MA trade ideas

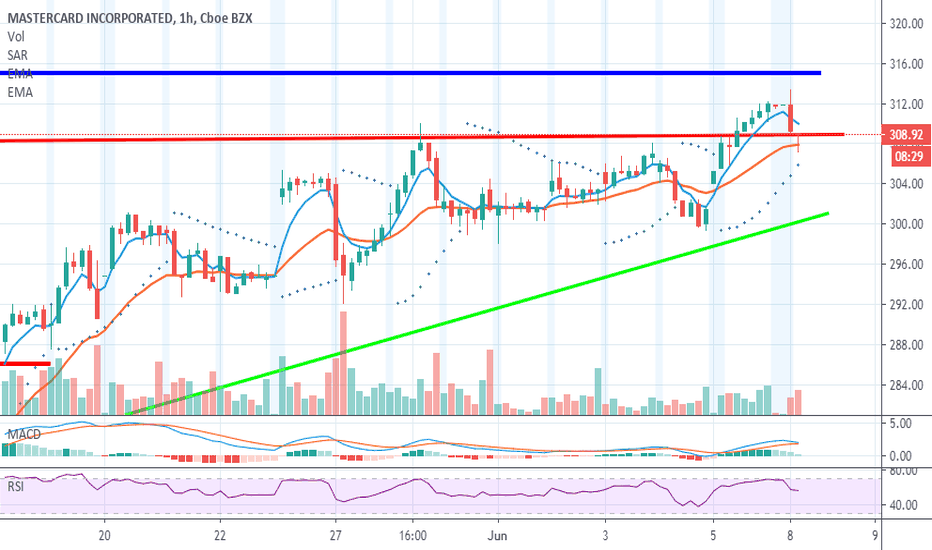

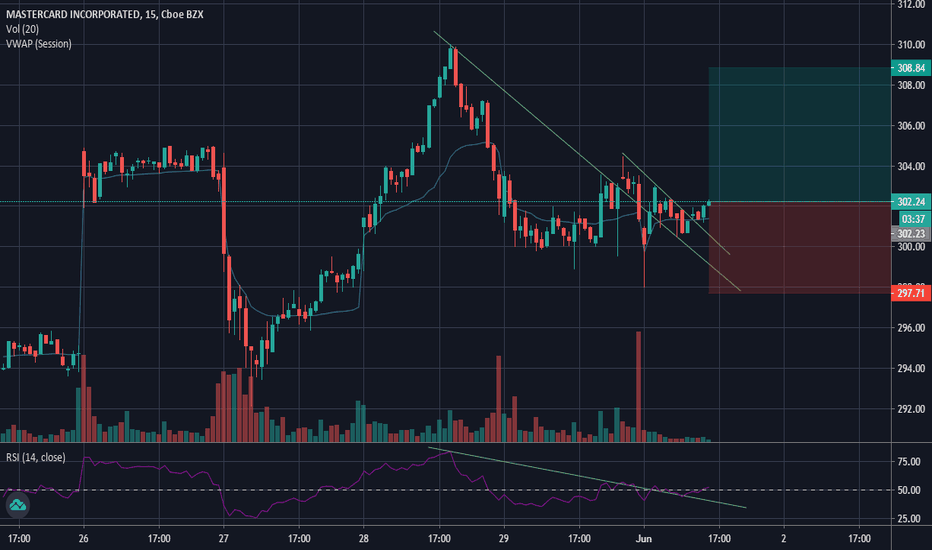

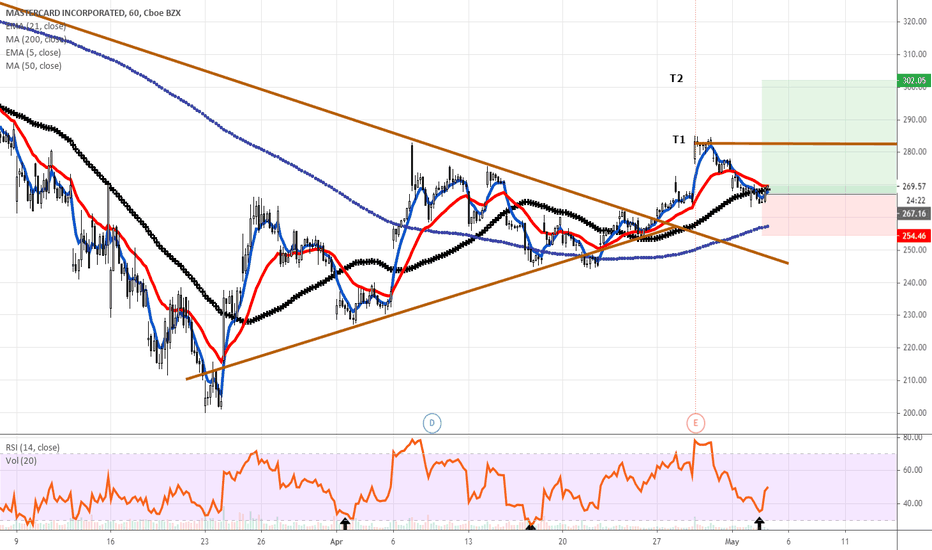

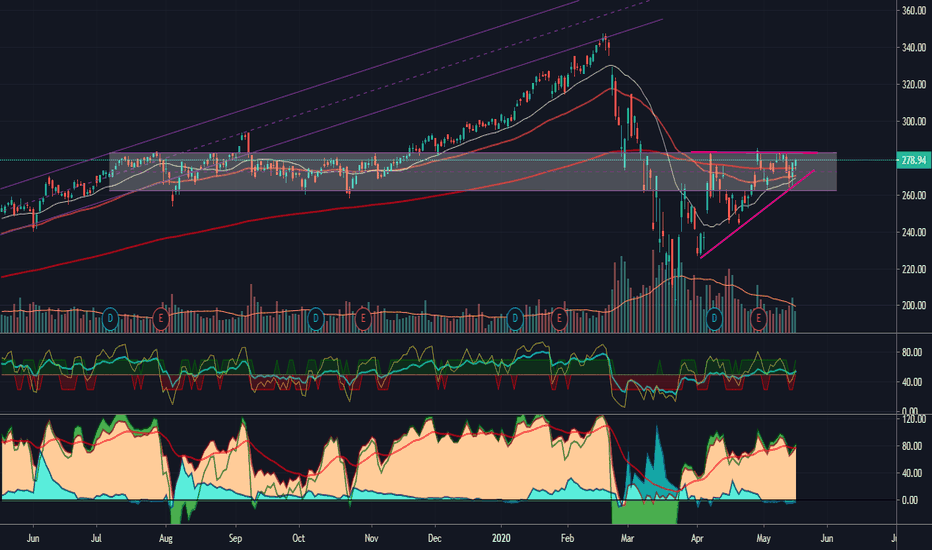

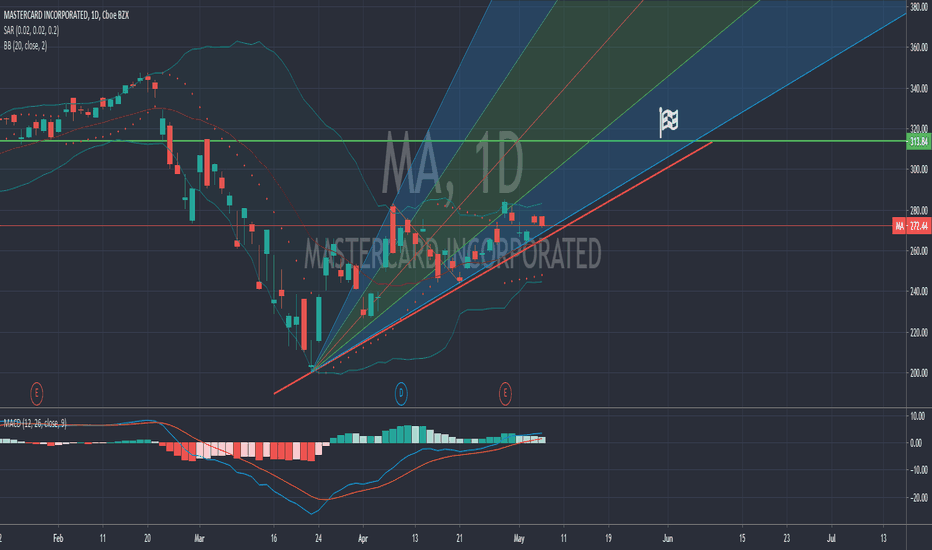

MA Waiting for More Volume TriggerPrice Side:

#Rising price with good trend channel

#Price supporting with good sight

#Trend Line as price defense

#Exit if price drop

#Trade with care

Volume Side:

#Flag for waiting volume trigger

#Volume showing average

#Expecting more rising volume

#Exit if volume drop

#Trade with care

*Disclaimer : This is Not Financial Advice

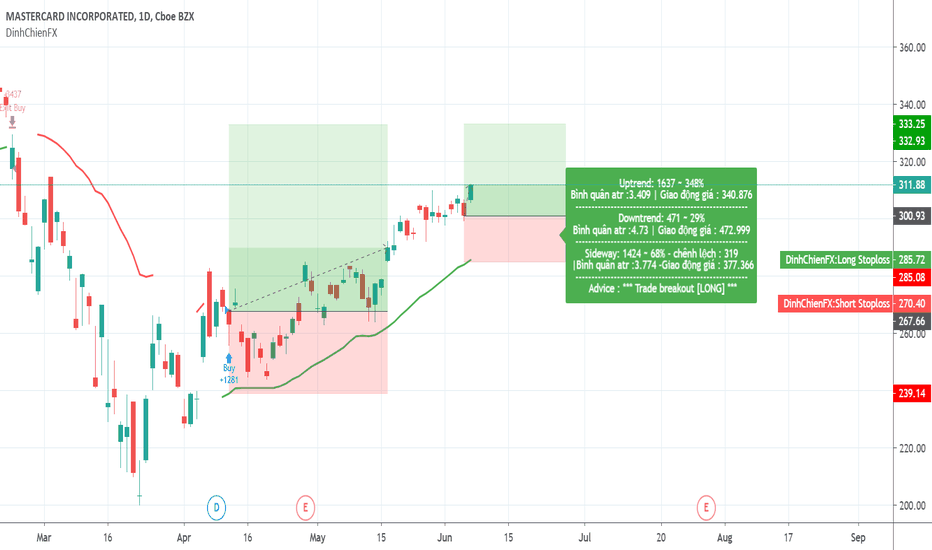

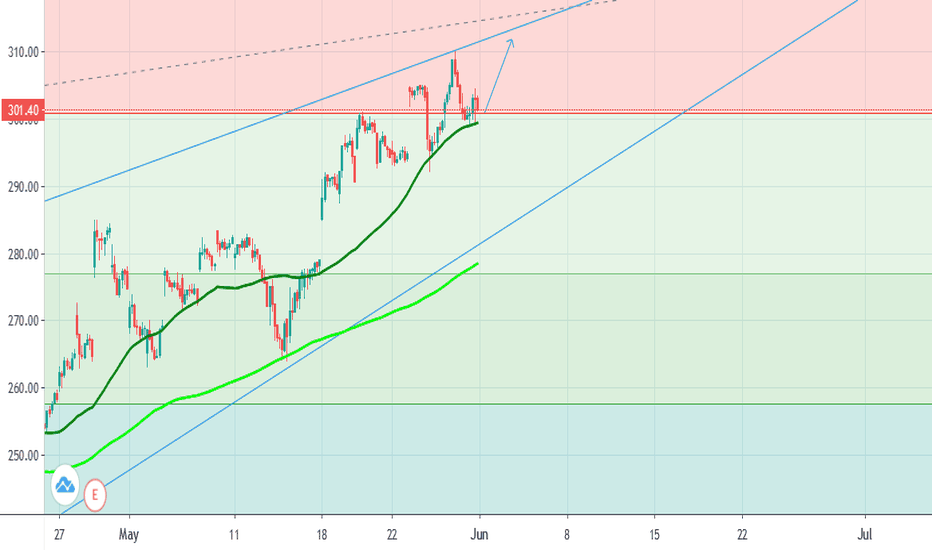

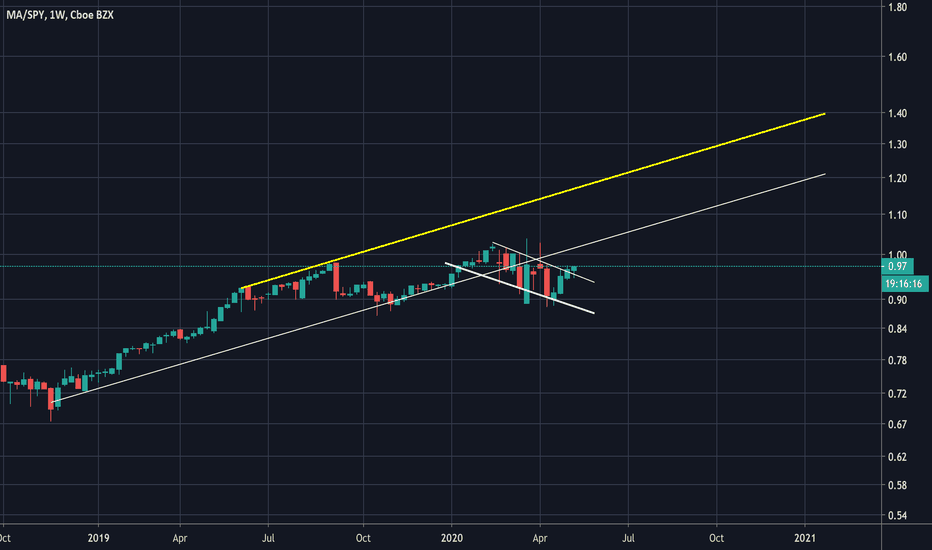

Long MAKeep your trading simple

Bullish Long Term

T1 = minimum risk reward 1:1

I always leave 1/3 of my position for long term gains - moving my stop to my entry if I need to give room for the volatility or using trailing stop for maximum gains.

Not a financial advise - trade smart trade safe.

Follow me to support my work, Thanks!

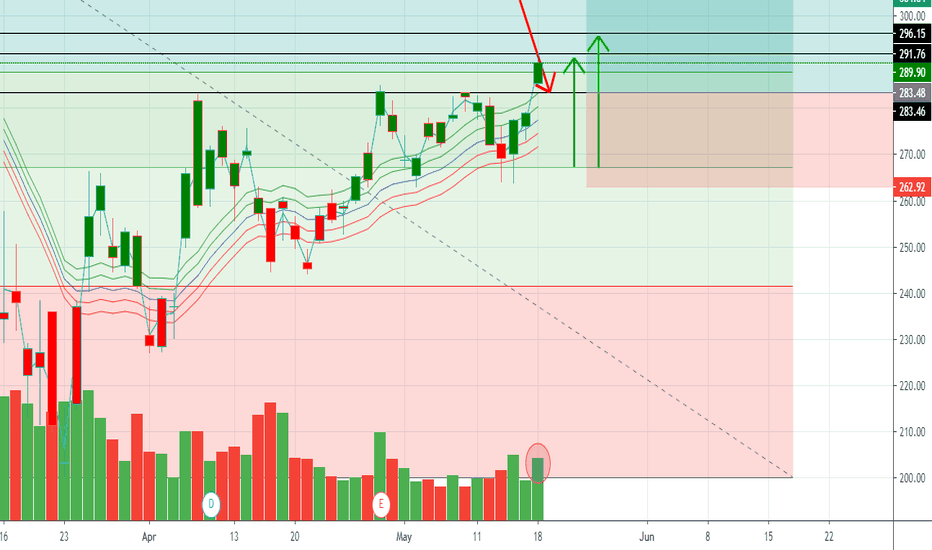

Long MA - Second chance entry!Keep your trading simple

Bullish Long Term - After closing profits on the first trade on MA now we have anther trading opportunity!

Long term target $335 - Closing gap.

T1 = minimum risk reward 1:1

I always leave 1/3 of my position for long term gains - moving my stop to my entry if I need to give room for the volatility or using trailing stop for maximum gains.

Not a financial advise - trade smart trade safe.

Follow me to support my work, Thanks!

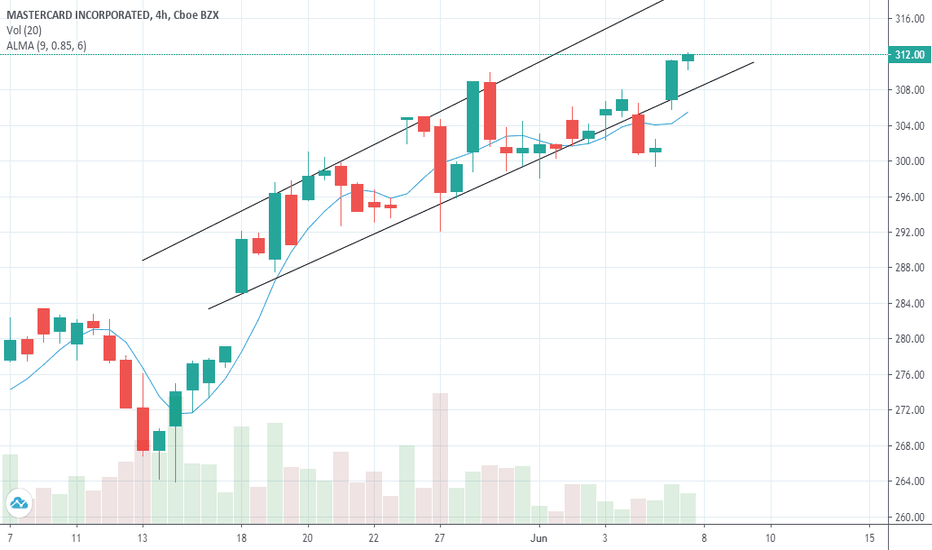

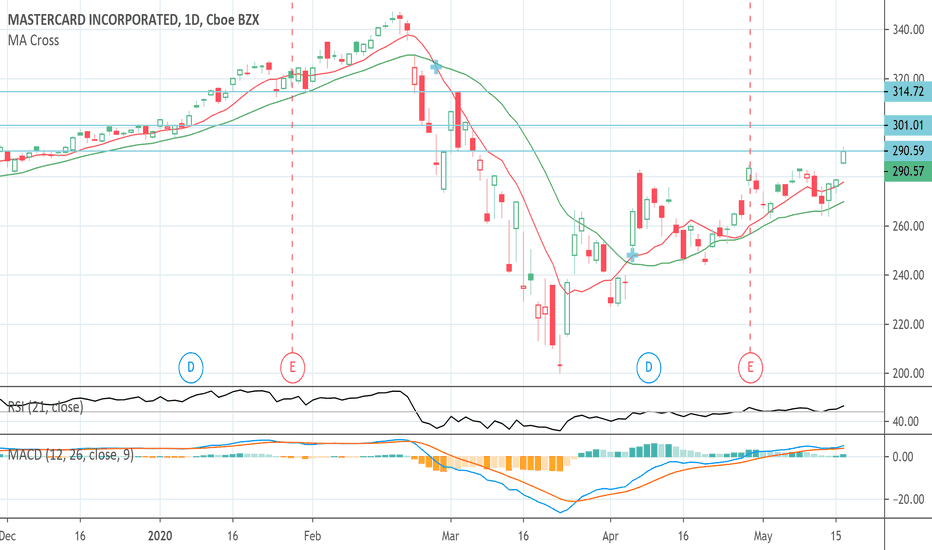

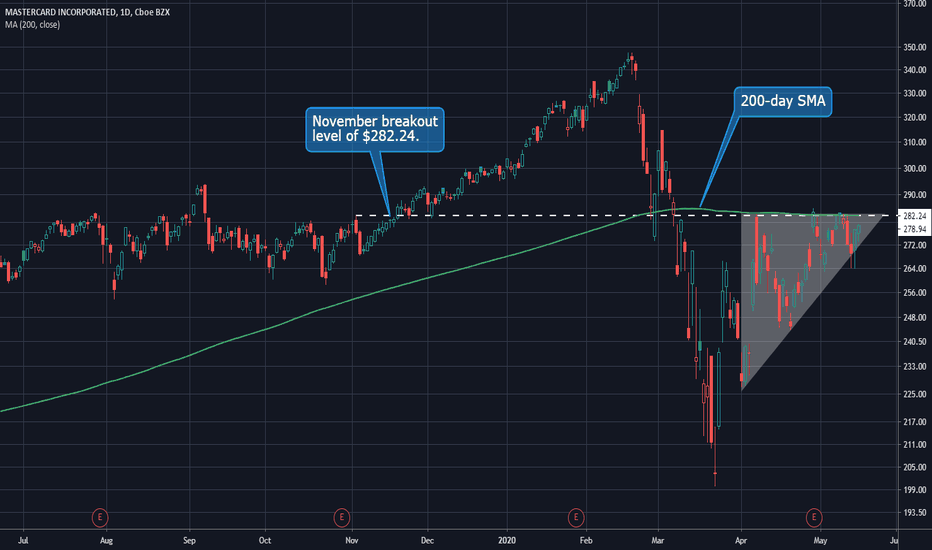

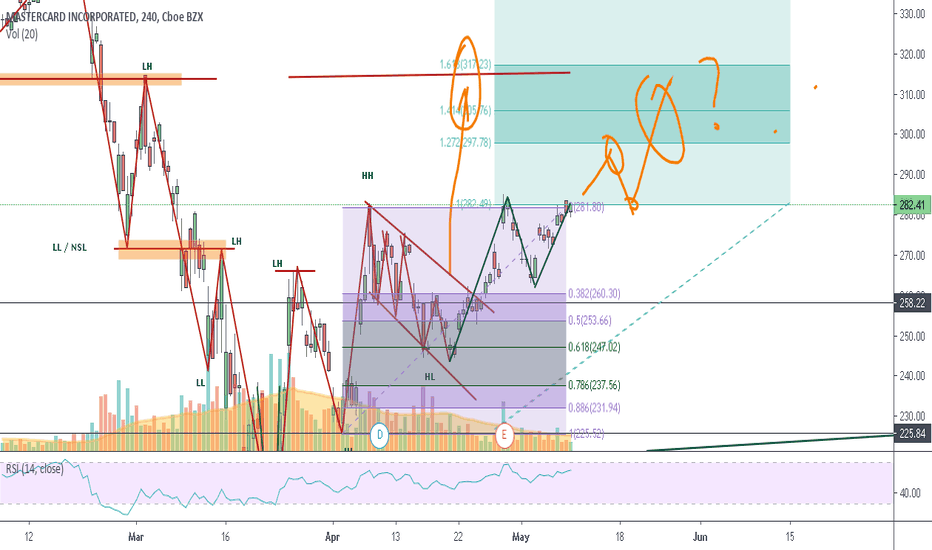

Mastercard: Another Triangle in Big TechSometimes people forget that the credit-card companies are members of the technology sector, but they are. We’ve already covered the bullish triangles in other tech names like Microsoft and Salesforce.com . And now Mastercard is showing a similar pattern.

MA has faced resistance around $282, which closely matches its 200-day simple moving average (SMA). Meanwhile it’s made steadily higher lows, forming an almost perfect ascending triangle.

The other interesting thing about MA is that it’s so clearly tied to consumer spending and the economy. That could make it a logical go-to stock for institutional investors as the coronavirus lockdowns end. It’s also a liquid options underlier, averaging more than 30,000 options contracts per session.

Looking at the weekly chart, we see MA has formed two inside weeks in a row. Combined with the April monthly high and the 200-day SMA, there’s a lot of importance in the $282-285 area. This creates the potential for buyers to get more active if it starts to break through this zone.

This is one to watch as the global economy reopens.

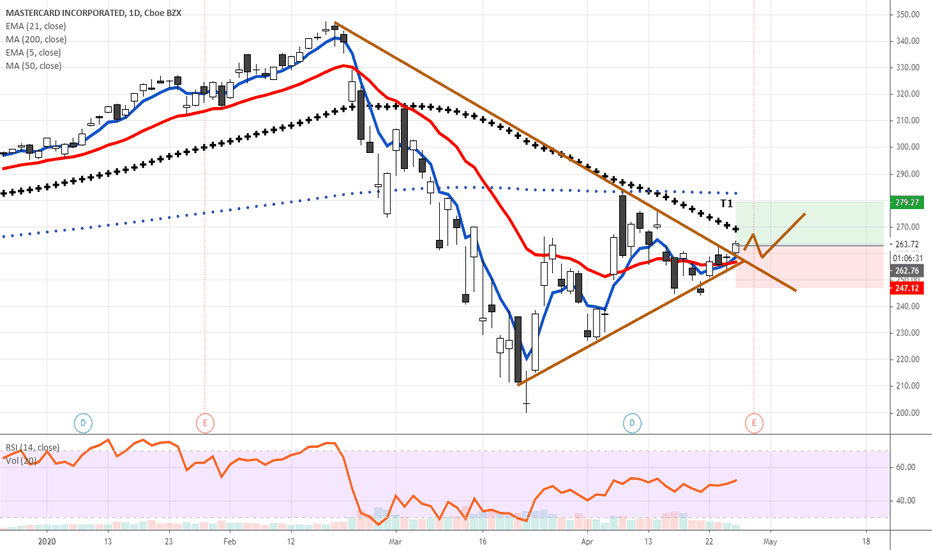

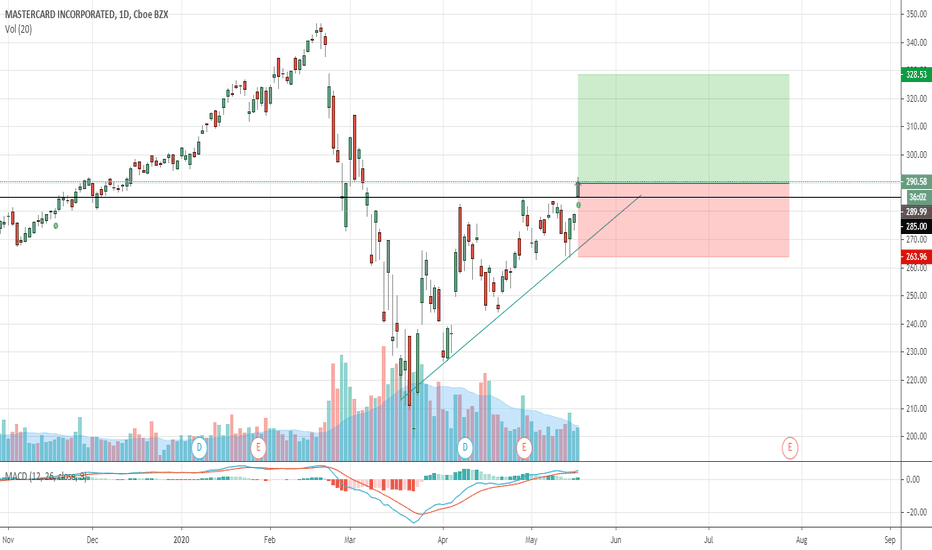

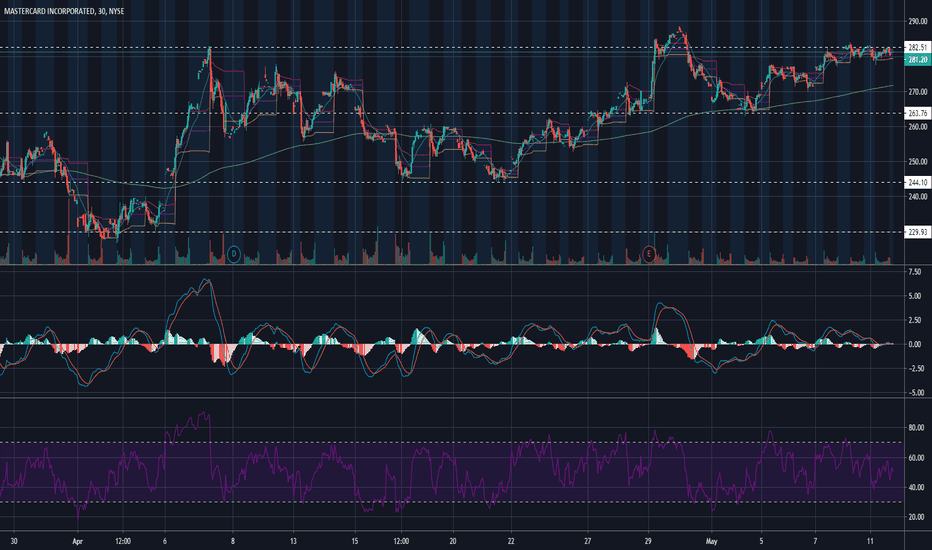

MAMaster Card

Potential Profit: ~10.50% based on Resistance level of $313.60

Potential Profit 2: ~22.5% based on resistance of $346(All time high)

Support Level: SMA line or $263.76

To be safe and to increase better point of entry look for a break above $282.51 or a bounce off the SMA line.

RSI: Tends to bounce around ~41 on the 1 Month.

Sell Off occurred due to the pandemic and the oil sell off. Fundamentally, I see this equity going back to all time high unless a new wave of surprising bad news comes in.

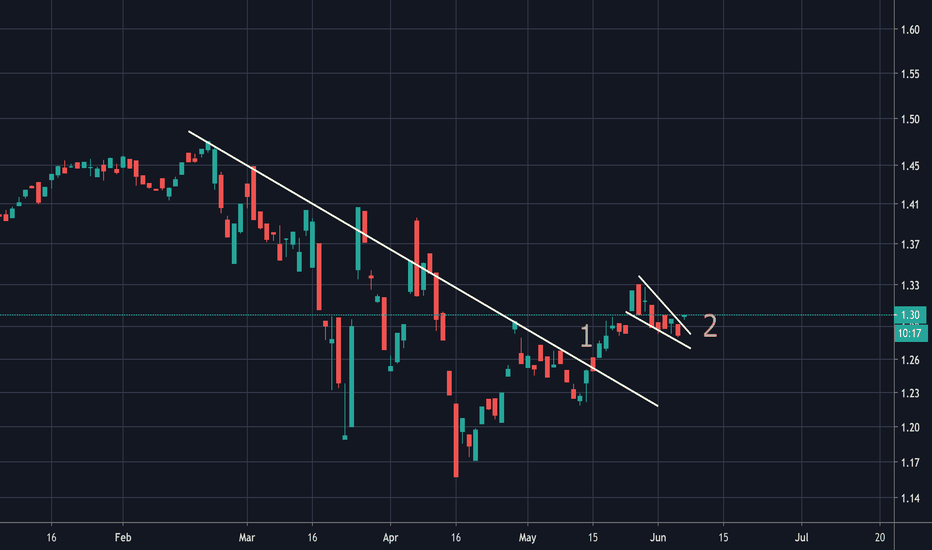

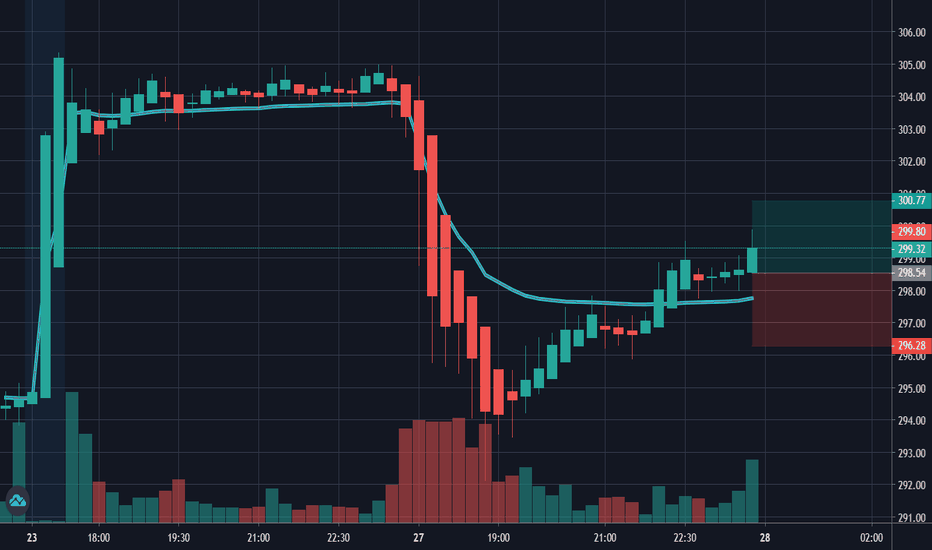

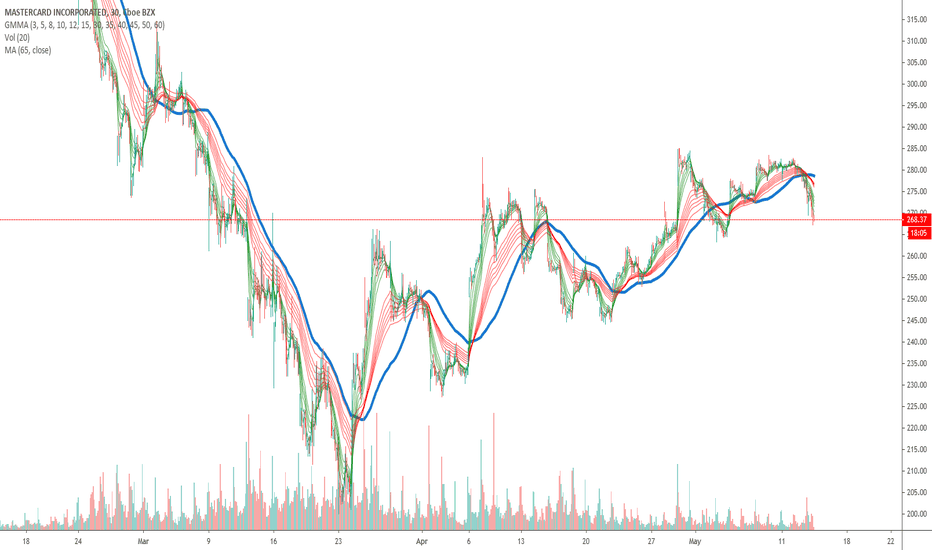

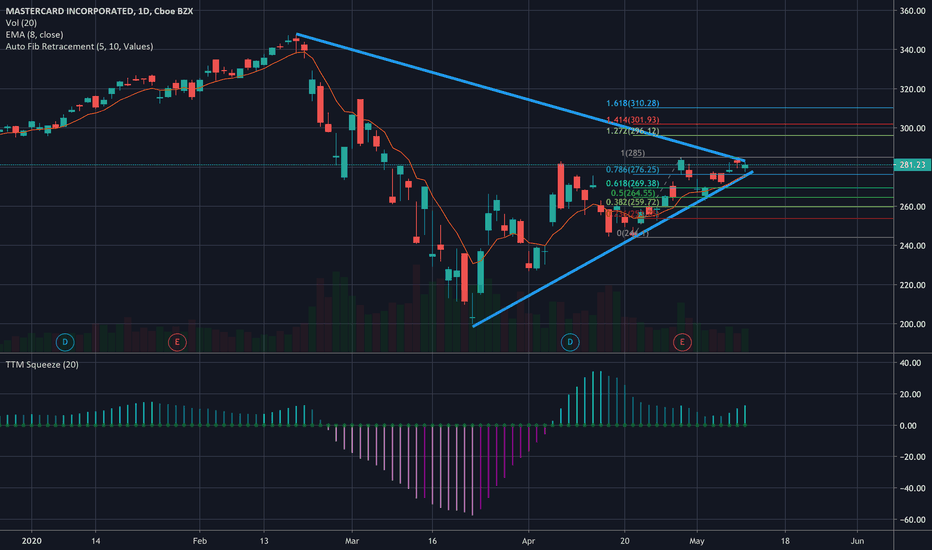

MA NEXT DAYS/WEEKS ANALYSIS - Counter thrend-next breakoutDAILY CHART

As ween can see in the daily chart , the Mastercard stock until the end of March was in a strong downtrend. Around end of March it has a double bottom (As Visa stock) and then began a new uptrend. We can say it is going for uptrend cause the Lower High around $260 was broken,and now as we can see the price is retesting that previous resistance that now is a new support.

We saw the price retrace at 0.618 fib level and now, it was consolidating for some period and after breaking the descending channel it went around 280$ and formed a double top (?) .

Scenarios

Maybe the price will retrace a little bit to test some previous supports and bounces back to retrace higher possible in the 1,27 or 1.618 fib extencion level that also around there is a strong resistance from previous months at around 320$.

This is just my opinion not a financial or trading advice.

MASTERCARD D1Master Card's stocks plummeted like all stock market assets. Given the fact that many shops and establishments were closed, mastercard cards were rarely used. Their main purpose was purchases through the Internet, grocery stores and pharmacies. Low business activity has led to the fact that the turnover on cards at times reduced the previous volumes. Now quarantine restrictions in many countries are beginning to partially remove, and online shopping activity is also growing. Amazon is a prime example of this fact. The banking system also begins its activity. MasterCard shares have good upside potential.