CADCHF trade ideas

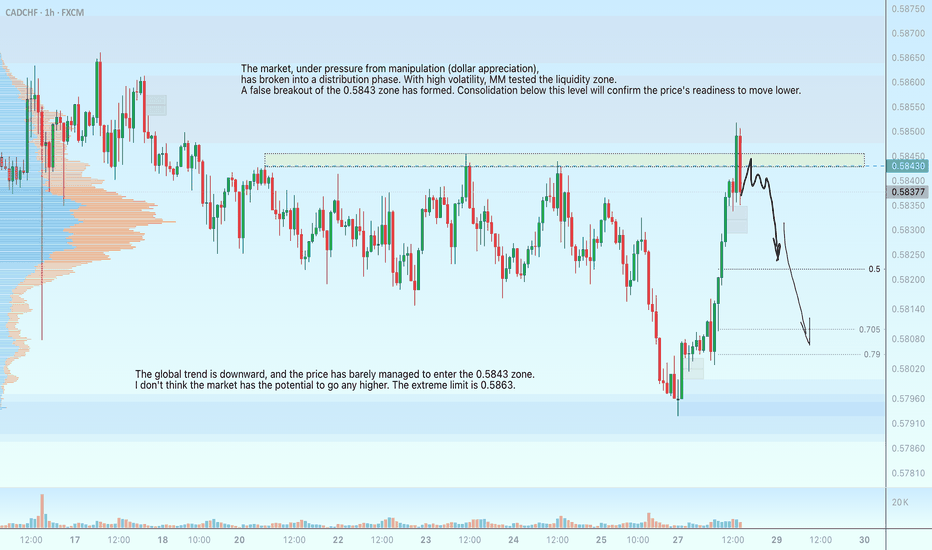

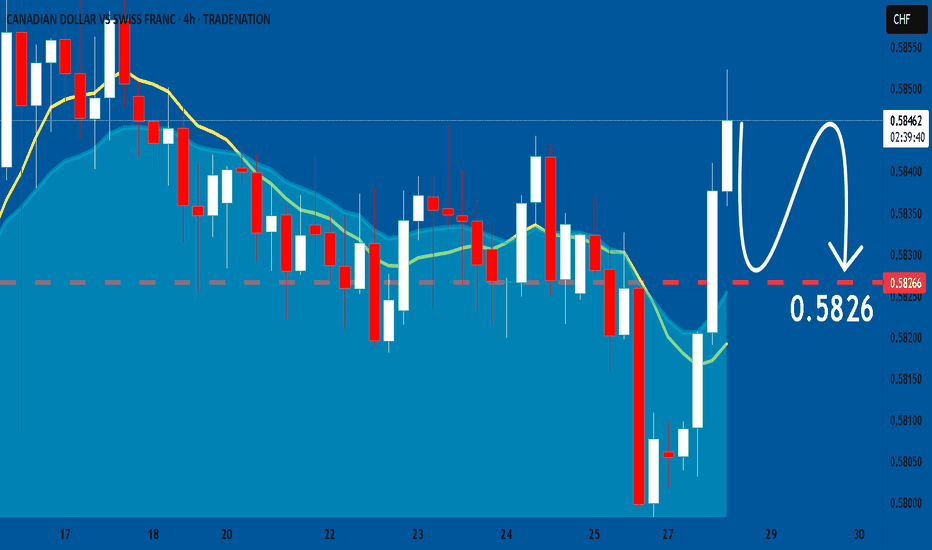

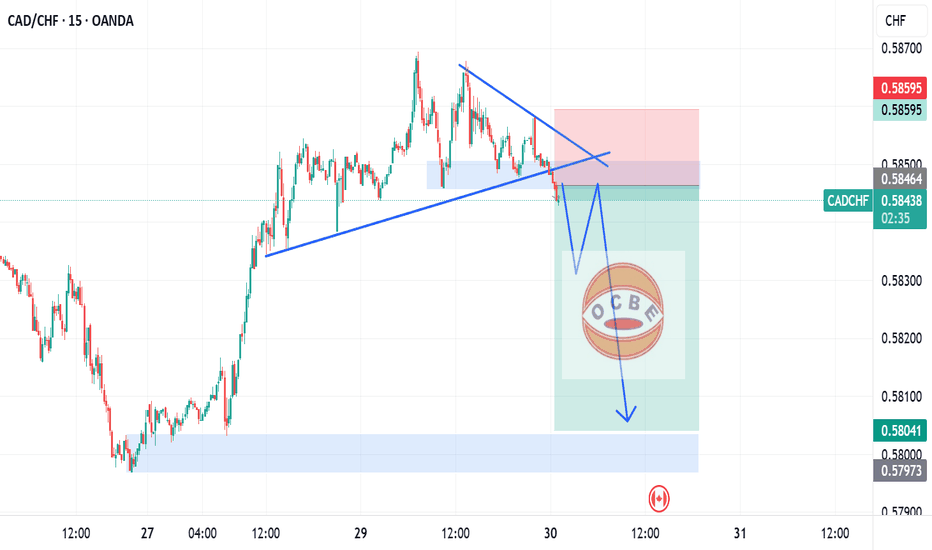

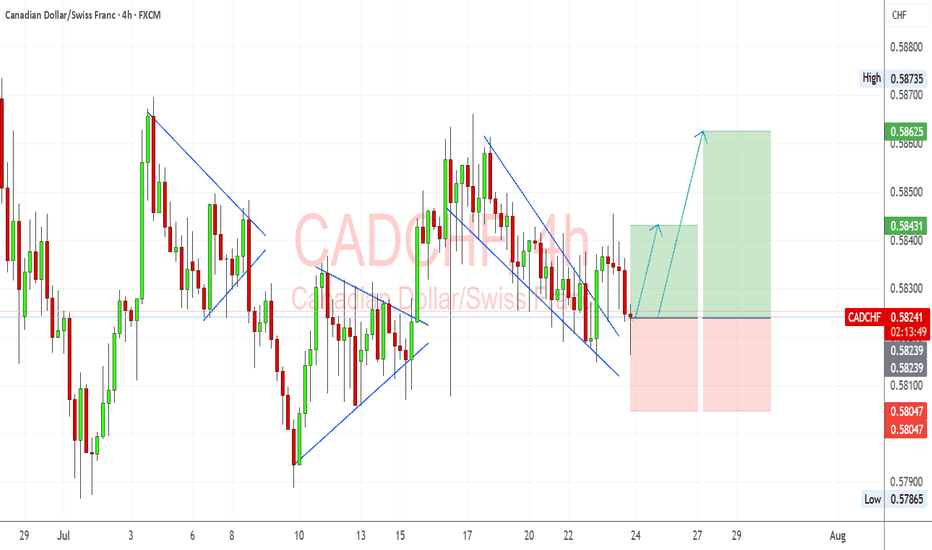

CADCHF - manipulative liquidity grab at 0.5843 before the dropThe market, under pressure from manipulation (dollar appreciation), has entered a distribution phase. Amid high volatility, MM tested the liquidity zone. A false breakout of the 0.5843 zone has formed. Consolidation below this level will confirm the price's readiness to move lower.

The global trend is downward, and the price has barely managed to enter the 0.5843 zone. I don't think the market has the potential to go any higher. The extreme limit is 0.5863.

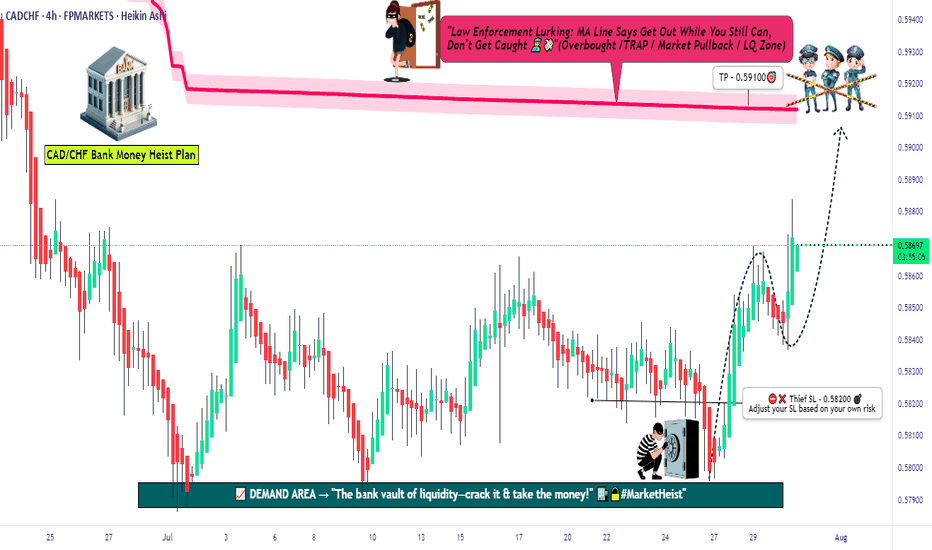

Bears Trapped — CADCHF Heist Begins (Buy Setup Inside)💎💣CAD/CHF Swiss Vault Breakout 💰 Heist in Progress (Scalp/Day Plan)💣💎

“When the market sleeps, we rob it clean!”

🌍 Hola! Bonjour! Hallo! Marhaba! Hello, Thieves & Market Movers! 🌍

💰🤑💸Welcome to another high-stakes heist from the vaults of Thief Trader HQ!💸🤑💰

This time, our radar’s locked on CAD/CHF — aka the Loonie vs the Swissy.

We’re executing a precise scalping/day trading robbery based on the mix of technical traps, macro fundamentals, and sentiment distortion.

The vault is unattended, the guards are napping — time to MOVE.

🎯 ENTRY PLAN 📈

The vault’s unlocked — bulls, suit up.

☑️ Execute BUY LIMITS closest to swing lows on the 15M or 30M chart for precision pullbacks.

☑️ Use DCA layering — multiple limit orders = more loot bags.

📌 Entry Zone: Flexible — "Any dip is a gift. Rob it!"

🛑 STOP LOSS STRATEGY 🚫

🔒 SL secured at 0.58200, based on 4H swing low.

🛡️ Adjust based on your risk appetite, trade size, and how heavy you stack your orders.

💸 TARGET TAKE 🏁

🎯 Primary TP: 0.59000

🤑 Trail if price rips through — let the robbery run.

📊 WHY THIS HEIST? 🔥

We’re seeing:

✔️ Bullish market shift

✔️ Overbought bait trap for late bears

✔️ Reversal zones tested

✔️ Consolidation breakout pattern forming

✔️ Risk-reward setup aligned for thieves

All backed by:

📌 COT Reports

📌 Macro Trend Forecasts

📌 Quant Models & Sentiment Flow

📌 Intermarket Confirmation (Oil correlations, CHF flows, risk sentiment)

📰⚠️ TRADING ALERT – News Watch 🚨

News is a market alarm system — don’t trip it.

✔️ Avoid entries during red-folder releases

✔️ Use trailing SLs to protect profit loot

✔️ Update your chart often — the game moves fast

❤️ SHOW SOME LOVE TO THE CREW

💥 SMASH the Boost Button if you love the plan 💥

🎯 Help grow the strongest robbery crew on TradingView

📈 Daily profits using Thief Trading Style — no cap, just charts.

🕶️ Stay stealthy. Stay smart. Stay Thief.

See you on the next plan.

Until then... 💼💸🧠

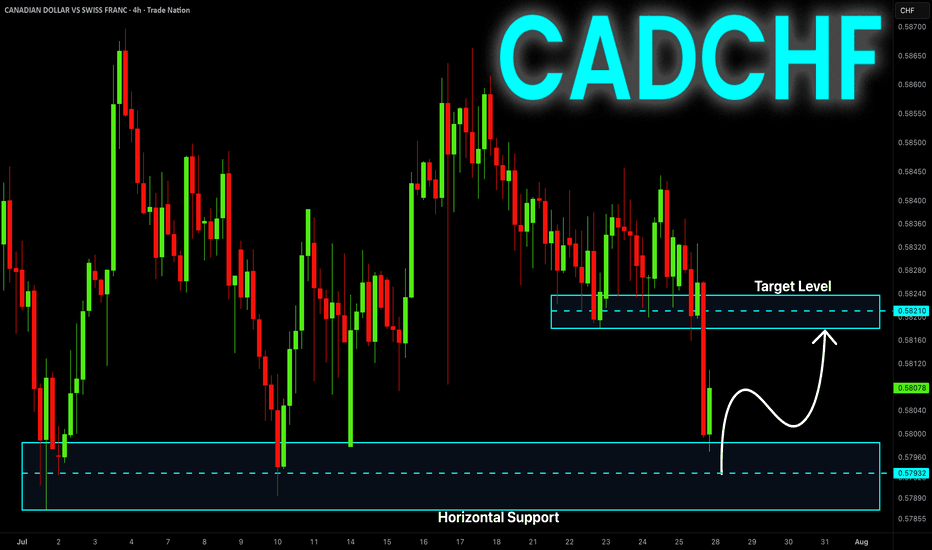

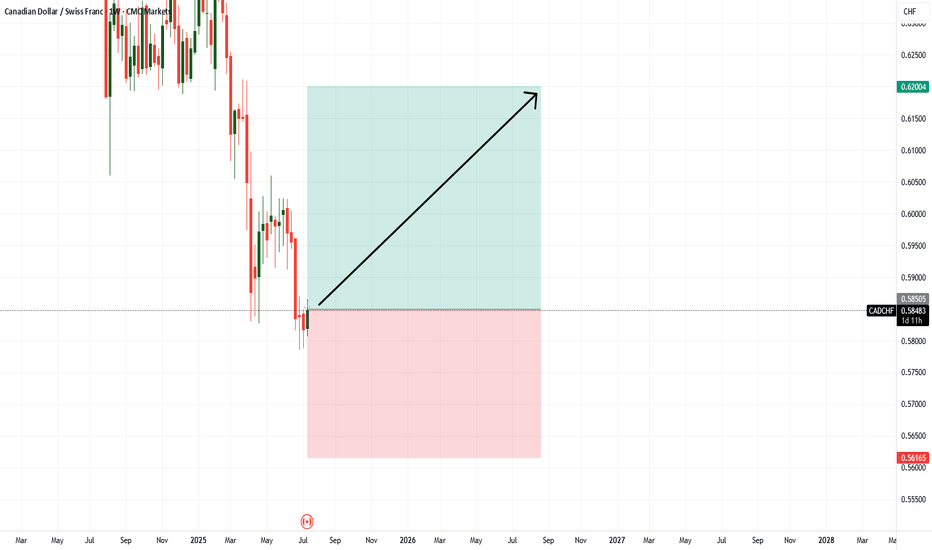

CAD-CHF Local Rebound Ahead! Buy!

Hello,Traders!

CAD-CHF made a retest

Of the horizontal support

At 0.5797 from where we

Are already seeing a bullish

Reaction so we will be

Expecting a further local

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

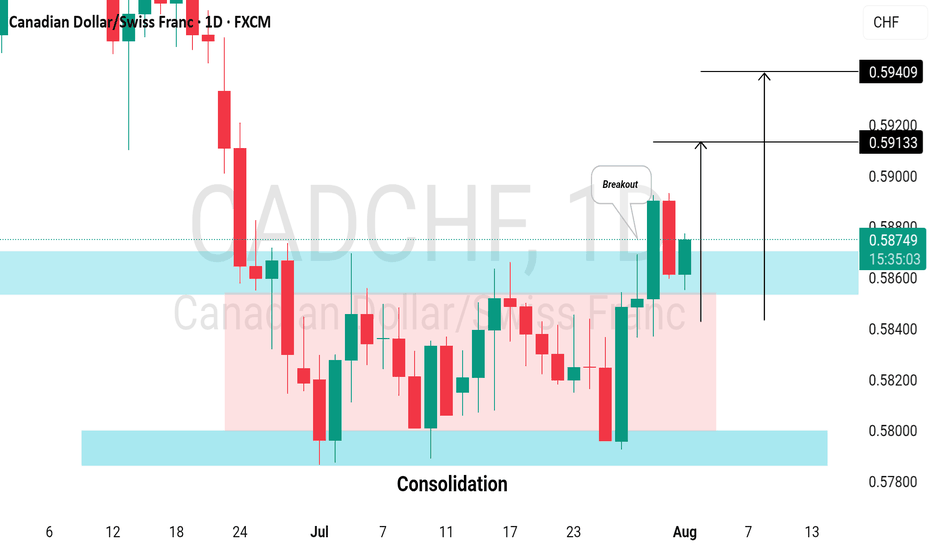

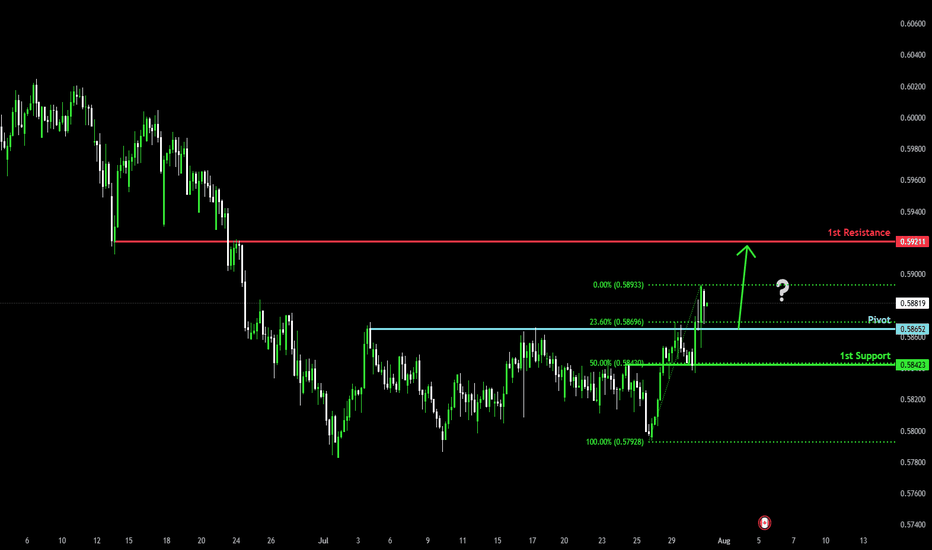

Bullish bounce off pullback support?CAD/CHF is falling towards the pivot, which acts as a pullback support and could bounce to the 1st resistance, which is also a pullback resistance.

Pivot: 0.58652

1st Support: 0.58423

1st Resistance: 0.59211

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

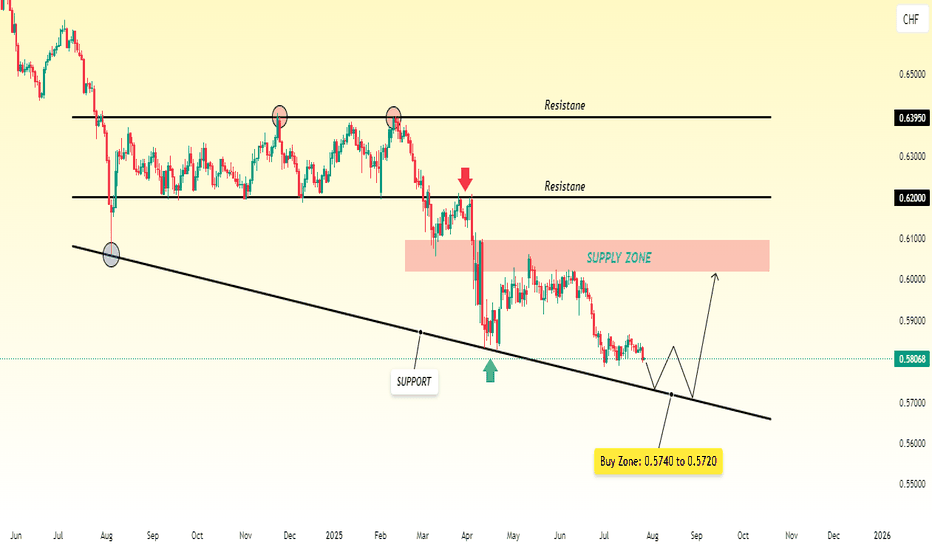

CAD/CHF Falling Toward 0.5740–0.5720: Buyers May Step In1. Trend Direction :

CADCHF is currently bearish — the price is going down consistently.

2. Price Action :

The pair is still falling and has not shown signs of reversing yet.

3. Target Area for Drop :

I expect the price to continue falling toward the 0.5740 to 0.5720 zone.

→ This is a support area, where price may slow down or bounce.

4. Support Level Importance :

This zone has acted as support in the past, meaning buyers might step in again here.

5. Buy Interest Zone :

If the price holds above 0.5720 and shows signs of strength, buying interest could return.

6. Possible Reversal :

From this support zone, there's a chance that CAD/CHF may reverse and move back up.

7. What to Watch For :

Look for bullish price action (like strong candles or a break of minor resistance) in the support area before considering long (buy) positions.

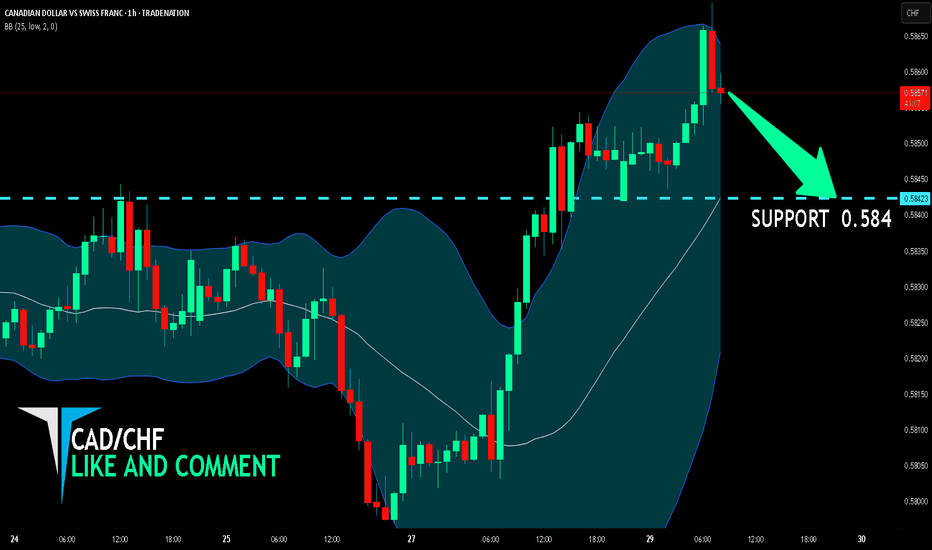

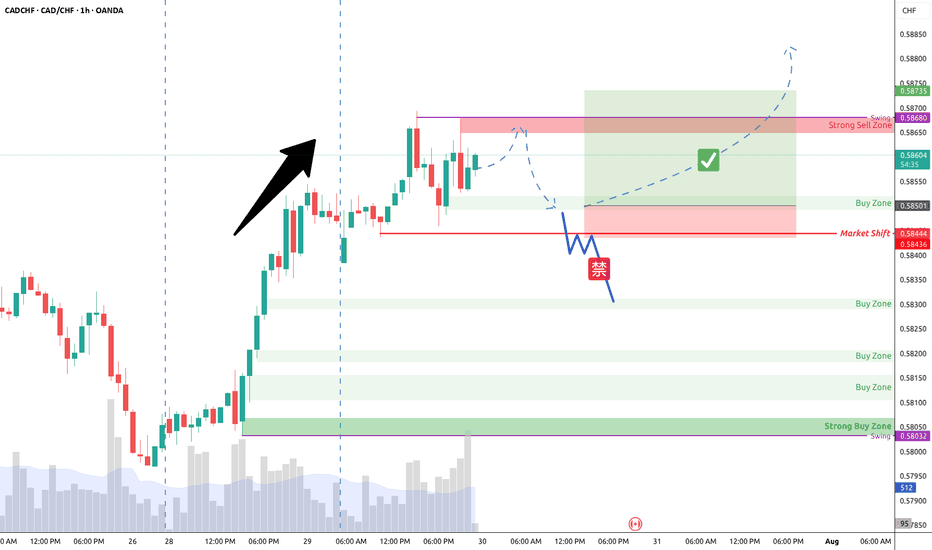

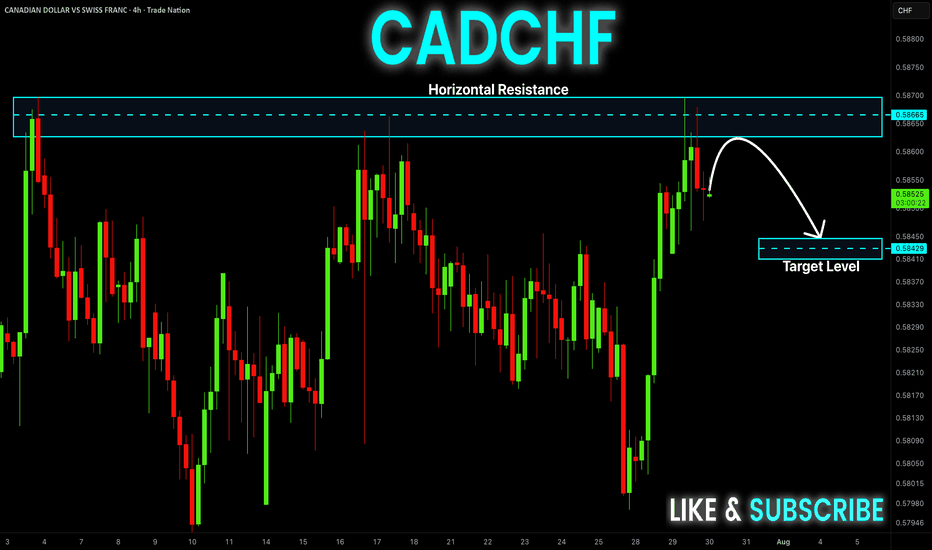

CAD/CHF BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

We are targeting the 0.584 level area with our short trade on CAD/CHF which is based on the fact that the pair is overbought on the BB band scale and is also approaching a resistance line above thus going us a good entry option.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

CADCHF: Market of Sellers

The recent price action on the CADCHF pair was keeping me on the fence, however, my bias is slowly but surely changing into the bearish one and I think we will see the price go down.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

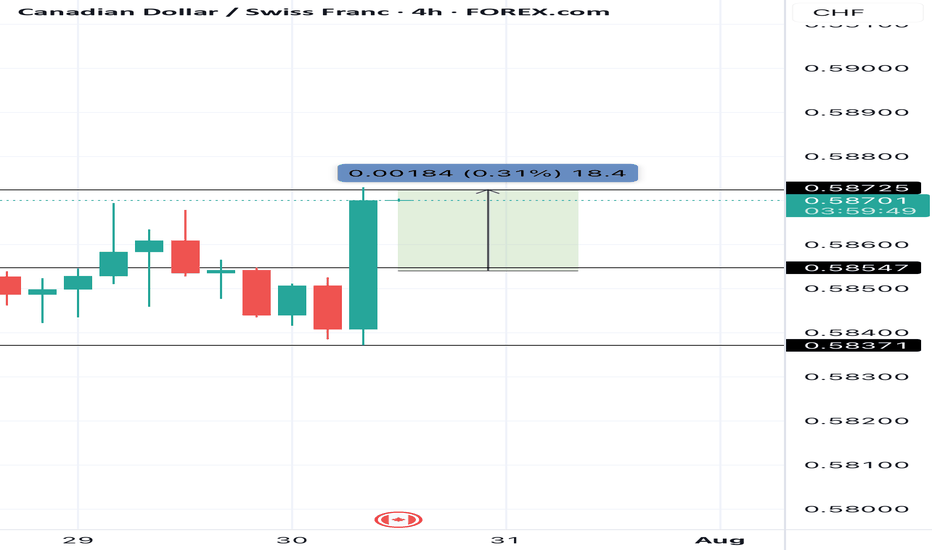

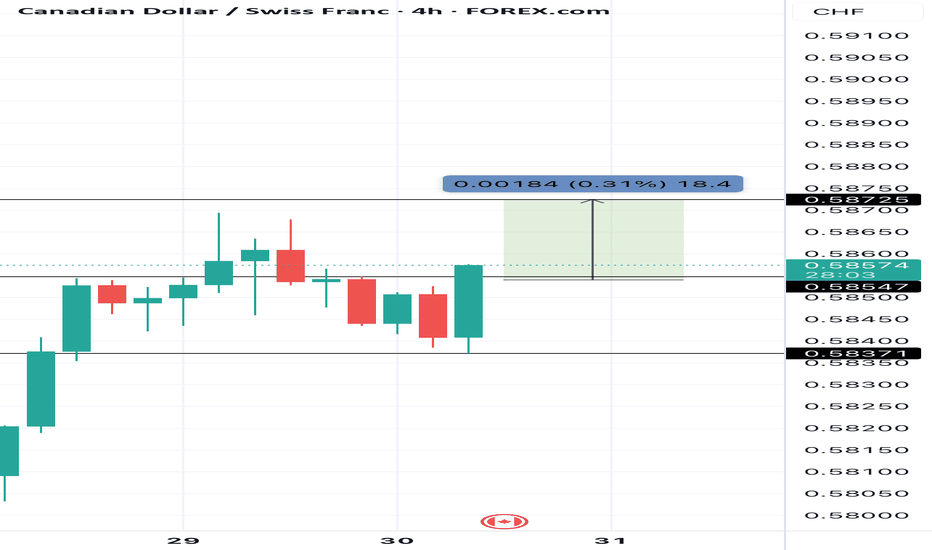

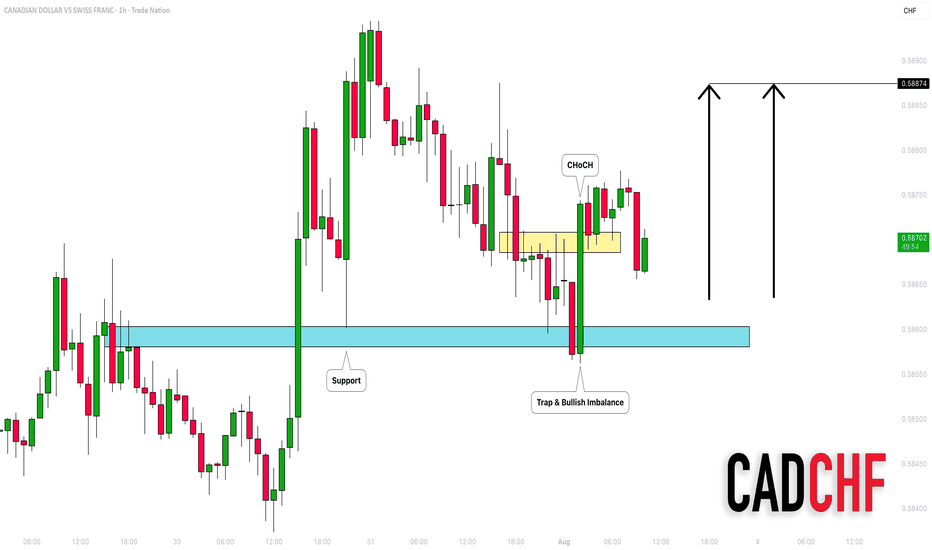

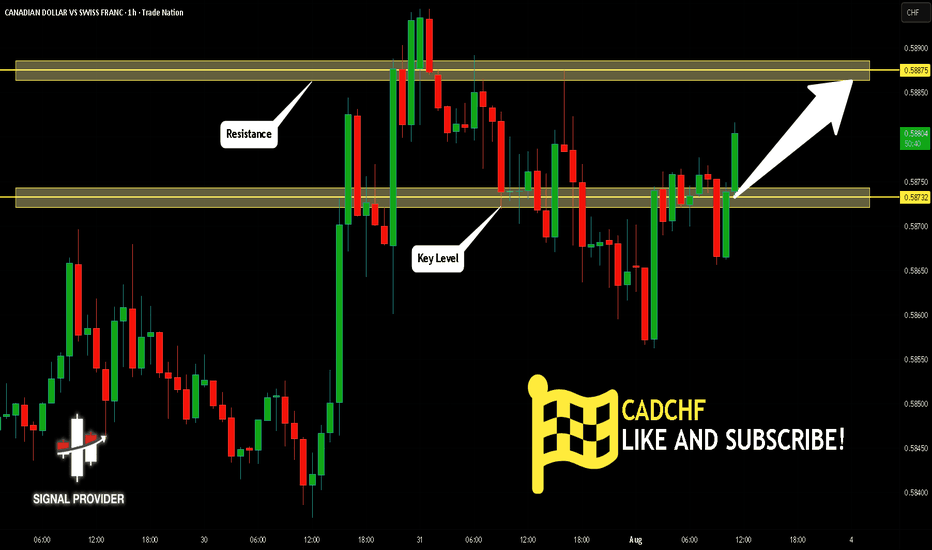

CADCHF: Bullish Move After the Trap 🇨🇦🇨🇭

There is a high chance that CADCHF will go up today.

After a test of a key horizontal support, the price formed

a liquidity grab with a consequent bullish imbalance.

We can expect growth to 0.5887

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

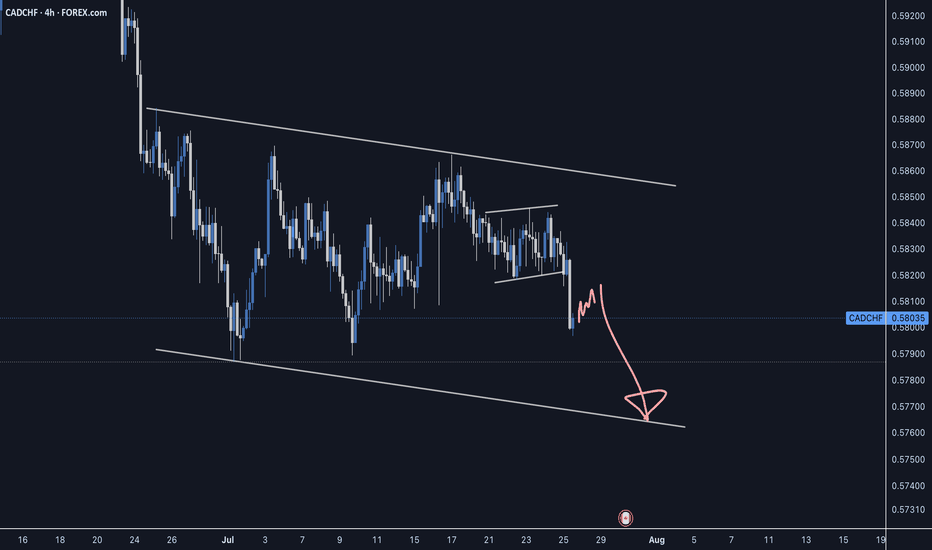

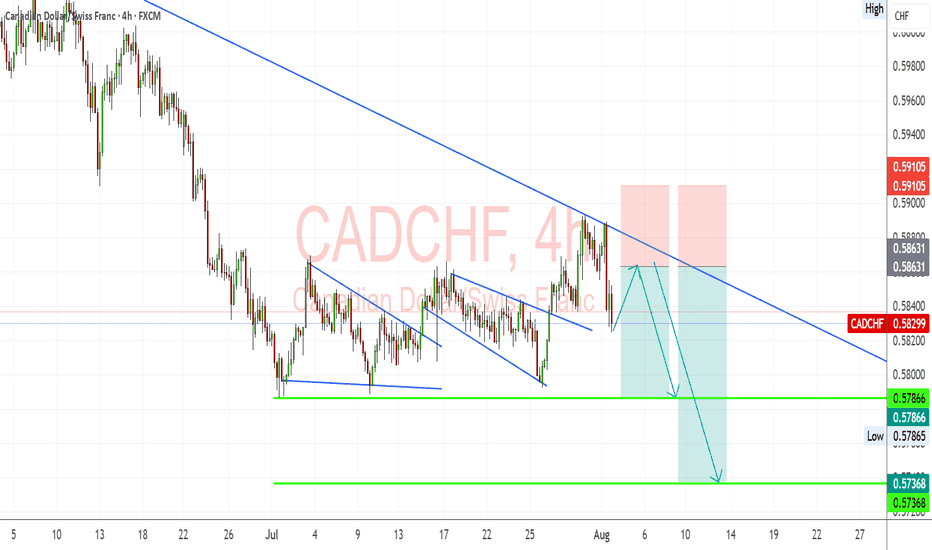

CAD/CHF: Bearish Trend Resumes After Retest of Downtrend LineCAD/CHF continues to respect its prevailing downtrend, with price reacting from the descending trendline and showing signs of renewed bearish pressure. Fundamentals support further downside as CAD remains weighed by weak domestic data, while CHF holds steady as a safe-haven currency amid global tariff concerns.

Technical Analysis (4H Chart)

Trend: Strong downtrend structure, with repeated rejections from the descending trendline.

Current Level: 0.5829, consolidating after failing to break above 0.5863 resistance.

Key Support Levels:

0.5786 (near-term support and first bearish target).

0.5736 (secondary support and next major target).

Resistance Levels:

0.5863 (immediate resistance at descending trendline).

0.5910 (upper resistance if a breakout occurs).

Projection: Likely pullback toward 0.5863 (retest zone) before continuation to 0.5786 and possibly 0.5736.

Fundamental Analysis

Bias: Bearish.

Key Fundamentals:

CAD: Weak Canadian manufacturing PMI and trade risks from US tariffs limit CAD upside.

CHF: Swiss Franc remains supported by safe-haven demand amid tariff uncertainty.

Oil Prices: Stable oil offers partial CAD support but insufficient to change the broader trend.

Risks:

A sharp rise in oil prices could strengthen CAD.

Global risk-on sentiment could weaken CHF and lift CAD/CHF.

Key Events:

BoC policy updates.

SNB stance and global risk sentiment shifts.

Oil market data.

Leader/Lagger Dynamics

CAD/CHF is a lagger, following CAD’s performance relative to oil and CHF’s safe-haven flows.

Summary: Bias and Watchpoints

CAD/CHF remains bearish, with price respecting the downtrend and targeting 0.5786 initially. A break below this level opens the door to 0.5736. The key watchpoints are oil price fluctuations, global risk sentiment, and potential safe-haven demand for CHF.

CAD-CHF Local Short! Sell!

Hello,Traders!

CAD-CHF went up and

Made a retest of the

Horizontal resistance

Around 0.5870 and we

Are already seeing a bearish

Pullback so we will be

Expecting a further

Bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CADCHF Will Grow! Long!

Please, check our technical outlook for CADCHF.

Time Frame: 1h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 0.587.

The above observations make me that the market will inevitably achieve 0.588 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

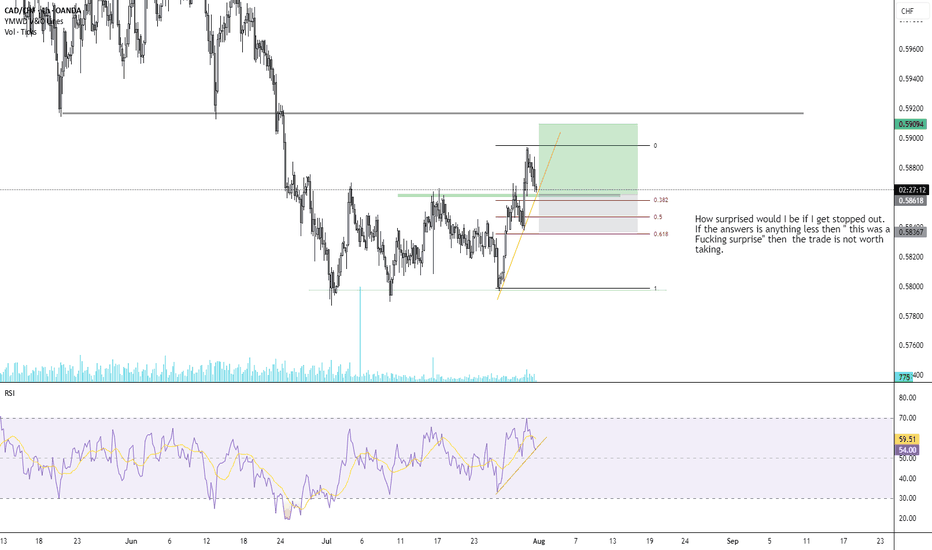

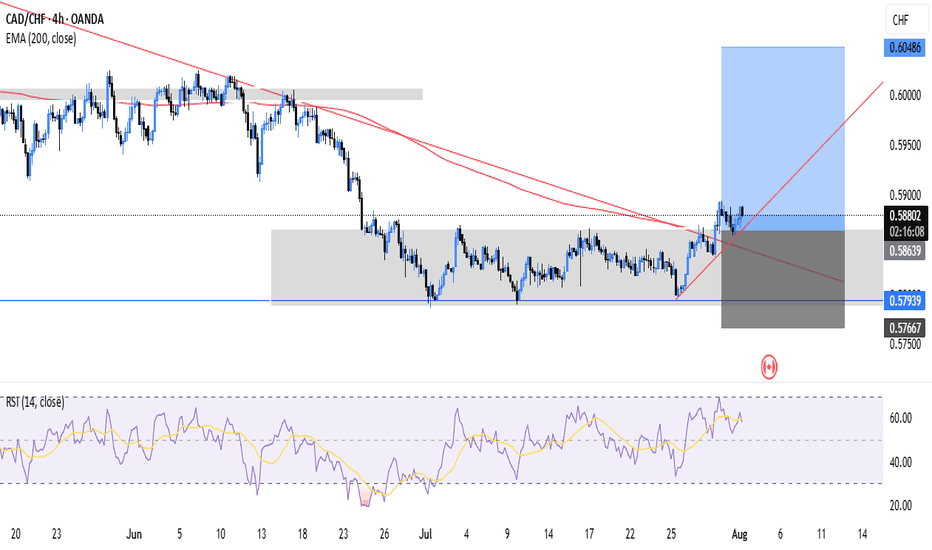

CADCHF Bullish Reversal in Motion Channel Break & Momentum ShiftCADCHF setup is developing into a potential bullish recovery after a breakout from a falling wedge. I’m looking for signs of buyer control as price attempts to build higher structure off the recent breakout.

📊 Technical View (My Setup Insight):

Falling Wedge Breakout: Price has cleanly broken out of the descending channel/wedge formation. That’s often a reversal signal, especially near support zones.

Support Holding: The pair found buyers around 0.5810–0.5820, an area tested multiple times in July. This zone has acted as a soft base.

Bullish Flag Recovery: Prior corrective patterns (flags/pennants) were followed by strong impulsive moves, and we may be repeating this pattern now.

Next Targets:

TP1: 0.5843 – aligns with previous structure and minor resistance.

TP2: 0.5862 – near the most recent high and top of consolidation.

Stop-Loss: Below 0.5800 to invalidate the reversal structure.

🧮 Fundamental Drivers (My Outlook):

CAD Support from Oil Stability: Oil prices have firmed around $78–$80, which helps the CAD via improved trade and energy revenue prospects.

SNB Stance Neutral-Dovish: Swiss inflation remains soft, and SNB has signaled comfort with its current policy rate, reducing CHF bullish pressure.

BoC Hawkish Bias: Despite softening Canadian CPI, the BoC remains cautious and hasn’t ruled out future hikes. CAD remains supported relative to CHF.

Global Risk Mood: CHF is sensitive to risk-off flows. With equities and commodities rebounding modestly, safe haven flows into CHF may slow.

⚠️ Risks to the Setup:

A sudden drop in oil prices could hurt CAD.

Risk-off sentiment due to geopolitical tensions or US equity selloffs could fuel CHF strength.

Any surprise SNB jawboning about FX could cause CHF to spike.

📆 Upcoming Events to Monitor:

Canadian GDP / Retail Sales – if strong, reinforces CAD recovery.

Swiss KOF Economic Barometer – gives insight into CHF macro tone.

Oil Inventories – strong builds or drawdowns influence CAD indirectly.

🔁 Leader/Lagger Context:

CADCHF is often a lagger, especially when risk sentiment or oil makes bigger moves. It can follow USDCHF or USDCAD behavior due to shared components.

If oil or global risk sentiment shifts, CADCHF tends to react with a small lag, making it great for secondary confirmation trades.

🧩 Summary – Bias & Watchpoints:

I currently hold a bullish bias on CADCHF following the falling wedge breakout and support defense. Fundamentals are moderately in favor of CAD due to oil stability and BoC’s cautious stance versus the more passive SNB. Key risks include any renewed CHF demand from risk-off shifts or soft Canadian economic surprises. The most critical levels now lie at 0.5843 and 0.5862 for upside targets, while 0.5800 remains key invalidation support.