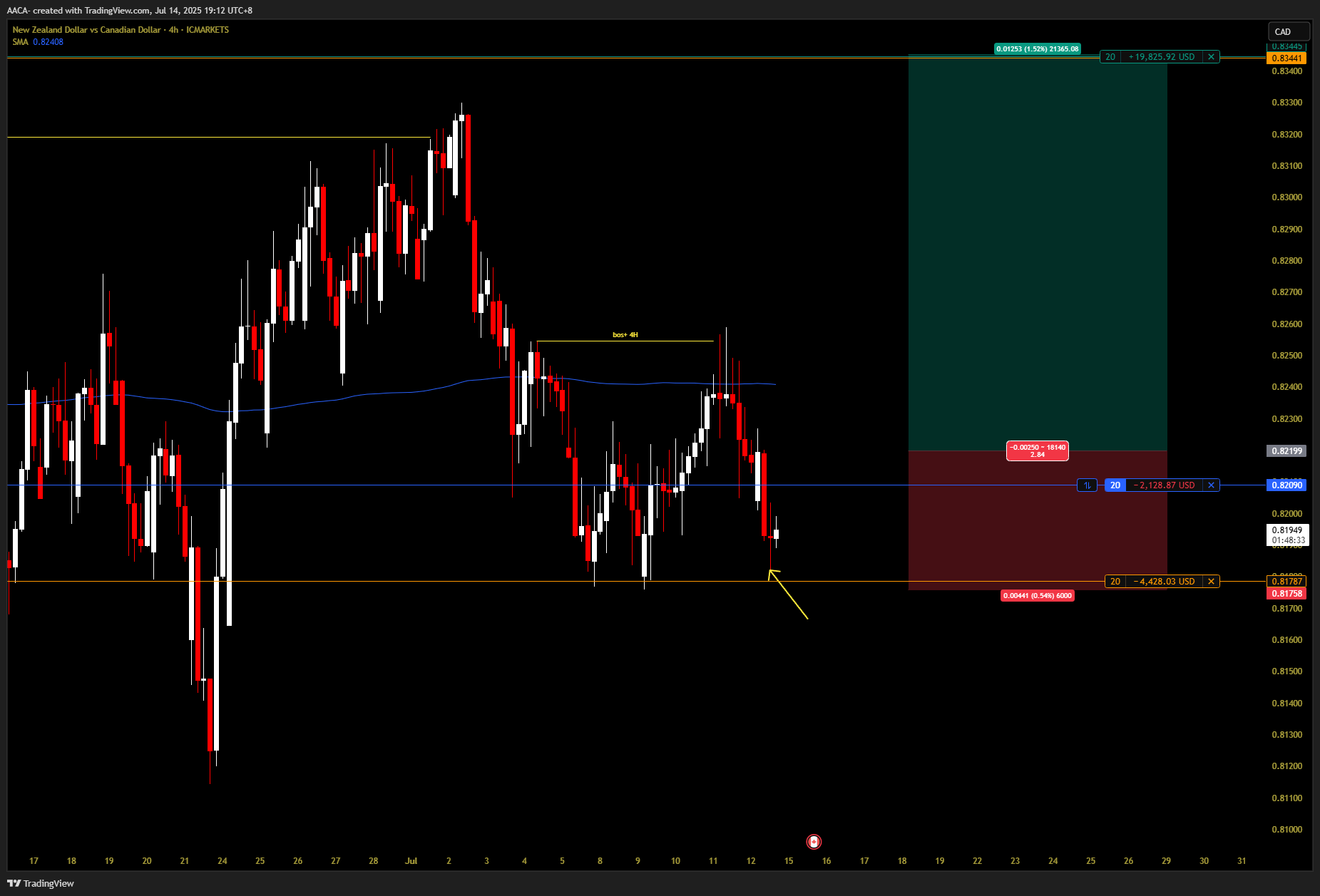

Idea: Sniper Series 3 \ NZDCAD This … This setup is kinda wild; it got me so excited I had to tell myself to calm down. There's a high chance it continues the drop before the weekend.

NZDCAD

NZDCAD

CANADIAN DOLLAR / NEW ZEALAND DOLLAR forum

The "Kiwi vs Loonie" is setting up for a high-risk, high-reward robbery—and we’re locking in the master plan. Long entry is the play, but this ain’t for the weak hands. Overbought? Consolidation? Reversal trap? Perfect. That’s where we strike.

🎯 THE HEIST BLUEPRINT

🔑 ENTRY ZONE (Breakout & Retest Strategy)

"Wait for the 4H candle to CLOSE ABOVE 0.82600 (MA Breakout + Retest)."

Option 1: Place a BUY STOP above the MA (momentum confirmation).

Option 2: BUY LIMIT near recent swing lows (15M/30M precision).

🚨 Set an ALERT! Don’t miss the breakout—timing is everything.

🛑 STOP LOSS (Escape Route)

SL at 0.82000 (near swing low wick on 4H).

⚠️ Golden Rule: NO ORDERS BEFORE BREAKOUT! Wait for confirmation.

Adjust SL based on your risk, lot size, and multi-order strategy.

🎯 TARGETS (Profit Escape Plan)

Take Profit 1: 0.83300 (First resistance).

Or… Exit Early if the market turns shaky.

Scalpers: Long-only scalp plays! Use trailing SL to lock in gains.

Doji candle formed at the support. Bullish reversal sign.

COT data suggests institutions are buying NZD less than CAD by the COT Friday release.

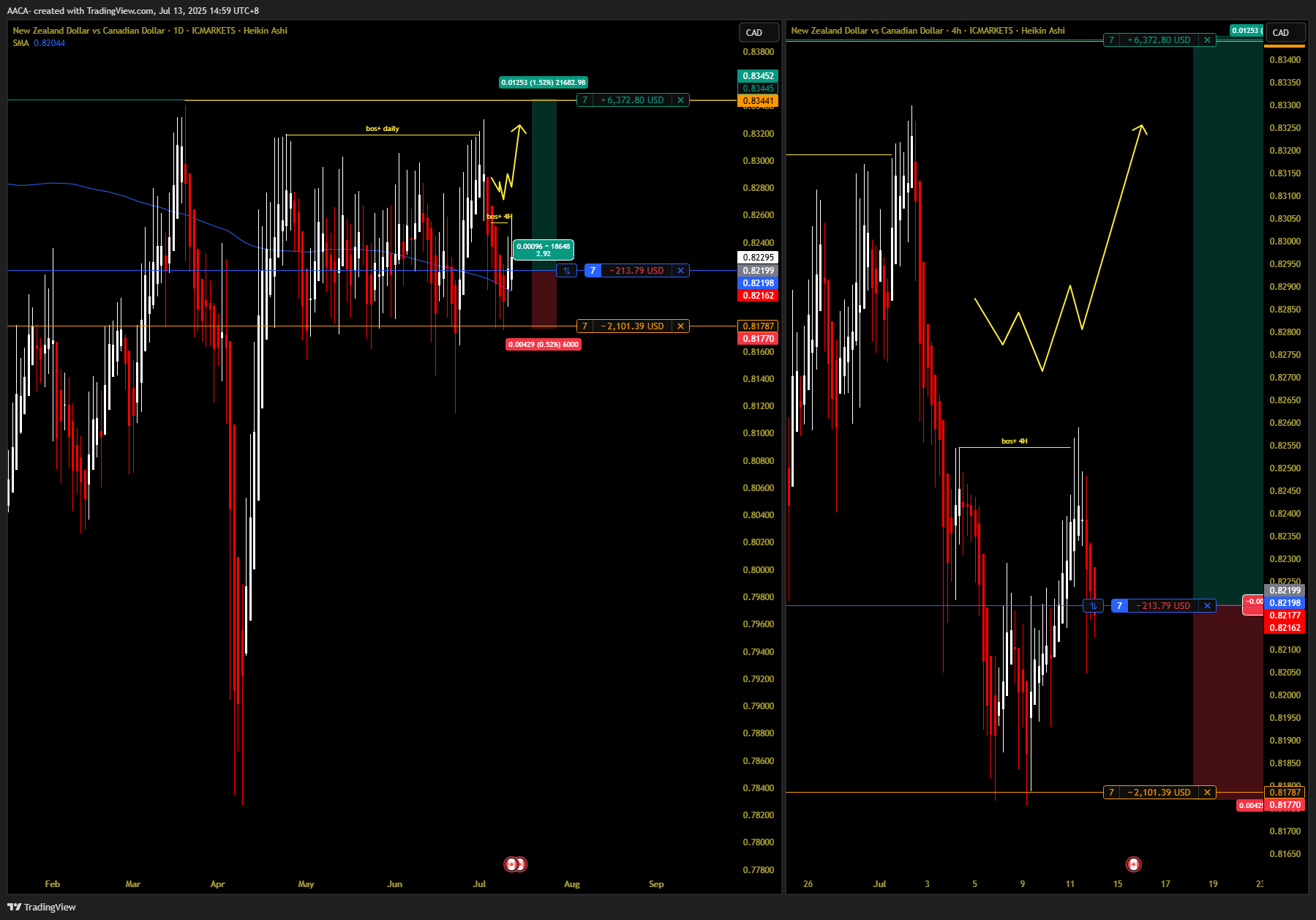

Marked on the daily chart, a bullish break of structure.

If we look at 4H timeframe, an internal bullish structure happened last Friday. This can be a signal that the Daily correction/pullback is done.

An internal bullish shift of structure is a confirmation that price may now continue its DAILY bullish move targeting the highs at 0.83441

Based on Thief Trading tactics (technical + fundamental analysis), we’re plotting a bullish heist on NZD/CAD ("Kiwi vs Loonie"). The vault is open—time to swipe the loot!

📈 Entry (Long Only):

Buy Limit Orders preferred (15-30min TF for pullbacks).

Aggressive? Enter anytime—just stick to the strategy!

🛑 Stop Loss (Protect Your Loot!):

Nearest swing low (4H TF) → 0.81500 (adjust based on risk & lot size).

Scalpers? Use trailing SL to lock profits!

🎯 Take Profit (Escape Before Cops Arrive!):

Primary Target: 0.83800 (or exit earlier if momentum fades).

0.827 has become a confluence of support and trendline. The pair is looking for more buying momentum at the support zone.

2 zones to watch are 0.827 and 0.823

If the 0.823 zone is broken, the uptrend is broken and the market turns to a downtrend. The target of the downtrend and the market finds the bottom of last month around 0.812.

Confirm SELL signal when breaking 0.823

Based on Thief Trading tactics (technical + fundamental analysis), we’re plotting a bullish heist on NZD/CAD ("Kiwi vs Loonie"). The vault is open—time to swipe the loot!

📈 Entry (Long Only):

Buy Limit Orders preferred (15-30min TF for pullbacks).

Aggressive? Enter anytime—just stick to the strategy!

🛑 Stop Loss (Protect Your Loot!):

Nearest swing low (4H TF) → 0.81500 (adjust based on risk & lot size).

Scalpers? Use trailing SL to lock profits!

🎯 Take Profit (Escape Before Cops Arrive!):

Primary Target: 0.83800 (or exit earlier if momentum fades).