URA trade ideas

Uranium future projection The race to reduce carbon emissions by 2050 is on. Uranium being one of the top runner up and The biggest in capacity holding of energy holds my number one spot in this new energy transition and I will show you why below.

AMEX:URA current environment

1.Market Response to Production Shortfall

- The news of Kazatomprom potentially cutting its 2024 production plan due to sourcing issues with sulfuric acid has led to a significant reaction from the market. Shares of uranium companies have seen a sharp increase as investors anticipate a tighter supply, which could drive up uranium prices. The immediate price jump is a direct reflection of the market’s sensitivity to supply disruptions, especially from a major producer like Kazakhstan.

2. Impact on Uranium Prices:

- Uranium prices have reached their highest since the end of 2007, indicating a robust bullish sentiment in the market. This price movement aligns with the fundamental analysis where supply constraints act as a significant driver for price increases. The $97/lbs price point could serve as a new resistance level, and if prices remain above this threshold, it could signal a continued bullish trend.

3. Performance of URA and Other ETFs:

- The Global X Uranium ETF (URA) climbing by 5.3% is a strong indicator that the ETF is benefiting from the current market dynamics. The rise of URA, along with other ETFs like the Sprott Uranium Miners ETF, shows that the bullish sentiment is widespread across the sector. This positive movement in ETFs also reflects broader investor confidence in the uranium market's growth potential, amidst the current production and geopolitical concerns.

*Driver of uranium price in a macro perspective*

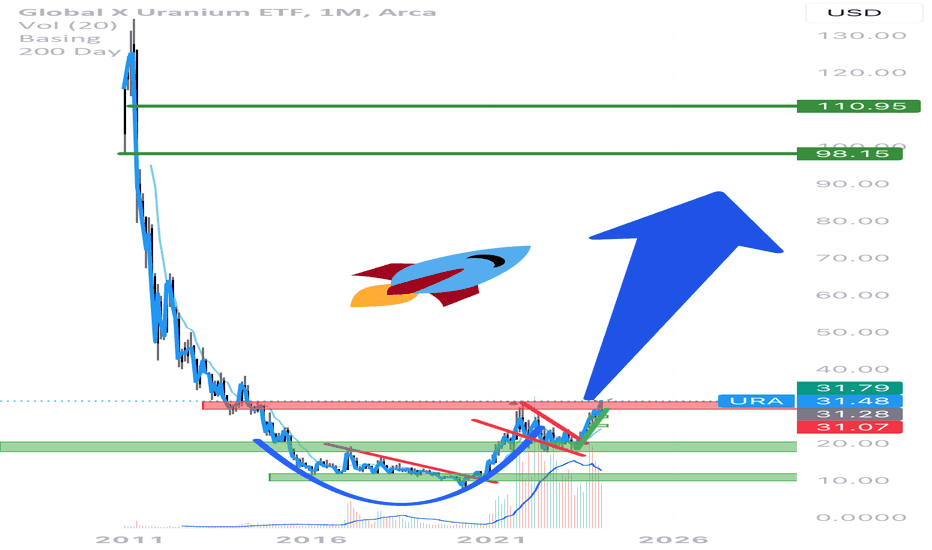

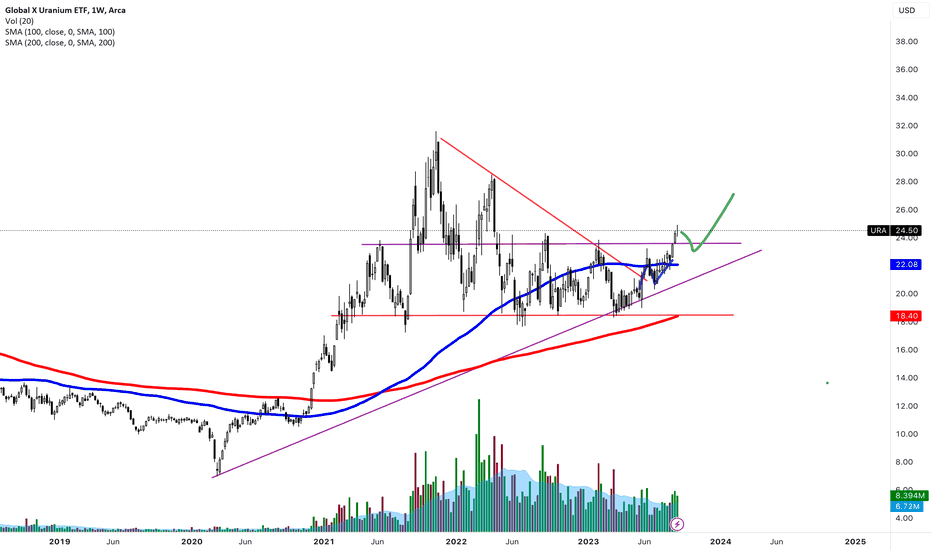

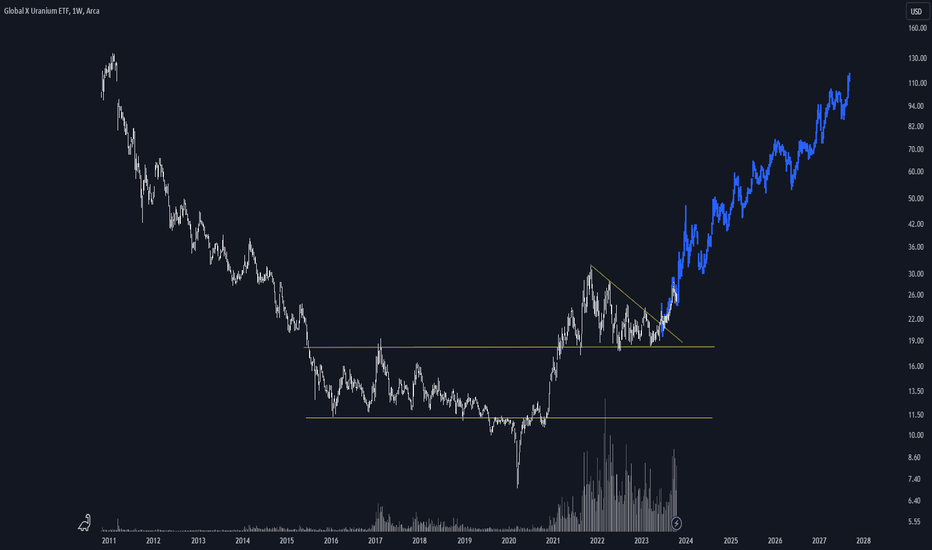

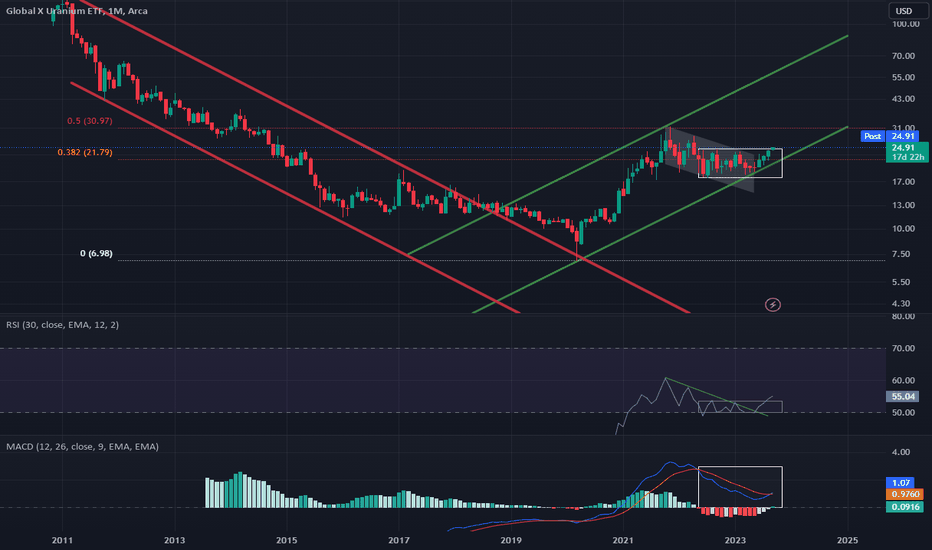

1. Technical Chart:

a "cup and handle," which is typically considered a bullish continuation pattern. This pattern is characterized by a gradual decline followed by a rise that mirrors the prior decline, forming a "cup," and then a smaller pullback before a breakout, forming the "handle." For URA, the pattern suggests that after a period of consolidation and pullback, there could be a potential upward breakout. The validity of this pattern would be further reinforced if it occurs with an accompanying increase in volume, which would indicate strong buying interest. Which is the case for ura on the 1 month chart

Volume: the volume on uranium has seen a significant increase which is visible on the chart. In September 29 2020 the average 30 day volume was 151,333.2 now fast forward todays day January 12, 2024 uranium is trading at an average 30 day volume of 2.85 million! Price Which is also near resistance level is just peaking above it currently looking like it wants to push higher given the significant Volume increase.

2. Fundamental Drivers:

- URA's performance is closely tied to the demand and supply dynamics of uranium. The push for clean energy and the need to reduce carbon emissions are driving countries to consider nuclear energy as a viable option. This could lead to an increased demand for uranium. Moreover, supply constraints, possibly due to geopolitical tensions in uranium-rich regions or production cuts like those potentially by Kazatomprom, can create a supply-side squeeze, leading to higher uranium prices, which would benefit URA.

3. Geopolitical Landscape

The geopolitical tensions, particularly those affecting countries like Kazakhstan which is a major uranium producer, can significantly impact uranium availability and prices. The Russia-Ukraine conflict also adds to the complexity, as it could lead to sanctions or disruptions that affect the global uranium market. Additionally, if European countries, in seeking to alleviate energy crunches, pivot more towards nuclear energy, that could further increase demand for uranium, benefiting URA in the process.

Outlook: uranium looks very bullish

BofA Global Research forecasts that spot uranium prices will reach $105 a pound this year and $115 a pound in 2025. Just how high prices can get depends in part on how quickly countries wean off Russian supplies.

Demand for uranium for nuclear plants is expected to rise to 83,840 tonnes by 2030 and 130,000 tonnes by 2040, from 65,650 this year, it said. The spot price of uranium has more than doubled over the past three years, but is well down from a peak of $140 a pound touched in 2007.

*Deeper analysis on URA*

1. Nuclear Energy's Reliability and Capacity Factor:

nuclear energy's high capacity factor, which measures the reliability of an energy source by comparing its actual output with its potential output. With a capacity factor of 92.5%, nuclear energy is presented as the most reliable energy source when compared to others like natural gas, coal, wind, and solar. This reliability is crucial for meeting base-load energy demands consistently, which is an advantage for countries aiming to reduce carbon emissions without compromising on energy availability.

2. Nuclear Energy in Carbon Emission Reduction:

- The fact that nuclear power produces zero carbon emissions during operation positions it as a clean energy source, especially important as countries race to meet emission reduction targets by 2030 and beyond. This bolsters the argument that demand for uranium, as a fuel for nuclear power plants, is likely to increase as part of global decarbonization efforts.

3. Nuclear Energy's Role in the Energy Transition:

- With the information on nuclear energy's big wins in 2023 and the goal of net-zero emissions by 2050, there is a clear indication that nuclear energy is gaining momentum. This trend can serve as a foundational driver for increased uranium demand, reinforcing the bullish outlook for uranium investments such as $URA.

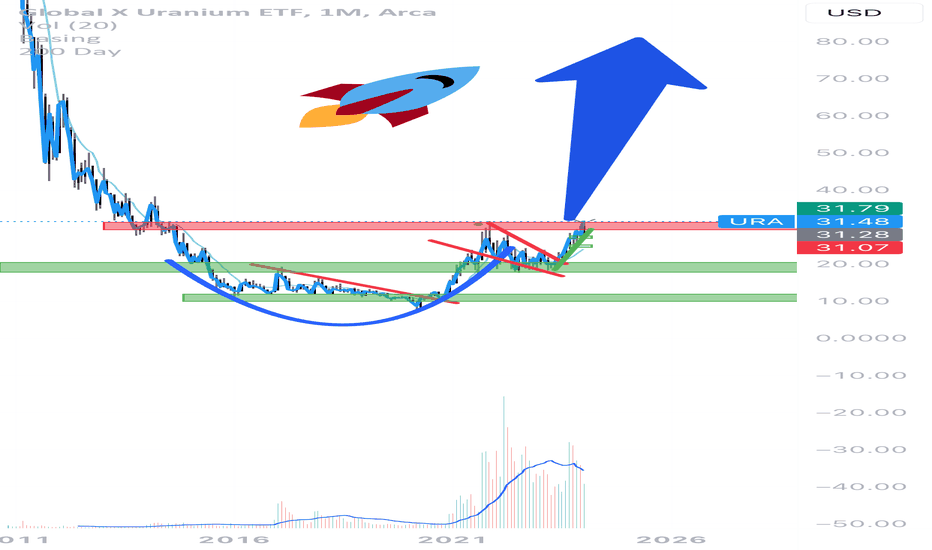

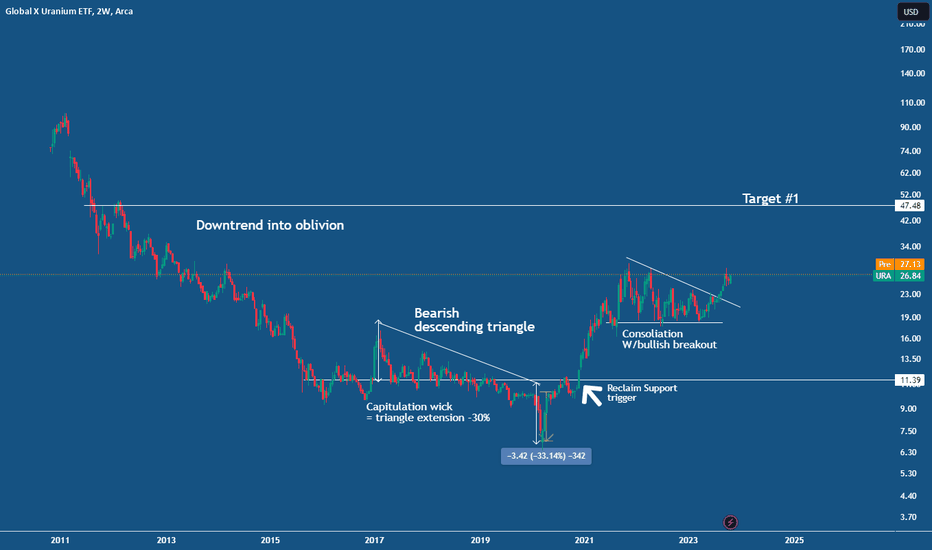

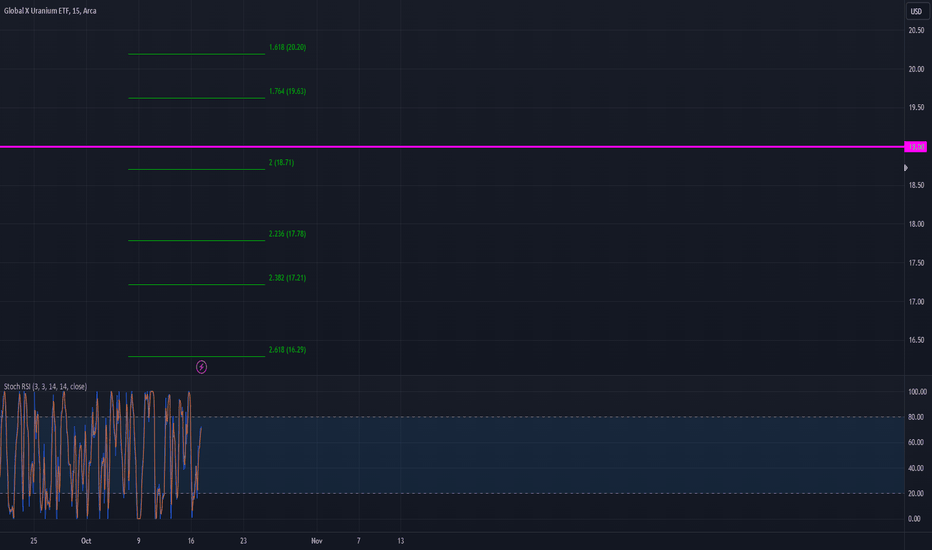

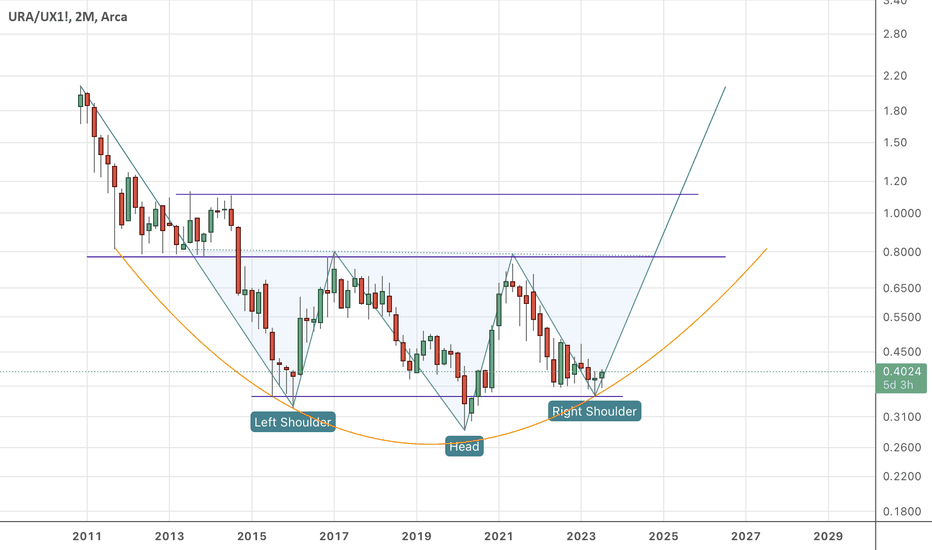

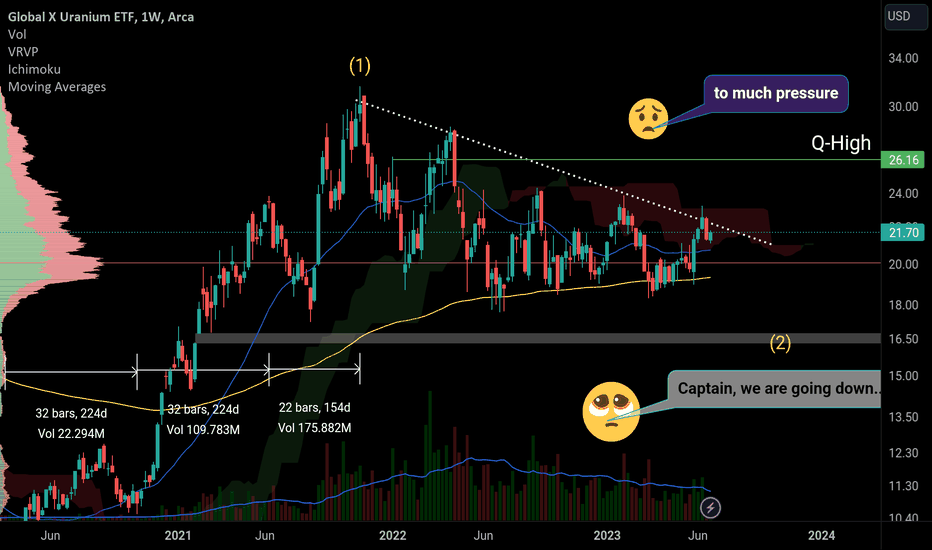

$URA double top, target sub 10?Looking at the chart, we've just formed a high timeframe double top. Unless price can break resistance and confirm it as support, price is heading down.

Based on the structure of the chart, if the midline gets broken at $18, the target of the move should be sub $10. Hitting the lower supports around $6-7.

If we get down there, that should setup a great multi-decade buy.

Let's see how it plays out.

Brend Oil interesting pattern forming but stil not complete!MOEX:BR1! Brent Oil

Head & shoulder pattern forming although pattern is not yet complete. we need to see how the right shoulder is forming and a break below 73.50 will trigger the head and shoulder breakdown.

But i guess OPEC wil not let it come this far and tighten their production before this.

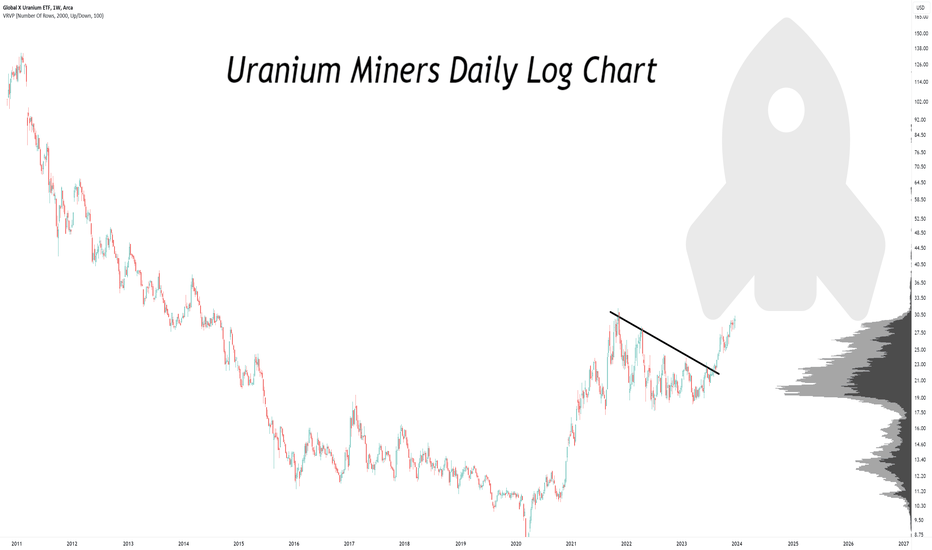

URA - potential for long-term longThe blue bar projection is less of a prediction and more of a possibility. It is the previous primary trend decline flipped around but equal in price and time scale.

URA experienced a long term primary down trend since opening for public trading.

From 2016-2021 the primary downtrend turned into a multi-year basing, which was broken out of bullishly in 2021 and then held above resistance-turned-support. It has now retested multiple times without falling back into the range.

You can see recently it has surged again upwards with good volume.

This has good potential for a U-shaped long term recovery.

As I am a technician I will leave out my personal fundamental opinions on nuclear as a clean source of energy.

Thank you.

-harambepay

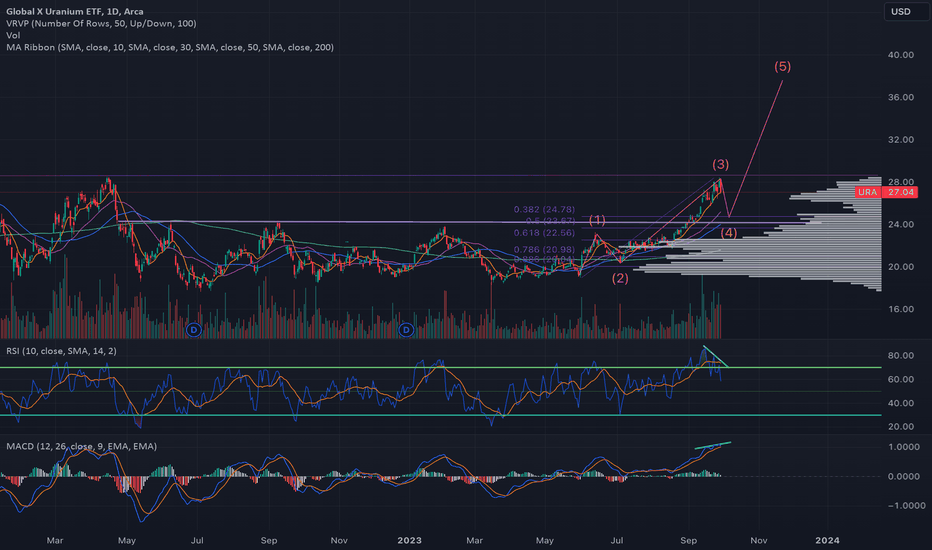

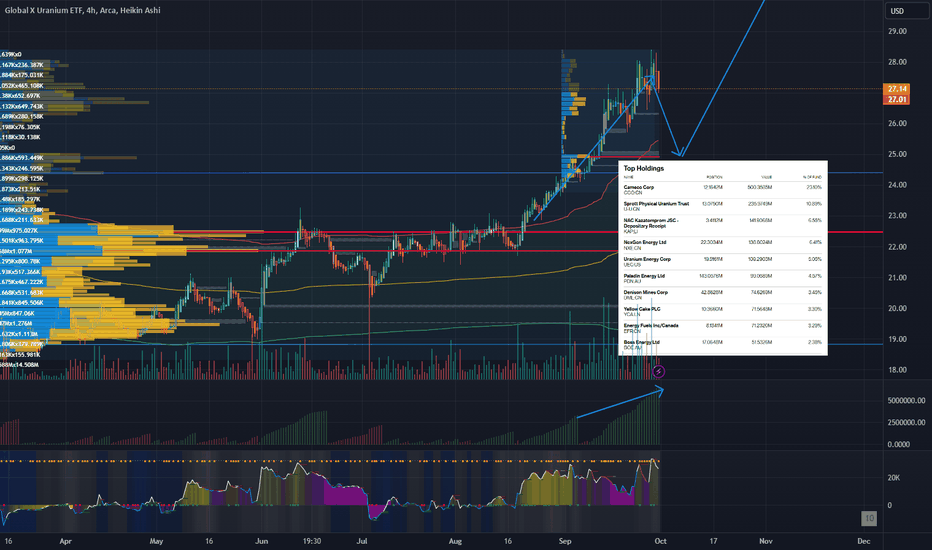

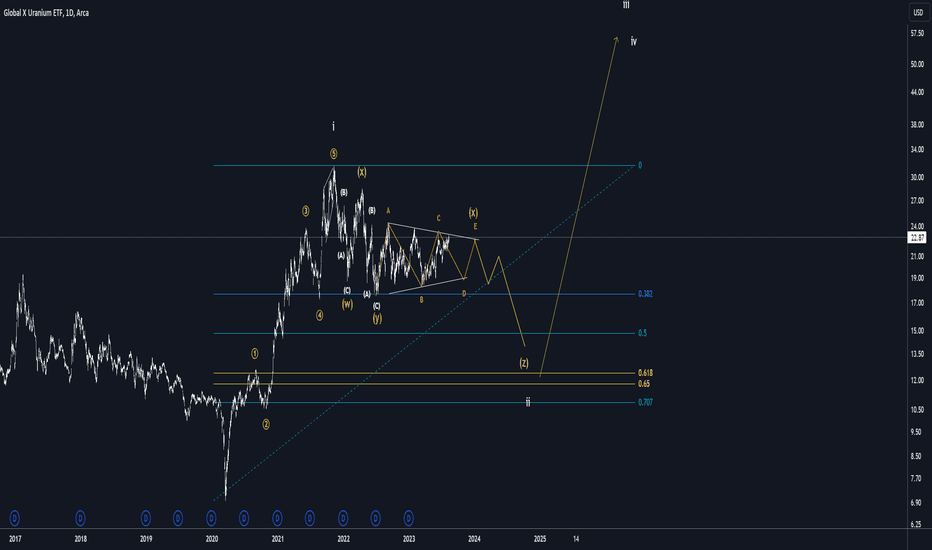

Uranium Mining OutlookURA in a 3rd wave and could possibly have topped here at the 28, but it also could be setting up higher for a 5th wave finish 32-36 area.

When I first looked at it, I saw the possibility of a great buying opportunity in the $14-16 area if things break down.

Right now I think we need to hold the $24-22.5 area to keep this bullish move upward. Otherwise the 14-16 becomes a greater likelihood and then will have to start seeing if the projections of the move line up to that target of $14-16.

Not financial advice

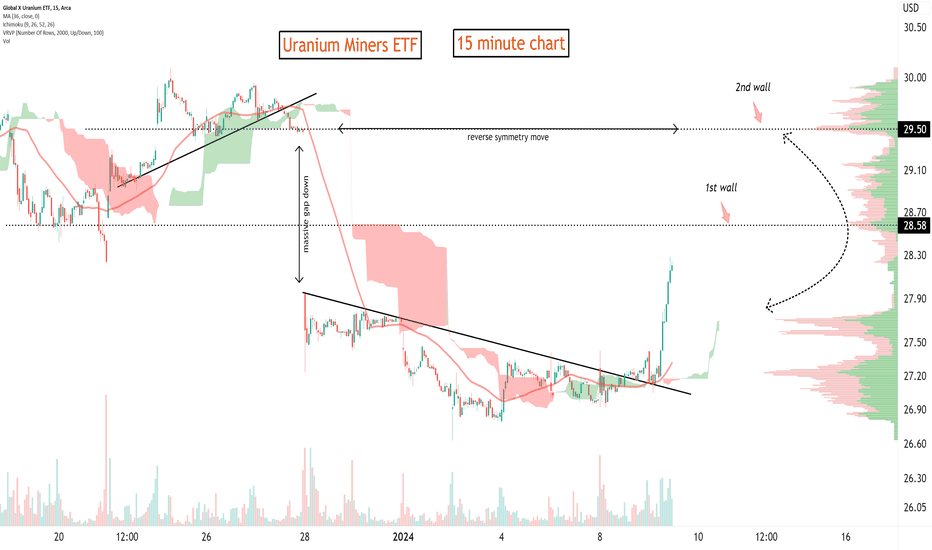

Short $ura short term long $ura long termI am super bullish on AMEX:URA medium and long term but believe the share needs a pullback to back test the breakout, complete the wave 4 before going nuclear on wave 5. Note the divergence on the RSI - lower lows lower highs - and MacD flattening. I expect a fairly shallow pullback to the 0.38 Fib at $24.78

Uranium middle termUranium is following a bullish trend.

Eurpean Union defines Nuclear Energy as Clean Energy in terms of CO2 emission.

Technology Companies are contracting Nuclear Energy due to their high level demand for data centers.

Hedge funds are investing in Nuclear stocks and ETF.

Cameco Corporation, Canadian Company, is under real production.

Saudi Arabia is pushing Oil Prices to high levels. Nuclear could be a sustitute in many activities.

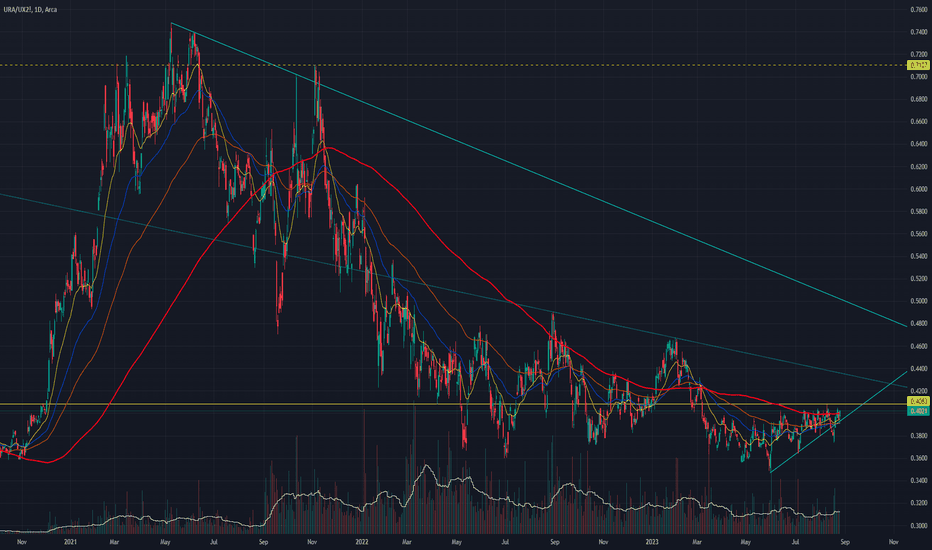

URA vs. U308 Futures ~ Snapshot TA / Uranium Bull IndicatorPerformance comparison between Global X Uranium ETF versus U308 Futures.

One of many Momentum Indicators out there that track Bullish movements in Uranium Sector.

Uranium stocks haven't always been closely-correlated to Futures due to their "risk-on" nature...so when stocks start outperforming when Futures + other confluences are also rallying..

You might have a good ol' fashion Uranium Bull run on your hands.

Boost/Follow appreciated, cheers.

Futures: COMEX:UX1! COMEX:UX2!

ASX ETFs: ASX:ATOM ASX:URNM

US/OTC ETFs: OTC:SRUUF AMEX:URA NASDAQ:URNJ AMEX:URNM

URA - one more low inc.No clear impulse visible...

we might still have to embrace one more low..

Once upon a time in the bustling world of financial markets, there existed an extraordinary exchange-traded fund (ETF) called URA, which was intricately tied to the price movements of uranium. URA, short for Uranium Resources ETF, was an investment vehicle that allowed individuals to participate in the uranium market without directly purchasing the commodity itself.

The story of URA was marked by its peculiar behavior, as its price fluctuations seemed to defy the expectations of many investors. It was a constant source of fascination and speculation, leaving seasoned traders scratching their heads in confusion.

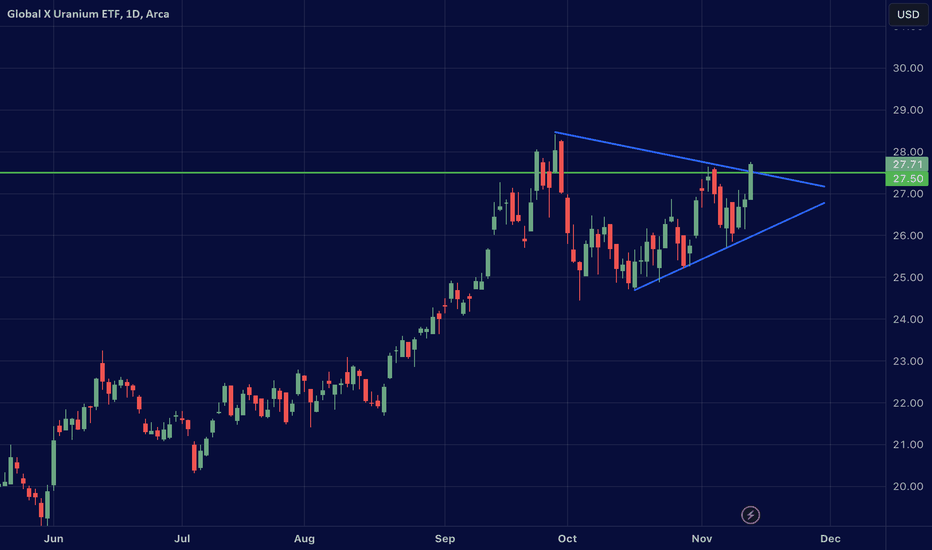

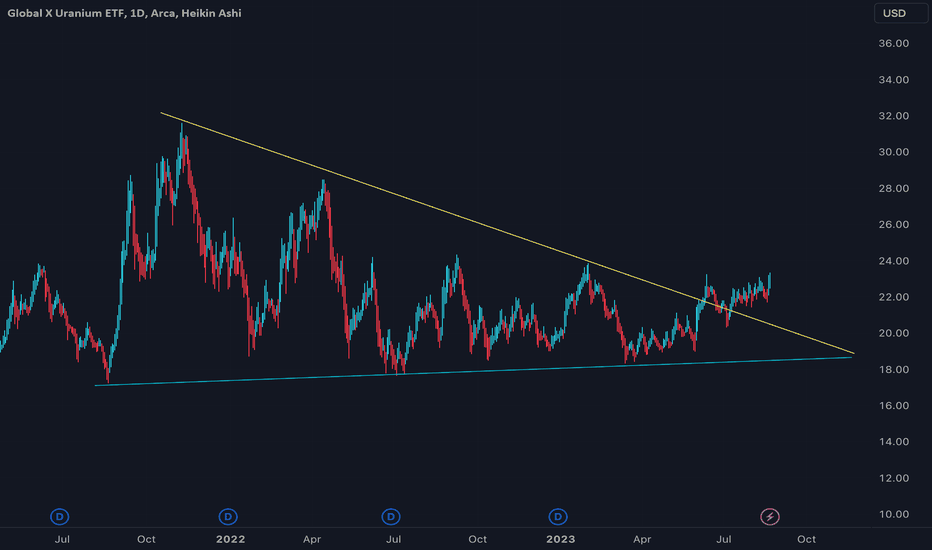

URA - You want to be long UraniumURA faked out initially by breaking its downtrend (yellow) but then failed the retest of its breakout by falling back into the triangle and dipping below 21. It has now broken out a second time, but this time it seems to have done so with conviction. One can buy the ETF (URA) or look for uranium stocks to punt.

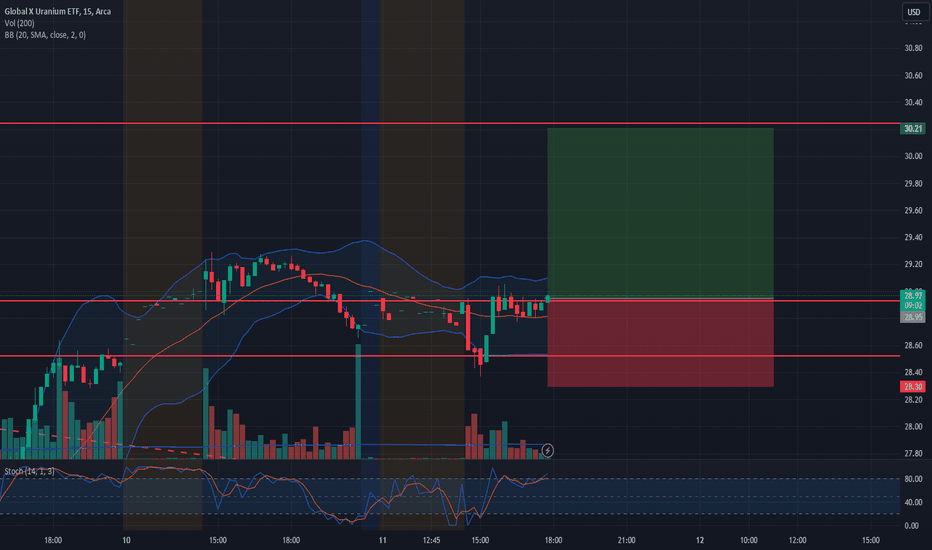

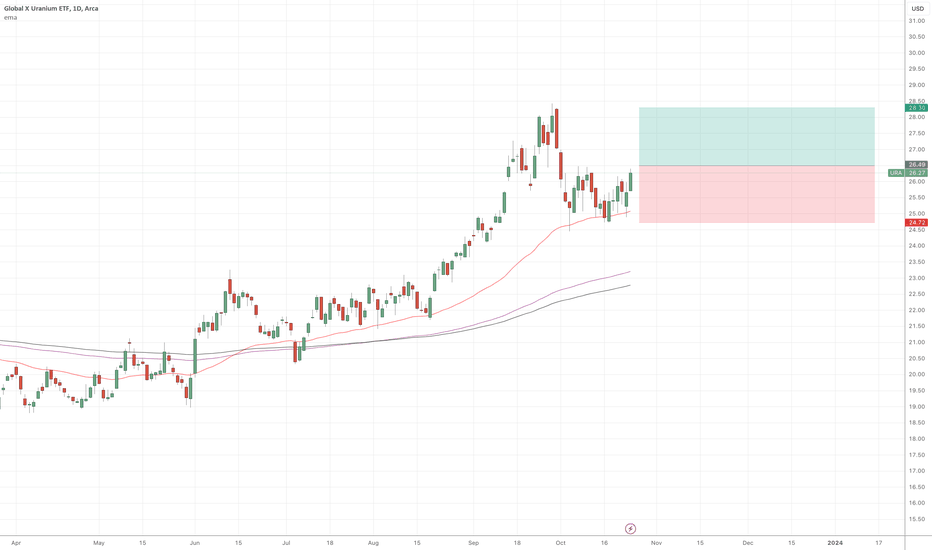

$URA longCould still make a lower high so my TP is set very conservatively without the best RR. If AMEX:URA clears the resistance in the grey box I will look for more longs. I just added more to this trade and raising the stop loss so thought I will post the trade idea incase it offers more opportunities to enter.

Secure your grandchildrenIf humanity doesnt go extinct.

Uranium . if it gives any price between 10 to 14$, im getting in and this is a full send.

The initial drop is not just enough for me to be sure in an elliott wave count correction wise. The faster it drops, the faster it will jump as well.

I would really like this to go lower.

But current global happenings might just send it already...

Long term hold