B trade ideas

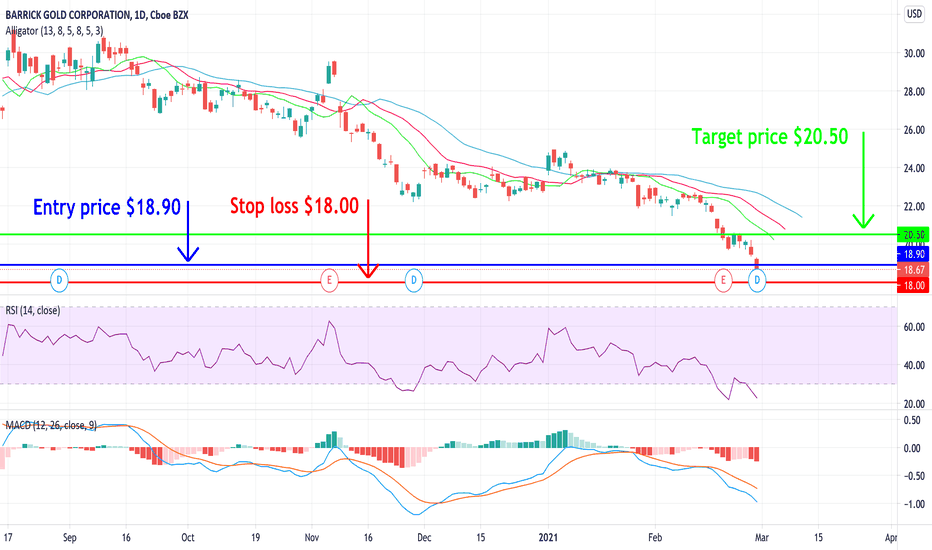

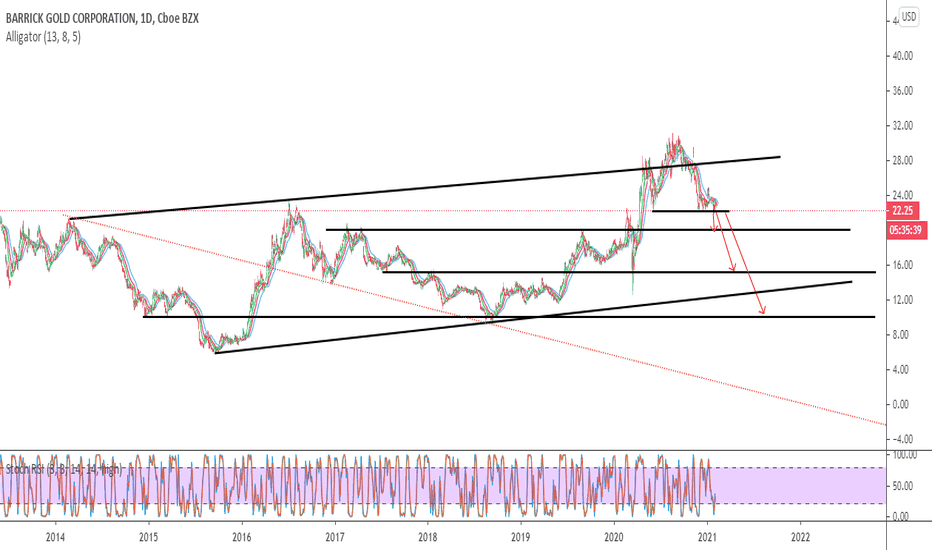

GOLD LongWilliams Alligator Indicator shows the lips, teeth and jaw lines moving downwards and further away from each other, indicating GOLD is in a downtrend and experiencing bearish momentum.

RSI shows that GOLD is oversold, therefore, it might be prime for a trend reversal or price correction.

MACD line is under the signal line, and both of them are under the baseline, indicating that GOLD is in a downtrend and experiencing bearish momentum.

Overview: Overall, all indicators suggest that GOLD is in a strong bearish trend. Due to that, the RSI suggests that it might be prime for a bullish trend reversal, or price correction. It is best to hold trade for a short period and be cautious with timing as it only aims to profit from the correction, and therefore, a long position is recommended. Entry price should be set slightly higher than current price for assurance, and stop loss should be set at about -5%.

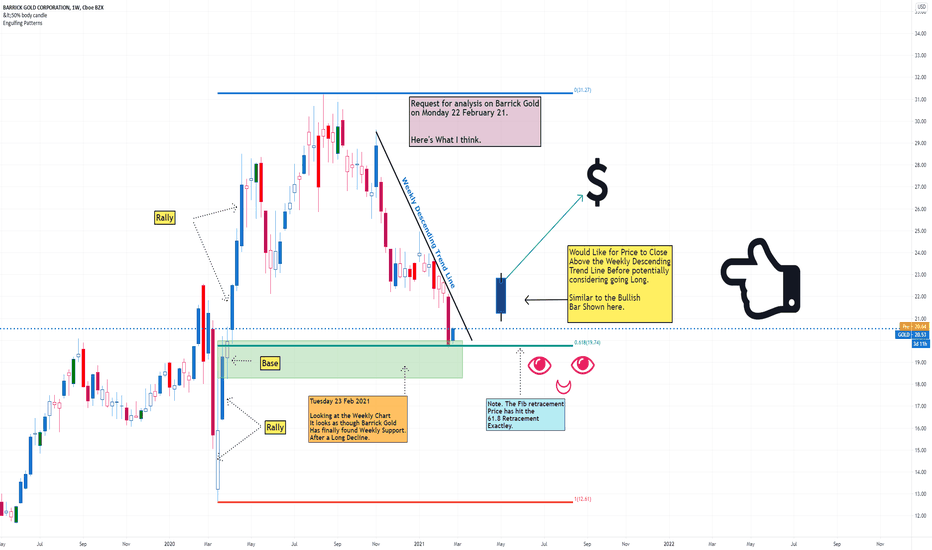

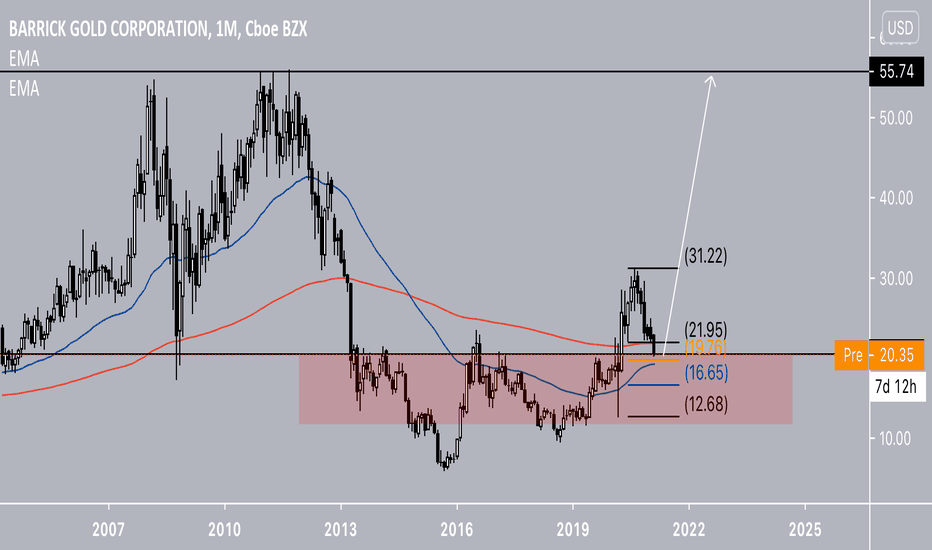

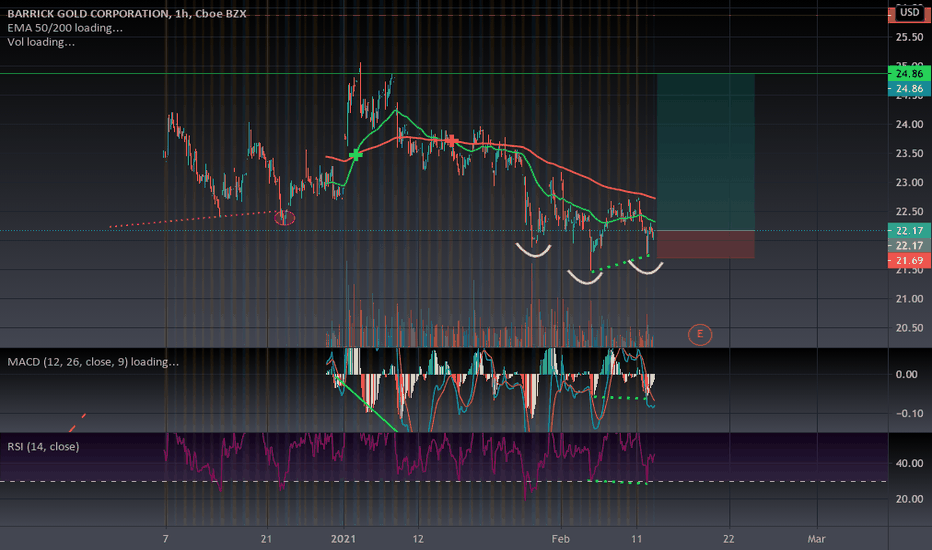

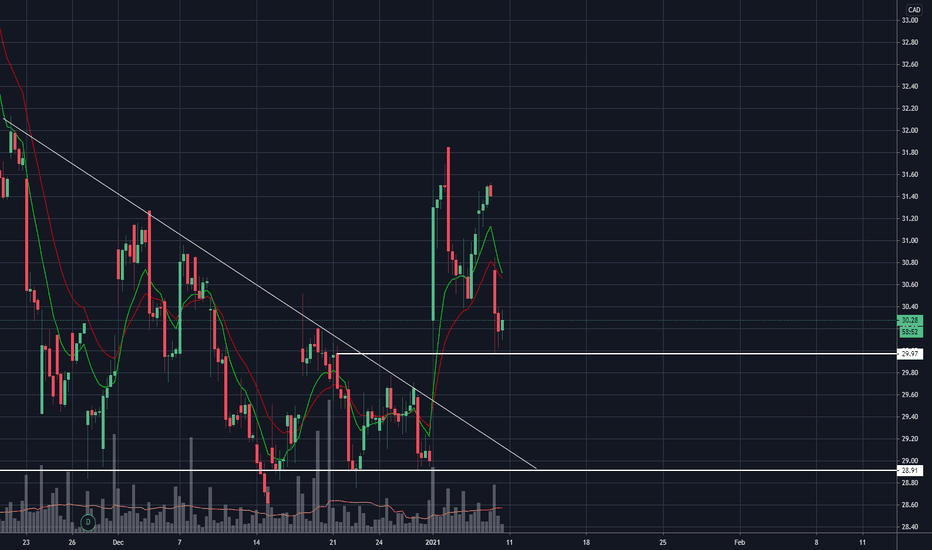

BARRICK GOLD CORPORATION. Potential Long Opportunity.NYSE:GOLD

Request for analysis on Barrick Gold

on Monday 22 February 21.

Here's What I think.

Tuesday 23 Feb 2021

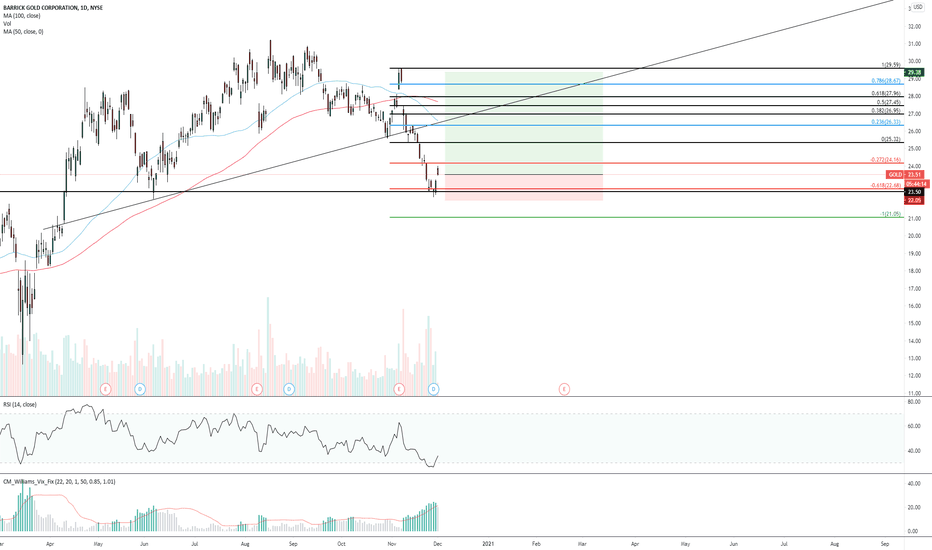

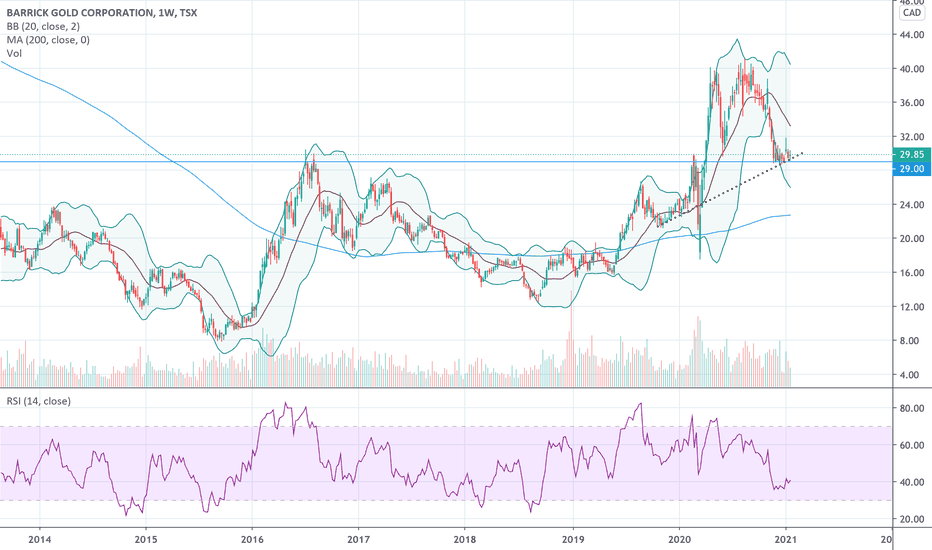

Looking at the Weekly Chart

It looks as though Barrick Gold

Has finally found Weekly Support.

After a Long Decline.

Note. The Fib retracement Price has hit the 61.8 Retracement Exactly.

Would Like for Price to Close

Above the Weekly Descending

Trend Line Before potentially

considering going Long.

Similar to the Bullish

Bar Shown on the Chart.

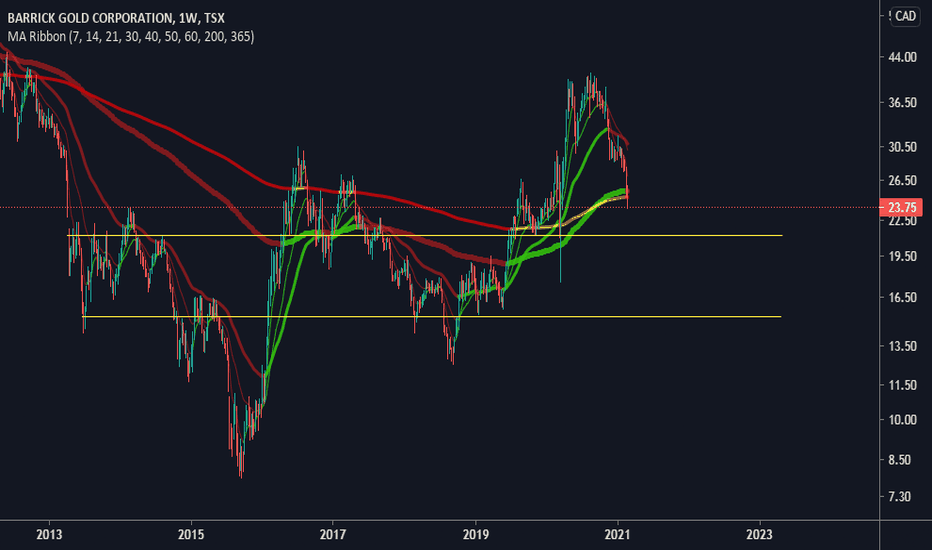

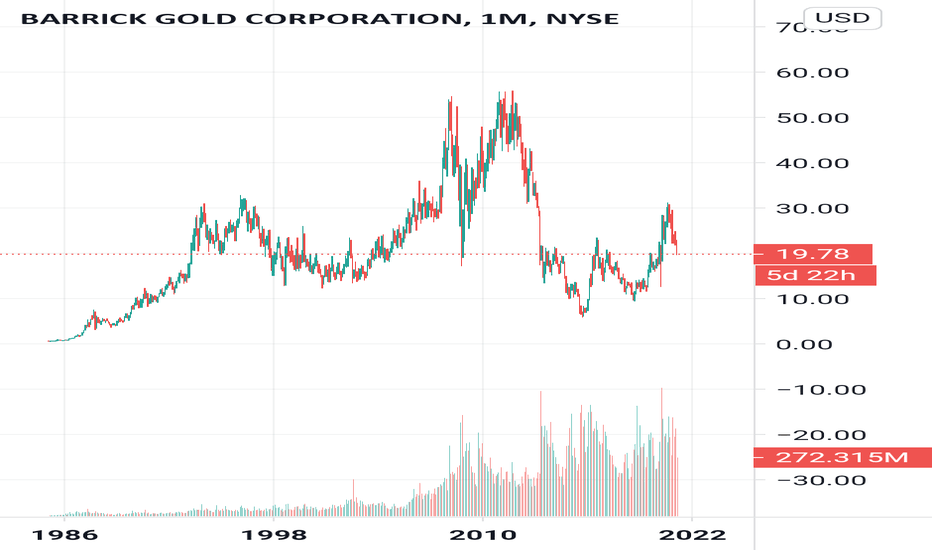

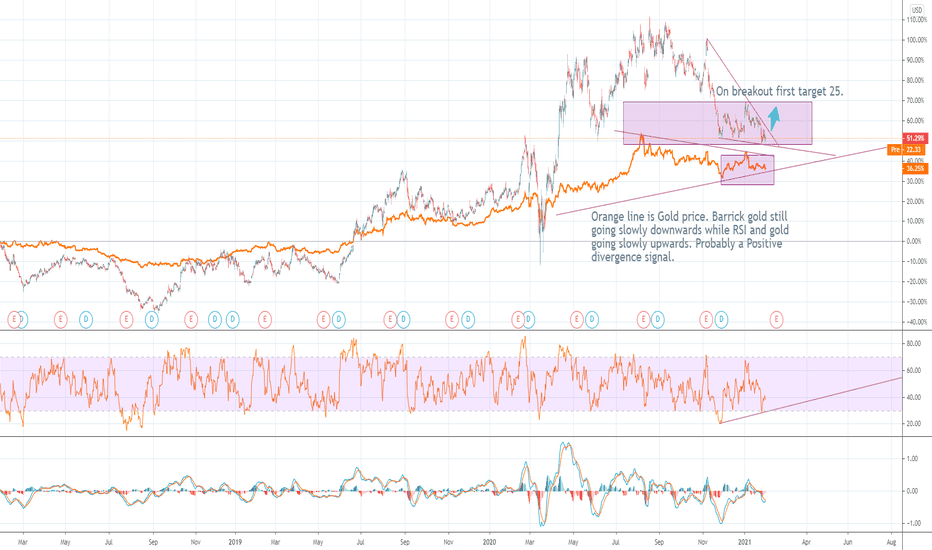

Can Barrick Gold make now the turnaround?Gold was on the pressure in 2020 and maybe now be cheap. Barrick gold has a good standing and may be benifical on current price to be a buy.

All depends for sure on the gold price, which is currently under pressure. But silver and platin are already on it way up, also copper is in a massiv uptrend.

Possible wins possible, if gold price lags behind the trend.

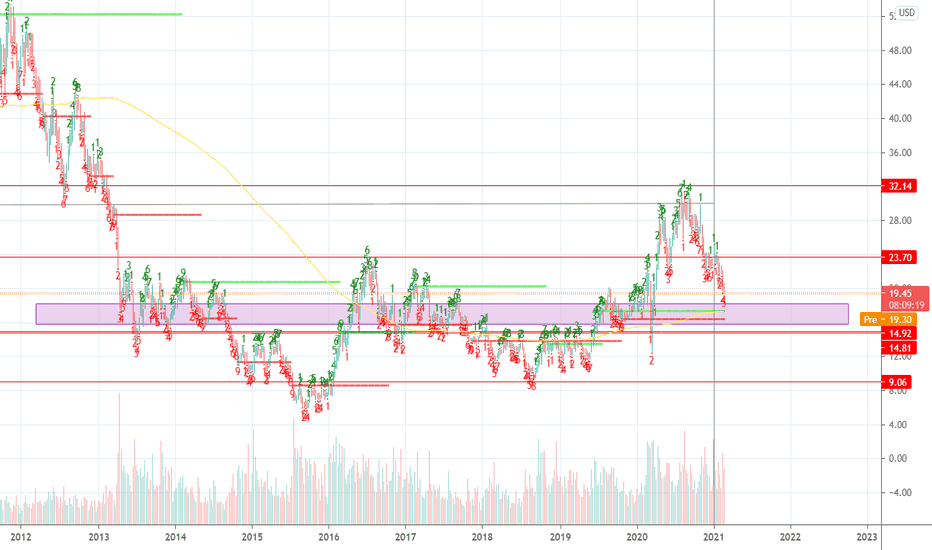

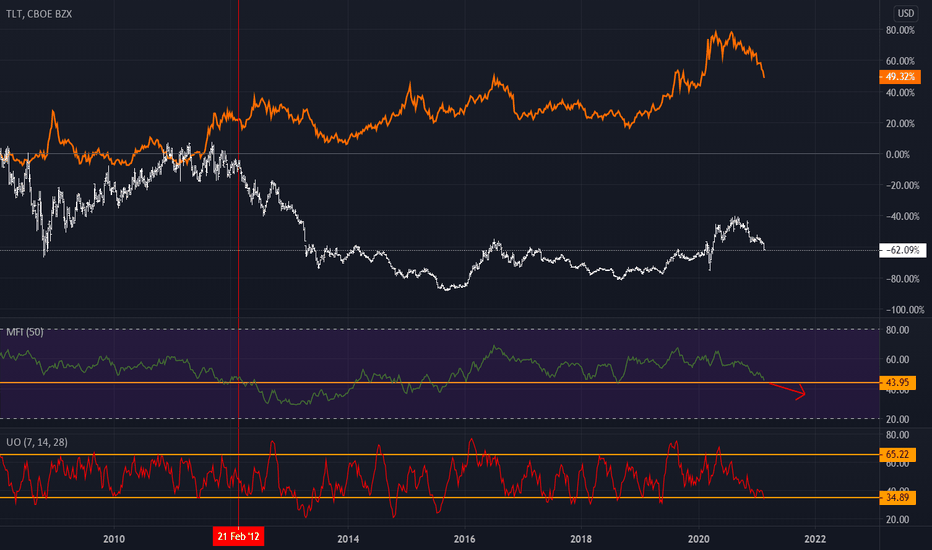

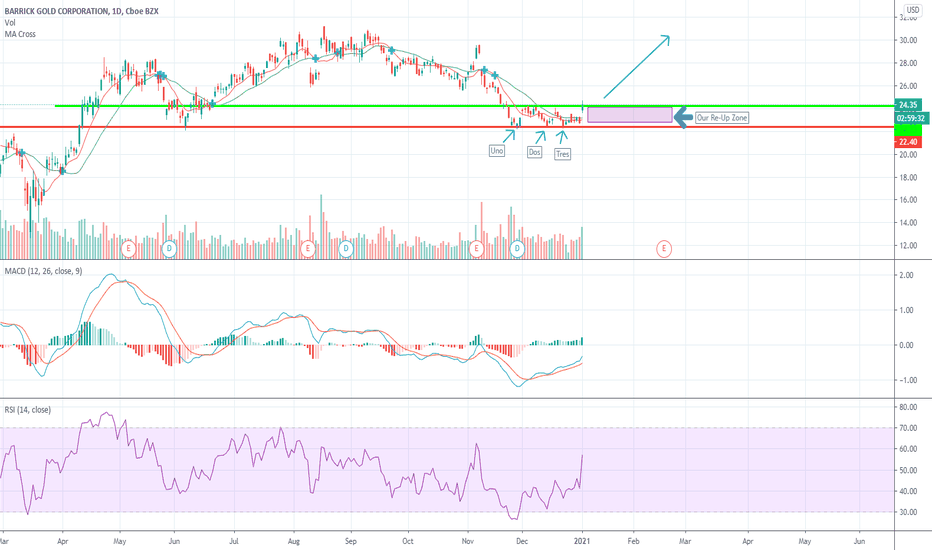

Gold Miners Smoked - Remember 2011, don't be a bag holderRising rates on the long-end are bad for gold and gold miners.

If you want to make MONEY stay long copper and nickel miners (FCX, VALE, BHP, etc.). Also heavily long energy and financials.

Don't get stuck with Peter Schiff, you will regret it.

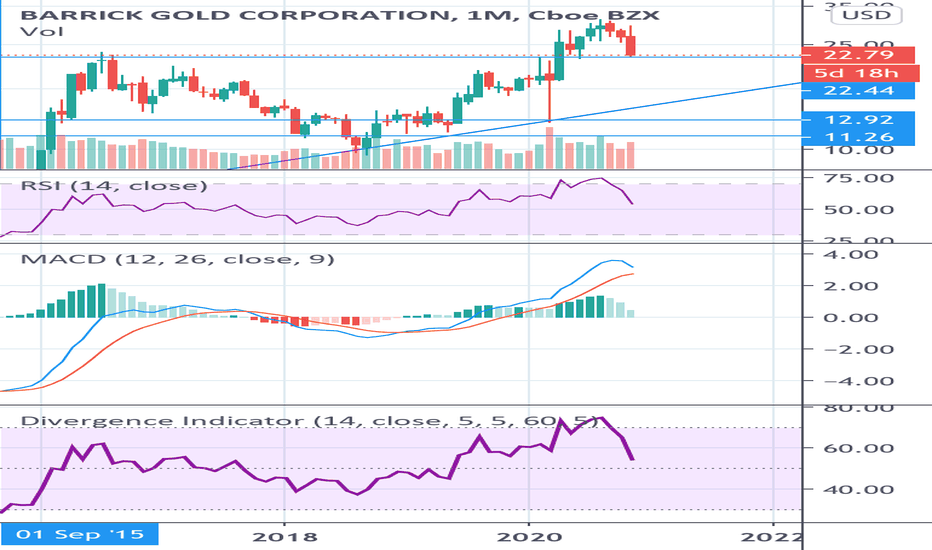

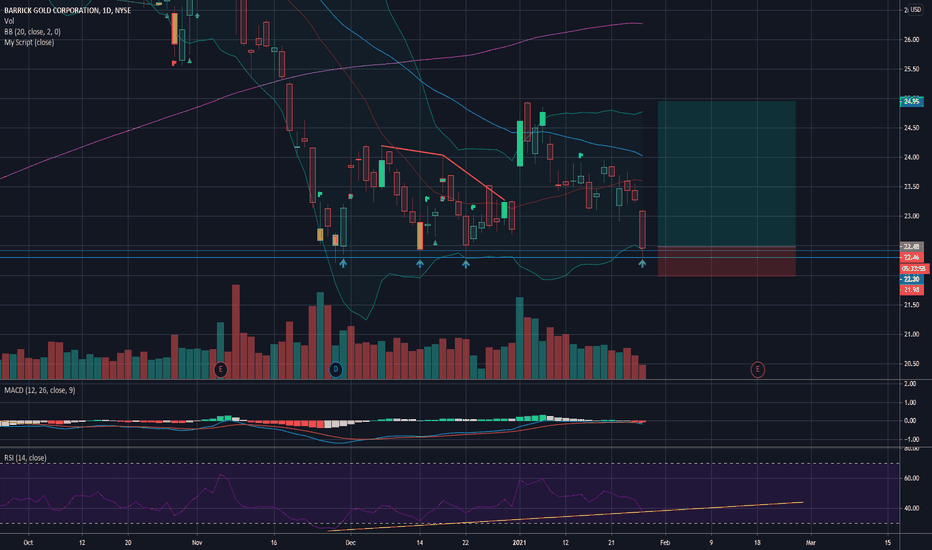

Barrick Gold is oversold but does not look goodBarrick Gold has dropped a lot recently and could be due for a bounce soon. But the monthly chart of this stock doesn't look good at all. The most recent rise looks like a corrective rebound and eventually more downside coukd be in play.

Big money moving out of big cap gold stocks into Bitcoin ? It might be part of the explanation...

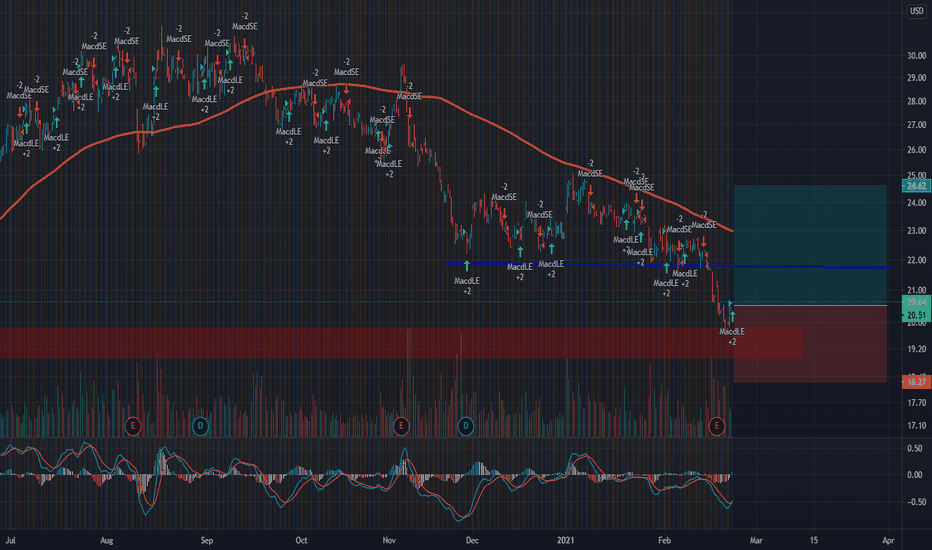

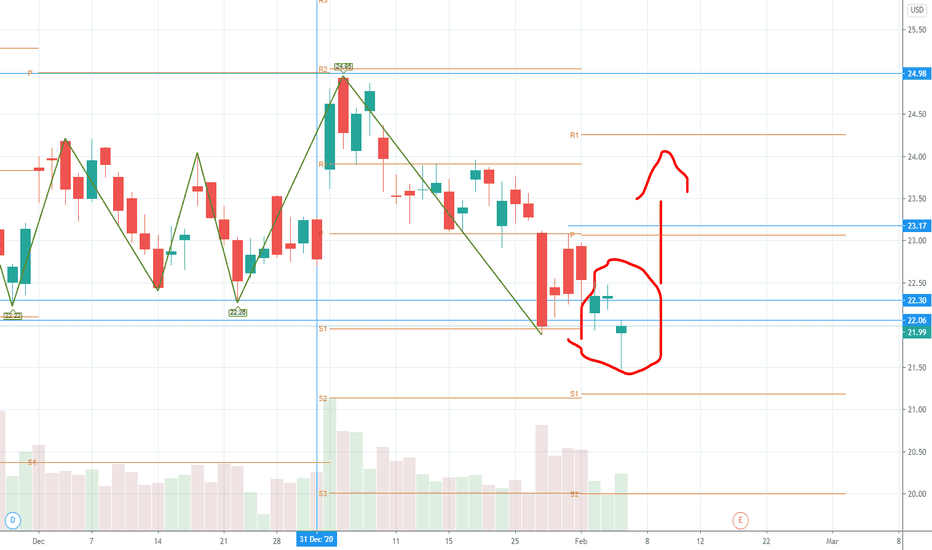

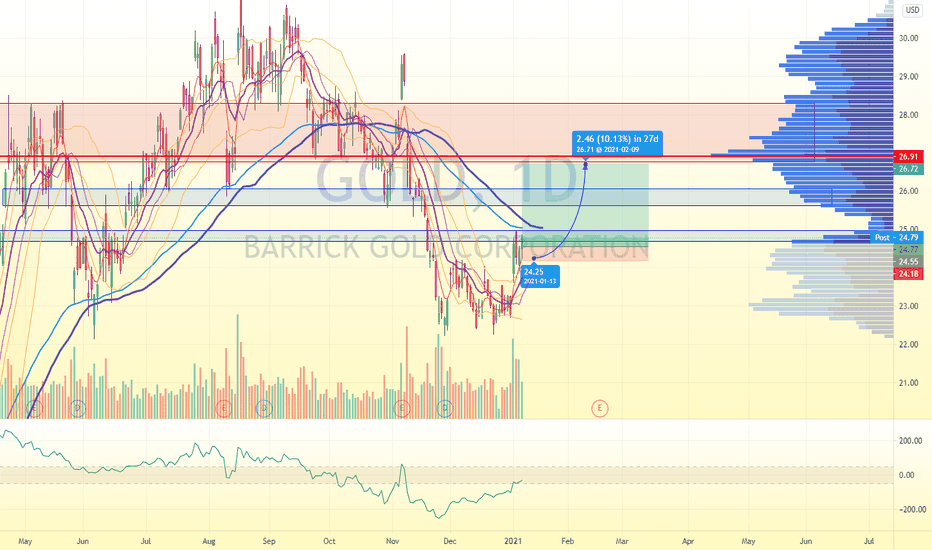

GOLD 01-12-2020 LongAsset and Time frame -GOLD,Daily&4H

Entry Price - 23.5699

Exit(Stop Loss) -22.05

Exit(Take Profit) -29.38

Technical Analysis - Price broke daily confirmed trend line and made an ABCD pattern on the daily Fibonacci -61.8 level, also we are sitting on a very strong support line

What can be improved & Conclusion & End of Trade -

LONG Barrick GOLDCurrently testing the previous horizontal resistance line of the monthly ascending triangle, now as a support line, which I posted about earlier this year. Opening a long position here.hidden bullish divergence also printing on the monthly. However the RSI is more useful on lower timeframes.

Barrick Gold with potential 100% upside in 2021 Barrick Gold is way oversold and appears to have nice support in the $29-30 range. Daily & weekly RSI in the 40s/30s and trending upward, along with ascending 200 dma on the weekly which we're well above.

I believe this will be the start of a year long uptrend IF volume appears soon and we can keep closing above ~$29. In order for this to happen, the gold chart cannot break down in the short term. We need to stay above $1800 for sure, and $1867 ideally.

People are extremely cautious with gold right now... why buy it when everything else is going up and the JPM riggers and central banks are hard at work keeping gold down?

But we're at a precarious point in time with Covid-19, all this money printing, disinformation and speculation/greed at recent or all time highs... and people know this. People know that gold is going to go up; theres just no rush to be in it... until there is.

Gold looks to me like its nearing a major breakout toward all time highs. I am fairly confident that it will happen this calendar year, and when it does, Barrick will rip through $40 and approach all-time highs in short order.

Recent copper price appreciation will also help reduce their costs significantly. They produce a lot of copper.

Long from $29.50. Stop Loss at $28.20.

Cheers

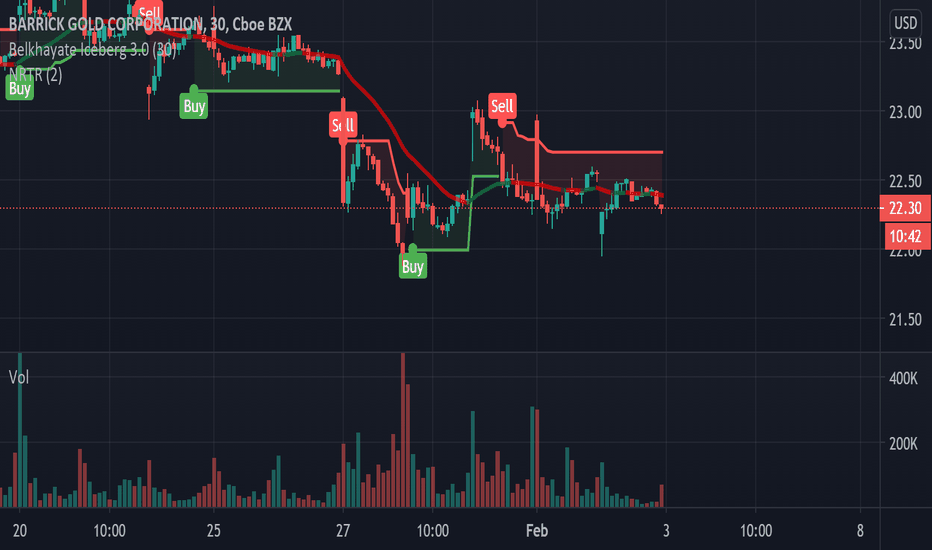

Swing Trade: Barrick Gold Corp.(GOLD) breakout setup 📈Hi fellows, just one of my today swingtrades:

Nice setup for breakout .

------------------------Trade setup ---------------------------

Entry: 24,80

Stop Loss: 23,83

Profit target: 27.73

Time stop: 5 days

------------------------------------------------------------------

If you like the idea, do not forget to support with a 👍 like and follow.

Leave a comment that is helpful or encouraging. Let's master the markets together.