CADCHF trade ideas

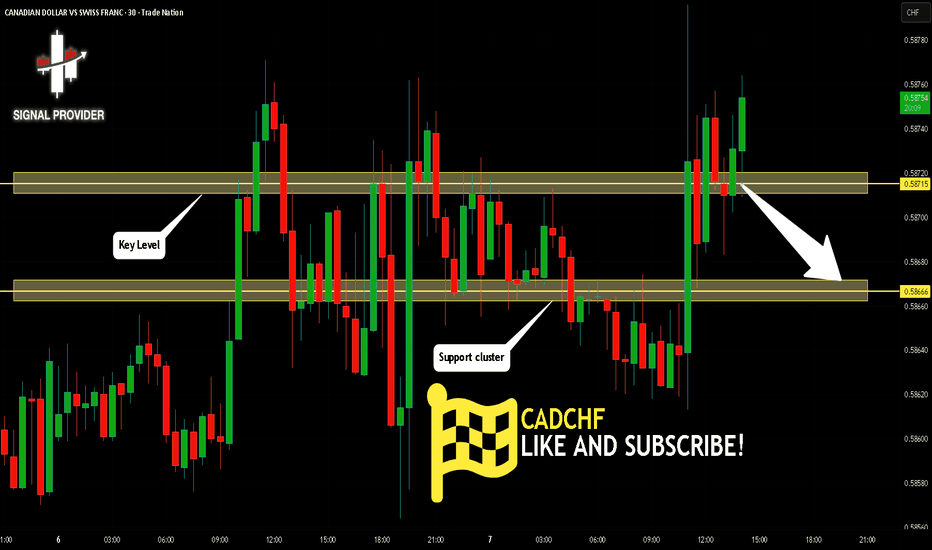

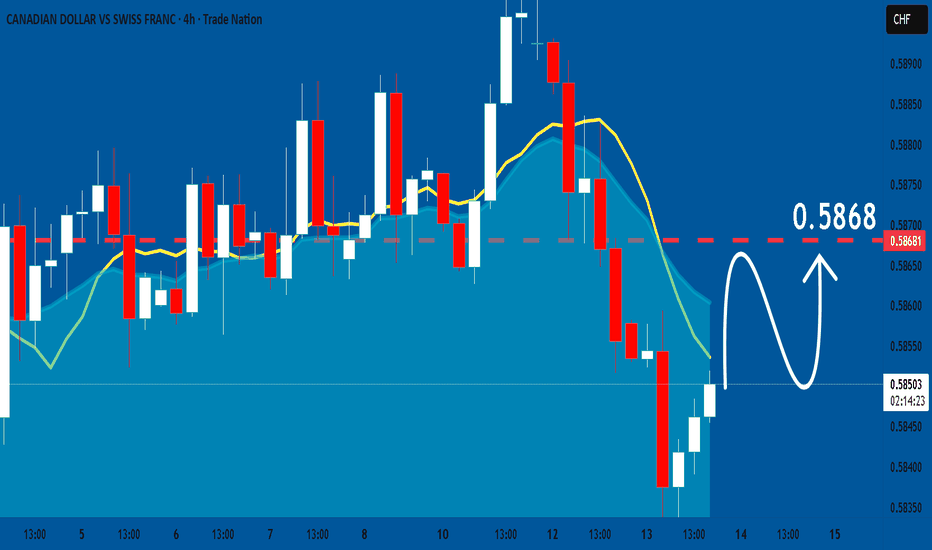

CADCHF Is Very Bearish! Short!

Please, check our technical outlook for CADCHF.

Time Frame: 30m

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 0.587.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 0.586 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

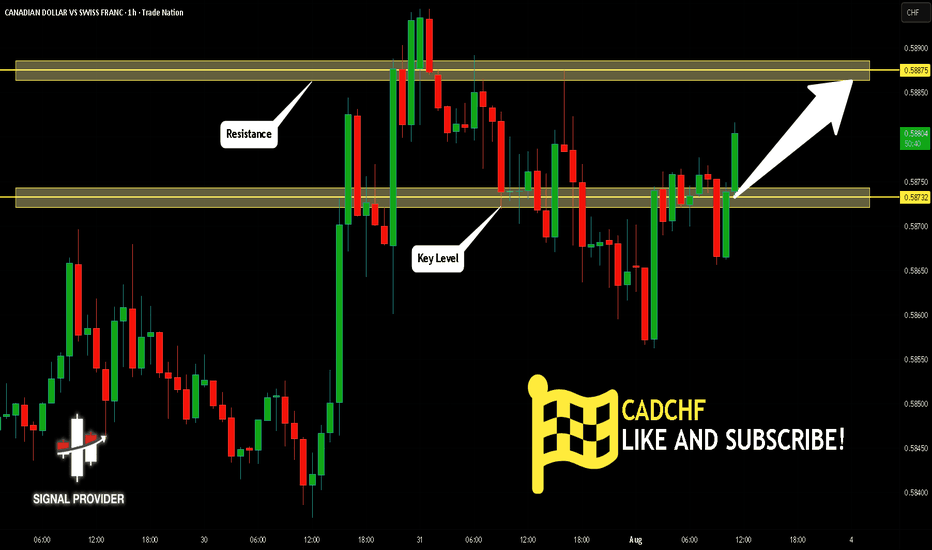

CADCHF Set To Fall! SELL!

My dear friends,

CADCHF looks like it will make a good move, and here are the details:

The market is trading on 0.5872 pivot level.

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 0.5866

Recommended Stop Loss - 0.5876

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

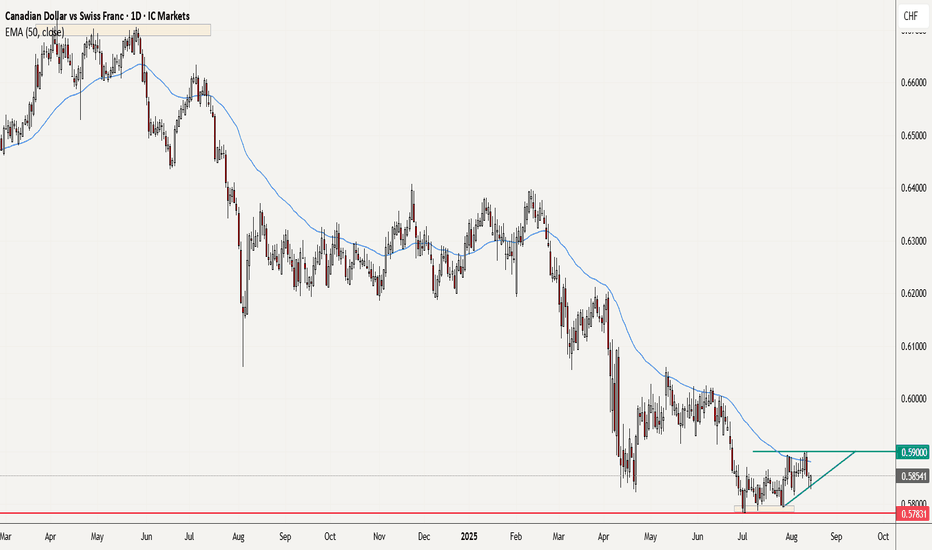

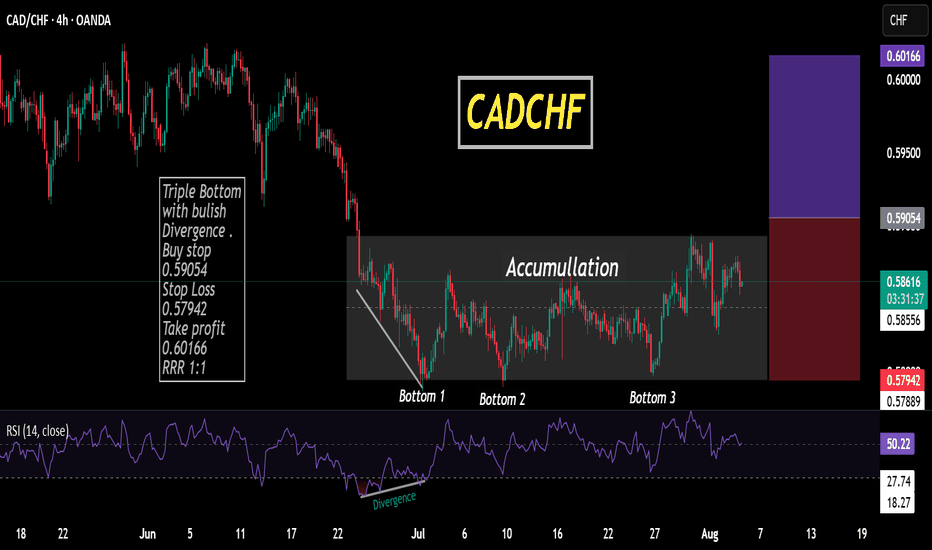

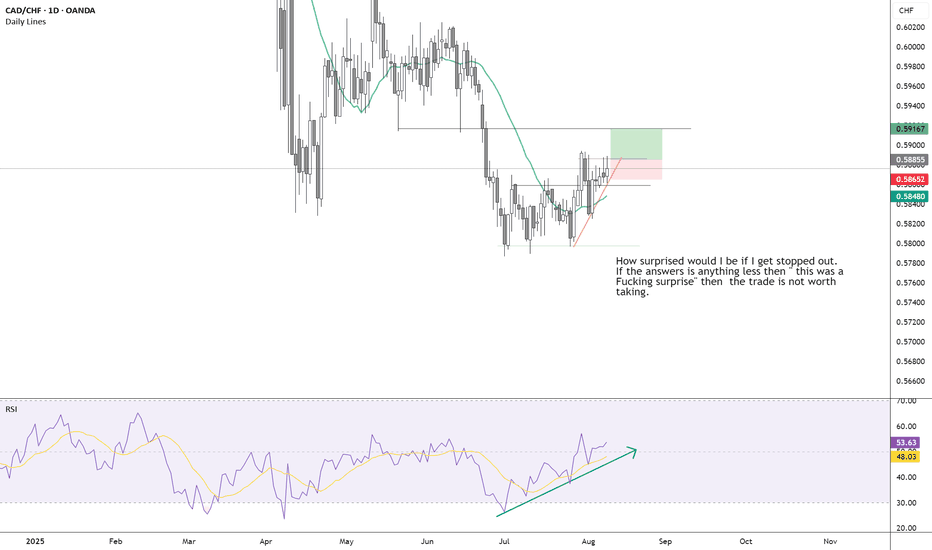

CADCHF - turnaround?A prolonged downtrend that started with a triple top led to an all time low at 0.57831.

A double or triple bottom followed, and then a couple of higher lows.

This could still go either way, I think its premature to conclude that this PA is an early sign of a bullish trend.

However, if we get a daily close above 0.5900 then this could get really interesting.

This is not a trade recommendation; it’s merely my own analysis. Trading carries a high level of risk so carefully managing your capital and risk is important. If you like my idea, please give a “boost” and follow me to get even more.

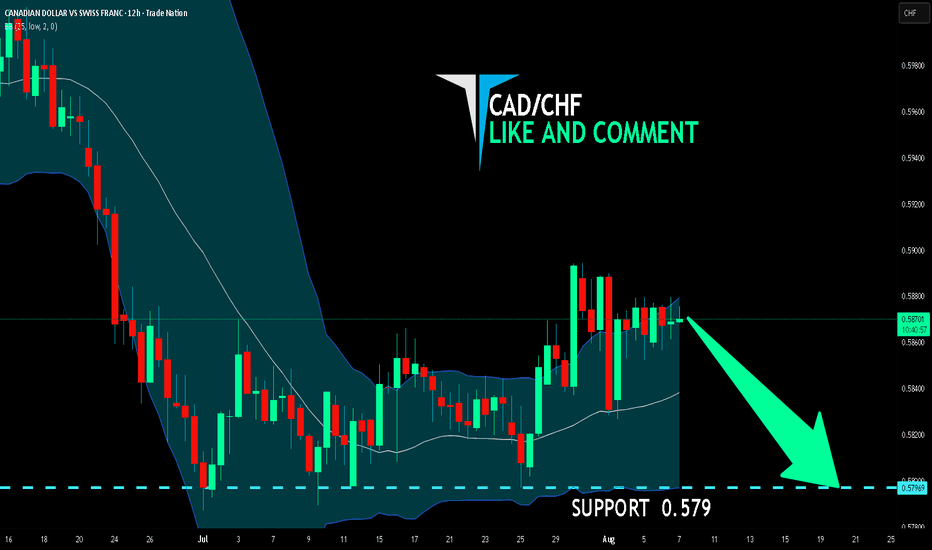

CAD/CHF SHORT FROM RESISTANCE

Hello, Friends!

CAD/CHF pair is in the downtrend because previous week’s candle is red, while the price is evidently rising on the 12H timeframe. And after the retest of the resistance line above I believe we will see a move down towards the target below at 0.579 because the pair is overbought due to its proximity to the upper BB band and a bearish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

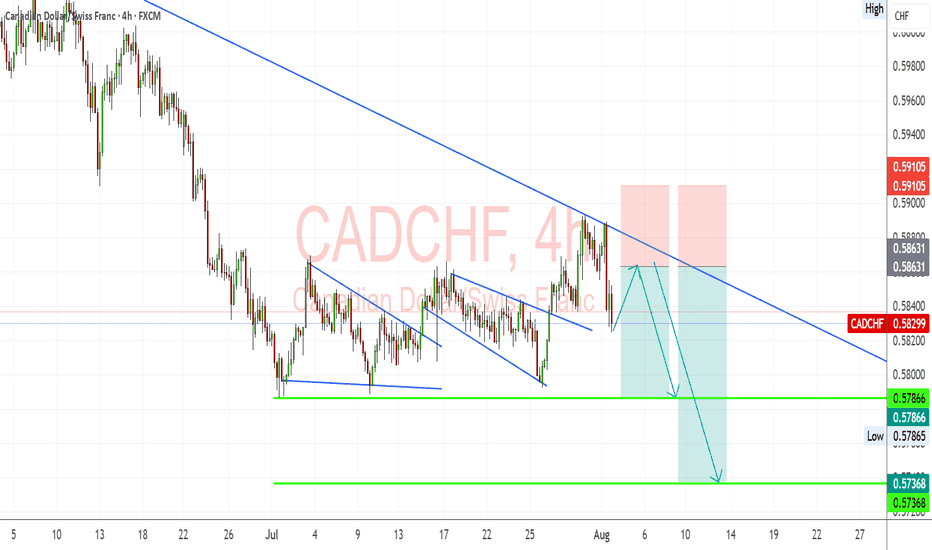

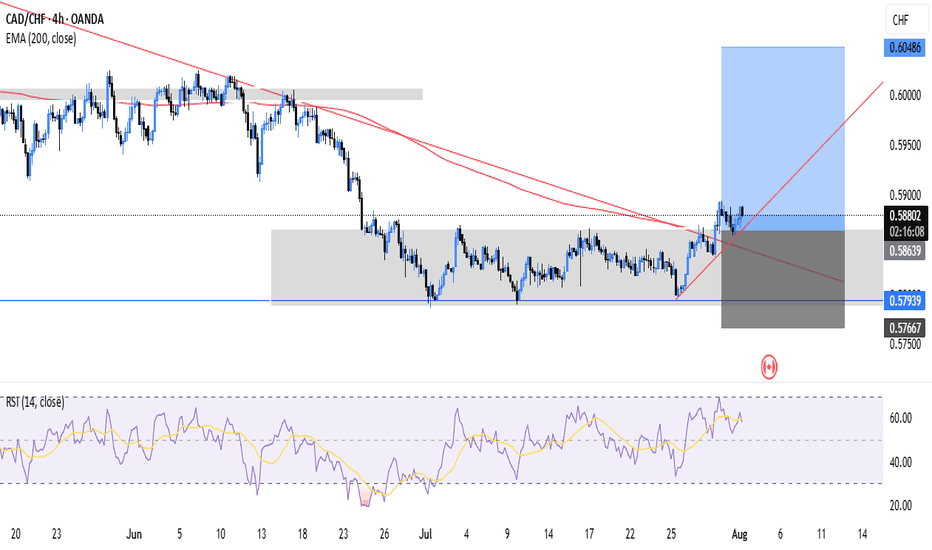

CAD/CHF: Bearish Trend Resumes After Retest of Downtrend LineCAD/CHF continues to respect its prevailing downtrend, with price reacting from the descending trendline and showing signs of renewed bearish pressure. Fundamentals support further downside as CAD remains weighed by weak domestic data, while CHF holds steady as a safe-haven currency amid global tariff concerns.

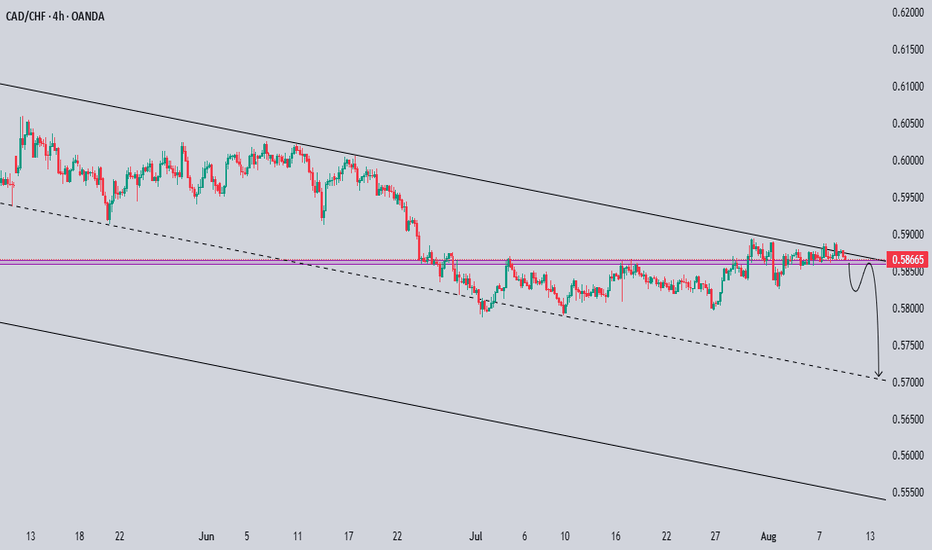

Technical Analysis (4H Chart)

Trend: Strong downtrend structure, with repeated rejections from the descending trendline.

Current Level: 0.5829, consolidating after failing to break above 0.5863 resistance.

Key Support Levels:

0.5786 (near-term support and first bearish target).

0.5736 (secondary support and next major target).

Resistance Levels:

0.5863 (immediate resistance at descending trendline).

0.5910 (upper resistance if a breakout occurs).

Projection: Likely pullback toward 0.5863 (retest zone) before continuation to 0.5786 and possibly 0.5736.

Fundamental Analysis

Bias: Bearish.

Key Fundamentals:

CAD: Weak Canadian manufacturing PMI and trade risks from US tariffs limit CAD upside.

CHF: Swiss Franc remains supported by safe-haven demand amid tariff uncertainty.

Oil Prices: Stable oil offers partial CAD support but insufficient to change the broader trend.

Risks:

A sharp rise in oil prices could strengthen CAD.

Global risk-on sentiment could weaken CHF and lift CAD/CHF.

Key Events:

BoC policy updates.

SNB stance and global risk sentiment shifts.

Oil market data.

Leader/Lagger Dynamics

CAD/CHF is a lagger, following CAD’s performance relative to oil and CHF’s safe-haven flows.

Summary: Bias and Watchpoints

CAD/CHF remains bearish, with price respecting the downtrend and targeting 0.5786 initially. A break below this level opens the door to 0.5736. The key watchpoints are oil price fluctuations, global risk sentiment, and potential safe-haven demand for CHF.

CADCHF: Overstretched, Overhyped, Overdue for a Drop**CADCHF: Overstretched, Overhyped, Overdue for a Drop 📉**

When a tired rally drags itself into resistance — overbought, overextended, and out of breath — it’s often a trapdoor waiting to open. That’s what I see on **CADCHF**. Price is pushing into a wall, in a clear downtrend, and I’m preparing to short the rejection.

🔻 **Trade Bias**: I’m bearish on CADCHF, looking to short from resistance after a technical bounce in a broader downtrend.

Here’s what’s supporting my view:

* 🇨🇭 CHF remains the king of safe havens amid global uncertainty

* 🇨🇦 CAD is vulnerable to US tariff shocks and fading oil optimism

* 🧊 The SNB has paused cuts at 0%, but inflation surprises are limiting further easing

* 🧯 Canada’s manufacturing and GDP momentum are cooling

* 🔄 Speculators are net short on CAD, suggesting underlying bearish pressure

The Canadian dollar is facing multiple headwinds — soft factory activity, a surprise GDP dip, and uncertainty around USMCA renegotiations under the Trump administration. With the threat of 35% tariffs from the US now past the August 1 deadline, the lack of resolution adds more tension than relief. Meanwhile, inflation is heating up just enough to keep the BoC from cutting again, but not enough to attract bullish flows.

On the flip side, the Swiss franc keeps flexing its safe-haven muscle. Even with a recent rate cut to 0%, its strong fiscal standing and resilience against inflation are keeping it well-bid. The CHF has been 2025’s top performer — and nothing’s changed yet to undo that status.

Price looks heavy here. I’m watching for weakness confirmation before entering, but this is where I want to strike.

**Is this the end of the CADCHF bounce — or just the pause before more pain?** Let’s talk. 👇

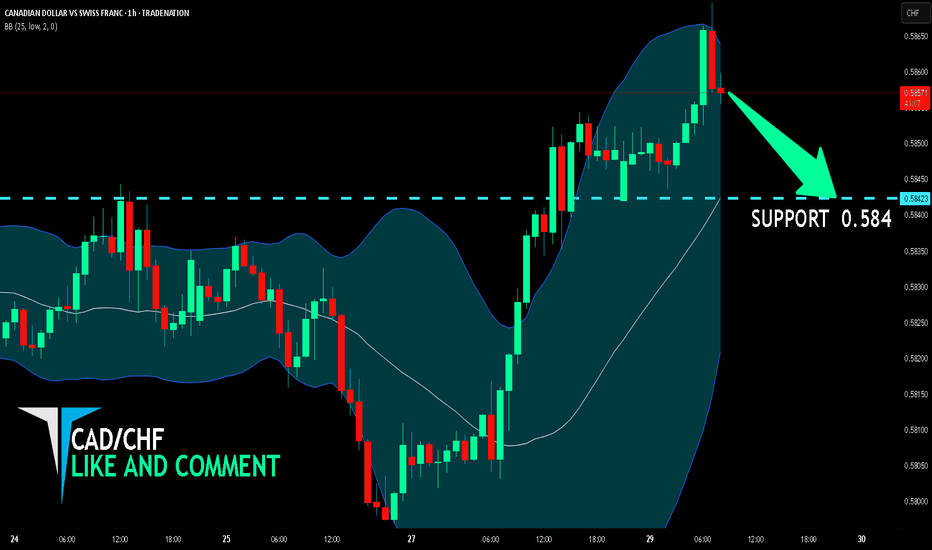

CAD/CHF BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

We are targeting the 0.584 level area with our short trade on CAD/CHF which is based on the fact that the pair is overbought on the BB band scale and is also approaching a resistance line above thus going us a good entry option.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

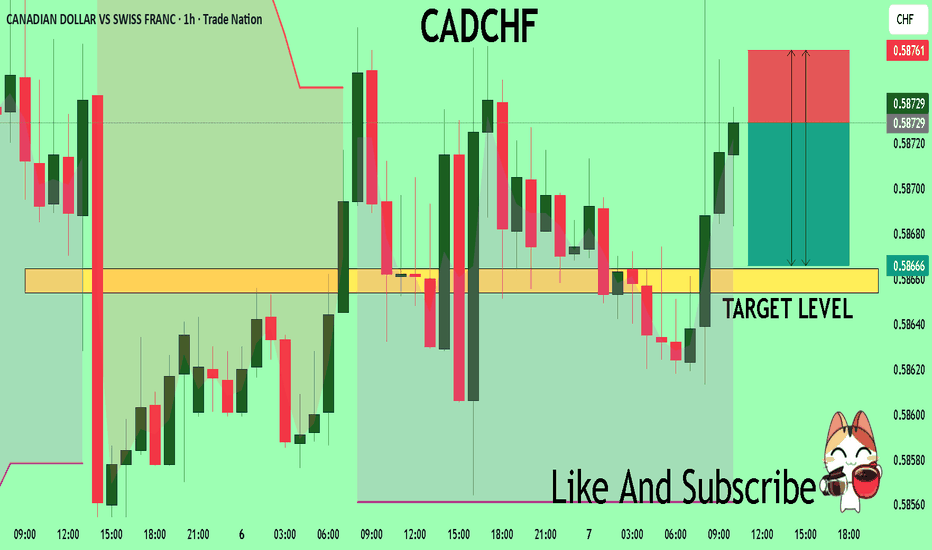

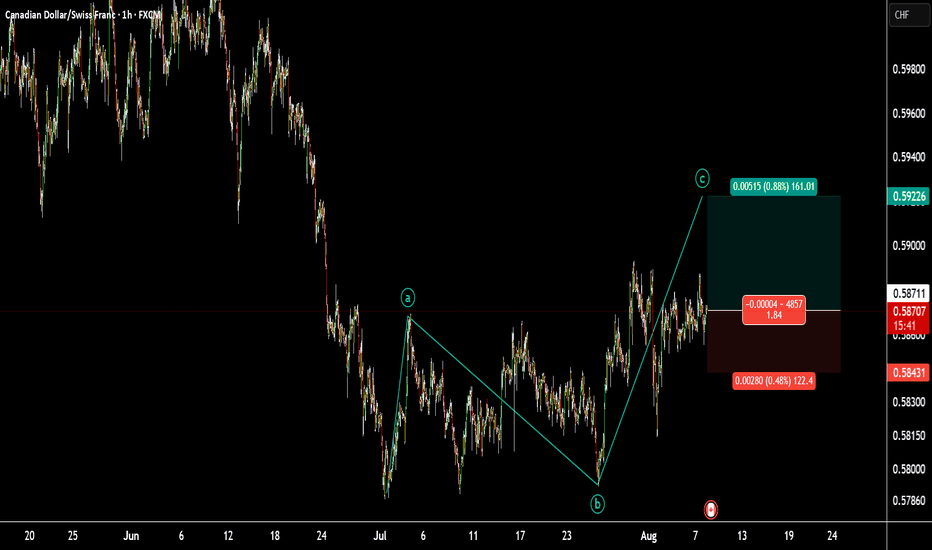

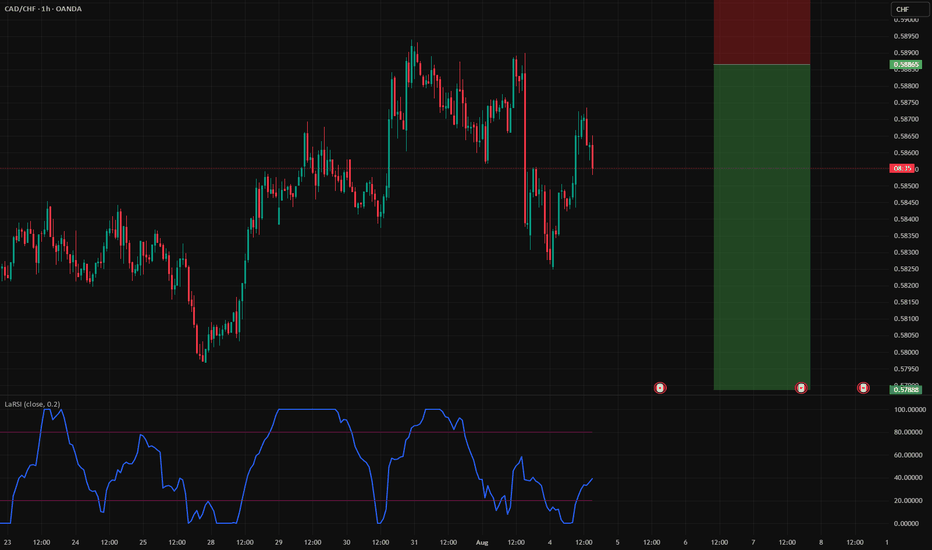

CADCHF Will Grow! Long!

Please, check our technical outlook for CADCHF.

Time Frame: 1h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 0.587.

The above observations make me that the market will inevitably achieve 0.588 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

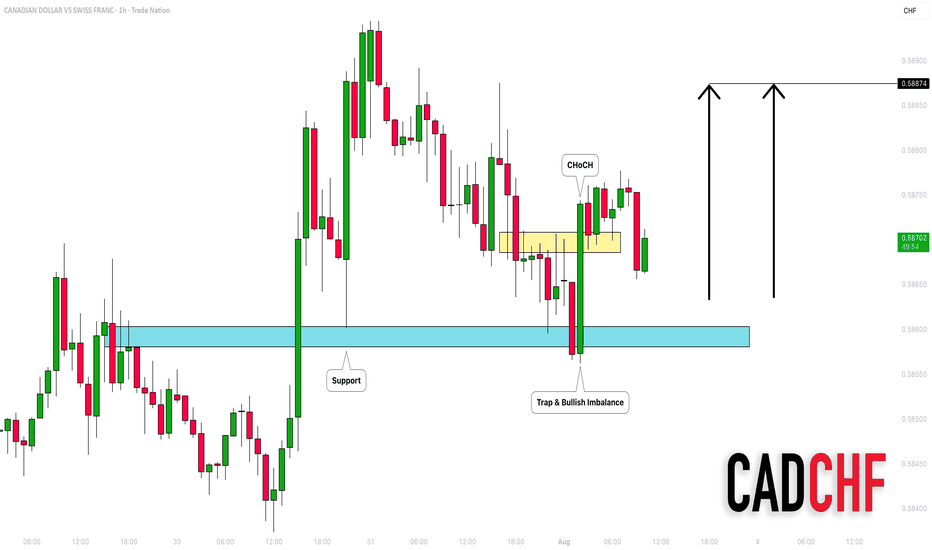

CADCHF: Bullish Move After the Trap 🇨🇦🇨🇭

There is a high chance that CADCHF will go up today.

After a test of a key horizontal support, the price formed

a liquidity grab with a consequent bullish imbalance.

We can expect growth to 0.5887

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

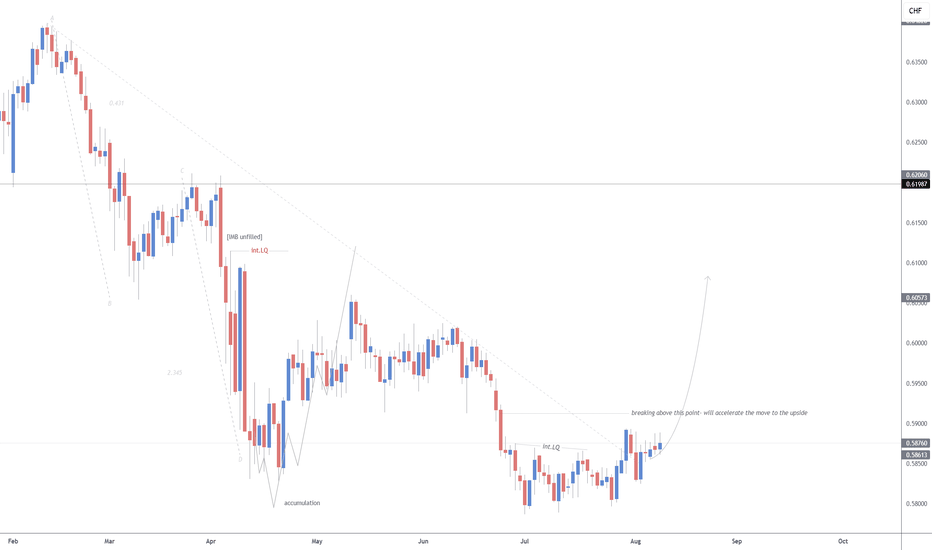

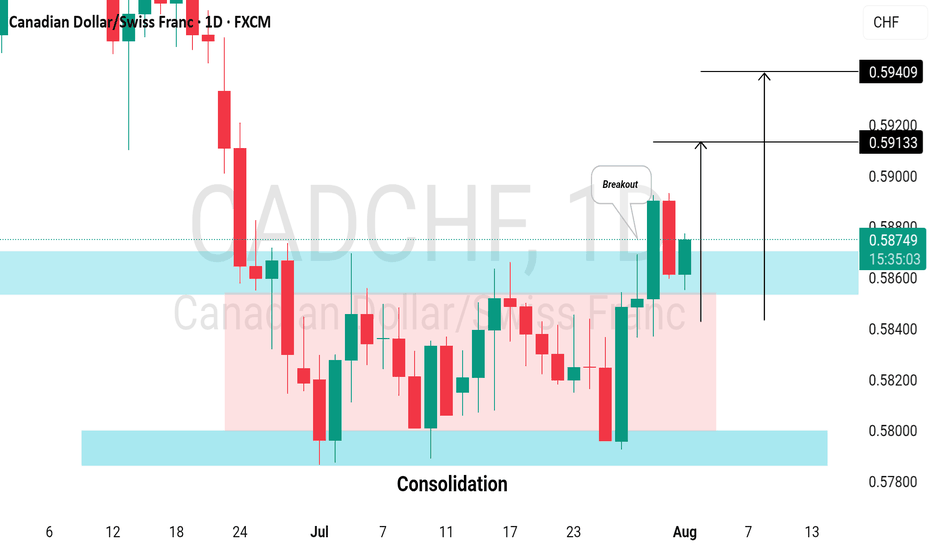

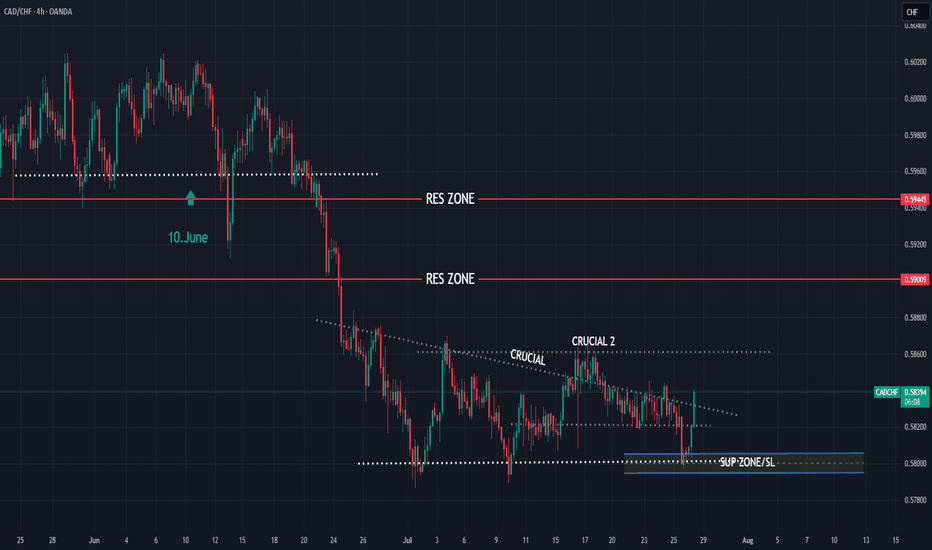

CADCHF bullish expectations for next period

OANDA:CADCHF interesting chart, bearish trend last 5M, i am have bullish expectations on 10.June, but price is make one more strong bearish push.

Currently nice structure created, price pushing bullish, from here expectations are bullish trend to see.

SUP zone: 0.58050

RES zone: 0.59000, 0.59450

CADCHF: Growth & Bullish Continuation

The price of CADCHF will most likely increase soon enough, due to the demand beginning to exceed supply which we can see by looking at the chart of the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

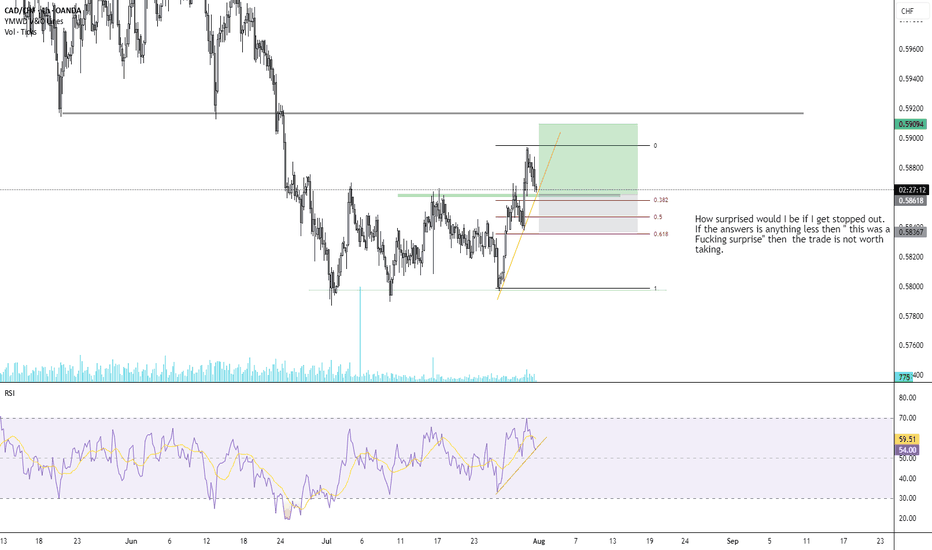

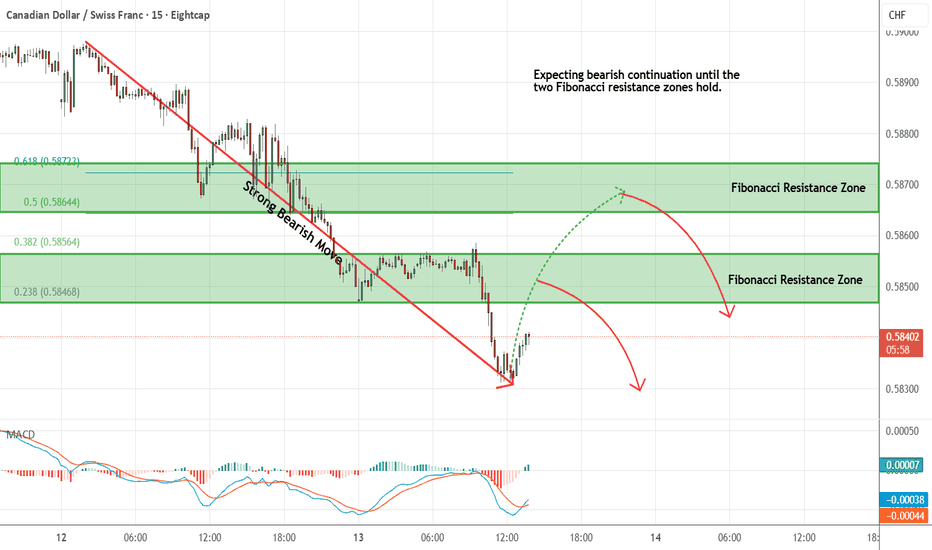

CADCHF - Looking To Sell Pullbacks In The Short TermM15 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

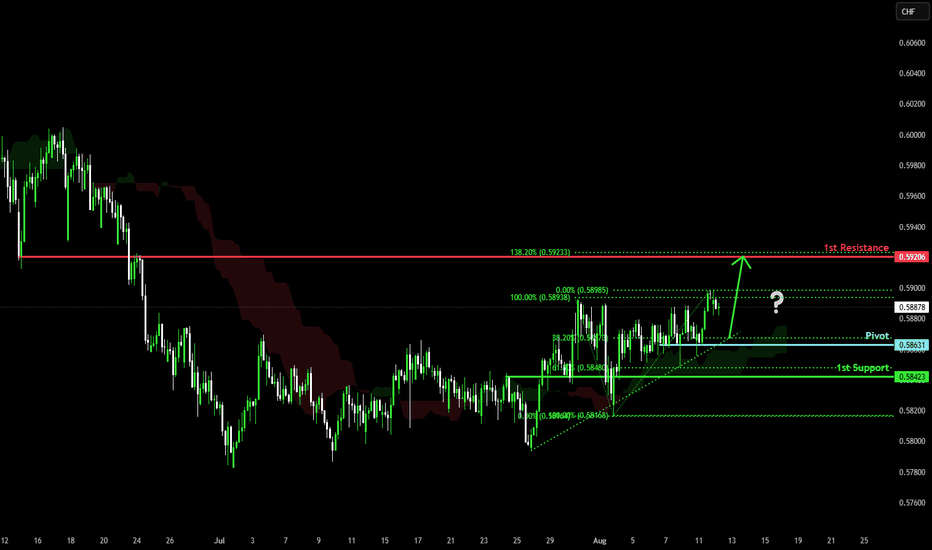

Bullish continuation?CAD/CHF is falling towards the pivot and could bounce to he 1st resistance, which is a pullback resistance.

Pivot: 0.586311

1st Support: 0.58423

1st Resistance: 0.59206

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

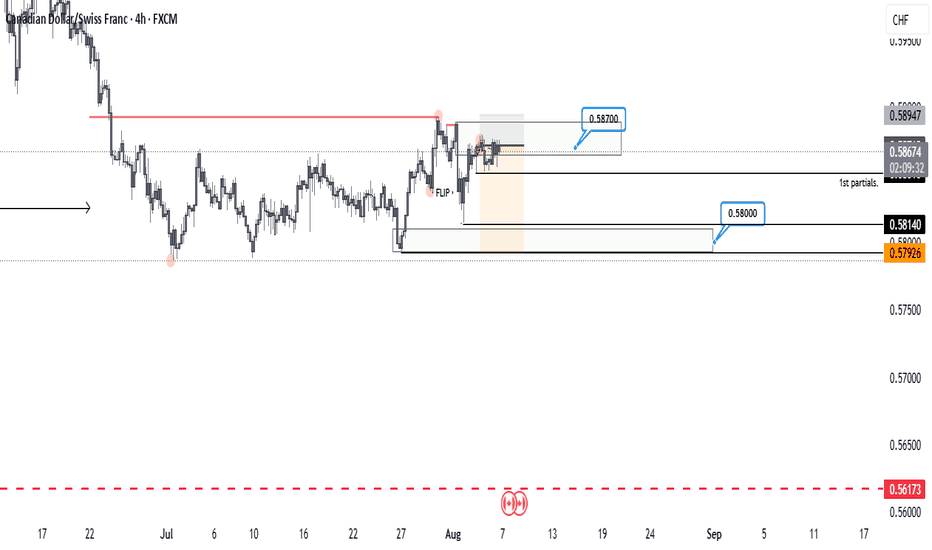

CADCHF SELLSI entered a sell on CADCHF that I didn’t share earlier. The reason behind the trade was that price mitigated a Daily inefficiency, which caused the 4H bullish structure to flip. After the flip, price pulled back into a well-defined 4H supply zone. I waited for confirmation on the 15-minute timeframe, and once the structure shifted there, the entry was triggered. Price has returned to the entry area, but the trade remains valid as long as the structure is intact. I'm aiming for a nice swing move if price cooperates, and I’ll definitely take partials at the first significant low.

CADCHF Technical & Order Flow AnalysisOur analysis is based on a multi-timeframe top-down approach and fundamental analysis.

Based on our assessment, the price is expected to return to the monthly level.

DISCLAIMER: This analysis may change at any time without notice and is solely intended to assist traders in making independent investment decisions. Please note that this is a prediction, and I have no obligation to act on it, nor should you.

Please support our analysis with a boost or

comment!

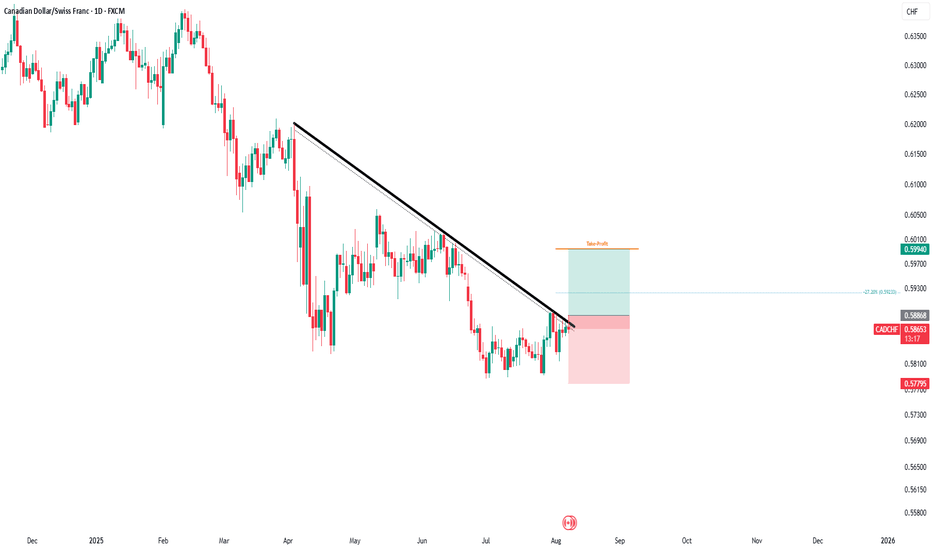

CAD/CHF - LongCAD/CHF has established a well-defined bullish channel, with price action suggesting further upside momentum. Technical projections indicate a probable advance toward the –27% Fibonacci extension level, which aligns with our breakeven target and serves as the immediate upside objective.