Do you have enough reasons to take the trade? IF NOT...stay outAll the information you need to find a high probability trade are in front of you on the charts so build your trading decisions on 'the facts' of the chart NOT what you think or what you want to happen or even what you heard will happen. If you have enough facts telling you to trade in a certain direction and therefore enough confluence to take a trade, then this is how you will gain consistency in you trading and build confidence. Check out my trade idea!!

tradingview.sweetlogin.com

CADCHF trade ideas

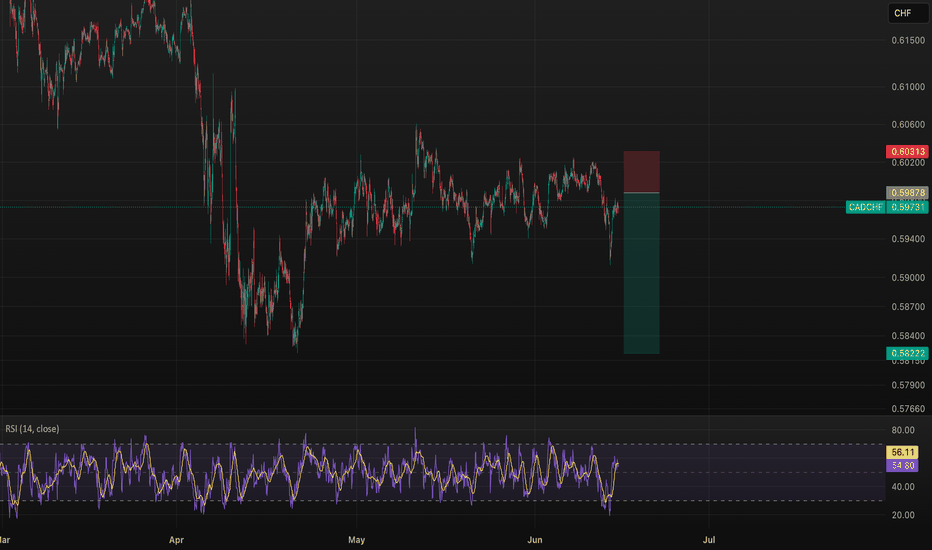

CAD/CHF – Bearish Continuation Setup🔍 **CAD/CHF – Bearish Continuation Setup**

The CAD/CHF pair is set up for a continuation of its bearish trend, with the macroeconomic calendar showing no major events for either currency that could disrupt technical flows. Canadian Housing Starts data is minor, and there is nothing significant for the Swiss franc, making this an ideal week for technical setups.

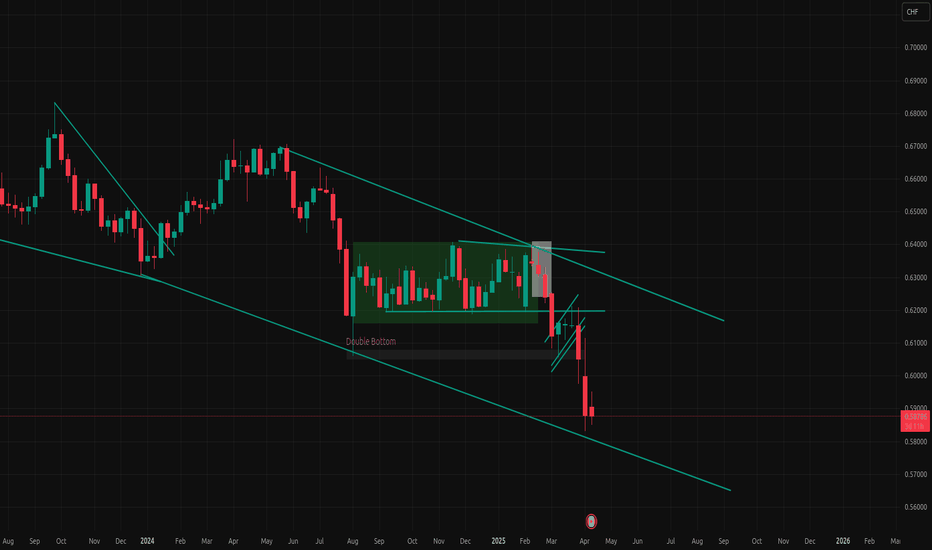

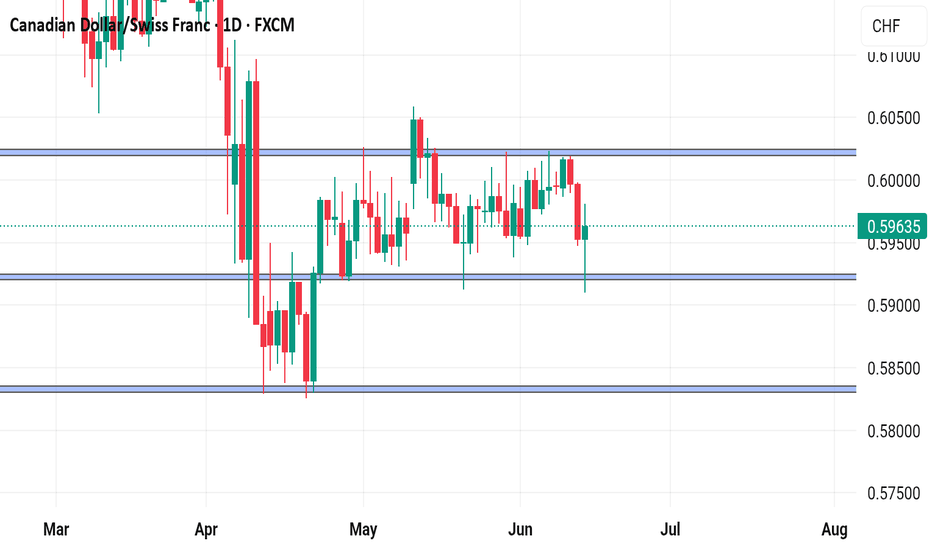

On the daily chart, CAD/CHF is firmly bearish, showing persistent lower highs and lower lows as price rides down a well-defined channel. Attempts to rally have consistently failed at order blocks located in premium zones, with each mitigation quickly sold into by institutional players. This is confirmed by the repeated sweeps of liquidity above prior highs before price resumes its decline.

The H1 and M15 timeframes show precise execution of smart money concepts: the most recent rally into premium was met with an aggressive bearish rejection, break of structure, and clear loss of bullish momentum on the RSI. The structure remains bearish and intact, with no signs of exhaustion or reversal.

Given the overall technical picture and the lack of upcoming news, the most probable scenario is continued movement lower into unmitigated discount zones. Traders should look to enter short on pullbacks to premium order blocks, with stops placed above the most recent liquidity highs, and targets set at well-defined support and imbalance zones below.

**In summary:**

CAD/CHF remains a sell this week, as bearish momentum and smart money distribution dominate. The lack of news supports pure price action trades, making this an attractive opportunity for SMC-based strategies.

---

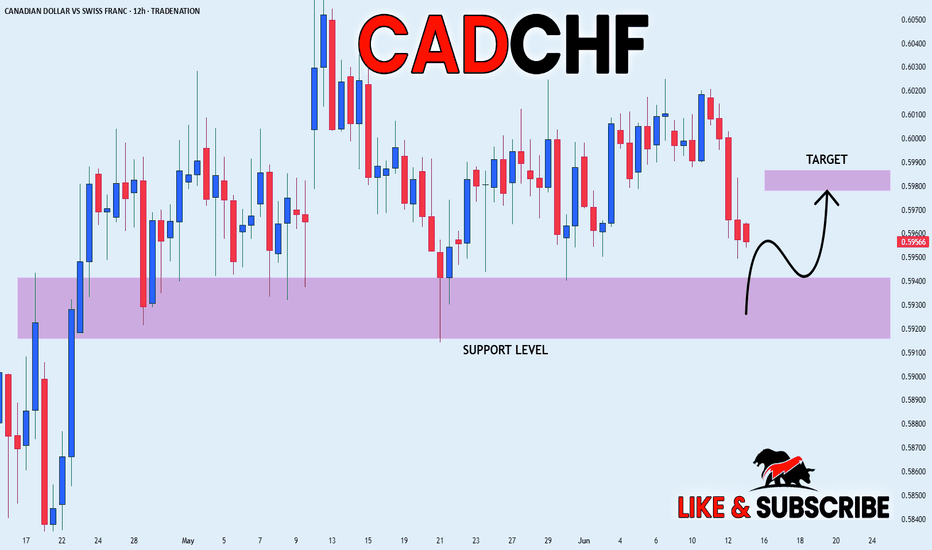

CAD_CHF STRONG SUPPORT AHEAD|LONG|

✅CAD_CHF will be retesting a support

Level soon around 0.5920

From where I am expecting a bullish reaction

With the price going up but we need

To wait for a reversal pattern to form

Before entering the trade, so that we

Get a higher success probability of the trade

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

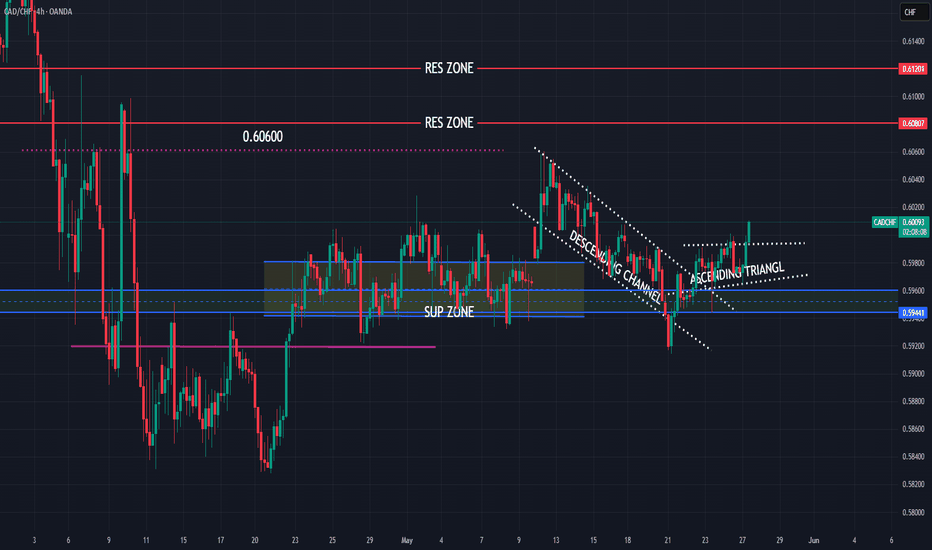

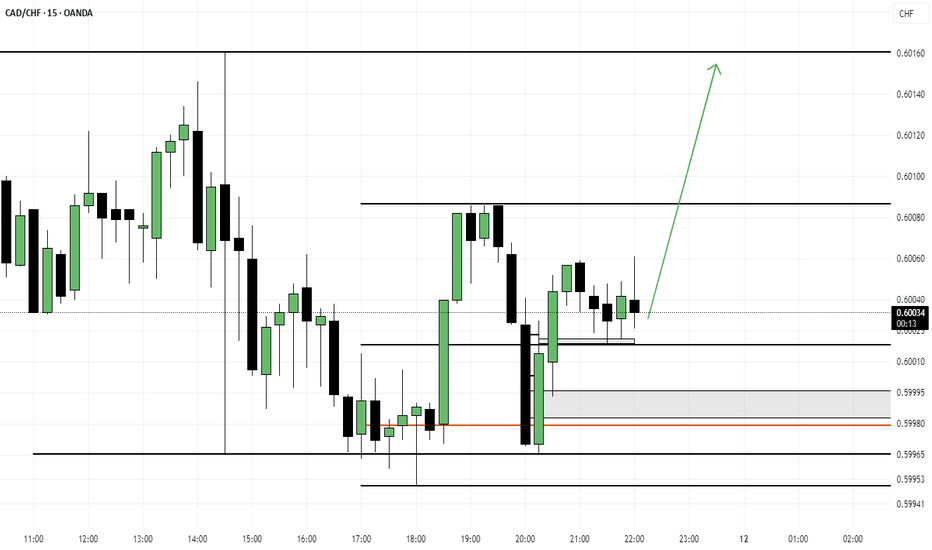

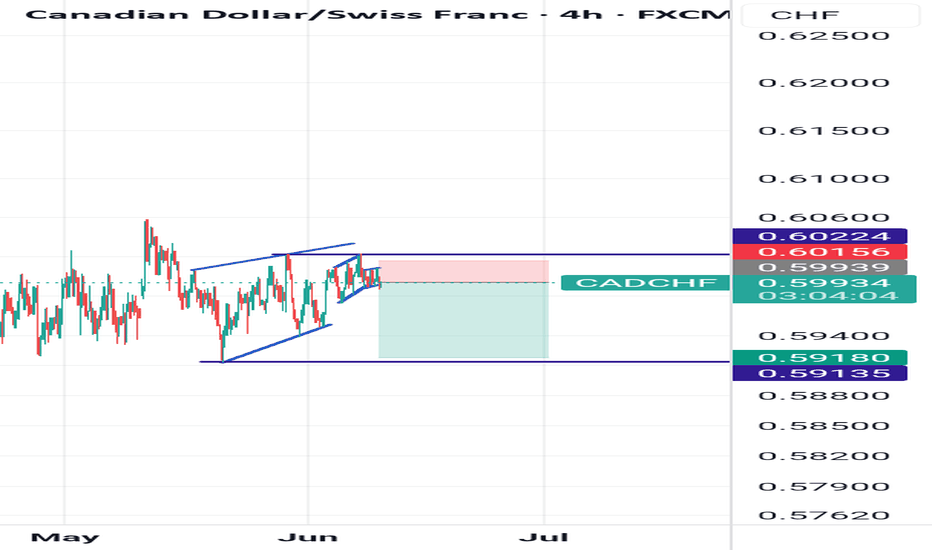

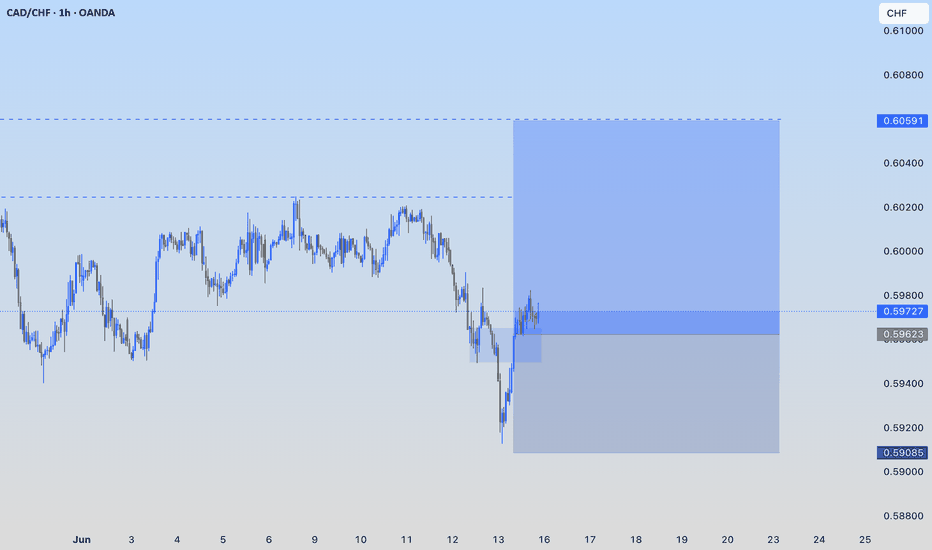

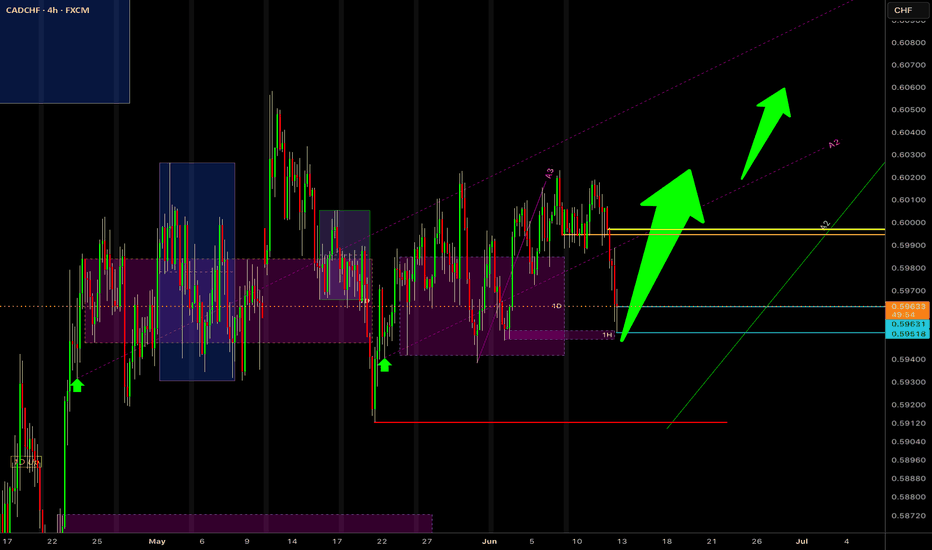

CADCHF new view, still bullish expectations

OANDA:CADCHF first analysis till TP1 (attached), having thoughts we are not see to much here and expecting higher bullish push than in previous analysis.

We are have break of zone, price is start pushing, at end its revers on first res zone (0.60600), in meantime DESCENDING CHANNEL is be created, on 22.Jun is be breaked, currently price is break and ASCENDING TRIANGL.

SUP zone: 0.59600

RES zone: 0.60800, 0.61200

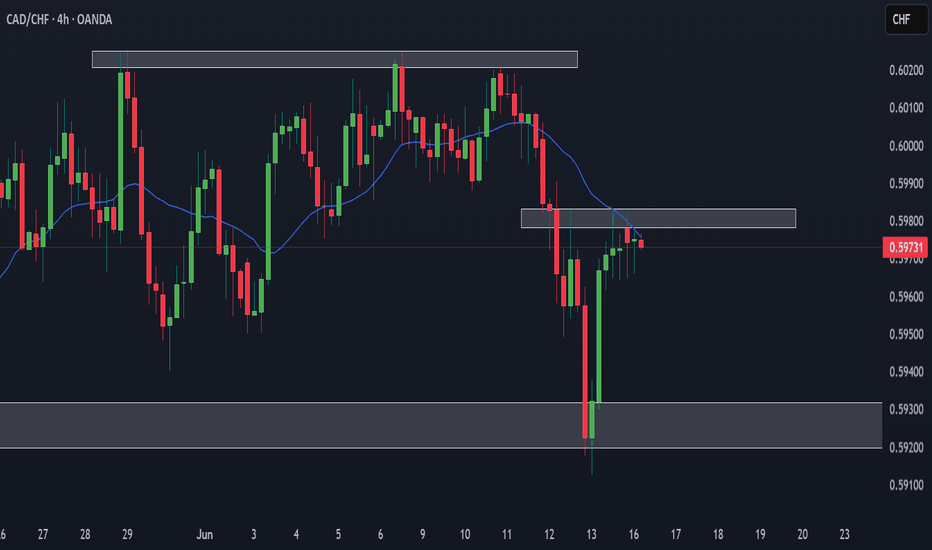

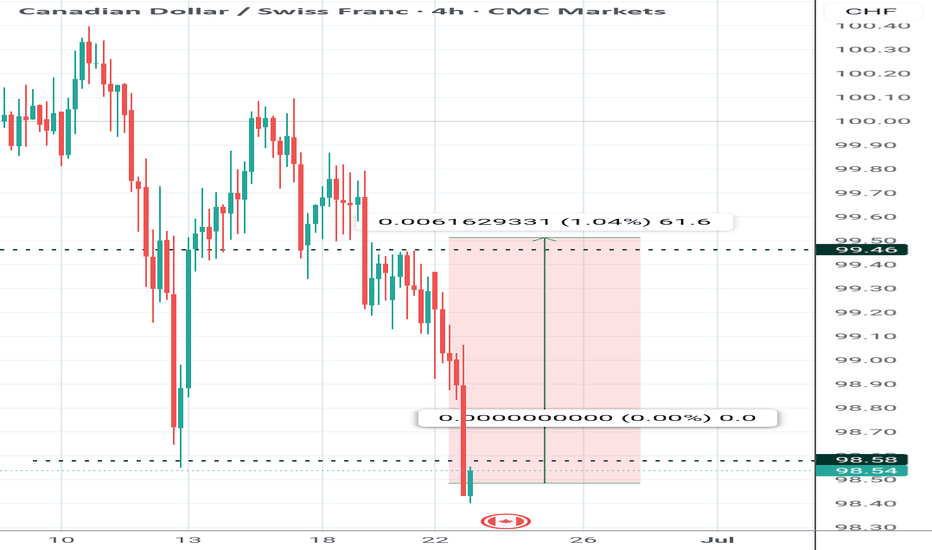

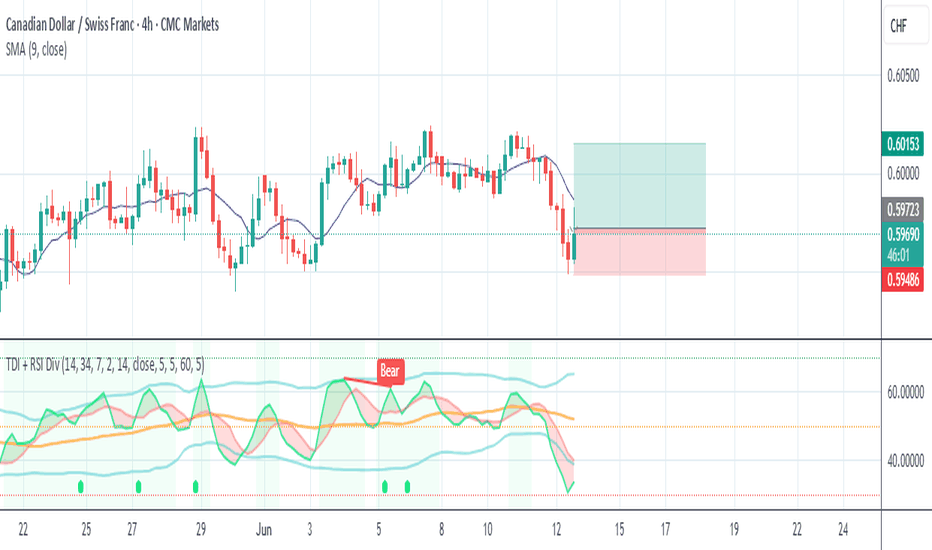

CADCHF Sell Now | Re-Entry at Supply ZoneSell Setup Active 🚨

Price has returned to a key supply zone after breaking structure. Clean rejection off:

• Previous support turned resistance

• Dynamic resistance from 50 EMA

• Bearish market structure still valid

📉 Re-entered short at 0.5966

🎯 Target 1: 0.5919

🎯 Target 2: 0.5862

❌ SL: Above the zone (~0.5985)

Let’s see how this plays out — momentum building for continuation.

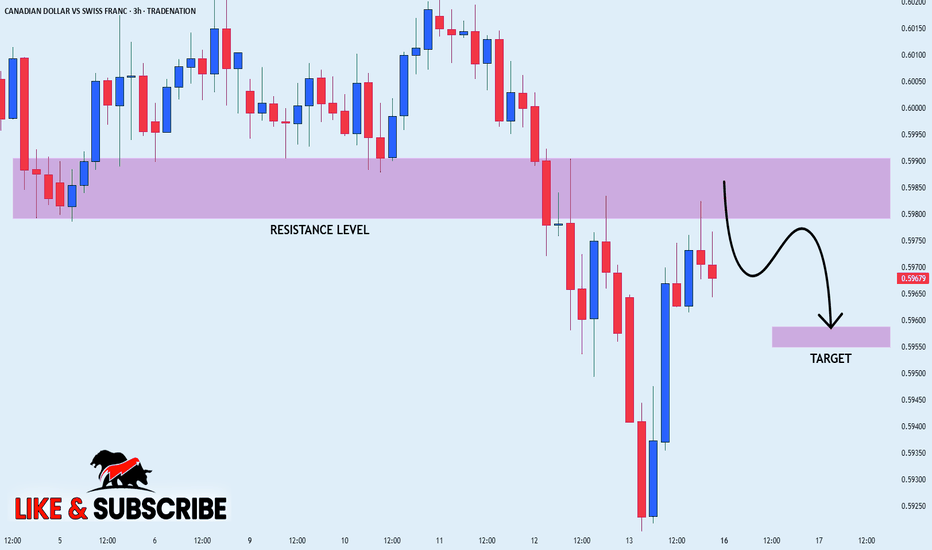

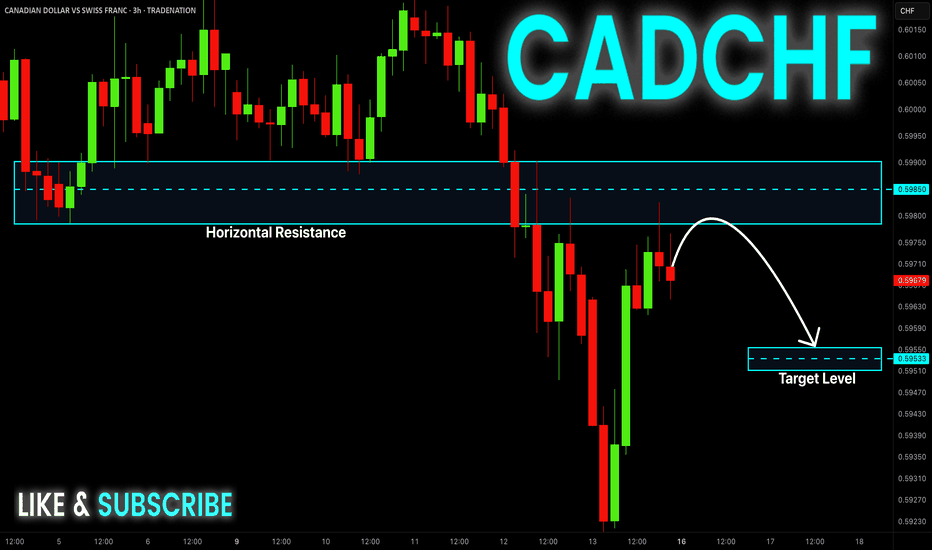

CAD_CHF SHORT FROM RESISTANCE|

✅CAD_CHF has retested a key resistance level of 0.5990

And as the pair is already making a bearish pullback

A move down to retest the demand level below at 0.5960 is likely

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CADCHFCADCHF has already swept sell-side liquidity below a significant low. This indicates that smart money has likely engineered a stop-hunt to remove weak long positions and trap breakout sellers. With the liquidity taken, I am now looking for signs of bullish intent, such as a market structure shift (BOS) or bullish displacement. Once confirmed, I will look to buy on a retracement to a bullish order block, fair value gap (FVG), or imbalance created after the sweep

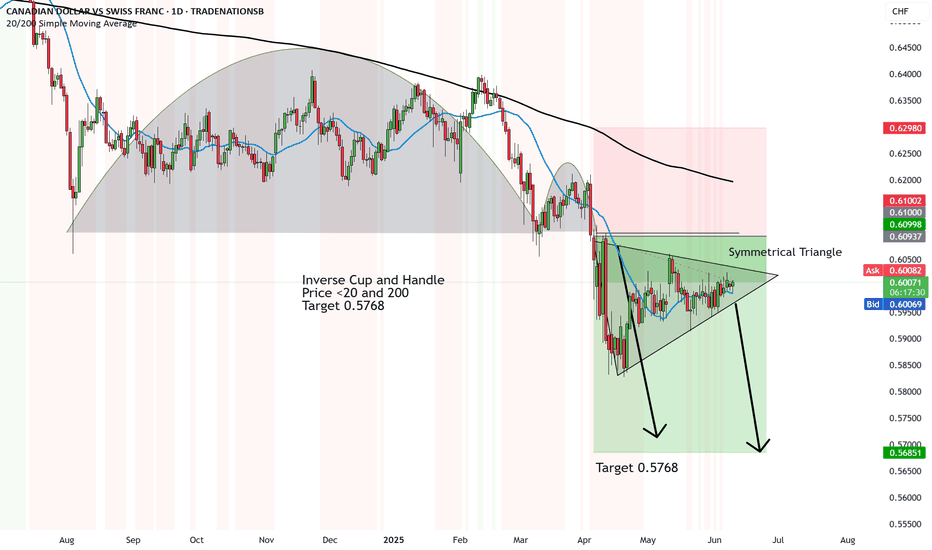

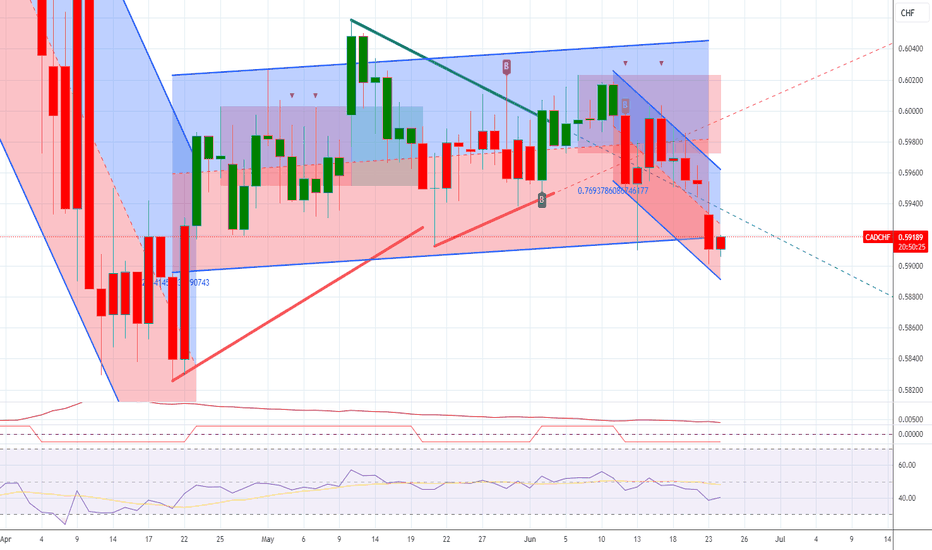

CAD/CHF taking a pit stop before the break down?We saw a MAJOR Inverse Cup and Handle on CAD/CHF.

And when it broke down, we were too optimistic that downside would prevail.

In the interim, a Symmetrical Triangle was forming instead.

The prior trend was down, the Symmetrical Triangle is sideways, and it would be wrong to say the price is going to just break down.

By probability yes, the price does tend to break below according to the prior trend. But if CAD picks up, it could very well break up. We just have to wait for the APEX and then the break up or down.

My bet and according to the analysis, remains DOWN.

Let's see how it plays.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

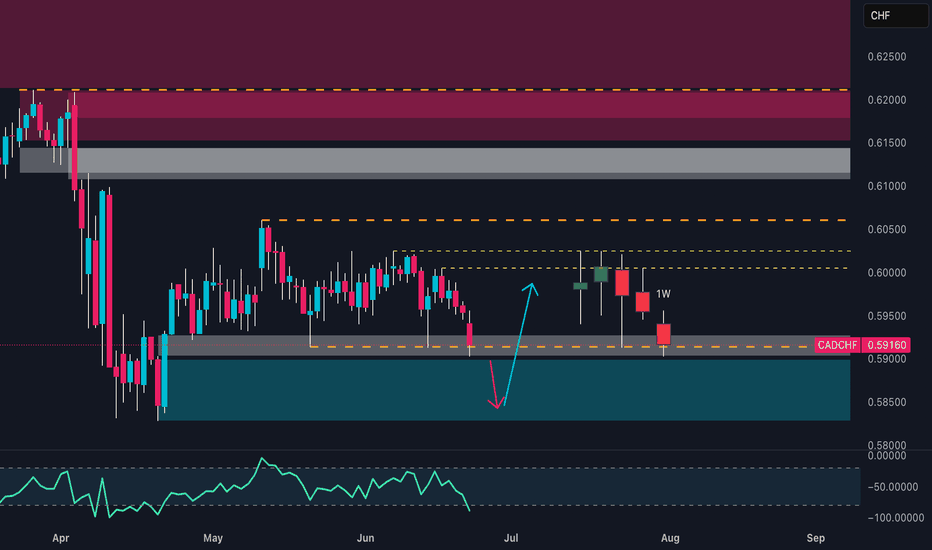

CADCHF at the Cliff's Edge – Is a Breakdown Imminent? 🧭 Technical Context

Price is currently sitting at the key support area of 0.5890–0.5900, tested multiple times since April.

This week’s candlestick shows a clear close below the intermediate micro-structure (two consecutive closes under recent lows), confirming bearish pressure.

The weekly RSI remains in a neutral-to-low zone, trending downwards with no active bullish divergence.

📉 Technical Conclusion: Active bearish bias. Watch out for potential false breaks below 0.5890 as liquidity traps.

📊 COT Report – as of June 17, 2025

🇨🇦 CAD

Non-Commercials: added +8.5k long contracts, aggressively cut −18.3k shorts

→ Excessive optimism, potential exhaustion on the buy-side

Commercials: added +31k shorts

→ Typical hedge behavior – signaling protection from CAD devaluation

🇨🇭CHF

Net positions in gradual decline with no sharp moves → CHF remains in consolidation, with a defensive tone

Open Interest dropped by −19.5k → Institutional money exiting positions

→ Interpretation: Market likely preparing for a directional breakout, CHF could act as a safe haven

📉 COT Conclusion: CAD appears overbought, CHF still gathering strength. Bearish bias on CADCHF remains intact.

📅 Seasonality – June Pattern

CHF tends to strengthen in June:

+0.0095 (10Y average), +0.0068 (5Y average)

CAD shows structural weakness in June:

−0.0027 (10Y), −0.0076 (5Y)

📉 Seasonality Conclusion: June favors CAD weakness and CHF strength → Bearish confirmation for CADCHF

🧠 Retail Sentiment

92% of retail traders are long CADCHF, only 8% are short

→ Extreme imbalance = classic contrarian signal

📉 Sentiment Conclusion: Confirms potential for continued downside on CADCHF

✅ Trade Plan Summary

📌 Base scenario:

Short CADCHF if we get a daily/weekly close below 0.5890

🎯 Target 1: 0.5820

🎯 Target 2: 0.5770

🚫 Invalidation: daily close above 0.5960 (invalidates current setup)

📌 Alternative scenario:

Short from 0.5960–0.6000 if we get a bearish rejection pattern → ideal for better R/R

Potential Reversal Setup on CAD/CHF as CHF Strength PeaksThe CAD/CHF pair has been under sustained bearish pressure, reaching historic lows amid continued CHF strength. The ongoing U.S. trade and tariff tensions have heightened global uncertainty, driving investors toward safe-haven currencies like the Swiss franc. In contrast, the Canadian dollar remains sensitive to risk sentiment and commodity demand, amplifying the pair's downside.

Technically, CAD/CHF has been trading within a well-defined **descending channel**, respecting both the upper resistance and lower support boundaries. After reaching the lower boundary of this channel — which coincides with a major historical support level — the pair is now showing early signs of a potential bullish reversal:

If the pair can hold this level and break above the midline or upper resistance of the channel, it could open the door for a corrective move to the upside. Key resistance levels to watch include

As always, any bullish move will depend on how global risk sentiment evolves in response to trade developments.

CAD-CHF Potential Short! Sell!

Hello,Traders!

CAD-CHF made a retest

Of the horizontal resistance

Of 0.5990 and pullback is

Already happening so we are

Locally bearish biased and

We will be expecting a

Further bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

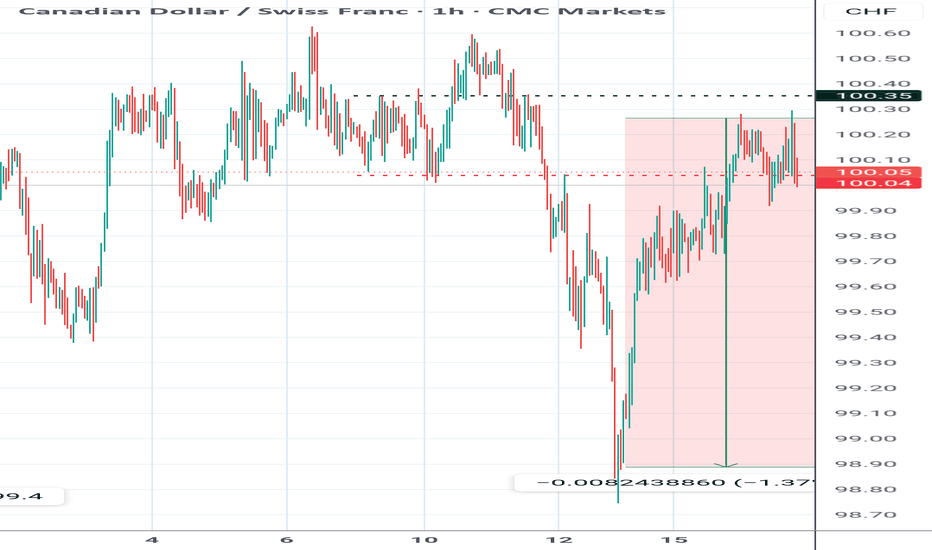

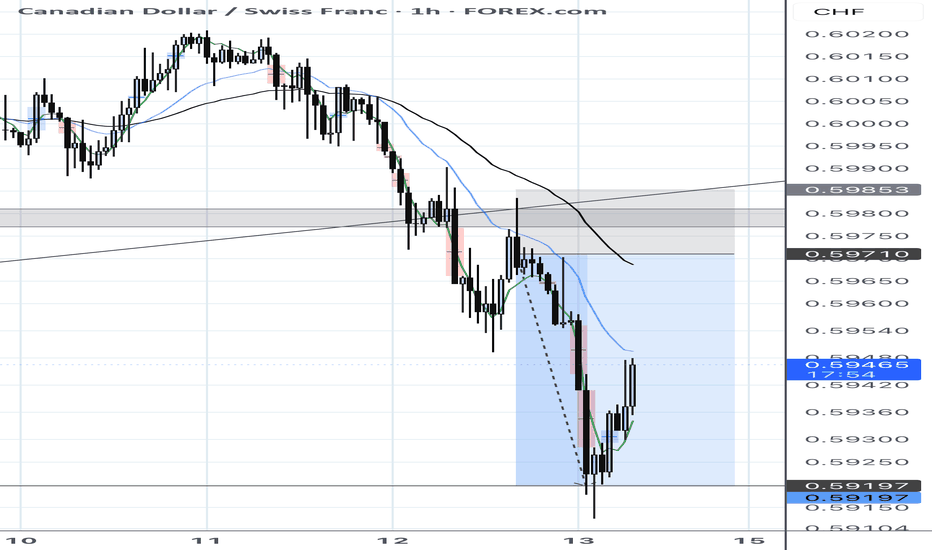

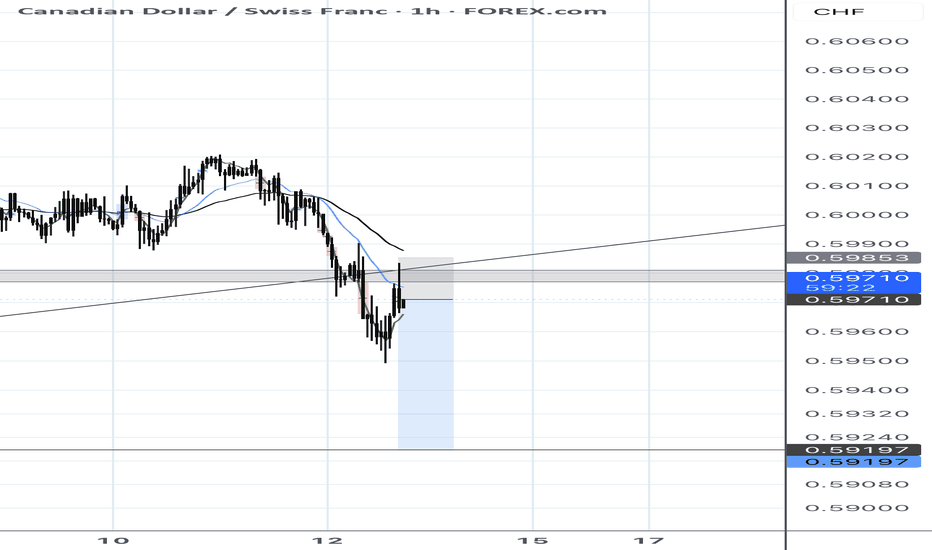

CADCHF 1H | 3R Achieved | Trendline + EMA Rejection Play

This was the clean setup I posted yesterday — textbook trend continuation with EMA dynamic resistance and support break structure.

Price tapped into the marked supply zone and melted straight to TP, delivering a clean 3R.

📍 Confluences:

• EMA 20/50 rejection

• Bearish structure + lower highs

• Clean retest of broken support

• Hourly continuation inside bearish channel

I’ll be watching for a potential reload setup if price pulls back into the 0.597 zone.

🟢 Drop a like if you caught this move — follow for more clean, real-time setups like this every week.

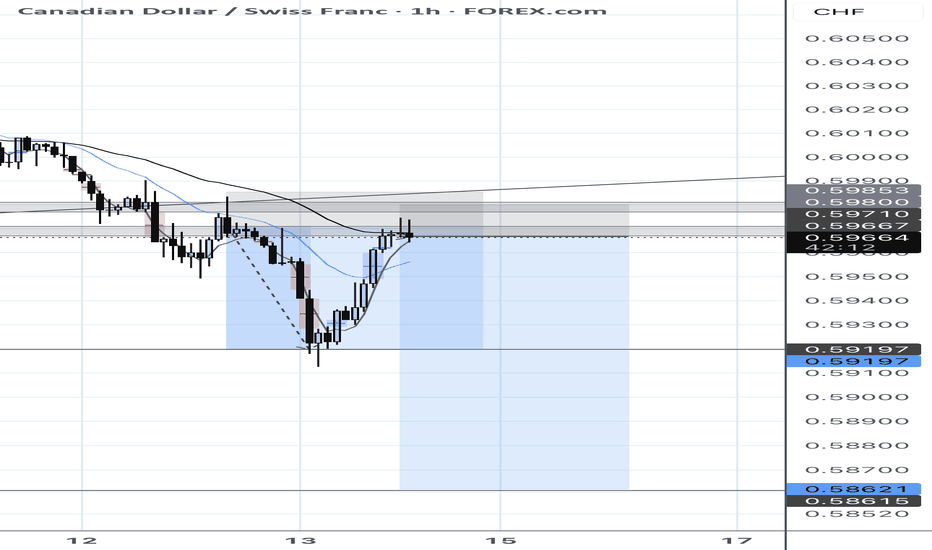

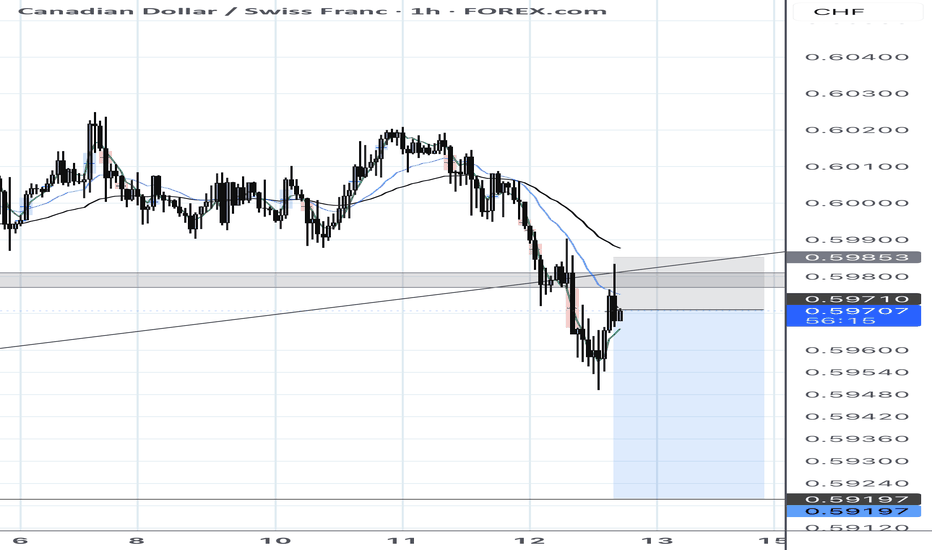

CADCHF 1H – Break of Structure & Retest | SELL NOWPrice has broken below the ascending trendline and key support zone. We’re now seeing a clean retest into previous structure + confluence with EMAs.

• ✅ 1H structure break confirmed

• 🔁 Retest of broken trendline and support turned resistance

• 📉 EMAs aligning for bearish momentum

• 🎯 Target: 0.59197 zone

• ❌ SL above 0.5985 zone

Entering short from current price — setup fits clean break and retest criteria.

📉 SELL NOW — trend shift confirmed unless price breaks back above structure.

CADCHF 1H – Break of Structure & Retest | SELL NOWPrice has broken below the ascending trendline and key support zone. We’re now seeing a clean retest into previous structure + confluence with EMAs.

• ✅ 1H structure break confirmed

• 🔁 Retest of broken trendline and support turned resistance

• 📉 EMAs aligning for bearish momentum

• 🎯 Target: 0.59197 zone

• ❌ SL above 0.5985 zone

Entering short from current price — setup fits clean break and retest criteria.

📉 SELL NOW — trend shift confirmed unless price breaks back above structure.

CADCHF Buy- Go for buy if entry setup given

- Refine entry with smaller SL for better RR, if you know how

A Message To Traders:

I’ll be sharing high-quality trade setups for a period time. No bullshit, no fluff, no complicated nonsense — just real, actionable forecast the algorithm is executing. If you’re struggling with trading and desperate for better results, follow my posts closely.

Check out my previously posted setups and forecasts — you’ll be amazed by the high accuracy of the results.

"I Found the Code. I Trust the Algo. Believe Me, That’s It."