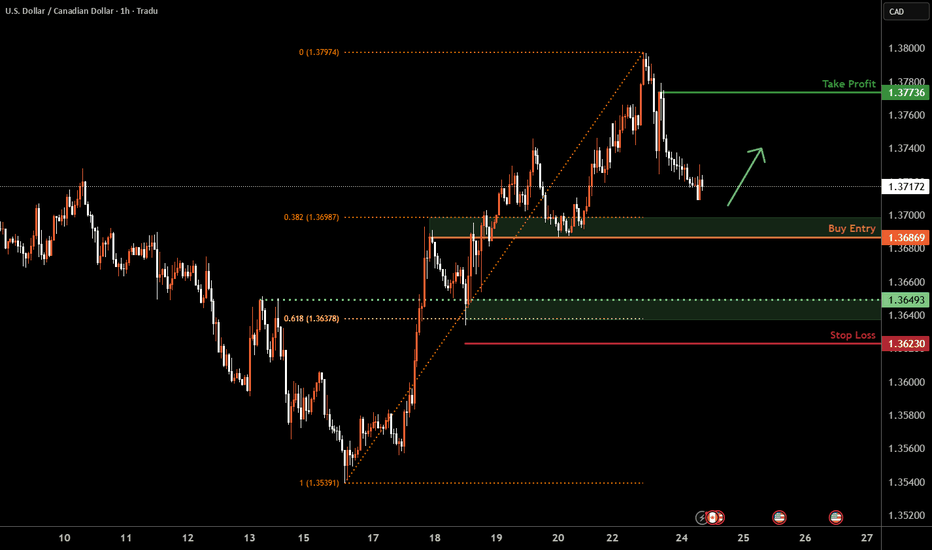

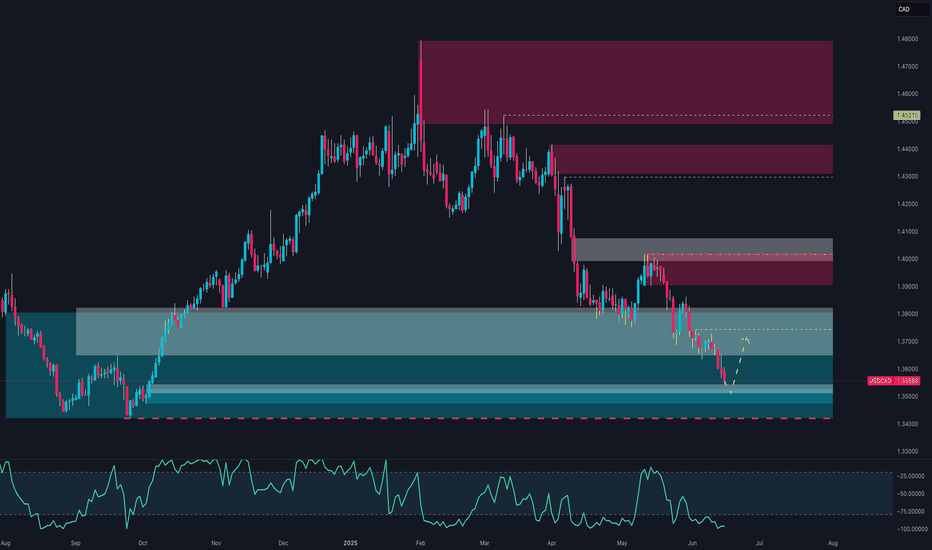

USD/CAD H1 | Overlap support at 38.2% Fibonacci retracementUSD/CAD is falling towards an overlap support and could potentially bounce off this level to climb higher.

Buy entry is at 1.3686 which is an overlap support that aligns closely with the 38.2% Fibonacci retracement.

Stop loss is at 1.3623 which is a level that lies underneath an overlap support and the 61.8% Fibonacci retracement.

Take profit is at 1.3773 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

CADUSD trade ideas

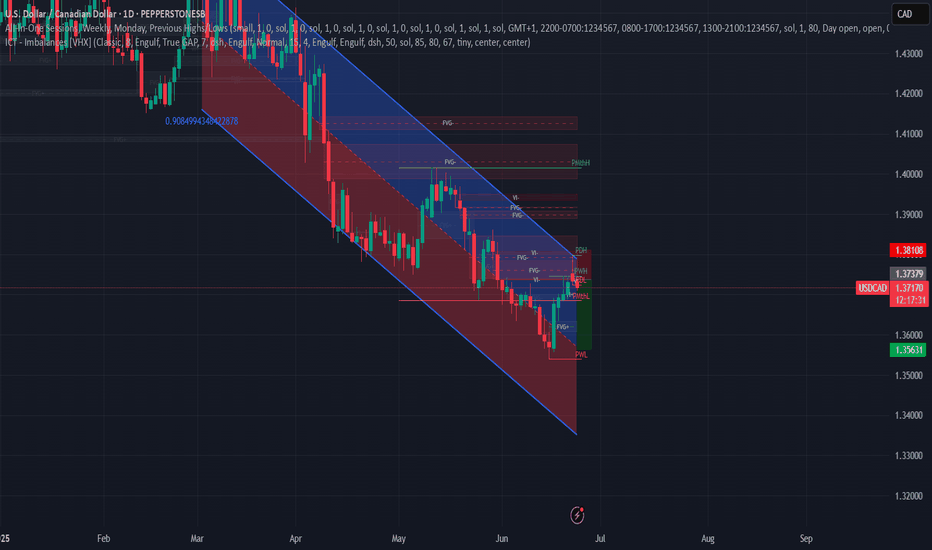

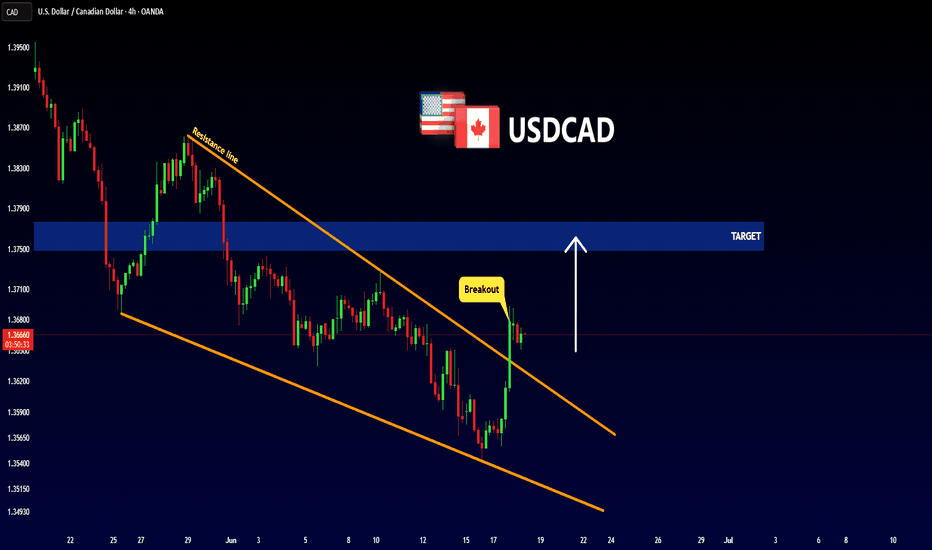

USDCAD - Long triggered We have entered into the discount area of the most recent swing point on USDCAD. With doing this we have taken out all the areas of liquidity within the trading range so it was time to look for potential long moves.

Now at current price we have had a great example of AMD where by we

Accumulate

Manipulate

and then the hope is that we begin to distribute higher.

There was also a nice fair value gap that was left behind on the 5min

So all that was left to do was execute.

Let us see how it plays out.

Win or lose great entry super happy with the trade. Lets see how it goes

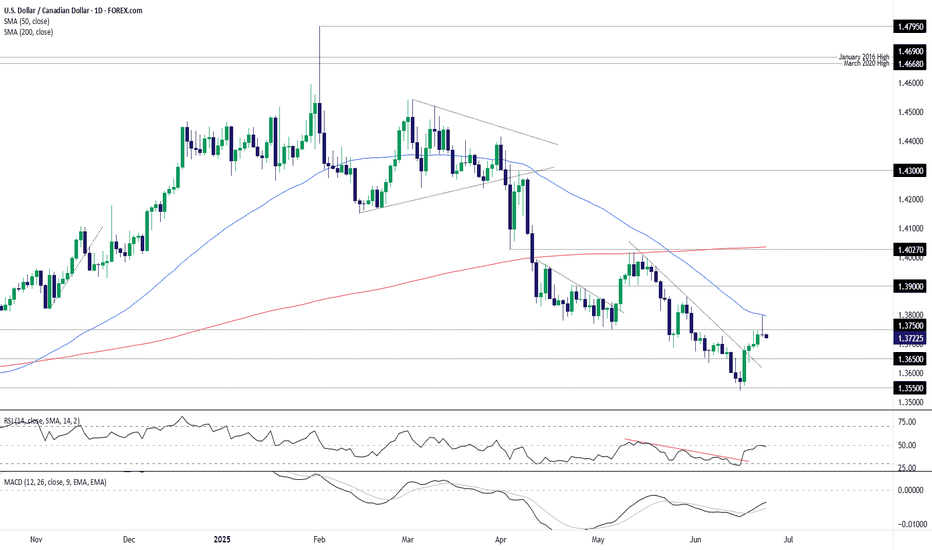

USD/CAD: Failed Break Leaves Bears in ControlWhether it’s Monday’s bearish pin candle, the rejection at the 50-day moving average, or what increasingly looks like an evening star pattern forming, directional risks for USD/CAD look to be skewing lower following the false break of 1.3750.

Those looking to position for renewed weakness could initiate shorts beneath 1.3750, with a stop above the level to guard against a reversal. 1.3650 and 1.3550 both stand as prospective targets, depending on the risk-reward profile you're seeking.

While momentum indicators are off their lows, with RSI (14) rolling over beneath 50 and MACD still in negative territory, the overall picture continues to favour downside over upside.

For those considering the setup, be aware Canadian inflation data will be released later Tuesday, with the key core rate (the average of the median and trimmed mean reads) expected to ease marginally to an annual clip of 3%. While offshore factors remain the dominant driver of USD/CAD moves, a stronger-than-expected result would likely benefit the trade.

Good luck!

DS

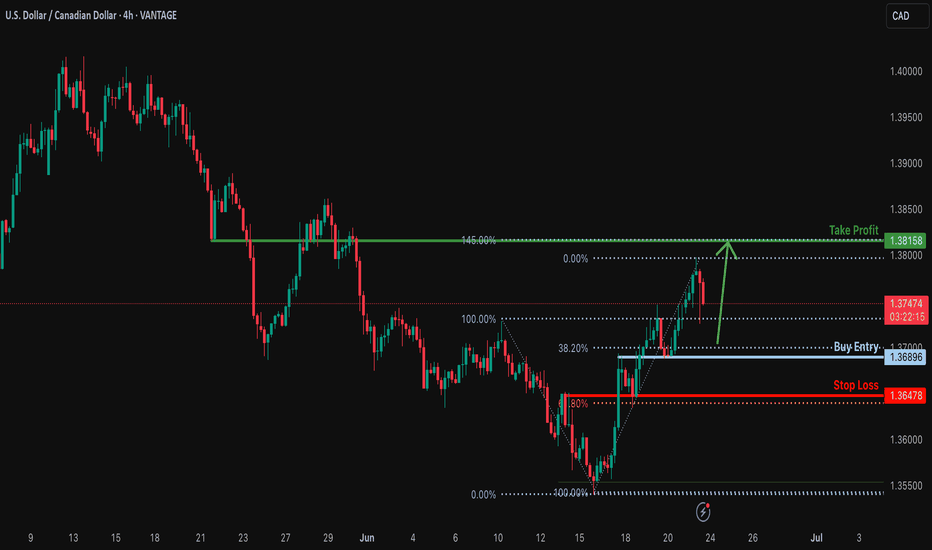

Bullish bounce off overlap support?USD/CAD is falling towards the support level which is an overlap support that lines up with the 38.2% Fibonacci retracement an could bounce from this level to our take profit.

Entry: 1.3689

Why we like it:

There is an overlap support level that lines up with the 38.2% Fibonacci retracement.

Stop loss: 1.3647

Why we like it:

There is an overlap support level that lines up with the 61.8% Fibonacci retracement.

Take profit: 1.3815

Why we like it:

There is a pullback resistance level that aligns with the 145% Fibonacci extension.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

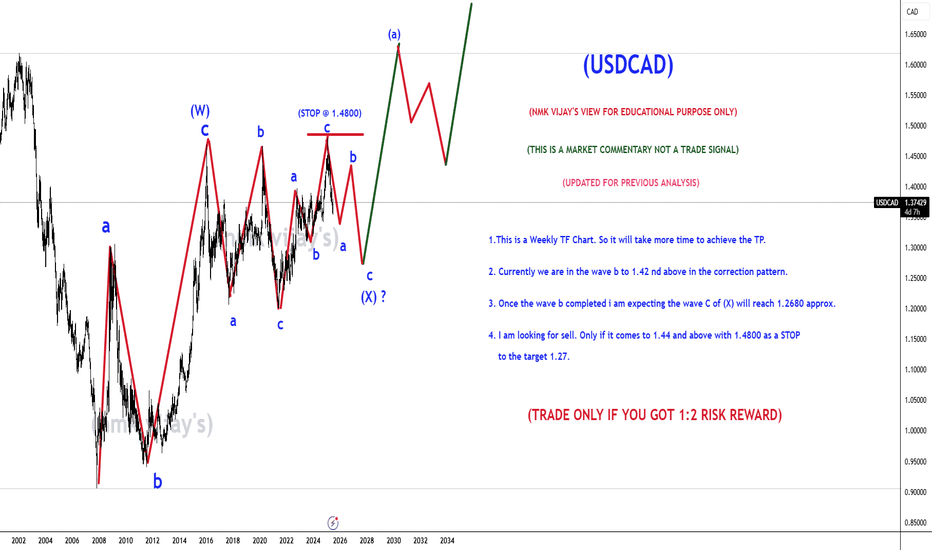

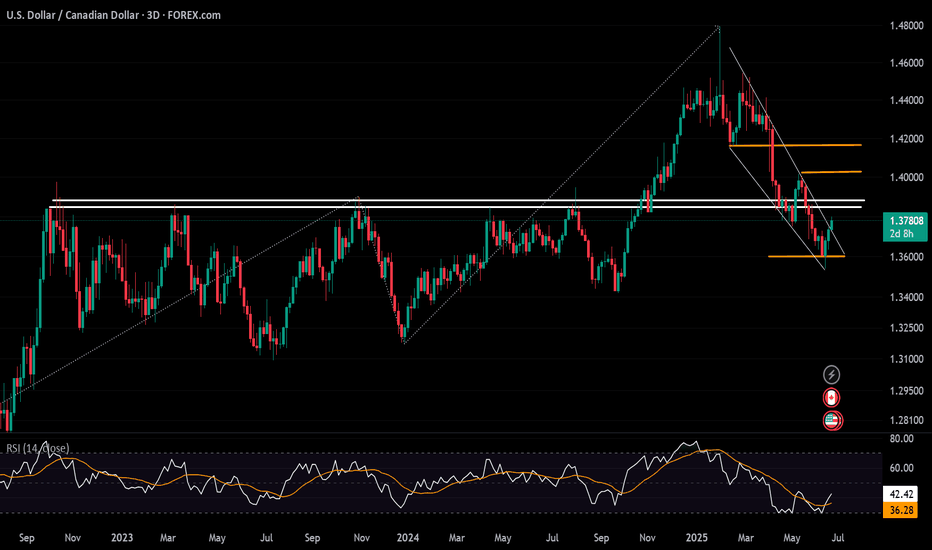

USDCAD-Expecting a PB to 1.42 and then HUGE FALL !!!DISCLAIMER : All labelling and wave counts done by me by manually and i will keep change according to the LIVE MARKET PRICE ACTION. So don't bias, hope on my trade plans...try to learn and make your own strategy...Following is not that much easy...I AM NOT RESPONSIBLE FOR ANY LOSSES IF U TOOK THE TRADE ACCORDING TO MY TRADE PLANS....THANKS LOT..CHEERS

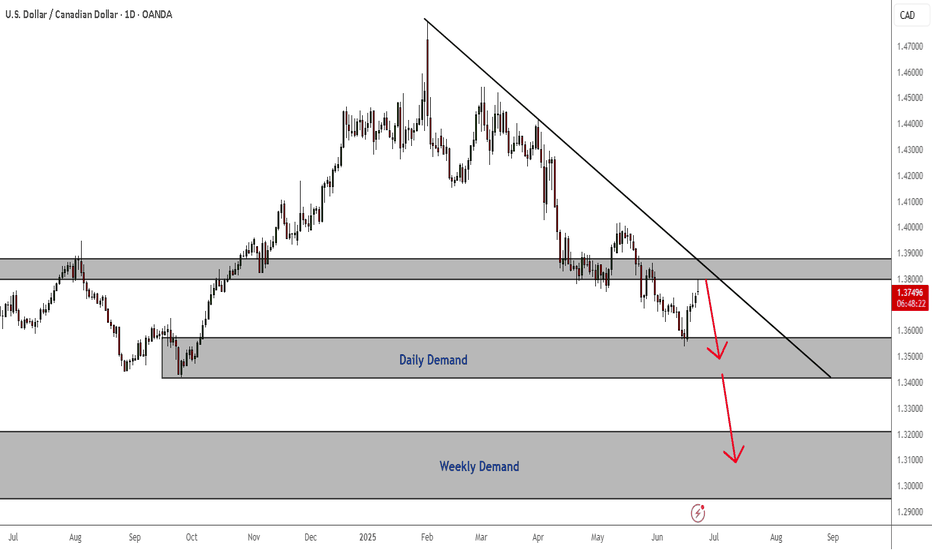

USDCAD Eyes Oct 2022 Resistance Once AgainFollowing the U.S.–Iran strike over the weekend, the U.S. dollar strengthened, posting solid rebounds across major dollar pairs. The USD/CAD chart, in particular, climbed back toward the 1.38 level.

The pair is now eyeing a key resistance zone between 1.3840 and 1.3880, a range that has consistently held since October 2022. A decisive break and hold above this zone could pave the way for a continued rally toward the 1.40 mark.

Conversely, a drop back below 1.3600 could signal renewed downside risk for 2025, in line with the broader bearish trend that has defined the year so far.

— Razan Hilal, CMT

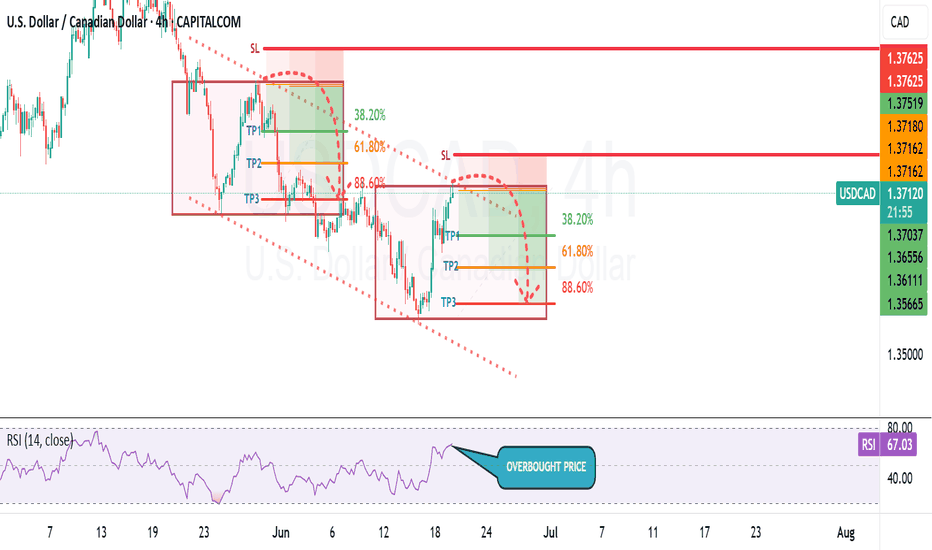

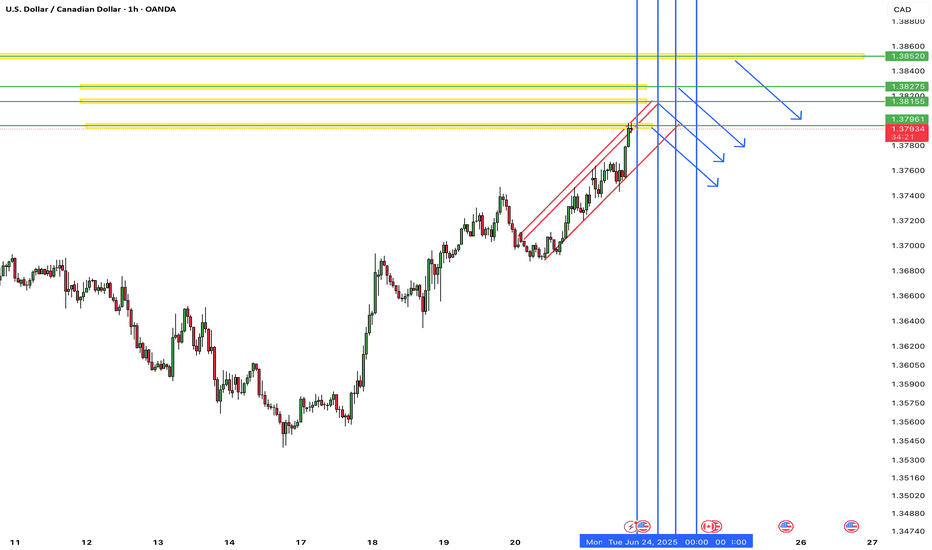

USD/CAD — Rising Wedge Reversal Loading…

A steep rising wedge has formed — a classic bearish pattern often signaling exhaustion.

Price is testing strong yellow resistance zones between 1.3795 – 1.3855.

Entry Dates:

📅 June 23 & 24 — ideal windows to catch a possible reversal.

📉 Bearish Targets:

→ 1.3750

→ 1.3700

→ 1.3640

→ More downside if momentum kicks in.

🧠 This setup screams “overbought squeeze → sharp drop”. Big players might be waiting to short the rip.

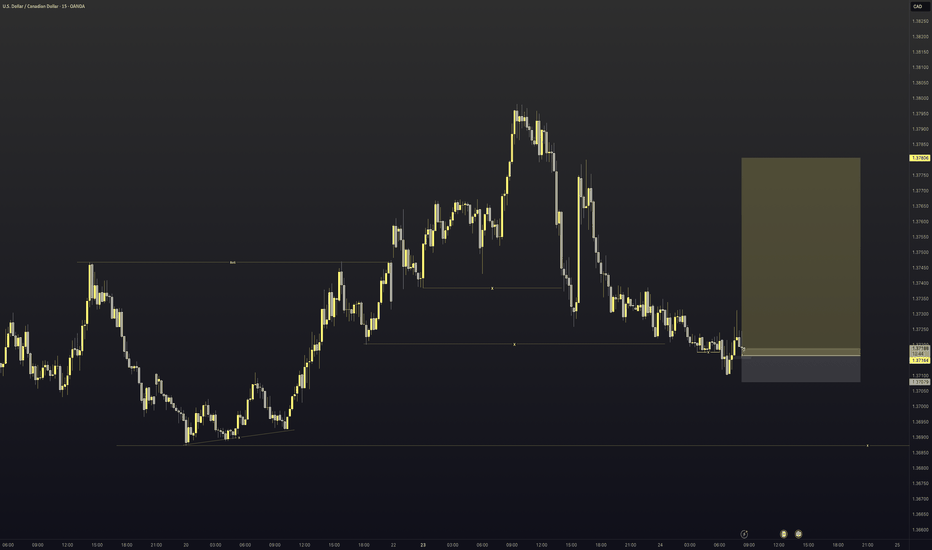

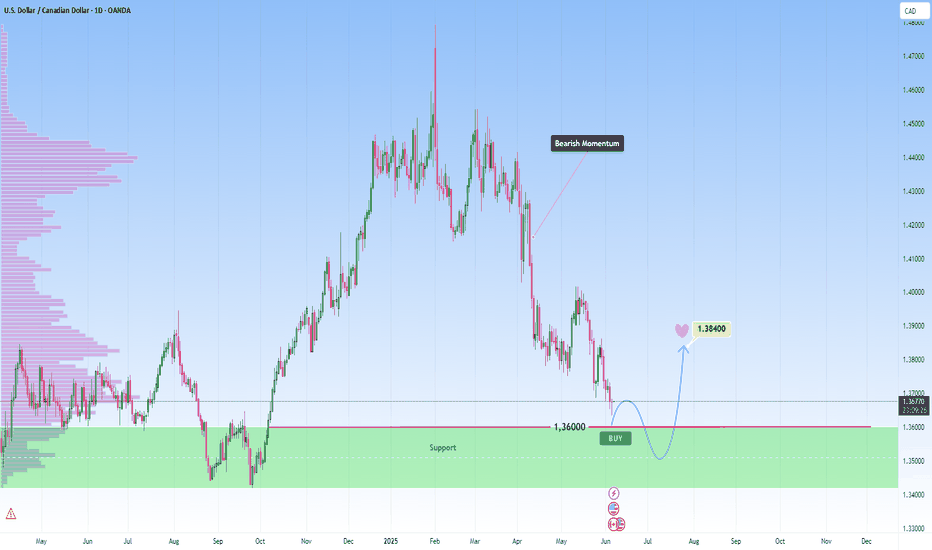

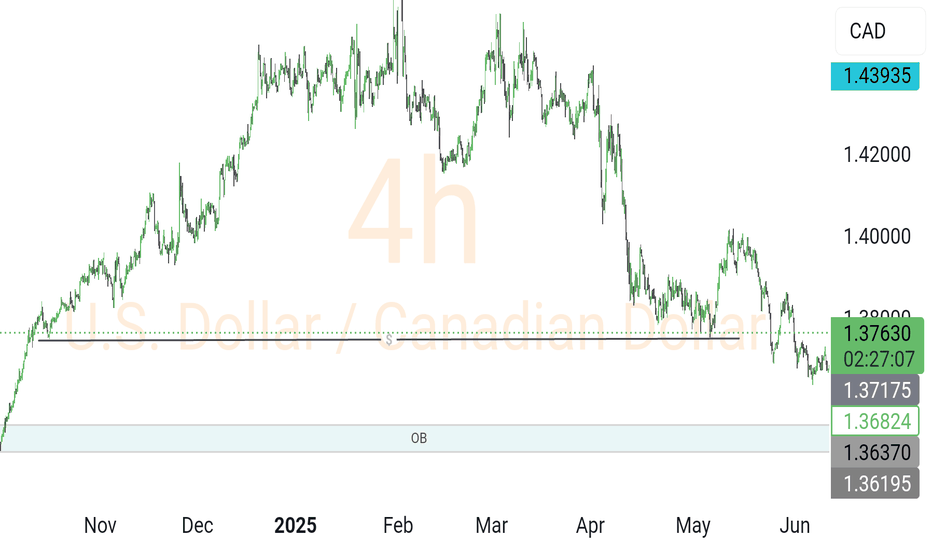

Bearish momentum to meet support on USDCAD: Looking for a bounceEvening, just wanted to share what I’m seeing on the USDCAD chart

Price on USDCAD has been in clear bearish momentum, but we’re now approaching a strong support zone, that’s held firm multiple times before, as I marked it on my chart. Price is approaching the zone again and I am taking it into account for a potential bounce.

I’ll be watching for bullish confirmation as usual requirement before entering. If that support holds, I’m targeting 1.38400 , totally achievable if momentum shifts.

BUT, if this zone breaks with momentum, I’ll reassess it and stay flexible.

💡 Reminder: Patience is power, no entry until price shows me something worth reacting to. This is not financial advice.

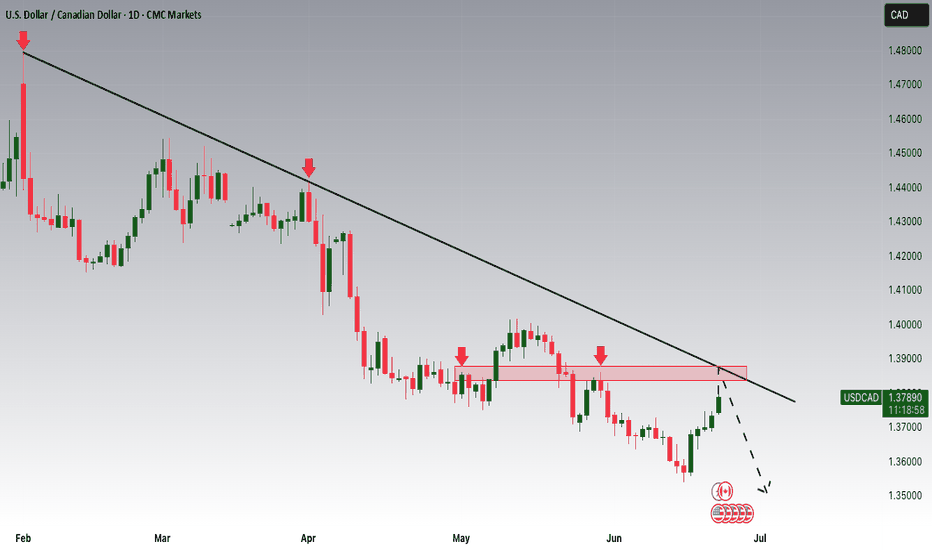

USDCAD is Nearing The Daily TrendHey Traders, in today's trading session we are monitoring USDCAD for a selling opportunity around 1.38500 zone, USDCAD is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 1.38500 support and resistance area.

Trade safe, Joe.

Market Analysis: USD/CAD Breaks HigherMarket Analysis: USD/CAD Breaks Higher

USD/CAD is rising and might aim for more gains above the 1.3765 resistance.

Important Takeaways for USD/CAD Analysis Today

- USD/CAD is showing positive signs above the 1.3720 support zone.

- There is a key bullish trend line forming with support at 1.3740 on the hourly chart at FXOpen.

USD/CAD Technical Analysis

On the hourly chart of USD/CAD at FXOpen, the pair formed a strong support base above the 1.3540 level. The US Dollar started a fresh increase above the 1.3600 resistance against the Canadian Dollar.

The bulls pushed the pair above the 1.3640 and 1.3700 levels. The pair cleared the 50-hour simple moving average and climbed above 1.3750. A high was formed at 1.3766 and the pair is now consolidating.

Initial support is near the 1.3740 level. There is also a key bullish trend line forming with support at 1.3740. The next major support is near the 1.3710 level or the 23.6% Fib retracement level of the upward move from the 1.3539 swing low to the 1.3766 high.

The main support sits near the 1.3650 zone on the USD/CAD chart. It is near the 50% Fib retracement level.

A downside break below the 1.3650 level could push the pair further lower. The next major support is near the 1.3595 support zone, below which the pair might visit 1.3540.

If there is another increase, the pair might face resistance near the 1.3765 level. A clear upside break above 1.3765 could start another steady increase. The next major resistance is the 1.3800 level. A close above the 1.3800 level might send the pair toward the 1.3880 level. Any more gains could open the doors for a test of the 1.4000 level.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Market Insights with Gary Thomson: 23 - 27 JuneMarket Insights with Gary Thomson: Canada Inflation, US Core Consumer Metrics, and Earnings Reports

In this video, we’ll explore the key economic events, market trends, and corporate news shaping the financial landscape. Get ready for expert insights into forex, commodities, and stocks to help you navigate the week ahead. Let’s dive in!

In this episode, we discuss:

— Inflation Rate in Canada

— US Durable Goods Orders

— US PCE Price Index, Personal Income & Personal Spending

— Corporate Earnings Statements

Don’t miss out—gain insights to stay ahead in your trading journey.

This video represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

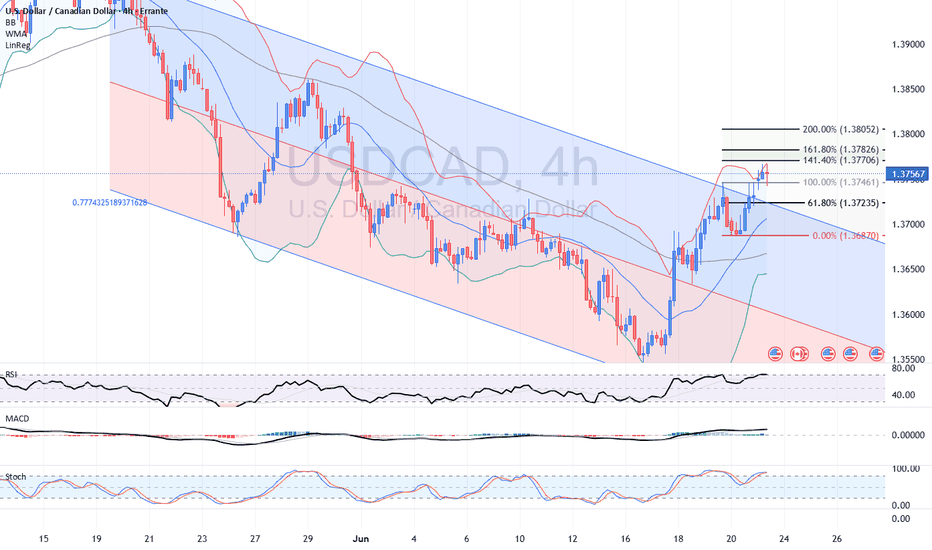

USD/CAD Tests Key Resistance Amid Mixed Global Economic SignalsTechnical Analysis

On the 4-hour chart, USD/CAD has broken above the 1.3746 resistance level, which corresponds to the top swing of the recent rally from 1.3687.

The breakout above this level is a bullish signal, reinforced by a positive RSI reading above 70, indicating strong buying momentum.

The MACD histogram is in positive territory, and the stochastic oscillator remains near overbought levels, showing sustained bullish energy.

Price action seems to retest the broken upper boundary of a descending channel drawn from the last high near 1.3723-1.3747.

This resistance zone near 1.3770-1.3783 also coincides with the 141.4% and 161.8% Fibonacci extensions, marking key targets for continuation should bulls maintain control.

Alternative Scenario

If the price fails to hold above the 1.3746 breakout level and retreats back below 1.3723 (61.8% Fibonacci retracement), we could see a pullback towards the lower support zone near 1.3687. A breakdown below this support may extend the correction into the mid-1.3600s, retesting the lower channel boundary.

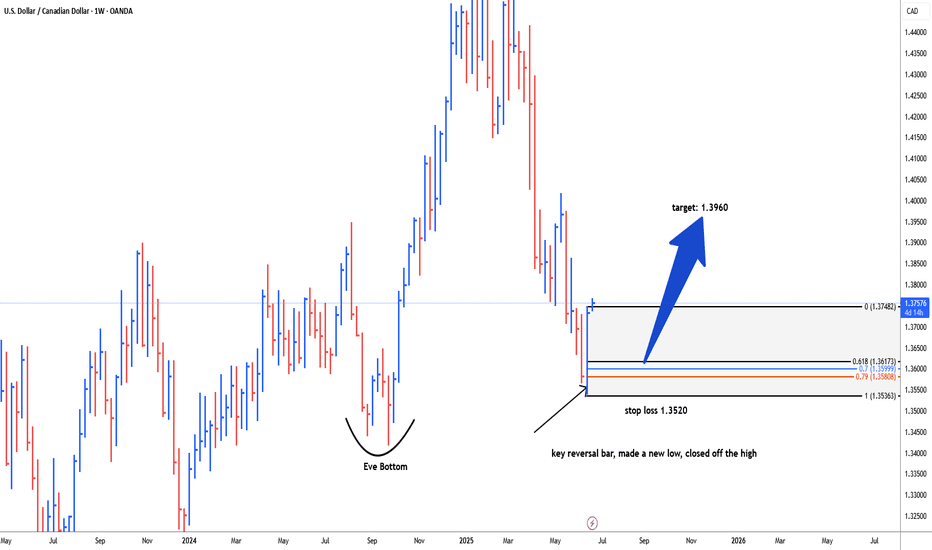

USDCAD possible bullish reversal for 1.3960#usdcad weekly key reversal bar, made a new low, closed off the high, early indication for reversal. It's better to wait for correction 61.8 fib level, 79.0 fib level and 79.0 fib level to reduce/secure drawdwon i.e. 1.3622-1.3585 is the area of interest for long trade. stop loss below key reversal bar i.e. 1.3520. target level: 1.3960

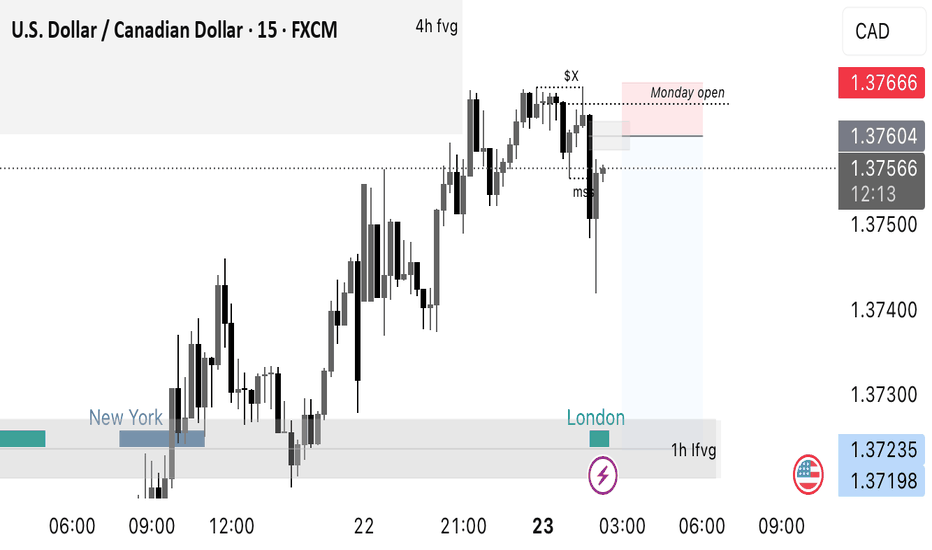

Looking to short USDCADPrice mitigates a 4h fvg and Monday opening price(New York time) has taken out sell side liquidity and gave a quick market structure shift to the down side confirming the set up. Looking to short at the median of a 5m fvg that resulted in the MSS. Target is a 1h inverted fvg which aligns with the 50% mark of the Fibonacci range.

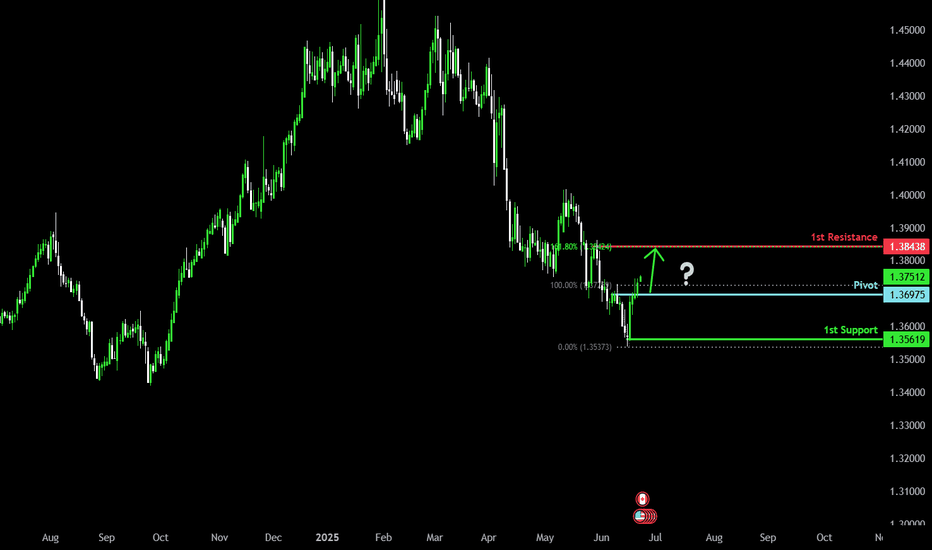

Bullish rise?The Loonie (USD/CAD) has reacted off the pivot and could potentially rise to the 1st resistance which acts as a pullback resistance.

Pivot: 1.3697

1st Support: 1.3561

1st Resistance: 1.3843

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

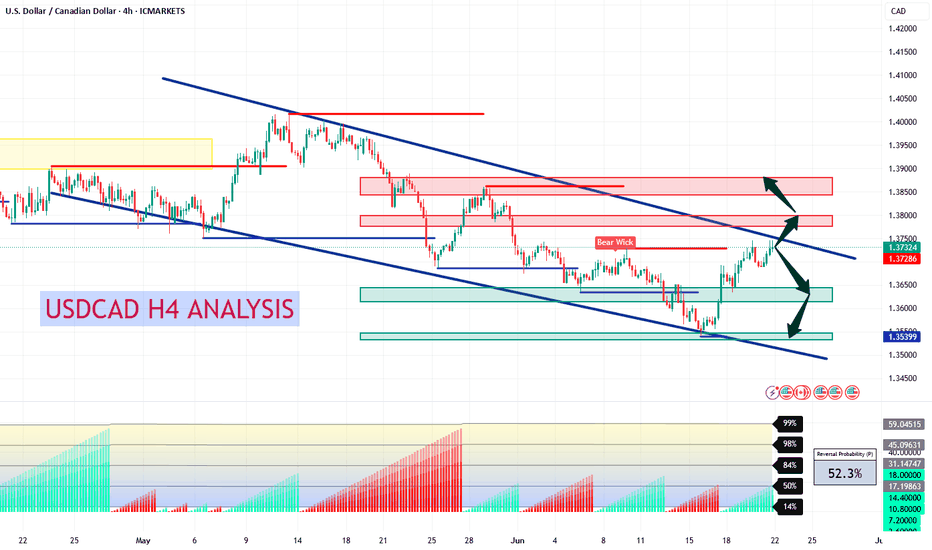

USDCAD H4 AnalysisUSDCAD Showing a Bearish Flag. If it breaks this zone above, Most probably can fly up to 1.37836 and higher to 1.38654. If no, Can rally between 1.36359, 1.35415 or even lower. Trading Analysis from 23-06-25 to 27-06-25. Take your risk under control and wait for market to break support or resistance on smaller time frame. Best of luck everyone and happy trading.🤗

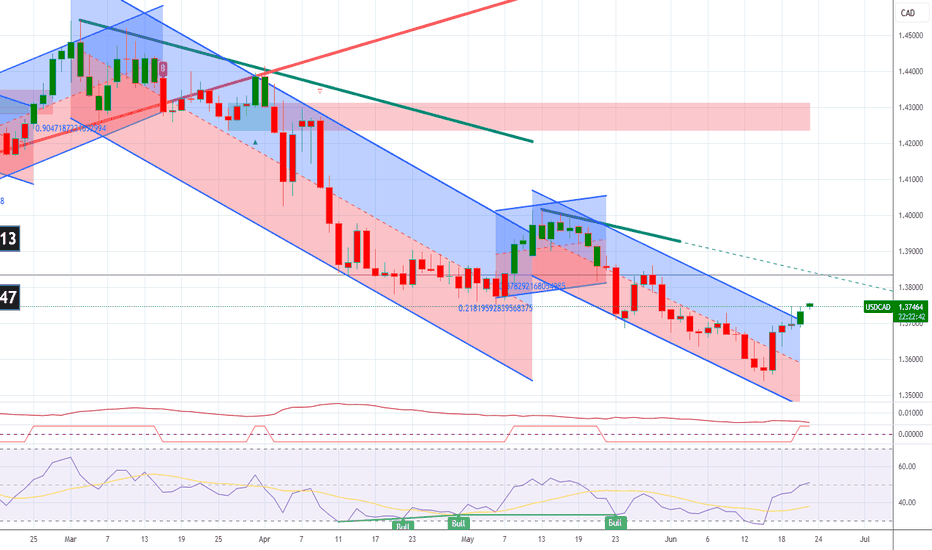

Smart Money Just Flipped Bearish on USD/CAD. Are You Still Long?🧠 1. COT Context & Institutional Flows

🇨🇦 CAD COT Report (CME) – June 10, 2025

Non-Commercials (speculators): net short 93,143 contracts (19,651 long vs. 112,794 short), with a short reduction of -14,319 → early bearish unwinding.

Commercials: net long 91,207 contracts (223,285 long vs. 132,078 short), with strong accumulation (+27,999 longs).

🔄 Net open interest change: +18,436 → renewed institutional interest on the long CAD side.

🇺🇸 USD Index COT Report (ICE) – June 10, 2025

Non-Commercials: net long 1,402 contracts (17,027 long vs. 15,625 short), with a +1,279 increase in longs → modest USD support.

Commercials remain net short -35 contracts, no clear shift.

🔄 Total open interest +2,652 → mild bullish interest in USD.

📌 Implication: Strong institutional support for CAD, USD mildly supported. Net positioning favors downside pressure on USD/CAD.

💹 2. Technical Analysis & Price Action

Primary trend: clearly bearish from the 1.38 zone.

Current price: 1.3552, testing a macro demand zone (1.3470–1.3540).

Daily RSI remains deeply oversold → possible technical bounce, but no reversal structure confirmed.

Recent candles show lower highs and lower lows, with no bullish momentum.

📌 Implication: The bearish trend remains in control. A technical rebound is possible, but bias stays short as long as price trades below 1.3640.

📈 3. Retail Sentiment

77% of retail traders are long USD/CAD, with an average entry at 1.3646.

Only 23% are short, positioned better at 1.3790.

📌 Implication: Retail is heavily long → contrarian bearish signal confirmed.

📊 4. Seasonality

June is historically weak for USD/CAD:

5Y Avg: -0.0118

2Y Avg: -0.0081

The June seasonal curve shows a stronger downside acceleration into the second half of the month.

📌 Implication: Seasonality adds downward pressure into month-end.