CADJPY trade ideas

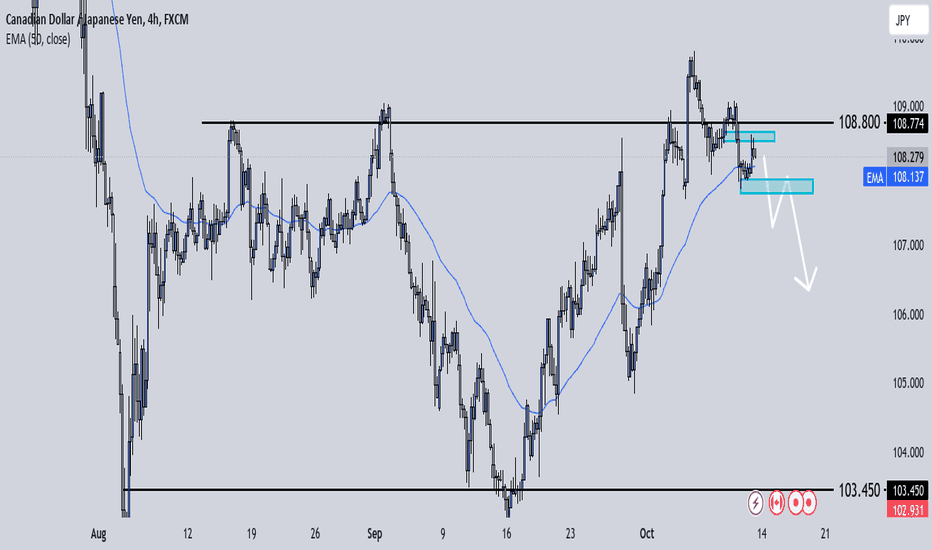

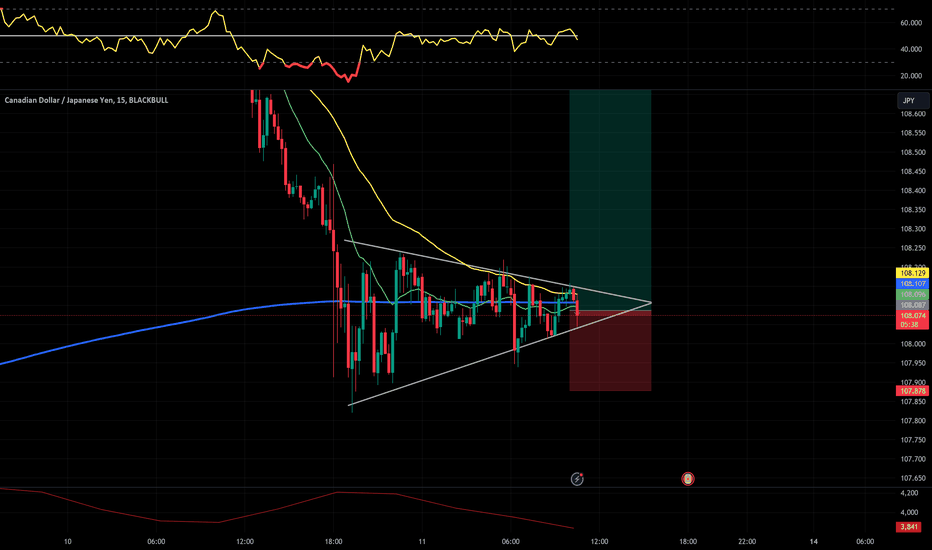

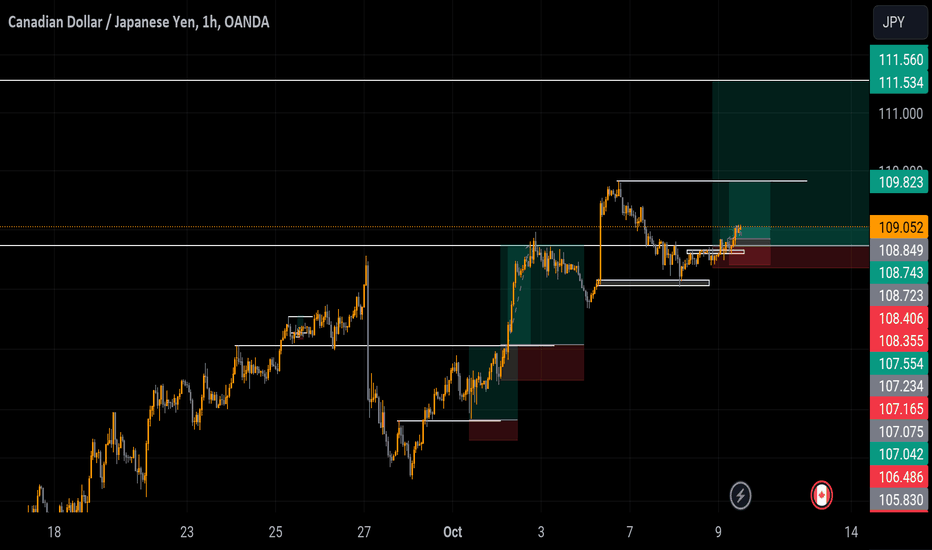

CadJpy Trade IdeaYou know what day it is! Gonna start this Sunday off with possible short set ups for CJ. I was looking for CJ to continue heading to the upside. I ended last week with a break even on CJ. CadJpy is currently back below a daily level of resistance with bearish structures to support our push to the downside. As long as CJ can maintain bearish structures below 108.8 we could definitely short the pair for the rest of the week. The break and retest of the level I have marked is CRUCIAL because it'll be the shift of higher time frames as well. That break and retest would break the last HL on higher time frames. I personally wanna see the shift at that HL being 107.800. From there we'll be clear to the downside.

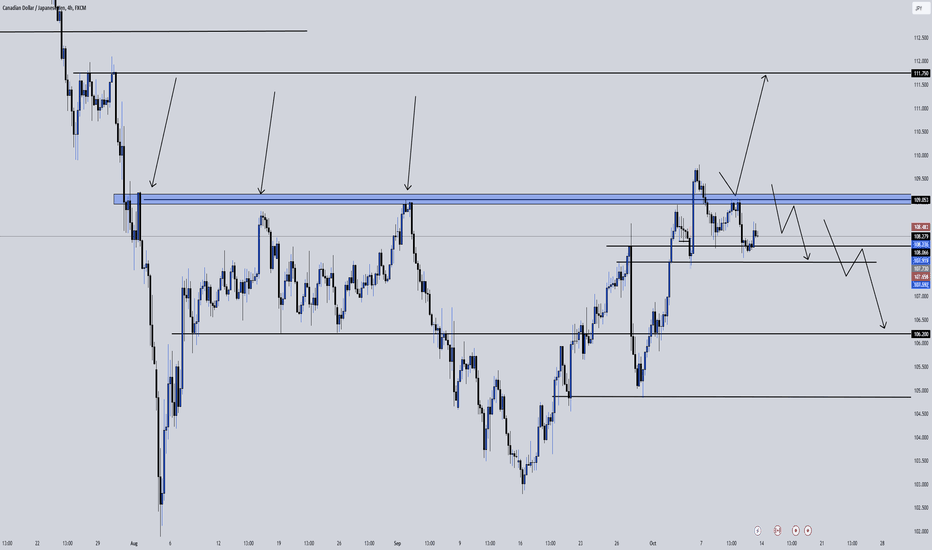

SELL TO BUY IDEADISCLAIMER THE BELOW IS JUST MY VIEW AND THOUGH, TRADE AT YOUR OWN RISK

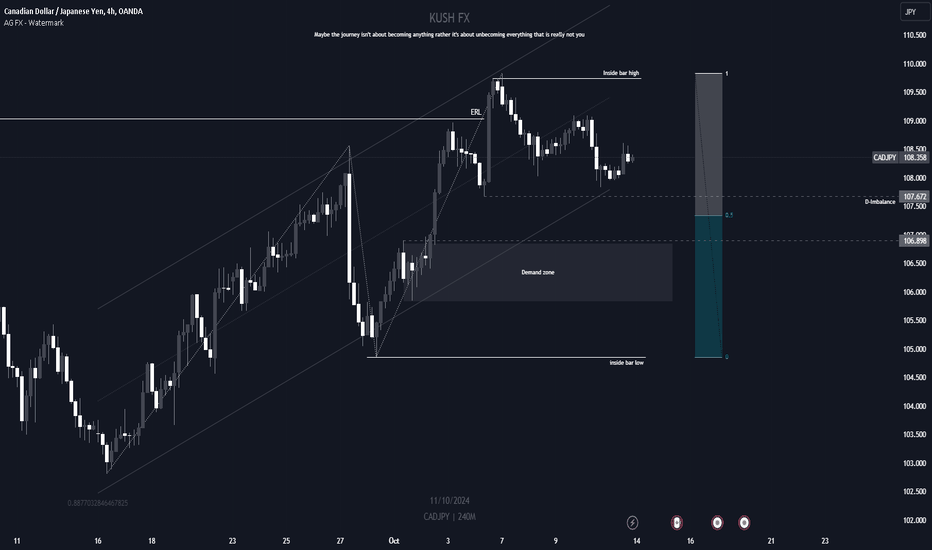

Before i give my view i would like to clarify something first the CADJPY is quite bullish with a Pearson square of +0.8 but it took out a significant high which i would like to clarify as an ERL, hence i am expecting a pullback of the current impulse leg, the price is currently trading at premium hence sellers may dominate until buyers kick in at discount, currently i have two poi's that i believe prices may react at to resume the uptrend.

1. The imbalance at the equilibrium of the range

2. The demand zone below the imbalance

That is my approach and hence my idea sell to buy

CADJPY pt 2Had time for a transparent post which is one of the more important posts you should pay attention to. I was in profit in hopes of price reaching my take profit easily. Price wasn't ready, so it reversed and took me out. I have no feelings about this trade and I would take the same trade every time I see it. Followed my rules and I controlled my risk so I lost exactly how much I wanted. Last month I made 50%+, so far this month I'm down -10%. I am going to still end this month profitable through the power of risk management , discipline, and applying my strategy. This is the mindset you have to have to be a profitable trader. Learn , Create a plan, and stick to that plan.

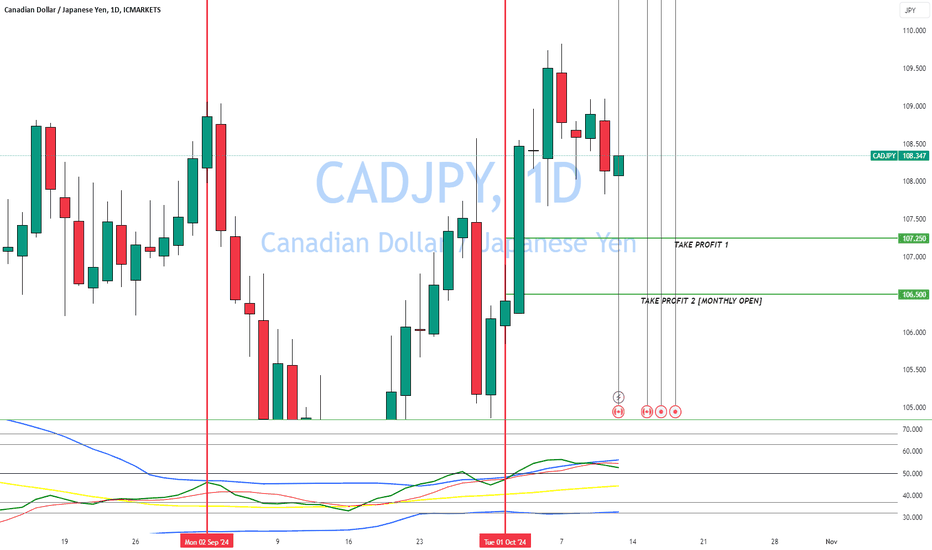

CAD/JPY October Setup: Bearish Divergence Confirmed with TDI

CAD/JPY October Market Structure and Trading Analysis

In the month of October, the CAD/JPY pair is exhibiting a classic open high-low-close structure, indicating a potential sell setup. This bearish outlook has now been confirmed with a TDI (Traders Dynamic Index) cross, signaling the appropriate time to consider sell entries.

Key Technical Highlights:

1. Bearish Divergence: A significant bearish divergence has been present since July 19, 2024, continuing to the current market price. This divergence suggests weakening bullish momentum and a likely shift towards a downward trend.

2. Open High Structure on Daily Timeframe: The daily chart for October reflects an open high structure, which is a strong indication of a bearish trend for the remainder of the month.

3. Overbought Conditions: Following a bullish breakout that began on October 1, 2024, the market had reached overbought levels, creating a favorable scenario for a reversal.

4. Confirmed Bearish TDI Cross: As of October 10, a bearish TDI cross has occurred, confirming the presence of sellers in the market. This cross is a key technical indicator, signaling that sell positions are now supported by market conditions.

**Take Profit Targets:**

- **Take Profit 1:** 107.250

- **Take Profit 2:** 106.500

Trading Recommendations:

Even though we have the confirmation from the TDI cross, it is essential to remain cautious and ensure that valid signals continue to align with the overall market conditions. Always apply risk management strategies to safeguard your capital while trading.

If this analysis has been useful, please feel free to like, comment, and follow for more updates. I’ll be sure to follow back. Best of luck with your trades!

---

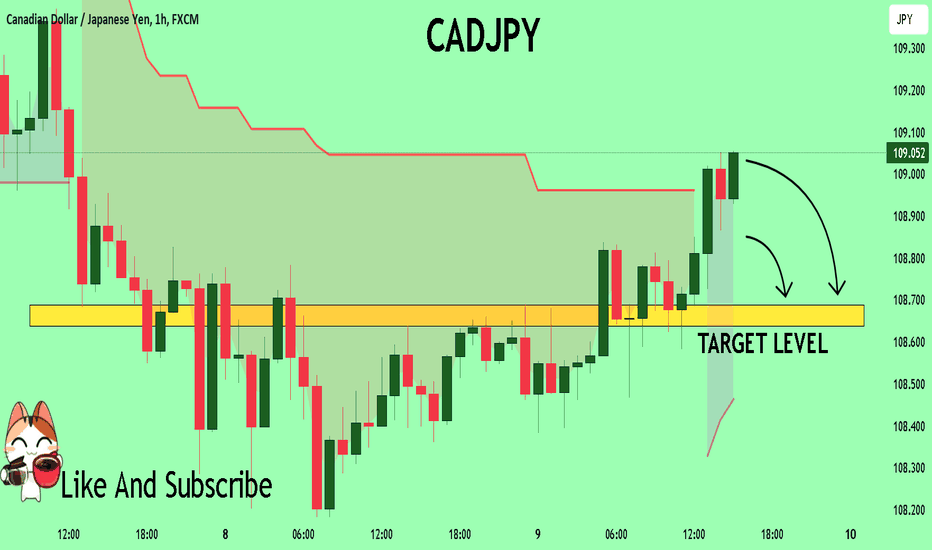

CADJPY Buyers In Panic! SELL!

My dear followers,

I analysed this chart on CADJPY and concluded the following:

The market is trading on 109.01 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 108.68

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

———————————

WISH YOU ALL LUCK

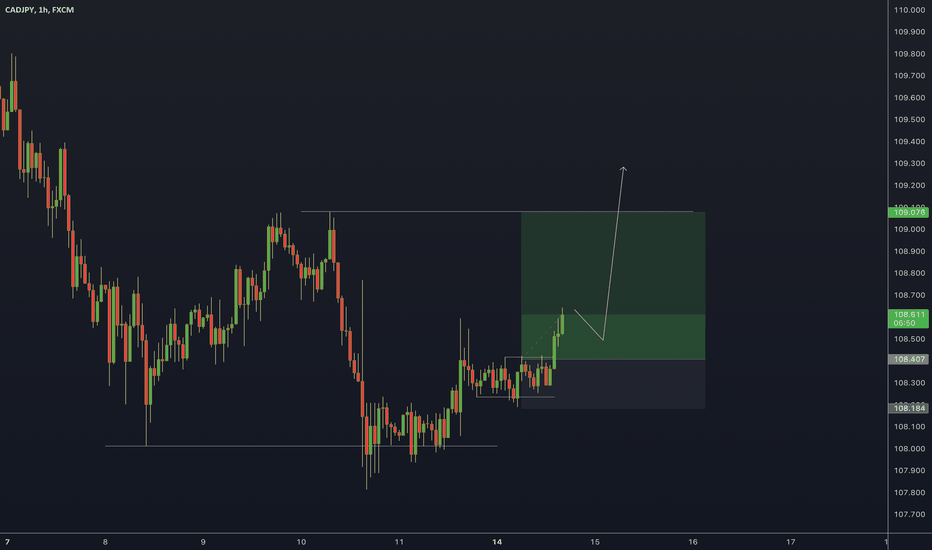

CadJpy Trade IdeaI personally just went long on CJ for a 1:3rr. On OCT 5th I spoke about the pair either respecting the range and crashing back down below 108.140 or continue with bullish structures breaking out the range possibly giving us longs for the week. Price ended up retesting both 108.140 and 108.800 where we than had a break of structure on the 15m confirming longs for me. I have stops just below structure with targets being around the last previous high. If all goes well we could even expect price to tap back into 109.800.

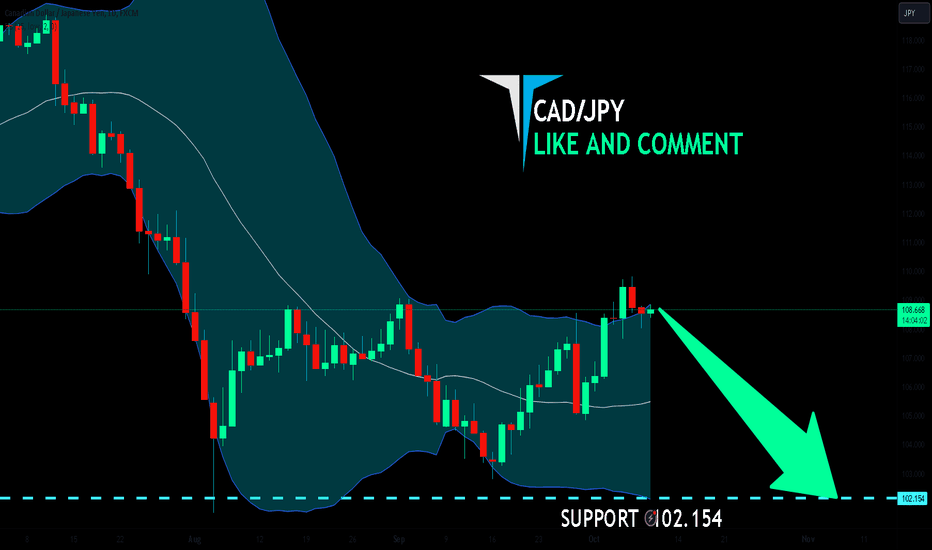

CAD/JPY BEARS ARE STRONG HERE|SHORT

Hello, Friends!

The BB upper band is nearby so CAD-JPY is in the overbought territory. Thus, despite the uptrend on the 1W timeframe I think that we will see a bearish reaction from the resistance line above and a move down towards the target at around 102.154.

✅LIKE AND COMMENT MY IDEAS✅

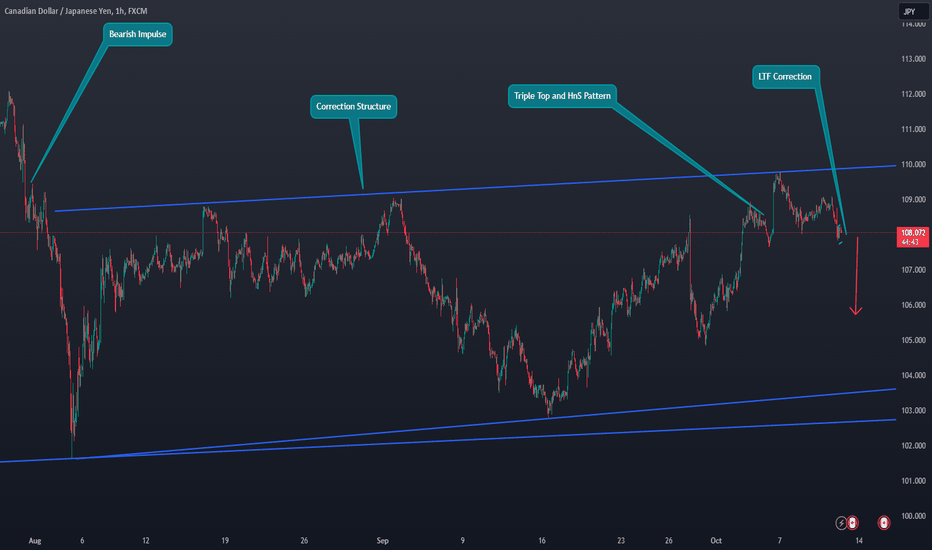

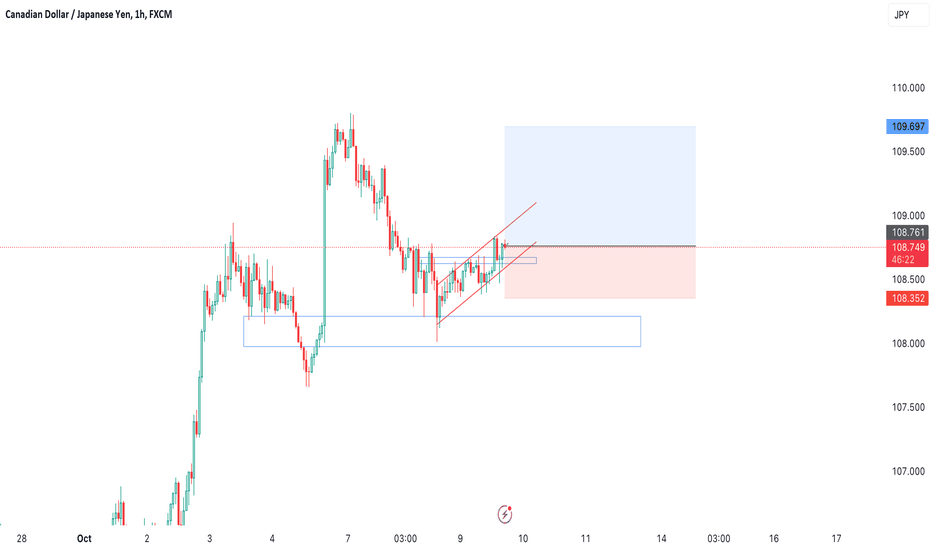

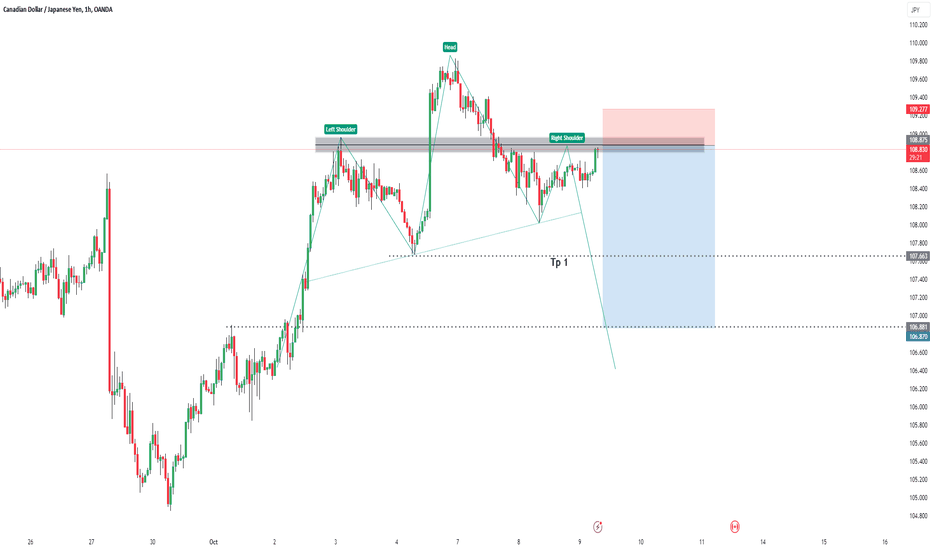

CAD/JPY Trade Setup 1 hour timeframe On the 1 hour timeframe CAD JPY has formed a Head and Shoulders reversal pattern.

The price is currently at the right shoulder which is our entry level, we need to wait for candlesticks confirmation from this level before taking our sell. ⏰

Note: This pattern was formed in a Daily resistance level.

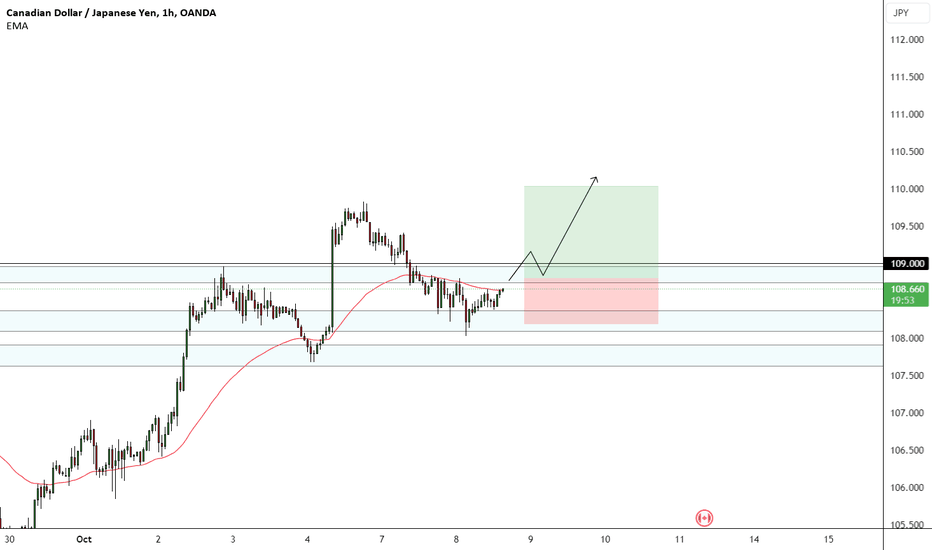

CADJPY - Look for a long !!Hello traders!

‼️ This is my perspective on CADJPY.

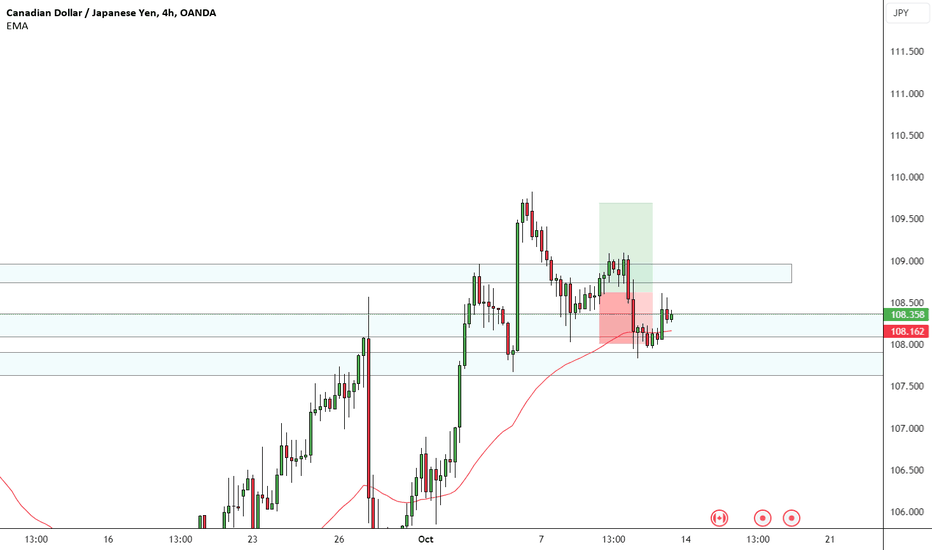

Technical analysis: Here we are in a bullish market structure from 4H timeframe perspective, so I look for a long. My point of interest is price to fill the imbalance lower and then to reject from bullish OB + level 108.000.

Like, comment and subscribe to be in touch with my content!