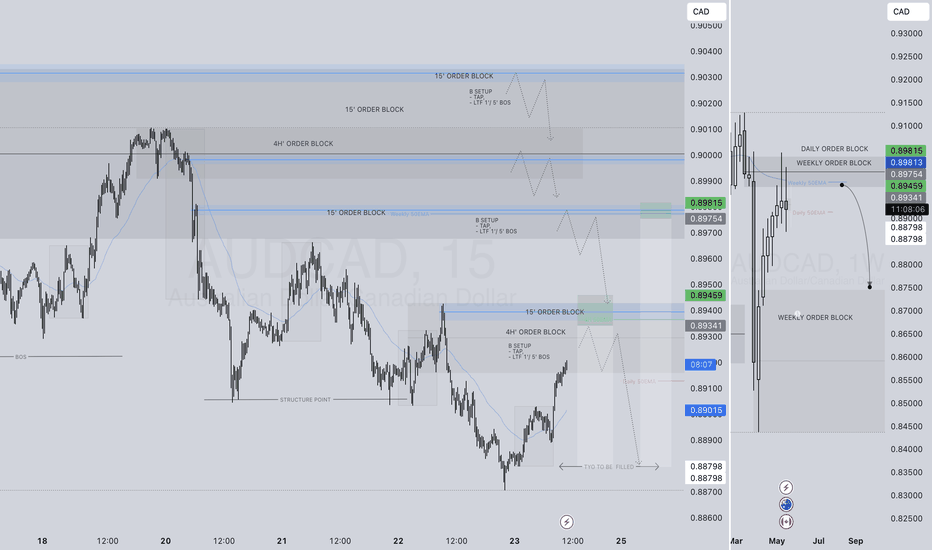

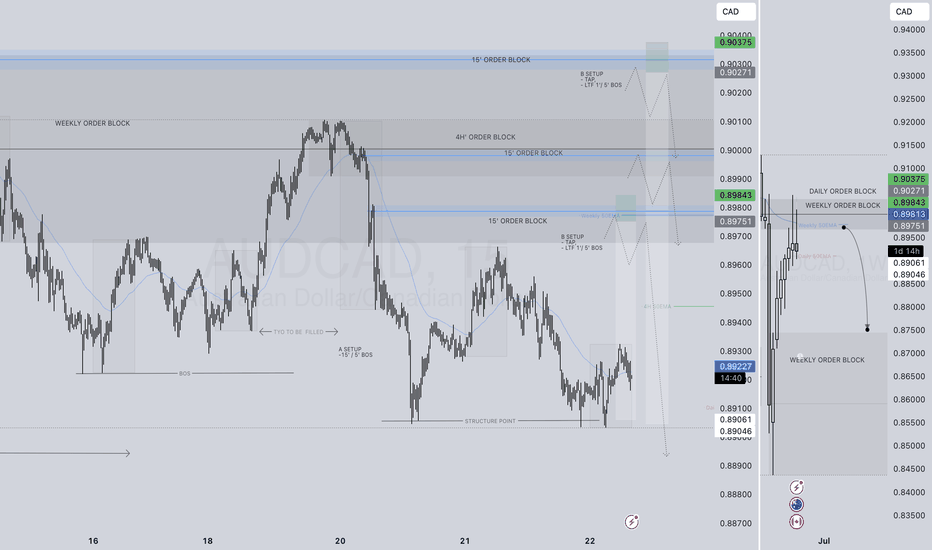

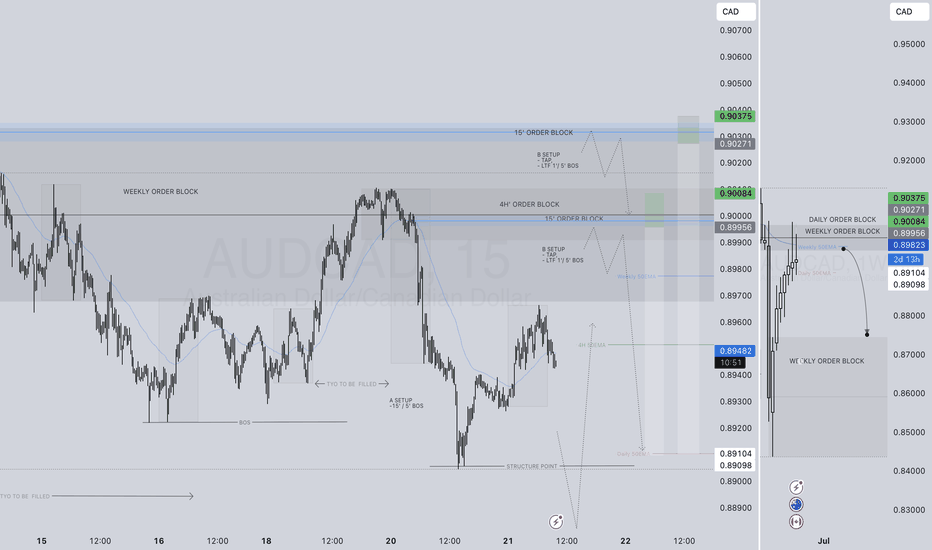

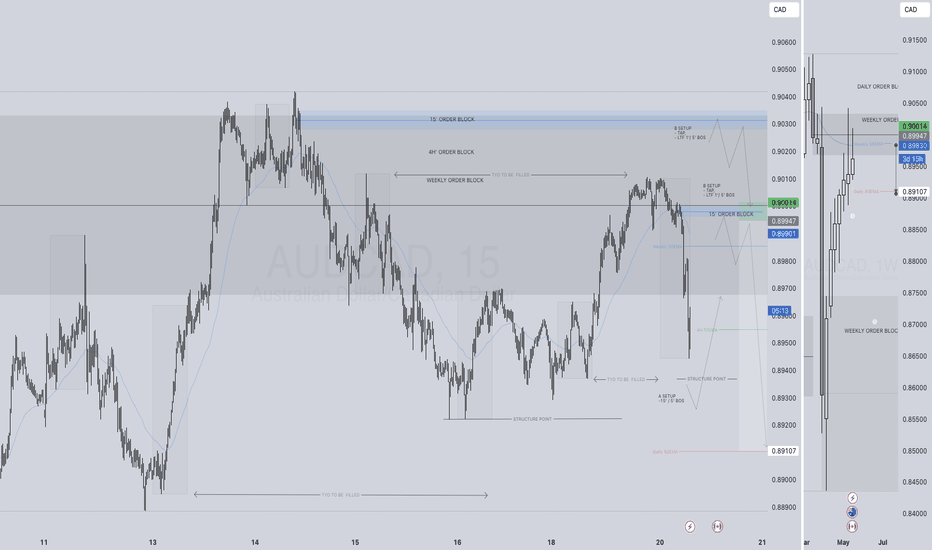

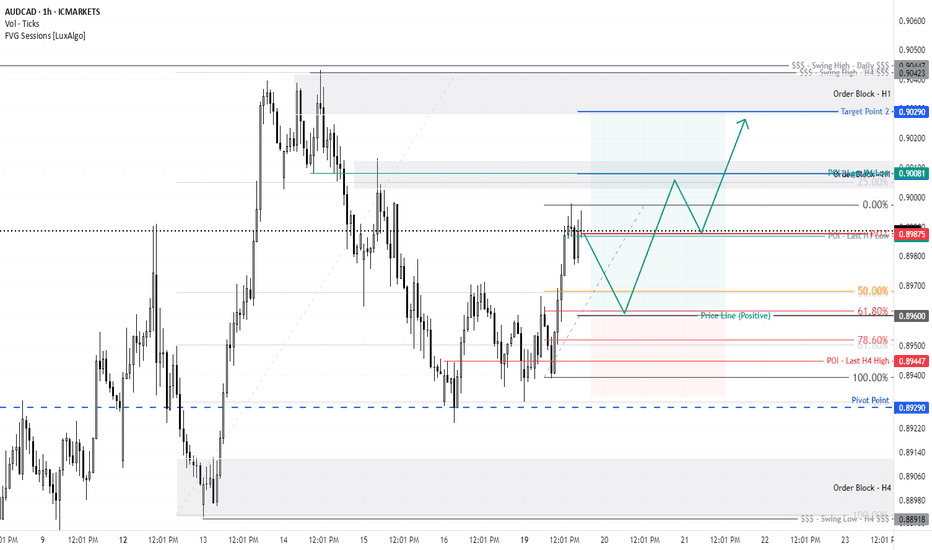

IT'S TIME AUDCAD - SHORT FORECAST Q2 W21 D23 Y25AUDCAD SHORT FORECAST Q2 W21 D23 Y25

NOW IS THE TIME! POI's are approaching. Await a turn around in price action at those points of interest & get your short shorts ready!

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅ Weekly order block

✅ Intraday 15 order block

✅Tokyo ranges to be filled

✅ Weekly 50 EMA

✅ Daily 50 EMA

✅ 4 hour 50 EMA

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

CADAUD trade ideas

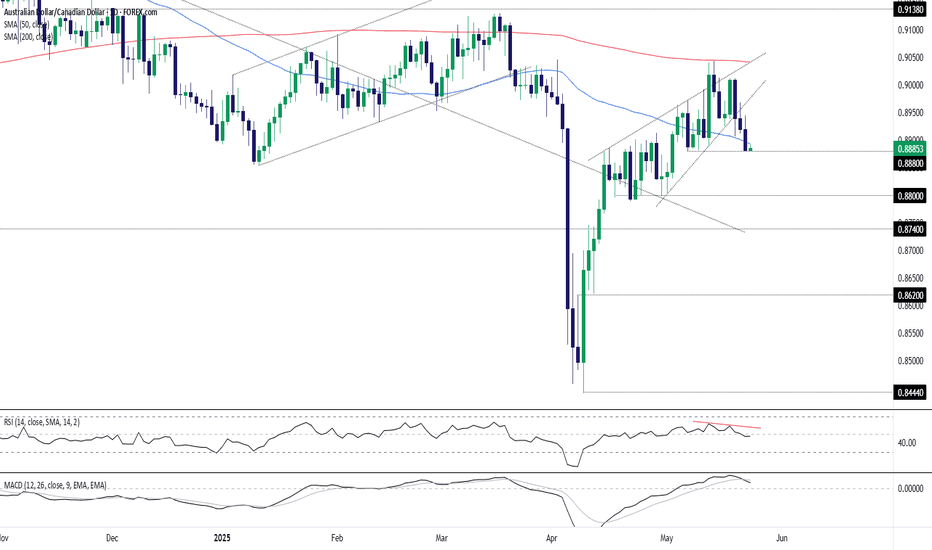

AUD/CAD: Ducks in a Row for a Drop Below .8880?The ducks look to be lining up for AUD/CAD downside.

It was comprehensively rejected at the 200DMA a fortnight ago, followed by wedge break on Tuesday before sliding below the 50DMA on Thursday. It now sits perched on .8880, a level it attracted buying from earlier this month.

With RSI (14) sub-50 and MACD crossing over from above, momentum signals are shifting neutral to moderately bearish, favouring downside. With both moving averages trending lower, it reinforces the bearish picture.

If AUD/CAD breaks beneath .8880, considering initiating shorts targeting a return to support at .8800. A stop above .8880 would provide protection against reversal.

Should it hold .8880, the bearish backdrop suggests there are better setups to consider than flipping the trade and going long.

Good luck!

DS

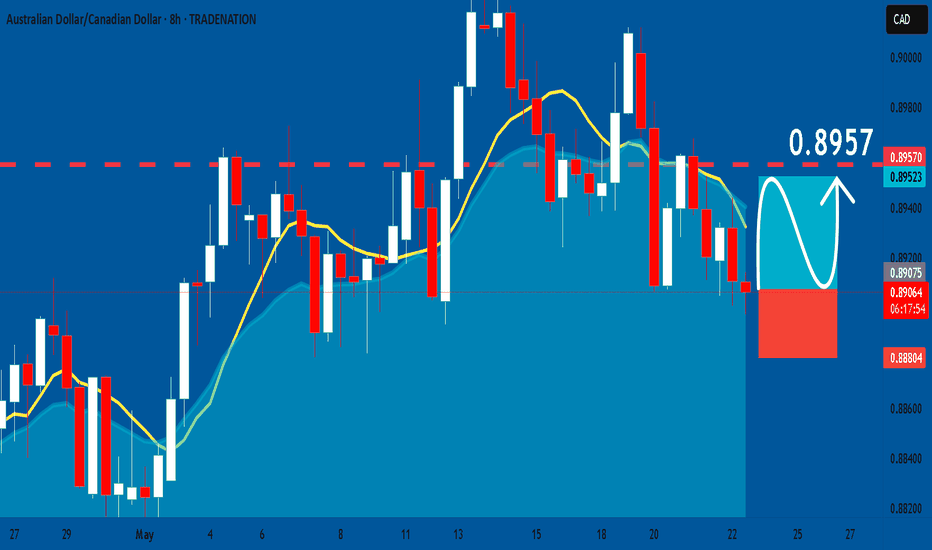

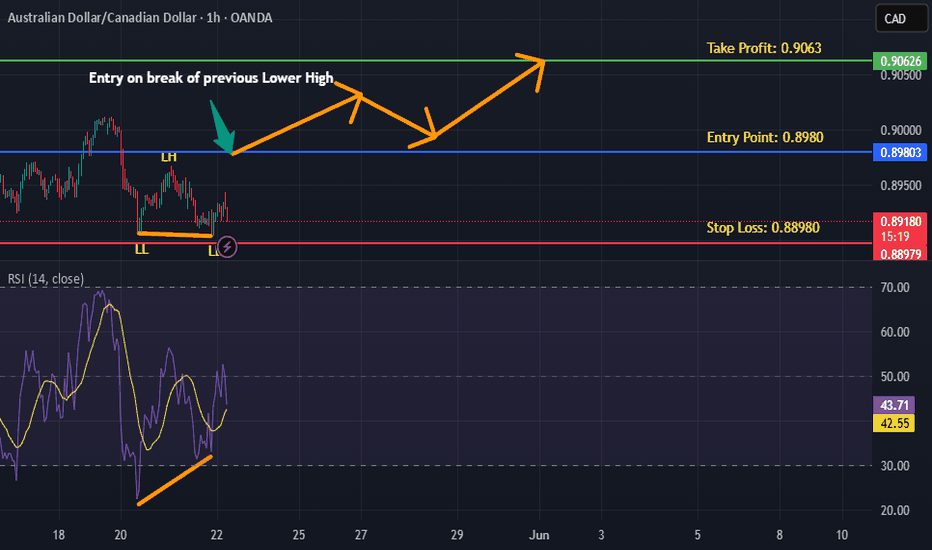

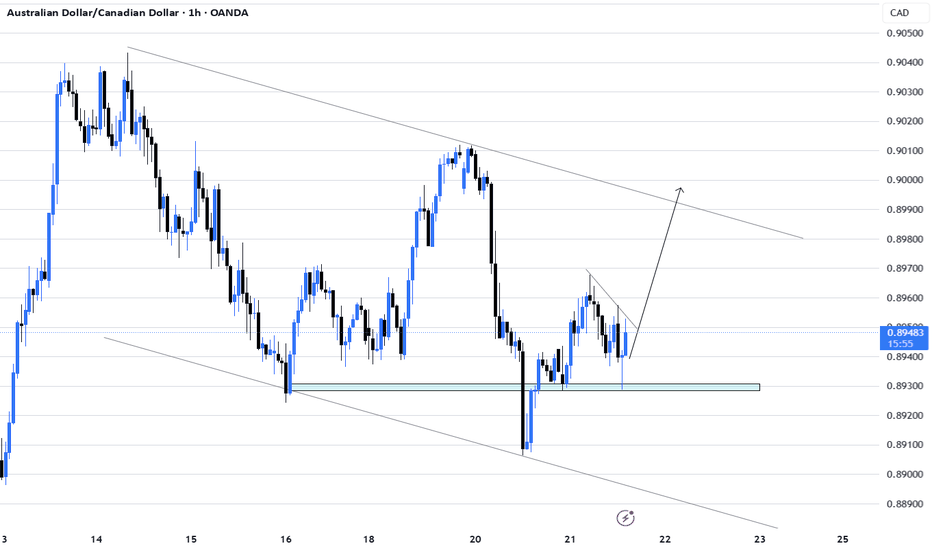

AUDCAD: Bullish Continuation & Long Signal

AUDCAD

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long AUDCAD

Entry - 0.8907

Sl - 0.8880

Tp - 0.8957

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

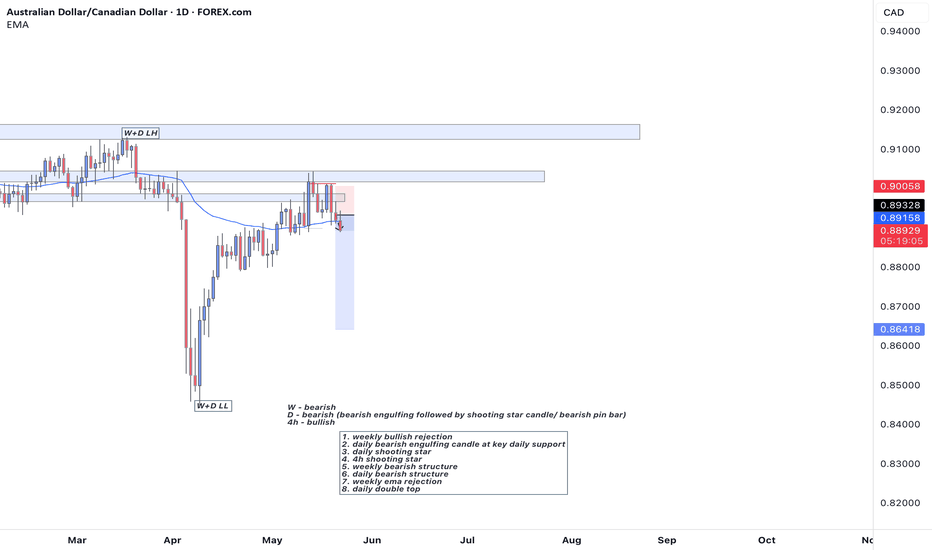

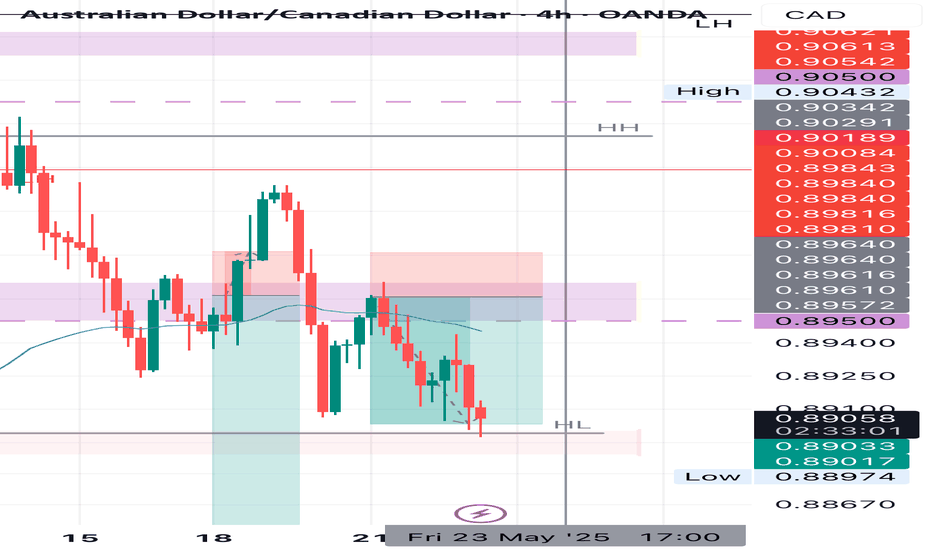

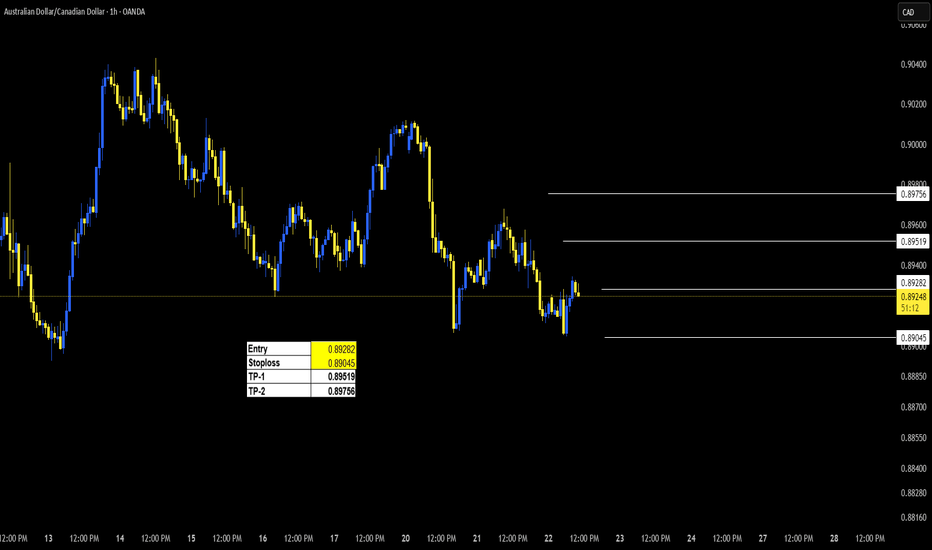

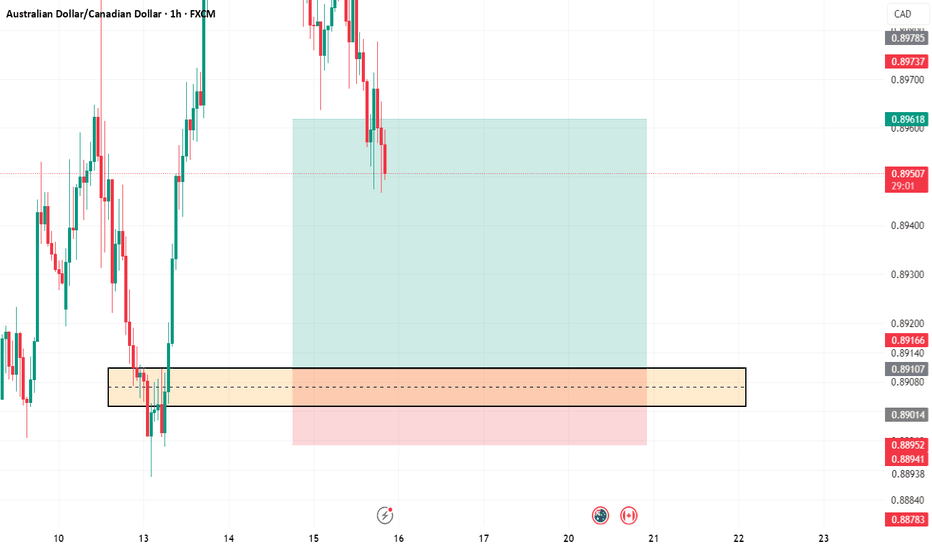

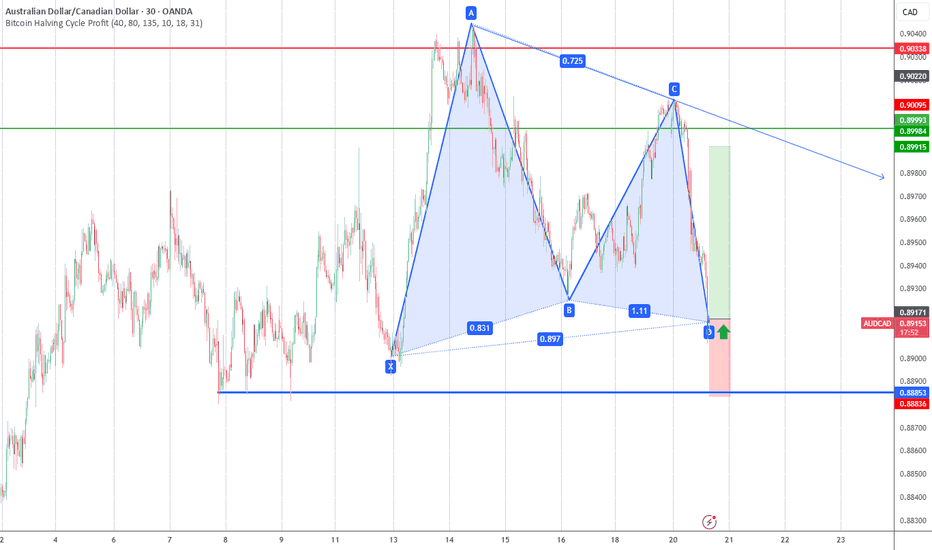

AUDCAD re-entry DocumentationRe-entry on my Monday trade as no confluence was broken;

Market structure bearish on HTFs DW

Entry at Both Daily and Weekly AOi

Weekly Rejection at AOi

Previous Structure point Weekly

Daily Rejection at AOi

Previous Structure point Daily

Around Psychological Level 0.89500

H4 EMA retest

H4 Candlestick rejection

Levels 5.21

Entry 100%

REMEMBER : Trading is a Game Of Probability : Manage Your Risk : Be Patient

: Every Moment Is Unique : Rinse, Wash, Repeat!

: Christ is King.

ALL WE NEED IS A PULL BACK.AUDCAD SHORT FORECAST Q2 W21 D22 Y25ALL WE NEED IS A PULL BACK

AUDCAD SHORT FORECAST Q2 W21 D22 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅ Weekly order block

✅ Intraday 15 order block

✅Tokyo ranges to be filled

✅ Weekly 50 EMA

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

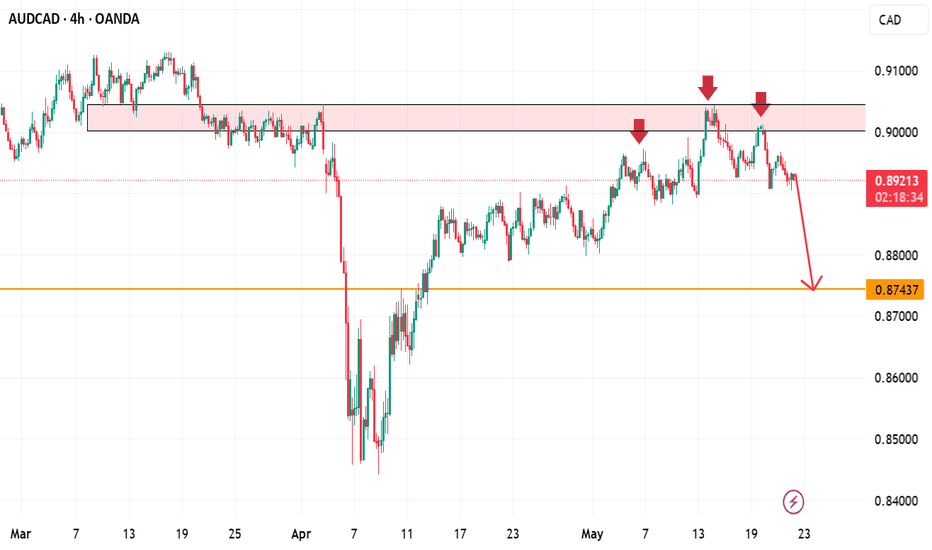

AUDCAD POTENTIAL SELL OPPORTUNITY!!A sell opportunity is envisaged from the current market price as we see price reacting at the 78.6% fibo retracement level. i anticipate a drop in price. our target profit is 0.87437

technically, we've seen clear head and shoulder pattern formation which further increase the sell probability

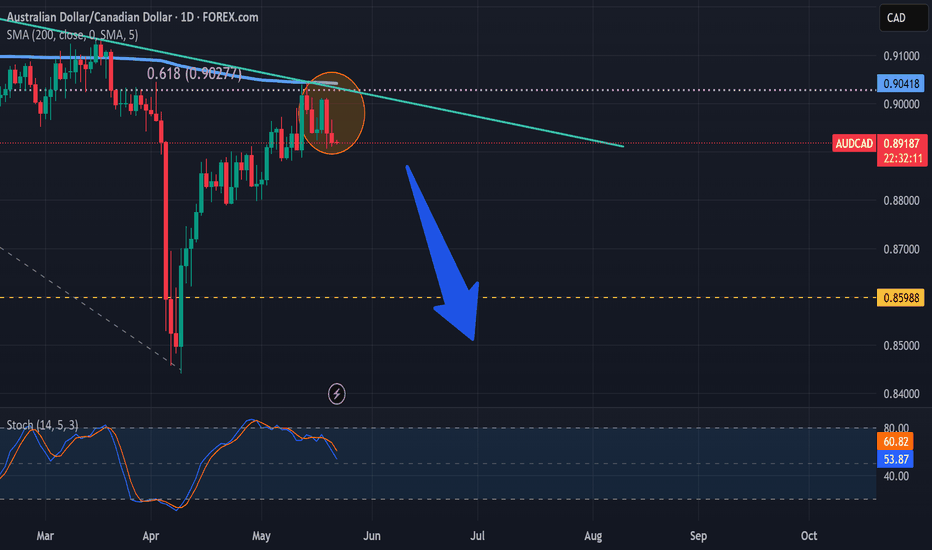

AUDCAD - Potential Sell-off ComingLooking pretty good for a sell based on a few technicals...

-- divergence from higher prices to stochastic K-line crossing under D -line

-- weekly candle show Spinning Top (almost a Doji) for last week

-- Daily & Weekly timeframes show price hitting 200 MA

If resistance gives way, could drop to previous low of .8441. If so, could be over 400 pips for a ~2 month period.

What do you think?!?

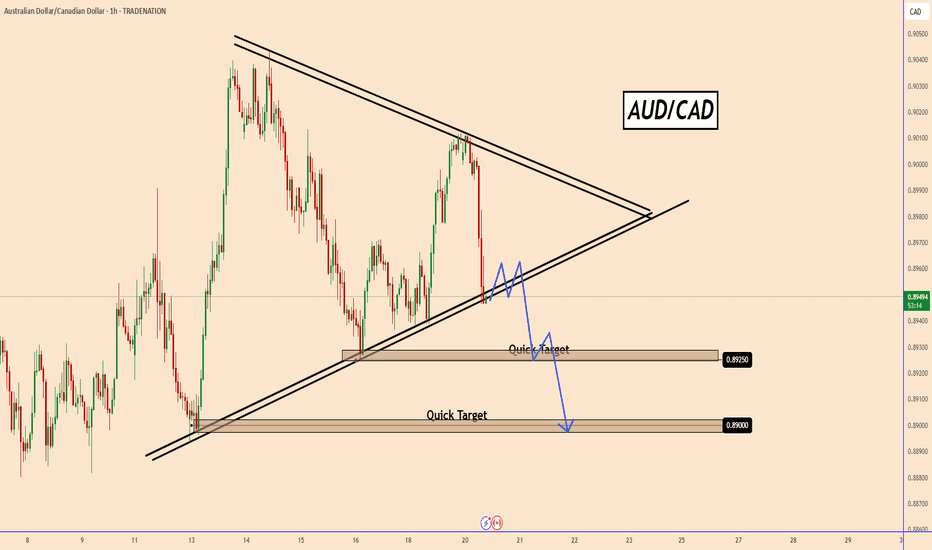

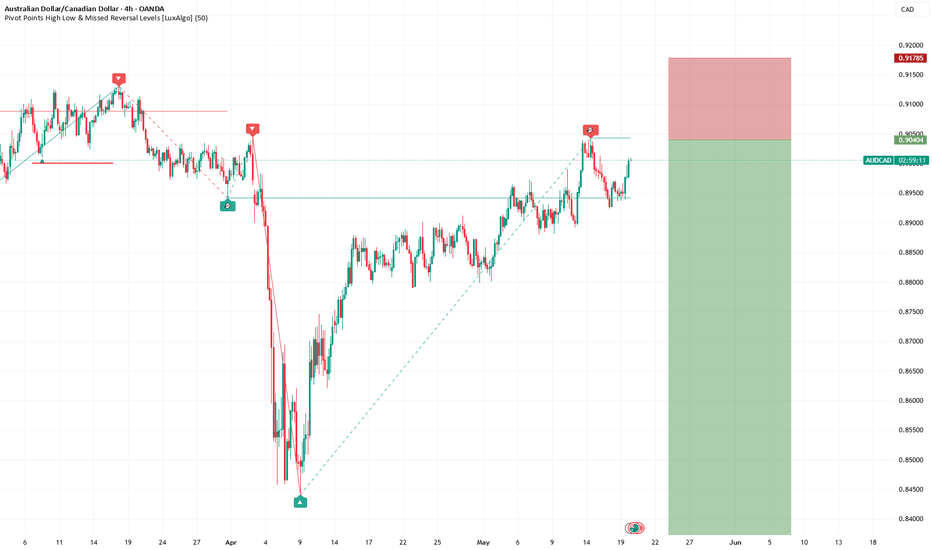

AUDCAD Approaching a Breakout Amid RBA Rate CutAUDCAD Approaching a Breakout Amid RBA Rate Cut

AUDCAD is nearing a breakout from a larger triangle pattern.

In the past few hours, the pair dropped nearly 50 pips following the Reserve Bank of Australia's (RBA) interest rate decision.

The RBA cut rates by 25 bps , bringing them down to 3.85% from 4.1%. They also signaled a willingness to continue cutting if needed to support the economy.

This marks the first rate cut in a long time where the RBA has openly backed a rate-cutting cycle, leading to a mild sell-off in AUD pairs.

AUDCAD could decline further in the coming hours as the US market reacts to the news.

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

HUGE RETURNS PENDING! AUDCAD SHORT FORECAST Q2 W21 D21 Y25HUGE RETURNS PENDING!

AUDCAD SHORT FORECAST Q2 W21 D21 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅ Weekly order block

✅ Intraday 15 order block

✅Tokyo ranges to be filled

✅ Weekly 50 EMA

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

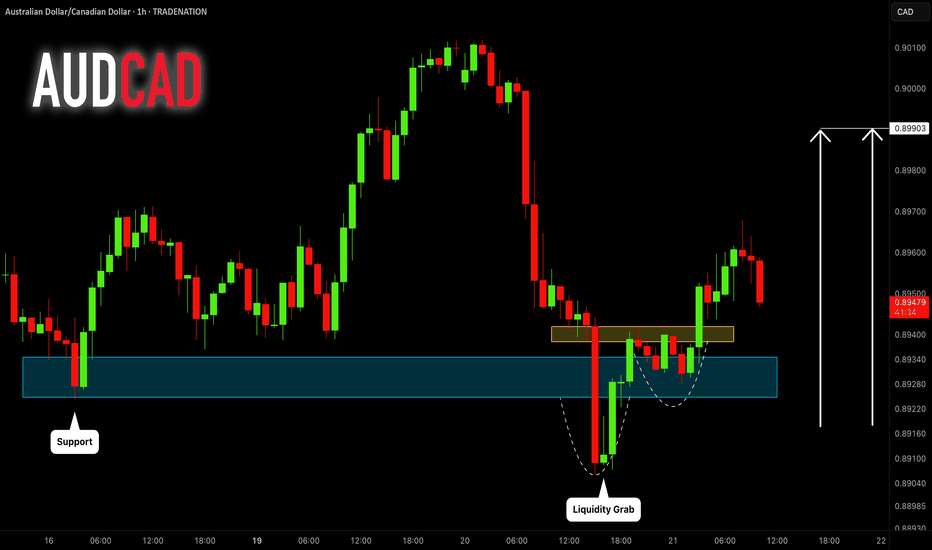

AUDCAD: Bull Trap & Bullish Confirmation 🇦🇺🇨🇦

AUDCAD formed a liquidity grab after a test of significant intraday/daily support.

A cup & handle pattern and a violation of its neckline with a bullish imbalance

provide a strong bullish confirmation.

I expect an up move now, at least to 0.899

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

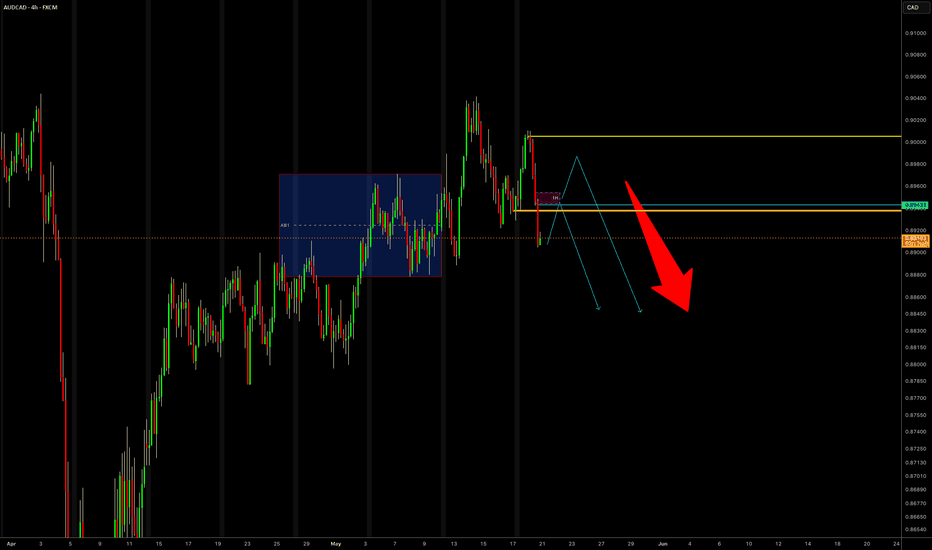

AUDCAD ForecastComing up next:

- look for sell when price pull back to premium level

- sell only if entry setup given

- refine entry with smaller SL for better RR, if you know how

- in any case it has to at least go down to 0.885 level or lower

- will post the setup again when trade is ready

A Message To Traders:

I’ll be sharing high-quality trade setups for a period time. No bullshit, no fluff, no complicated nonsense — just real, actionable forecast the algorithm is executing. If you’re struggling with trading and desperate for better results, follow my posts closely.

Check out my previously posted setups and forecasts — you’ll be amazed by the high accuracy of the results.

"I Found the Code. I Trust the Algo. Believe Me, That’s It."

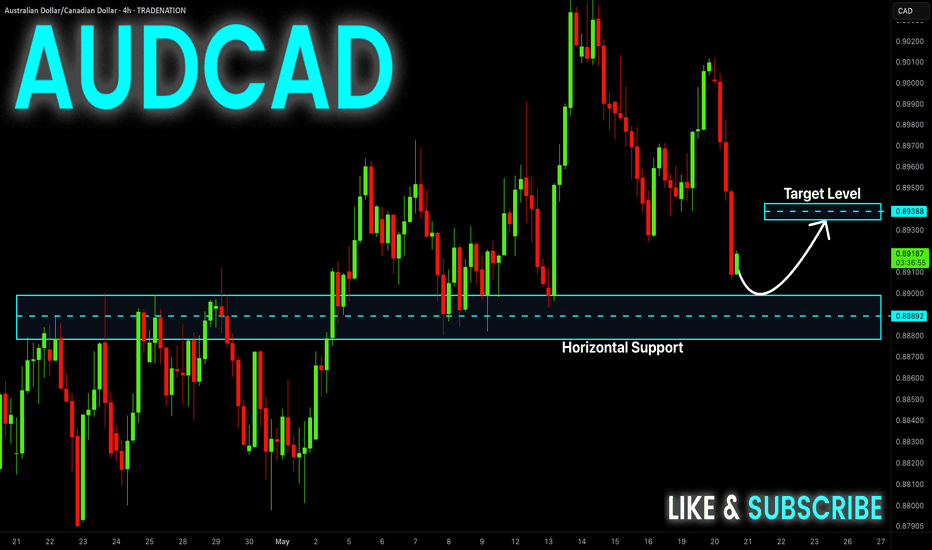

AUD-CAD Local Long! Buy!

Hello,Traders!

AUD-CAD will soon hit

A horizontal support level

Of 0.8888 after a sharp

Fall down but its a strong

Support so we will be

Expecting a rebound and

A local move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

FUN TO BE HAD WITH AUDCAD SHORT FORECAST Q2 W21 D20 Y25THERE IS A LOT OF FUN TO BE HAD WITH OUR FRIEND ...

AUDCAD

AUDCAD SHORT FORECAST Q2 W21 D20 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅ Weekly order block

✅ Intraday 15 order block

✅Tokyo ranges to be filled

✅ Weekly 50 EMA

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDCAD SELLI’m looking to short AUD/CAD as a swing trade, and the reason is tomorrow’s interest rate decision from the Reserve Bank of Australia.

Markets expect the RBA to cut rates by 0.25%. If that happens—or if they sound more cautious about the economy—the Australian dollar could drop.

Lower interest rates usually make a currency less attractive. That’s bad for AUD.

At the same time, Canada’s central bank isn’t cutting rates. That makes the Canadian dollar stronger by comparison.

If the RBA does cut, I’ll watch for AUD/CAD to lose support on the daily chart. A lower high and a clean break down would be my entry signal.

This trade is based on fundamentals, not just a chart pattern. If the news confirms the setup, I’m in. Clear plan, managed risk, simple trade.