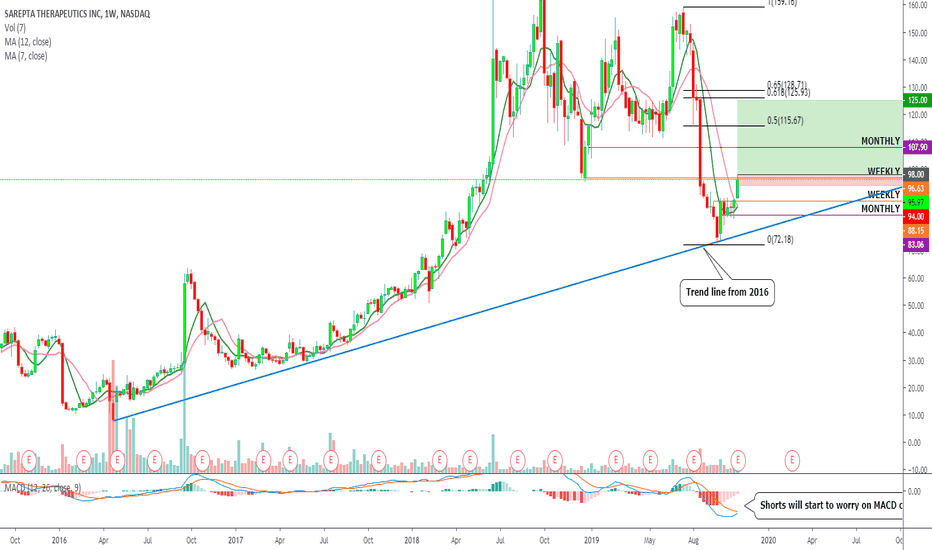

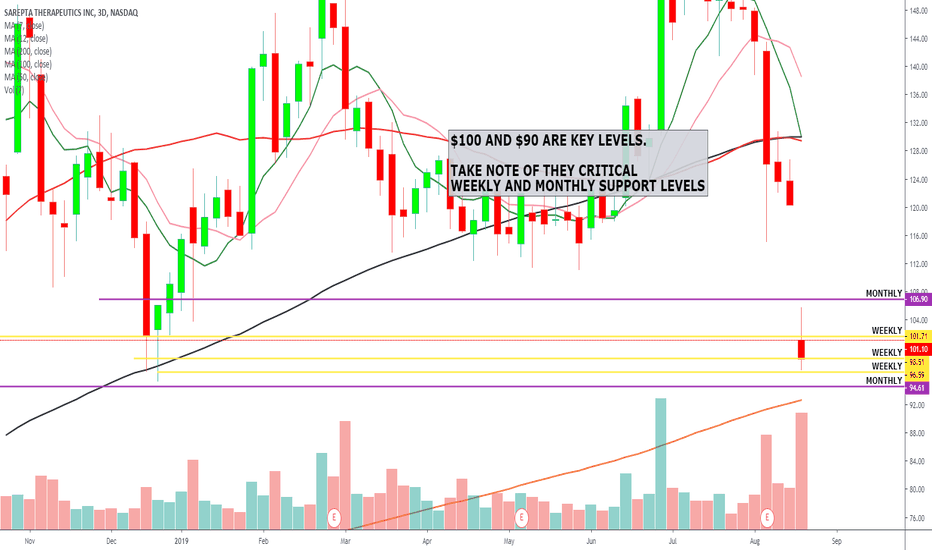

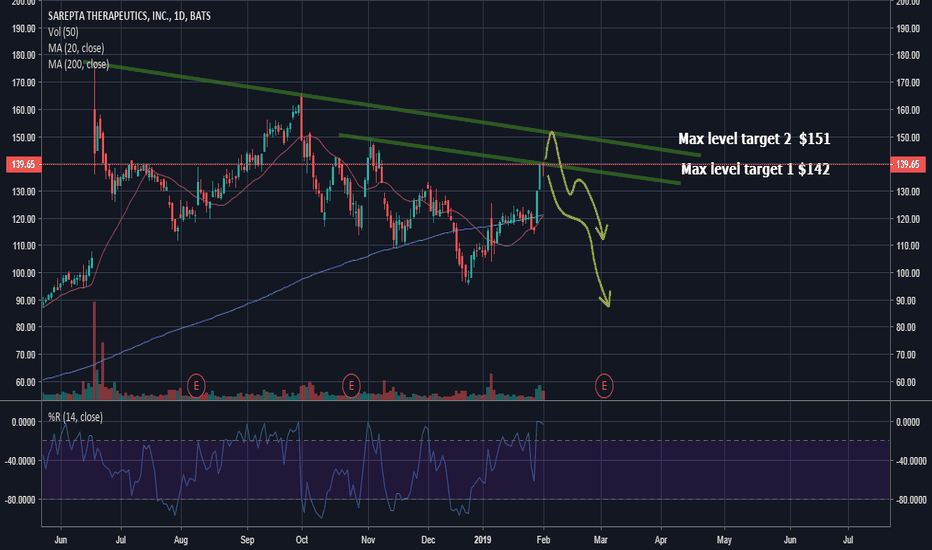

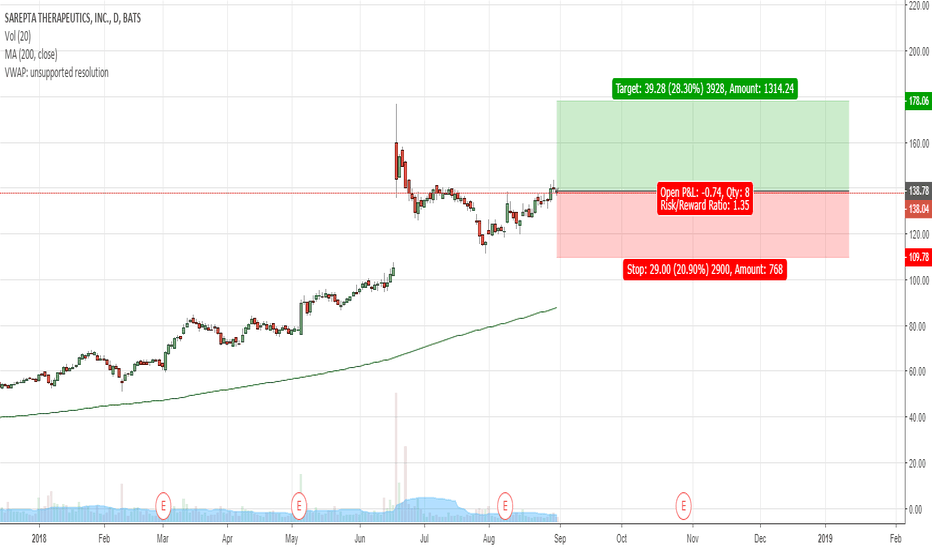

$SRPT Reversal trade in SareptaEntry level $98 = Target price $125 (long term) $108 (short term)

Looks like a strong reversal setup, the macd is about to cross while the histogram is also in the process of turning green.

Bullish 7&12 MA cross imminent.

Resistance as per the chart.

Earnings article by Barrons.

Earnings at the biotech firm Sarepta Therapeutics fell short of expectations in the third quarter of the fiscal year, but sales of a key drug, Exondys, were in line with Wall Street estimates.

The company reported earnings after the market closed on Thursday. The stock was steady in premarket trading on Friday.

Sarepta (ticker: SRPT) reported a loss of $1.14 per share, $0.22 worse than the Wall Street consensus reported by S&P Capital IQ. But the company reported sales of $99 million for Exondys 51, its treatment for Duchenne’s muscular dystrophy treatment. Analysts tracked by FactSet had expected $96.6 million.

“We think that Sarepta continues to make good progress on key objectives, including manufacturing, clinical trial enrollment of its gene therapy DMD study, and dose escalation for limb girdle gene therapy,” wrote Cantor Fitzgerald analyst Alethia Young in a Thursday note.

The back story. Shares of Sarepta are down 14.4% this year. Shares fell sharply in August and September after the Food and Drug Administration declined to provide accelerated approval for a Duchenne muscular dystrophy treatment called golodirsen.

What’s new. Sarepta nodded to the setbacks in its earnings statement, but said it was progressing.

“While not without its challenges, 2019 has been one marked by a significant advancement of our platform,” said Doug Ingram, the company’s president and CEO. “We continued to exceed revenue expectations, built our pipeline and advanced our programs, reported additional positive and validating clinical data, advanced our manufacturing strategy.”

The company reported that it has $1.1 billion in cash, cash equivalents, and investments. “We think that Sarepta remains well-capitalized,” wrote Cantor’s Young.

The company highlighted its continuing gene therapy programs, including one for Limb-girdle muscular dystrophy diseases. “SRPT’s multiple gene therapy programs are making incremental steps toward commercialization,” wrote SVB Leerink’s Joseph Schwartz.

Looking ahead. Cantor’s Young noted that Sarepta had little to say on golodirsen. “Mum is the word on golodirsen path forward, for which we think it’s probably fair to keep expectations low,” Young wrote. “We expect the company to provide an update when it has conclusive details. For the most part, we think that golodirsen expectations are out of the stock.”

Shares of Sarepta were down 0.1% in premarket trading on Friday.

Write to Josh Nathan-Kazis at josh.nathan-kazis@barrons.com

AB3A trade ideas

$SRPT Nomura sees 150% upside in Sarepta.Nomura $230 price target

Sarepta analyst commentary at Nomura Instinet Sarepta has 'signficant upside catalysts ahead,' says Nomura Instinet. Nomura Instinet analyst Christopher Marai sees "significant upside catalysts ahead into mid-2020" for Sarepta Therapeutics. Ahead of the company's Q3 results on November 7 he keeps a Buy rating on the shares with a $230 price target. The analyst thinks Golodirsen's Complete Response Letter will likely be resolved in the near-term and that Sarepta's "valuation floor" is based on its current exon skipping platform.

Source Thefly

High Call options traded pre earnings.

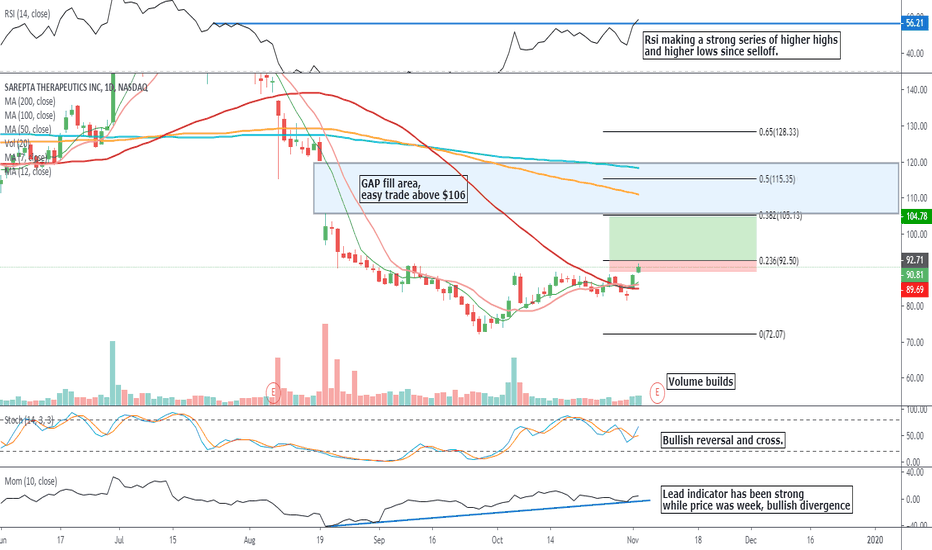

Indicators bullish and volume increasing.

Short squeeze potential with a very high 22.14% short interest.

Company profile

Sarepta Therapeutics, Inc. is a commercial-stage biopharmaceutical company, which is engaged in the discovery and development of therapeutics for the treatment of rare diseases. The company was founded on July 22, 1980 and is headquartered in Cambridge, MA.

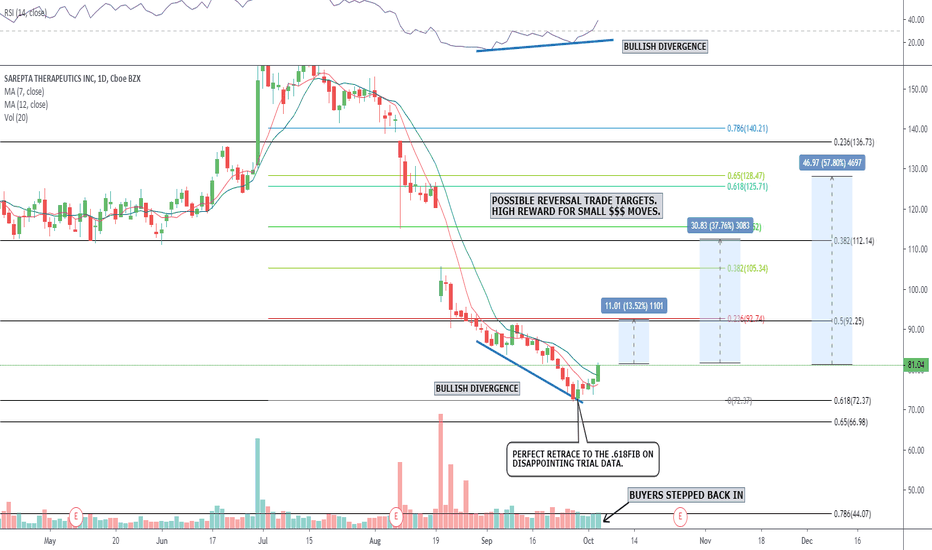

$SRPT Sarepta Therapeutics owes its investors, big time.Possible short term breakout in SRPT above $89 with $96 as a 1-2-1 Fibonacci extension target.

This may be a contrarian trade but maybe sentiment and expectations are so poor it presents a good short squeeze opportunity.

Short interest is high at 21% and increased since the July disappointment.

The average analysts price target is $186 and a BUY rating which is a 100% upside expectation.

Company profile

Sarepta Therapeutics, Inc. is a commercial-stage biopharmaceutical company, which is engaged in the discovery and development of therapeutics for the treatment of rare diseases. The company was founded on July 22, 1980 and is headquartered in Cambridge, MA.

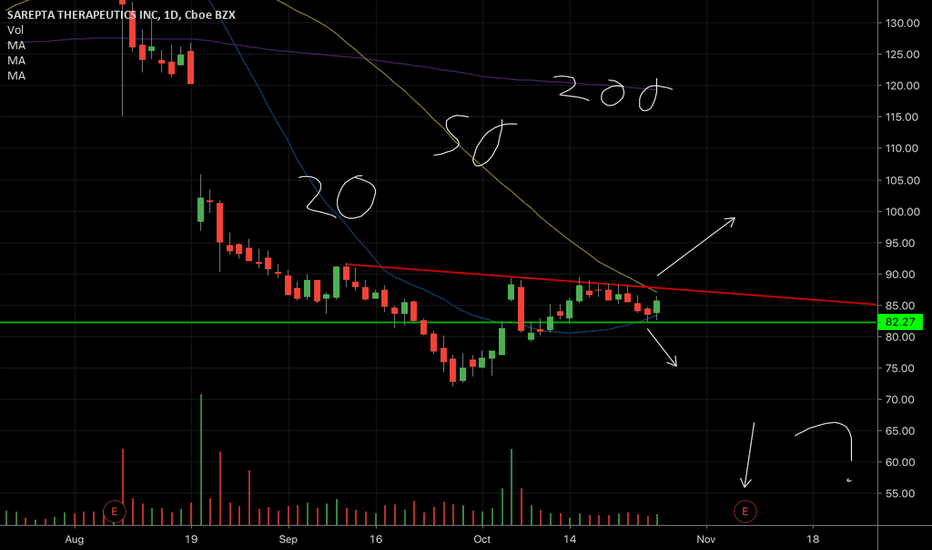

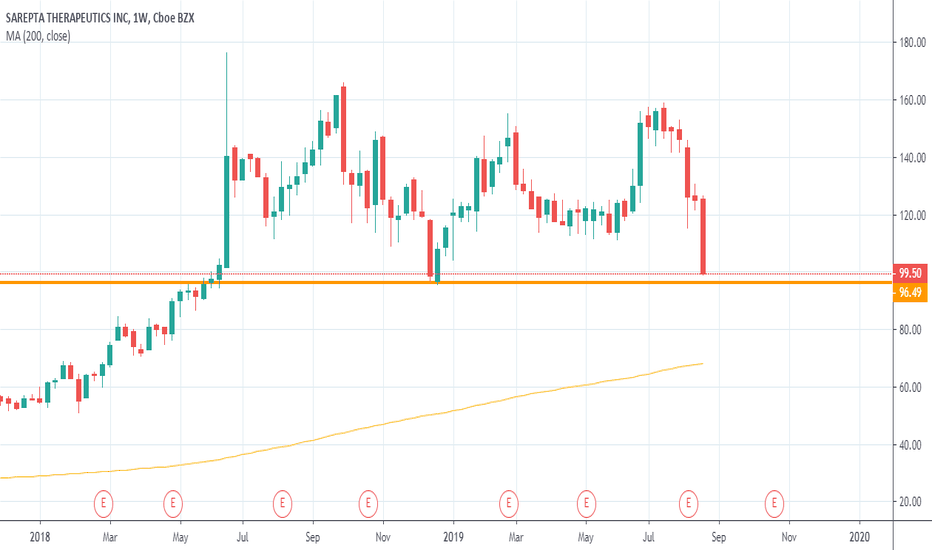

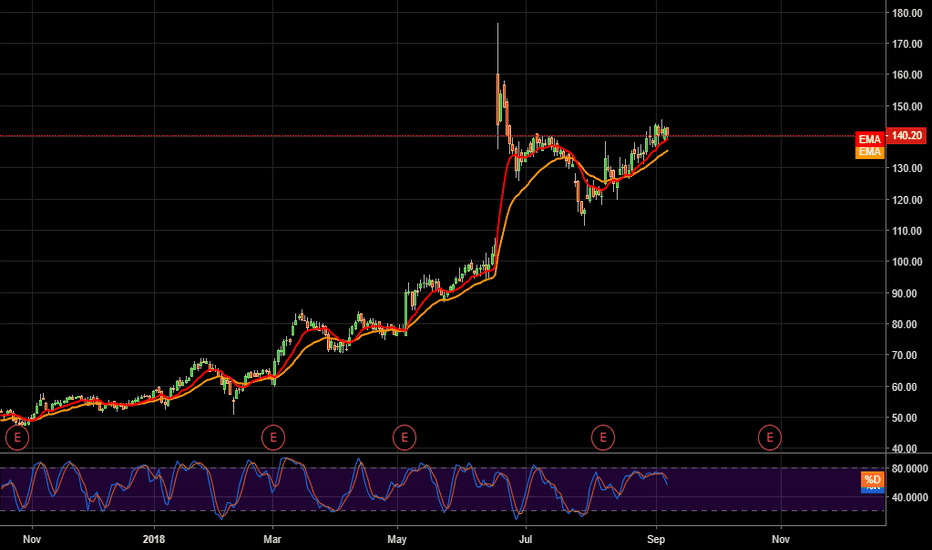

Sarepta Therma holds some great opportunities, Selling overdone.AVERAGE ANALYSTS PRICE TARGET $190

AVERAGE ANALYSTS RECOMMENDATION BUY

HIGH 20% SHORT INTEREST.

Sarepta Therapeutics, Inc. is a commercial-stage biopharmaceutical company, which is engaged in the discovery and development of therapeutics for the treatment of rare diseases. The company was founded on July 22, 1980 and is headquartered in Cambridge, MA.

SPRT near to strong support levelSPRT near to strong weekly support level. possibly buy. wait for confirmation. I cant believe the Food and Drug Administration rejected the latest Duchenne muscular dystrophy drug, dubbed golodirsen. This could get ugly. Watching for a bounce and keeping an eye on the overall market as well. also watching this one .

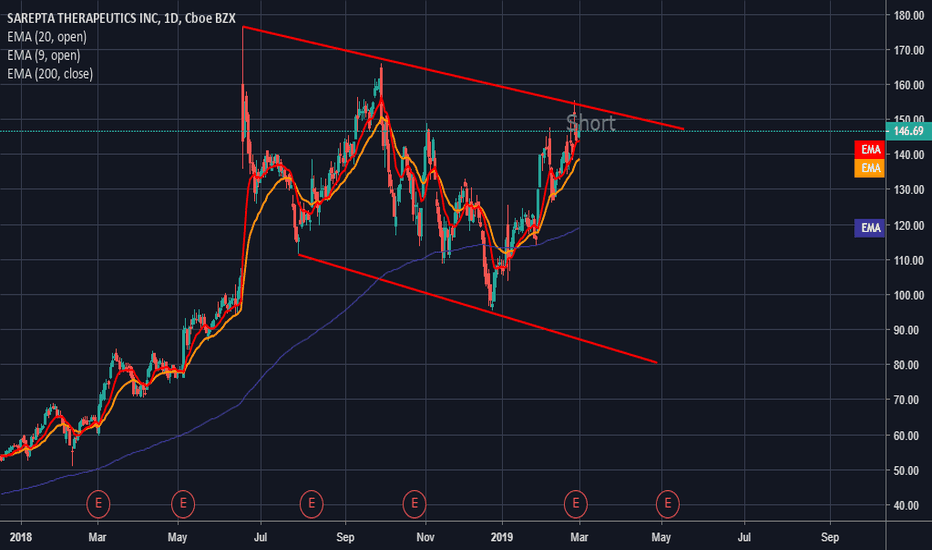

Sarepta's initial breakout failed, Whats next?It looked almost certain that SRPT would break out to new highs in late June, but as the market turmoil continued the stock lost favour, seemingly the stock has now found relative support and ready for another move higher. Options markets have seen higher call buying and sentiment and speculation has also become quite bullish as the possibility of larger companies seeing SRPT as a great M&A target.

Factors at Play SOURCE ZACKS

Sarepta’s sole marketed drug, Exondys 51, is likely to drive its revenues higher in the second quarter of 2019. The drug has shown a strong uptrend since its launch in 2016 and is the only approved treatment for Duchenne muscular dystrophy (“DMD”) in the United States.

Apart from Exondys 51, the company is developing multiple pipeline candidates, which include exon-skipping and gene therapies, for treating DMD. The company is likely to provide an update on the progress of these candidates in clinical studies.

The most advanced pipeline candidate — golodirsen, an exon-skipping candidate — is under review in the United States. A decision is expected next month. The company may provide an update on its plans for the commercial launch of the candidate following a potential approval.

Gene Therapy

Sarepta is also focused on developing gene therapies for the treatment of central nervous system (“CNS”) disorders as well as DMD.

The company is evaluating several gene therapy candidates in early- to mid-stage studies for CNS disorders and muscular dystrophy. The most advanced gene therapy candidate, LYS-SAF302 is being evaluated in a phase II/III study as a treatment for mucopolysaccharidosis Type IIIA, a progressive CNS disorder.

In May, Sarepta expanded its gene therapy pipeline to six candidates by signing an agreement with the Research Institute at Nationwide Children’s Hospital.

With several clinical studies underway, we expect operating expenses to increase in the soon-to-be-reported quarter. Moreover, commercial initiatives to support golodirsen potential launch will also drive expenses higher. Meanwhile, higher demand for Exondys 51 is also driving royalty payments to BioMarin BMRN. We expect to see the same trend in the to-be reported quarter.

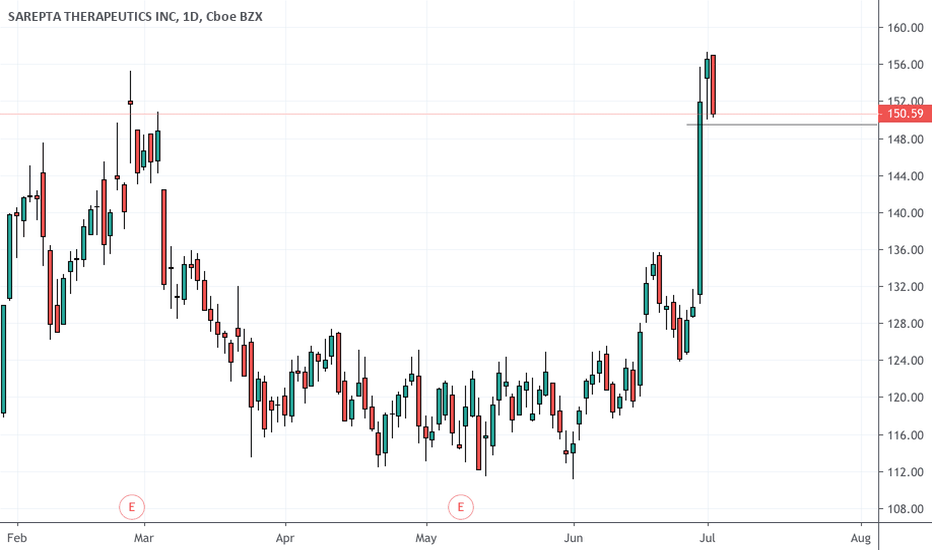

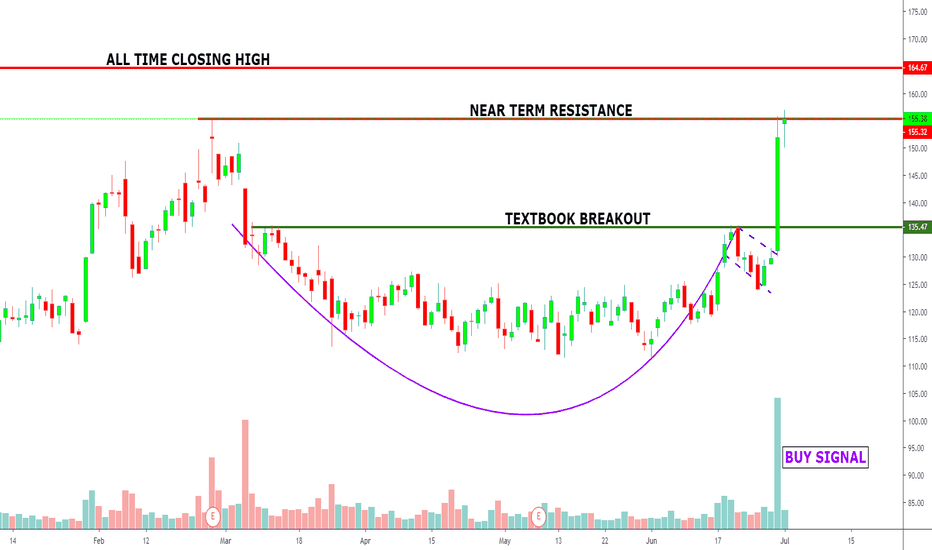

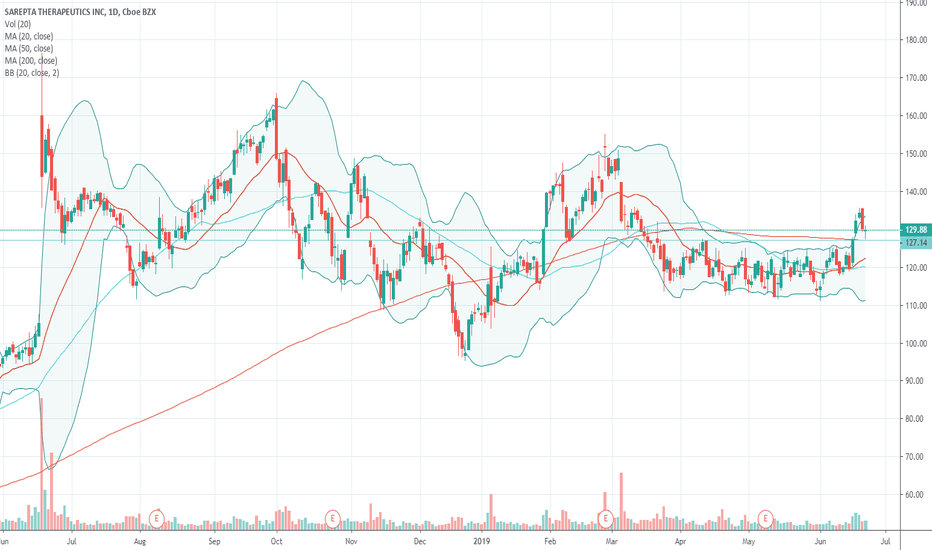

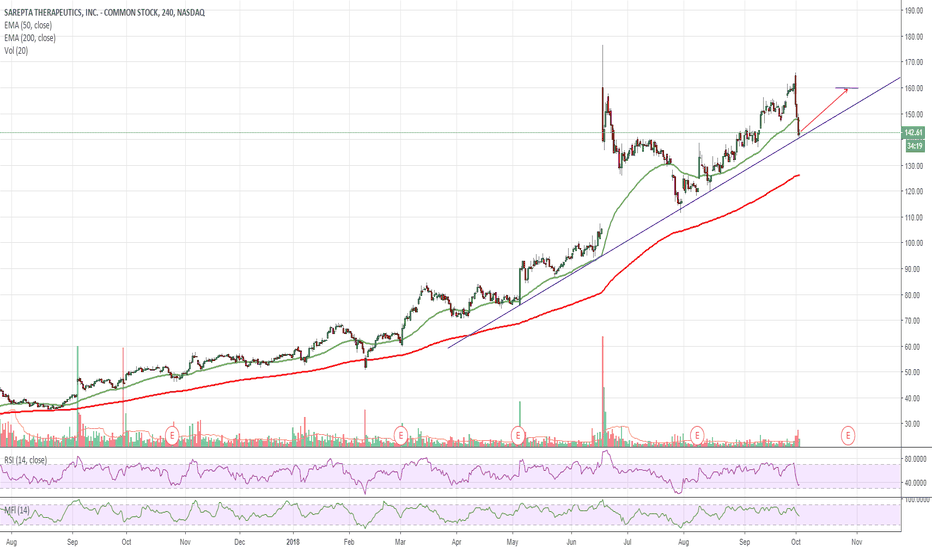

SAREPTA THERAPEUTICS IN BULLISH BREAKOUT In our last analysis we had identified the possibility off a breakout in SRPT, that has now come to fruition and has played out perfectly, this is a prime example of why you should analysis every company not just those highlighted on mainstream media. Such opportunities are easier to identify in larger time frames and produce mush greater gains, 24% gain in 4 days is difficult to beat. Happy investors.

AVERAGE ANALYSTS PRICE TARGET $204

AVERAGE ANALYSTS RECOMMENDATION BUY

P/E RATIO

SHORT INTEREST 15%

COMPANY PROFILE

Sarepta Therapeutics , Inc. is a commercial-stage biopharmaceutical company, which is engaged in the discovery and development of therapeutics for the treatment of rare diseases. The company was founded on July 22, 1980 and is headquartered in Cambridge, MA.

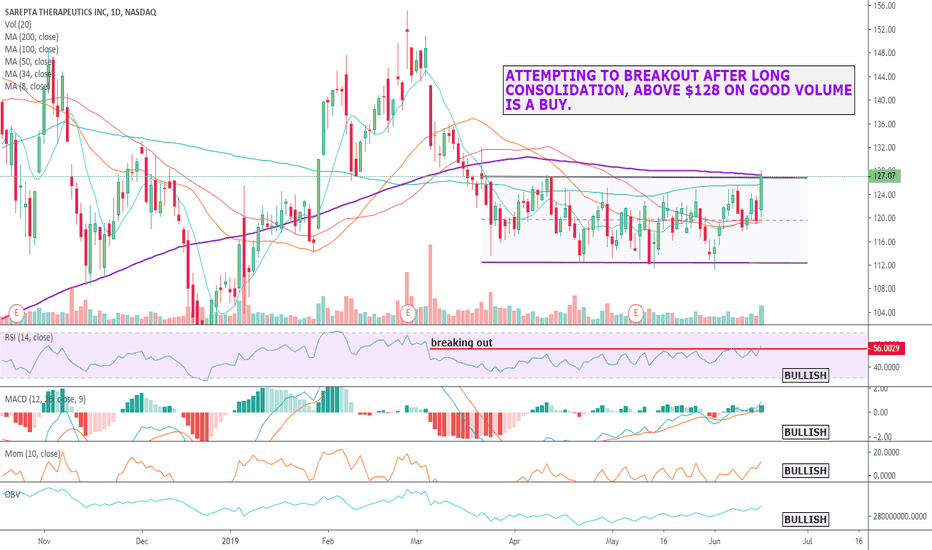

Sarepta Therapeutics looks like breaking out BullishSarepta is on the brink of a considerable breakout and the NASDAQ:ARRY deal yesterday has just added more fuel to the fire. Currently sitting just below the 200ma and the $128 price level,a break above looks inevitable and all indicators are very bullish with the RSI aalso breaking out.

AVERAGE ANALYSTS PRICE TARGET $204

AVERAGE ANALYSTS RECOMMENDATION BUY

P/E RATIO

SHORT INTEREST 15%

COMPANY PROFILE

Sarepta Therapeutics, Inc. is a commercial-stage biopharmaceutical company, which is engaged in the discovery and development of therapeutics for the treatment of rare diseases. The company was founded on July 22, 1980 and is headquartered in Cambridge, MA.

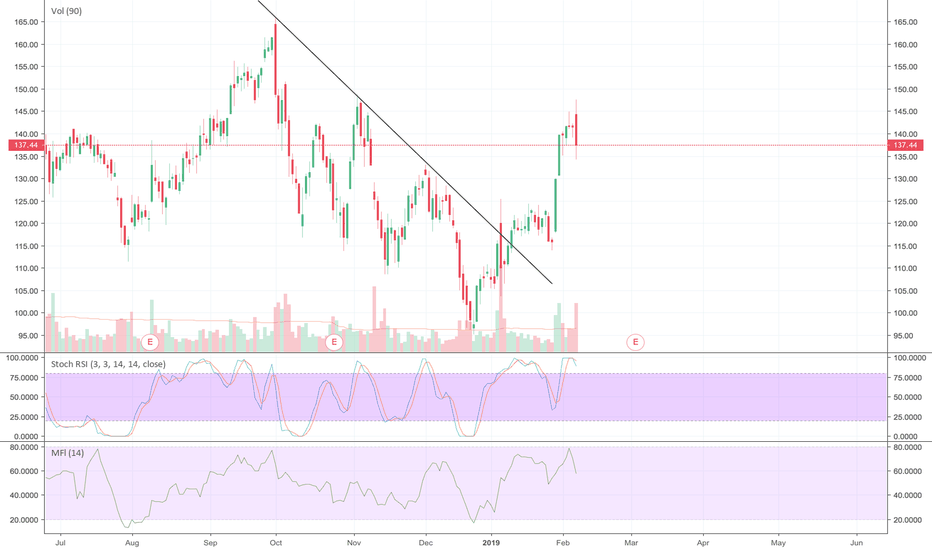

SRPT: Very close to bounce area (114.43)Strong name and see the chart. It has bounce unlimited amount of times from 0.236fib (114.43 ish). Wait for this to come down to this price or close to it. I am willing to play this name for earning run 100%.

I expect this to be near 140 by the time er comes in.

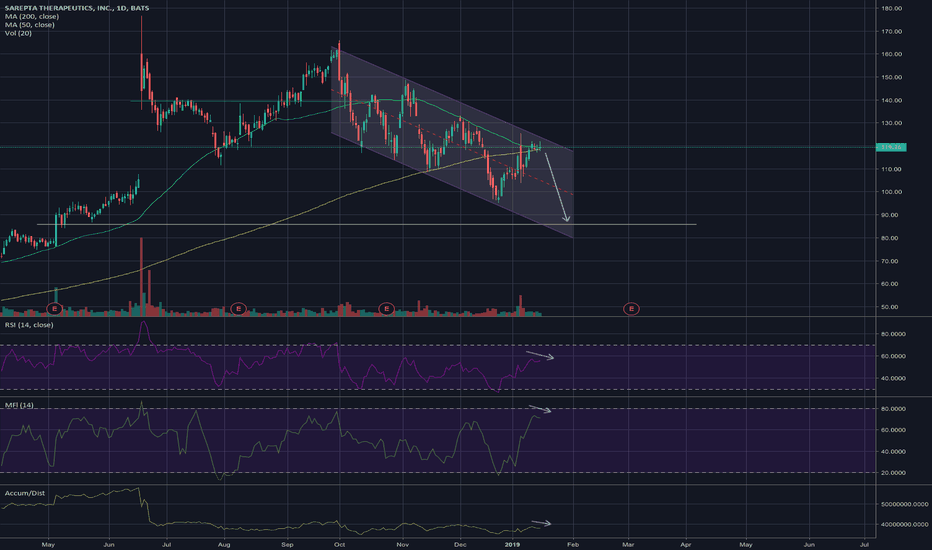

All kinds of sell signals...1) Local Adam & Eve top potential... or play it safe and wait for confirmation on a break of $110.58

2) Top of current downward channel

3) RSI, MFI, Accumulation bearish ALL diverging on the daily for the past several days

4) Broader markets ready for a correction

5) Death cross OTW on the daily chart

In other words... sell.