5ZM trade ideas

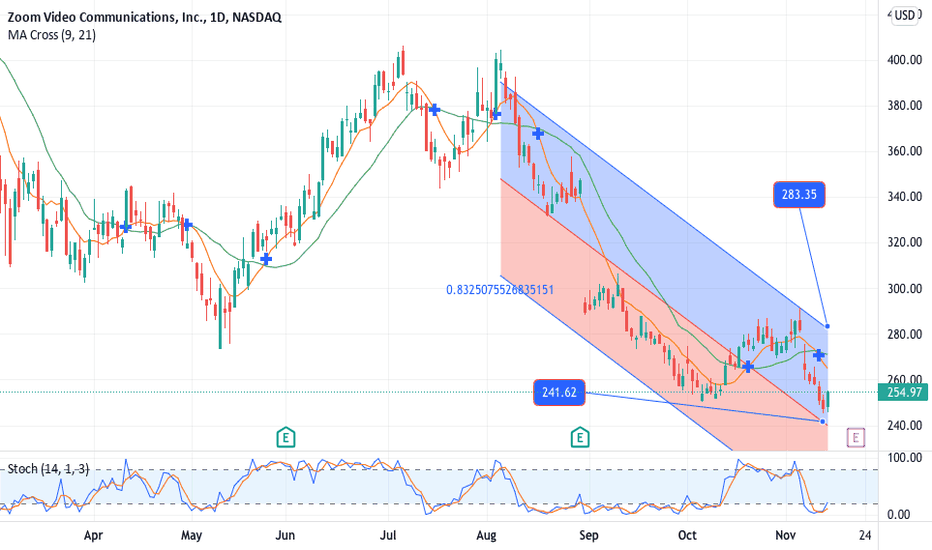

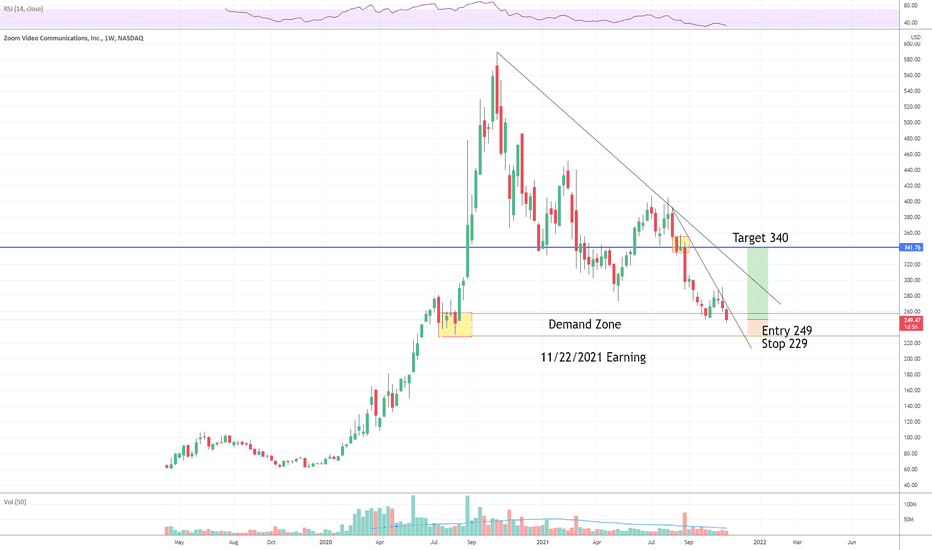

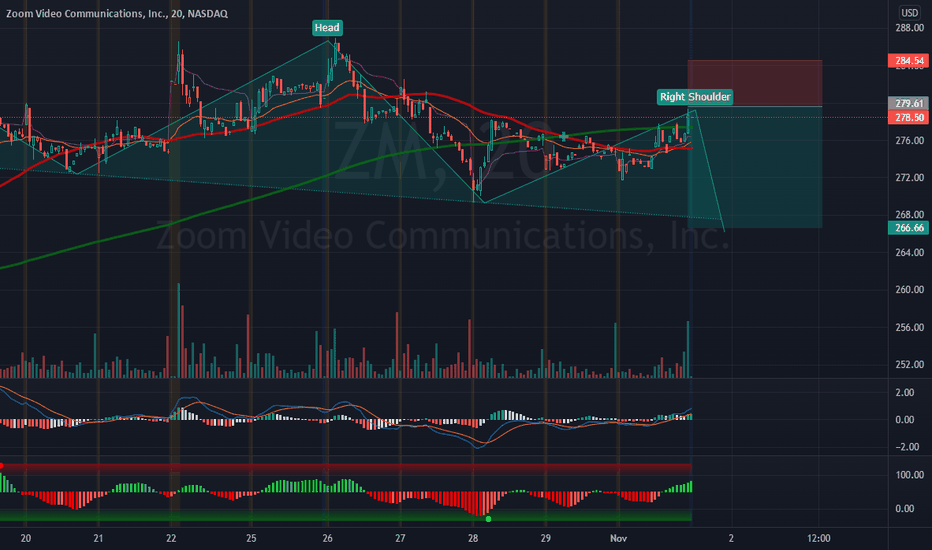

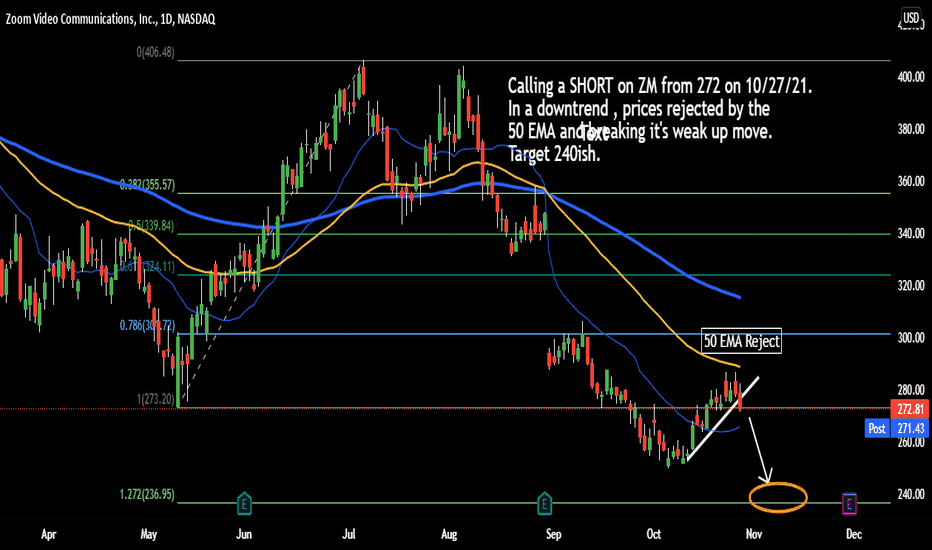

ZM Short setupHopefully you find the chart helpful in terms of Supports & Resistance etc. we refrain from adding commentary on the chart as that is reserved for our members and we are very conscious of not giving financial or trading advice. Thank you for taking time to consult our chart and we would really appreciate a like, follow or comment

Parsing ZOOM CommunicationsZoom Video Communications - The company provides remote conferencing services using cloud computing. Zoom also offers communication software that integrates video conferencing, online meeting, chat and mobile collaboration. Headquartered in San Jose, California.

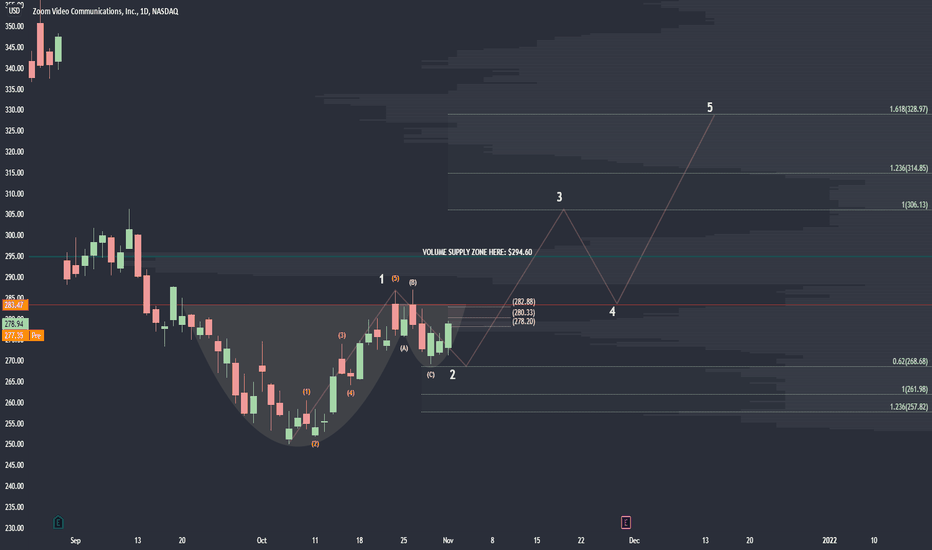

Analysts expect earnings per share and revenue for 2021 of $ 4.8 and $ 4.01 billion, respectively. Such figures would mean an increase in earnings per share by 43.71% and revenue by 51.41%. In terms of P / E and PEG (P / E taking into account expected growth rates), ZOOM lags behind its sector indicators by 27% and 38%, respectively. Large funds are increasing their positions in $ ZM and are looking at the shares very positively.

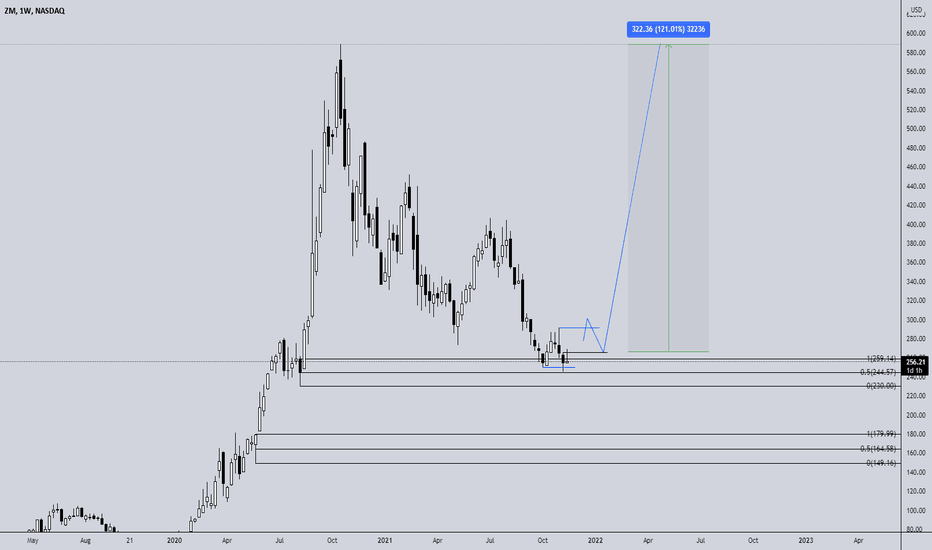

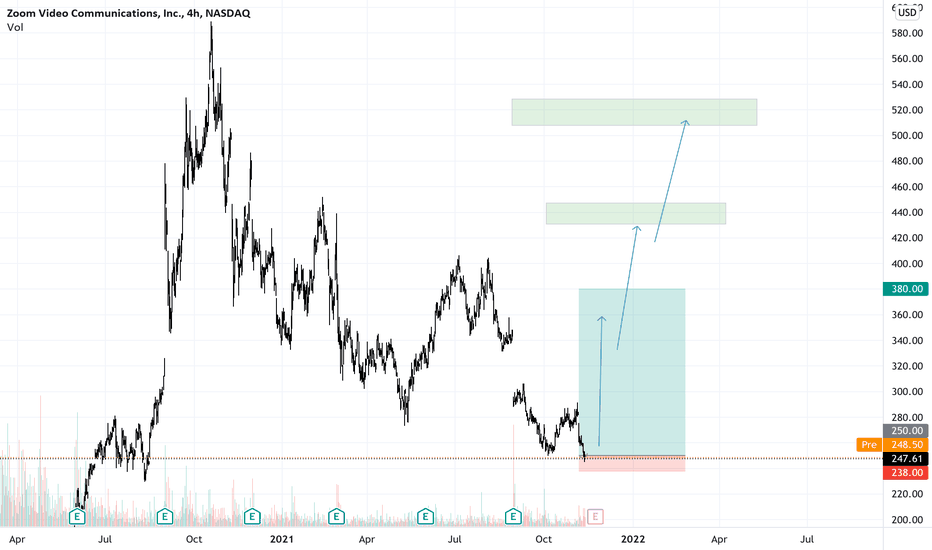

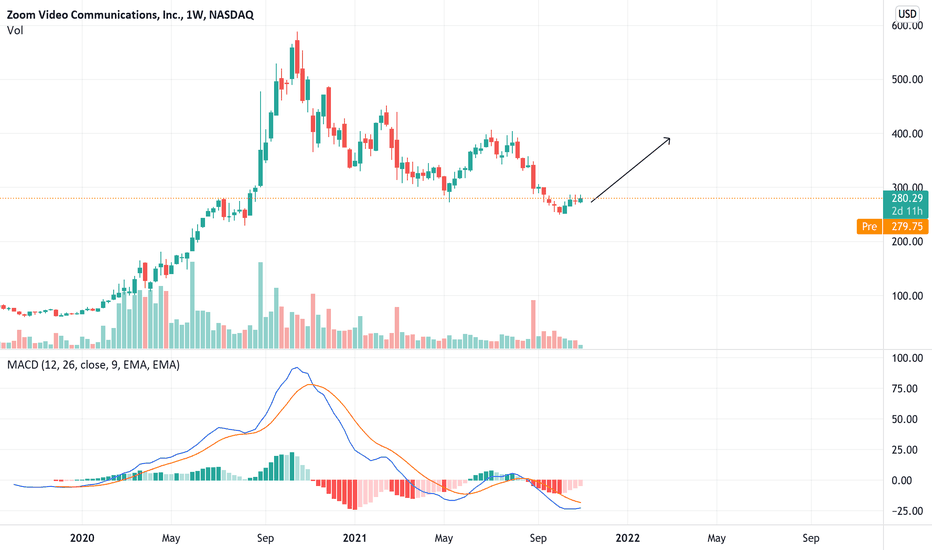

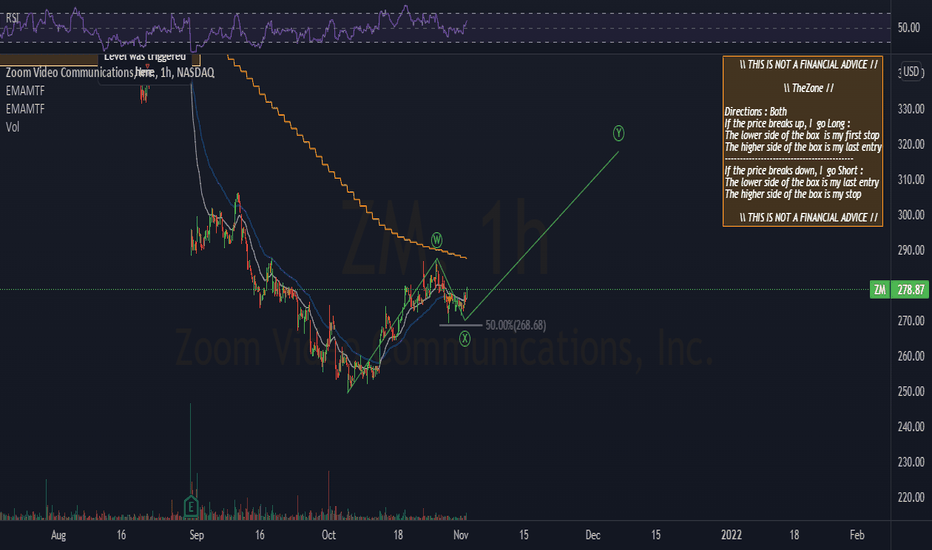

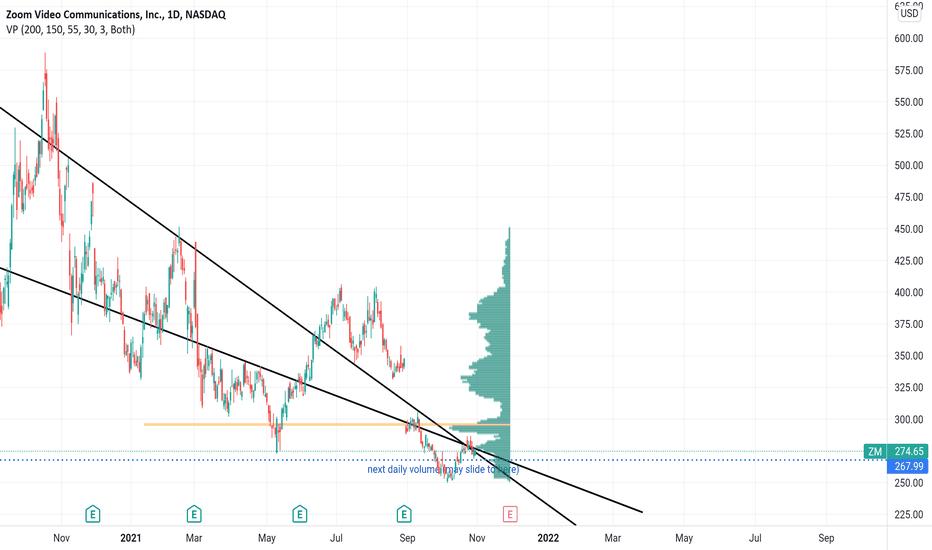

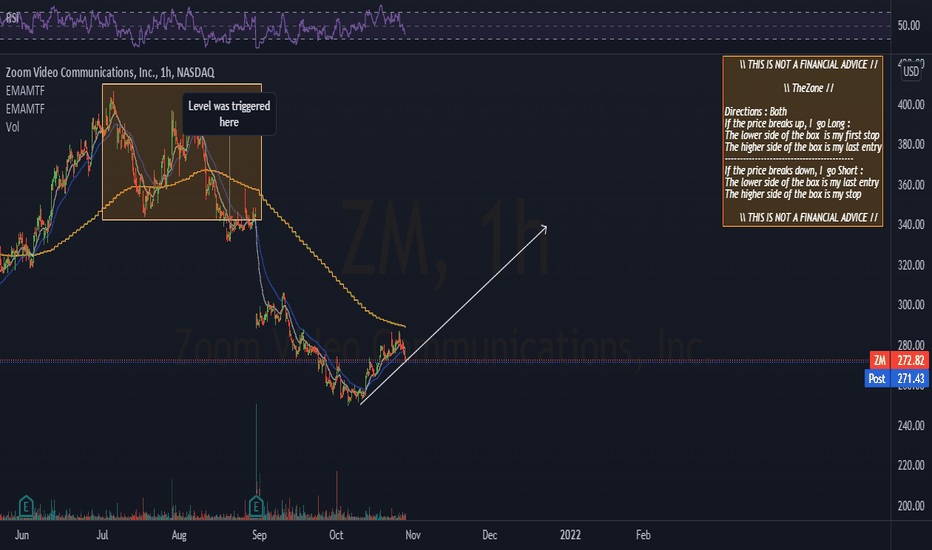

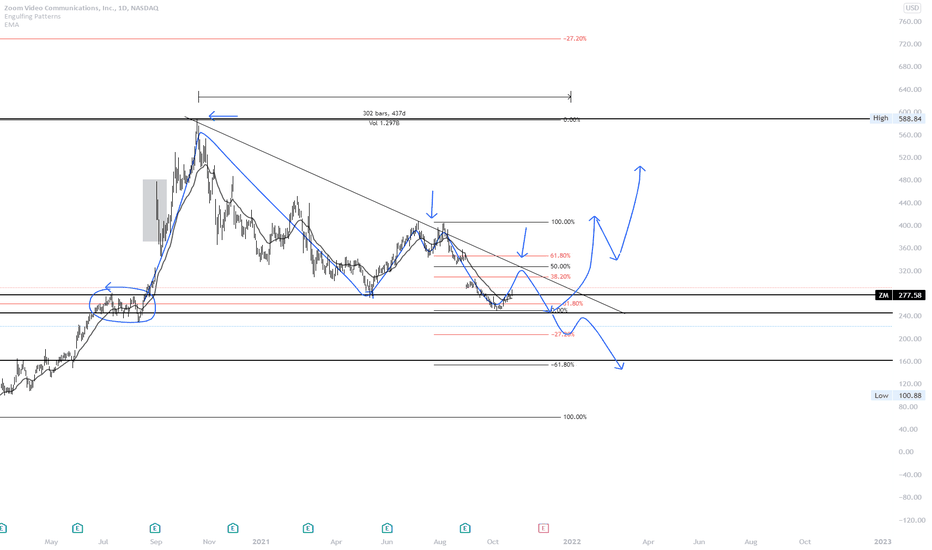

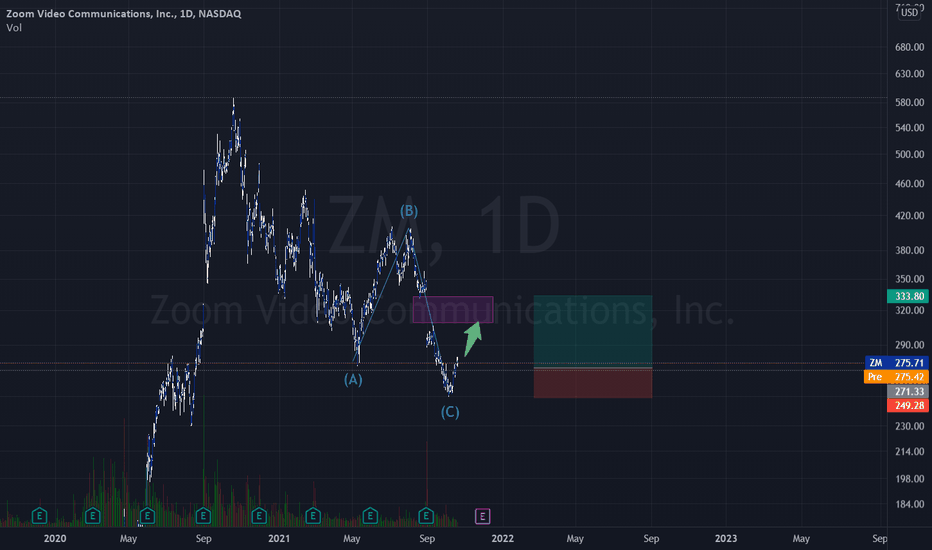

After the hype in 2020, $ ZM shares have traded within the downtrend channel for a year, reaching a 52-week low in early October, which provided support. I expect growth from the current one to the $ 312-330 block. Next, I expect a descent to the support block at $ 230-260, with the formation of a double bottom and an upward exit from the descending channel, or an exit from the channel through the $ 274-289 block.

NOT IRR.

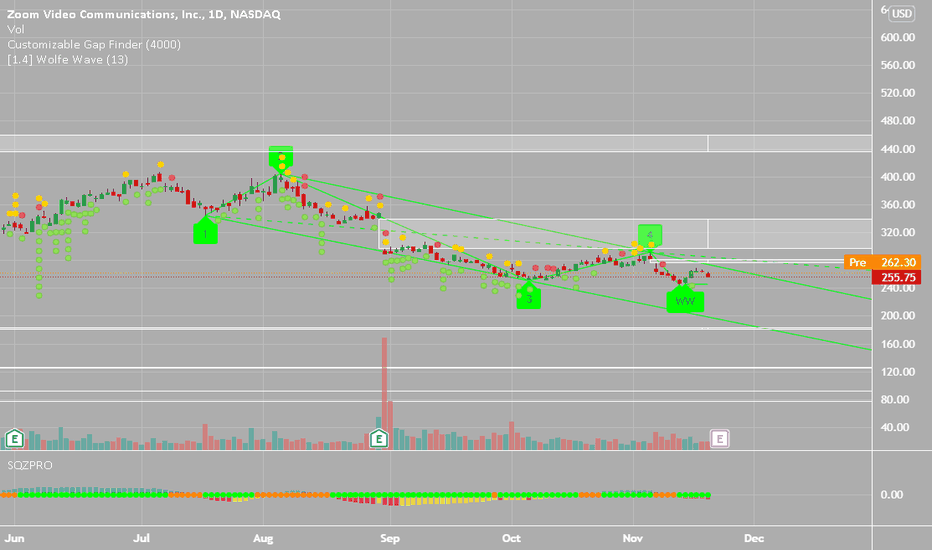

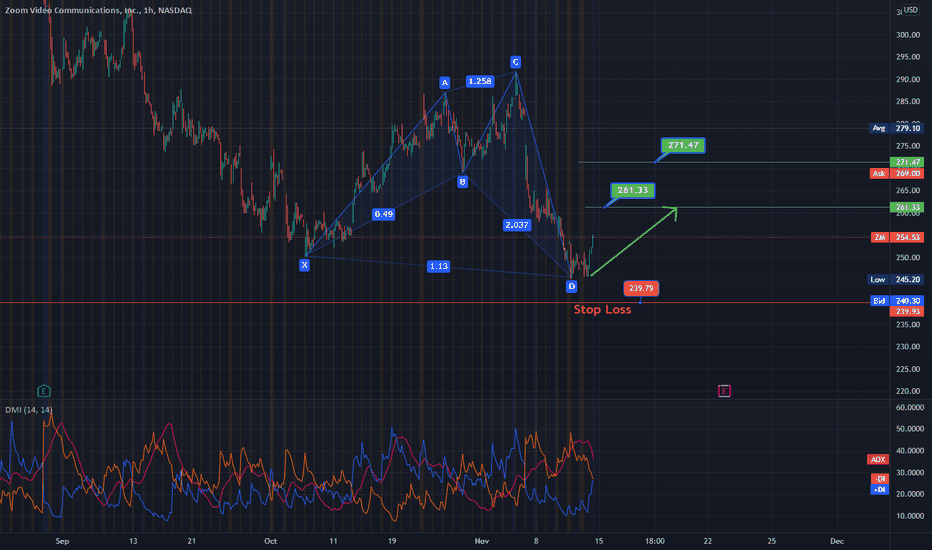

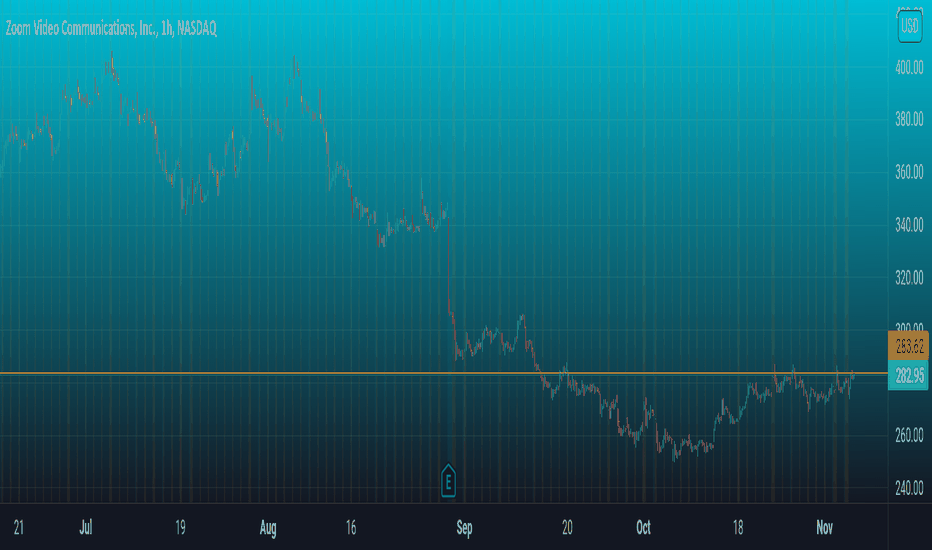

ZoomGot rejected off a split channel early on last week .. Looks like a bear pennant is forming here now with pennant support at 260. there's also EMA100 support on the weekly at 263.

I wouldn't go long here unless it can break through that split channel, a break above that area and I'd be targeting 340 gap close.

Short entry below 260 and I'd target the 253 low; if that support doesn't hold we could be headed to wedge bottom around 200$

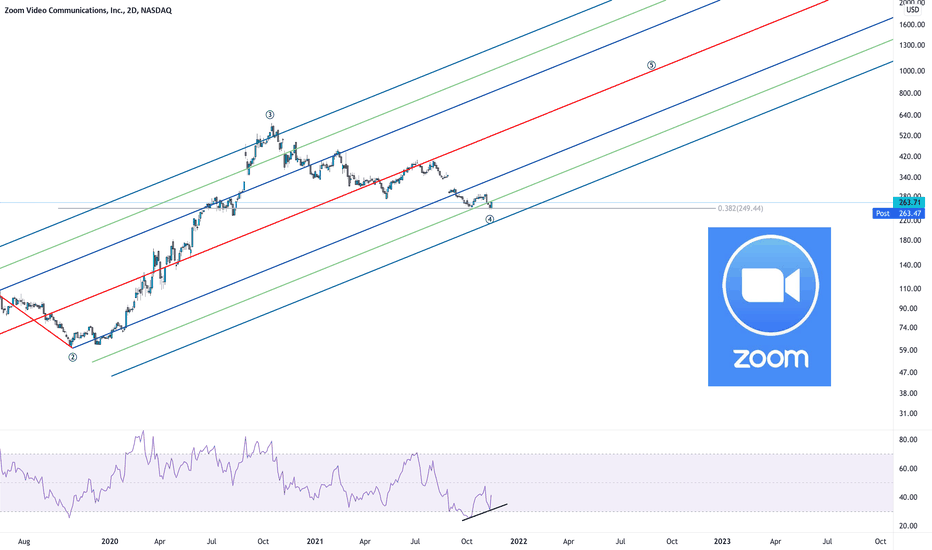

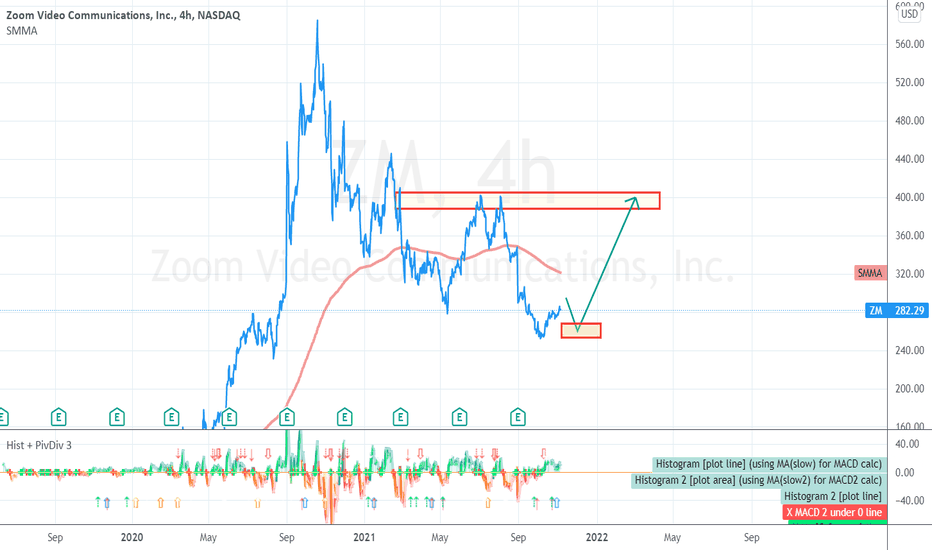

ZOOM AnalysisAfter the pandemic hit, video streaming services like ZOOM were able to solve a huge problem for businesses and retail customers alike - thus netting an ~+780% price gain.

Unfortunately due to increasing competition and having to share market cap along with vaccines and other health protocols coming into play, people began coming back into the public and no longer needed Zoom *as much*

Since then price has been on a year long downtrend falling almost 60%.

In the video I go over my technical view of ZOOM and likely outcomes I see.

I believe that ZOOM can make a comeback due to people now realizing everything doesnt need to be in person. Life as we know it is slowly shifting to being managed online in the metaverse and a product like zoom helps that. I can definitely see it keeping its popularity in the business sector as more and more people will start to work remotely.

Leave a like and let me hear your thoughts.