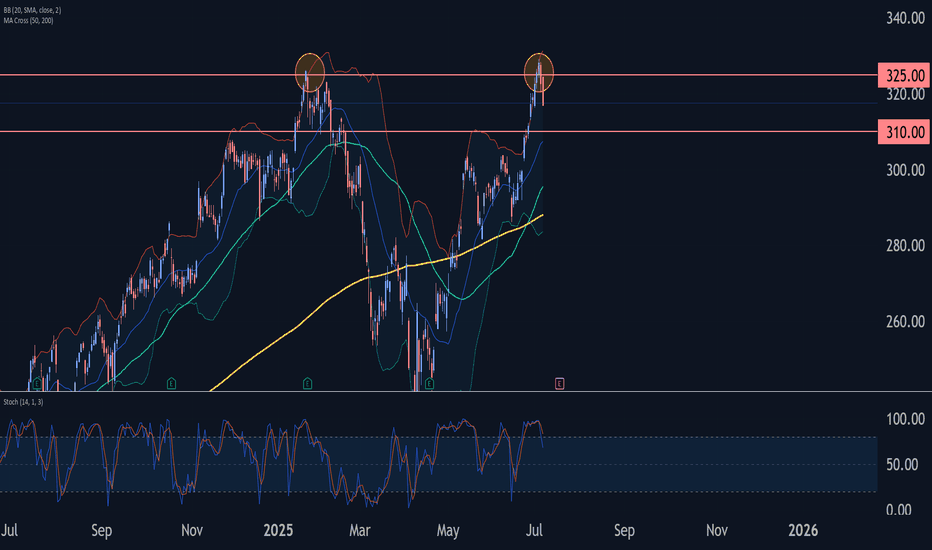

American Express Wave Analysis – 8 July 2025

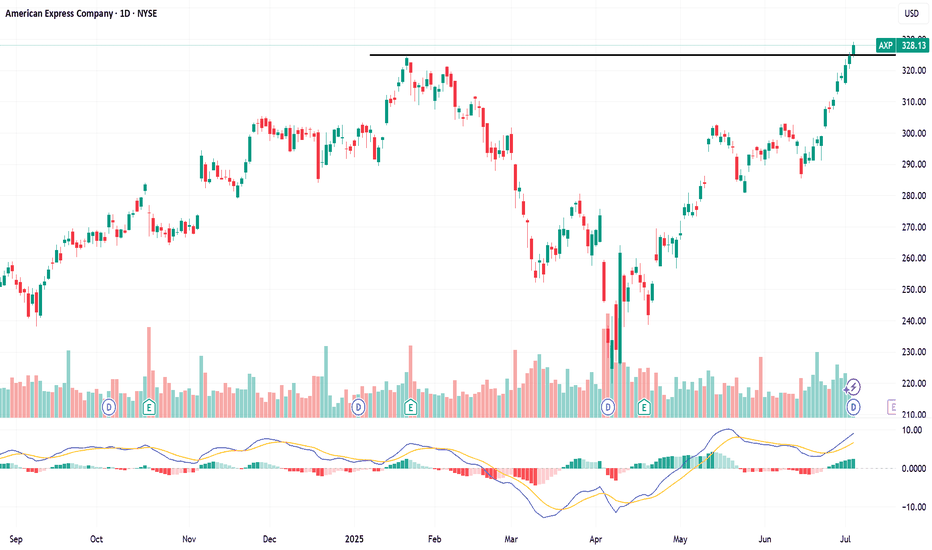

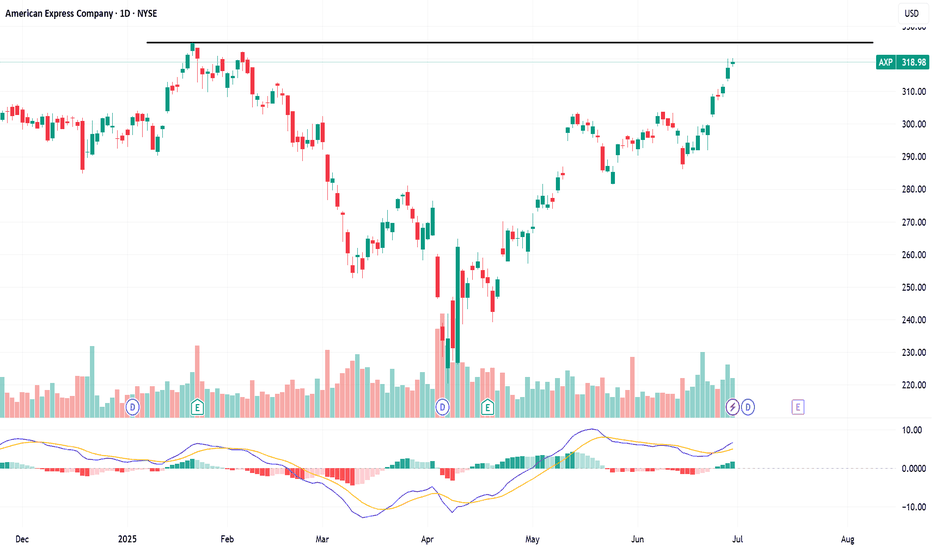

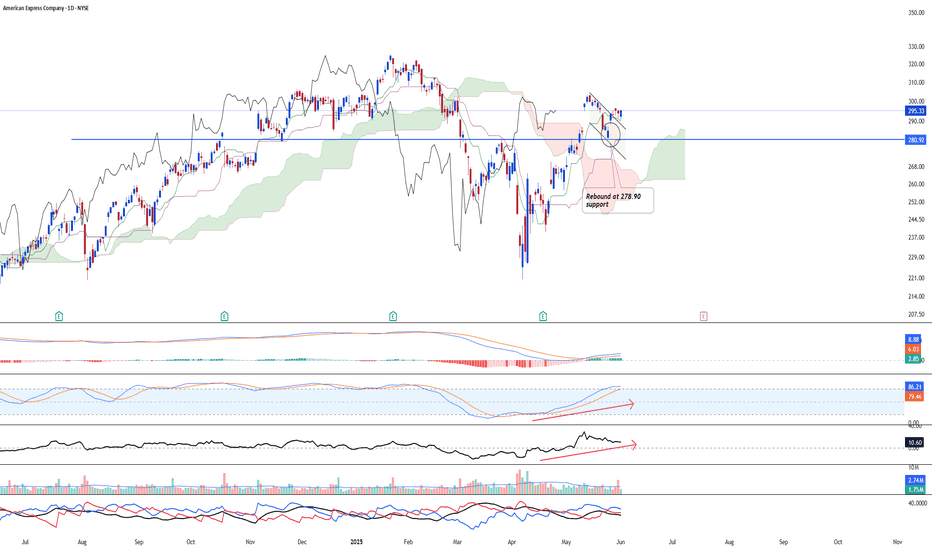

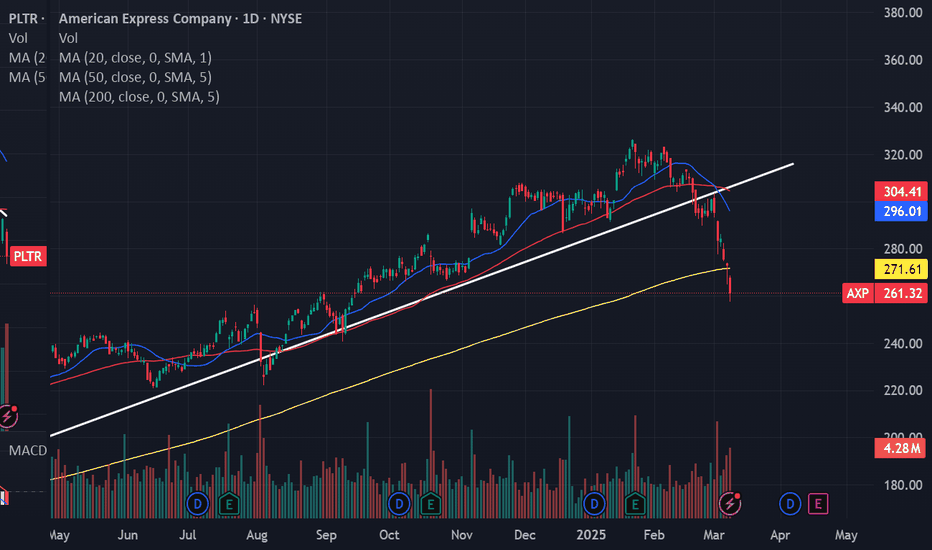

- American Express reversed from key resistance level 325.00

- Likely to fall to support level 310.00

American Express recently reversed from the resistance area between the key resistance level 325.00 (which stopped the sharp daily uptrend in January) and the upper daily Bollinger Band.

The down

Key facts today

RBC has raised its price target for American Express (AXP) from $310 to $360, while keeping an 'Outperform' rating.

American Express is scheduled to report its latest quarterly financial results later this week, alongside major companies including Netflix, Johnson & Johnson, and PepsiCo.

American Express has a separate agreement with the Reserve Bank of Australia, exempting it from the proposed interchange rules that seek to eliminate surcharges on most debit and credit card payments.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

12.690 CHF

9.13 B CHF

67.38 B CHF

699.45 M

About American Express Company

Sector

Industry

CEO

Stephen J. Squeri

Website

Headquarters

New York

Founded

1850

FIGI

BBG006M6Y340

American Express Co. engages in the provision of card-issuing, merchant-acquiring, and card network businesses. Its products and services include credit cards, business credit cards, corporate programs, gift cards, savings accounts and CDs, and the American Express App. It operates through the following segments: the United States Consumer Services (USCS), Commercial Services (CS), International Card Services (ICS), Global Merchant and Network Services (GMNS), and Corporate and Other. The USCS segment includes proprietary consumer cards and provides services to United States consumers. The CS segment offers corporate and small business cards and provides services to United States businesses. The ICS segment provides consumers, small businesses, and corporate cards outside the United States. The GMNS segment is involved in operating a global payments network that processes and settles card transactions, acquires merchants, and provides multi-channel marketing programs and capabilities, services and data analytics. The Corporate and Other segment covers corporate functions and certain other businesses and operations. It also operates through the following geographical segments: United States, EMEA, APAC, LACC, and Other. The EMEA segment represents Europe, the Middle East, and Africa. The APAC segment refers to Asia Pacific, Australia, and New Zealand. The LACC segment focuses on Latin America, Canada, and the Caribbean. The Other segment includes net costs which are not directly allocated to specific geographic regions. The company was founded by Henry Wells, William G. Fargo, and John Warren Butterfield on March 28, 1850 and is headquartered in New York, NY.

Related stocks

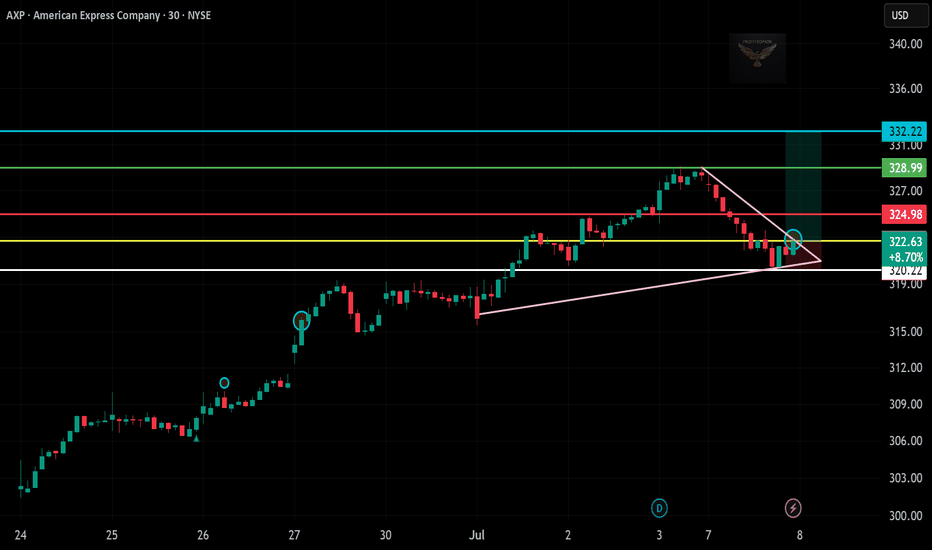

AXP Breakout Trade – Triangle Pattern Alert!🚨 🚨

American Express (AXP) has bounced perfectly off trendline support and is now breaking out of a descending triangle. Price action shows buyer strength stepping in near $320.22 with a clean breakout retest at $322.63.

📌 Trade Details:

🔹 Entry: $322.63 (breakout candle)

🔹 Stop Loss: $320.22 (be

Stock Watch: AXP (American Express Co.) 🚨

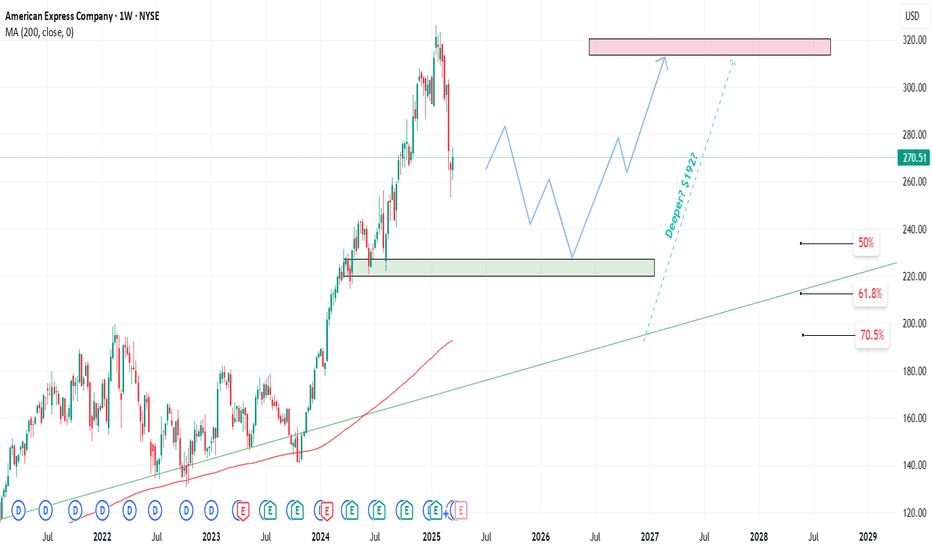

We're eyeing AXP for a strategic multi-entry swing trade based on strong technical structure and long-term potential. Here's the plan:

📌 Entry Points:

1️⃣ $248 – First touch on short-term support

2️⃣ $234 – Healthy correction zone

3️⃣ $219 – Strong base of demand

🔻 Deeper Load Zone: $195 – Long

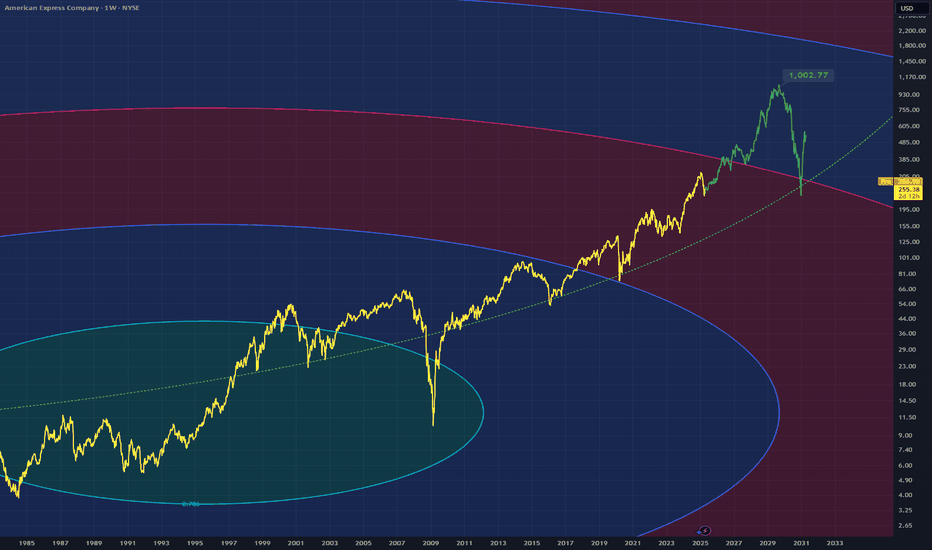

AXP - Parabolic CurvePlotting a parabolic curve that acts as a support along the fib circle

Price dumps along each of the circle lines just to recover along the curved dotted line comes into play

The next dump will be down to the pink line after we see the finishing of bull movement

Bullish idea on this weekly timeframe

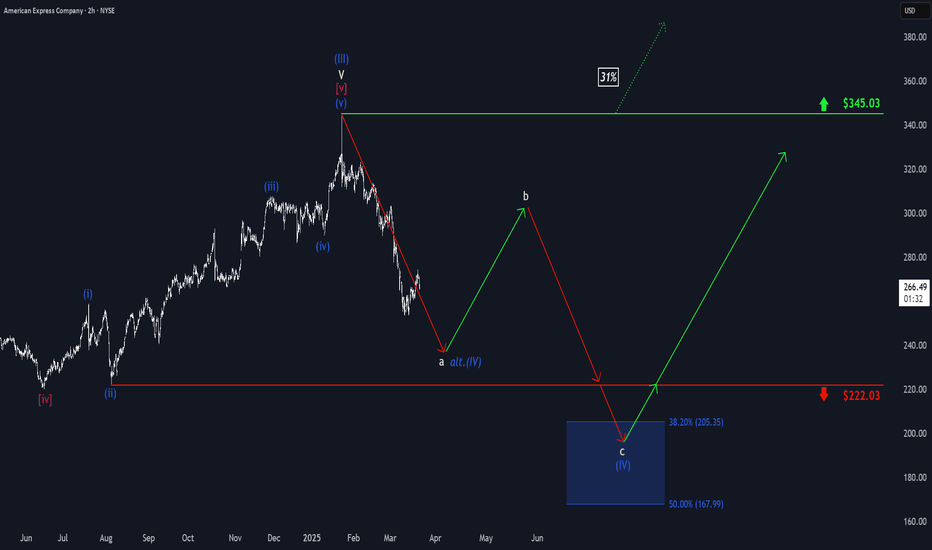

American Express: Room to Fall FurtherWhile it’s possible that we’ve already seen the low of the beige wave a, we’re not fully convinced. For now, we prepare for another potential decline toward the support at $222.03. That said, the stock should reverse well above this level and begin to rise again as part of the beige wave b, which sh

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US25816BF5

AMER. EXPRESS 2042Yield to maturity

6.08%

Maturity date

Dec 3, 2042

US25816DL0

AMER.EXPRESS 23/26 FLRYield to maturity

5.97%

Maturity date

Oct 30, 2026

US25816DD8

AMER.EXPRESS 23/26 FLRYield to maturity

5.49%

Maturity date

Feb 13, 2026

AXP5797774

American Express Company 5.915% 25-APR-2035Yield to maturity

5.39%

Maturity date

Apr 25, 2035

AXP5991979

American Express Company FRN 30-JAN-2031Yield to maturity

5.34%

Maturity date

Jan 30, 2031

AXP5991980

American Express Company 5.442% 30-JAN-2036Yield to maturity

5.34%

Maturity date

Jan 30, 2036

AXP5674402

American Express Company FRN 30-OCT-2026Yield to maturity

5.32%

Maturity date

Oct 30, 2026

AXP6059330

American Express Company 5.667% 25-APR-2036Yield to maturity

5.31%

Maturity date

Apr 25, 2036

AXP5855583

American Express Company 5.284% 26-JUL-2035Yield to maturity

5.26%

Maturity date

Jul 26, 2035

AXP5624111

American Express Company 5.625% 28-JUL-2034Yield to maturity

5.24%

Maturity date

Jul 28, 2034

AXP6059331

American Express Company FRN 25-APR-2029Yield to maturity

5.24%

Maturity date

Apr 25, 2029

See all AEC1 bonds

Curated watchlists where AEC1 is featured.

Frequently Asked Questions

The current price of AEC1 is 250.938 CHF — it has decreased by −3.42% in the past 24 hours. Watch AMER EXPRESS CO stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange AMER EXPRESS CO stocks are traded under the ticker AEC1.

AEC1 stock has fallen by −0.98% compared to the previous week, the month change is a 2.78% rise, over the last year AMER EXPRESS CO has showed a 18.83% increase.

We've gathered analysts' opinions on AMER EXPRESS CO future price: according to them, AEC1 price has a max estimate of 295.59 CHF and a min estimate of 191.22 CHF. Watch AEC1 chart and read a more detailed AMER EXPRESS CO stock forecast: see what analysts think of AMER EXPRESS CO and suggest that you do with its stocks.

AEC1 reached its all-time high on Jan 24, 2025 with the price of 295.383 CHF, and its all-time low was 0 CHF and was reached on Jun 25, 2021. View more price dynamics on AEC1 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

AEC1 stock is 3.54% volatile and has beta coefficient of 1.34. Track AMER EXPRESS CO stock price on the chart and check out the list of the most volatile stocks — is AMER EXPRESS CO there?

Today AMER EXPRESS CO has the market capitalization of 178.61 B, it has decreased by −2.31% over the last week.

Yes, you can track AMER EXPRESS CO financials in yearly and quarterly reports right on TradingView.

AMER EXPRESS CO is going to release the next earnings report on Jul 18, 2025. Keep track of upcoming events with our Earnings Calendar.

AEC1 earnings for the last quarter are 3.22 CHF per share, whereas the estimation was 3.07 CHF resulting in a 4.82% surprise. The estimated earnings for the next quarter are 3.08 CHF per share. See more details about AMER EXPRESS CO earnings.

AMER EXPRESS CO revenue for the last quarter amounts to 15.02 B CHF, despite the estimated figure of 15.00 B CHF. In the next quarter, revenue is expected to reach 14.05 B CHF.

AEC1 net income for the last quarter is 2.27 B CHF, while the quarter before that showed 1.96 B CHF of net income which accounts for 16.17% change. Track more AMER EXPRESS CO financial stats to get the full picture.

Yes, AEC1 dividends are paid quarterly. The last dividend per share was 0.65 CHF. As of today, Dividend Yield (TTM)% is 0.91%. Tracking AMER EXPRESS CO dividends might help you take more informed decisions.

AMER EXPRESS CO dividend yield was 0.94% in 2024, and payout ratio reached 19.97%. The year before the numbers were 1.28% and 21.41% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 15, 2025, the company has 75.1 K employees. See our rating of the largest employees — is AMER EXPRESS CO on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. AMER EXPRESS CO EBITDA is 19.42 B CHF, and current EBITDA margin is 29.52%. See more stats in AMER EXPRESS CO financial statements.

Like other stocks, AEC1 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade AMER EXPRESS CO stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So AMER EXPRESS CO technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating AMER EXPRESS CO stock shows the buy signal. See more of AMER EXPRESS CO technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.