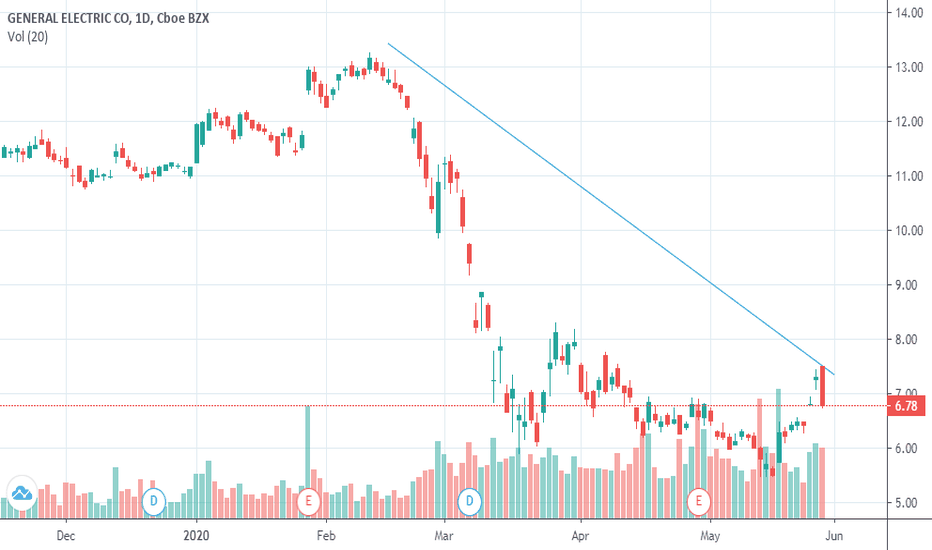

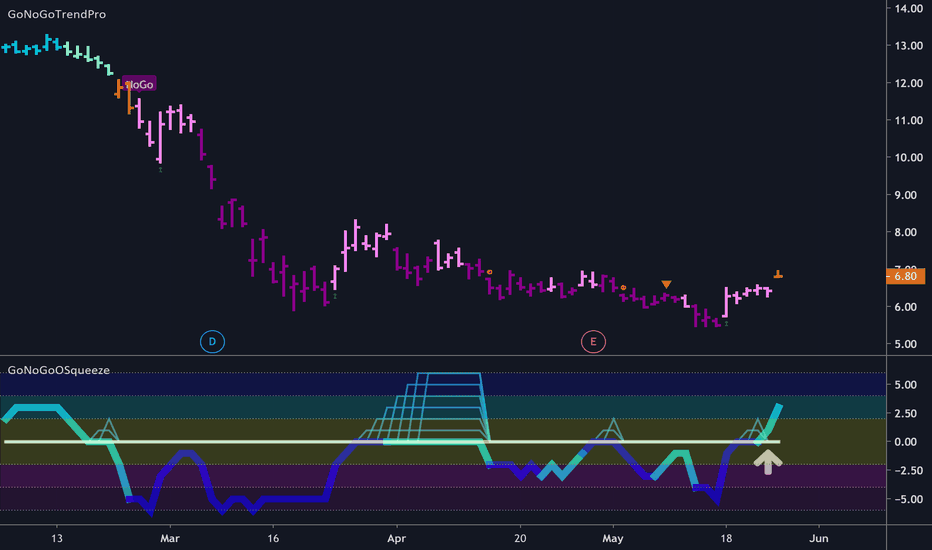

GoNoGo Trend change for GE?Is the tide turning for GE?

For the first time since February 26th the GoNoGo Trend indicator is unable to paint a bearish color instead showing the amber neutral of “No Trend”.

This color change has happened on a gap and above prior highs.

The GoNoGo Oscillator hinted at this change as it broke above zero for the first time since mid February one bar earlier. This new positive momentum could lead to a “Go” in the price chart and a test of the prior highs around 8 dollars

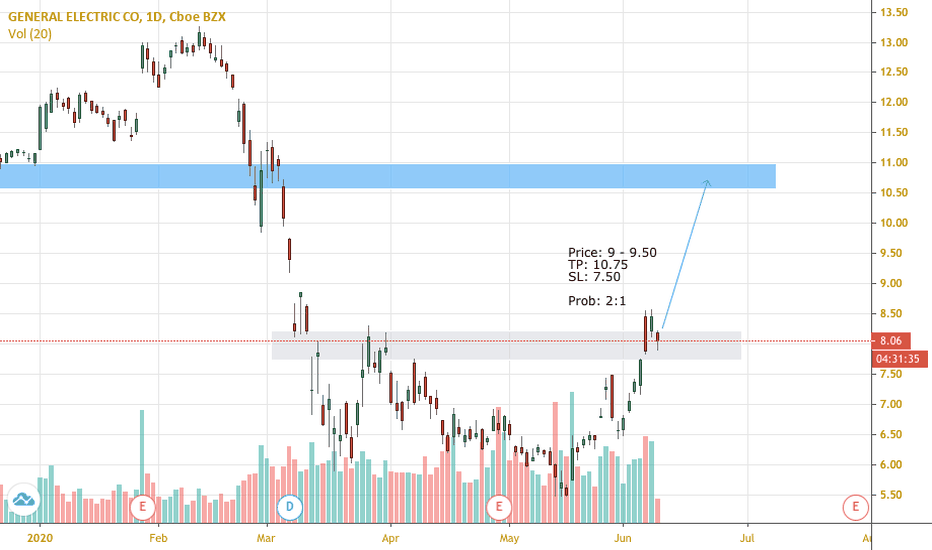

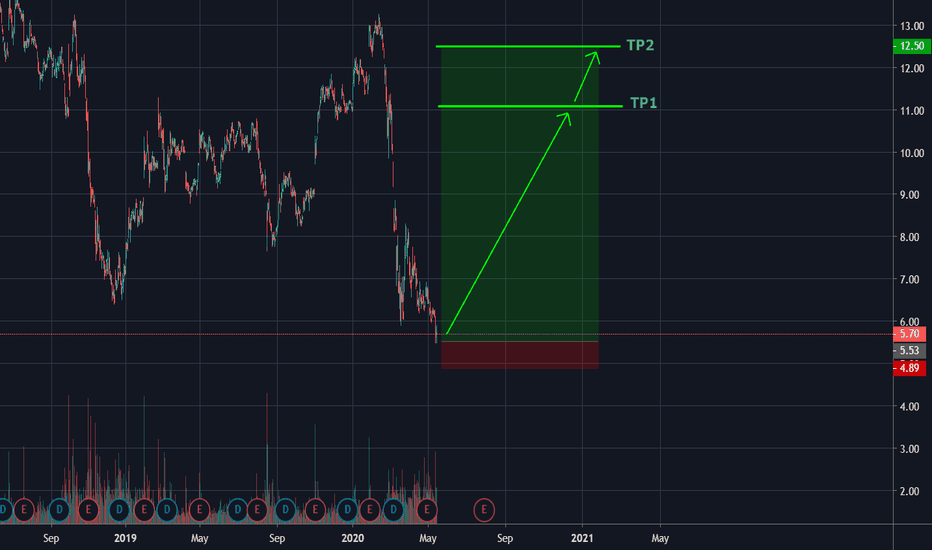

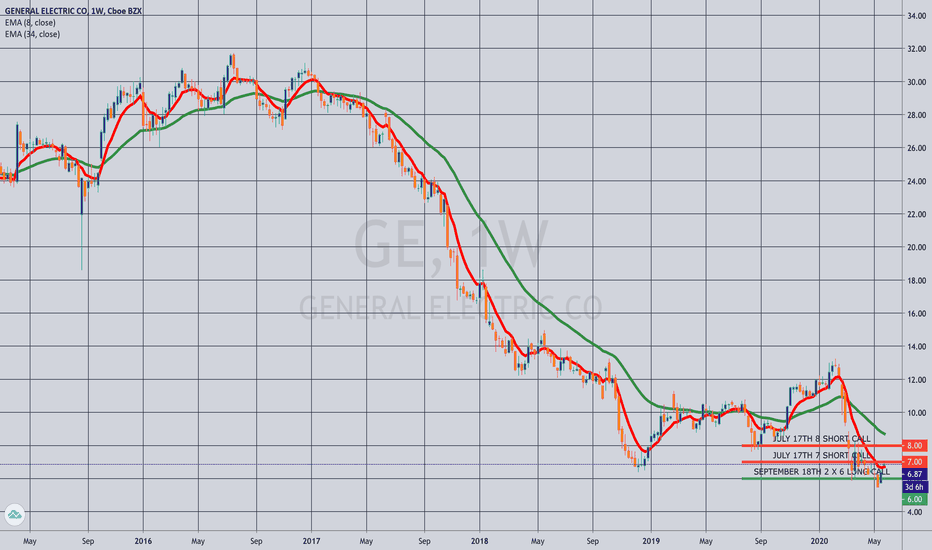

OPENING: GE SEPTEMBER/JULY 6/7/8 COVERED ZEBRAOver the weekend, I did a post on "Zero Extrinsic Back Ratios" or "Zebras," (See Post Below), and am resetting a trade I got a smidge too impatient and/or aggressive with in GE to show how this setup works in practice with a minor twist: I'm covering it with an extra short call.

Metrics:

Max Loss: 1.96/contract

Max Profit: 3.00/contract (the width of the 6/7 or 1.00 plus the width of the 6/8 or 2.00)

Break Even vs. Spot: 6.98 vs. 6.86 (total debit paid (1.96) divided by the number of longs (2) or .98 plus the long call strike (6.00) or 6.98)

Delta/Theta: 72/.10

Notes: In my Brazilian Zebra Post, I indicated that a straight Zebra should be looked at in parts: (a) a standalone, in-the-money long; and (b) a long call vertical. Assuming favorable movement, the long call vertical would be taken off at or near max, after which the long call could be allowed to ride. Alternatively, the short call is rolled out for further credit and cost basis reduction, with the take profit reduced by the amount of credit received (e.g., if max is 2.00 and the credit received on roll is .20, the new take profit target is 1.80).

Here, I'm twisting that setup slightly by covering what would have been the stand alone long with an additional short call so that -- in essence, I've got two long call diagonals in place: a September/July 6/7 with a max of 1.00 and at September/July 6/8 with a max of 2.00. The goal: to take profit on the 6/7 at or near max and the 6/8 at or near max. Otherwise, I'll just roll the short calls out to reduce cost basis further.

An additional variation would involve laddering the short calls out in time by strike and duration: September 2 x 6 long call/July 7 short call/August 8 short call.