URA trade ideas

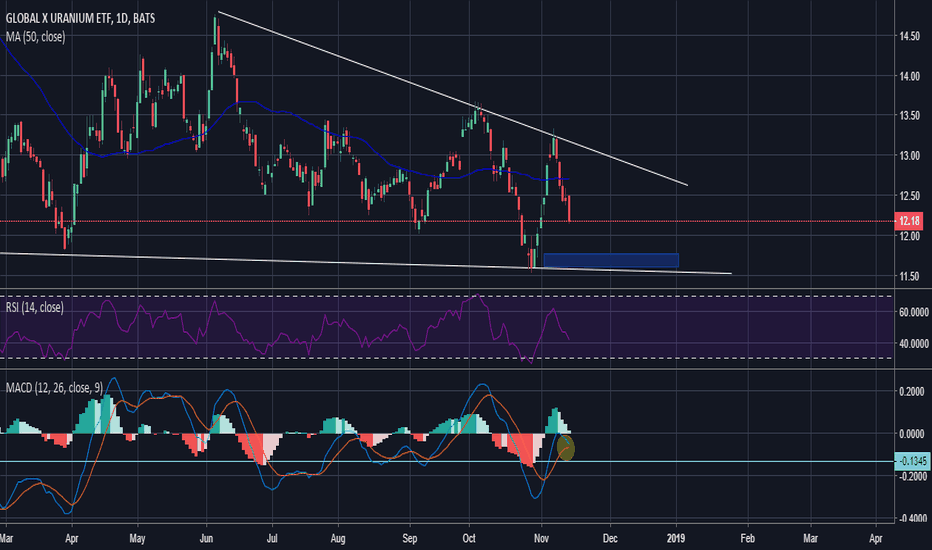

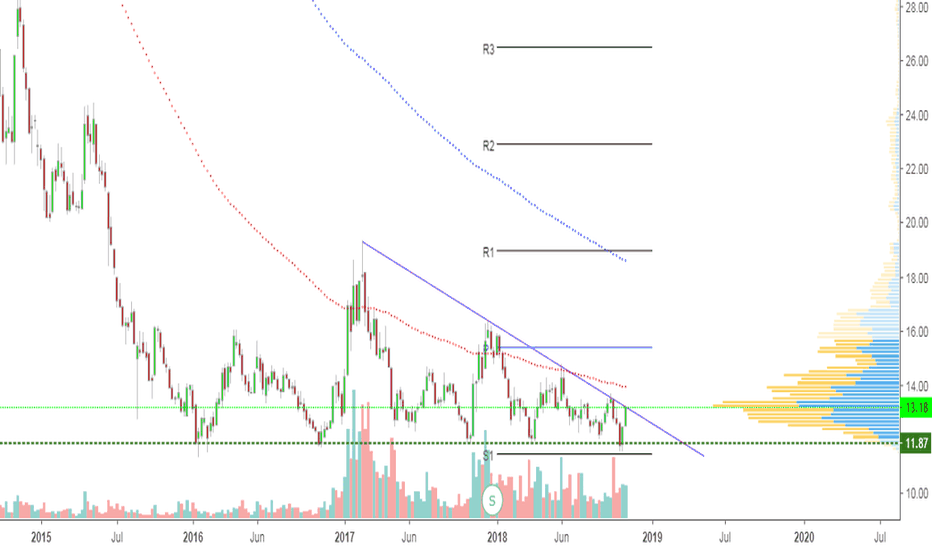

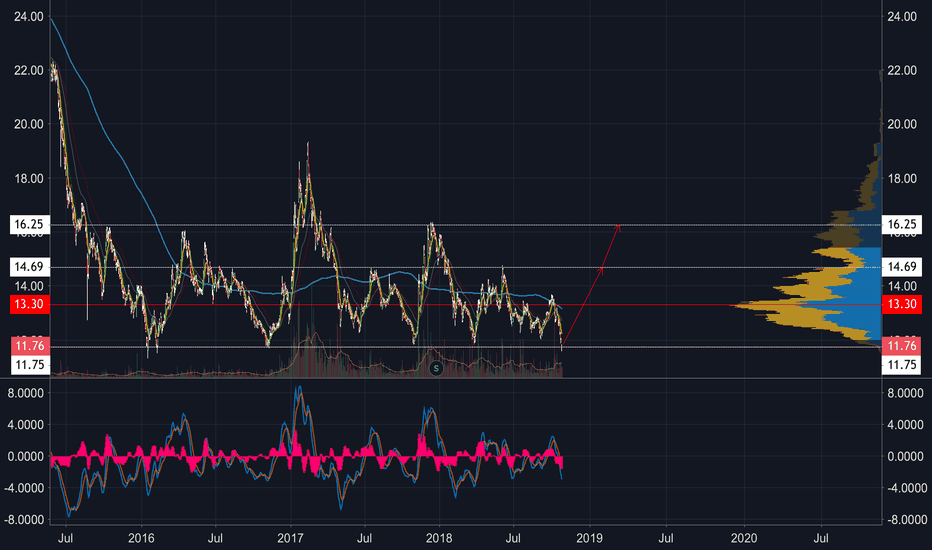

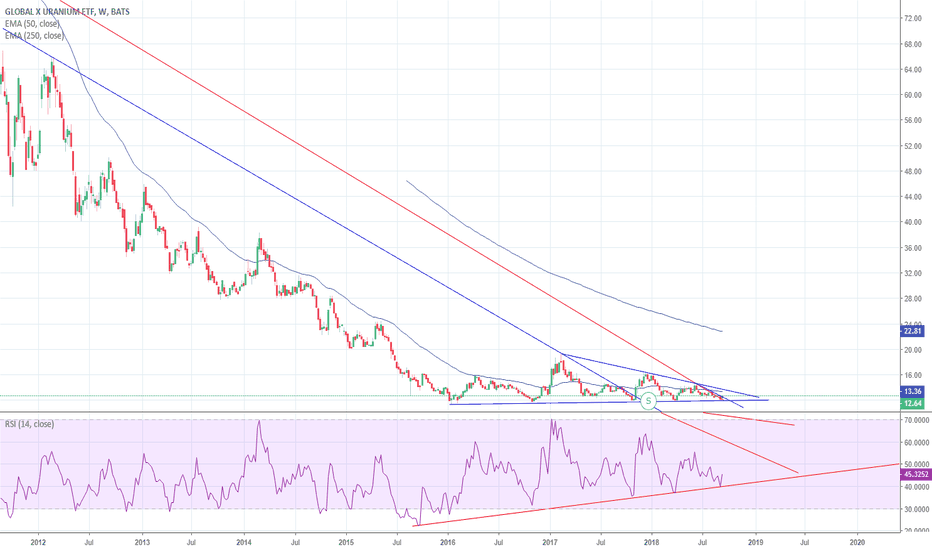

More Down Before Next Uptrend-RSI looking weak telling us this sell off is not over

-MACD about to cross below MACD signal line signaling a continuation of downtrend as we stay below 50 Day Moving Average

Safe Buy Zone at long term support 11.60-11.75

This is my first published idea :) If you have any criticism or other ideas please share in comments

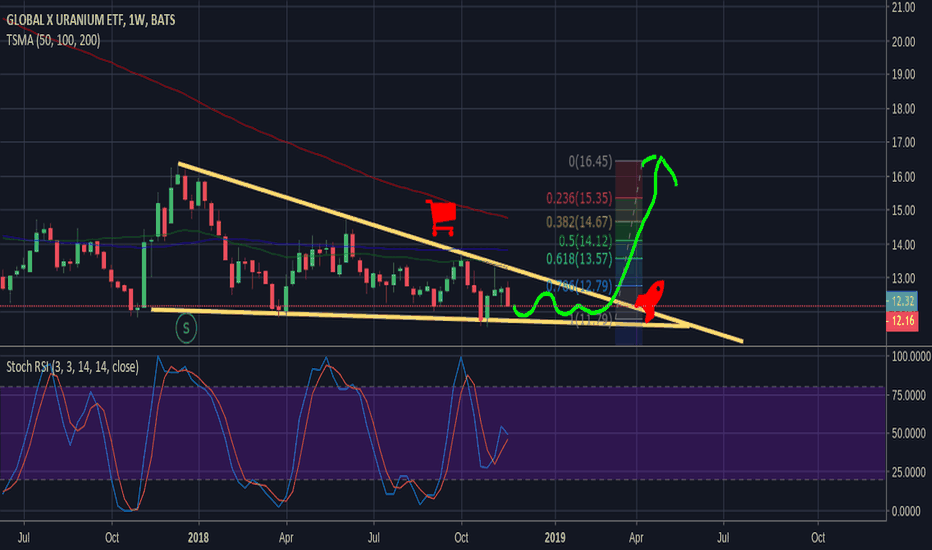

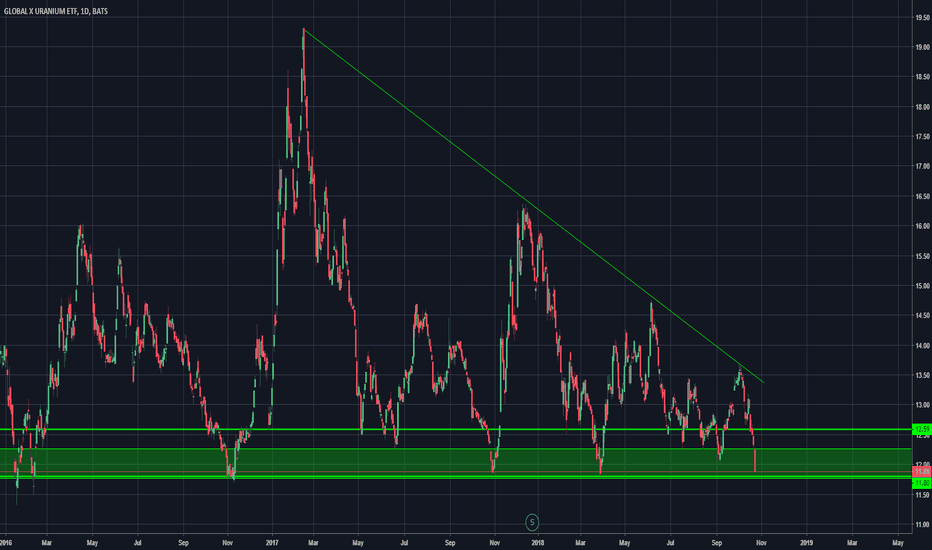

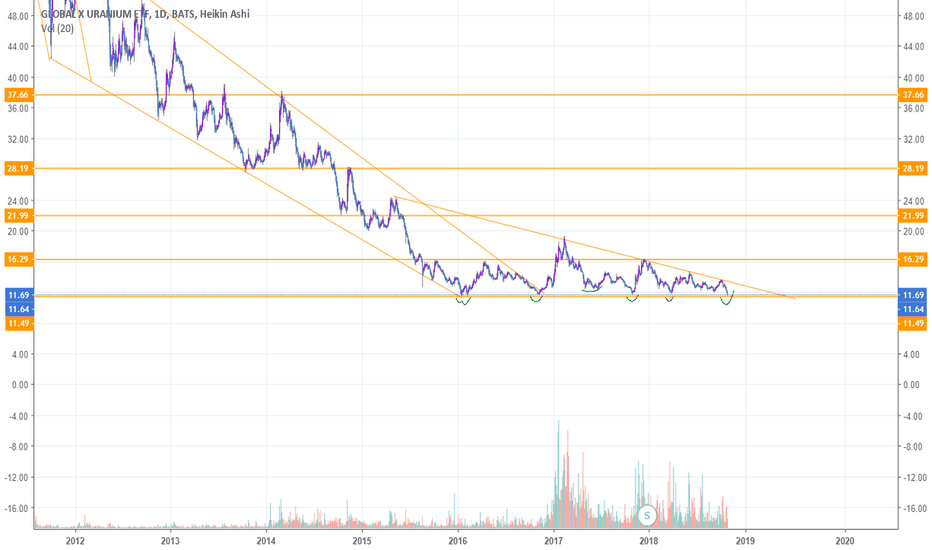

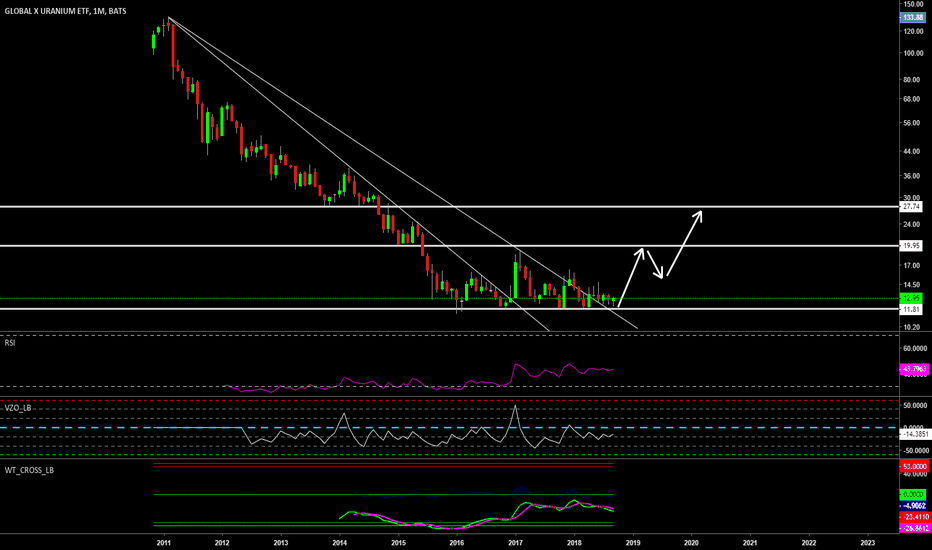

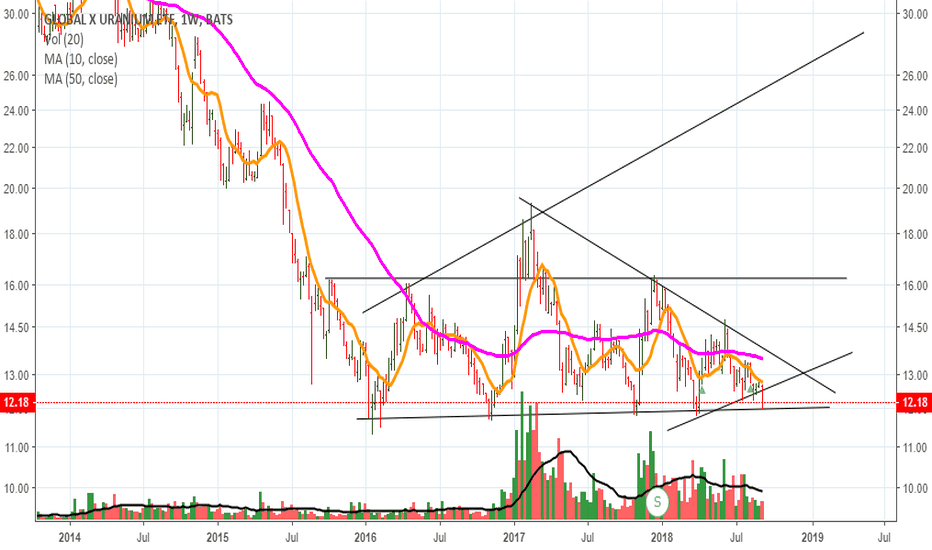

Possible Trend Reversal Expecting a Breakout SoonLooks like the bear market for Uranium ETF will be over soon. The price of URA has been in a bear market since 2011 with a high of $130 losing about 90% of it's value dropping as low as $11.25.

On October 2016 it started a small rally that ended with a shooting star candle with the 150 Weekly MA acting as resistance at the price of $19 Top.

Since then it has been forming a triangle of higher lows with the price of $11.50 acting as support.

That triangle is expected to break by late 2018 to early 2019.

As the current market conditions for commodities which overall are at the all time low, it shows chances of maximal financial opportunities.

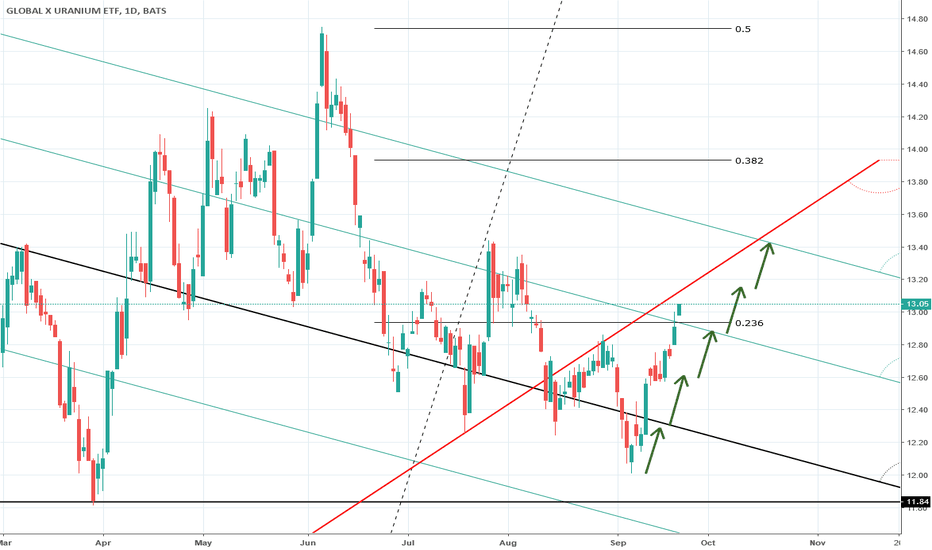

We are currently close to test the resistance at the range of $13.75.

Breaking that level would take us to a new higher high changing the over all trend Uranium ETF.

I'm not a financial advisor, this is my personal opinion. Only invest what you can afford to lose.

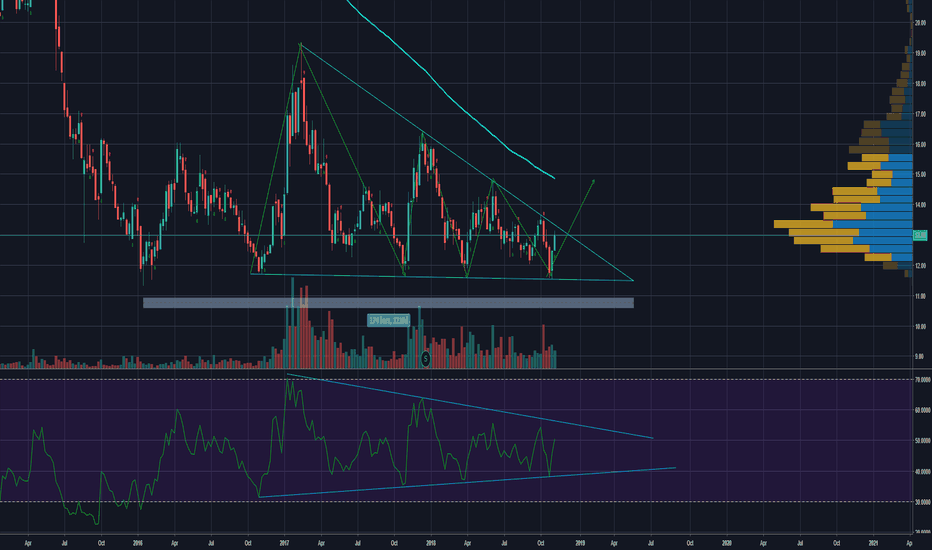

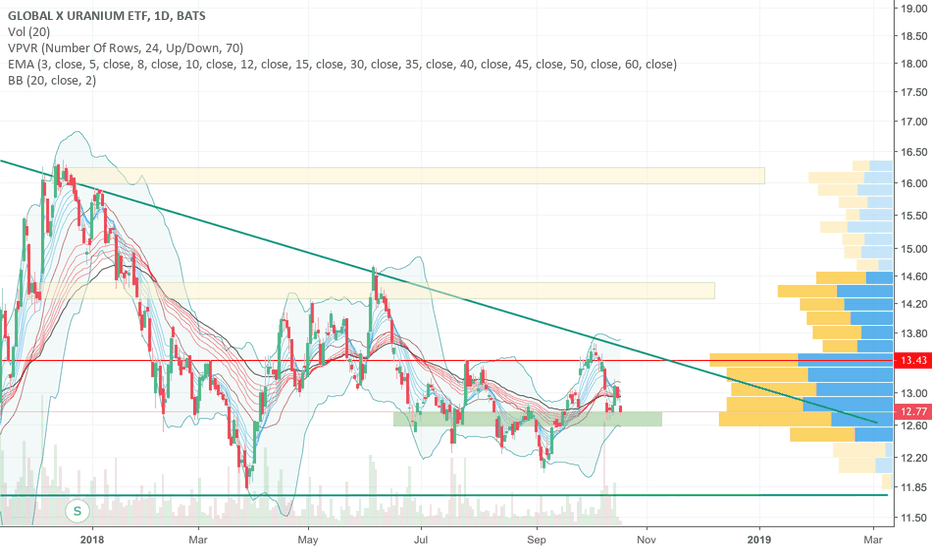

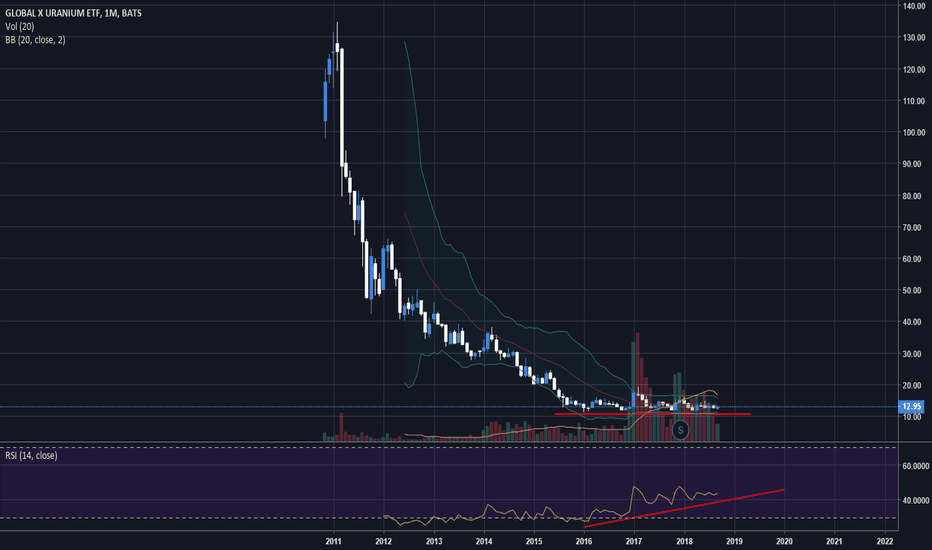

$URA Prolonged consolidation or bullish bias?Fundamental - uranium has declined in price from its inception because of simple supply and demand. URA has now been in a consolidation pattern since 14 Oct 2015. Supply have meet demand in the zone of primarily 11.57 to 16.31. The bullish bias comes from uranium miners first making profit when price reaches 20. Therefore some uranium miners have been shutting down their operation until a price hike. Japan could be opening new facilities to enrich they energy supply to the mainland after they haven been open to it in public forums.

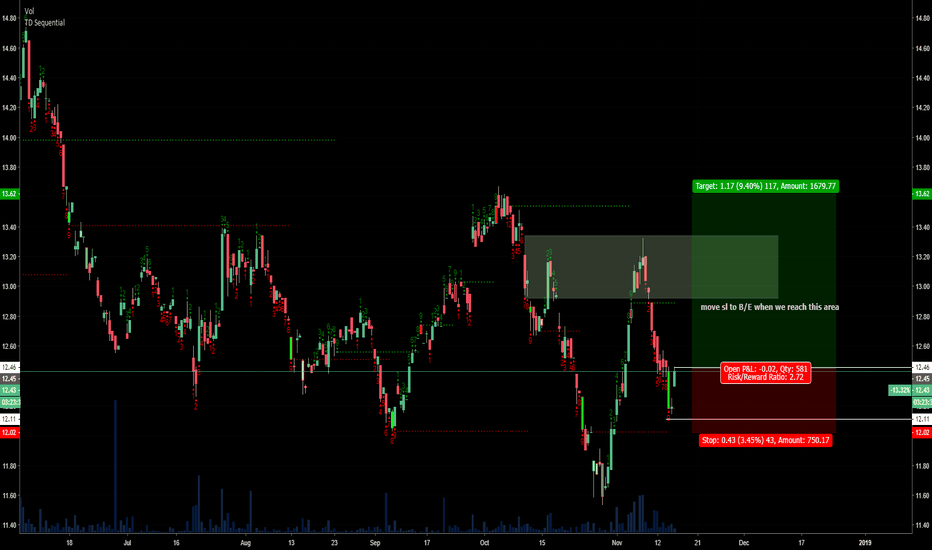

First trade

A rise over 16.31 makes a bullish entry with a stop loss at 11.57 and TP levels at 20 and 23.93 (support and resistance levels formed before consolidaton formation).

Second trade

TSI supports short term bullish momentum and entry on the price now and sell if it doesn`t break 16.31!

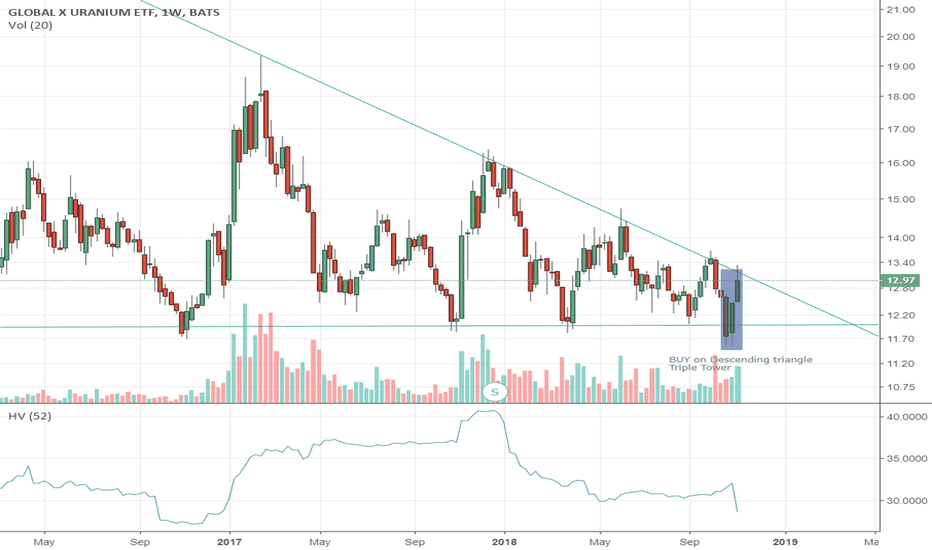

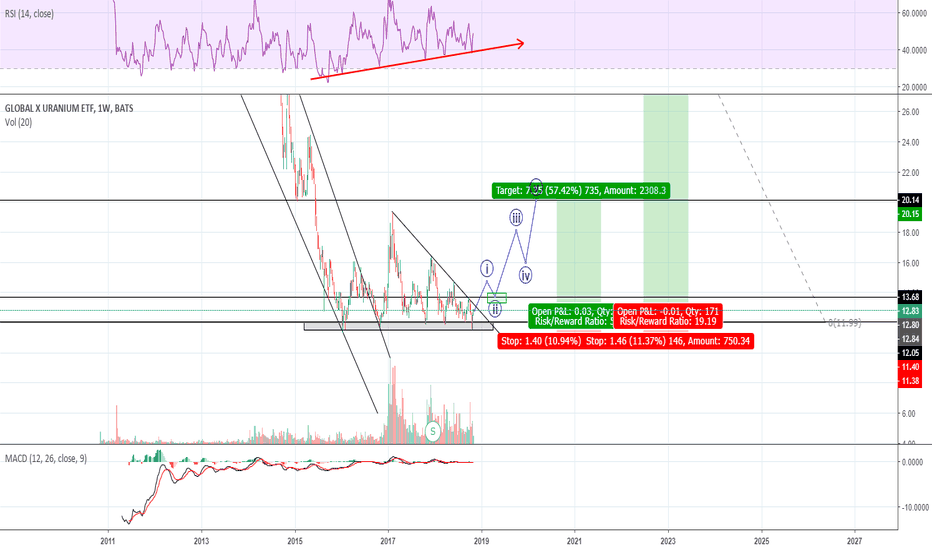

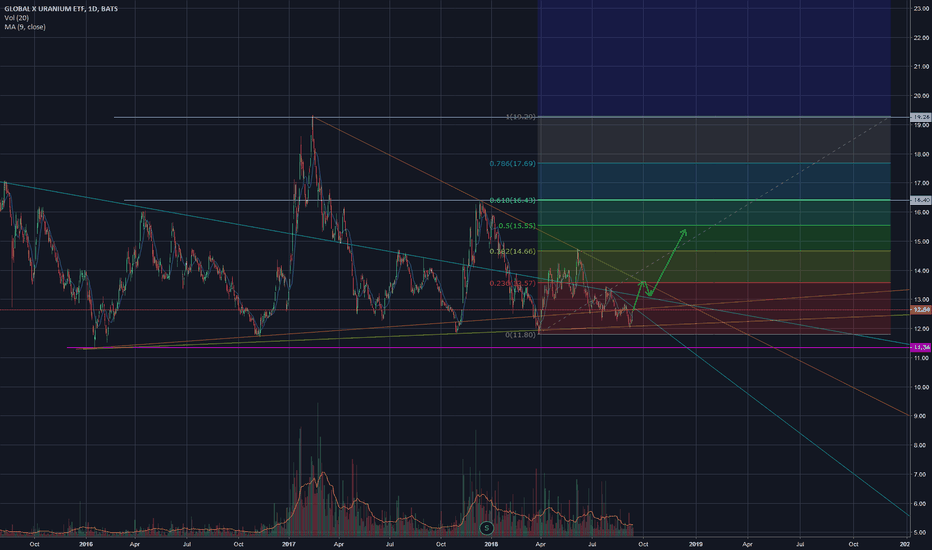

forgotten and undervalued ETFPay attention to Uranium futures, correlation is obvious but right now we have divergence which should be reduce. UX1! is very bullish.

We are 90% down from the top, descending trinagle ends in december. I think this is a good moment to get in.

SL -10%, exit in case of second Chernobyl disaster.

Peace.

RF