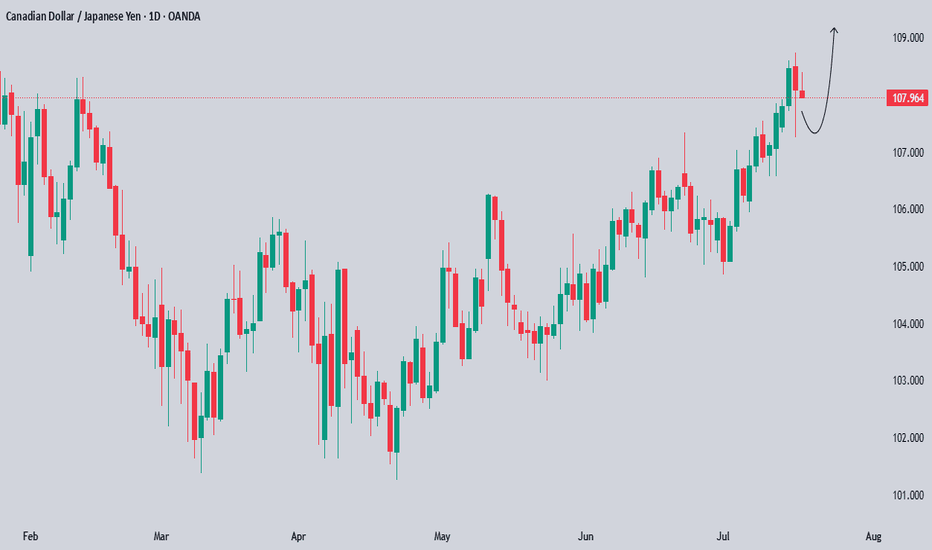

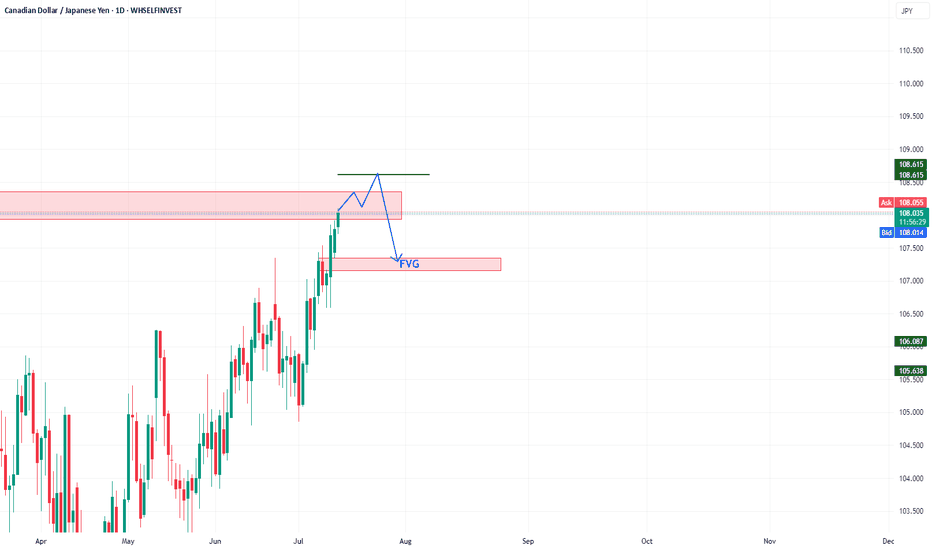

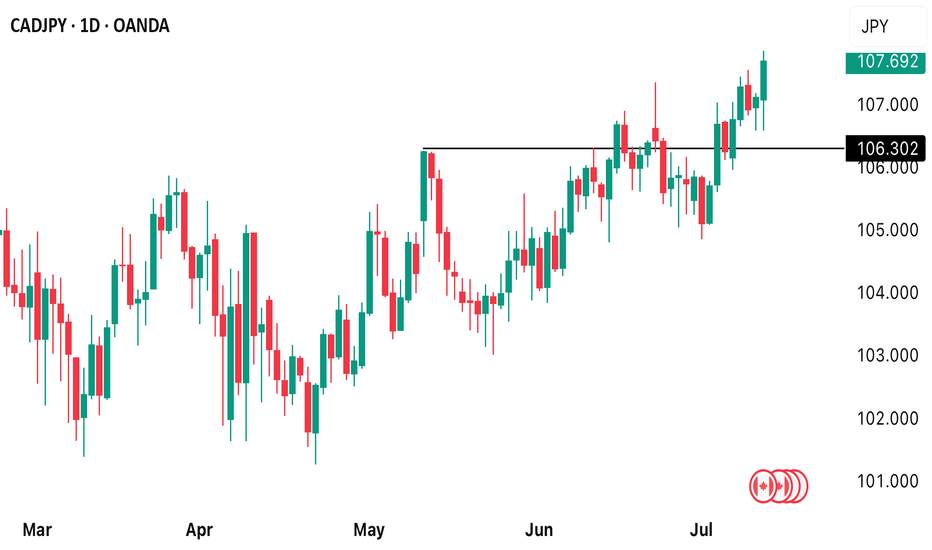

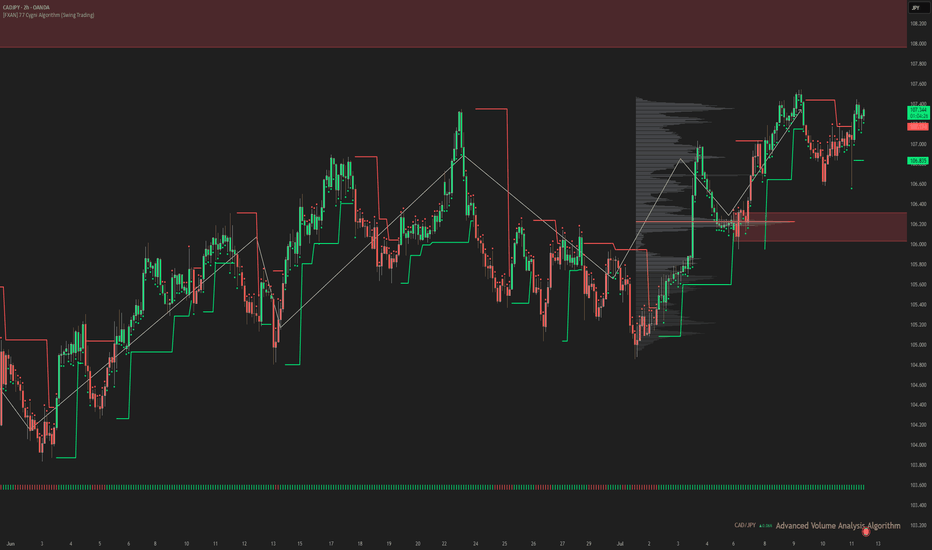

CADJPY Technical & Order Flow AnalysisOur analysis is based on a multi-timeframe top-down approach and fundamental analysis.

Based on our assessment, the price is expected to return to the monthly level.

DISCLAIMER: This analysis may change at any time without notice and is solely intended to assist traders in making independent investment decisions. Please note that this is a prediction, and I have no obligation to act on it, nor should you.

Please support our analysis with a boost or comment!

CADJPY trade ideas

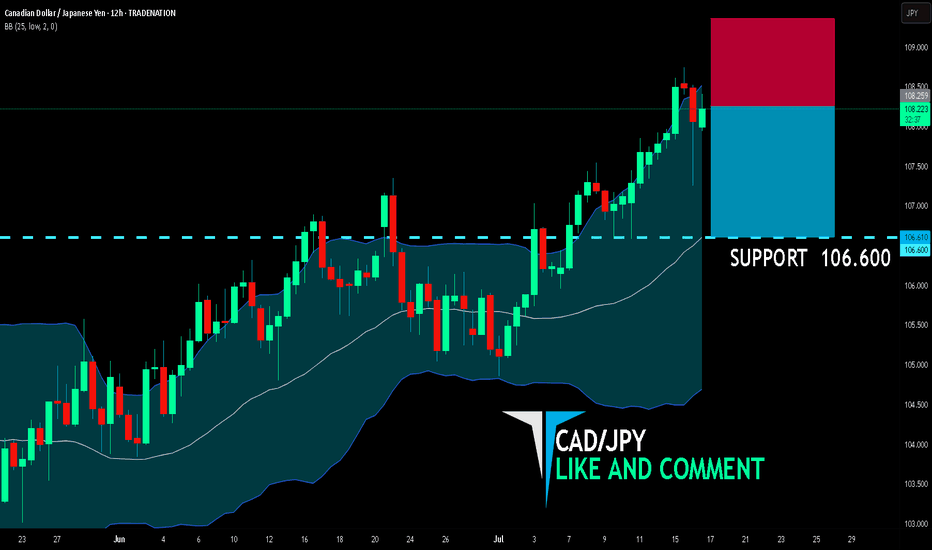

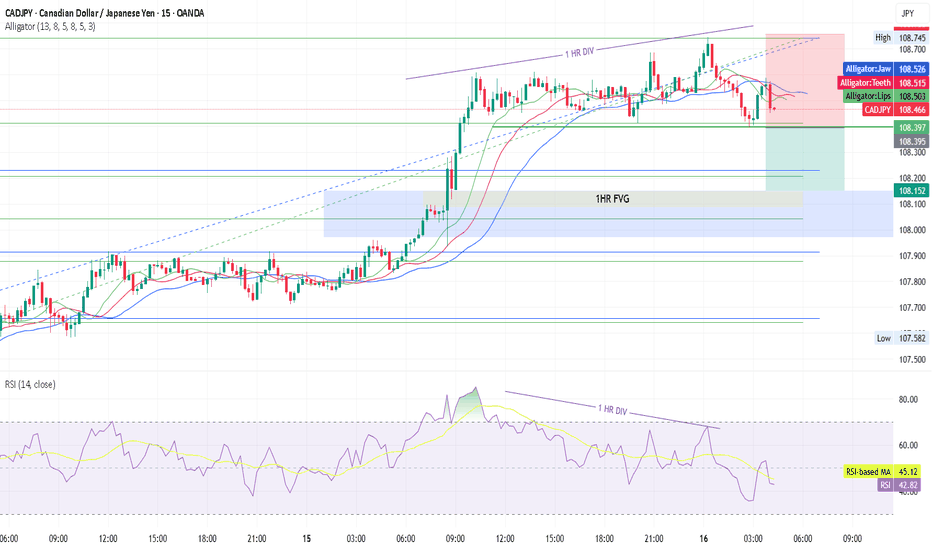

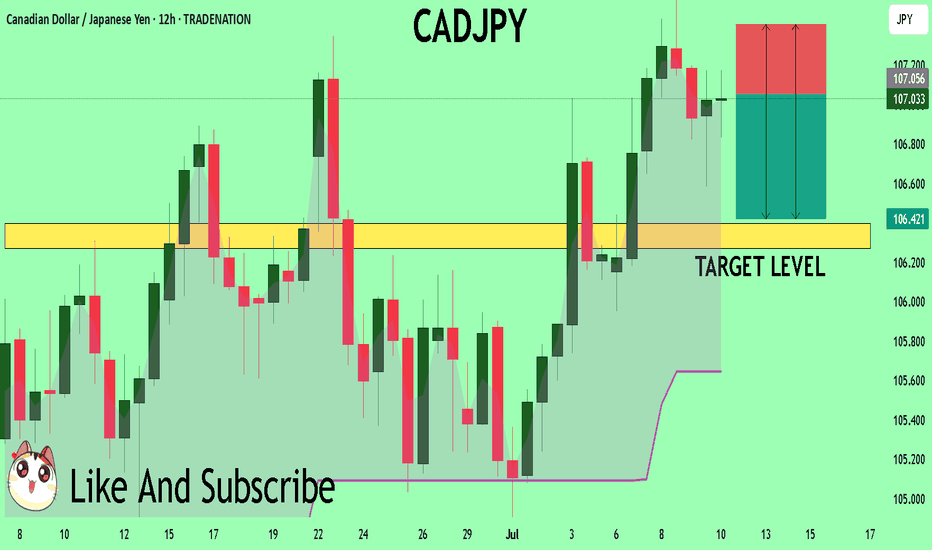

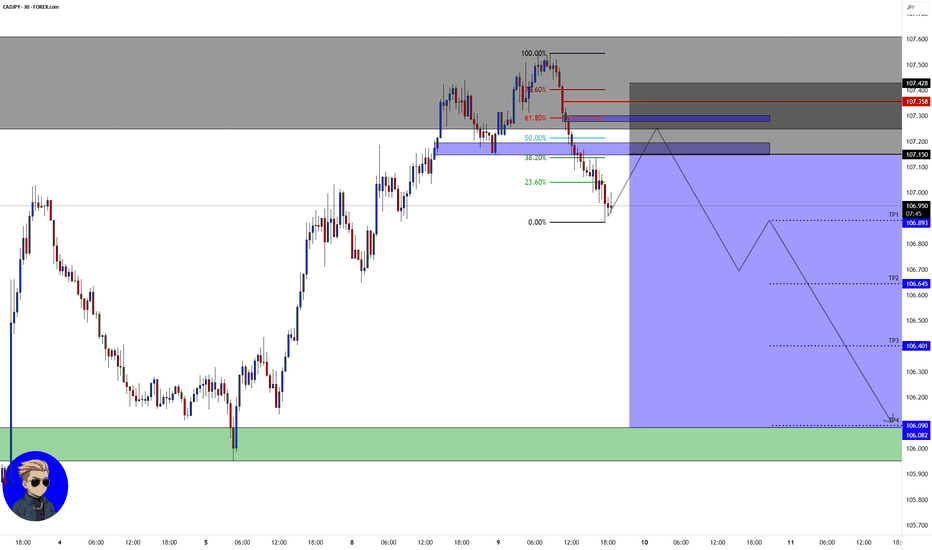

CAD/JPY BEARS WILL DOMINATE THE MARKET|SHORT

CAD/JPY SIGNAL

Trade Direction: short

Entry Level: 108.259

Target Level: 106.600

Stop Loss: 109.355

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 12h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

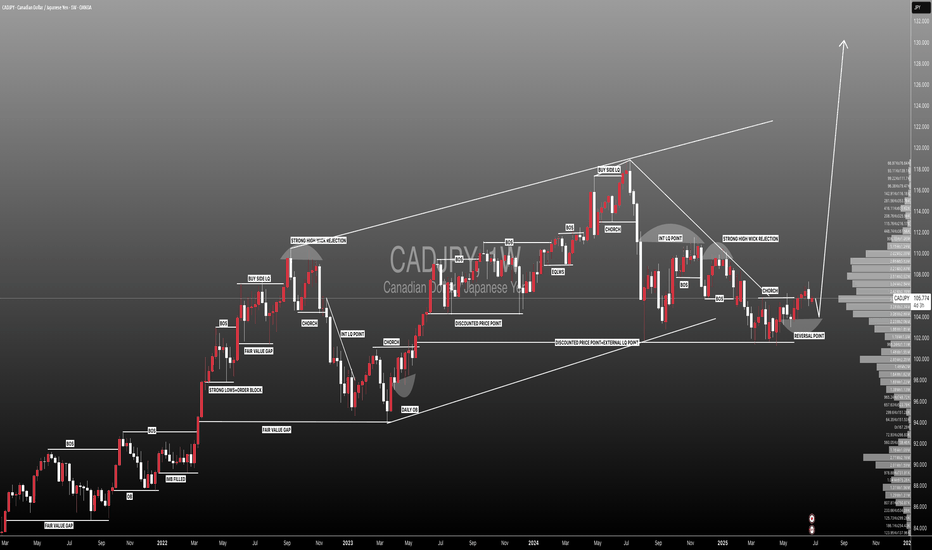

#CADJPY:Targeting 130.00 Almost 30,000 Pips Swing TradeThe long-term outlook for CADJPY remains extremely bullish in the coming week. My initial target is 115, followed by 120, and ultimately 130. This would result in a total of 30,000 pips of movement in the swing. Please use this analysis for educational purposes only.

Good luck and trade safely!

Like, comment, and share this idea!

Team Setupsfx_

❤️🚀

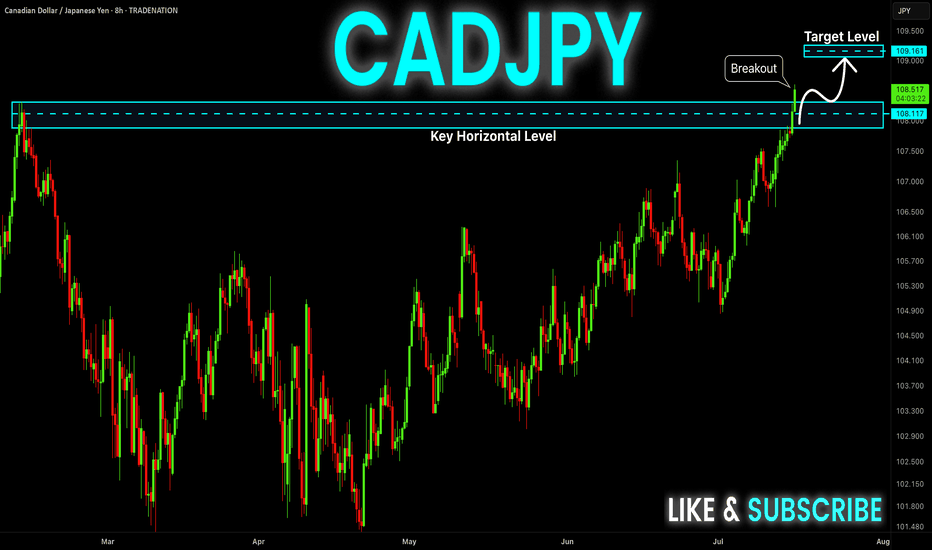

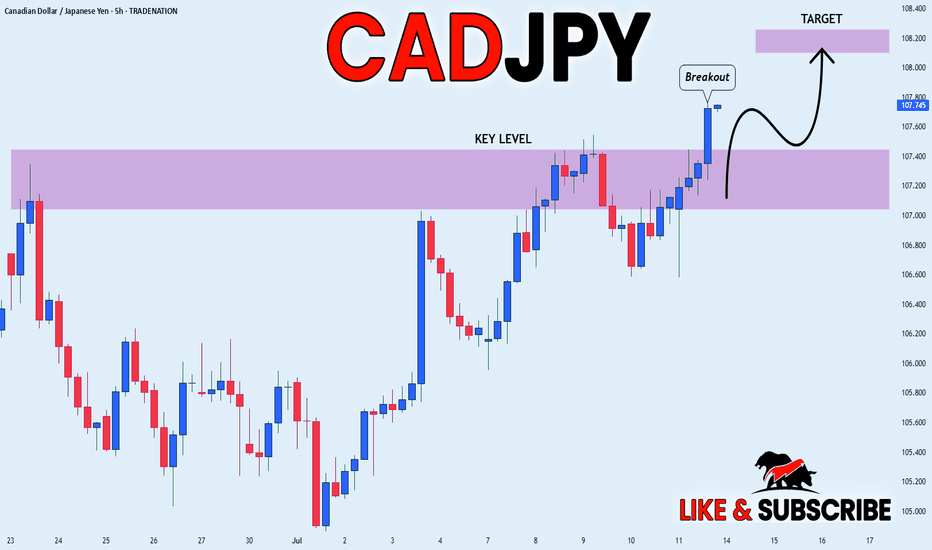

CAD-JPY Strong Bullish Breakout! Buy!

Hello,Traders!

CAD-JPY keeps trading in a

Strong uptrend and the pair

Made a strong bullish breakout

Of the key horizontal level

Of 108.299 so we are bullish

Biased and we will be expecting

A further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

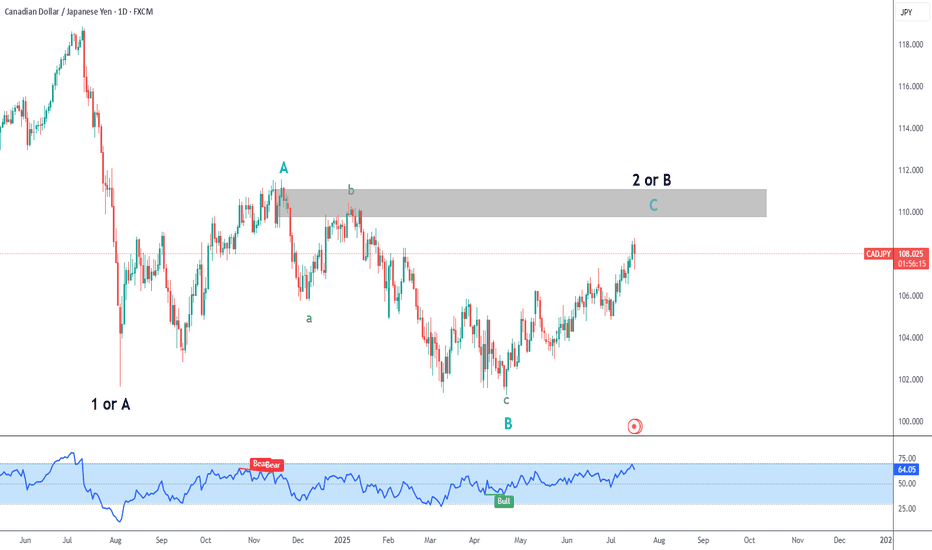

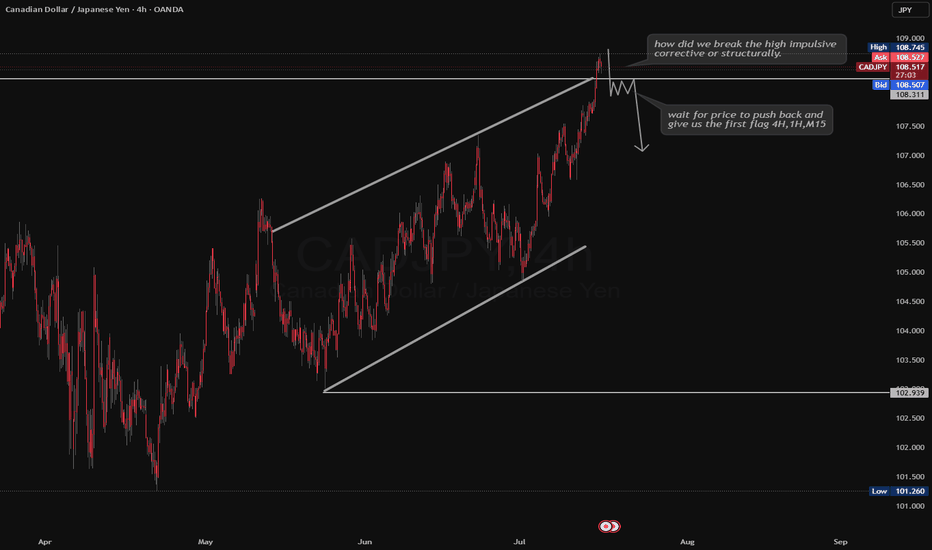

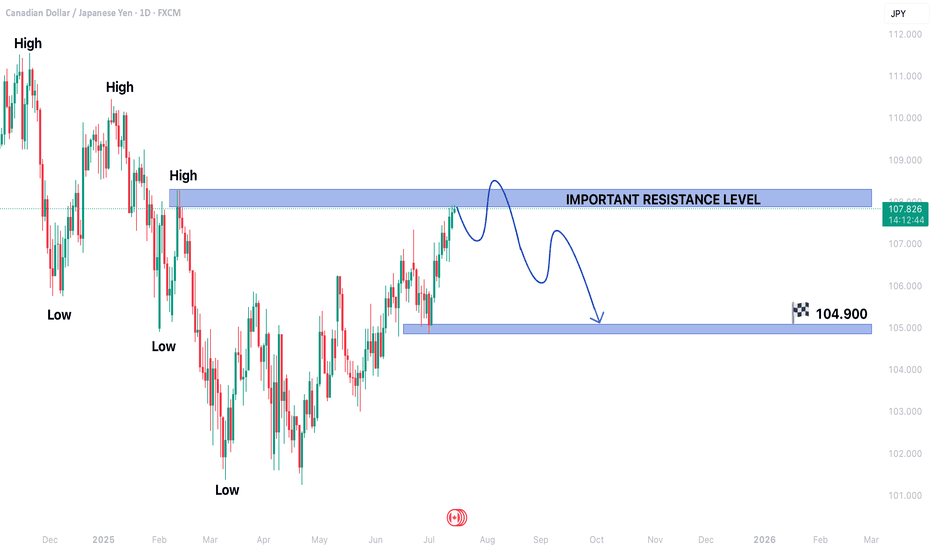

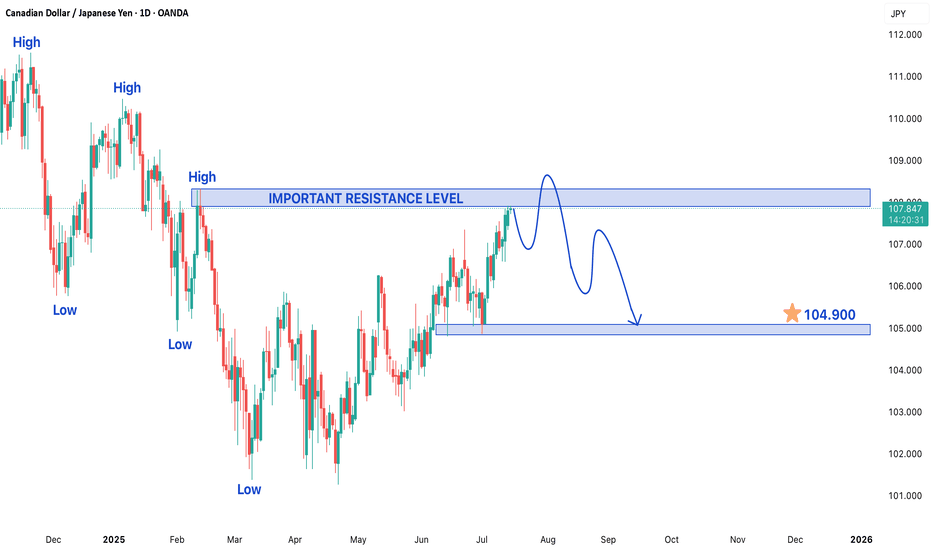

CAD/JPY is currently exhibiting a bearish trend structureThe CAD/JPY currency pair is currently exhibiting a bearish trend structure, indicating a prevailing downward momentum in its price action. At present, the pair is trading within a secondary trend near a significant resistance level, which is a critical point that could determine its next directional move. Traders and investors are closely monitoring this level as a breakout or rejection here could set the tone for future price movements.

On the lower side, if the bearish momentum continues, the price may decline toward the target of 104.900. This level could act as a key support zone, where buyers might step in to halt further losses. A break below this support could intensify selling pressure, potentially pushing the pair toward lower levels. Conversely, if the price finds stability near this support, a short-term rebound could occur, providing traders with potential buying opportunities in a corrective phase.

On the higher side, if the pair manages to overcome the current resistance, it may attempt to test the next key resistance level at 108.300. A successful breakout above this level could signal a shift in market sentiment, possibly leading to a trend reversal or a stronger corrective rally. However, given the prevailing bearish structure, any upward movement may face strong selling pressure near resistance zones, limiting upside potential.

Traders should remain cautious and watch for confirmation signals before entering positions. Key indicators such as moving averages, RSI, and MACD can provide additional insights into momentum and potential reversals. Risk management strategies, including stop-loss orders, should be employed to mitigate downside risks in case the market moves against expectations. Overall, the CAD/JPY pair remains in a bearish phase, and its next major move will depend on how it reacts to the critical resistance and support levels mentioned.

CADJPY TRADING IN A BEARISH TREND STRUCTUREThe CAD/JPY currency pair is currently exhibiting a bearish trend structure, indicating a prevailing downward momentum in its price action. At present, the pair is trading within a secondary trend near a significant resistance level, which is a critical point that could determine its next directional move. Traders and investors are closely monitoring this level as a breakout or rejection here could set the tone for future price movements.

On the lower side, if the bearish momentum continues, the price may decline toward the target of 104.900. This level could act as a key support zone, where buyers might step in to halt further losses. A break below this support could intensify selling pressure, potentially pushing the pair toward lower levels. Conversely, if the price finds stability near this support, a short-term rebound could occur, providing traders with potential buying opportunities in a corrective phase.

On the higher side, if the pair manages to overcome the current resistance, it may attempt to test the next key resistance level at 108.300. A successful breakout above this level could signal a shift in market sentiment, possibly leading to a trend reversal or a stronger corrective rally. However, given the prevailing bearish structure, any upward movement may face strong selling pressure near resistance zones, limiting upside potential.

Traders should remain cautious and watch for confirmation signals before entering positions. Key indicators such as moving averages, RSI, and MACD can provide additional insights into momentum and potential reversals. Risk management strategies, including stop-loss orders, should be employed to mitigate downside risks in case the market moves against expectations. Overall, the CAD/JPY pair remains in a bearish phase, and its next major move will depend on how it reacts to the critical resistance and support levels mentioned.

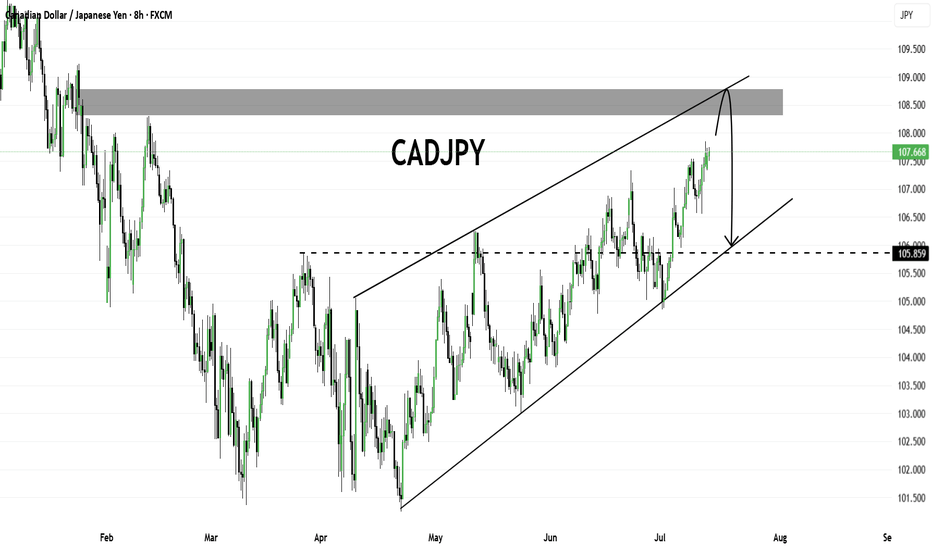

CADJPY Analysis – Bearish Rejection Expected from Key ResistanceCADJPY is currently trading within a rising wedge structure and approaching a major supply zone around the 108.300–108.700 region, which previously acted as strong resistance. Price has shown consistent upward momentum, but as it nears the upper boundary of the wedge and supply area, signs of exhaustion may appear.

A potential bearish rejection from this zone could lead to a corrective move towards the lower trendline of the wedge, aligning with the previous breakout level at 105.850, which also acts as horizontal support.

Traders should watch for bearish confirmation signals near the supply zone for a potential short opportunity, targeting the 105.850 region. A breakout above the supply zone would invalidate this bearish scenario

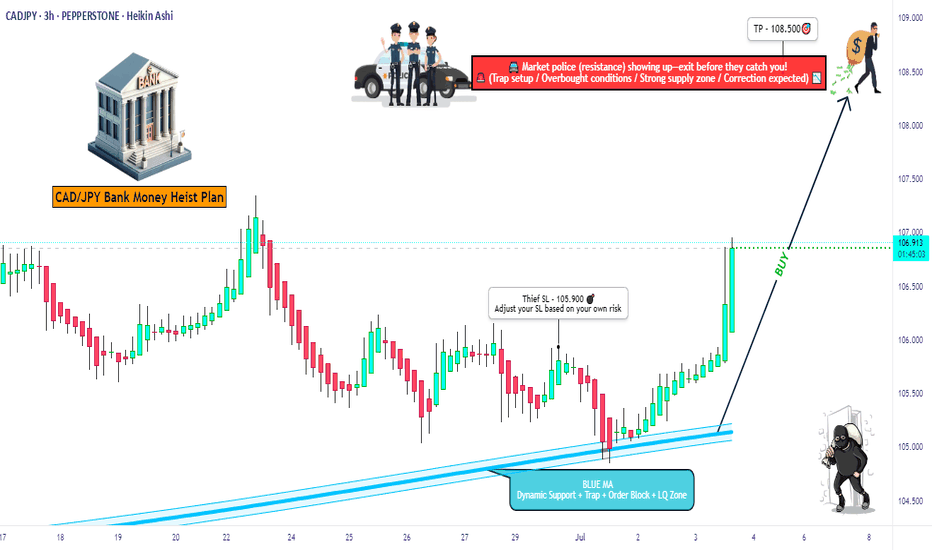

"Loonie-Yen Heist: CAD/JPY Bullish Blueprint in Motion"🕶️💼 “Operation Loonie-Yen: The CAD/JPY Clean Sweep Blueprint” 💼🕶️

(Scalp & Swing Strategy by the Thief Trader Guild)

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Movers & Strategic Operators, 🤑💰✈️

This blueprint is part of our 🔥Thief Trading Style🔥 operation—a fusion of technical precision and fundamental edge designed to tactically exploit the CAD/JPY (Loonie-Yen) setup.

🎯 Mission Objective:

Infiltrate the Bullish Zone & secure profits before the authorities (sellers) regroup.

📌 Entry Point:

"The vault's wide open!"

🔓Buy into momentum at any key level OR set a buy limit on recent swing lows using the 15m–30m charts. Wait for a pullback? Perfect—join the crew on the next dip.

🛑 Stop-Loss (SL):

Place it just below the 4H swing low (105.900) candle body wick.

But remember, your SL should match your risk style, position size, and trade frequency. Risk management is part of every successful heist.

🎯 Target Zone:

Aim for 108.500 – but exit smart if market behavior changes. Lock profits and vanish before the trap closes!

⚔️ Scalpers' Game Plan:

Only long-side jobs here. Got deep pockets? Dive right in. If not, team up with swing robbers and ride the trend. Use trailing SLs to secure every coin.

🧠 Fundamentals & Sentiment:

CAD/JPY strength is supported by intermarket flow, macro shifts, and trader sentiment. Check reports and correlations to stay a step ahead.

📰 Trading Alerts:

Be cautious around news releases—volatile spikes could trigger alarms. Avoid new entries during major drops and always protect active trades with trailing SLs.

💖 Support the Heist:

Hit that Boost button to power up the crew. Every push fuels another successful strategy. Thief Trading Style isn’t just a tactic—it’s a movement. 🏆💪

Stay alert. More heist blueprints coming soon.

Till then, trade smart. Loot legally. Vanish profitably. 🐱👤📈💸

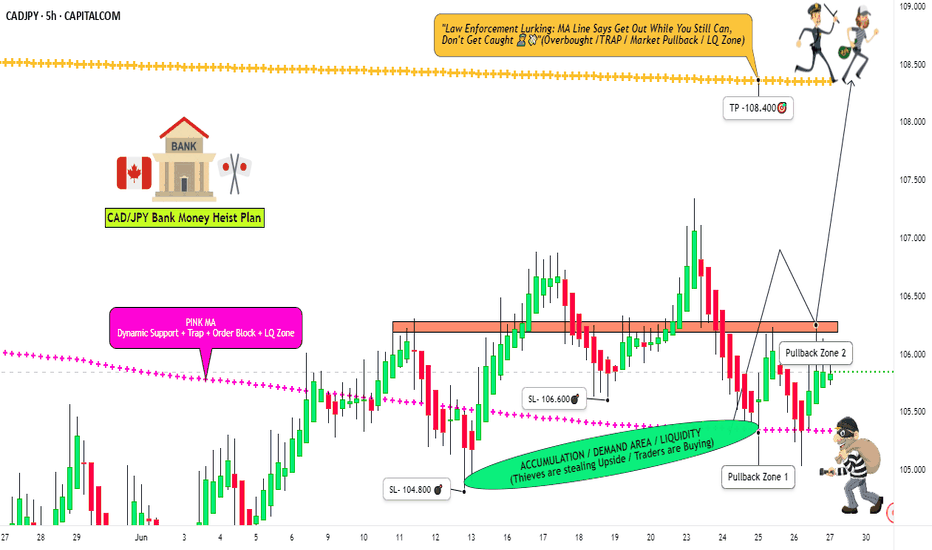

Forex Bank Job: CAD/JPY Profit Extraction Strategy🏦 "Operation Loonie Lift-Off" – CAD/JPY Forex Heist Blueprint! 💰💣

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

To all fellow Market Bandits & Profit Seekers, 🕶️💸💼

We’ve scoped out our next target – the CAD/JPY vault – and the blueprint is ready. This isn’t just a trade... it's a full-blown Forex infiltration mission based on undercover technical and fundamental recon 🔎📊.

🎯 The Mission Plan:

📍Entry Point – The Vault's Backdoor

💥 Strike at Pullback Zones 1 & 2

→ Use 15–30 min timeframe to ambush at recent lows or swings.

The best loot lies in waiting – buy limits only!

🛡️Stop Loss – Escape Routes

Set SL like a pro thief:

Pullback 1 ➤ 104.800

Pullback 2 ➤ 105.600

Base it on your crew’s bankroll and lot size. Always prep a clean getaway.

🏁Target – Secure the Goods

Primary loot zone: 106.000

(Or vanish before heat arrives 🚓💨)

⚔️ Scalpers’ Special Ops:

Only operate long side. Big wallets = quick hits. Small stacks? Join the swing squad and trail your SL like a shadow 🕶️🔐.

🔥Why This Hit?

CAD/JPY is in bullish mood driven by:

COT shifts 📈

Sentiment setups 🧠

Macro flow + cross-asset whispers 🔄

🚨 But remember: market conditions flip like fake IDs. Stay alert.

🧠 Final Tips from HQ:

🔕 Avoid new ops during major news drops

💣 Use trailing SLs to lock profits before the sirens go off

💖 Smash that 💥BOOST💥 to fund the next big mission

💼 From the Black Market Desks of the Thief Trading Syndicate™

This ain't your grandpa's trade plan — it's a strategic smash-and-grab with style and smarts. 📡🔐

💬 Drop a comment, hit the like, and recruit more to the crew.

📍See you in the next chart heist. Keep it stealthy, sharp, and profitable. 🤑🚀👊

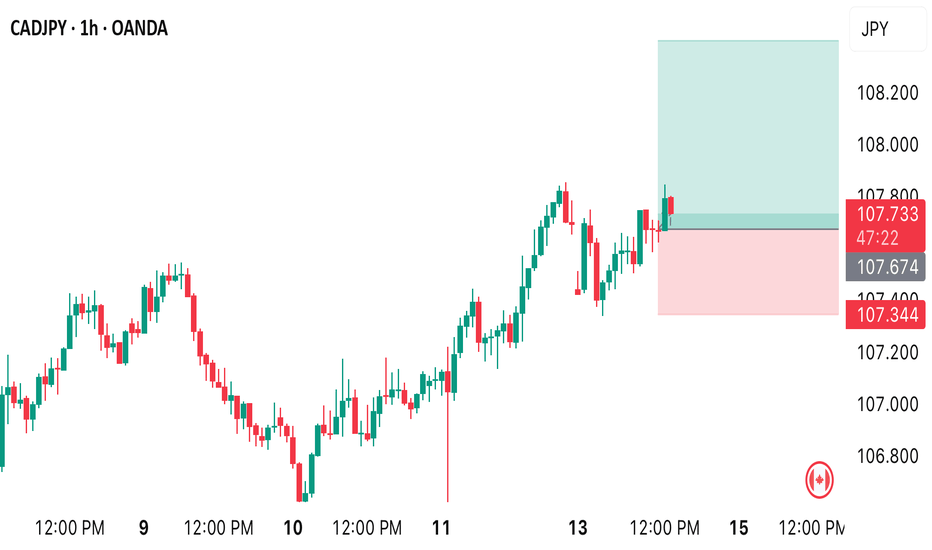

CAD_JPY BULLISH BREAKOUT|LONG|

✅CAD_JPY broke the key

Structure level of 107.400

While trading in a strong uptrend

Which makes me bullish biased

And I think that after the retest of

The broken level is complete

A rebound and bullish continuation will follow

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CADJPY; Heikin Ashi Trade IdeaIn this video, I’ll be sharing my analysis of CADJPY, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

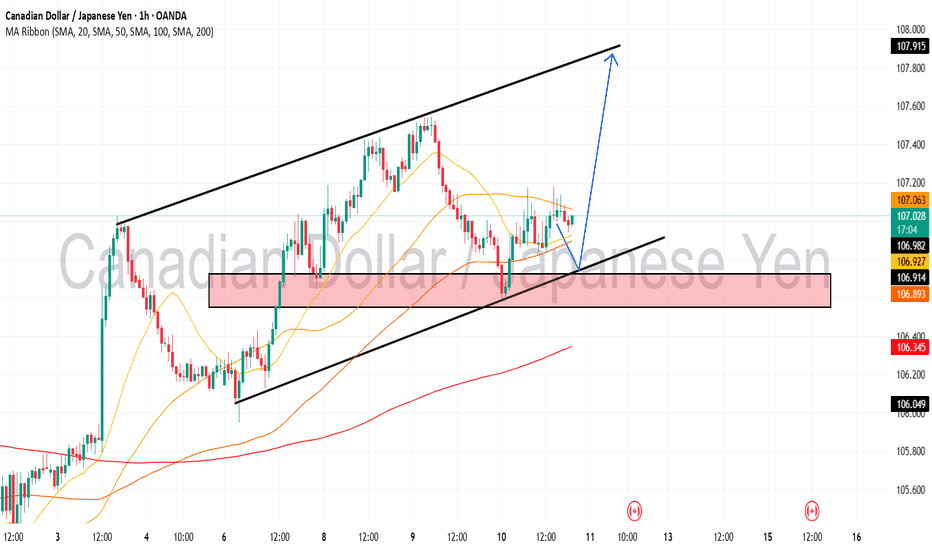

CADJPY is in the Up Trend Hello Traders

In This Chart CADJPY HOURLY Forex Forecast By FOREX PLANET

today CADJPY analysis 👆

🟢This Chart includes_ (CADJPY market update)

🟢What is The Next Opportunity on CADJPY Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

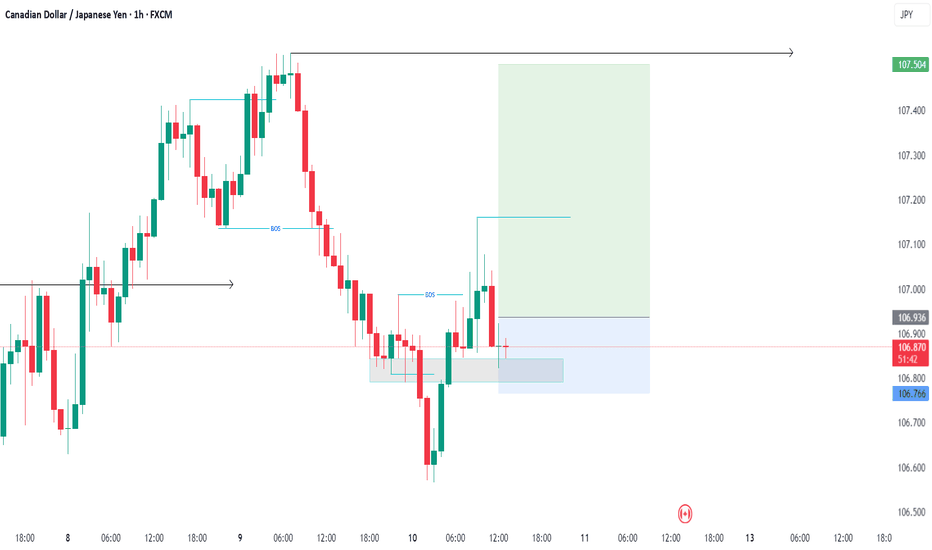

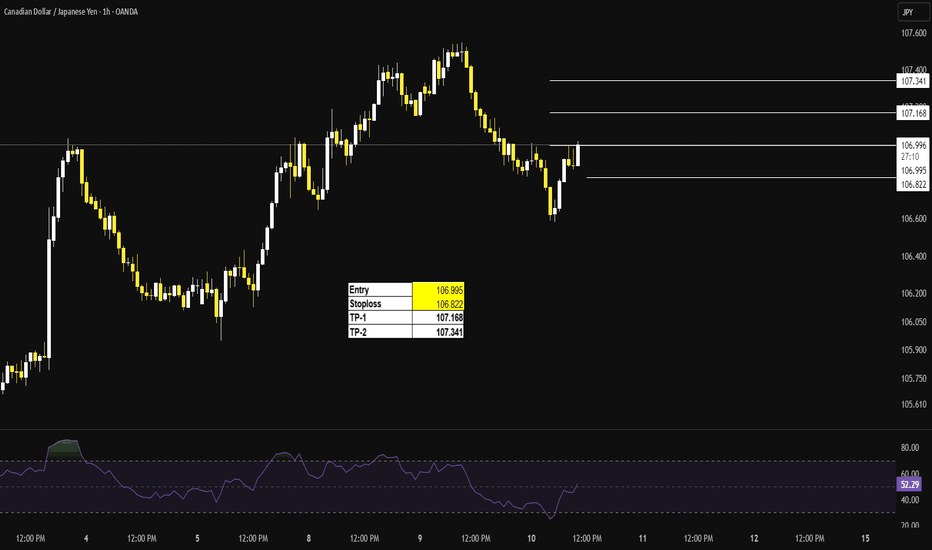

CADJPY Under Pressure! SELL!

My dear subscribers,

CADJPY looks like it will make a good move, and here are the details:

The market is trading on 107.07 pivot level.

Bias - Bearish

My Stop Loss - 107.40

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 106.39

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK