CADEUR trade ideas

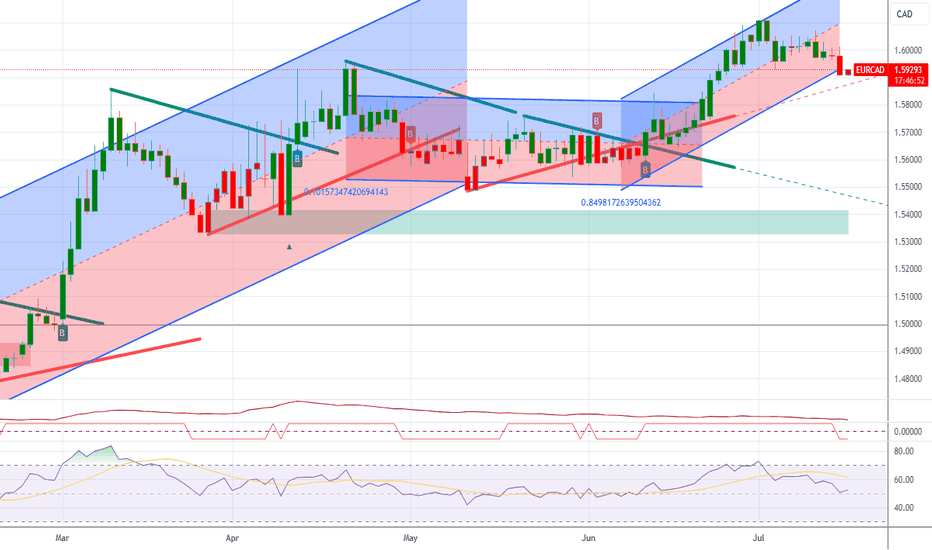

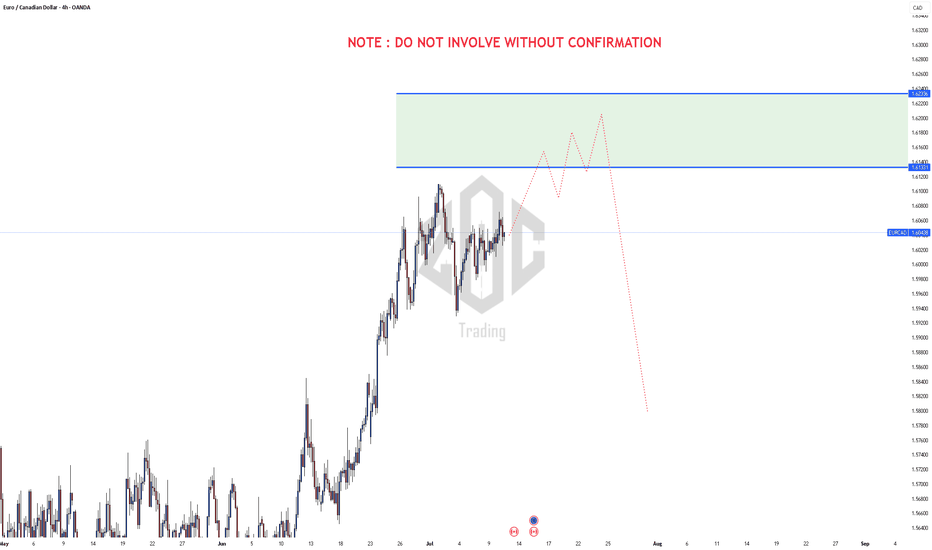

EURCAD: Bullish Forecast & Bullish Scenario

The price of EURCAD will most likely increase soon enough, due to the demand beginning to exceed supply which we can see by looking at the chart of the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

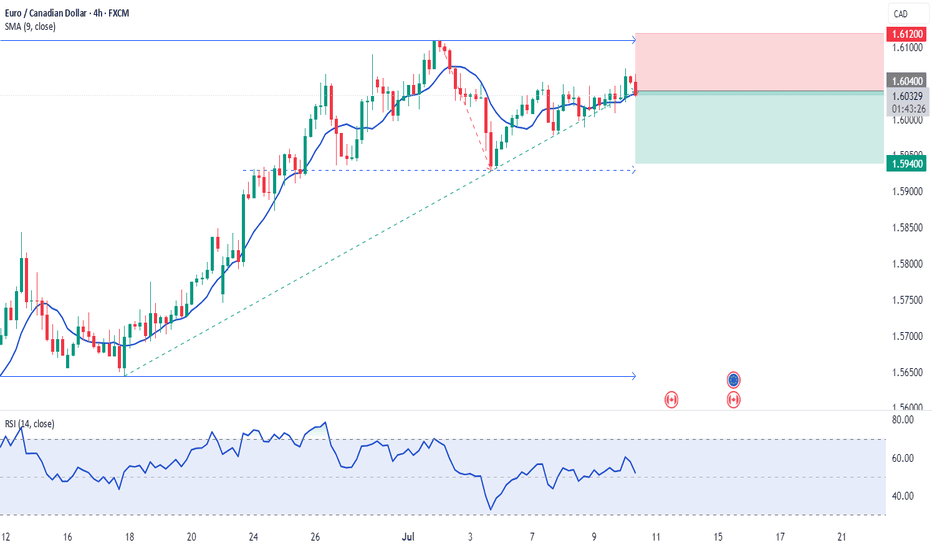

EUR/CAD: Quant-Verified ReversalThe fundamental catalyst has been triggered. The anticipated strong Canadian CPI data was released as expected, confirming the primary driver for this trade thesis. Now, the focus shifts to the technical structure, where price is showing clear exhaustion at a generational resistance wall. 🧱

Our core thesis is that the confirmed fundamental strength of the CAD will now fuel the technically-indicated bearish reversal from this critical price ceiling.

The Data-Driven Case 📊

This trade is supported by a confluence of technical, fundamental, and quantitative data points.

Primary Technical Structure: The pair is being aggressively rejected from a multi-year resistance zone (1.6000 - 1.6100). This price action is supported by a clear bearish divergence on the 4H chart's Relative Strength Index (RSI), a classic signal that indicates buying momentum is fading despite higher prices.

Internal Momentum Models: Our internal trend and momentum models have flagged a definitive bearish shift. Specifically, the MACD indicator has crossed below its signal line into negative territory, confirming that short-term momentum is now bearish. This is layered with a crossover in our moving average module, where the short-term SMA has fallen below the long-term SMA, indicating the prevailing trend structure is now downward.

Quantitative Probability & Volatility Analysis: To quantify the potential outcome of this setup, we ran a Monte Carlo simulation projecting several thousand potential price paths. The simulation returned a 79.13% probability of the trade reaching our Take Profit target before hitting the Stop Loss. Furthermore, our GARCH volatility model forecasts that the expected price fluctuations are well-contained within our defined risk parameters, reinforcing the asymmetric risk-reward profile of this trade.

The Execution Plan ✅

Based on the synthesis of all data, here is the actionable trade plan:

📉 Trade: Sell (Short) EUR/CAD

👉 Entry: 1.6030

⛔️ Stop Loss: 1.6125

🎯 Take Profit: 1.5850

The data has spoken, and the setup is active. Trade with discipline.

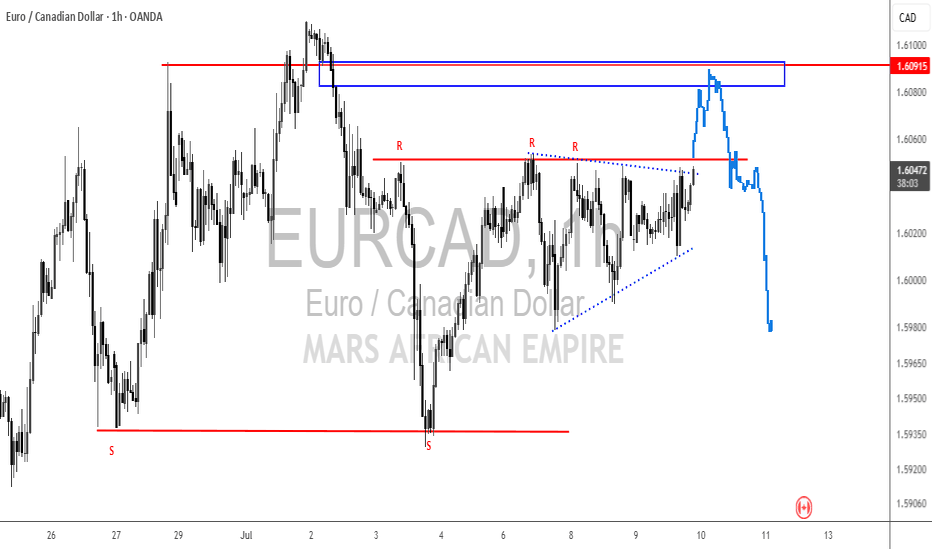

EURCAD Breakdown and Retest , All Eyes on SellingHello Traders

In This Chart EURCAD HOURLY Forex Forecast By FOREX PLANET

today EURCAD analysis 👆

🟢This Chart includes_ (EURCAD market update)

🟢What is The Next Opportunity on EURCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

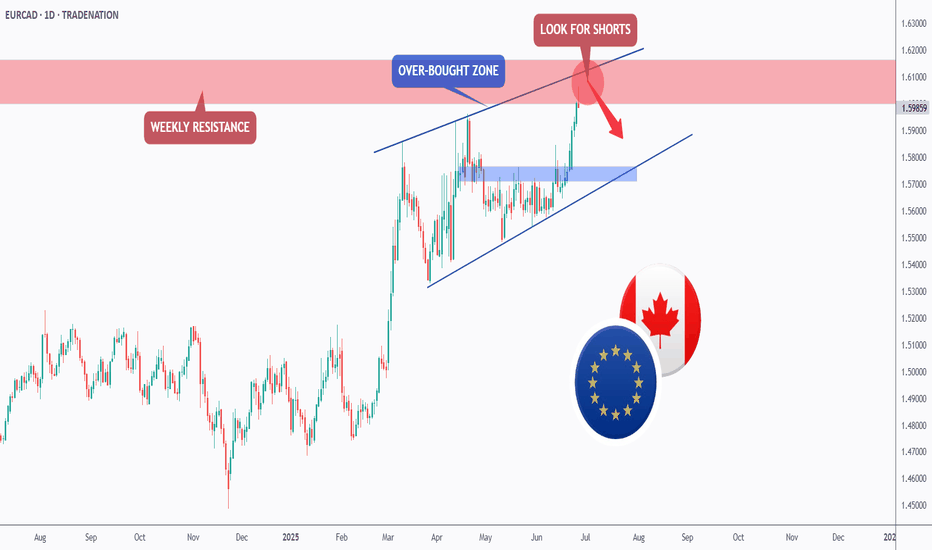

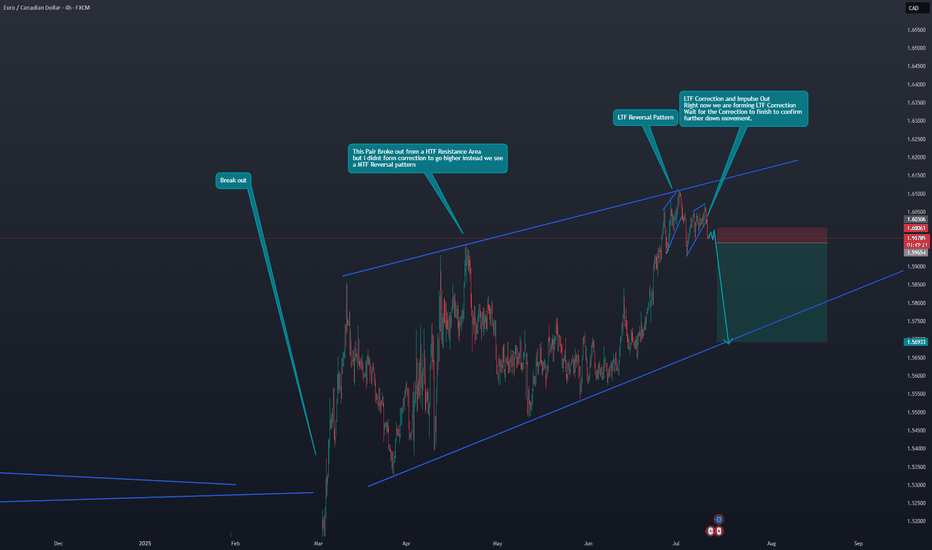

EURCAD - Weekly Resistance Might Shift The Momentum!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈EURCAD has been overall bullish trading within the rising channel marked in blue. However, it is currently approaching the upper bound of the channel.

Moreover, the red zone is a strong weekly resistance.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the upper blue trendline and resistance.

📚 As per my trading style:

As #EURCAD approaches the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

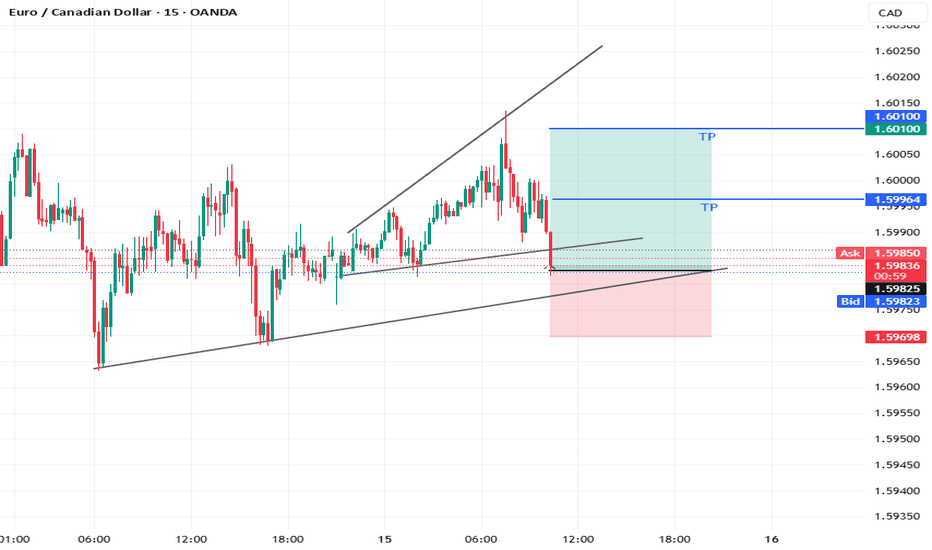

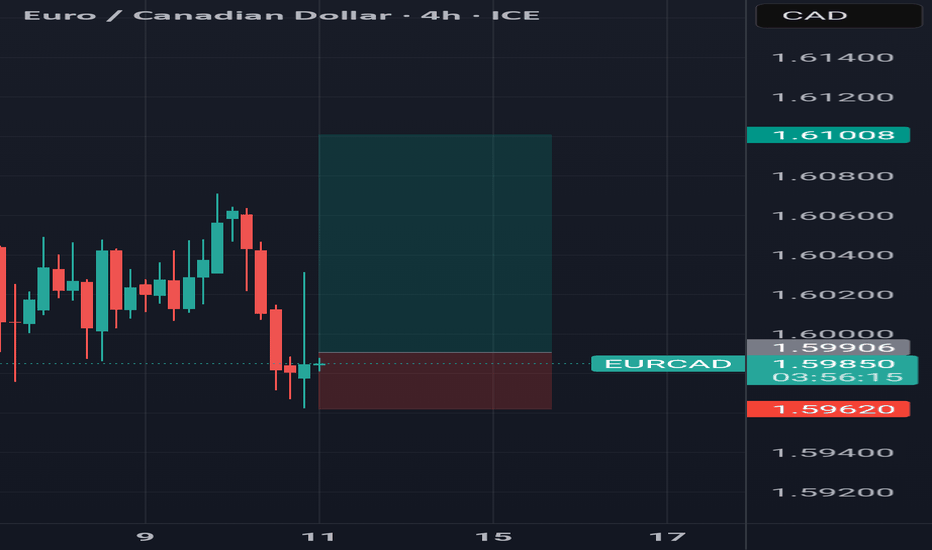

EUR_CAD GROWTH AHEAD|LONG|

✅EUR_CAD went down to retest

A horizontal support of 1.5964

Which makes me locally bullish biased

And I think that a move up

From the level is to be expected

Towards the target above at 1.6040

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

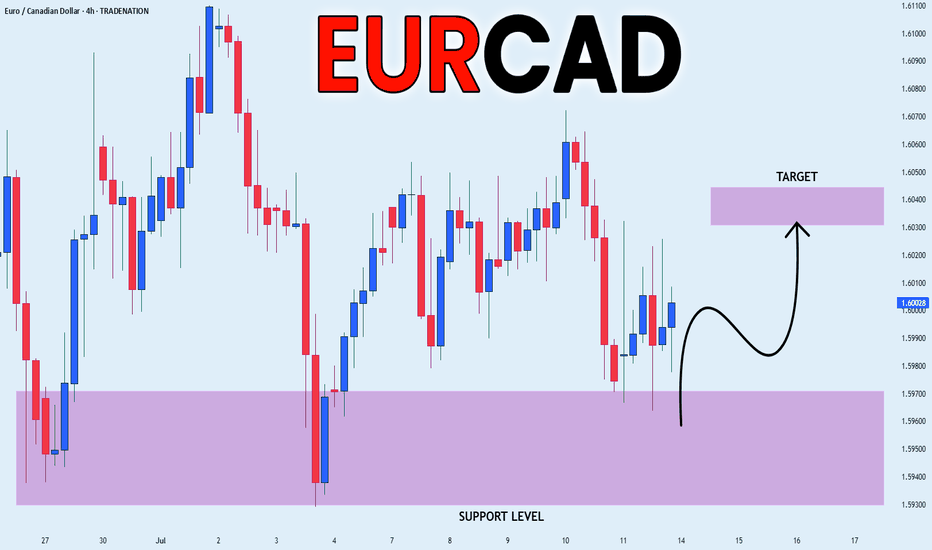

EURCAD MAY RETEST ALL-TIME-HIGH AGAIN If you look at this very closely, you would see that the monthly candle of June 2025 already closed above June 2020 after 5 years exactly. That was very instructive. However, there may be opportunities for sell as counter trade as we are currently seeing some rejections that can be seen more clearly in lower timeframes.

Nevertheless, I am ultimately bullish and would be looking to buy to that 1.75 zone in the near-future, depending on the price action I am seeing on the daily.

Let us see if daily is in perfect alignment with the monthly.

Trade with caution!!!!

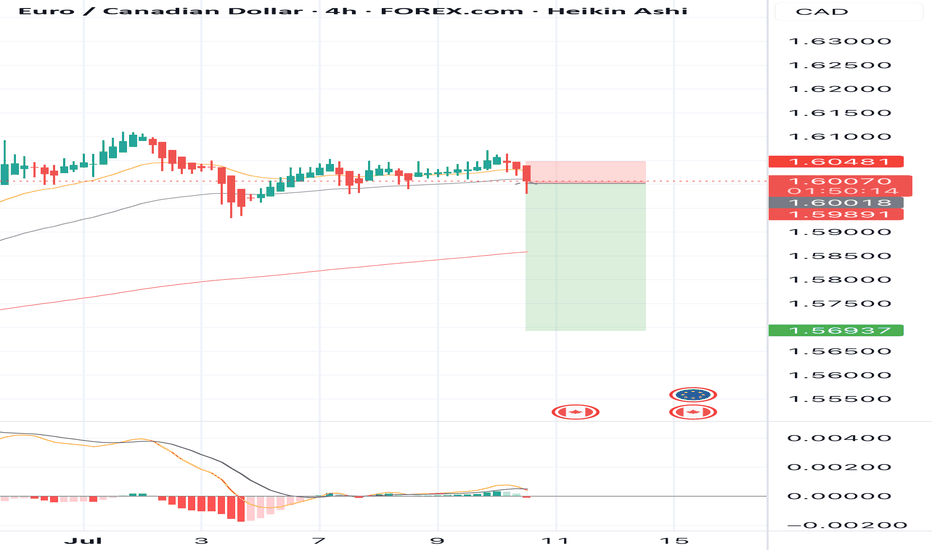

EUR/CAD Bears are getting strongerHI Traders.

I think when we develop more LTF correction there is a good chance that we will at least reach the buttom of the structure. I havent entered the posiition yet because i was already envolved in a EUR PAIR. But this is running in profit so i consider to enter one more when the setups plays out.

SELL EURCAD for bullish divergence trend reversal STOP LOSS: 1.6SELL EURCAD for bullish divergence trend reversal STOP LOSS: 1.6048

Regular Bearish Divergence

In case of Regular Bearish Divergence:

* The Indicator shows Lower Highs

* Actual Market Price shows Higher Highs

We can see a strong divergence on the MACD already and There is a strong trend reversal on the daily time frame chart.....

The daily time frame is showing strength of trend reversal from this level resistance so we are looking for the trend reversal and correction push from here .....

TAKE PROFIT: take profit will be when the trend comes to an end, feel from to send me a direct DM if you have any question about take profit or anything

Remember to risk only what you are comfortable with........trading with the trend, patient and good risk management is the key to success here

EURCAD DISCLAIMER: I am not a financial adviser. those videos and posts on my channel are for educational and entertainment purposes ONLY. I'm documenting my trading journey so that you have the potential to take ideas and inspiration from the videos that may help you within your own journey. But remember, trading/investing of any kind involves risk. Your trading/investments are solely your responsibility .

EURCAD Will Grow! Long!

Please, check our technical outlook for EURCAD.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The price is testing a key support 1.603.

Current market trend & oversold RSI makes me think that buyers will push the price. I will anticipate a bullish movement at least to 1.623 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

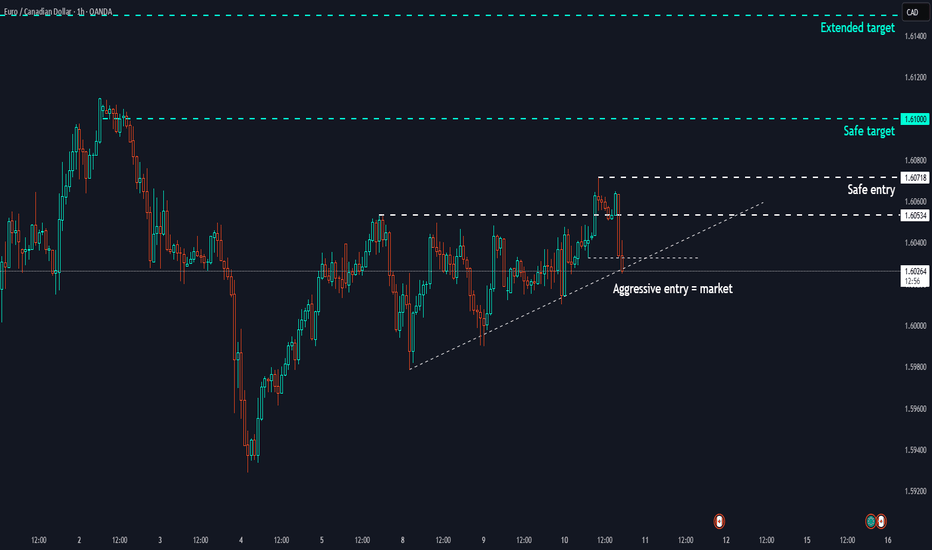

EURCAD - Long Bias explanation and Entry/SL/TP ideasThe main reasons this seems like a very good opportunity to me are :

Trend : EURCAD is in a strong uptrend at the moment

Retail : Majority have a BEARISH sentiment on this pair

Institutions : More holdings in EUR than CAD

Structures : Equal highs up above that MAY act as a magnet

Price action : Recent breakout of a consolidation and resistance shelf

Targets : levels at round numbers

Stops : Many options to place stops below

Entries : Many options in terms of entry aswell

This is primarily for me as a reference in the future.

For educational purposes only

EURCAD - Long Bias explanation and Entry/SL/TP ideasThe main reasons this seems like a very good opportunity to me are :

Trend : EURCAD is in a strong uptrend at the moment

Retail : Majority have a BEARISH sentiment on this pair

Institutions : More holdings in EUR than CAD

Structures : Equal highs up above that MAY act as a magnet

Price action : Recent breakout of a consolidation and resistance shelf

Targets : levels at round numbers

Stops : Many options to place stops below

Entries : Many options in terms of entry aswell

This is primarily for me as a reference in the future.

For educational purposes only

EURCAD BUY TRADE PLAN ✅ EURCAD TRADE PLAN

📅 **Date**: July 10, 2025

🕐 **Pair**: EUR/CAD

---

### 1️⃣ STRUCTURAL ALIGNMENT

| TF | Structure Status | Key Levels | Market Bias |

| -- | ------------------- | ------------------------------ | ----------------- |

| D1 | Bullish Trend | HH: 1.6108 / HL: 1.5910 | ✅ Bullish |

| H4 | Trend Resumption | Range Break > 1.6060 Confirmed | ✅ Bullish |

| H1 | Micro Bullish Shift | Price > 1.6040 key minor HL | ✅ Bullish (Ready) |

🧠 **Comment**: Market holding higher low structure across all TFs. Compression breakout likely underway.

---

### 2️⃣ ENTRY TRIGGER ZONE

| Parameter | Level / Zone |

| --------------- | ---------------------------------- |

| 🎯 ENTRY | **1.6025–1.6038** (retest pocket) |

| ⛔ STOP LOSS | **1.5975** (below H1 invalidation) |

| 🎯 TP1 | **1.6100** (prev swing high) |

| 🎯 TP2 | **1.6170** (measured extension) |

| 🧠 Optional TP3 | **1.6235** (macro fib proj) |

📌 **Only enter on valid wick or LTF confirmation candle inside zone.**

📉 Avoid mid-candle chases or breakout impulse entries. Let it *pull back*.

---

### 3️⃣ RISK MODEL INTEGRITY

| Metric | Value |

| ------------------- | -------------------------------- |

| SL Distance | ≈ 50-60 pips max |

| Minimum RRR | **1:2.5 to 1:3.5** |

| Break-even Protocol | Lock BE after 1H close > 1.6080 |

| Trade Invalidation | 1H Close < 1.5975 |

⚠️ Risk size calibrated to avoid breach of core portfolio risk ceiling.

---

### 4️⃣ MACRO–FUNDAMENTAL ALIGNMENT

| Macro Driver | Current Stance | Effect |

| ----------------------- | ------------------------------------------------ | ------------------- |

| 🇨🇦 CAD | Weak (Oil pressure + BOC dovish bias) | ✅ CAD Soft |

| 🇪🇺 EUR | Strong (Post-NFP euro demand + ECB hawkish tone) | ✅ EUR Strong |

| Intermarket Correlation | Oil ↓ → CAD ↓ | ✅ Pro-EURCAD |

| Macro Bias | **EUR Strength > CAD Weakness** | ✅ Bullish Alignment |

🧠 No conflict with structural plan = ✅ Macro Confirmed

---

### 5️⃣ EXECUTION PROTOCOL

* 💎 *Type*: **Limit Order** ONLY — no market chasing

* 🎯 Wait for rejection or bullish engulfing on 15M or 30M inside entry zone

* 🔒 Trail after price > 1.6080 with hourly close

* ❌ Do not trade this setup if **1.5980 is breached intraday**

---

🚫 NOT INVESTMENT ADVICE – For institutional execution only under your risk model.