GDX trade ideas

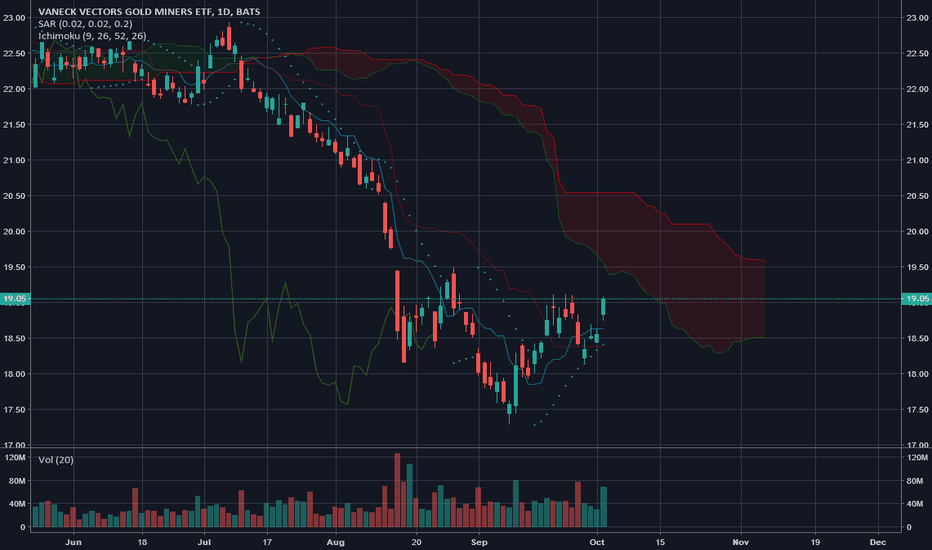

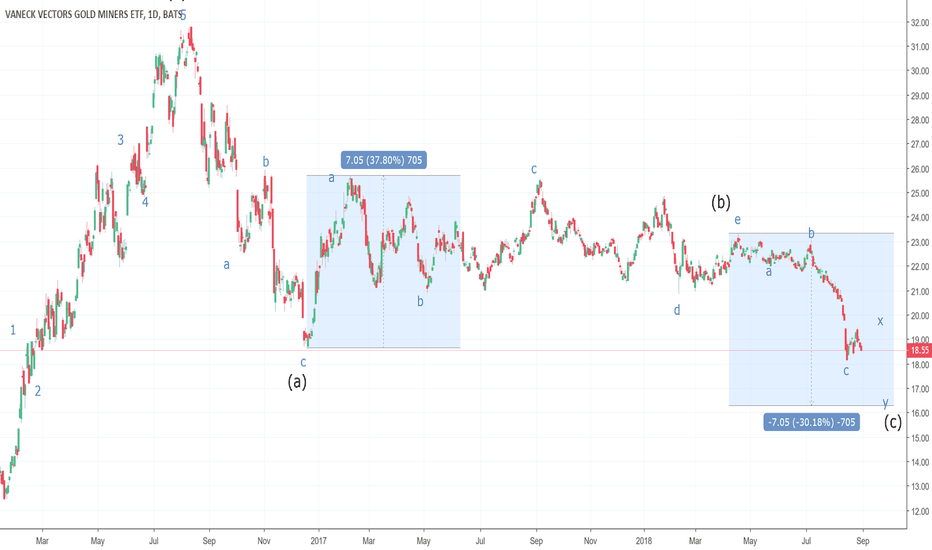

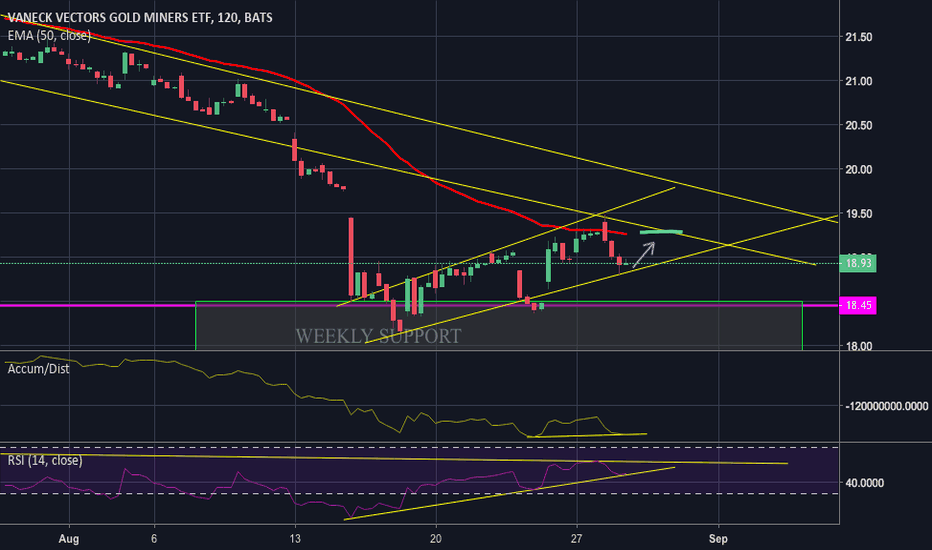

GDX good buy in for a flip or a long term accumilationGDX is currently finding support

How to trade it:

- Enter a small position at these levels

If it bounces to 19.20-20.5 sell for a quick flip.

If it drops further double down 17.7-17, downside past this point is unlikely as GDX is already oversold. Sell the bounce after this second buy.

Not financial advise, just educational

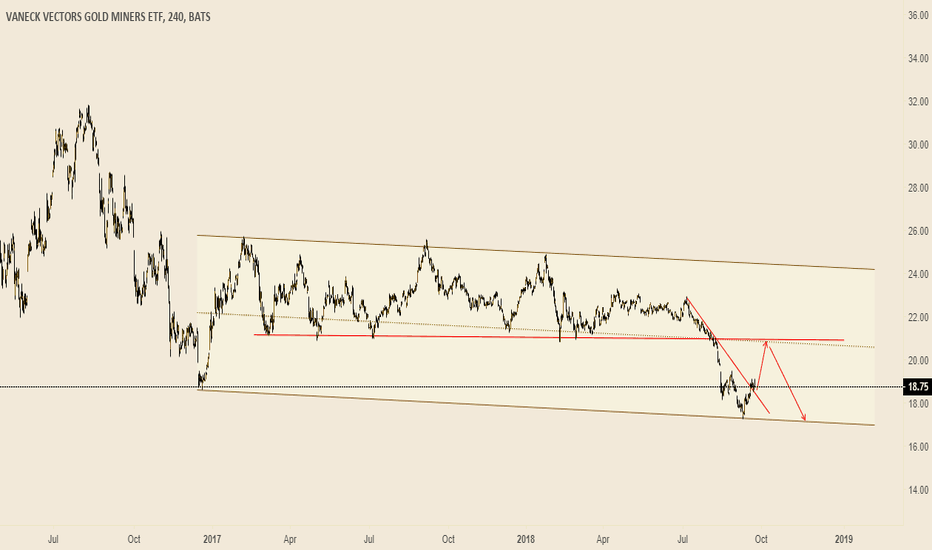

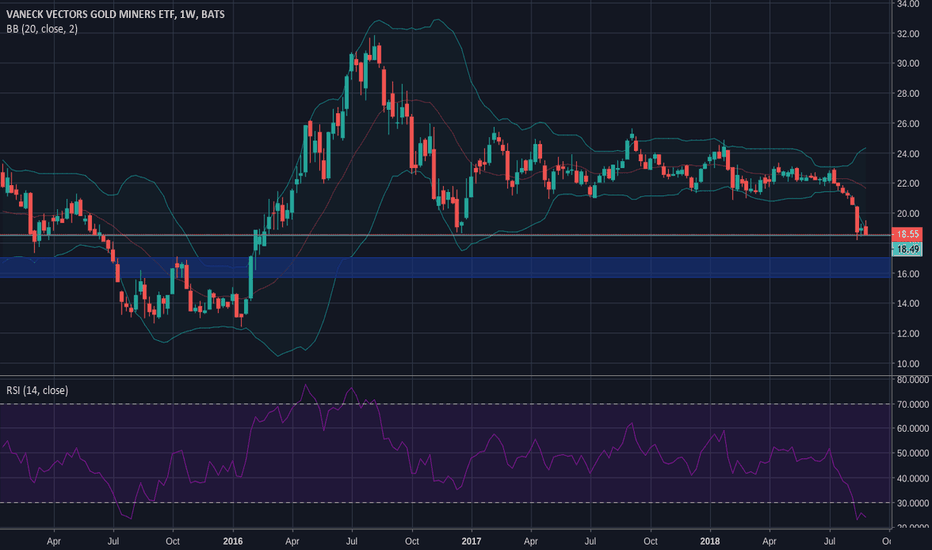

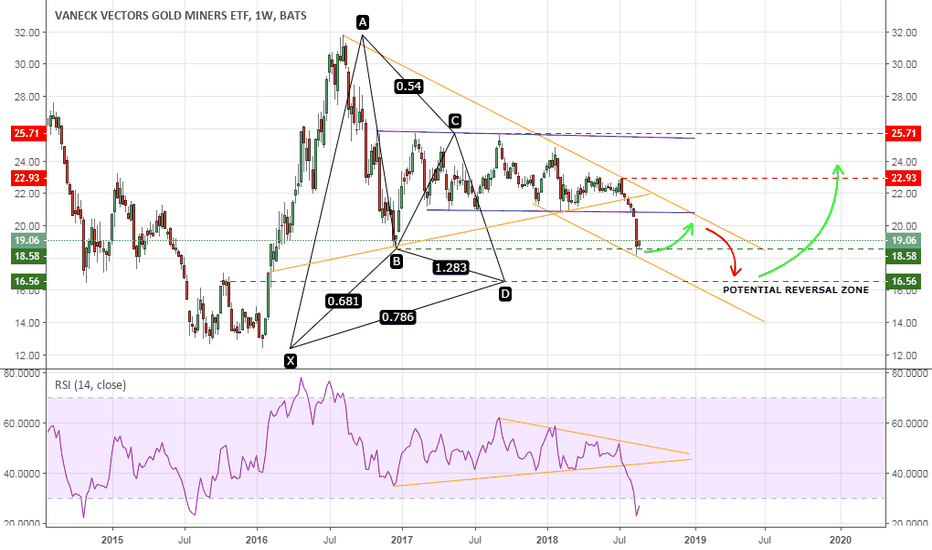

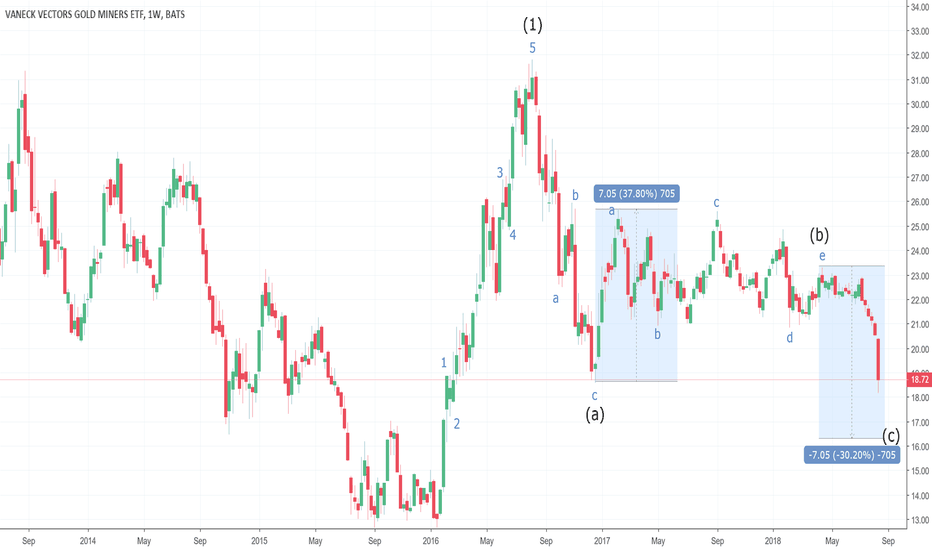

GDX POTENTIALLY TO SET BULLISH GARTLEYIn the weekly chart the movement of the GDX last month continues to decline out of the sideways channel and the triangle pattern is bearish. Although there is a rebound after touching the support at 18.55, bearish pressure is clear as long as the index value is still moving in the formed downtrend channel, or the index value is unable to move up above 22.93 as the previous swing high. A downtred push has the potential to set Bullish Gartley pattern if the GDX value touches to the next support in the 16.62 area, meaning if the pattern has been fulfilled then the last point of the pattern has the potential to be a reversal zone, a failed pattern is formed if the price turns up and exceeds 25.71.

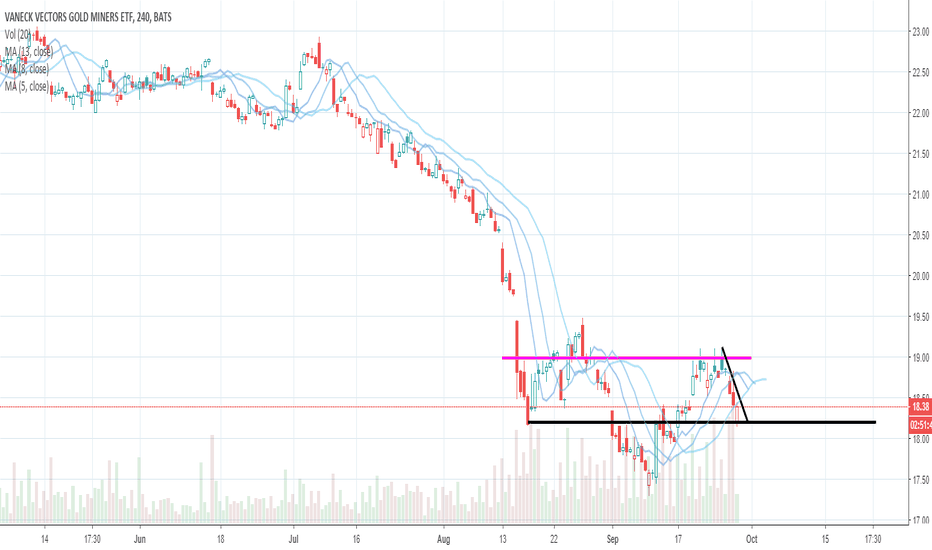

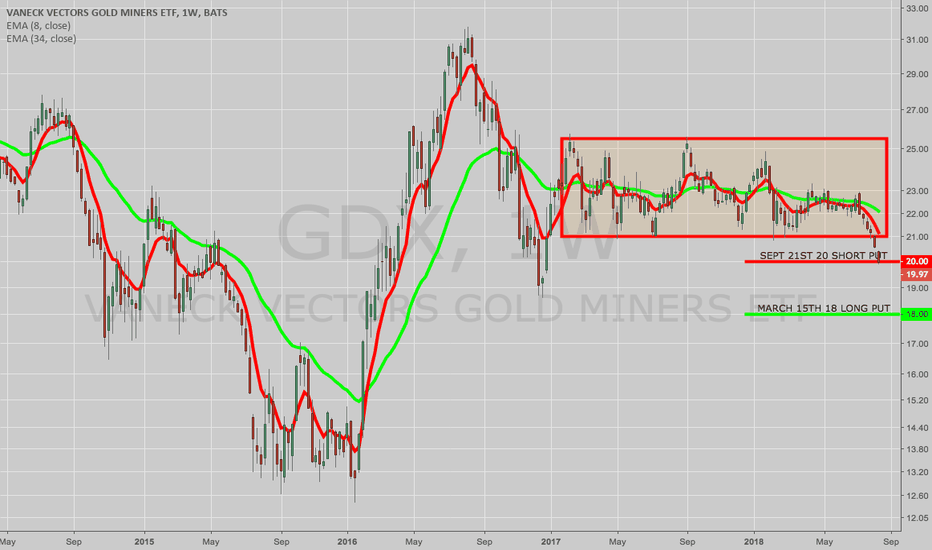

Short $GDX transition to Long $GDX Play$GDX has been the consolidation king for quite some time. Many big players have been gambling on the options of this fella yet the GDX refused to breakdown/up from the consolidation pattern. FINALLY, this fella broke down and this is just the 1st inning of this potential short which we will enter a short after taking profits.

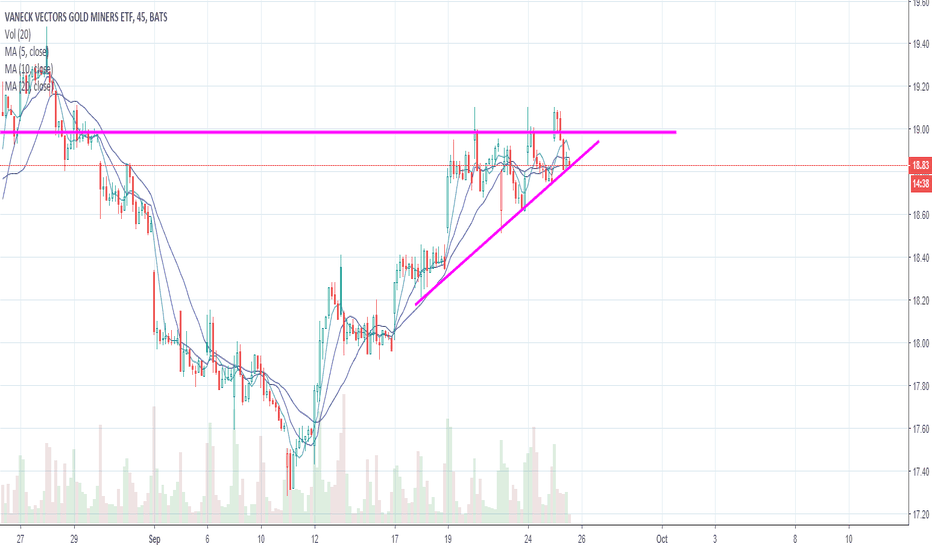

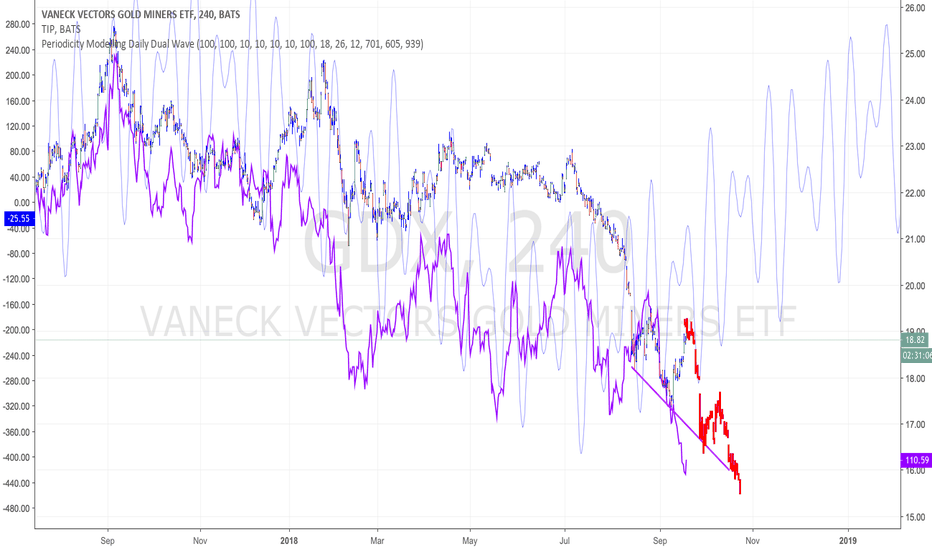

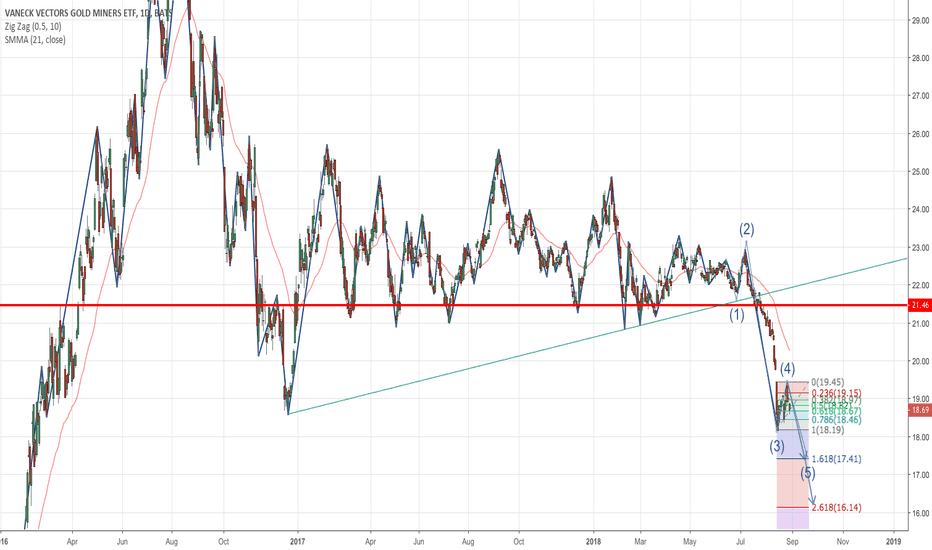

Cycle View of Gold Miners ETF: GDXLooking at the Gold Miners ETF GDX as a potential investment. Seasonally, PM's tend to bottom in July and December, but July didn't work out this year!

So the market is showing what looks like a descending horizontal triangle targeting the point 16.30 which would be a price drop from the end of the triangle equal to the height of the triangle. The implication being that PM's will bottom when the dollar tops in correlation to the USDCNY (the Chinese appear to be putting a floor under the market, buying at a certain support level, but they keep devaluing their currency with respect to the dollar).

Really could see this pattern morphing from a triangle to a running flat, and bottoming in December anyways... time will tell.

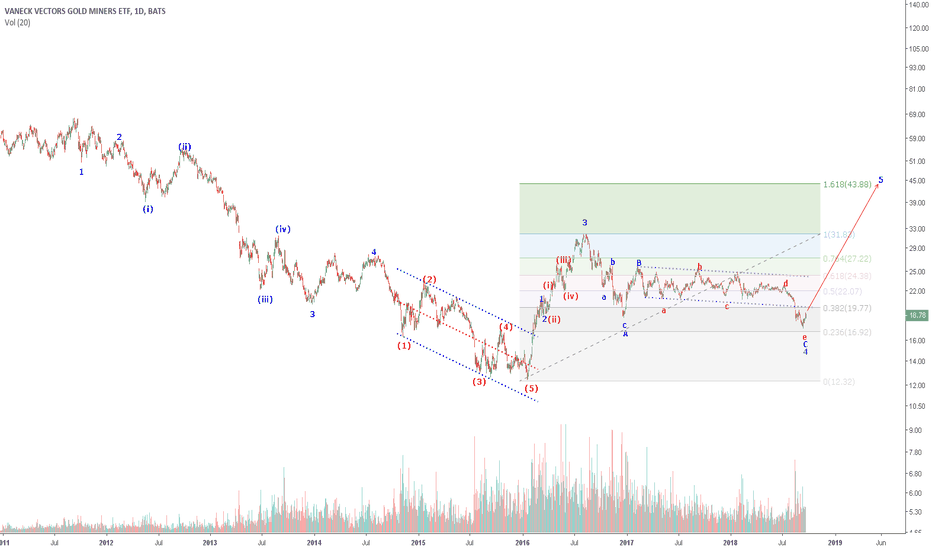

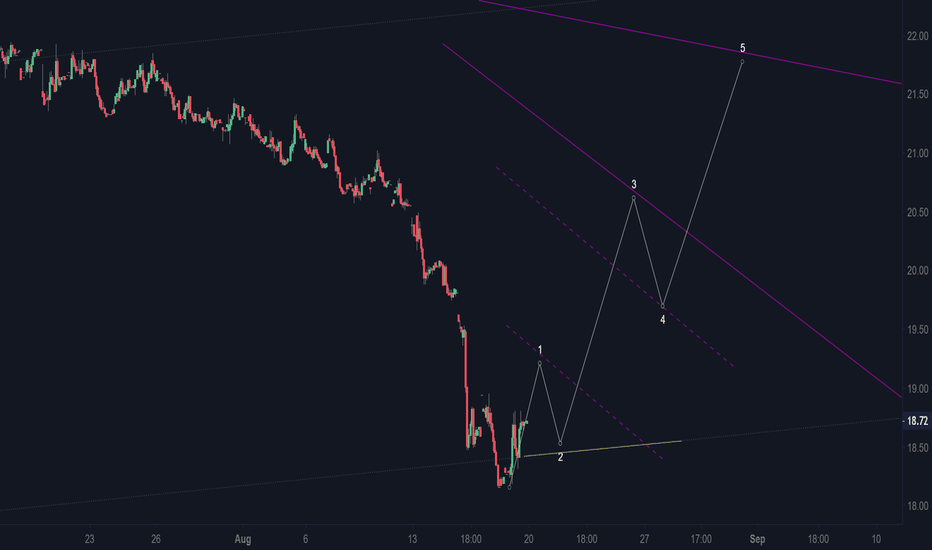

Gold miners are rising?...Gold miners are rising? The ETF technical image of GDX Vaneck Vector Gold Minners shows this. GDX's price began to build a rising three-wave wave structure. This equally starts as a correction of a long decreasing trend back. Low D1 ATR decreasing volatility. If the exchange rate is capable of building a full three-wave structure, it can predict a more steady trend turnaround and a longer rise.

OPENING: GDX MARCH/SEPT 18/20 UPWARD PUT DIAGONAL... for a .04/contract credit.

Max Profit on Setup: $4/contract

Max Loss on Setup: $196/contract (width of the spread minus credit received)

Break Even on Setup: 19.96

Delta: 27.37

Theta: .43

Notes: Taking a small bullish shot on gold weakness here with a net credit, calendarized short put vertical. Naturally, I'm not collecting much credit here on fill, but I'll be looking to roll the short put aspect over time to collect additional credit, and look to manage it for a take profit that's at least one-third the width of the spread.

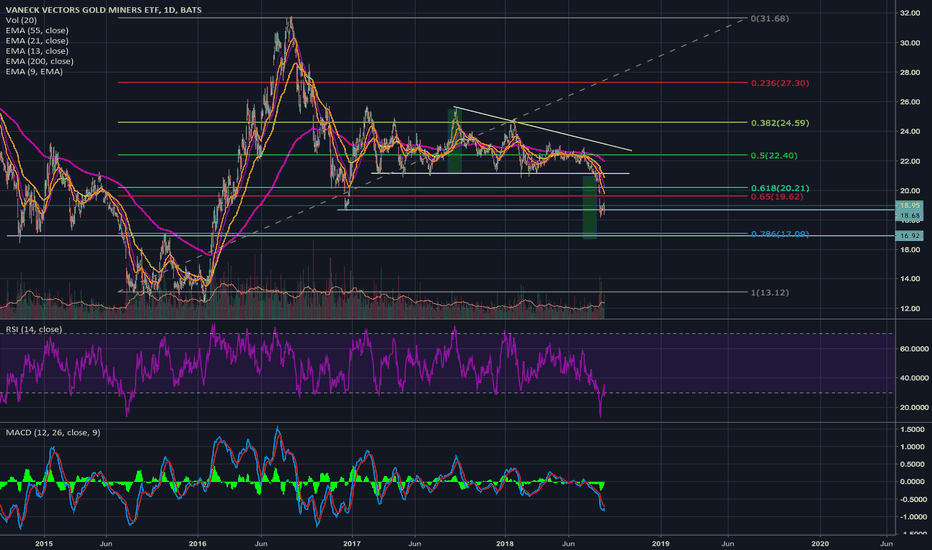

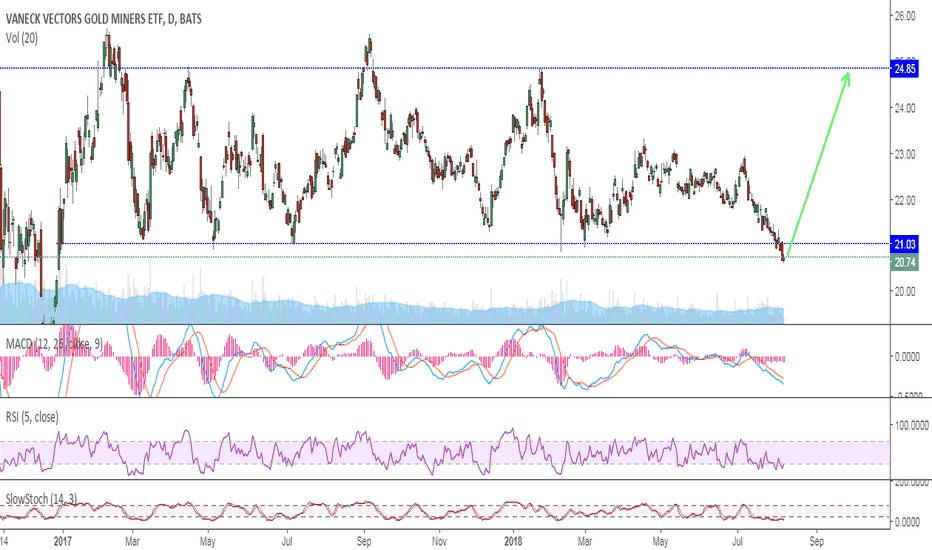

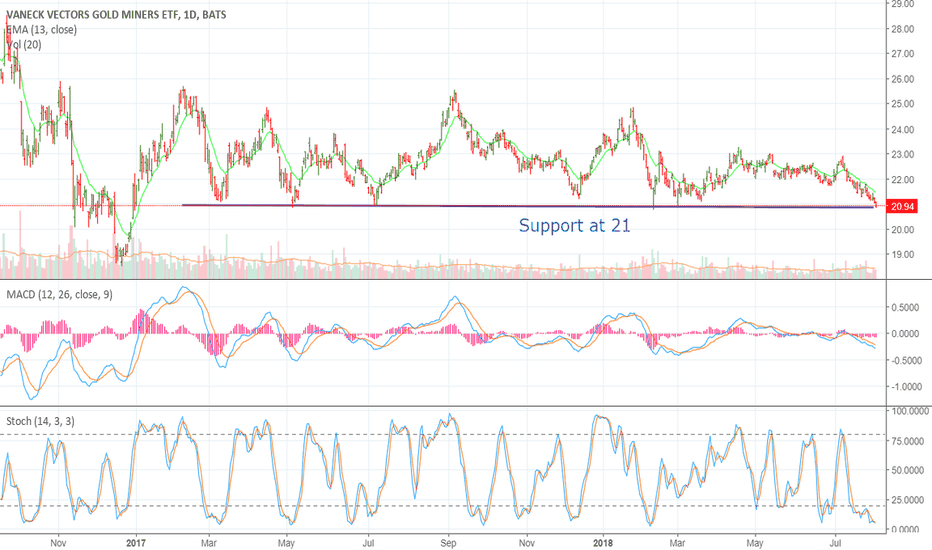

GDX Support at 21GDX has had support at around the $21 level since the beginning of 2017. Each time GDX has hit $21, the stochastic has hit oversold. Buying at that point, and holding until stochastic > 50 (or even stochastic overbought) would have brought decent profits.

Well, GDX has hit support at $21 again, and stochastic is oversold. There's several ways to play this one.

Can buy GDX ETF straight-up. Or if you wish to add more risk, buy NUGT which is 3X the GDX return. Or do a combination of both. Depends on your risk profile.

Personally, I did 50-50 GDX-NUGT.

Now remember that in 2017 fed interest rates were holding steady. Now we are in an increasing interest rate environment, which generally bodes negatively for gold.

I've got a stop on GDX to 20.25 (3 or 4%), that's about 10-12% on NUGT. NUGT is currently at $20, Stop at $18.

Upside target = GDX $22 (~5%), NUGT (~15%)

Good luck out there!