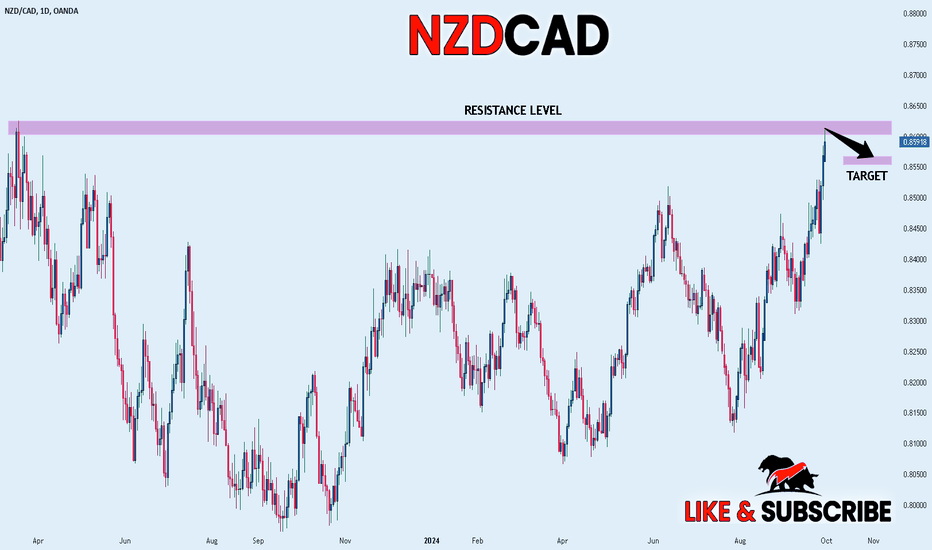

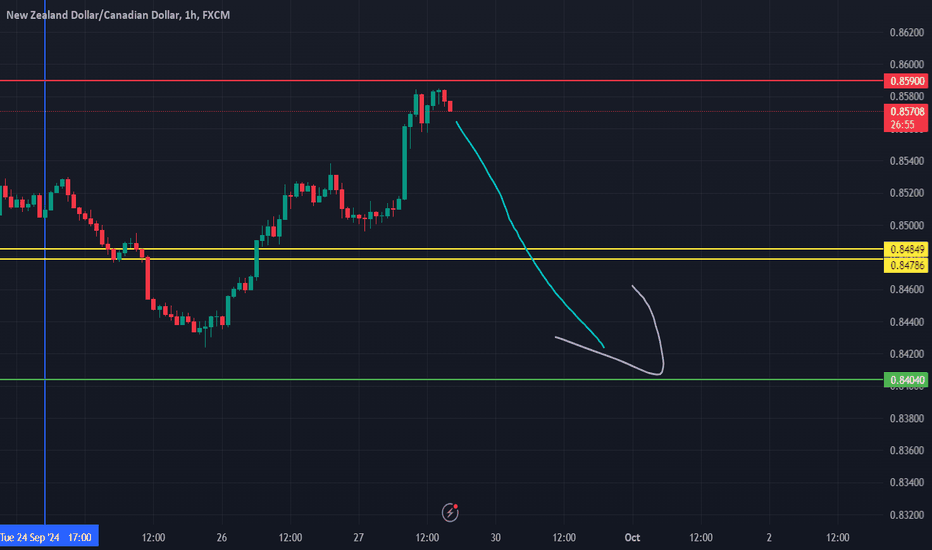

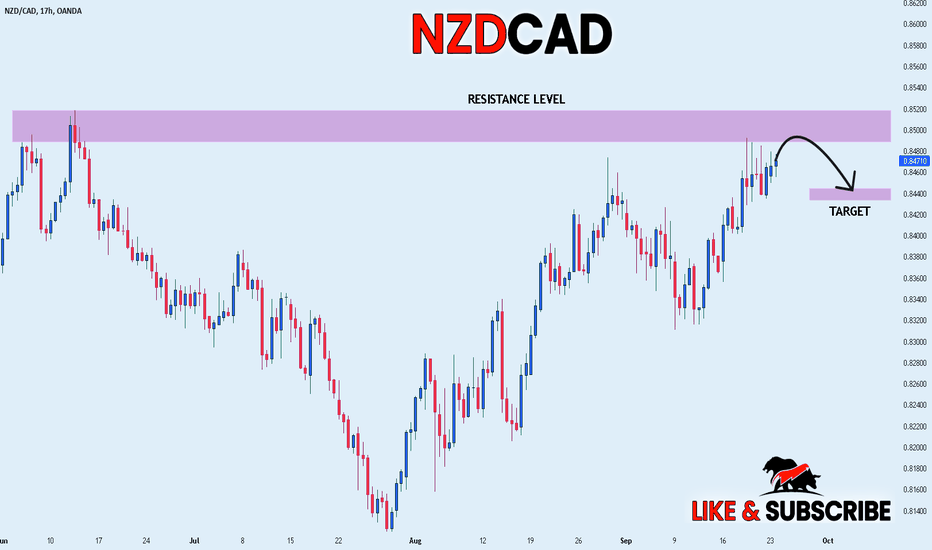

NZD_CAD LOCAL SHORT|

✅NZD_CAD went up just as

I predicted in my previous analysis

But is now approaching a supply level of 0.8624

So according to our strategy

We will be looking for the signs of the reversal in the trend

To jump onto the bearish bandwagon just on time to get the best

Risk reward ratio for us

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

CADNZD trade ideas

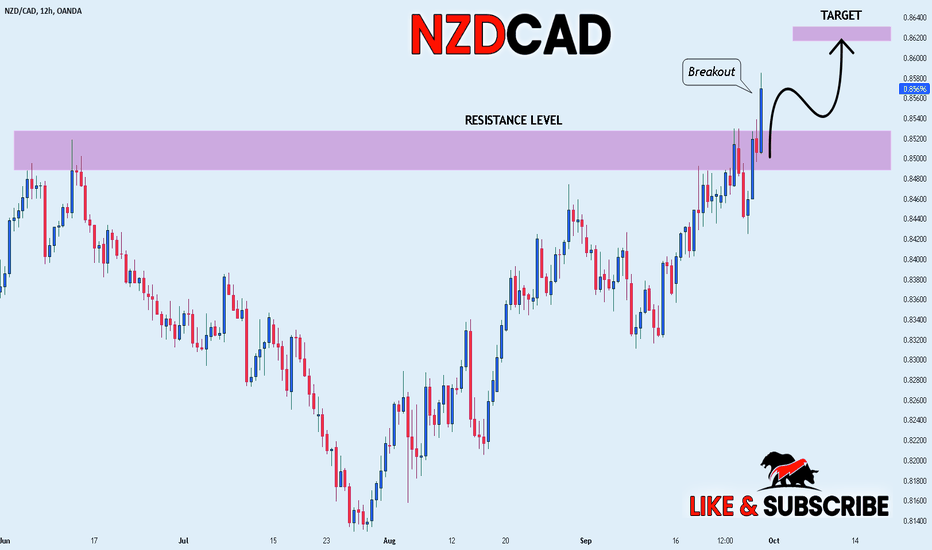

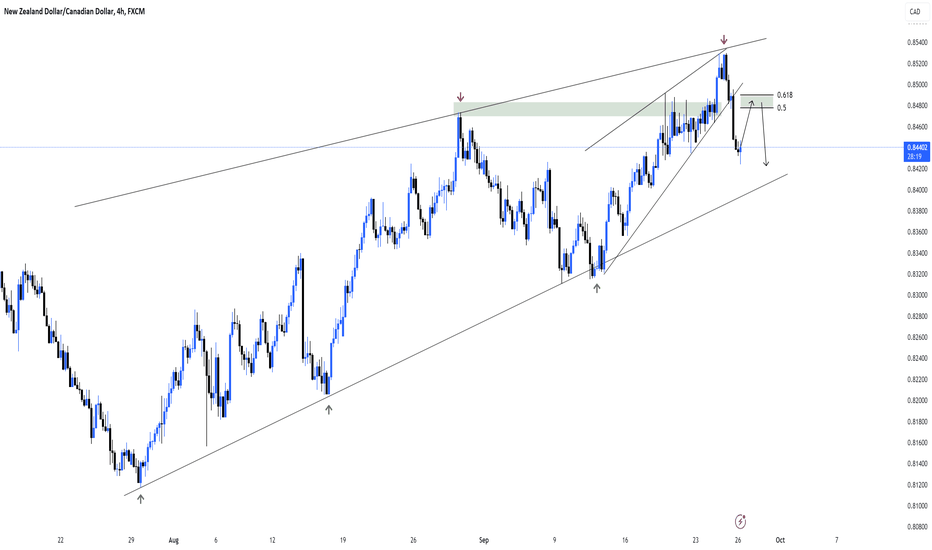

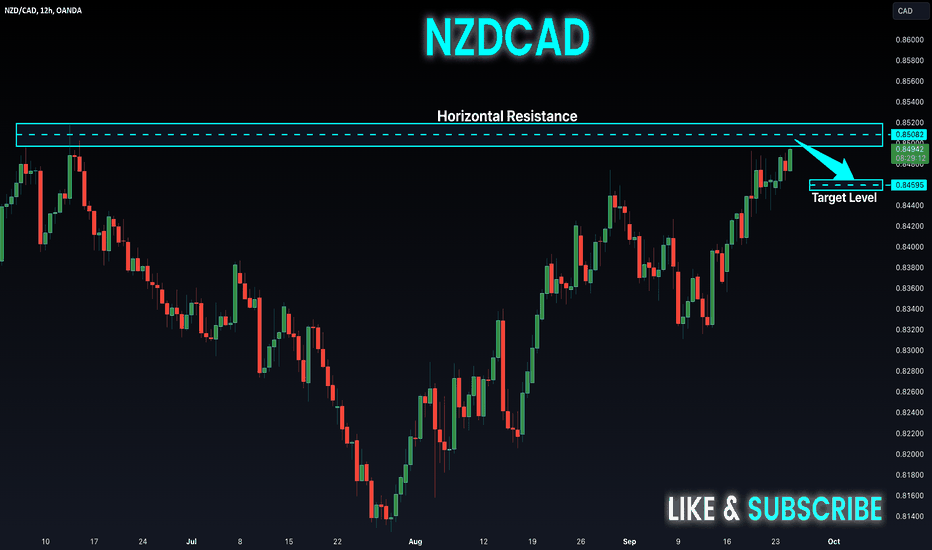

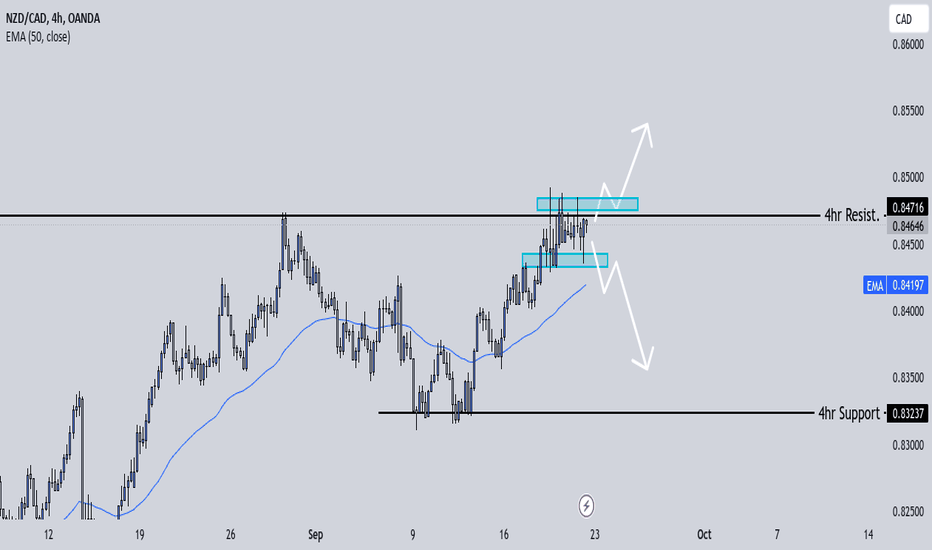

NZD_CAD BULLISH BREAKOUT|LONG|

✅NZD_CAD is trading in an

Uptrend and we are seeing a

Strong bullish breakout of the

Key horizontal level of 0.8520

Which is now a support so

After a potential local pullback

We will be expecting a

Further bullish continuation

LONG🚀

✅Like and subscribe to never miss a new idea!✅

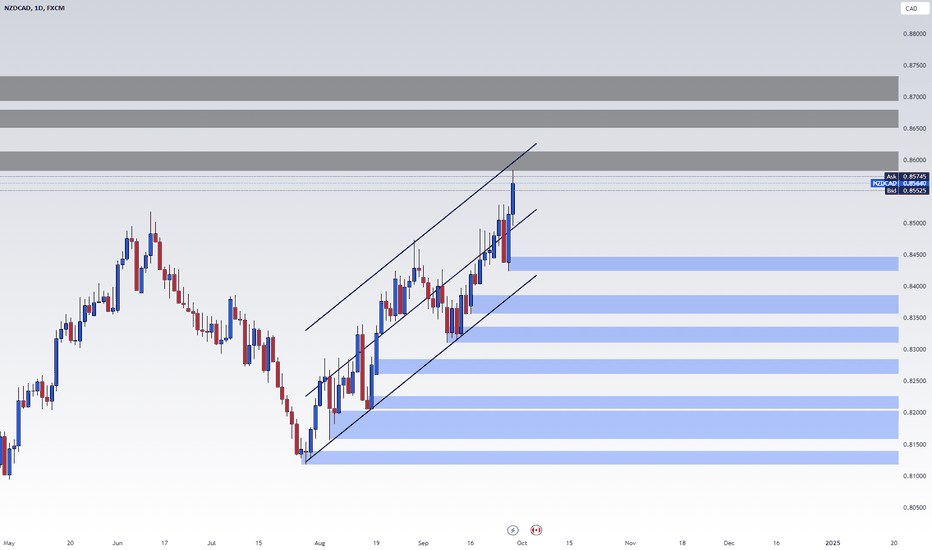

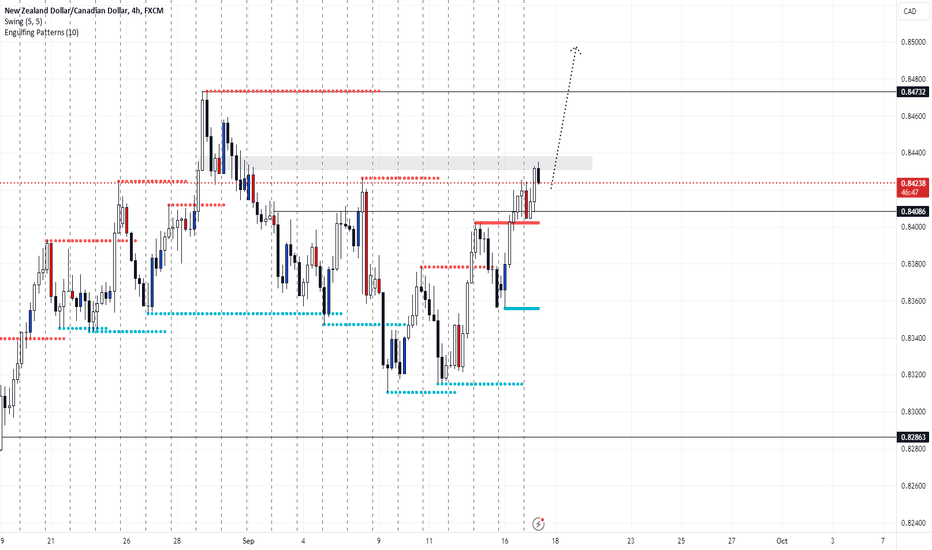

Ncad more upside to come,it seems :)Hello fellow traders , my regular and new friends!

Welcome and thanks for dropping by my post.

Should be getting to see more upside

Do check out my recorded video (in trading ideas) for the week to have more explanation in place.

Do Like and Boost if you have learnt something and enjoyed the content, thank you!

-- Get the right tools and an experienced Guide, you WILL navigate your way out of this "Dangerous Jungle"! --

*********************************************************************

Disclaimers:

The analysis shared through this channel are purely for educational and entertainment purposes only. They are by no means professional advice for individual/s to enter trades for investment or trading purposes.

*********************************************************************

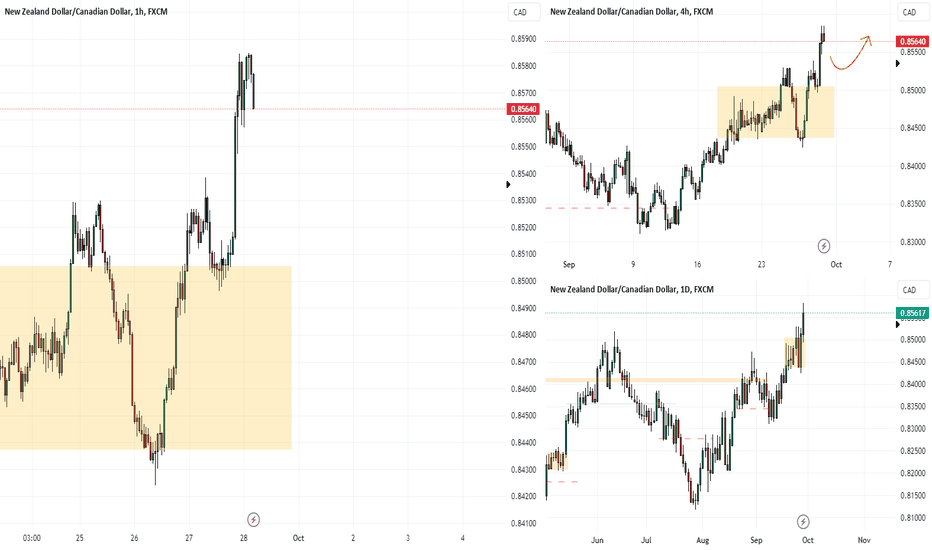

Bullish bounce off 50% Fibonacci support?NZD/CAD is reacting off the pivot and could potentially rise to the 1st resistance which acts as a pullback resistance.

Pivot: 0.8368

1st Support: 0.8368

1st Resistance: 0.8488

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

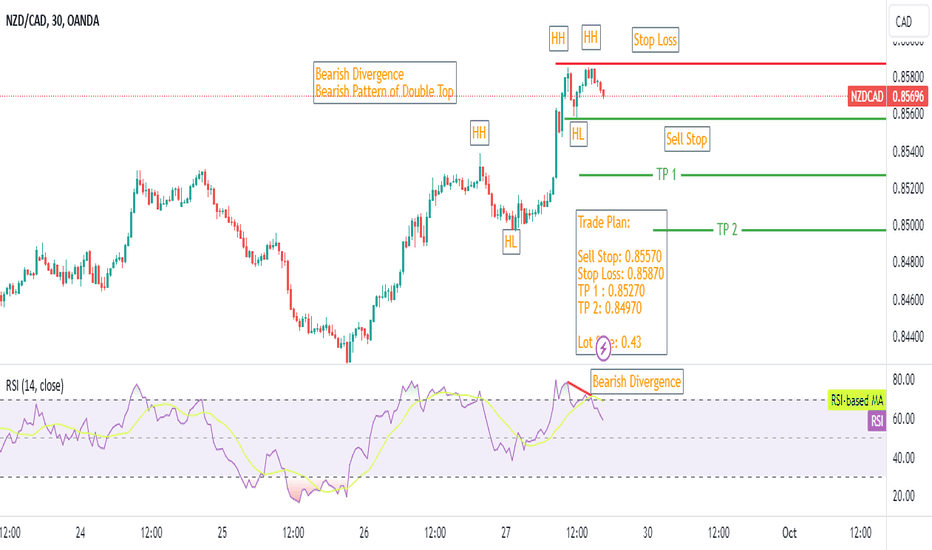

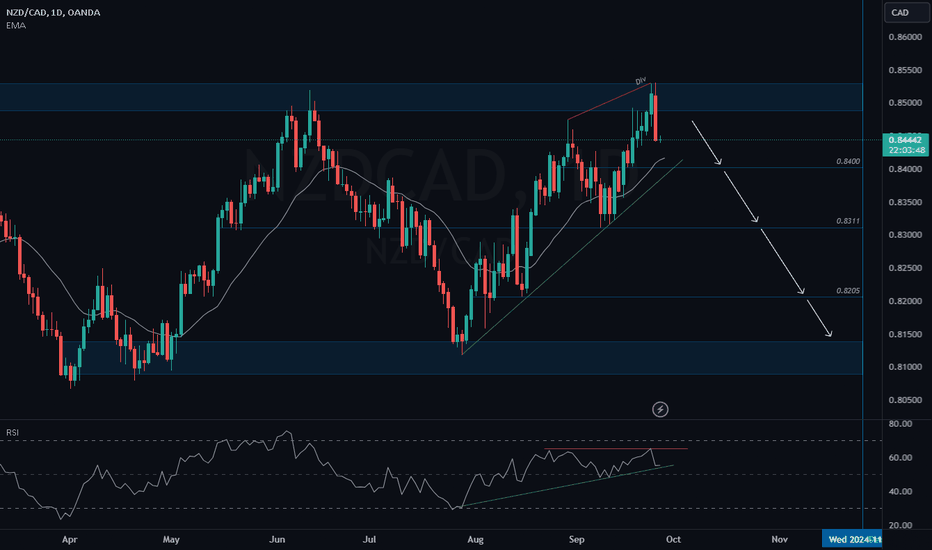

NZD/CAD Sell Trade Idea - Bearish Reversal SetupAnalysis:

NZD/CAD is showing signs of a potential bearish reversal. The price has recently tested a strong resistance zone near 0.8550 and failed to break higher. This rejection, combined with bearish divergence on momentum indicators like RSI , suggests that sellers are regaining control. The formation of a bearish candlestick pattern at resistance reinforces the probability of a downside move.

Reasons for the Trade:

Rejection from a strong resistance level with confirmation from bearish divergence.

The price structure suggests a lower high, pointing towards a continuation of the bearish trend.

Risk Management: Properly set your stop loss and adjust your position size according to your risk tolerance to manage potential drawdowns.

Disclaimer: This is a trade idea, not financial advice. Always conduct your own analysis and consider your risk tolerance before executing any trade.

NZDCAD is in the Bearish direction From Solid ResistanceHello Traders

In This Chart nzdcad HOURLY Forex Forecast By FOREX PLANET

today NZDCAD analysis 👆

🟢This Chart includes_ (NZDCAD market update)

🟢What is The Next Opportunity on NZDCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

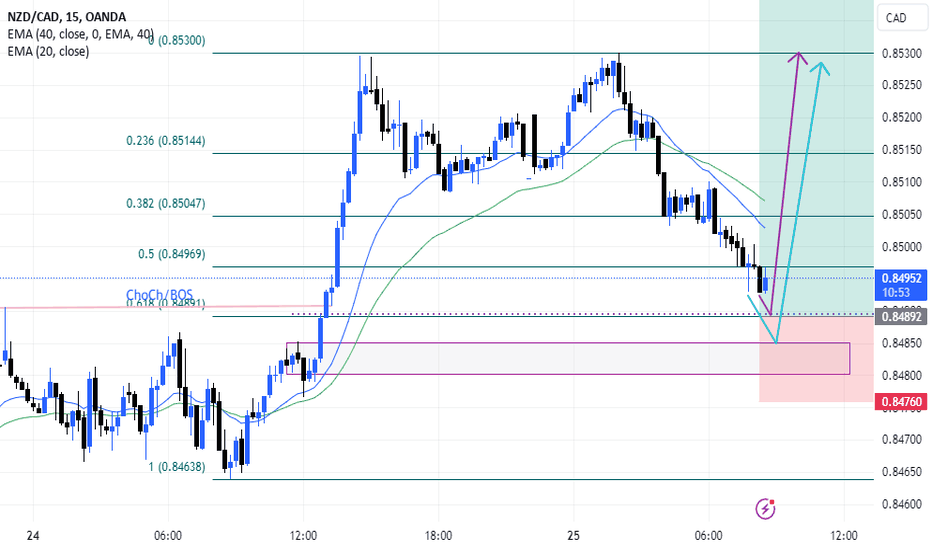

NZDCAD BULLSWeekly created a HH and Daily chart retracing to the demand zone for upward momentum, tested the demand still continuing upward. 4 hour and M15 chart pulling toward the demand zone which is the 61.8% Fibonacci level. Wait for a reversal candlestick purple dotted line in the M1 chart and/or 20EMA cross above 40EMA on the M15 demand zone for buys!

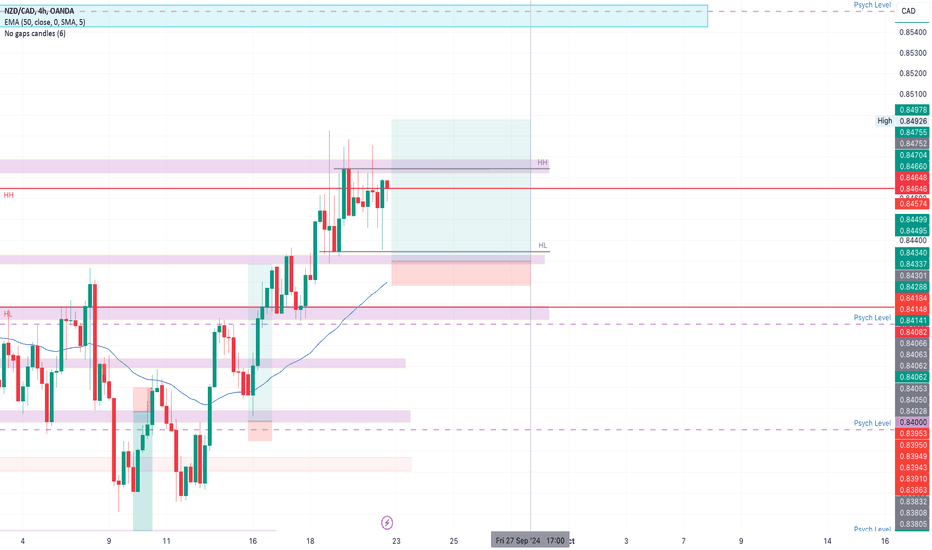

NZDCAD LONGMarket structure Bullish on HTFs 30

Entry at Weekly and Daily AOi

Strong Weekly Engulfing

Strong Weekly Resistance Level broken

Daily Rejection at AOi

Previous Structure point on the Daily

Touching EMA Y

H4 Candlestick rejection

Levels 5.79

Entry 95%

Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King

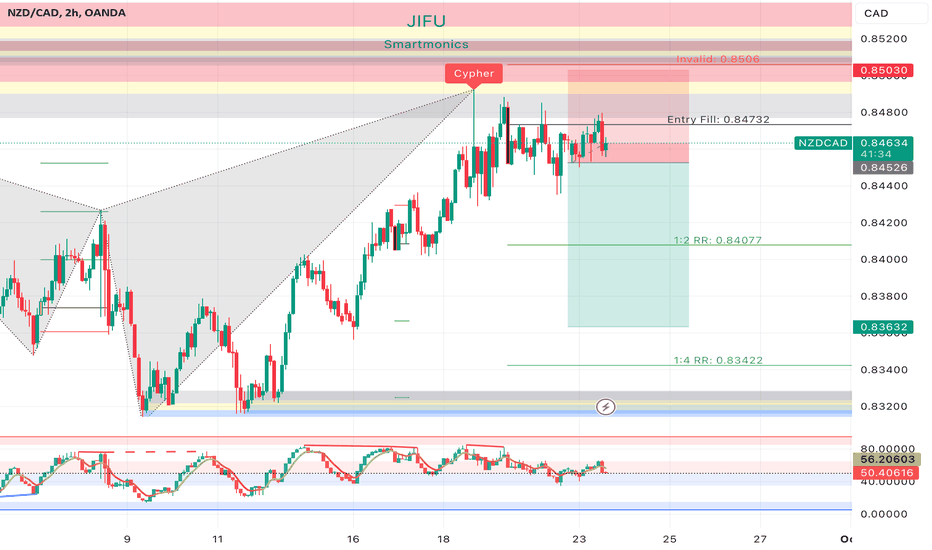

NZDCAD Will Go Lower From Resistance! Short!

Here is our detailed technical review for NZDCAD.

Time Frame: 2h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 0.846.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 0.844 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

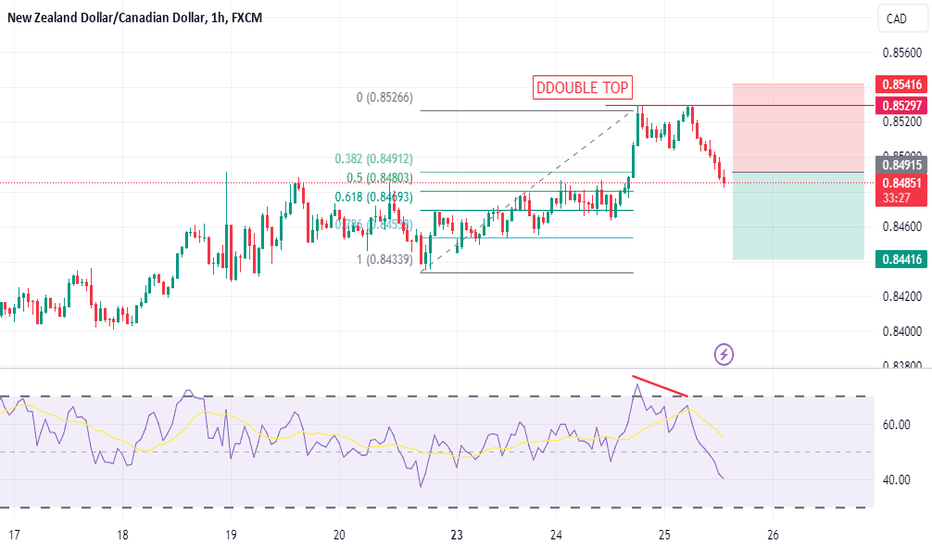

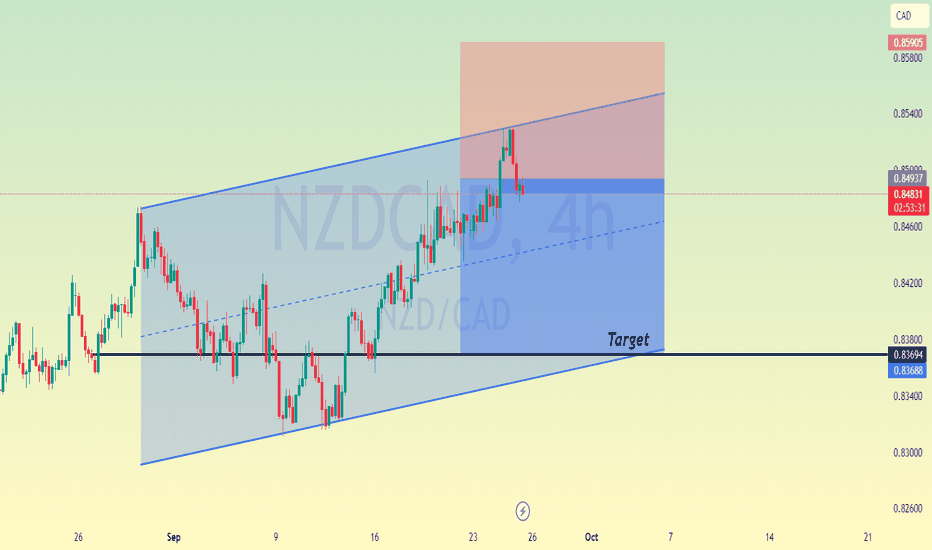

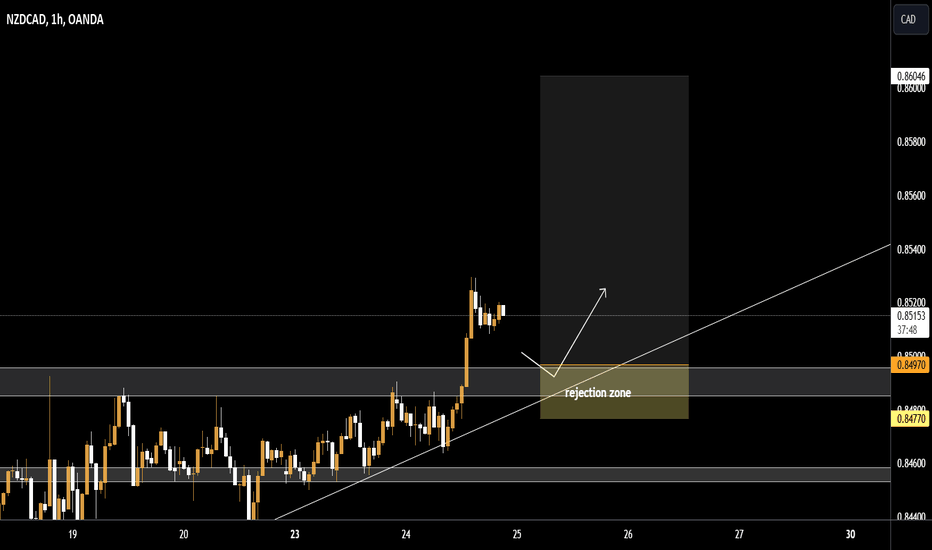

NZD_CAD RESISTANCE AHEAD|SHORT|

✅NZD_CAD is set to retest a

Strong resistance level above at 0.8520

After trading in a local uptrend for some time

Which makes a bearish pullback a likely scenario

With the target being a local support below at 0.8440

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

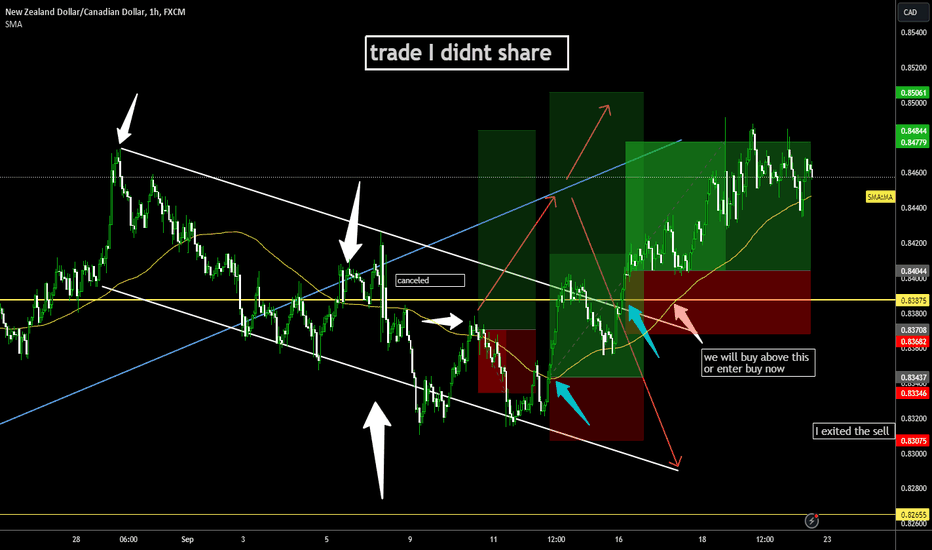

NzdCadNC giving us 2 possible plays that could play out beautifully. Again with patience being our best friend. Price can either break back down below to respect the range we've had going on for some time or we can continue last weeks bullish structures. There's a monthly range between 0.88000 and 0.77300. Once price tapped 0.88000 we went bearish. I was honestly expecting price to continue bearish until we hit that monthly support which is why I'm personally looking for shorts on this set up but we'll see what happens.