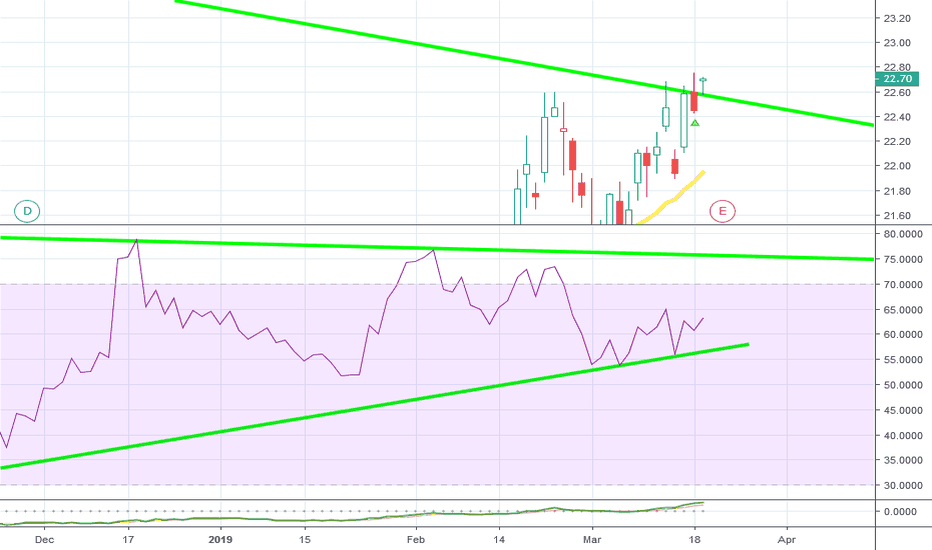

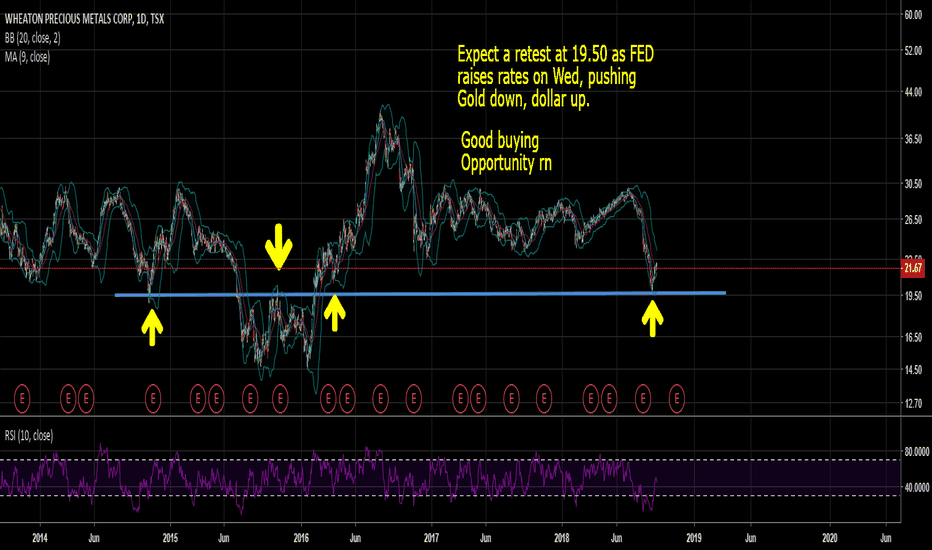

ultra silver play. part of my studies into hacking order flow. WPM makes up roughly 20% of the sil etf and comprises a major holding in other major metals etfs. that being said money flow is not equally distributed and is based on a certain weighting. this is the same concept of how i played BA from december melt down. the idea is to capture the uneven distribution based on the major holdings of those etfs. wpm is a stand out canidate. it just clipped a major milestone resistance wise. lets see what happens. yolo

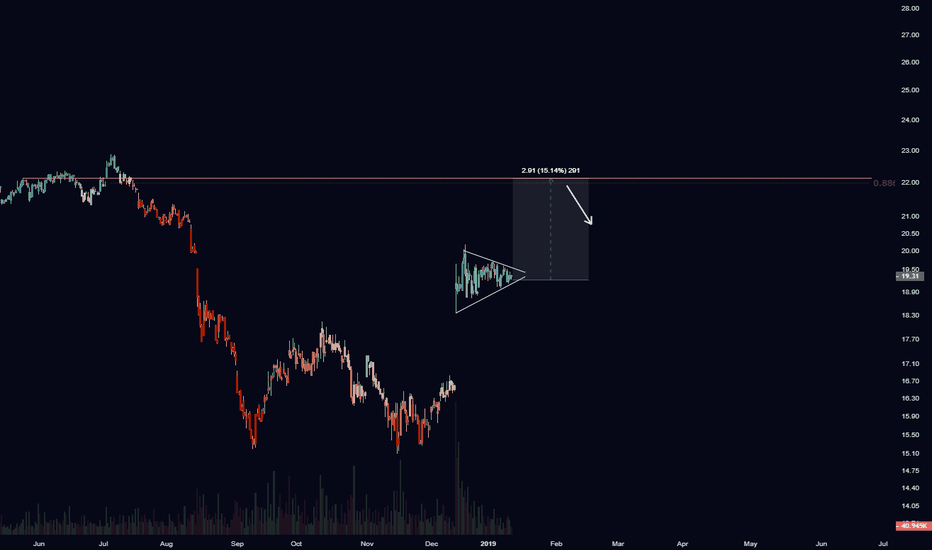

SII trade ideas

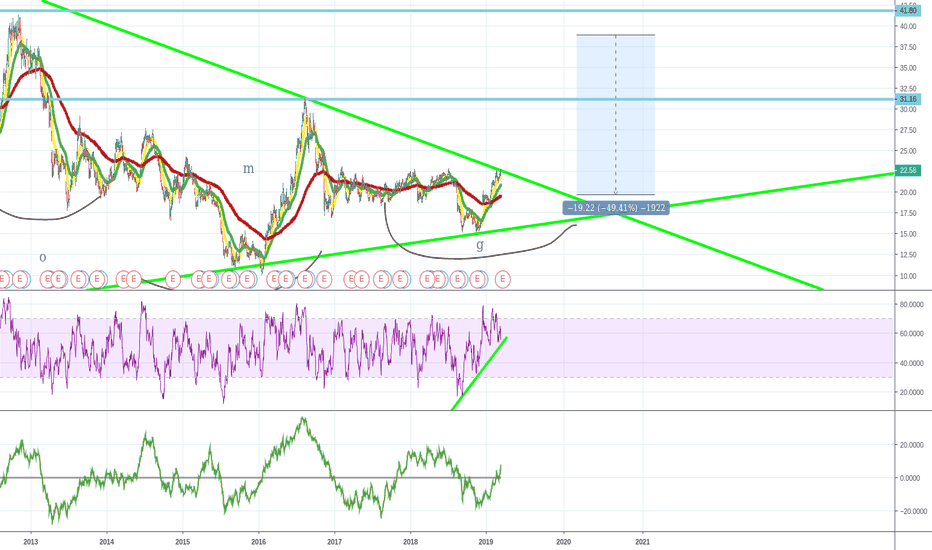

WPM prepare for launchgold, silver, and bonds want to hear powell say uncle. rather playing any i prefer to choose the biggest holdings within those sectors. one stands out to me option wise, asset allocation wise, and pattern wise. wpm is about to make itself at home in ranges not seen for some time.

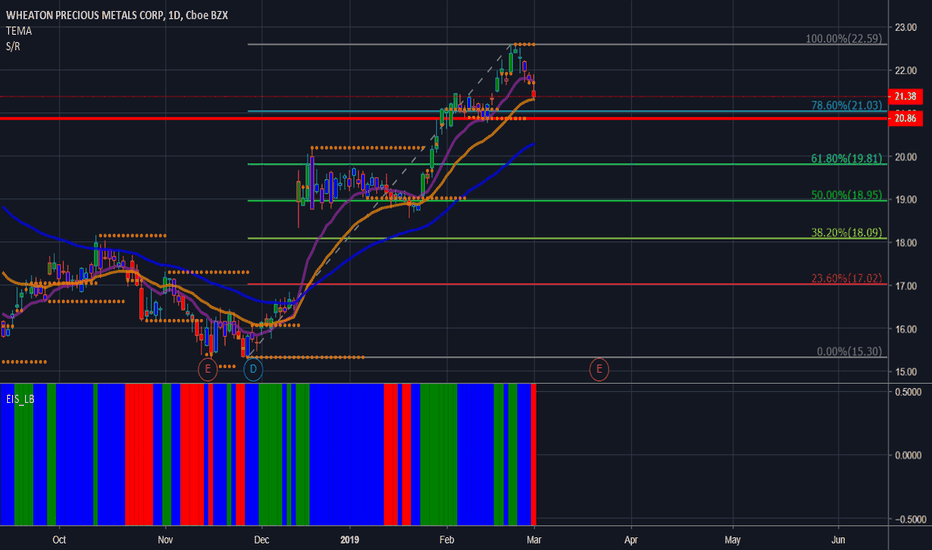

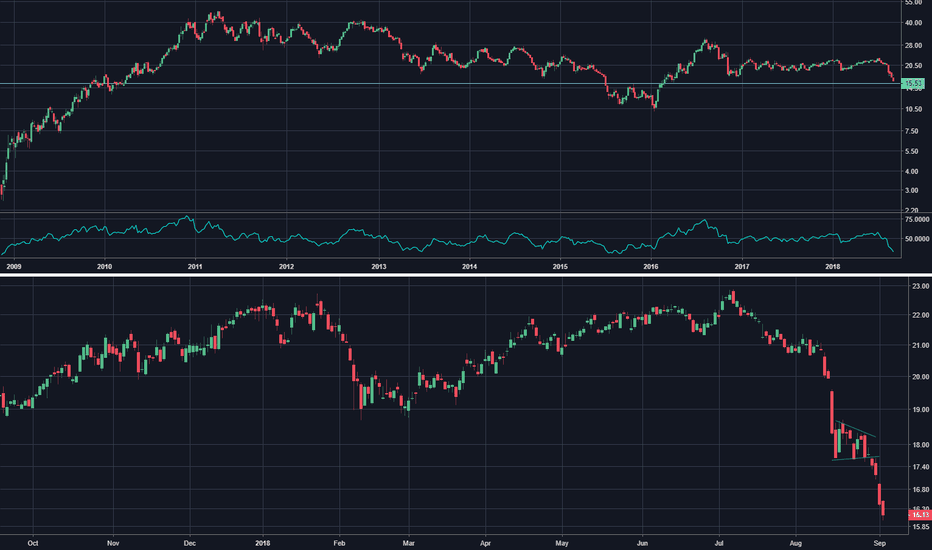

WPM: Sell OTM puts for 9% p.a.On Friday, June 16, we successfully closed our previous short-put trade on WPM (see previous post below).

Today WPM is showing continued signs of weakness, in an otherwise strong market. It is currently trading towards the lows of its trading range. It could continue to show weakness if the broader market continues its journey upwards. However, in the context of a much anticipated market correction and rather high equity valuations, any market correction should help push safe haven assets (precious metals) upwards.

STRATEGY: Sell WPM 11% OTM puts on the September expiry

RISK: Get exercised at the strike and end up long the asset 13% below current price

REWARD: 9% annualized yield

SELL WPM 09/15/17 $17 PUT = $0.40/SHARE (8.81% annualized)

Depending on your risk appetite, the $18 strike and the Jan 19, 2018 maturity could also be interesting.