CADGBP trade ideas

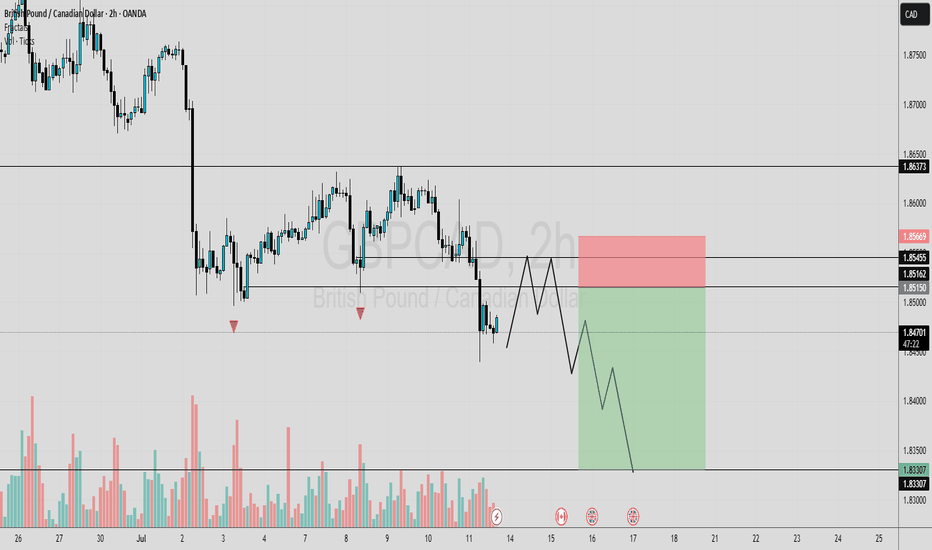

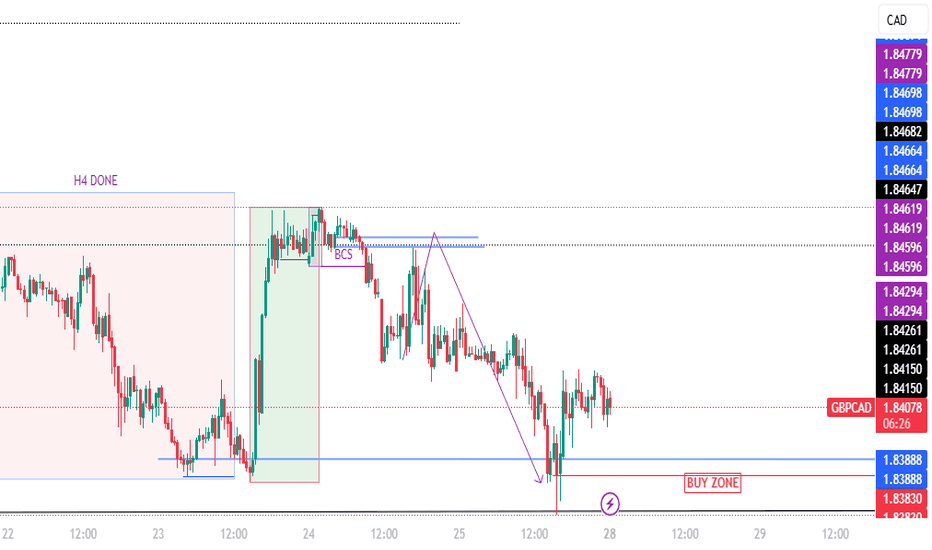

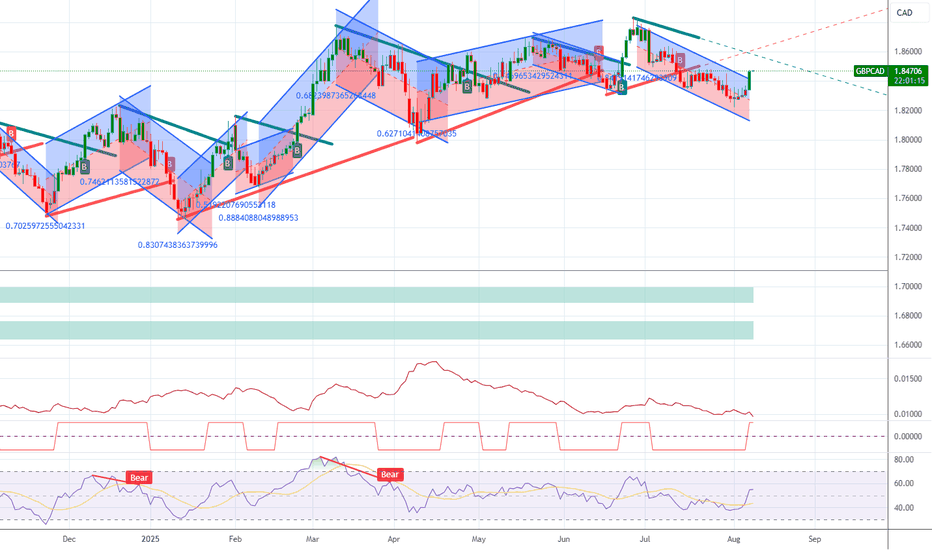

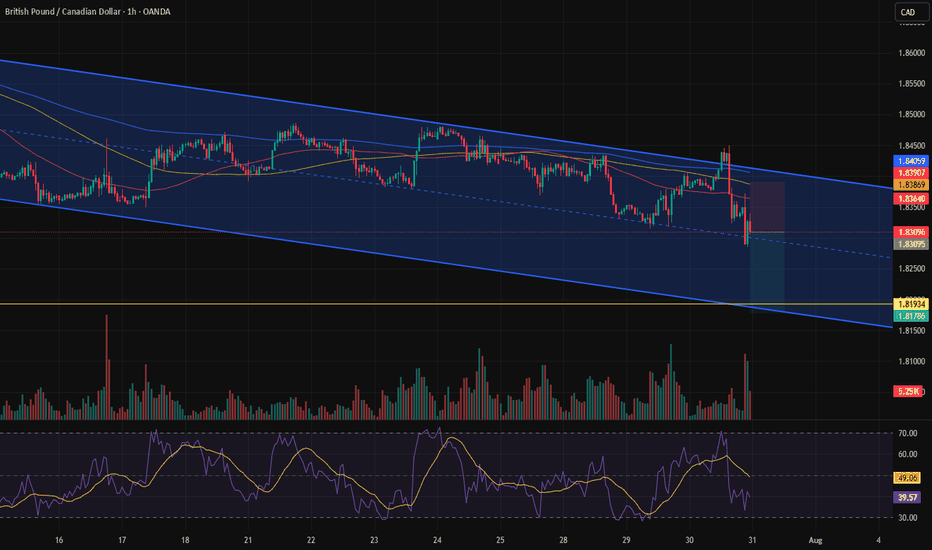

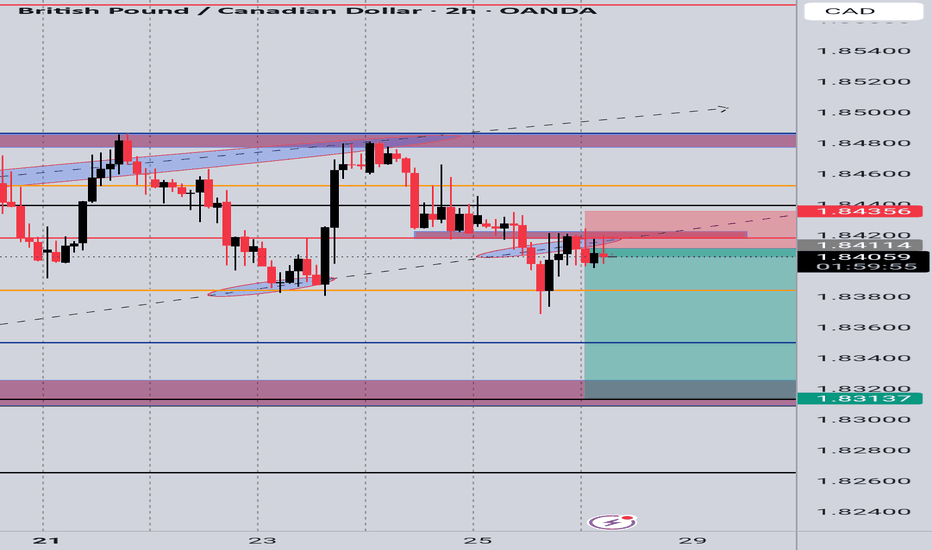

GBPCAD OUTLOOKIn this analysis we're focusing on 2H time frame for finding possible upcoming movement in price. So as per my strategy today I'm looking for a sell trade opportunity. Confirmation is very important, after confirmation we'll execute our trade. Let's see which opportunity market will give us.

Always use stoploss for your trade.

Always use proper money management and proper risk to reward ratio.

This is my prediction.

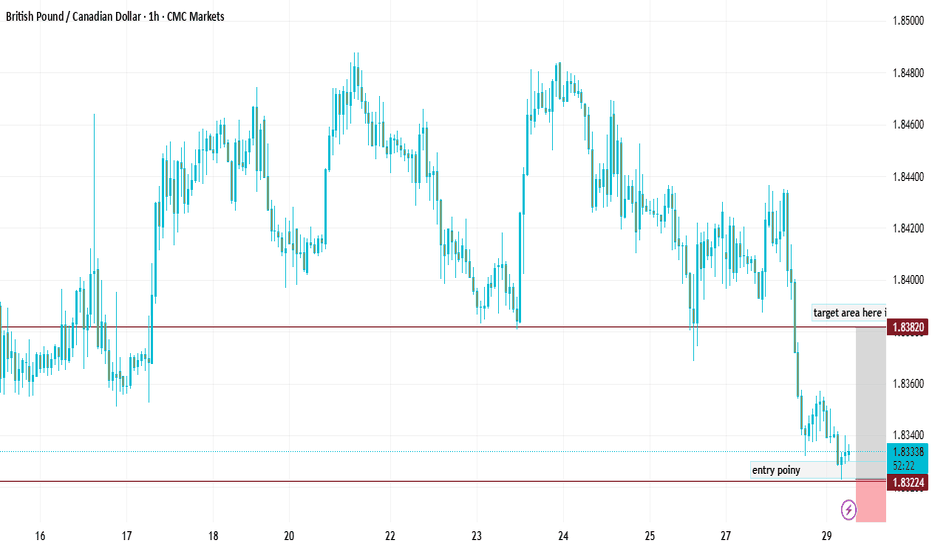

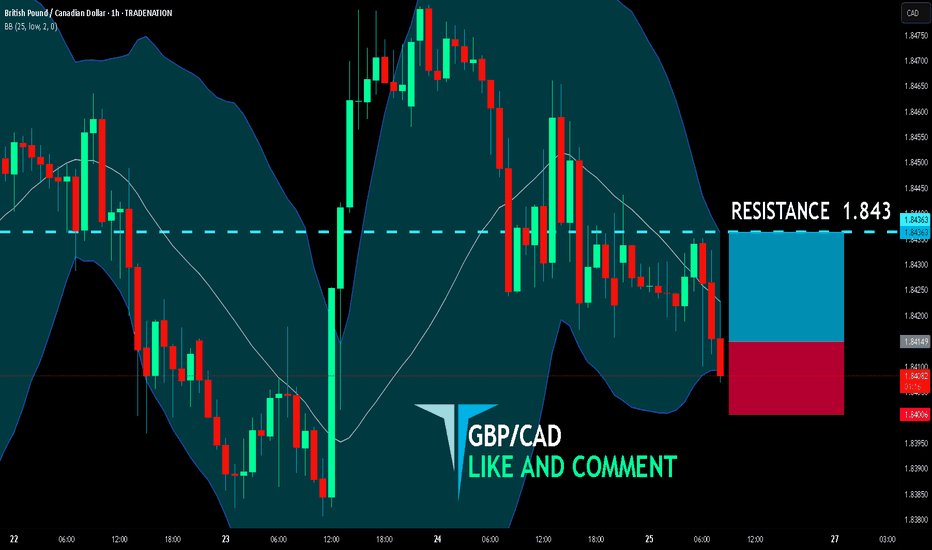

#GBPCAD 1H Technical Analysis Expected Move.

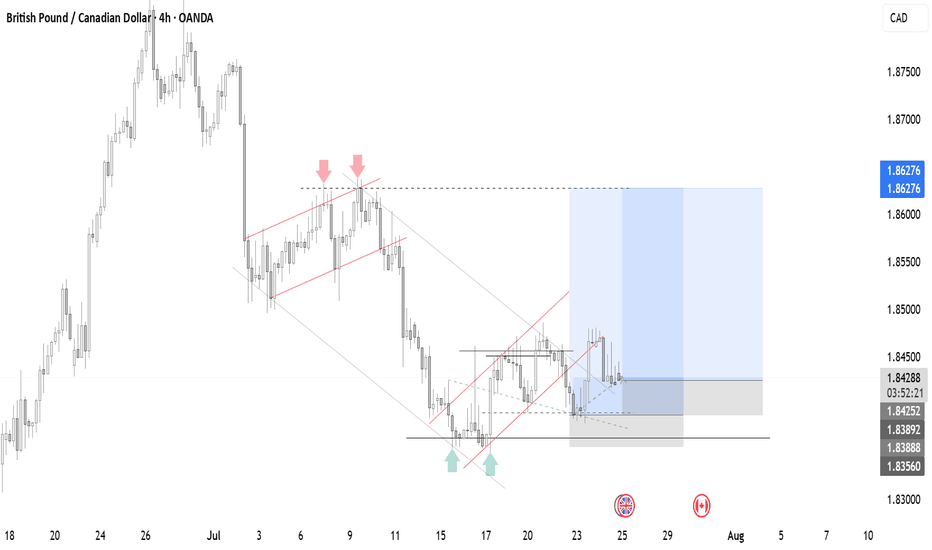

#011: Long Investment Opportunity on GBP/CAD

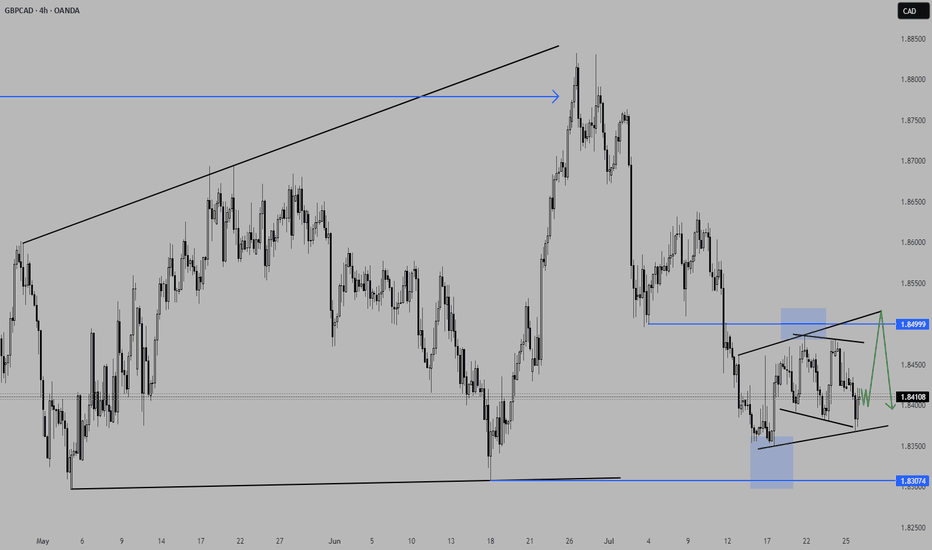

After weeks of compression, GBP/CAD is showing clear signs of institutional accumulation. The price recently released a false bearish breakout below 1.8400, followed by a reabsorption and spike with decreasing volumes: a typical "retail flush" structure.

Added to this are clear macro elements:

The pound is supported by a still-tight monetary policy, with the BoE maintaining a hawkish tone.

The Canadian dollar is suffering from declining oil expectations and the risk of a more rapid rate cut by the BoE.

📉 What happened?

The market attempted to "clear" the 1.838–1.840 zone with a rapid, unfollow-through bearish move. This behavior, combined with the Open Interest reading and retail positioning, suggests an institutional entry intention in the area between 1.8375 and 1.8365.

📈 Positioning

A Buy Limit was placed at 1.83740, with a wide Stop Loss at 1.82890, outside any visible hunting zone, and a Take Profit at 1.86280, where profit-taking has historically occurred on similar patterns.

🎯 Main motivations for long

Accumulation visible with stop-hunt below support at 1.8400

Net long GBP futures position

Retail short above 70%, a typical reversal signal

No significant volume obstacles until 1.8620

Psychological resistance already tested (1.846, 1.850)

⏳ Estimated timeframe

The setup could develop over several days, with the first movement as early as today (Friday) and completion by mid-next week. The intention is to follow the banking flow, without anticipating or reacting to emotional price movements.

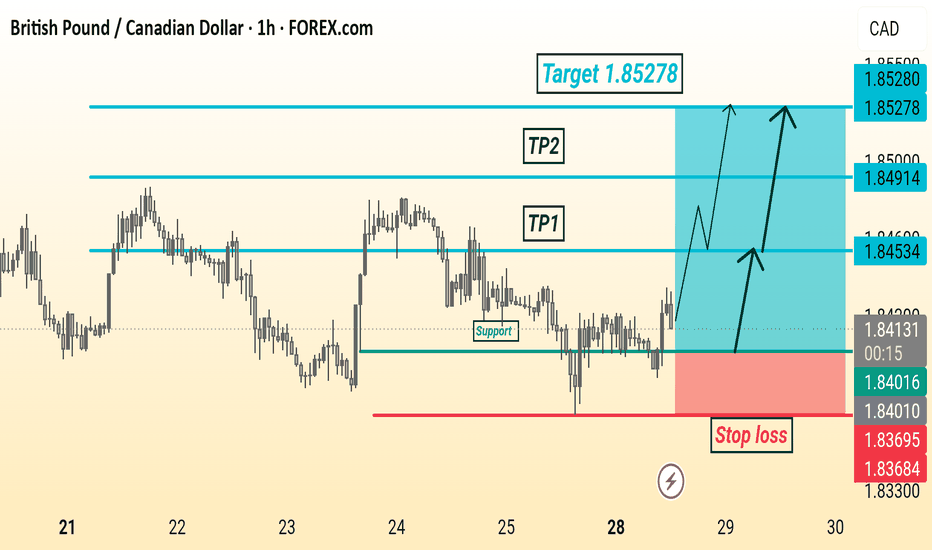

GBP/CAD Analysis Is Ready Move Will Be FlyThis is a bullish trade setup for GBP/CAD on the 1-hour chart. Price is expected to rise from the current level (1.84177) after bouncing from a support zone. The chart shows two potential take profit levels:

TP1 at 1.84534

TP2 at 1.84914

Final target is 1.85278, with a stop loss placed below support at 1.83684. Arrows suggest possible upward price movements

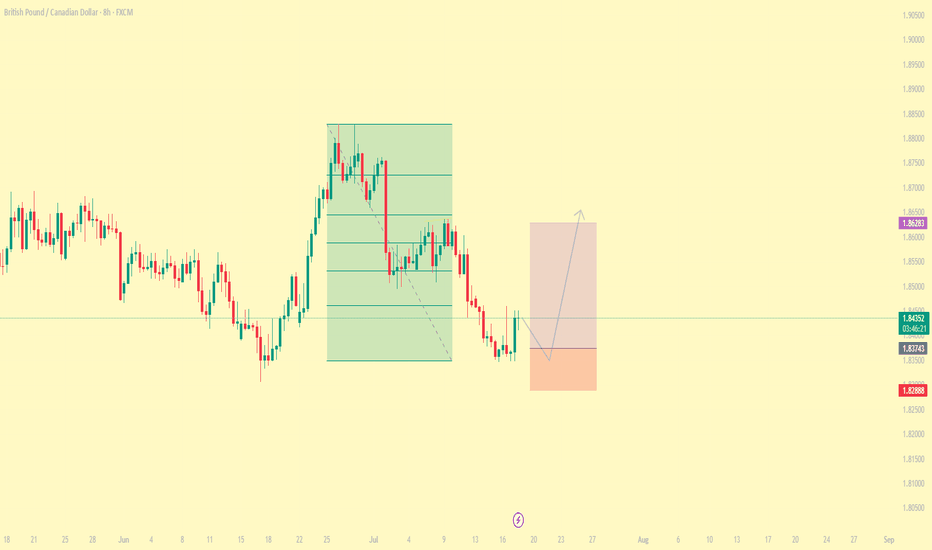

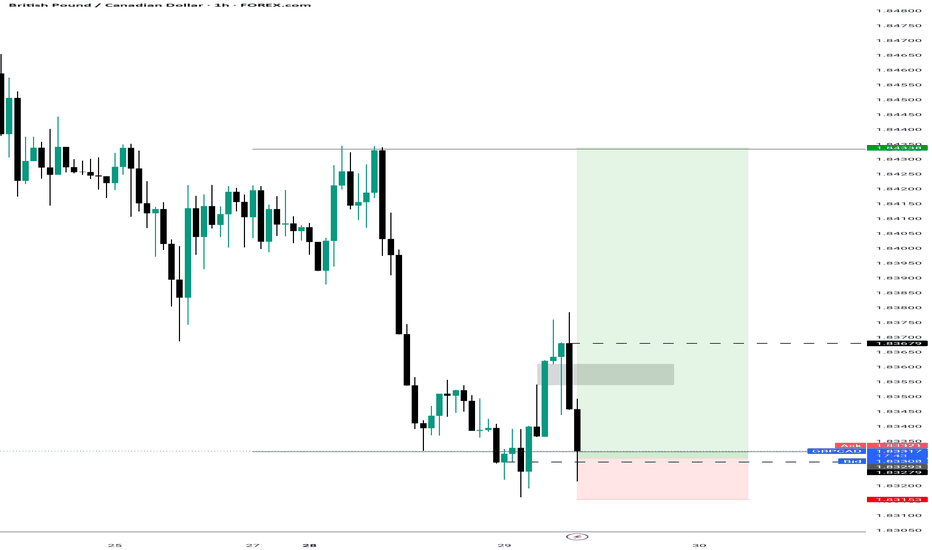

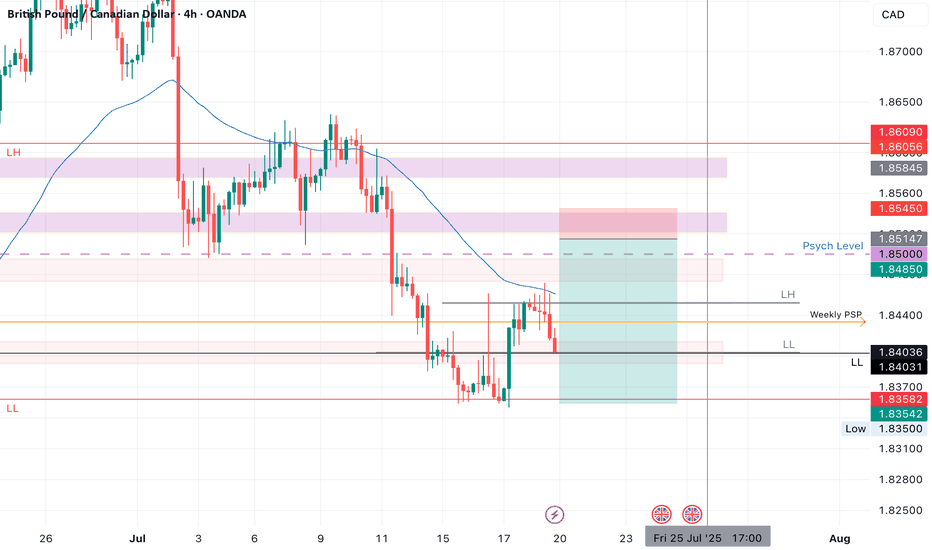

GBPCAD a short-term long trade into a HTF short area.GBPCAD presents a potential LTF long trade into a HTF short area. I am overall still bearish biased, but considering we have gaps to the top of the structure we might get an opportunity for a short-term counter long trade to finish the consolidation before we see the next bigger move to the downside.

📈 Simplified Trading Rules:

> Follow a Valid Sequence

> Wait for Continuation

> Confirm Entry (valid candlestick pattern)

> Know When to Exit (SL placement)

Remember, technical analysis is subjective; develop your own approach. I use this format primarily to hold myself accountable and to share my personal market views.

⚠ Ensure you have your own risk management in place and always stick to your trading plan.

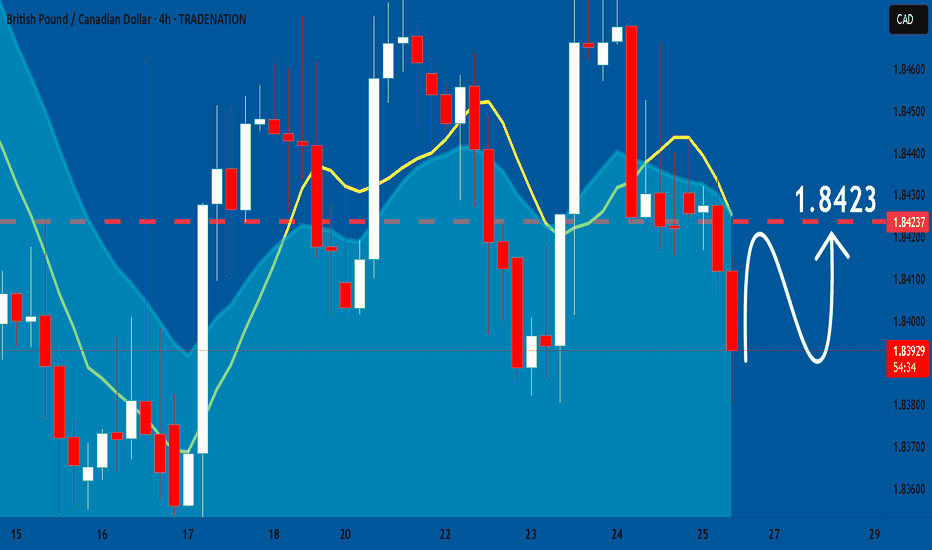

GBPCAD | One Kiss at 1.8390, and I’m All In!The big picture of GBPCAD is BUY possible up to 1.8550

See the H4 BUY range?

It slid love note to BUY into my DMs since 17/JulY. I didn't fall blindly since H4 SELL range came in like a jealous ex.

So I flipped to SELL and I shared my love signal with you here. (check my last week GBPCAD signal).

See that bottom black line at 1.8370?

It got a gentle kiss from the Daily candle (REJECTION).

Then 15m already whispered, "a sweet breakout"!

📌LONG STORY SHORT, I'M BUY AT 1.8390

If H4 comes and kisses 1.8390 (just a touch and wick), I’m BUYING — no more playing hard to get. 😘

TP? 1.8490 — that’s a sweet 100-pips date night!

But if it cuddles (closes by body) That’s it — my heart will be broken. 💔

WISH ME LUCK...or TISSUES! 😂!!!

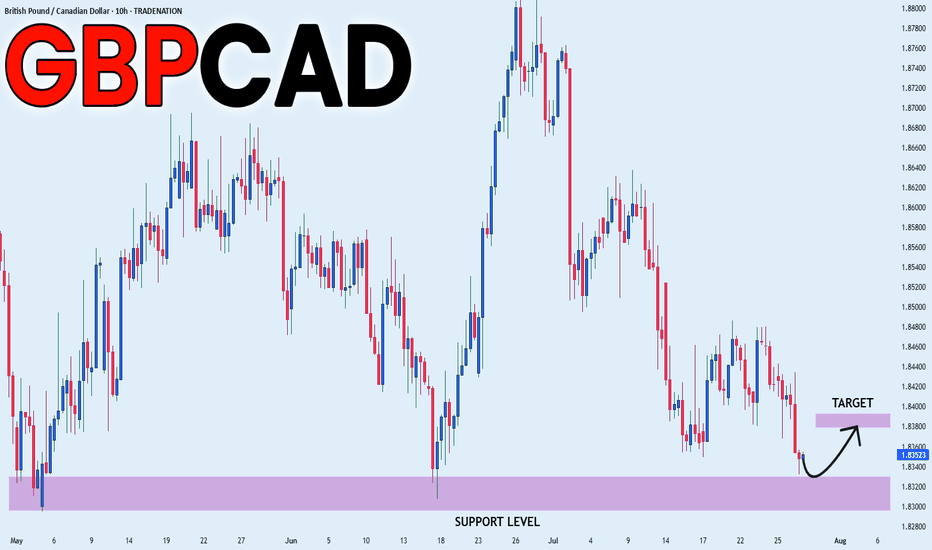

GBPCAD bullish reaction to BoE rate decisionThe GBPCAD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 1.8240 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 1.8240 would confirm ongoing upside momentum, with potential targets at:

1.8510 – initial resistance

1.8600 – psychological and structural level

1.8690 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 1.8240 would weaken the bullish outlook and suggest deeper downside risk toward:

1.8160 – minor support

1.8076 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the GBPCAD holds above 1.8240. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

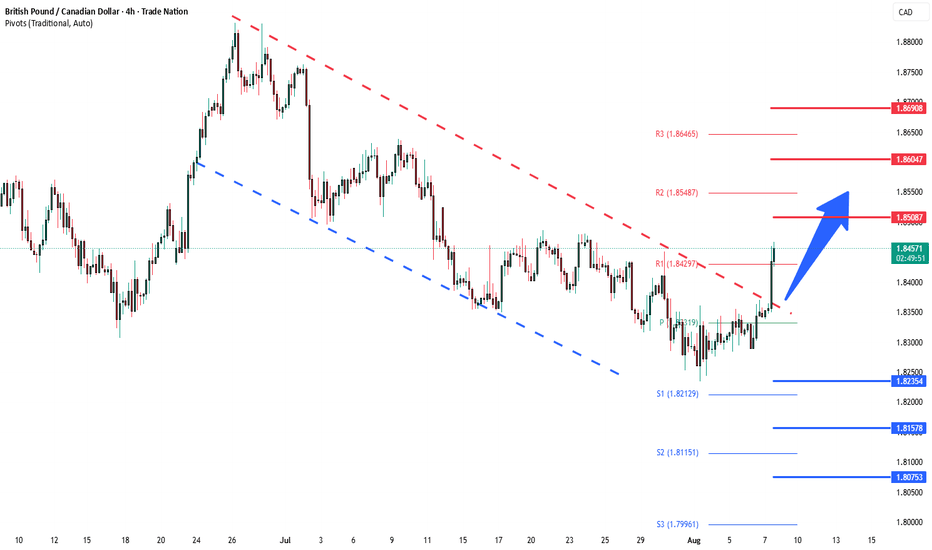

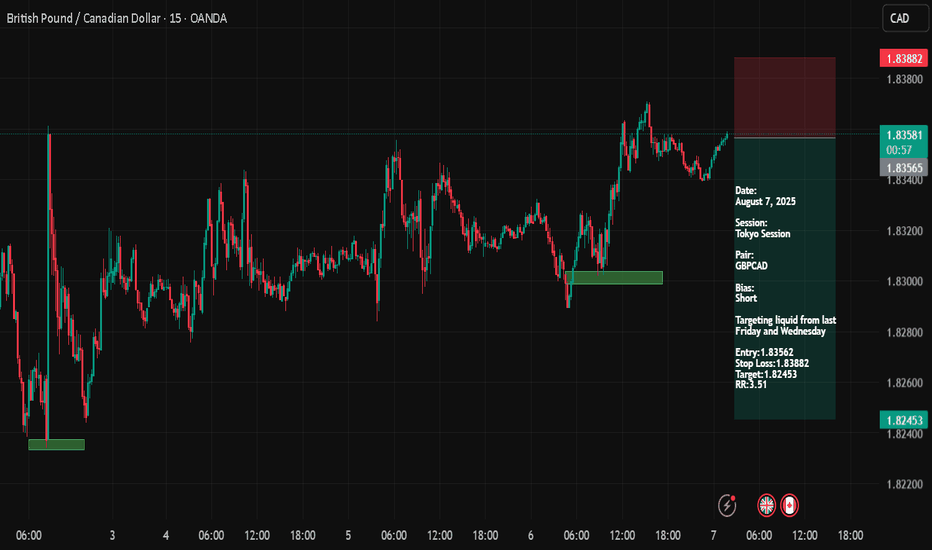

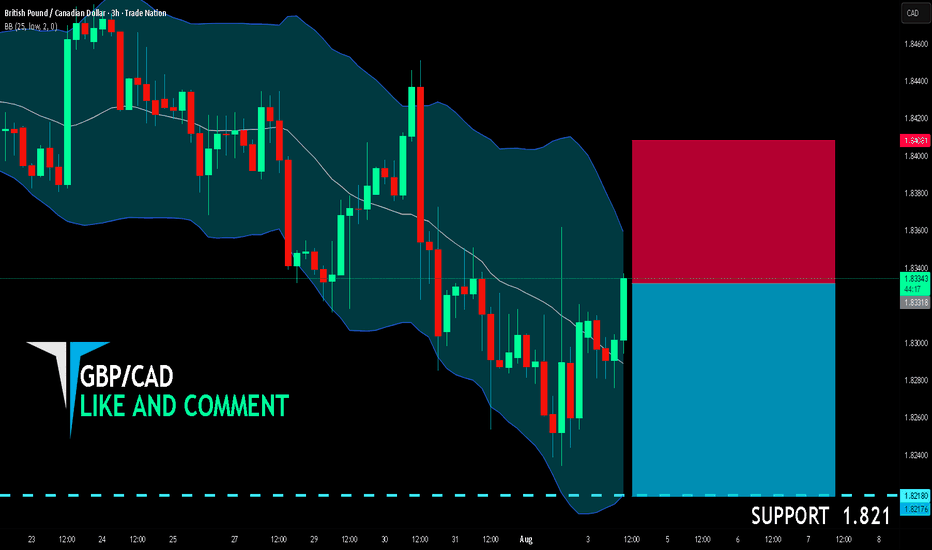

GBP/CAD SENDS CLEAR BEARISH SIGNALS|SHORT

GBP/CAD SIGNAL

Trade Direction: short

Entry Level: 1.833

Target Level: 1.821

Stop Loss: 1.840

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 3h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

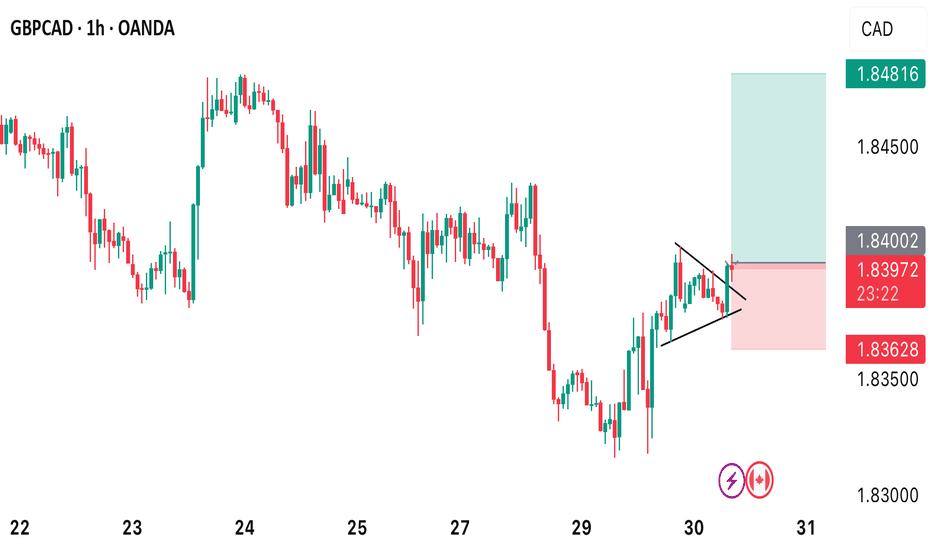

GBPCAD BUY OPPORTUNITY Price provides a buy opportunity from the current market price of 1.84002. As support level of 1.83192 remain unbroken and the recently formed triangular pattern which is a continuation pattern also get broken. Our buy target profit level is 1.84816.

Take advantage of this potential opportunity.

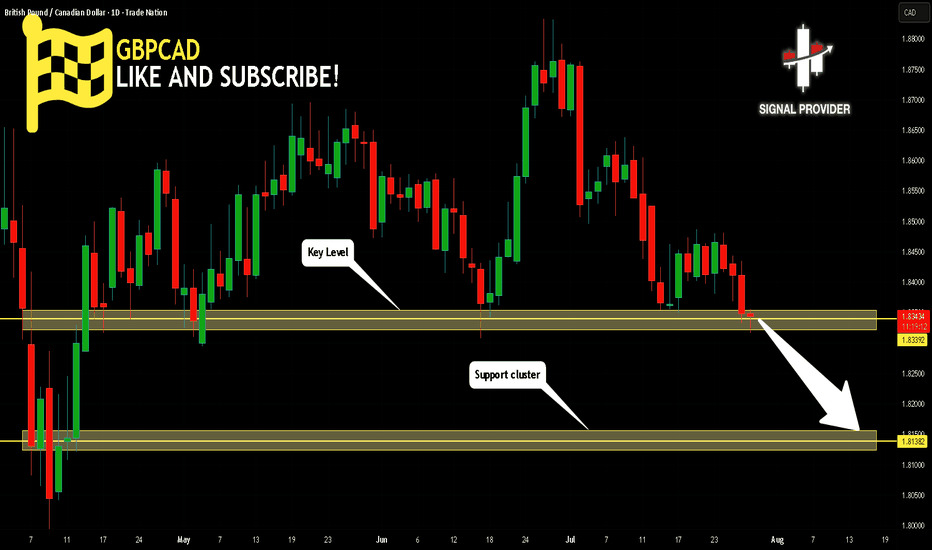

GBPCAD Will Go Down! Short!

Please, check our technical outlook for GBPCAD.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 1.833.

The above observations make me that the market will inevitably achieve 1.813 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

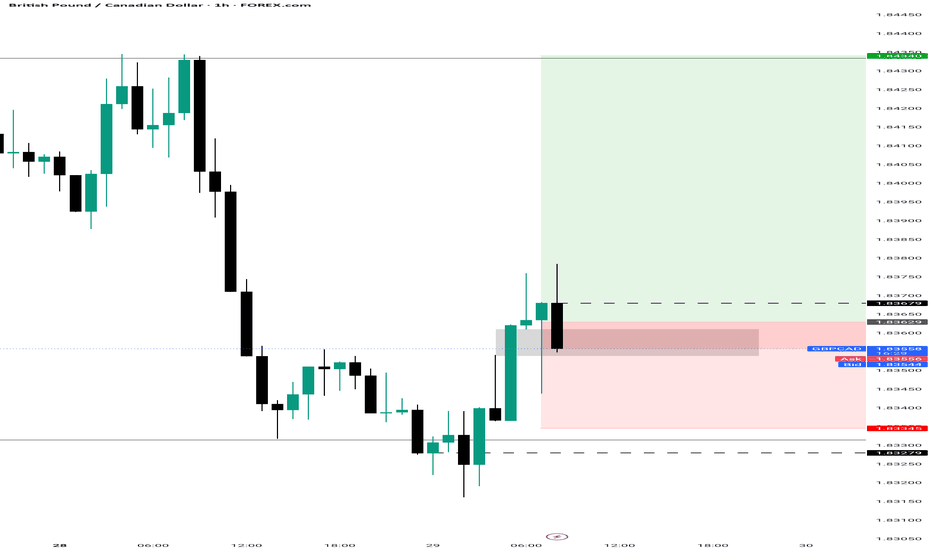

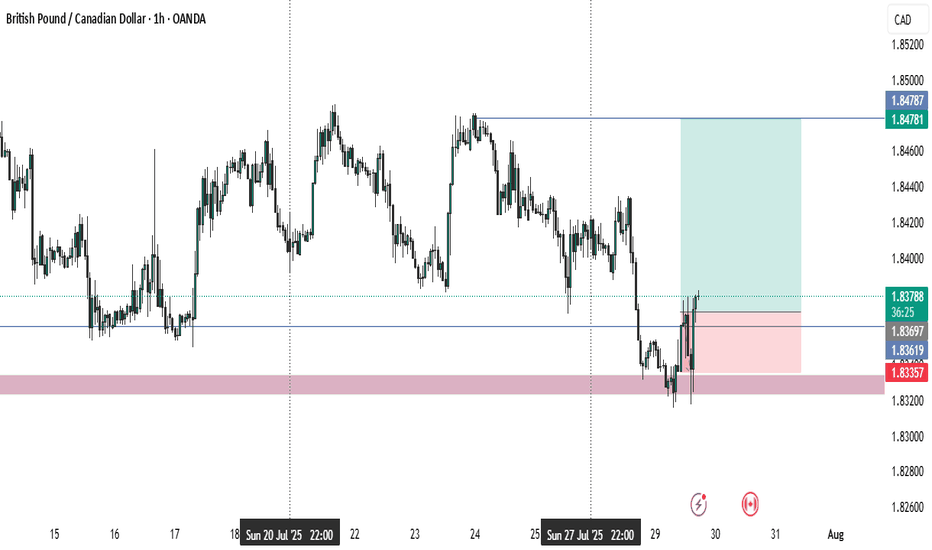

gbpcadThe entry point of 1.83350 is strategically placed to catch the breakout above minor resistance.

The first target at 1.83480 captures a short-term price retracement zone with high probability.

The second target, 1.83610, aligns with the upper boundary of a recent consolidation range.

The third target, 1.83700, is placed just below a psychological resistance level, offering a solid reward.

A tight stop loss at 1.83200 limits downside risk while keeping the risk-reward ratio favorable (approximately 1:2+).

GBP_CAD RISKY SETUP|LONG|

✅GBP_CAD is going down to retest

A horizontal support of 1.8320

Which makes me locally bullish biased

And I think that we will see a rebound

And a move up from the level

Towards the target above at 1.8380

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

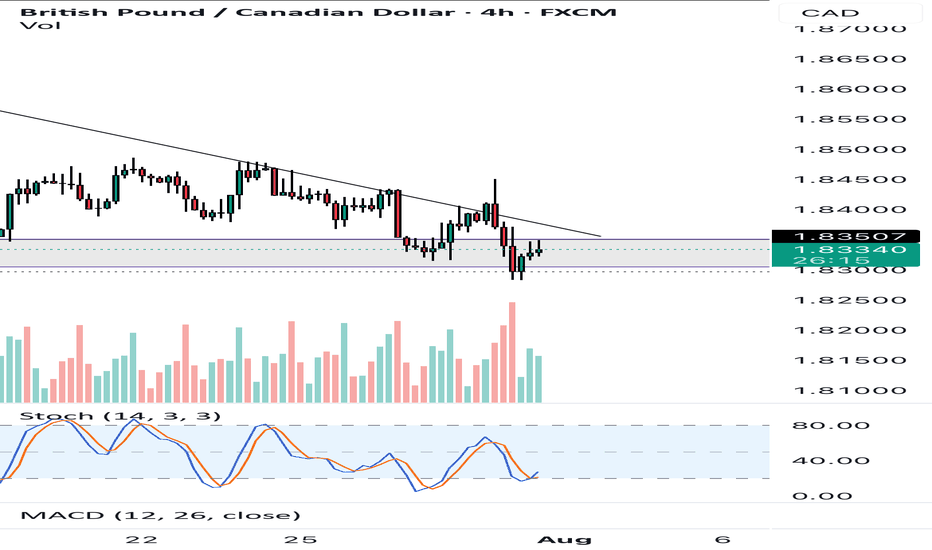

GBP/CAD 4H Setup – Bearish Rejection at Key ZonePrice retested the 1.8420–1.8437 supply zone and showed a clear rejection, aligning with the previous trendline break. We're now seeing lower highs forming with bearish momentum.

🔻 Entry: Around 1.8410 – 1.8400

🎯 Target: 1.8313 (previous demand zone)

🛑 Stop Loss: 1.8437 (above structure)

Bias: Bearish below 1.8437 zone

If momentum continues, price could drop toward the 1.8310 support zone. Structure shows clean bearish control unless a breakout occurs back above the supply area.

GBPCAD: Growth & Bullish Continuation

The price of GBPCAD will most likely increase soon enough, due to the demand beginning to exceed supply which we can see by looking at the chart of the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBP/CAD BUYERS WILL DOMINATE THE MARKET|LONG

GBP/CAD SIGNAL

Trade Direction: long

Entry Level: 1.841

Target Level: 1.843

Stop Loss: 1.840

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBPCAD SHORTMarket structure bearish on HTFs DW

Entry at both Weekly and Daily AOi

Weekly Rejection at AOi

Previous Weekly Structure Point

Daily Rejection at AOi

Daily EMA retest

Around Psychological Level 1.85000

H4 Candlestick rejection

Levels 5.3

Entry 90%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.