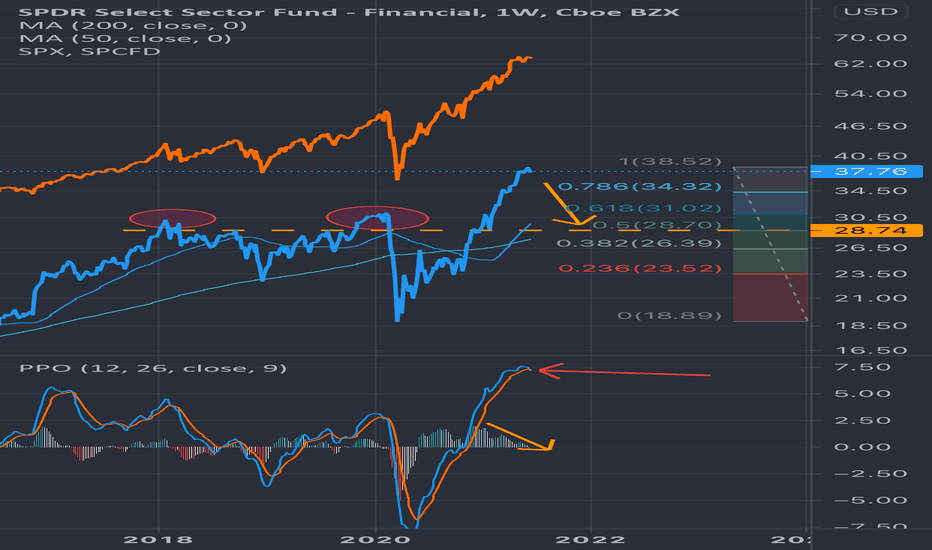

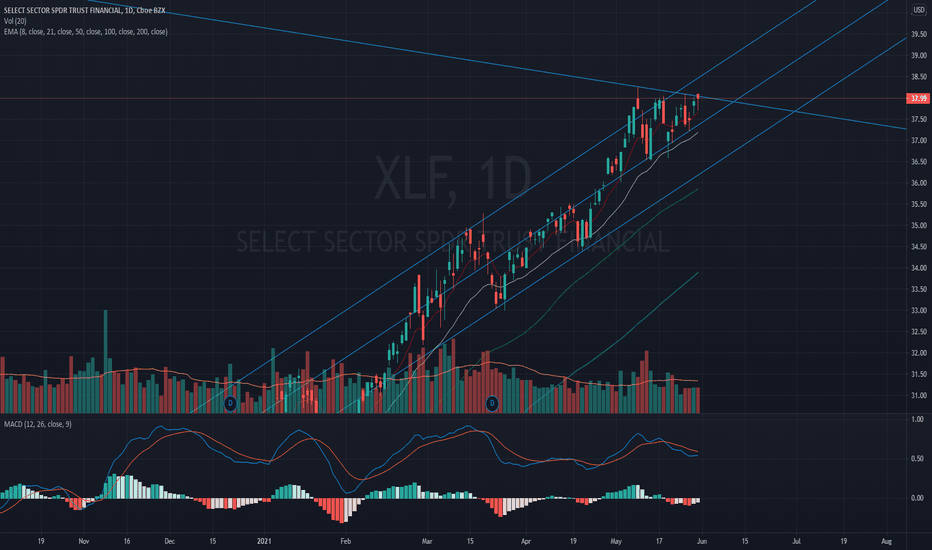

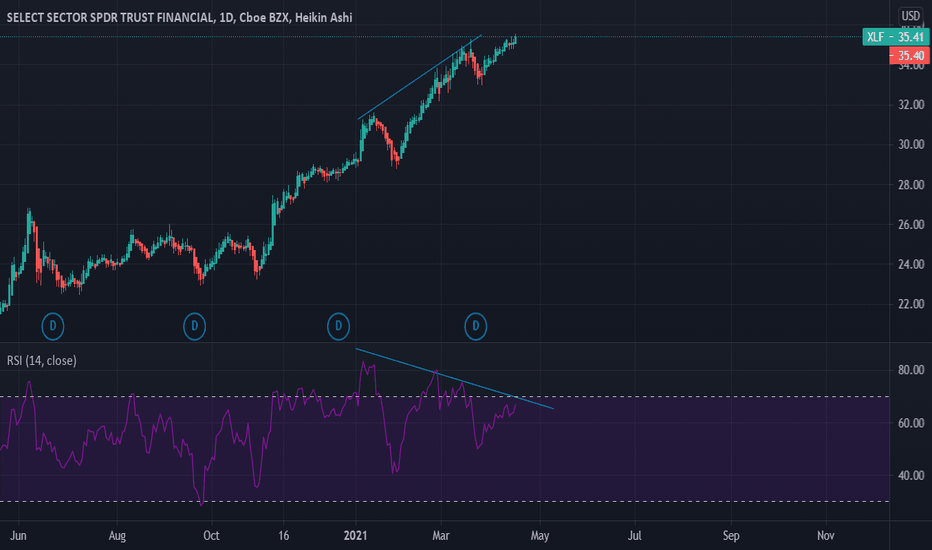

The Credit Cycle - Free Wealth is Over?Idea for Macro:

- Financial sector selling off heavily.

- While it's early to call a bear market, the exhaustion gap at an all time high is a reasonable signal for market reversal.

- XLF, XLE and FAAMG have been holding up the broader markets at this high... Cracks appearing?

Underlying conditions:

- Institutions will invest based on 18 months into the future (Druckenmiller).

- There are 3 relevant possibilities for the banks:

(1) Inflation is sticky, interest rates will be raised in the future, within 18 months. This actually increases the banking sector's profitability, but the price is declining because they have been speculated above valuations.

(2) Inflation is transitory, interest rates will not be raised, and we will have negative real rates. This will hurt the banks' profit margins. This is a possibility due to the 40 year demand-push deflation the US has been in (see Oil/CPI).

(3) More importantly, the economy will decelerate (deflationary). Liquidity components of the Fed B/S have been decelerating and global credit impulse (lending) has gone negative. No more easy lending, less loans, meaning less earnings for the banks. Investors know this and are exiting the overheated trade.

Either way for inflation, global liquidity and global credit impulse are turning down, so the Long Volatility trade seems to be ideal.

Why did global risk assets rise to such insane levels? Credit impulse - easy lending. Now that supply of sugar is gone. Only one thing left that can happen.

GLHF

- DPT

XLF trade ideas

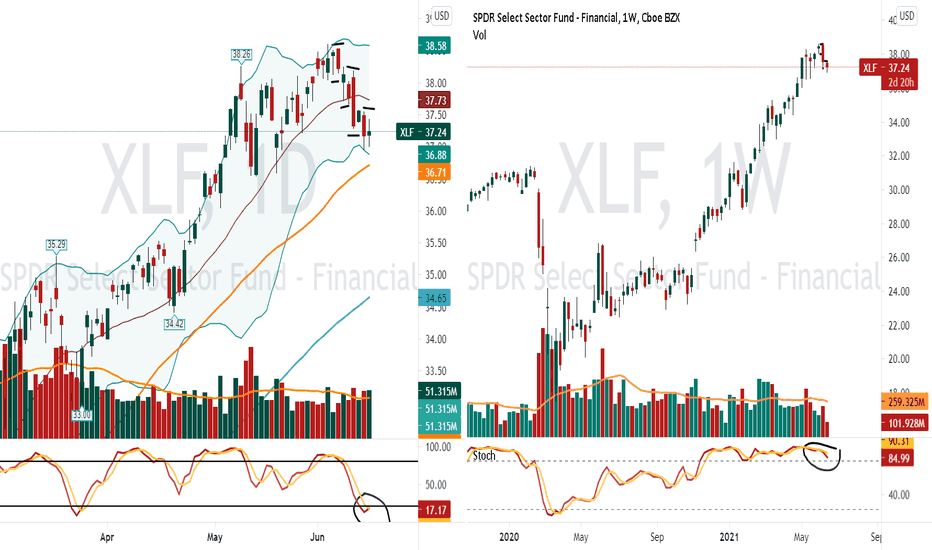

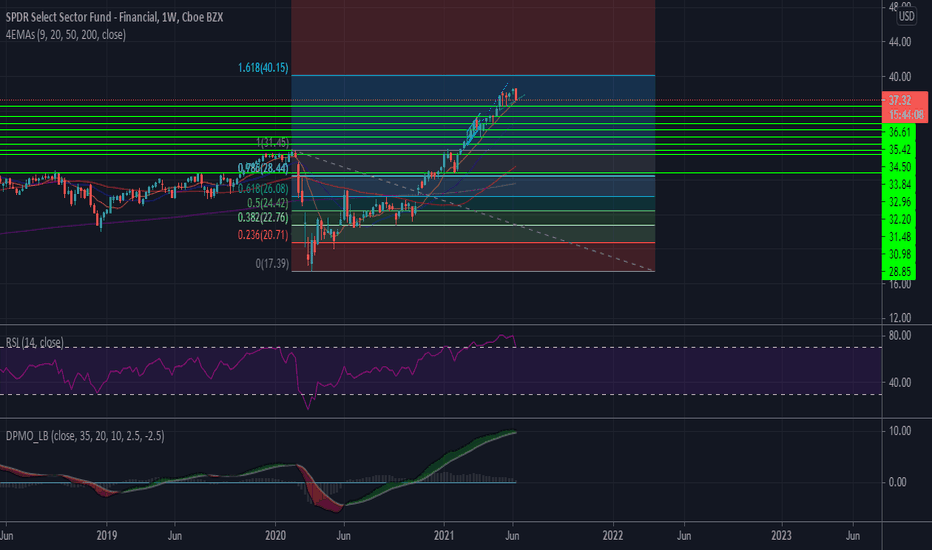

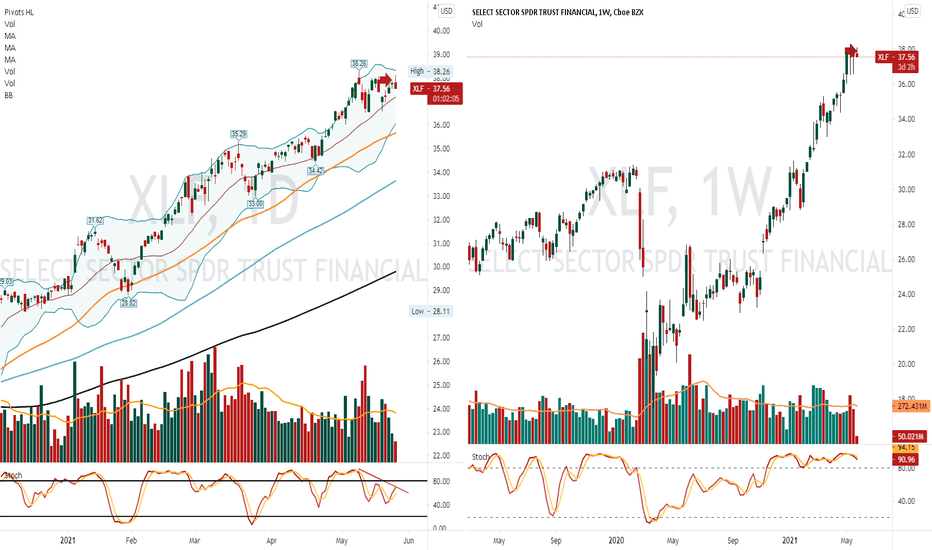

XLF Forecast XLF broke out of multi year resistance level at $29~ After multiple failed attempts. Typically resistance levels become support zones after prices goes thru them. I’m watching current trend for any weakness that could indicate possible move to retest $29.

On weekly chart PPO EMAs have crossed, but week is not over yet. It’s 3rd time this year this cross attempted to happen. If week closes with EMAs being crossed, it would indicate weakness of the trend’s momentum. Interestingly $29 is currently at .5 fib level since 2020 lows.

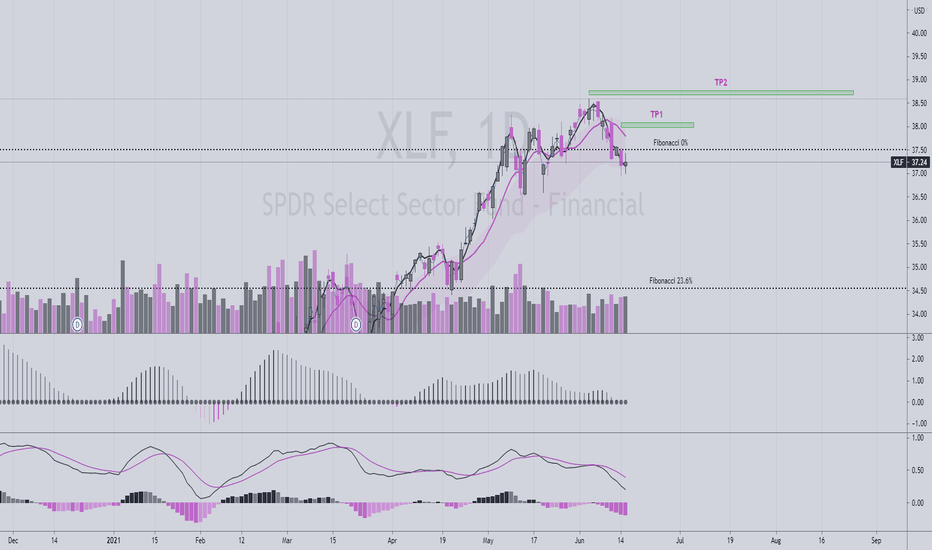

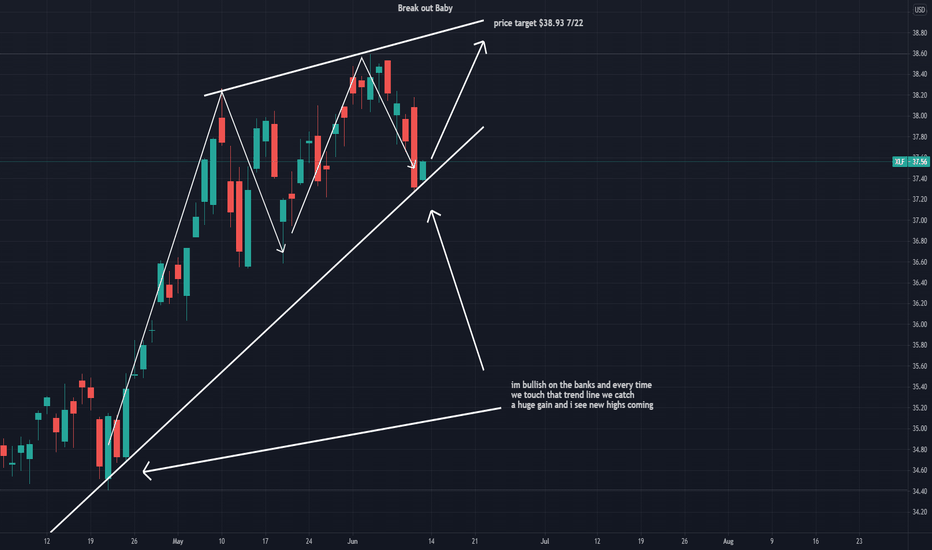

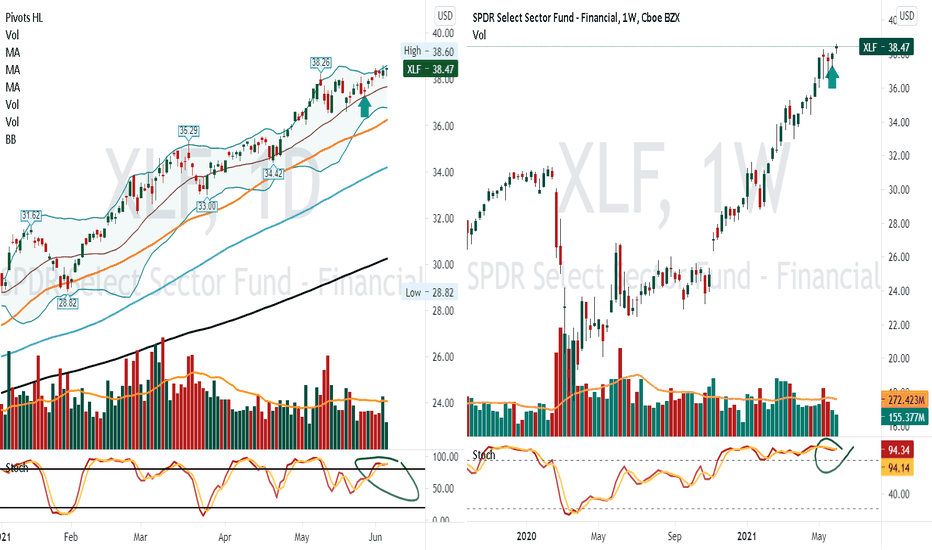

#XLF: Financial names look strongI like the setup here for some quick gains in this ETF. Downside risk is very low compared to potential upside within the next 10 days give or take.

Longer term this could go higher, value stocks are strong in general due to inflation concerns and the reopening momentum.

Best of luck if taking this trade.

Cheers,

Ivan Labrie.

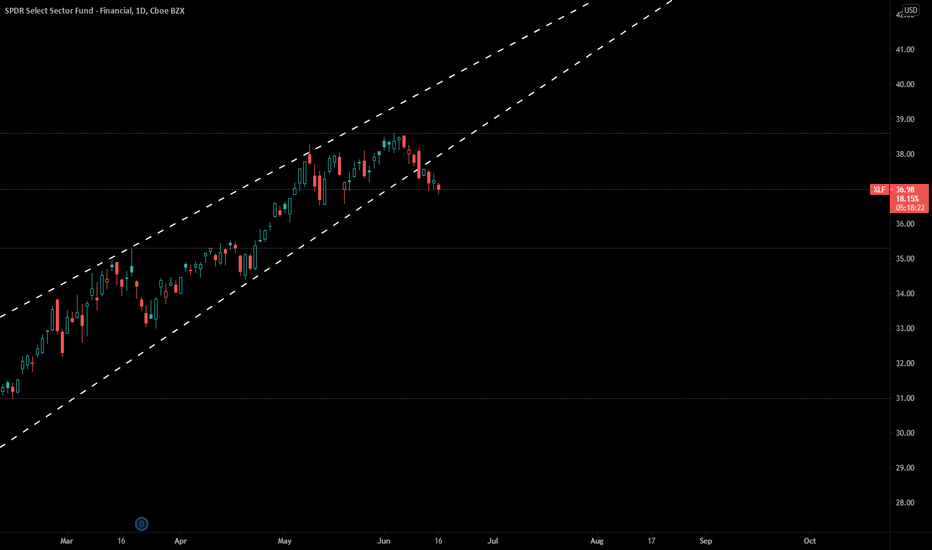

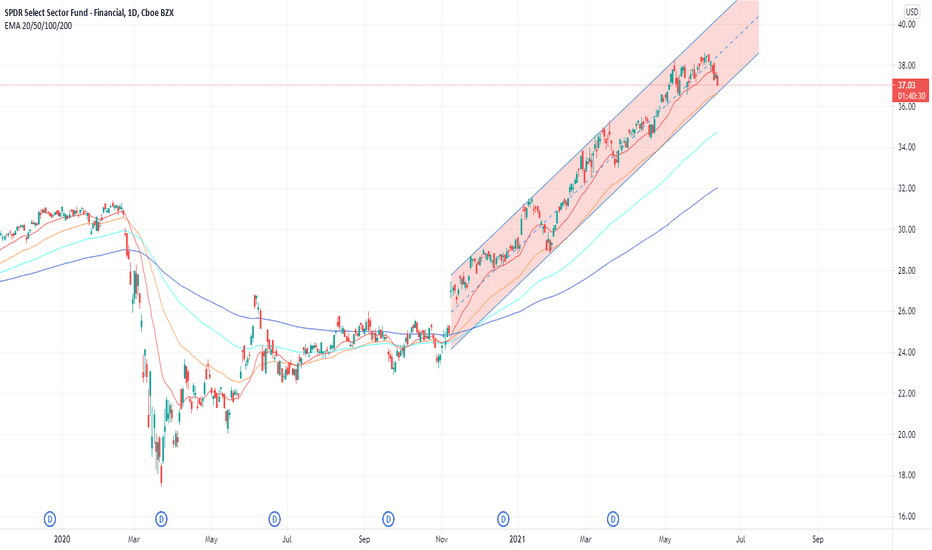

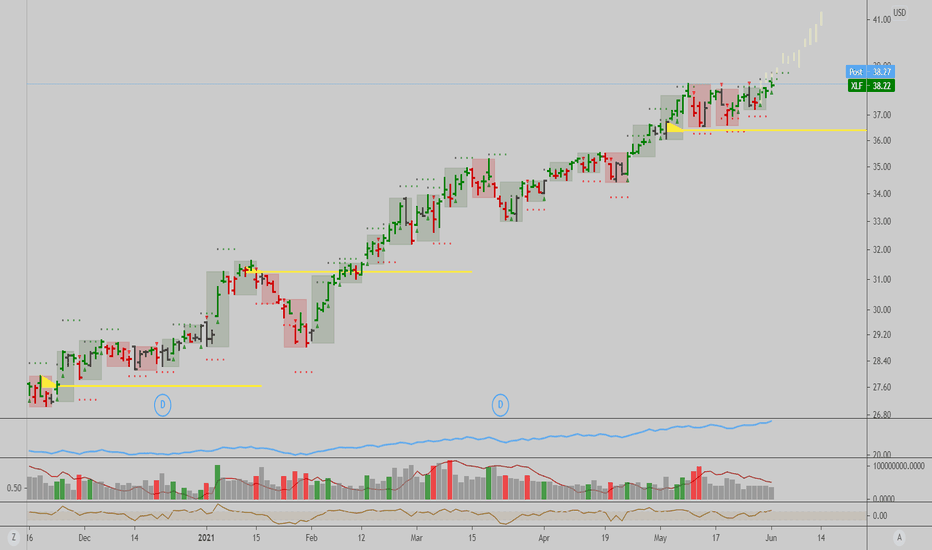

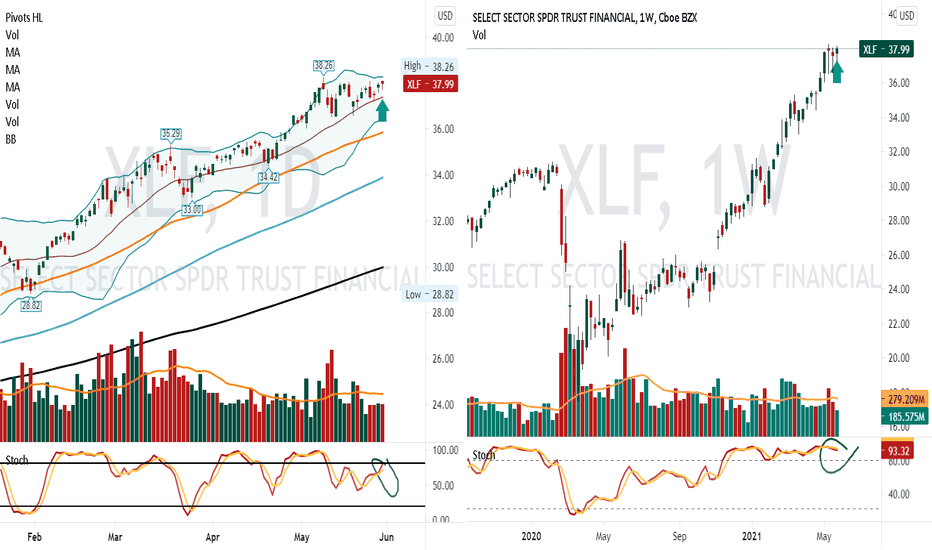

XLF and others might lead the wayAs noted in my previous ideas about $SPY (bearish), $XLF, $XLI, $IWM, $XLE might be the catalyst that leads the markets higher. $XLF tapped the 8day EMA twice before going back to positive which to me shows resilience with a market that has no sense of direction. A nice hammer doji before breaking off into Memorial Weekend. XLF might try and tap the upper band (38.50 - 39) before fading back to middle channel.

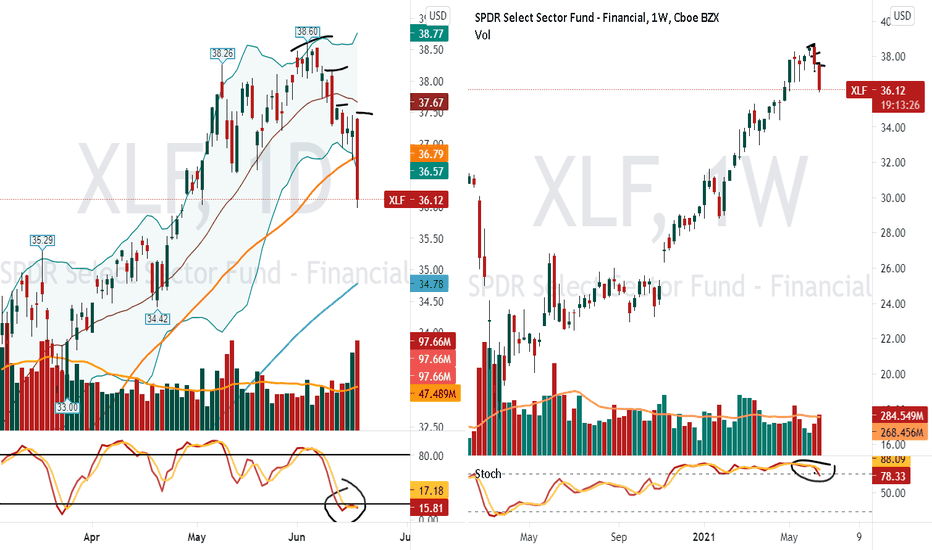

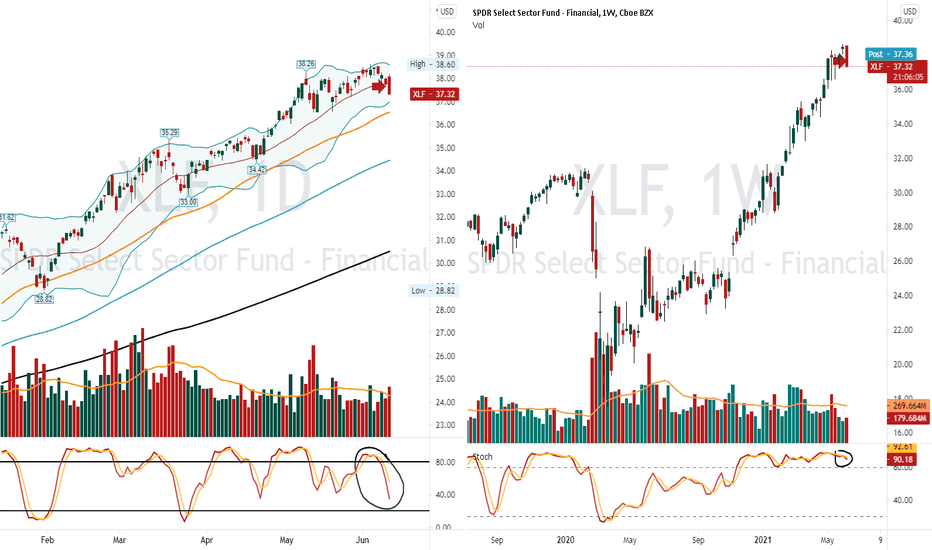

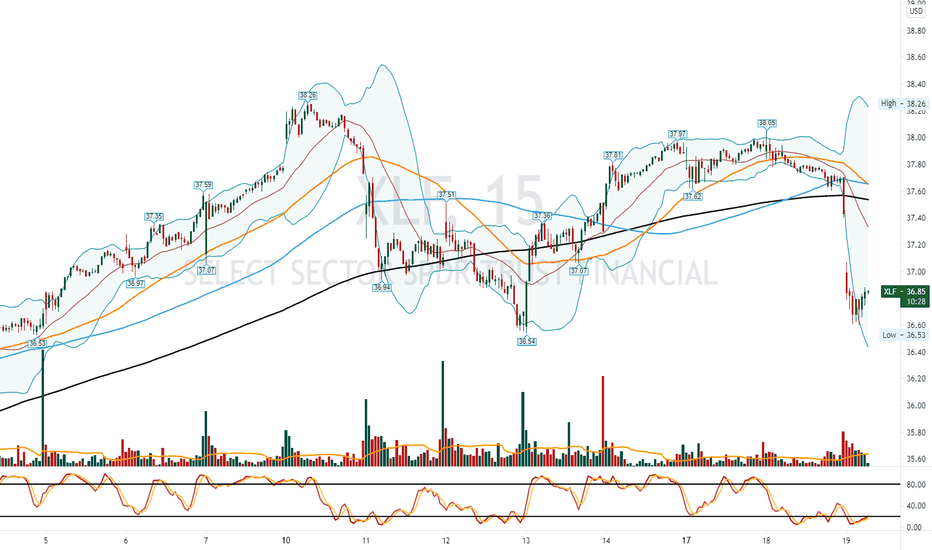

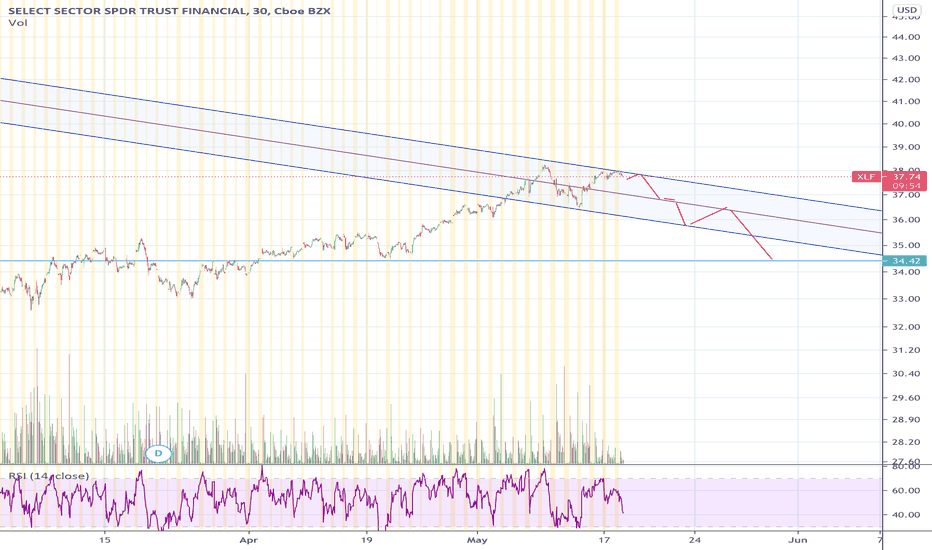

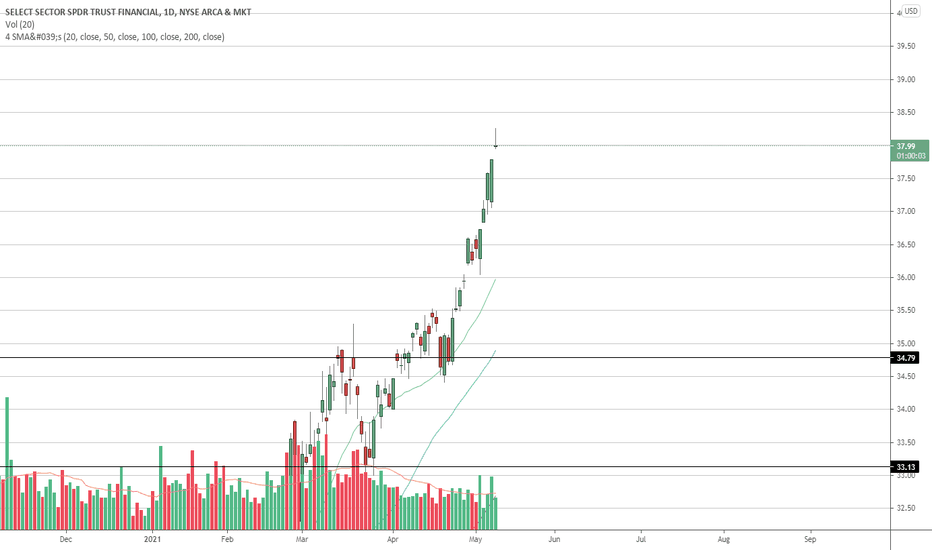

XLF Short Round 2: Do You Believe in Second Chances?Upset that you weren't set up for the first drop that occurred last week? Well lucky you the market loves to trap people and right now XLF is in a bull trap (in my opinion of course) which has brought it back close to its all time highs. Massively overbought on the weekly and we ended with a big volume red hammer candle on the weekly. On the daily we have moved almost 2 dollars in 2 days with volume completely dying out on 5/14. On the hourly and daily we are almost back to our highs at around 38 with much lower MACD, RSI and VOLUME. Expecting a last push up over 38 for a few minutes on 5/17 then the beginning of a drop that will last 3 weeks. The XLF has been one of the sectors keeping SPY up when QQQ was selling off. The Qs have finished most of their selling but SPY has rebounded back going back up almost 2.5% in 2 days (a pretty significant move for SPY). There are so many sectors that are in the same spot as XLF. Helping to keep SPY up while the Qs sold off. XLE (energy), XLV (healthcare), XLI (industrials), XLP(staples), ARE ALL IN THE SAME BOAT WITH THE EXACT SAME CHART ALMOST. SPY and all these ETFs showing bearish sighs leads me to believe we are still in for bearish activity for the next 2 to 3 weeks for the overall market. Out of all of these etfs, XLF offers the lowest options spreads between bid and ask.

PT: Price comes back to next high volume VPVR range which is around 35.5. Also the 4 hour 100 ema can possibly bounce the price in the following days.

OVERALL: EXPECTING A SELL OFF THEN WE CONTINUE BACK TO ALL TIME HIGHS

ENTRY: BELOW 37.5

PT: 37.5-35.5

STRIKE: 36.5

DATE: JUN 11