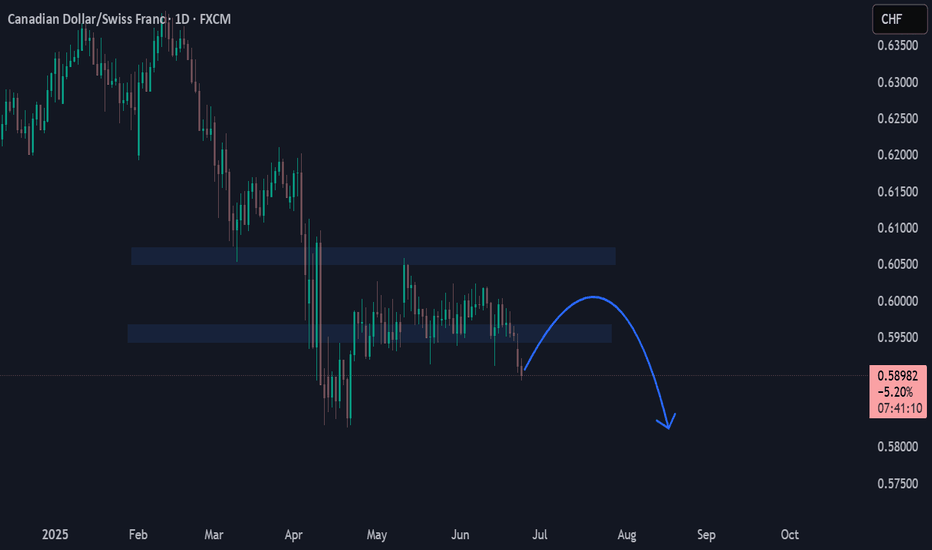

CADCHF at the Cliff's Edge – Is a Breakdown Imminent? 🧭 Technical Context

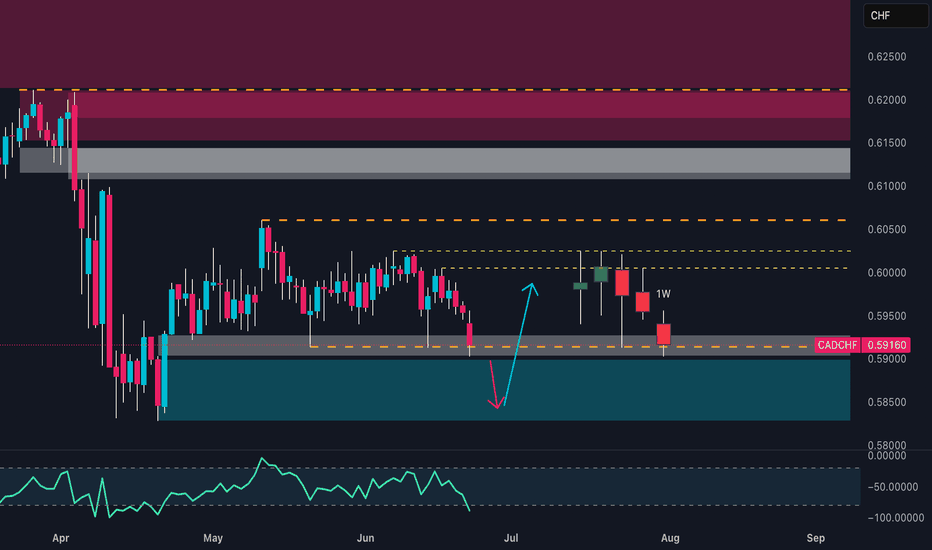

Price is currently sitting at the key support area of 0.5890–0.5900, tested multiple times since April.

This week’s candlestick shows a clear close below the intermediate micro-structure (two consecutive closes under recent lows), confirming bearish pressure.

The weekly RSI remains in a neutral-to-low zone, trending downwards with no active bullish divergence.

📉 Technical Conclusion: Active bearish bias. Watch out for potential false breaks below 0.5890 as liquidity traps.

📊 COT Report – as of June 17, 2025

🇨🇦 CAD

Non-Commercials: added +8.5k long contracts, aggressively cut −18.3k shorts

→ Excessive optimism, potential exhaustion on the buy-side

Commercials: added +31k shorts

→ Typical hedge behavior – signaling protection from CAD devaluation

🇨🇭CHF

Net positions in gradual decline with no sharp moves → CHF remains in consolidation, with a defensive tone

Open Interest dropped by −19.5k → Institutional money exiting positions

→ Interpretation: Market likely preparing for a directional breakout, CHF could act as a safe haven

📉 COT Conclusion: CAD appears overbought, CHF still gathering strength. Bearish bias on CADCHF remains intact.

📅 Seasonality – June Pattern

CHF tends to strengthen in June:

+0.0095 (10Y average), +0.0068 (5Y average)

CAD shows structural weakness in June:

−0.0027 (10Y), −0.0076 (5Y)

📉 Seasonality Conclusion: June favors CAD weakness and CHF strength → Bearish confirmation for CADCHF

🧠 Retail Sentiment

92% of retail traders are long CADCHF, only 8% are short

→ Extreme imbalance = classic contrarian signal

📉 Sentiment Conclusion: Confirms potential for continued downside on CADCHF

✅ Trade Plan Summary

📌 Base scenario:

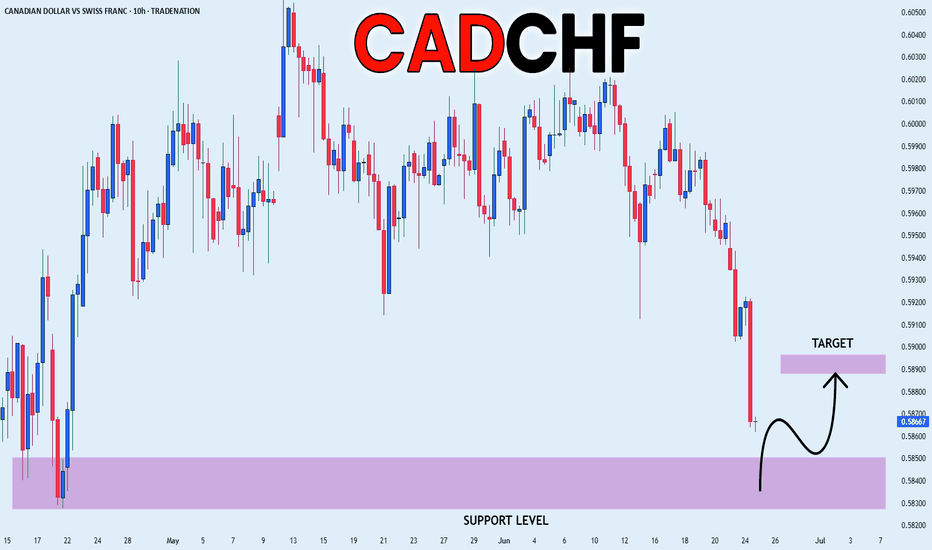

Short CADCHF if we get a daily/weekly close below 0.5890

🎯 Target 1: 0.5820

🎯 Target 2: 0.5770

🚫 Invalidation: daily close above 0.5960 (invalidates current setup)

📌 Alternative scenario:

Short from 0.5960–0.6000 if we get a bearish rejection pattern → ideal for better R/R

CADCHF trade ideas

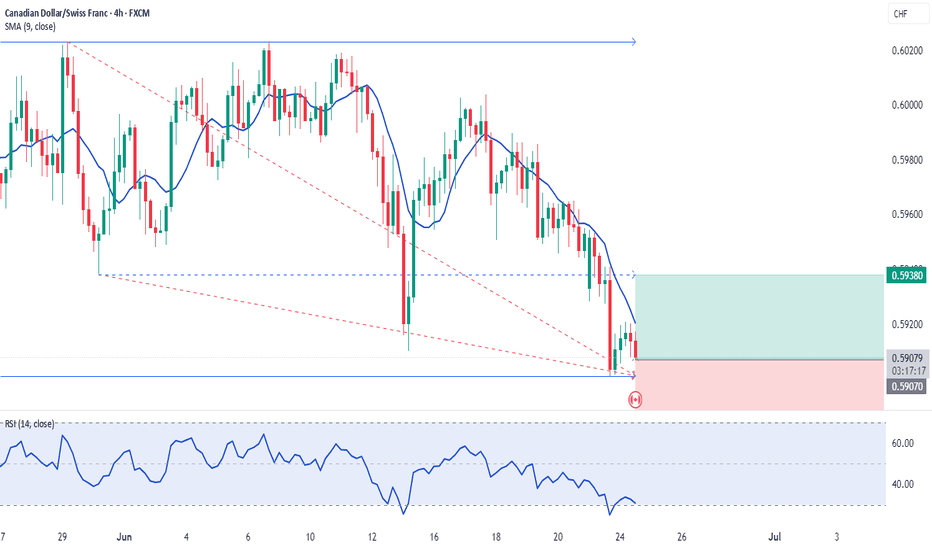

CADCHF SellOne strong reason for this trade is that the price clearly broke down from an inverted Cup and Handle pattern and confirmed the move with a small bearish flag, making this a high-probability trend continuation short setup. These patterns together signal strong bearish momentum and give a solid reason for entering a short position.

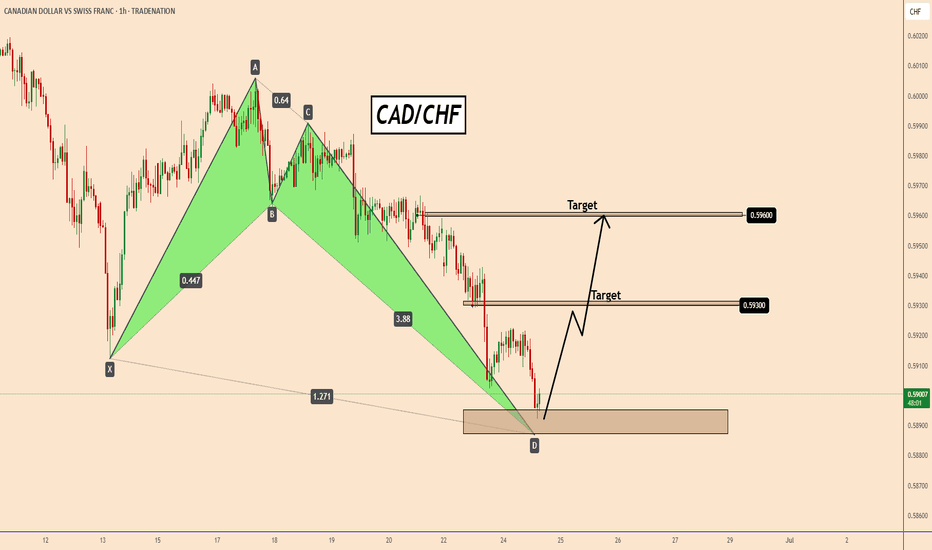

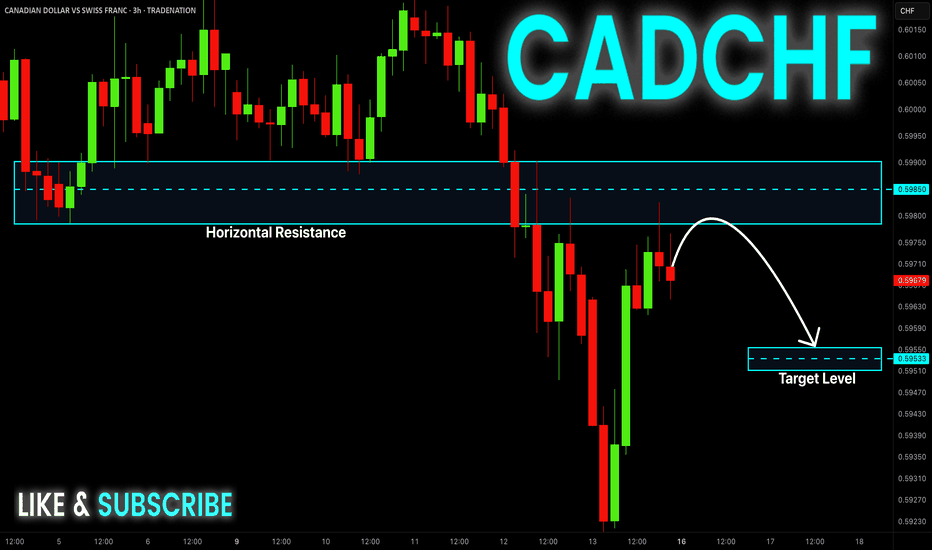

CADCHF: Bullish Harmonic Pattern - Shor-Term Trade SetupCADCHF: Bullish Harmonic Pattern

CADCHF completed a bullish harmonic pattern near to a strong resisntace zone.

The chances are that we can see the price to rise the bullish volume more during the coming hours.

Remains a bit strange the fact that SNB it's not giving up from manipulating the forex market but probably they will try to be more careful now that the U.S added them on the back list as Market Manipulators.

The price may rise in the short term and CADCHF could reach 0.5930 and 0.5960

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

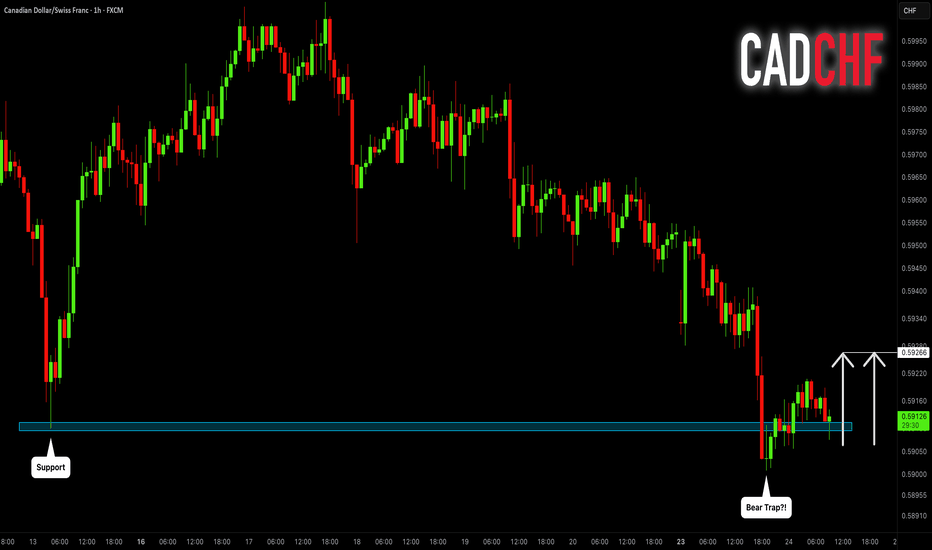

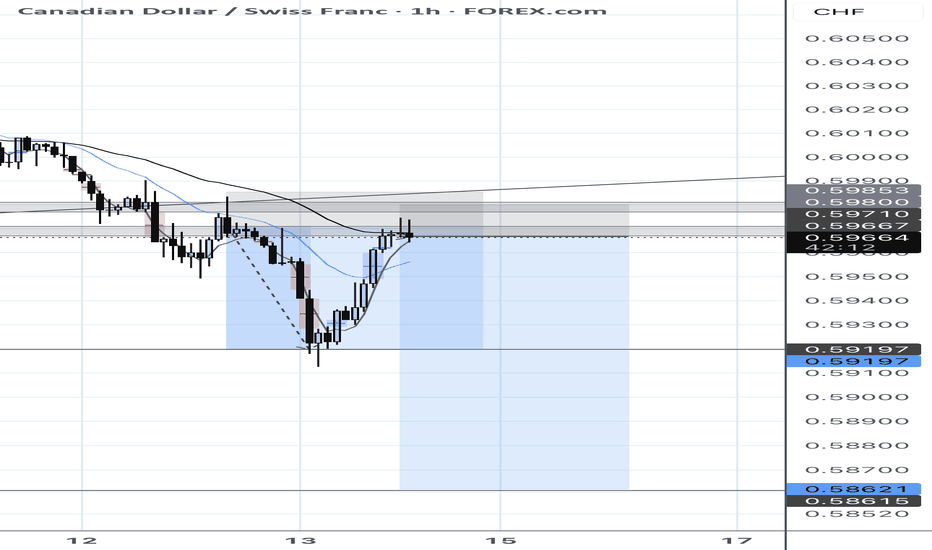

CADCHF: Confirmed Bearish Trap?! 🇨🇦🇨🇭

There is a high chance that CADCHF will bounce from the underlined

blue support.

As a confirmation, I see a cup & handle pattern on an hourly time frame

that compose a bearish trap.

Goal - 0.5926

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

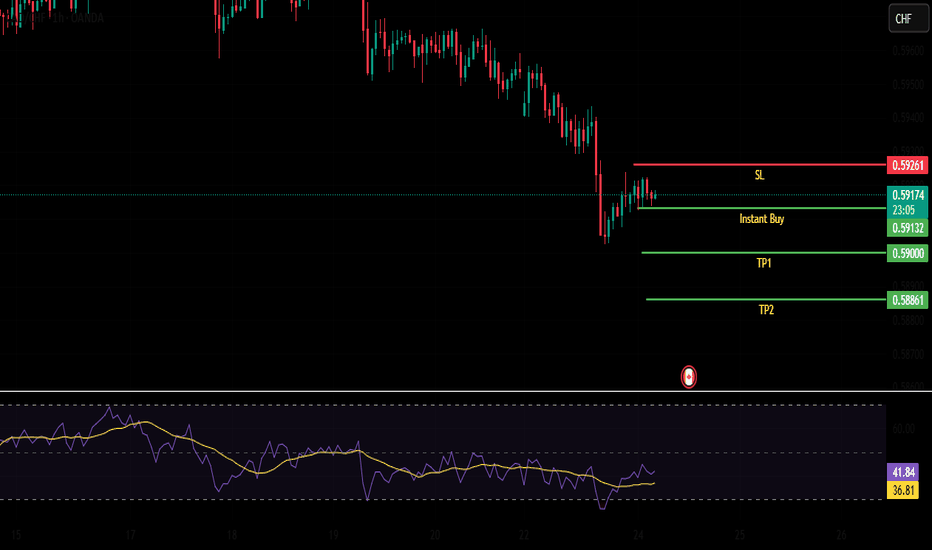

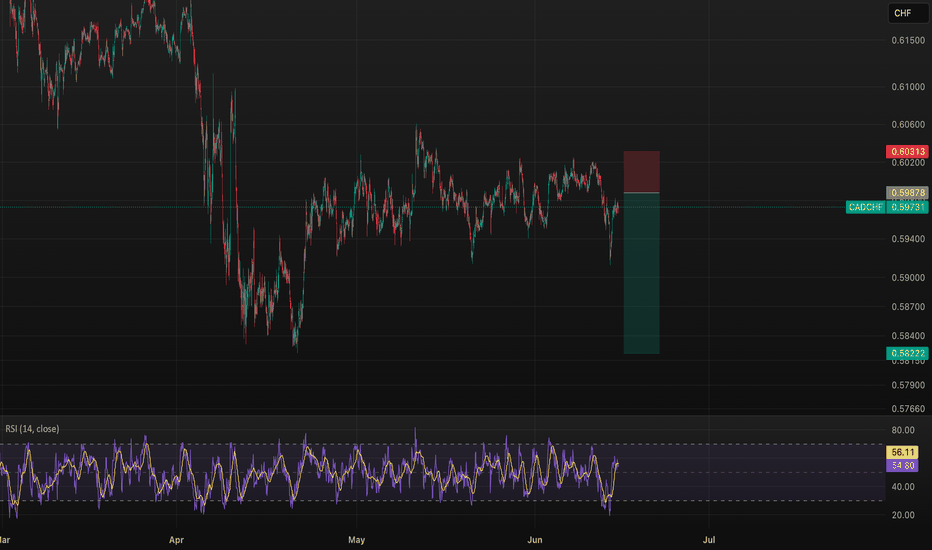

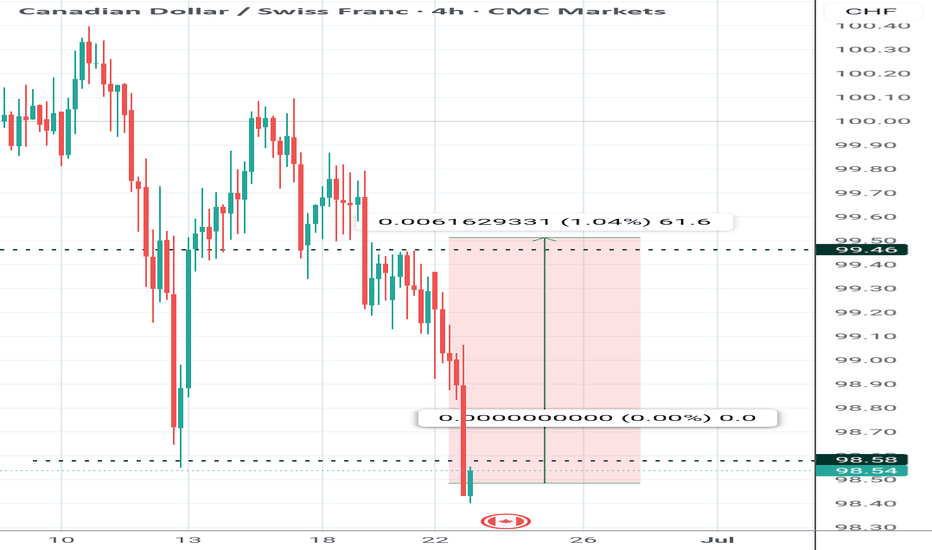

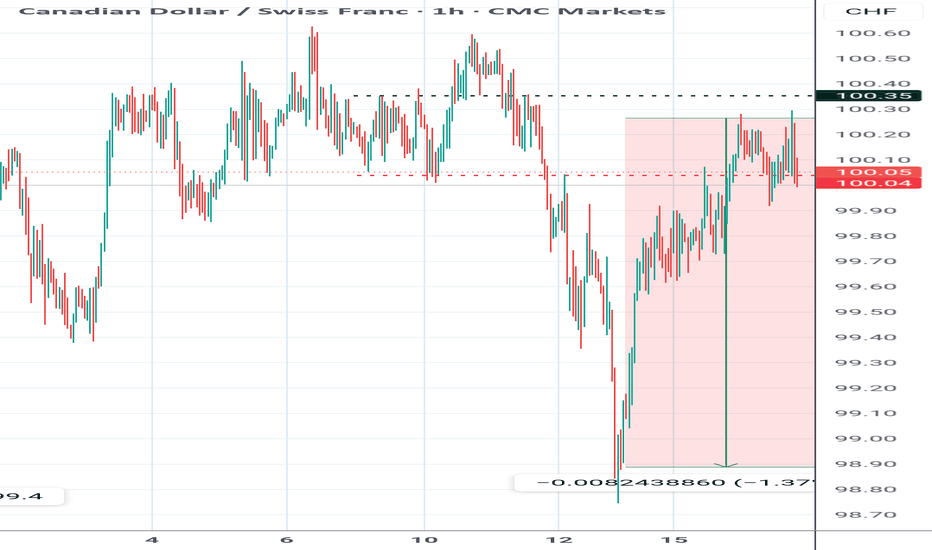

CADCHF SELL

🚨 **CAD/CHF: Strong downtrend despite fundamental divergence!**

The pair keeps dropping, but a correction could offer a better short entry. Here's my full breakdown 👇

🔎 **CAD/CHF Analysis – Ongoing Tech/Fundamental Divergence**

📉 The trend on **CAD/CHF** remains clearly bearish and has been intact for several weeks. We’ve broken key levels multiple times, notably **0.61990**, which was retested and then broken again. Most recently, a short-term support around **0.59600** has also been breached, reinforcing the bearish momentum.

🕵️♂️ I’m currently watching for **a corrective move** to get a cleaner entry for shorts. However, **client sentiment is largely short**, which isn’t ideal if we expect an immediate continuation — risk of overcrowding.

📊 On the **fundamental side**, rate differentials favor the Canadian dollar, but the **Swiss franc remains highly attractive**, especially in a risk-off environment. That’s where things get tricky: **technicals are strongly bearish**, yet **fundamentals would suggest a potential rebound for CAD/CHF**.

🔁 For now, **there’s no clear technical trigger** for a long-term bullish reversal. As long as that remains the case, I maintain a **bearish bias**, waiting for a potential pullback to re-enter short.

---

\#Forex #CADCHF #TradingView #TechnicalAnalysis #FundamentalAnalysis #BearishTrend #CarryTrade #SwissFranc #CanadianDollar #FXMarket #BreakoutTrading #RetailSentiment #TechFundDivergence

Do you have enough reasons to take the trade? IF NOT...stay outAll the information you need to find a high probability trade are in front of you on the charts so build your trading decisions on 'the facts' of the chart NOT what you think or what you want to happen or even what you heard will happen. If you have enough facts telling you to trade in a certain direction and therefore enough confluence to take a trade, then this is how you will gain consistency in you trading and build confidence. Check out my trade idea!!

tradingview.sweetlogin.com

CAD/CHF – Bearish Continuation Setup🔍 **CAD/CHF – Bearish Continuation Setup**

The CAD/CHF pair is set up for a continuation of its bearish trend, with the macroeconomic calendar showing no major events for either currency that could disrupt technical flows. Canadian Housing Starts data is minor, and there is nothing significant for the Swiss franc, making this an ideal week for technical setups.

On the daily chart, CAD/CHF is firmly bearish, showing persistent lower highs and lower lows as price rides down a well-defined channel. Attempts to rally have consistently failed at order blocks located in premium zones, with each mitigation quickly sold into by institutional players. This is confirmed by the repeated sweeps of liquidity above prior highs before price resumes its decline.

The H1 and M15 timeframes show precise execution of smart money concepts: the most recent rally into premium was met with an aggressive bearish rejection, break of structure, and clear loss of bullish momentum on the RSI. The structure remains bearish and intact, with no signs of exhaustion or reversal.

Given the overall technical picture and the lack of upcoming news, the most probable scenario is continued movement lower into unmitigated discount zones. Traders should look to enter short on pullbacks to premium order blocks, with stops placed above the most recent liquidity highs, and targets set at well-defined support and imbalance zones below.

**In summary:**

CAD/CHF remains a sell this week, as bearish momentum and smart money distribution dominate. The lack of news supports pure price action trades, making this an attractive opportunity for SMC-based strategies.

---

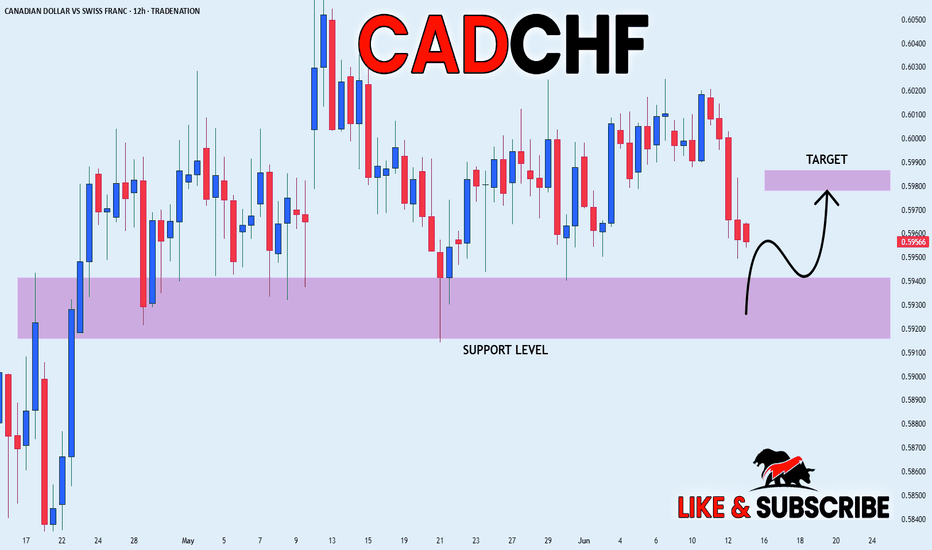

CAD_CHF STRONG SUPPORT AHEAD|LONG|

✅CAD_CHF will be retesting a support

Level soon around 0.5920

From where I am expecting a bullish reaction

With the price going up but we need

To wait for a reversal pattern to form

Before entering the trade, so that we

Get a higher success probability of the trade

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

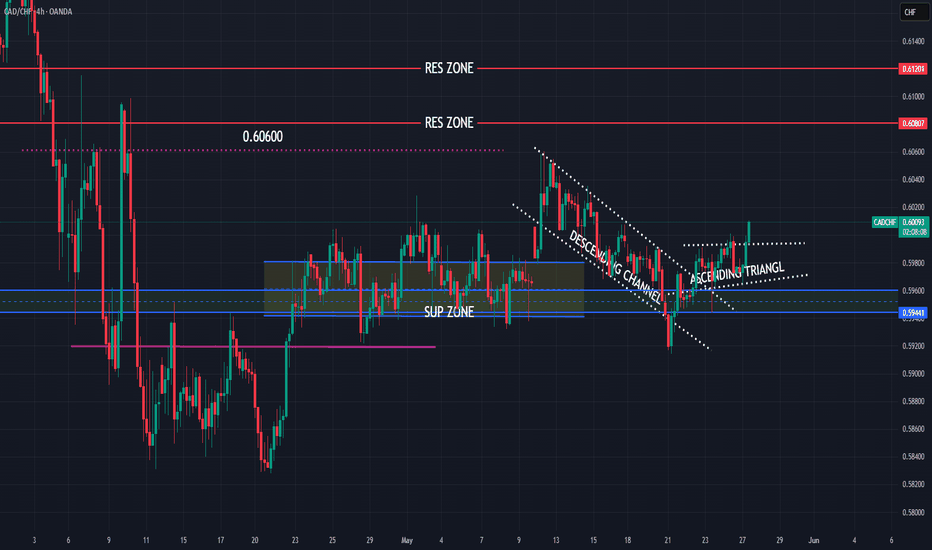

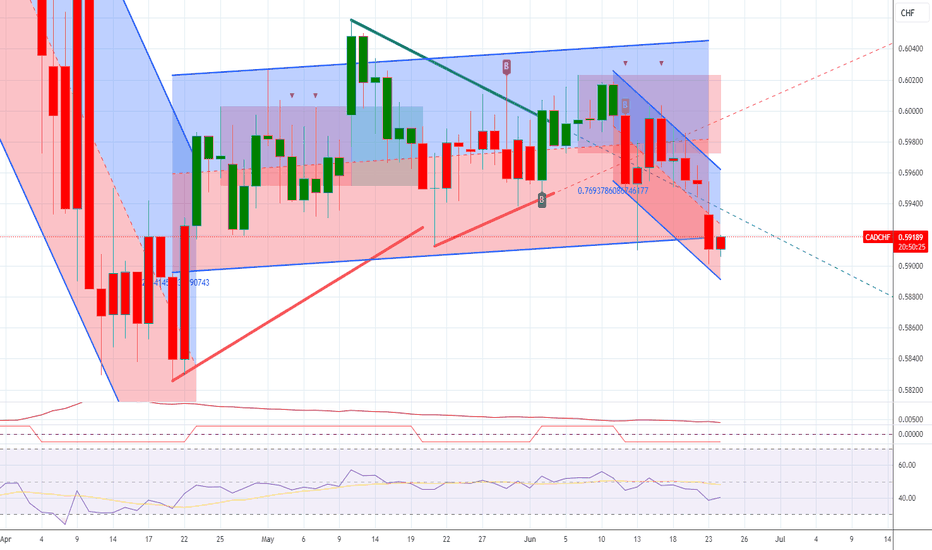

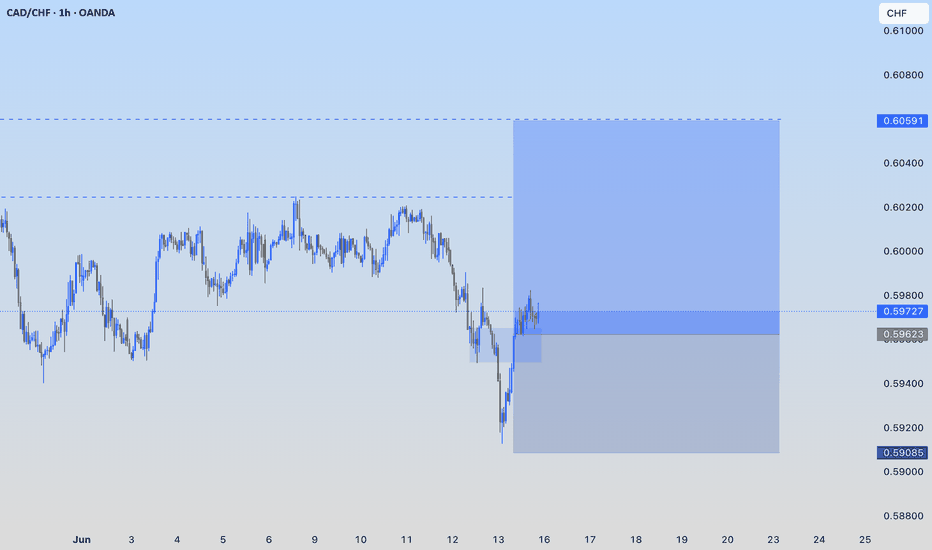

CADCHF new view, still bullish expectations

OANDA:CADCHF first analysis till TP1 (attached), having thoughts we are not see to much here and expecting higher bullish push than in previous analysis.

We are have break of zone, price is start pushing, at end its revers on first res zone (0.60600), in meantime DESCENDING CHANNEL is be created, on 22.Jun is be breaked, currently price is break and ASCENDING TRIANGL.

SUP zone: 0.59600

RES zone: 0.60800, 0.61200

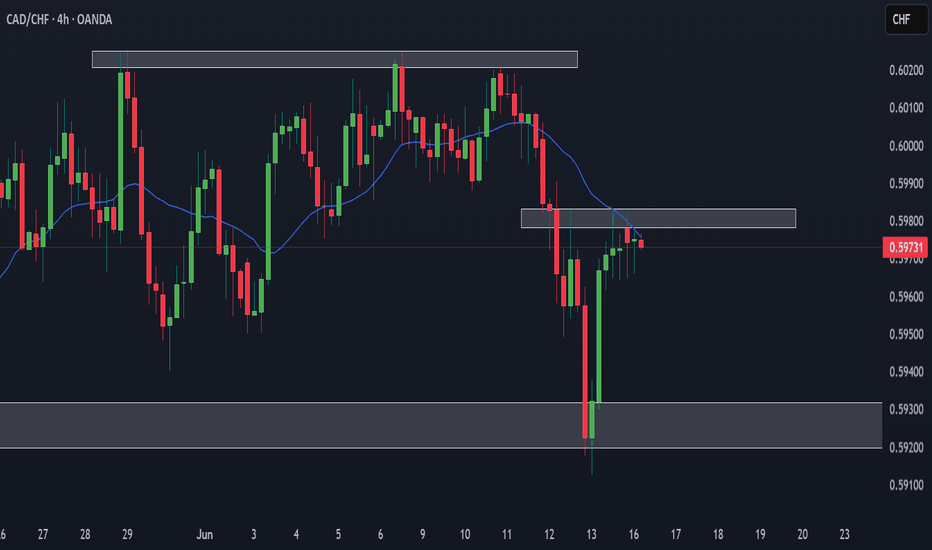

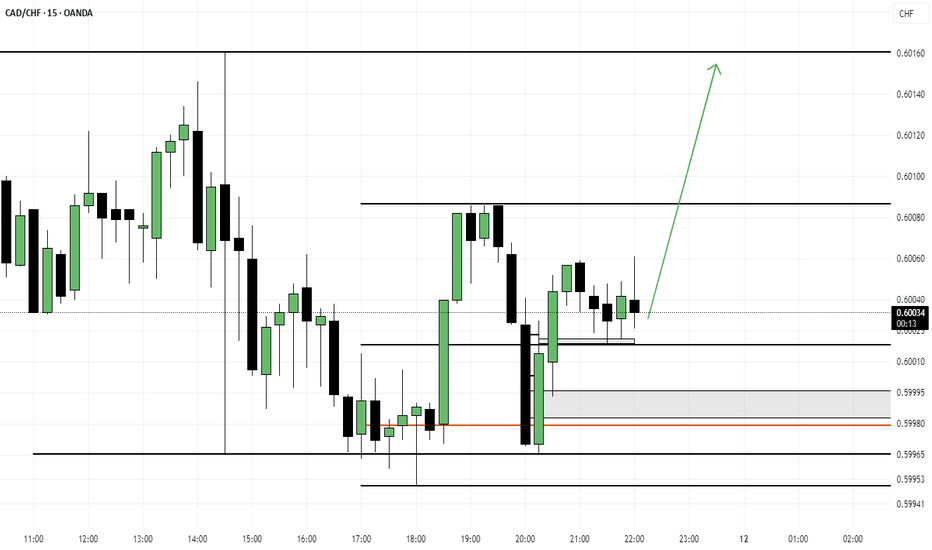

CADCHF Sell Now | Re-Entry at Supply ZoneSell Setup Active 🚨

Price has returned to a key supply zone after breaking structure. Clean rejection off:

• Previous support turned resistance

• Dynamic resistance from 50 EMA

• Bearish market structure still valid

📉 Re-entered short at 0.5966

🎯 Target 1: 0.5919

🎯 Target 2: 0.5862

❌ SL: Above the zone (~0.5985)

Let’s see how this plays out — momentum building for continuation.

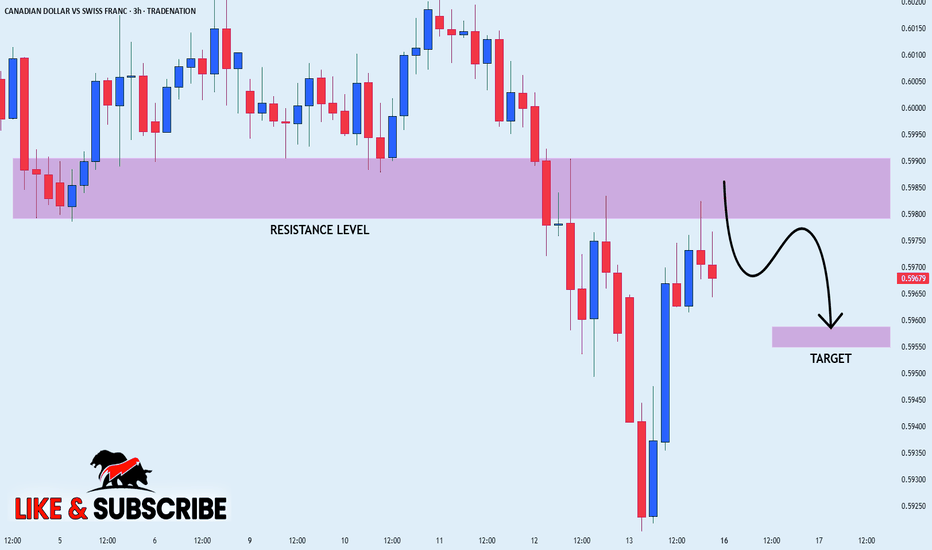

CAD_CHF SHORT FROM RESISTANCE|

✅CAD_CHF has retested a key resistance level of 0.5990

And as the pair is already making a bearish pullback

A move down to retest the demand level below at 0.5960 is likely

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CADCHFCADCHF has already swept sell-side liquidity below a significant low. This indicates that smart money has likely engineered a stop-hunt to remove weak long positions and trap breakout sellers. With the liquidity taken, I am now looking for signs of bullish intent, such as a market structure shift (BOS) or bullish displacement. Once confirmed, I will look to buy on a retracement to a bullish order block, fair value gap (FVG), or imbalance created after the sweep

CAD_CHF RETESTING LOWS|LONG|

✅CAD_CHF will be retesting a support level soon around 0.5830

Which is a deeps low for the pair

From where I am expecting a bullish reaction

With the price going up but we need

To wait for a reversal pattern to form

Before entering the trade, so that we

Get a higher success probability of the trade

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

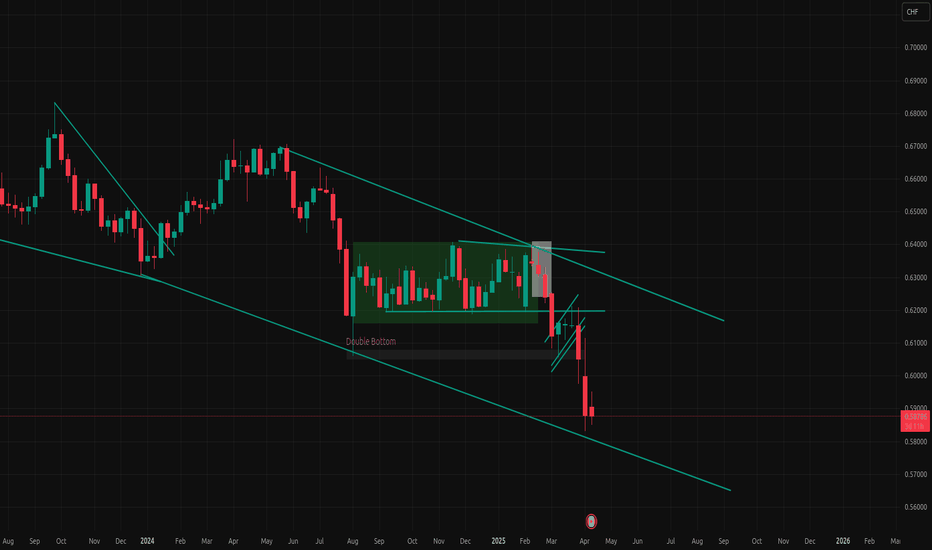

Potential Reversal Setup on CAD/CHF as CHF Strength PeaksThe CAD/CHF pair has been under sustained bearish pressure, reaching historic lows amid continued CHF strength. The ongoing U.S. trade and tariff tensions have heightened global uncertainty, driving investors toward safe-haven currencies like the Swiss franc. In contrast, the Canadian dollar remains sensitive to risk sentiment and commodity demand, amplifying the pair's downside.

Technically, CAD/CHF has been trading within a well-defined **descending channel**, respecting both the upper resistance and lower support boundaries. After reaching the lower boundary of this channel — which coincides with a major historical support level — the pair is now showing early signs of a potential bullish reversal:

If the pair can hold this level and break above the midline or upper resistance of the channel, it could open the door for a corrective move to the upside. Key resistance levels to watch include

As always, any bullish move will depend on how global risk sentiment evolves in response to trade developments.

CAD-CHF Potential Short! Sell!

Hello,Traders!

CAD-CHF made a retest

Of the horizontal resistance

Of 0.5990 and pullback is

Already happening so we are

Locally bearish biased and

We will be expecting a

Further bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.