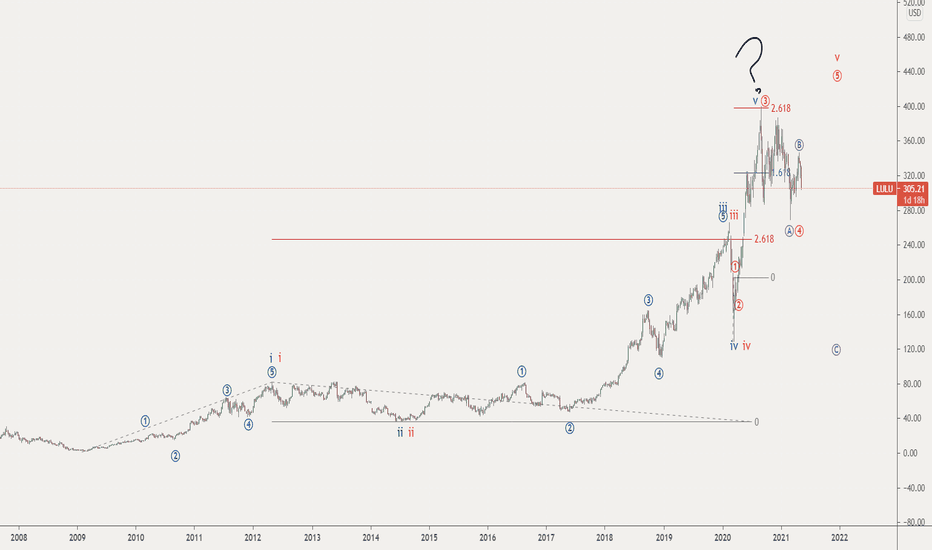

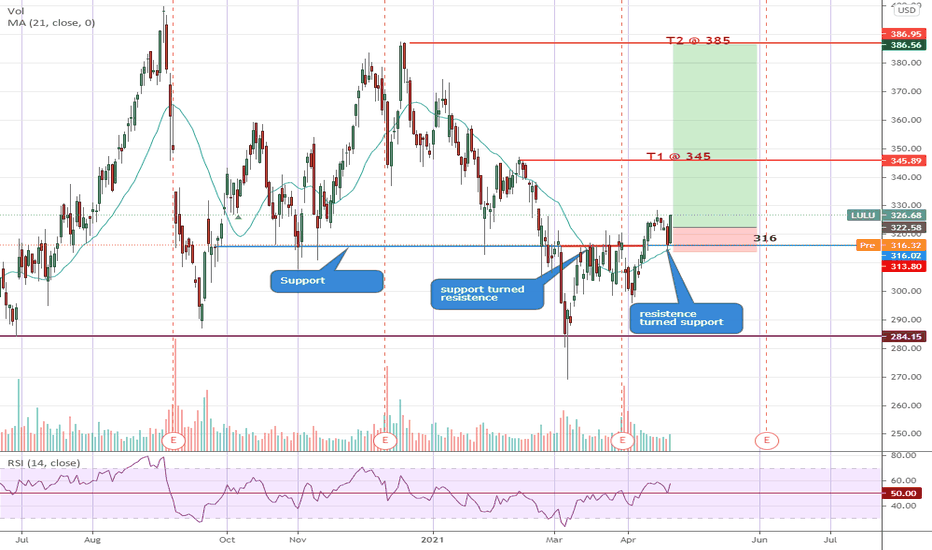

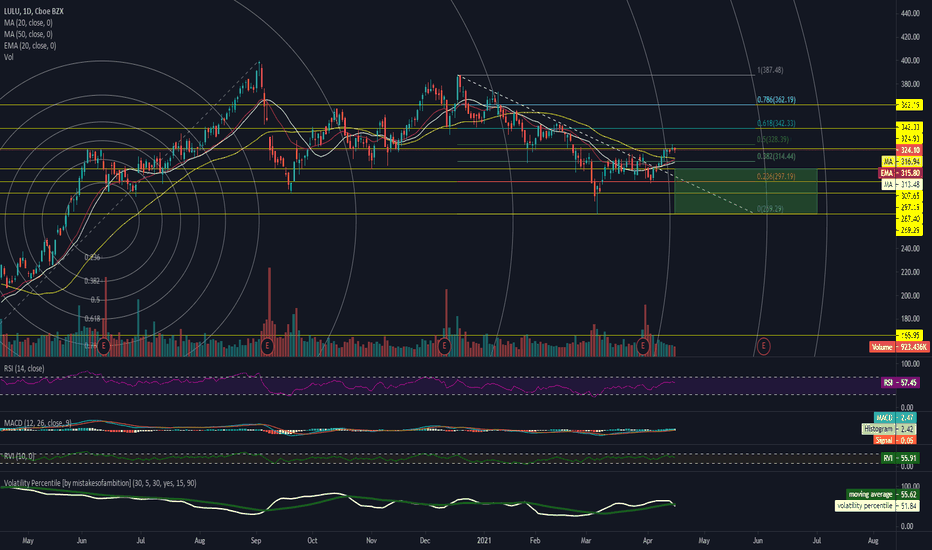

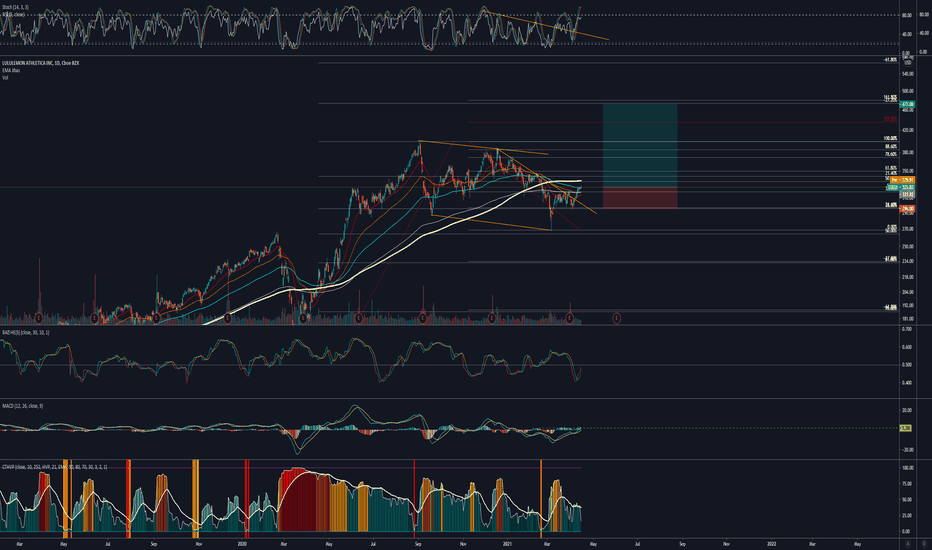

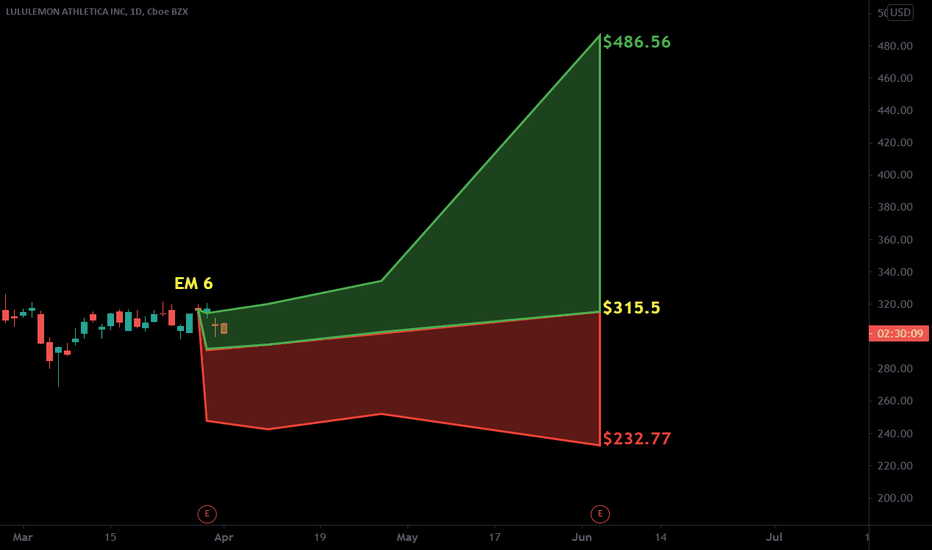

$LULU PT upgrades, aggressively beats earnings. Expecting to fly$LULU Recent PT upgrades, aggressively beats earnings. The stock is consolidating at the point of control with a triple EMA crossing. Relative volume looking good and new buyers should be coming in. Expecting this stock to fly!

"Revenue increased 88% to $1.2 billion

Diluted EPS of $1.11, Adjusted EPS of $1.16

lululemon athletica inc. (NASDAQ:LULU) today announced financial results for the first quarter of fiscal 2021.

Calvin McDonald, Chief Executive Officer, stated: "Our first quarter results reflected strength across all drivers of growth, fueled by the continued expansion in our e-commerce business and a rebound in brick and mortar stores. Our strong performance across categories, channels and geographies demonstrates the momentum and strength of lululemon as we shift into the new normal. All of us on the leadership team are grateful to our teams around the world who enabled these results, and who continue to focus on realizing growth."

The fiscal year ending January 30, 2022 is referred to as "2021" and the fiscal year ended January 31, 2021 is referred to as "2020". The adjusted non-GAAP financial measures below exclude certain costs incurred in connection with the acquisition of MIRROR, and the related tax effects.

For the first quarter of 2021, compared to the first quarter of 2020:

Net revenue increased 88% to $1.2 billion. On a constant dollar basis, net revenue increased 83%.

Company-operated stores net revenue increased 106% to $536.6 million.

Direct to consumer net revenue increased 55% to $545.1 million. On a constant dollar basis, direct to consumer net revenue increased 50%.

Net revenue increased 82% in North America, and increased 125% internationally.

Direct to consumer net revenue represented 44.4% of total net revenue compared to 54.0% for the first quarter of 2020.

Gross profit increased 109% to $700.3 million and gross margin increased 580 basis points to 57.1%.

Income from operations increased 492% to $193.8 million. Adjusted income from operations increased 479% to $201.5 million.

Operating margin increased 1,080 basis points to 15.8%. Adjusted operating margin increased 1,110 basis points to 16.4%.

Income tax expense increased 827% to $49.1 million. The effective tax rate for the first quarter of 2021 was 25.3% compared to 15.6% for the first quarter of 2020. The adjusted effective tax rate was 24.5% for the first quarter of 2021 compared to 14.7% for the first quarter of 2020.

Diluted earnings per share were $1.11 compared to $0.22 in the first quarter of 2020. Adjusted diluted earnings per share were $1.16 compared to $0.23 in the first quarter of 2020.

The Company repurchased 0.3 million shares of its own common stock at an average cost of $311.02 per share.

The Company opened two net new company-operated stores during the quarter, ending with 523 stores.

The consolidated statement of operations for the first quarter of 2019 is included in the tables at the end of this release for reference. For the first quarter of 2021, compared to the first quarter of 2019:

Net revenue increased by $444.2 million, or 57%, representing a two-year compound annual growth rate of 25%.

Gross margin increased 320 basis points.

Operating margin decreased 70 basis points. Adjusted operating margin decreased 10 basis points.

Diluted earnings per share were $1.11 compared to $0.74 in the first quarter of 2019. Adjusted diluted earnings per share were $1.16 in the first quarter of 2021."

33L trade ideas

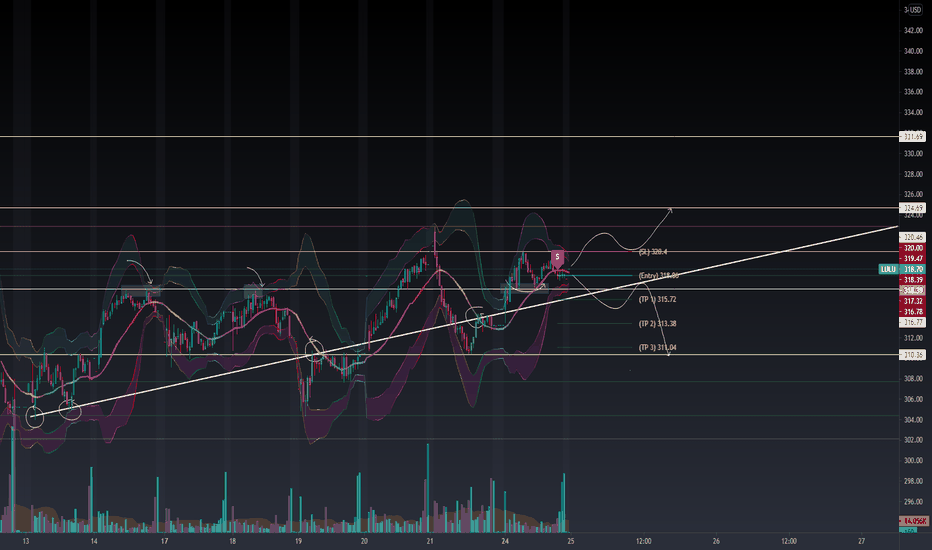

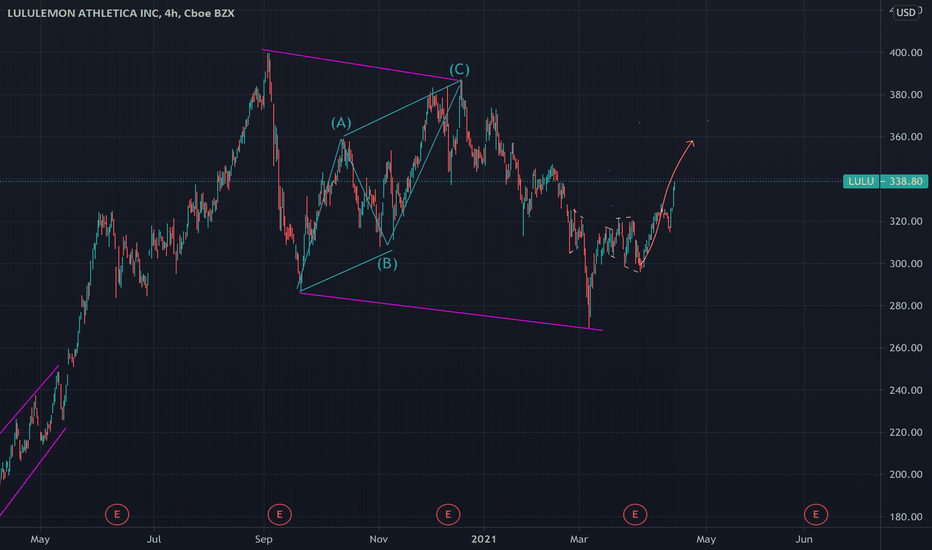

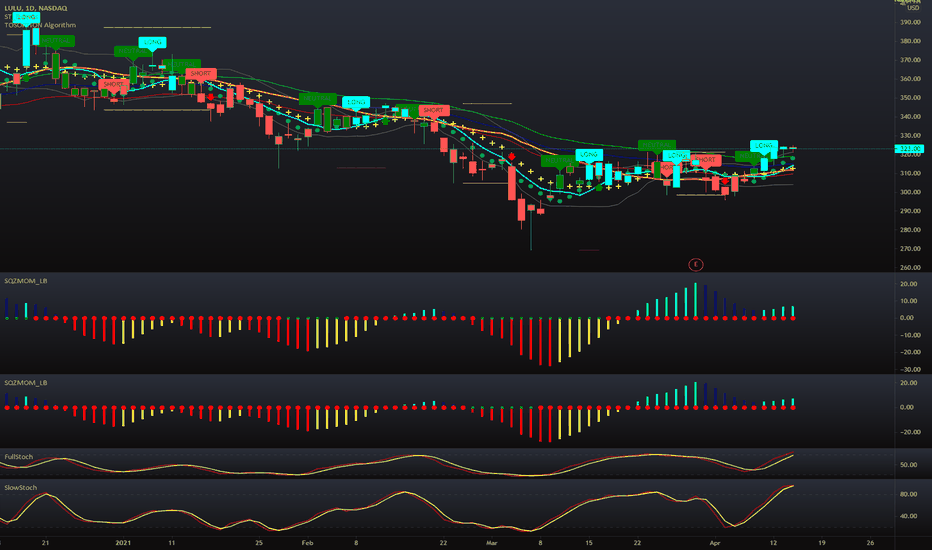

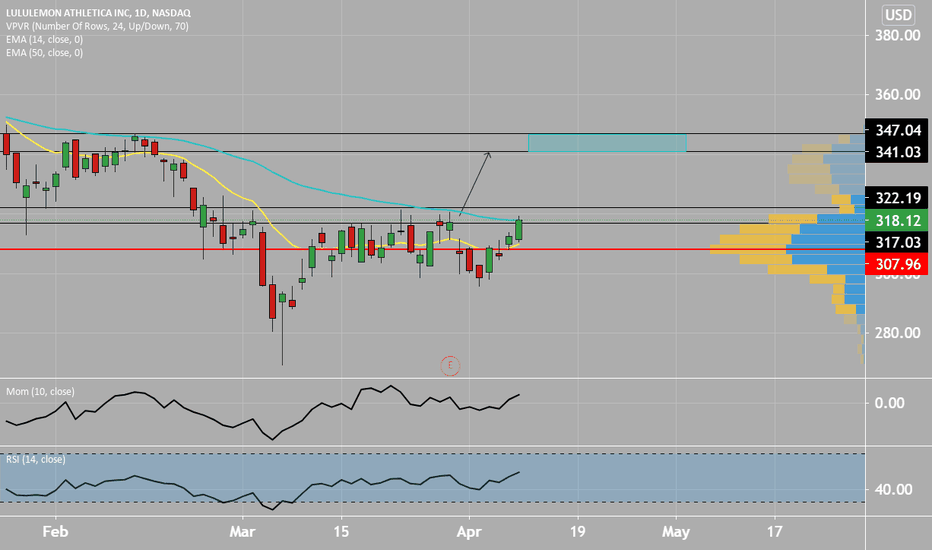

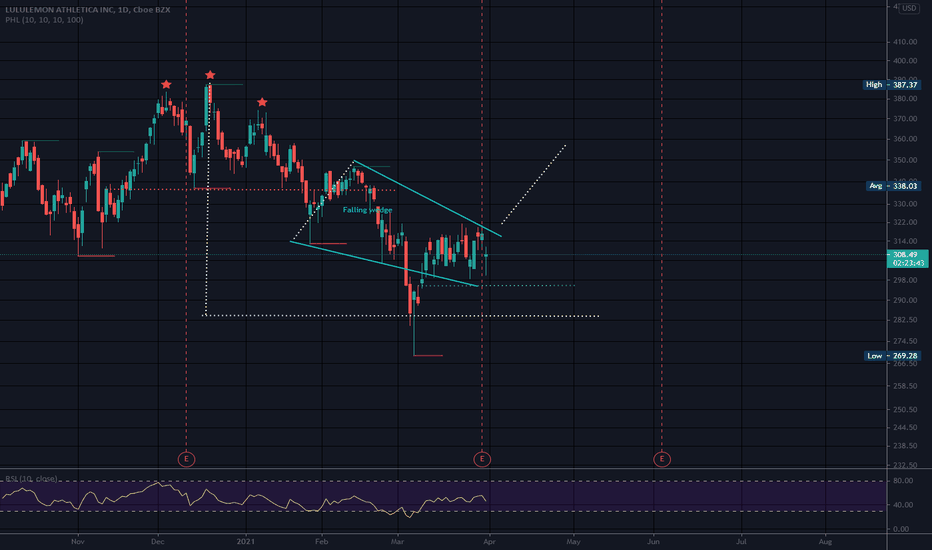

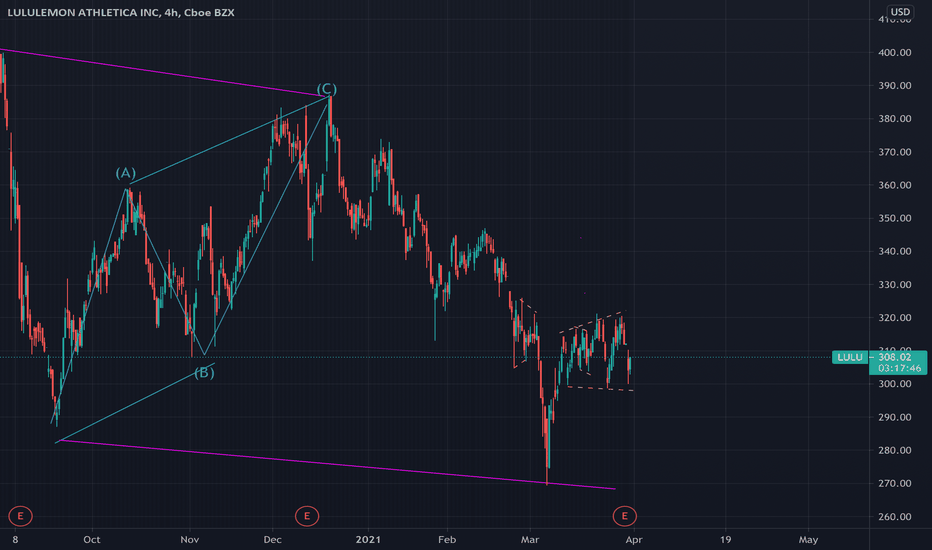

LULU - upside to resumeAfter hitting a low of 270 in early March, LULU began a rebound that soon hit into resistence between 316-320 and pretty much gyrate between 300-320 till 9th April when it finally broke above this resistence.

However it soon stall a few days later and then "crashed" all the way back to test 316 on Tuesday and rebounded strongly from there the next day (ie yesterday). A break above resistence and then a retest of this level a few days later has now establised that the resistence has now turned into a support.

The odds of LULU continuing the uptrend is good (plus RSI is still above 50) with new found support around 314-316.

Disclaimer: This is just my own analysis and opinion for discussion and is not a trade advice. Kindly do your own due diligence and trade according to your own risk tolerance. Thank you. Feel free to give me your thoughts ! :)

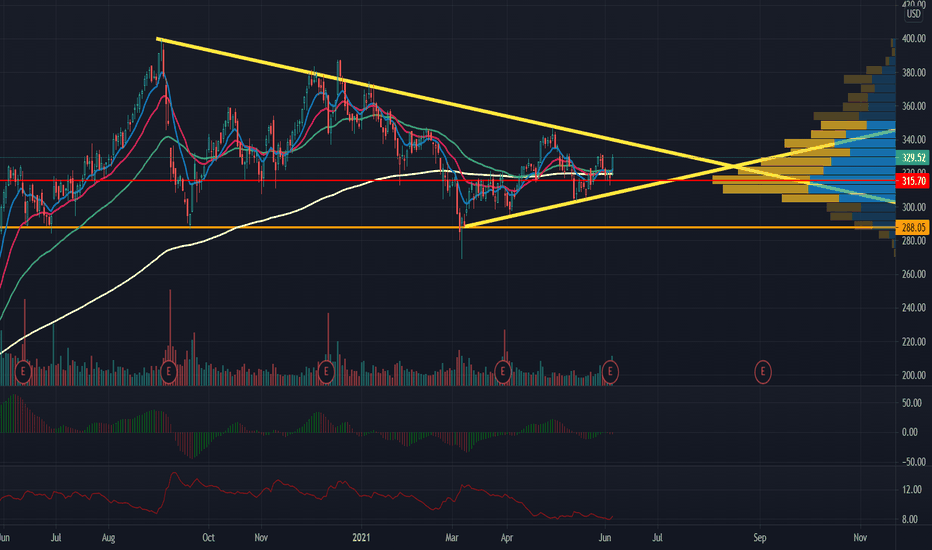

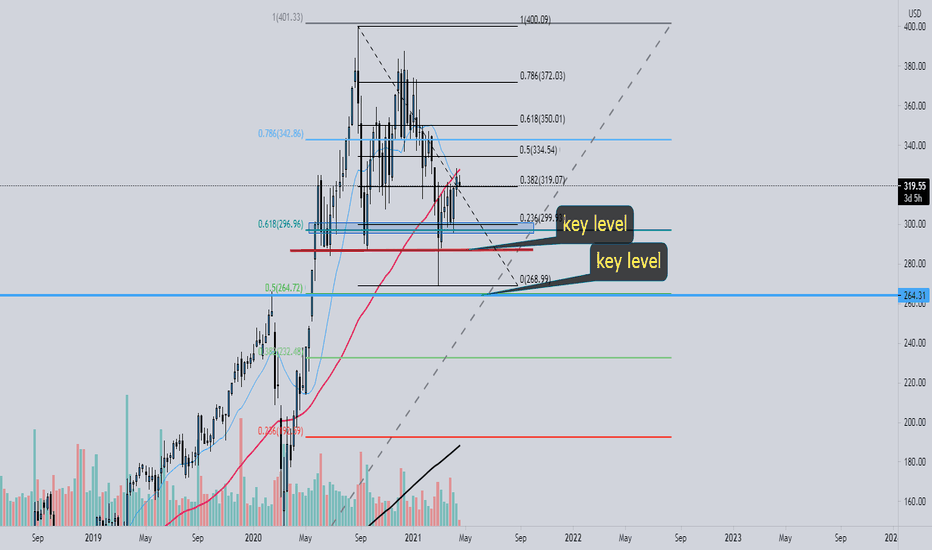

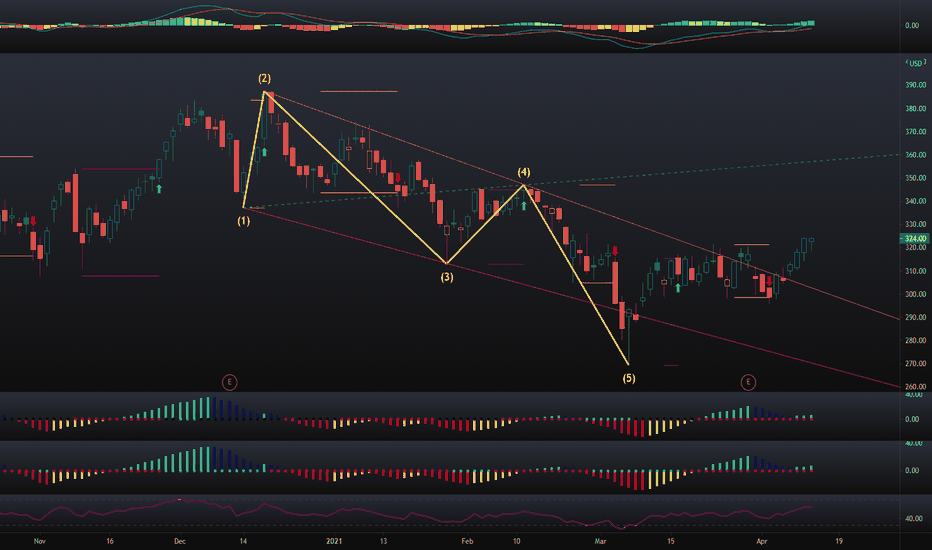

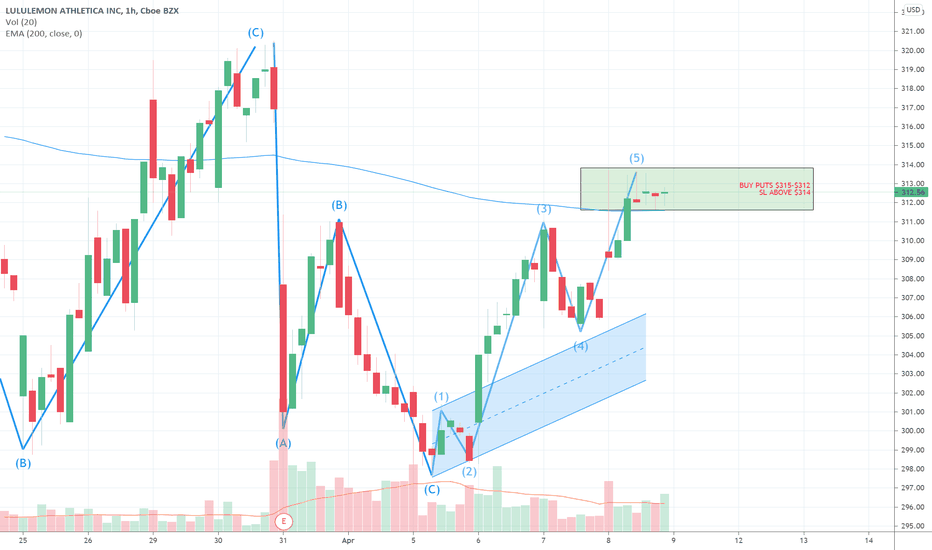

LULU breakout level!LULU is squeezing on multiple time frames and is getting ready to fire. We are also in a wolf wave pattern with a price target of 350.70 (green dotted line). Today, it formed a doji after a full body candle on the previous day which signals a bullish uptrend ahead of its earnings. We might see LULU get into the earnings run soon!

Looking for this wolf wave to pan out in the next couple weeks. If you're planning on getting into this option trade, I'd go 2-3 weeks out. I'll update this as we go.

Suggested contracts:

LULU 4/30 350C @ 1.25

LULU 4/30 340C @ 2.40

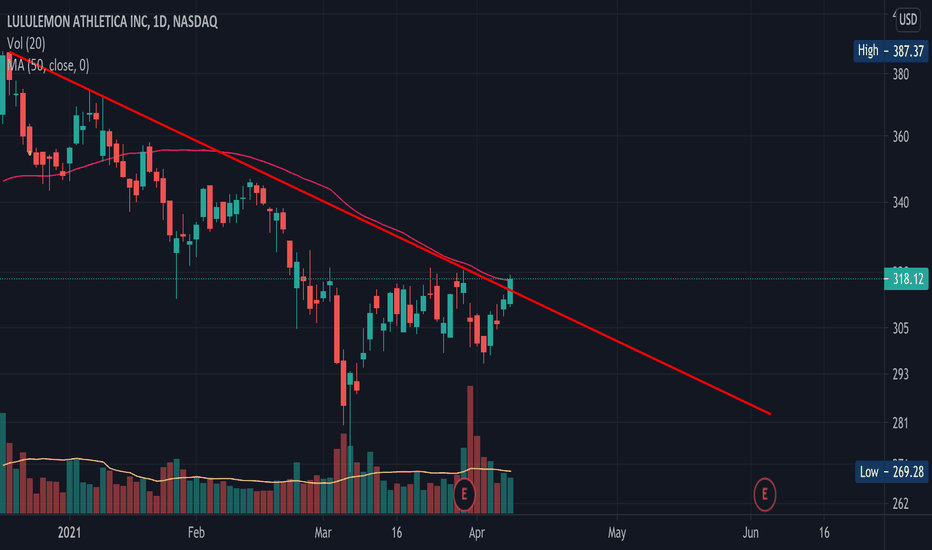

$200 jogging pants I have a 345 april 30 call set to expire, this thing decided to actually participate in the free money chase to the upper right quadrant. What a turd after earnings. record quarter and the street got all pissy about guidance. So then tell me why the S&P hits a new record daily, d bags. PT 360 would be nice, but will take 353. nobody going back to the office, just buy another pair of this elitist crap and get me a win finally.

$LULU with a Neutral outlook following its earnings #Stocks

The PEAD projected a Neutral outlook for $LULU after a Negative Under reaction following its earnings release placing the stock in drift D

If you would like to see the Drift for another stock please message us. Also click on the Like Button if this was useful and follow us or join us.

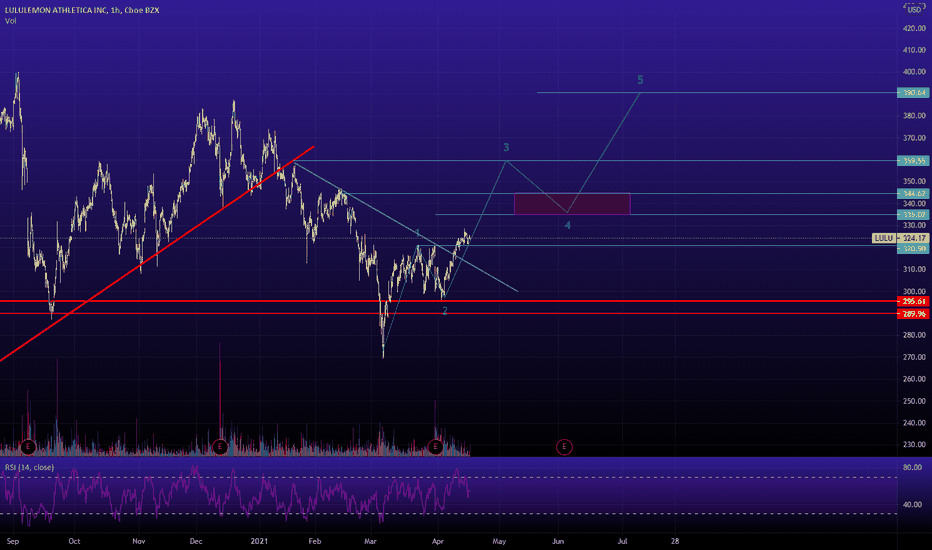

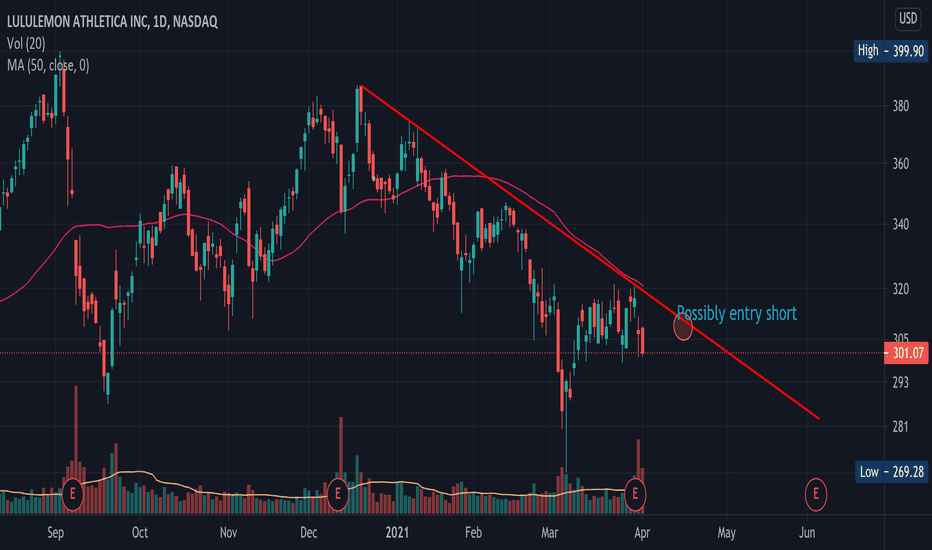

Pull Back FishingLooks like some were not happy with earnings.

There was a possible head and shoulders pattern prior to the deep pull back.

Now there is a falling wedge which can be bullish when price breaks up and out of the upper trendline. A falling wedge slopes against the trend and converges at the apex. LULU has not broken upper trendline of the wedge.

The falling wedge pattern is interpreted as both a bullish continuation and bullish reversal pattern.

The differentiating factor that separates the continuation and reversal pattern is the direction of the trend when the falling wedge appears. A falling wedge is a continuation pattern if it appears in an uptrend and is a reversal pattern when it appears in a downtrend.

Falling wedges are formed

No recommendation