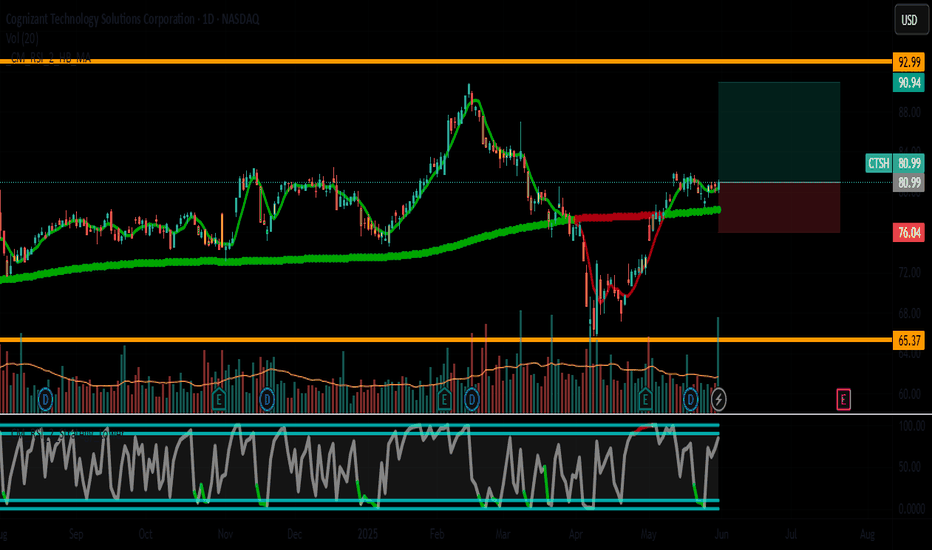

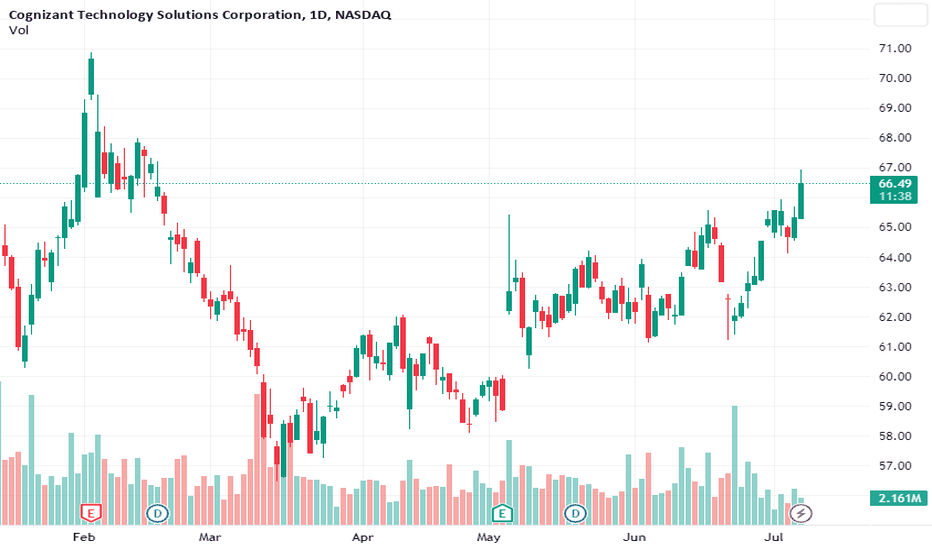

CTSH – Buy on Uptrend (Stability + Momentum) - LONGAnalysis:

Fundamental:

Moderate growth, fair ratios (P/E 16.97).

Low debt (Score 10).

Technical:

Daily trend: Bullish, 20-SMA ($79.83) as support.

RSI: 62.07 (positive momentum).

MACD: Recent bullish crossover.

Trade:

Entry: $81.00 (pullback) or $83.00 (breakout).

Stop Loss: $76.00 (below

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

4.211 CHF

2.03 B CHF

17.92 B CHF

490.86 M

About Cognizant Technology Solutions Corporation

Sector

Industry

CEO

Ravi Kumar Singisetti

Website

Headquarters

Teaneck

Founded

1988

FIGI

BBG006TLNVQ6

Cognizant Technology Solutions Corp. engages in providing information technology, consulting, and business process outsourcing services. Its services include application services, artificial intelligence, business process services, cloud solutions, and core modernization. It operates through the following segments: Financial Services (FS), Healthcare Sciences (HS), Products and Resources (P and R), and Communications, Media, and Technology (CMT). The FS segment focuses on banking and insurance services. The HS segment is involved in healthcare and life sciences. The P and R segment includes retail and consumer goods. The CMT segment relates to communications, information, media and entertainment, and technology. The company was founded by Wijeyaraj Kumar Mahadeva and Francisco D'Souza on April 6, 1988 and is headquartered in Teaneck, NJ.

Related stocks

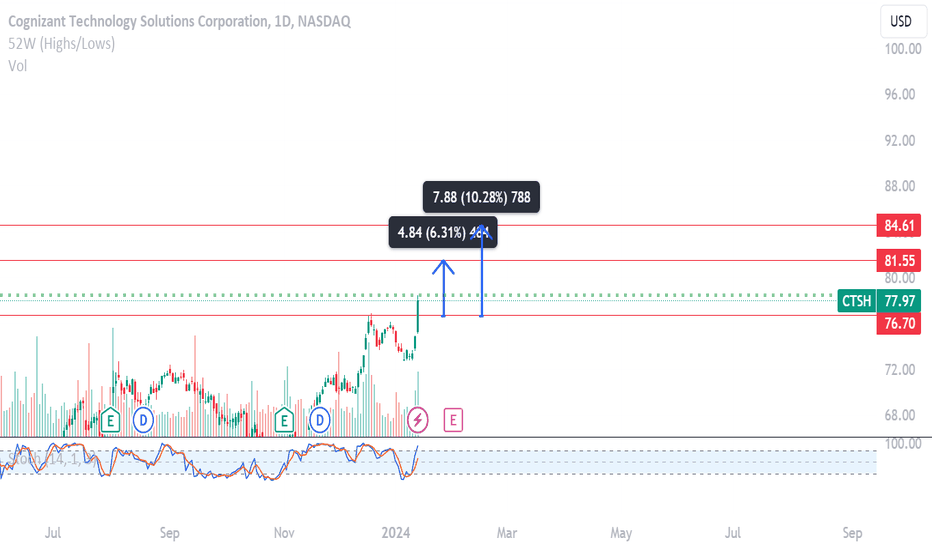

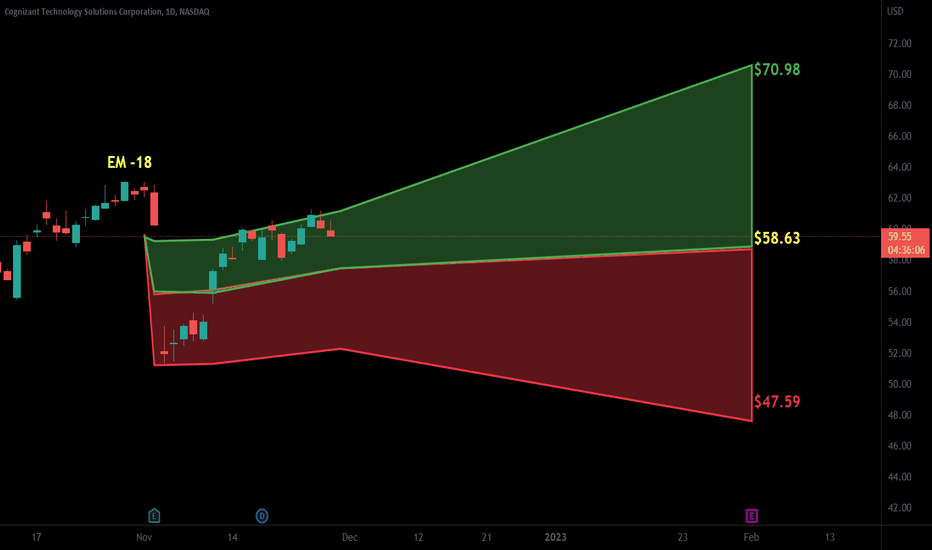

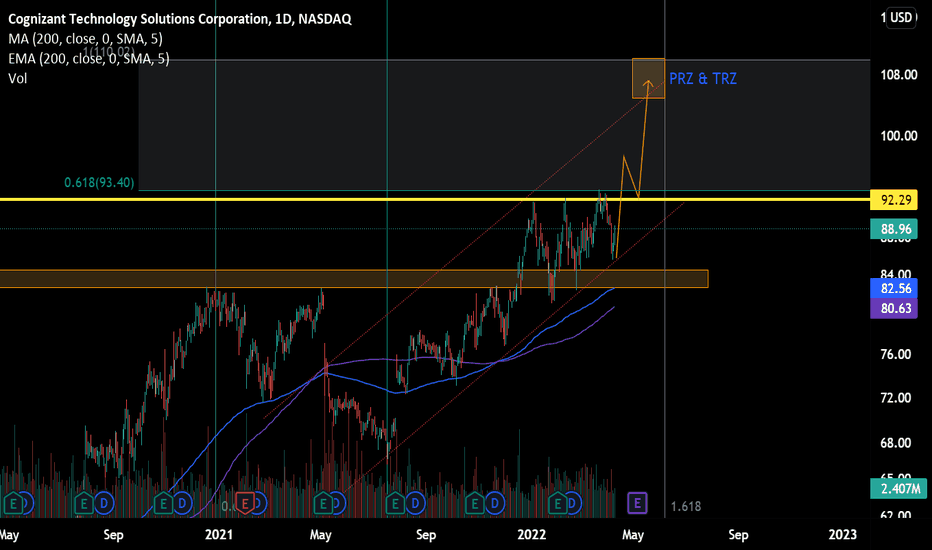

$CTSH Break a key levelTrading is simple. so don’t make it complicated.

everything is on the chart.

around 6% for first target and 16% for second target.

the most important :

1. At the moment we are in a very fast ascending sequence. Wait for a few red days to give confidence to the trade.

2.In the breakout we would like

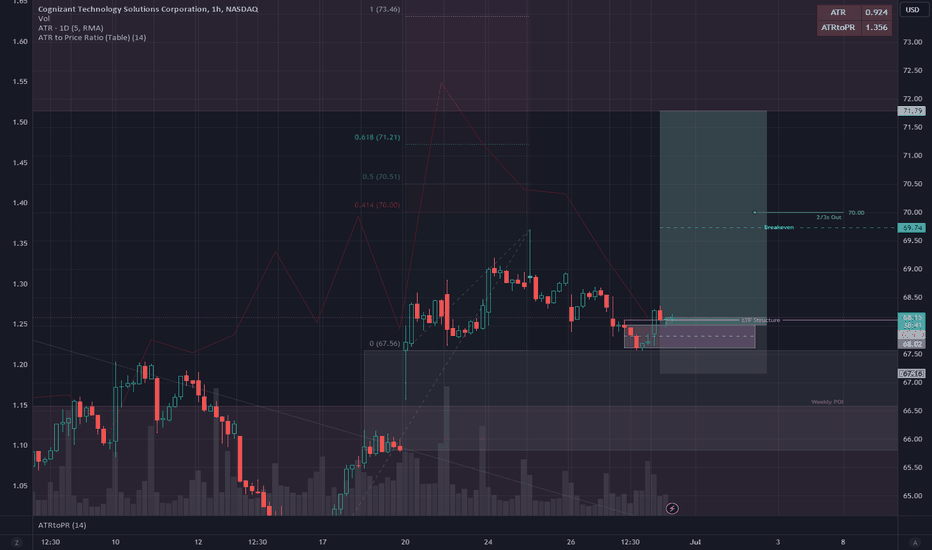

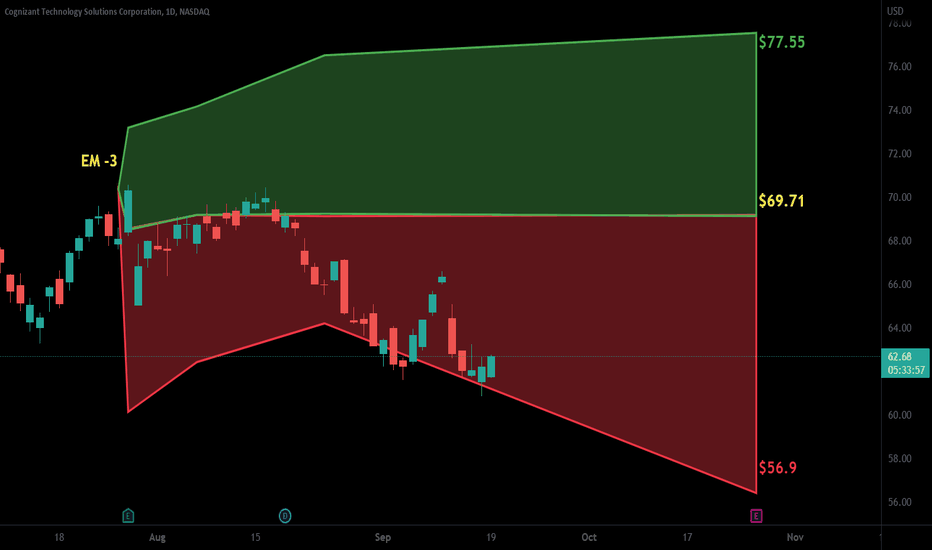

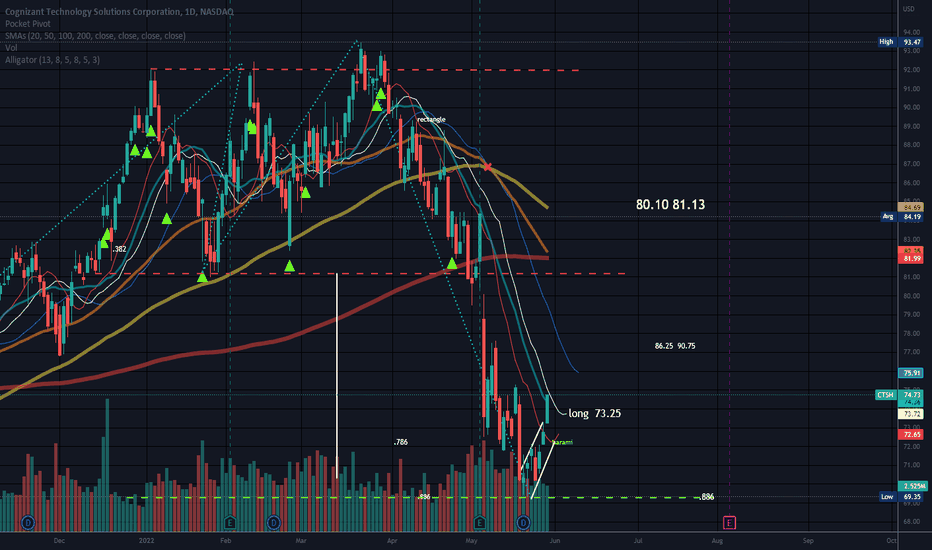

Short Term LongStrong stock with good fundamentals. Long/73.30.

Not super volatile.

I just not sure how far anything will go right now but until QQQ and SPY hit the targets for last leg up of their W patterns there is no way to know.

For harmonic patterns, the .886 is very common for the last leg to hit if it is

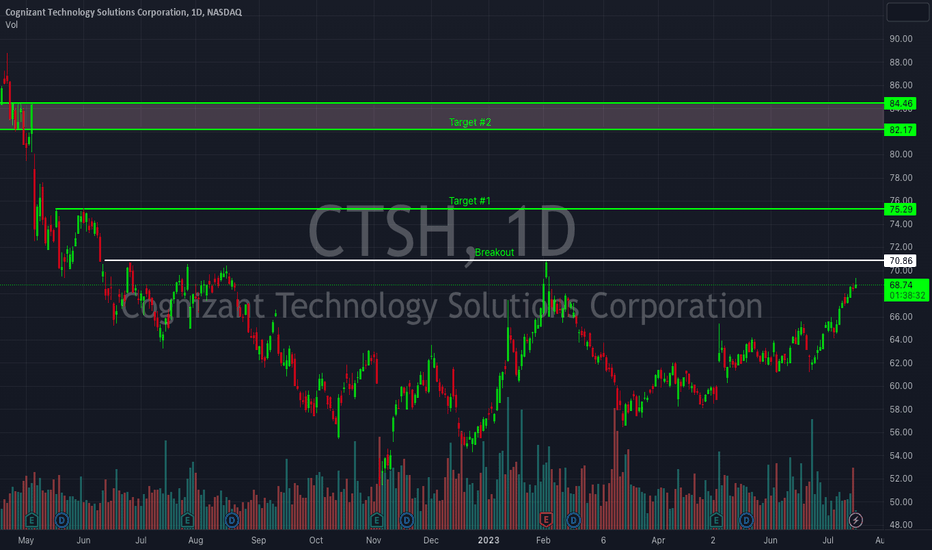

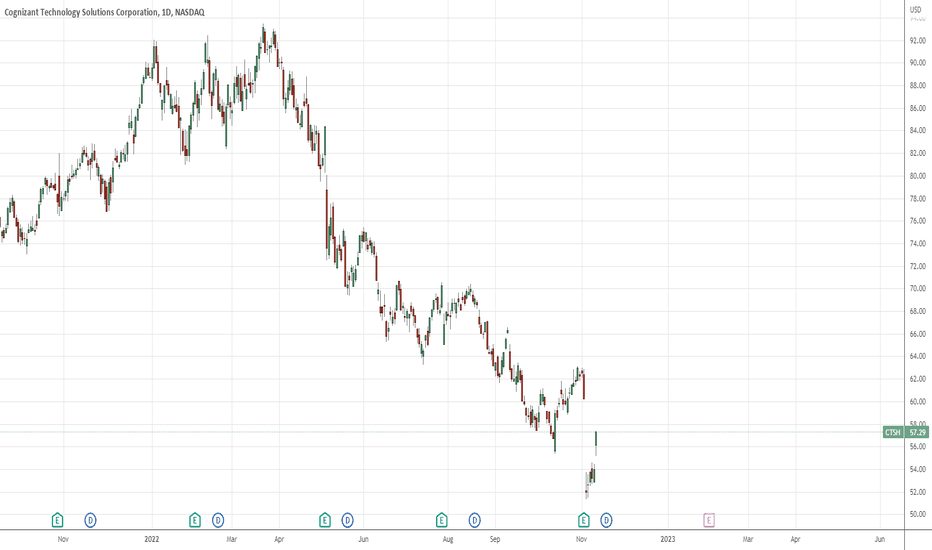

CTSH - Trigger is activated for a Long!The long-term previous top of NASDAQ:CTSH has been broken in December 2021. Since then, this stock has been doing a nice pullback to the broken zone, which I expect to be acted as the new support line of the chart. During January, February and April 2022, the price retouched this support line, and

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of COZ is 59.678 CHF — it has decreased by −7.24% in the past 24 hours. Watch COGNIZANT TECHNOLO stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange COGNIZANT TECHNOLO stocks are traded under the ticker COZ.

COZ stock has fallen by −7.24% compared to the previous week, the month change is a −7.24% fall, over the last year COGNIZANT TECHNOLO has showed a −7.24% decrease.

We've gathered analysts' opinions on COGNIZANT TECHNOLO future price: according to them, COZ price has a max estimate of 82.70 CHF and a min estimate of 64.23 CHF. Watch COZ chart and read a more detailed COGNIZANT TECHNOLO stock forecast: see what analysts think of COGNIZANT TECHNOLO and suggest that you do with its stocks.

COZ stock is 7.80% volatile and has beta coefficient of 0.90. Track COGNIZANT TECHNOLO stock price on the chart and check out the list of the most volatile stocks — is COGNIZANT TECHNOLO there?

Today COGNIZANT TECHNOLO has the market capitalization of 29.56 B, it has increased by 0.93% over the last week.

Yes, you can track COGNIZANT TECHNOLO financials in yearly and quarterly reports right on TradingView.

COGNIZANT TECHNOLO is going to release the next earnings report on Jul 30, 2025. Keep track of upcoming events with our Earnings Calendar.

COZ earnings for the last quarter are 1.09 CHF per share, whereas the estimation was 1.06 CHF resulting in a 2.53% surprise. The estimated earnings for the next quarter are 1.00 CHF per share. See more details about COGNIZANT TECHNOLO earnings.

COGNIZANT TECHNOLO revenue for the last quarter amounts to 4.53 B CHF, despite the estimated figure of 4.48 B CHF. In the next quarter, revenue is expected to reach 4.11 B CHF.

COZ net income for the last quarter is 586.92 M CHF, while the quarter before that showed 495.88 M CHF of net income which accounts for 18.36% change. Track more COGNIZANT TECHNOLO financial stats to get the full picture.

Yes, COZ dividends are paid quarterly. The last dividend per share was 0.26 CHF. As of today, Dividend Yield (TTM)% is 1.63%. Tracking COGNIZANT TECHNOLO dividends might help you take more informed decisions.

COGNIZANT TECHNOLO dividend yield was 1.56% in 2024, and payout ratio reached 26.63%. The year before the numbers were 1.54% and 27.55% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 17, 2025, the company has 336.8 K employees. See our rating of the largest employees — is COGNIZANT TECHNOLO on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. COGNIZANT TECHNOLO EBITDA is 3.21 B CHF, and current EBITDA margin is 17.95%. See more stats in COGNIZANT TECHNOLO financial statements.

Like other stocks, COZ shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade COGNIZANT TECHNOLO stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So COGNIZANT TECHNOLO technincal analysis shows the strong sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating COGNIZANT TECHNOLO stock shows the strong sell signal. See more of COGNIZANT TECHNOLO technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.