Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

3.414 CHF

403.32 M CHF

922.12 M CHF

121.86 M

About Halozyme Therapeutics, Inc.

Sector

Industry

CEO

Helen I. Torley

Website

Headquarters

San Diego

Founded

1998

FIGI

BBG00LVDJMV7

Halozyme Therapeutics, Inc. is a biopharmaceutical technology platform company. It engages in developing, manufacturing, and commercializing drug-device combination products using advanced auto-injector technology that are designed to provide commercial or functional advantages such as improved convenience and tolerability, and enhanced patient comfort and adherence. The company was founded by Gregory Ian Frost on February 26, 1998 and is headquartered in San Diego, CA.

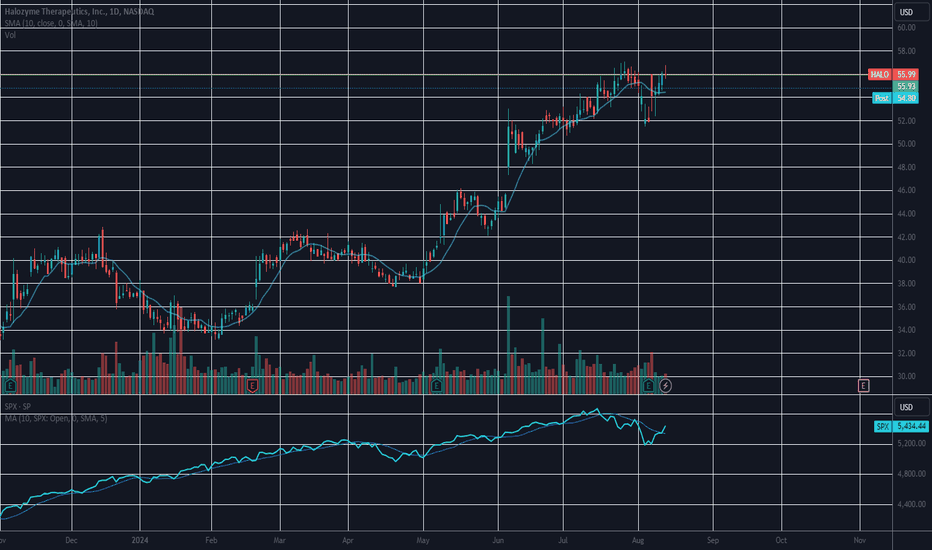

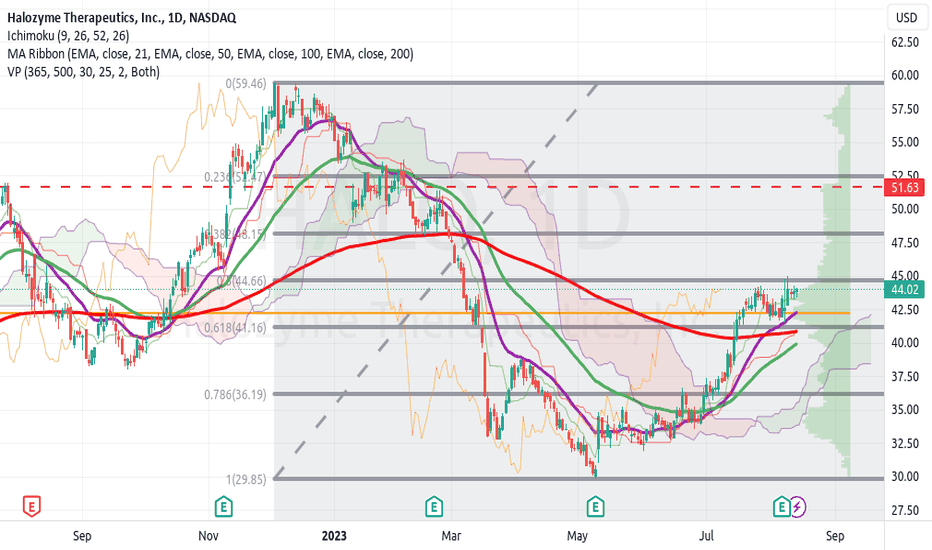

HALO Daily safe bet pharma swingVRTX I already own, looking to add some more pharma in due time.

HALO has good upside, I calculate +25 pct from 41.16 buy point to dashed line 51.63. 21/50/100 EMA crossover.

17.5 pct ROIC, 5.1 pct free cash flow yield (so so), accelerating revenue growth, buybacks, ROE 105%, Operating margin, 42

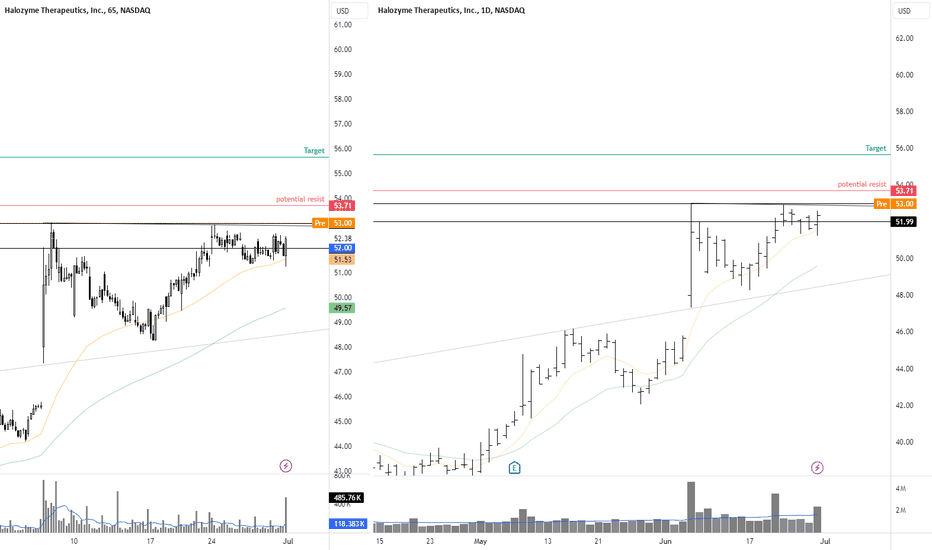

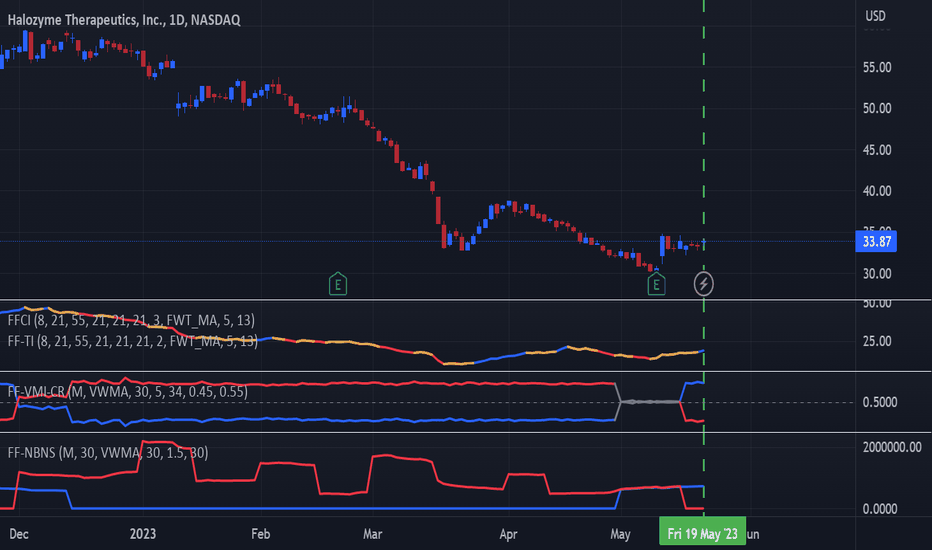

Halozyme Therapeutics (HALO) - Frequency Formula Strategy - LongStrategy Overview: The Frequency Formula

Our trading strategy, "The Frequency Formula," is built on cutting-edge Fourier Wave Transform theory. The strategy utilizes four unique indicators: the Frequency Formula Chop Indicator (FF-CI), Frequency Formula Trend Indicator (FF-TI), the Frequency Formu

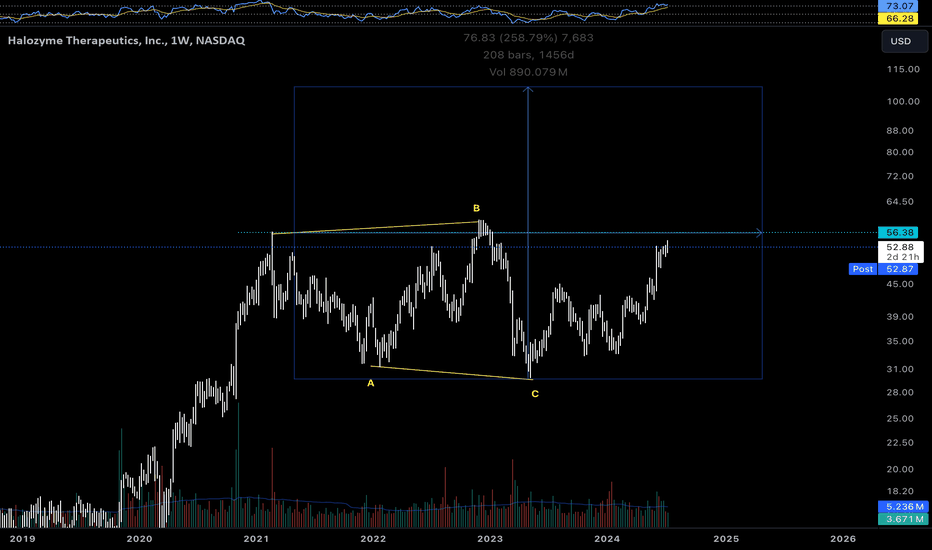

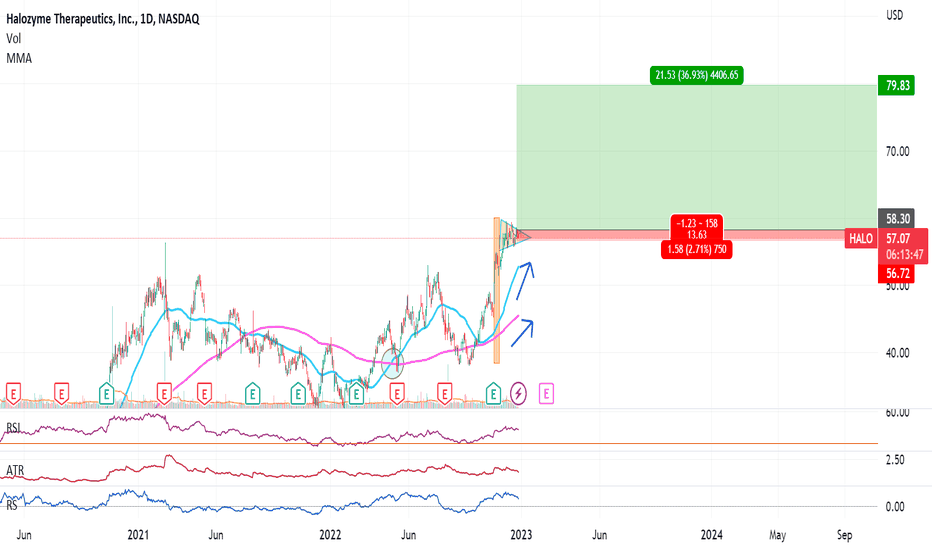

HALO: Bullish Pennant, not confirmed (+38%)Halo is showing yet again some positive pattern in price action.

Currently building into a bullish pennant (not confirmed) after last week's ascending triangle.

If the price action breaks the top of the flag with volume, we may be in for a 36-37% profit.

Target #1 on confirmed flag = 79.83$

Target

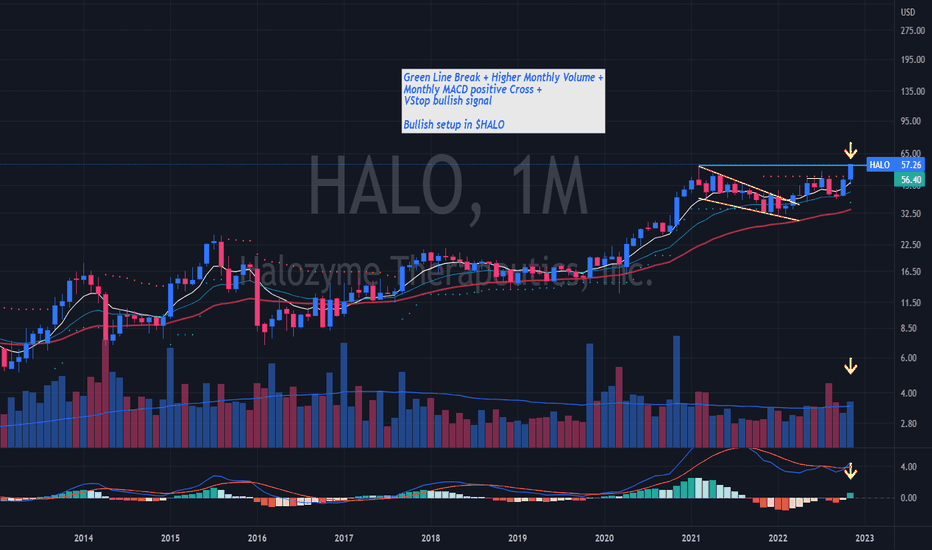

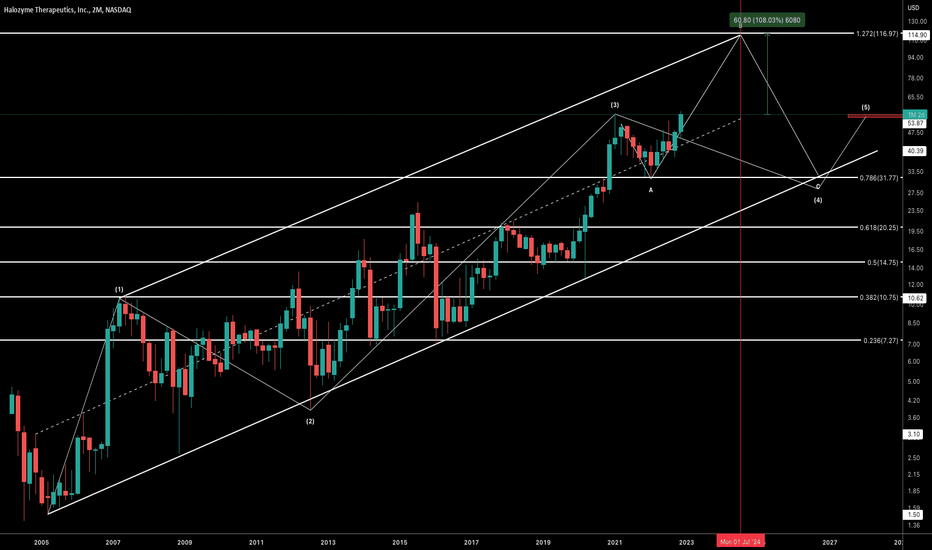

HALO 2Mtest

Halozyme Therapeutics, Inc. is a biopharmaceutical company, which engages in research, development and commercialization of human enzymes and drug candidates. It focuses on novel oncology therapies that target the tumor microenvironment. The firm products include rHuPH20, and HYLENEX recombinan

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

HALO5387960

Halozyme Therapeutics, Inc. 0.25% 01-MAR-2027Yield to maturity

0.25%

Maturity date

Mar 1, 2027

HALO5638653

Halozyme Therapeutics, Inc. 1.0% 15-AUG-2028Yield to maturity

−3.11%

Maturity date

Aug 15, 2028

See all RV7 bonds

Curated watchlists where RV7 is featured.

Related stocks

Frequently Asked Questions

The current price of RV7 is 44.991 CHF — it has increased by 5.83% in the past 24 hours. Watch HALOZYME THERAPEUT stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange HALOZYME THERAPEUT stocks are traded under the ticker RV7.

RV7 stock has risen by 5.83% compared to the previous week, the month change is a 5.83% rise, over the last year HALOZYME THERAPEUT has showed a 29.19% increase.

We've gathered analysts' opinions on HALOZYME THERAPEUT future price: according to them, RV7 price has a max estimate of 66.67 CHF and a min estimate of 39.67 CHF. Watch RV7 chart and read a more detailed HALOZYME THERAPEUT stock forecast: see what analysts think of HALOZYME THERAPEUT and suggest that you do with its stocks.

RV7 stock is 5.52% volatile and has beta coefficient of 0.29. Track HALOZYME THERAPEUT stock price on the chart and check out the list of the most volatile stocks — is HALOZYME THERAPEUT there?

Today HALOZYME THERAPEUT has the market capitalization of 5.37 B, it has decreased by −0.73% over the last week.

Yes, you can track HALOZYME THERAPEUT financials in yearly and quarterly reports right on TradingView.

HALOZYME THERAPEUT is going to release the next earnings report on Aug 12, 2025. Keep track of upcoming events with our Earnings Calendar.

RV7 earnings for the last quarter are 0.98 CHF per share, whereas the estimation was 0.82 CHF resulting in a 20.18% surprise. The estimated earnings for the next quarter are 1.00 CHF per share. See more details about HALOZYME THERAPEUT earnings.

HALOZYME THERAPEUT revenue for the last quarter amounts to 234.47 M CHF, despite the estimated figure of 203.70 M CHF. In the next quarter, revenue is expected to reach 231.89 M CHF.

RV7 net income for the last quarter is 104.54 M CHF, while the quarter before that showed 124.43 M CHF of net income which accounts for −15.99% change. Track more HALOZYME THERAPEUT financial stats to get the full picture.

No, RV7 doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jun 19, 2025, the company has 350 employees. See our rating of the largest employees — is HALOZYME THERAPEUT on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. HALOZYME THERAPEUT EBITDA is 601.13 M CHF, and current EBITDA margin is 62.32%. See more stats in HALOZYME THERAPEUT financial statements.

Like other stocks, RV7 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade HALOZYME THERAPEUT stock right from TradingView charts — choose your broker and connect to your account.