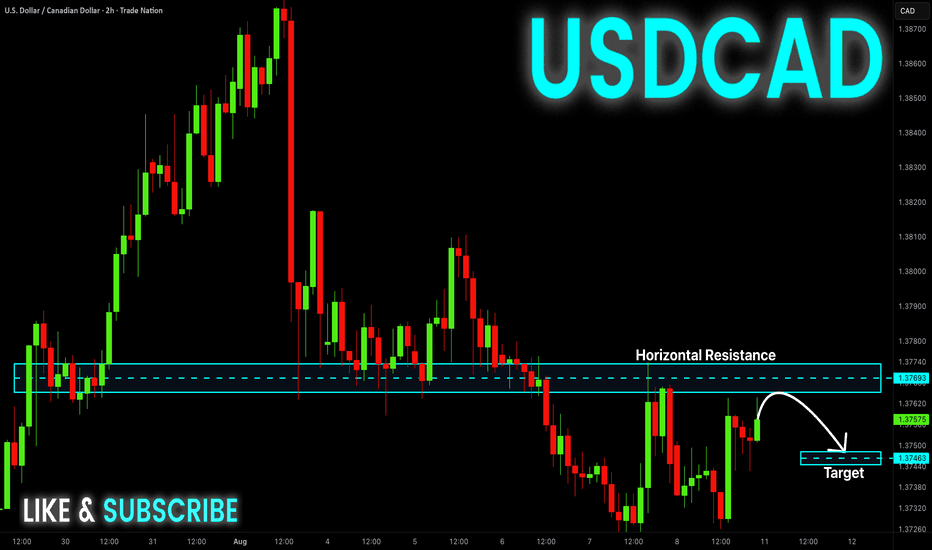

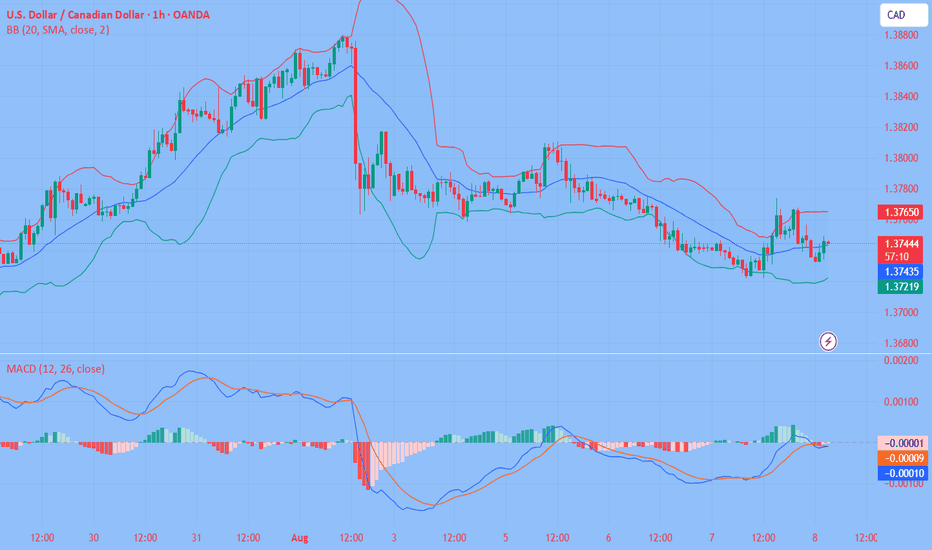

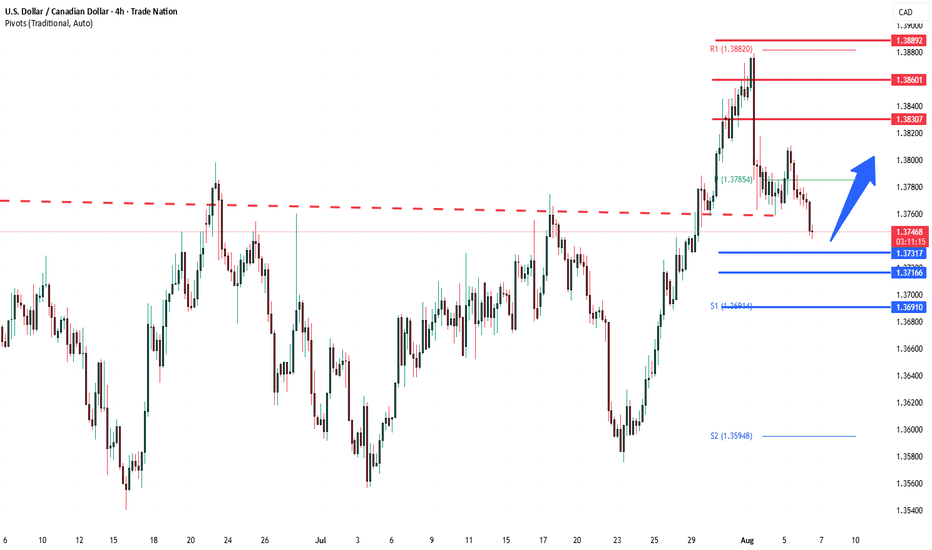

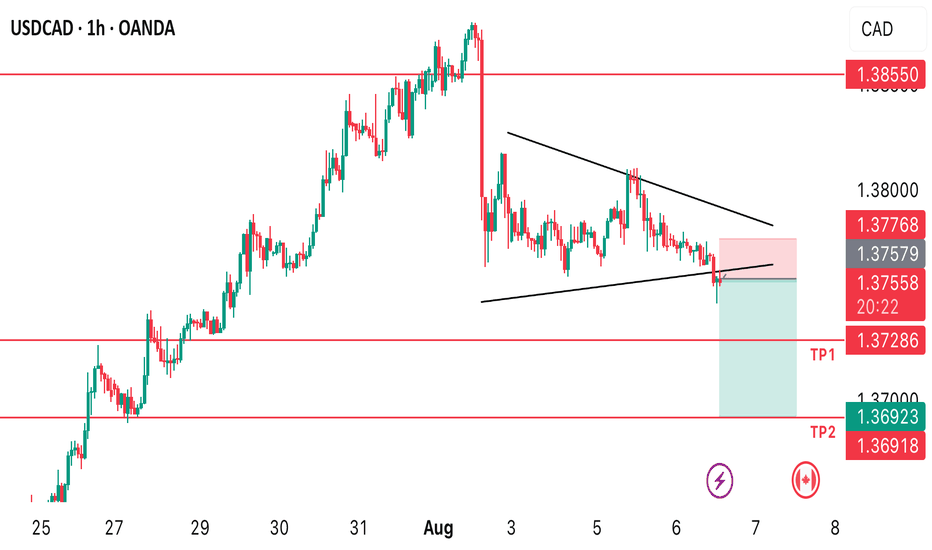

USD-CAD Resistance Ahead! Sell!

Hello,Traders!

USD-CAD went up and will

Soon hit a horizontal resistance

Of 1.3774 from where

We will be expecting a

Local bearish pullback

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CADUSD trade ideas

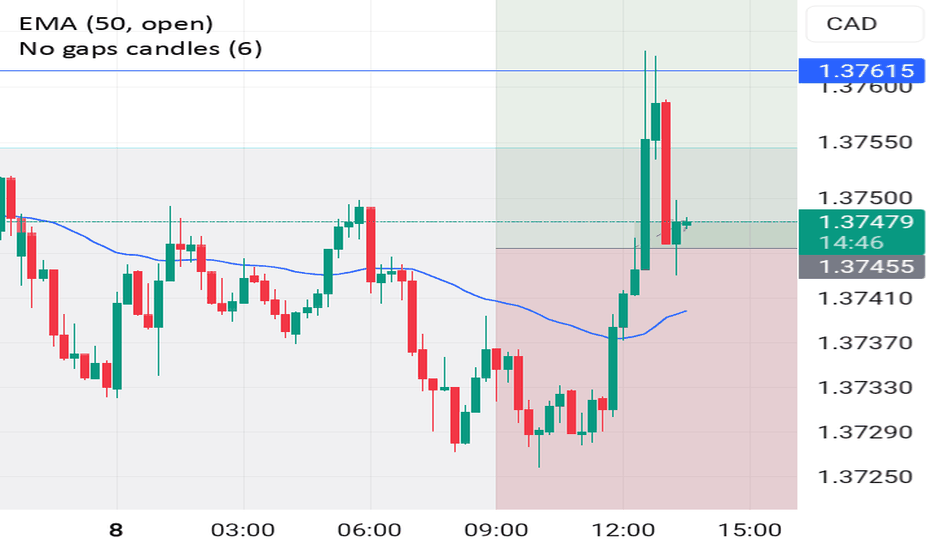

USDCAD(20250808)Today's AnalysisMarket News:

① Trump nominated Stephen Milan, Chairman of the White House Council of Economic Advisers, to serve on the Federal Reserve Board, with a term ending January 31, 2026.

② Waller is reportedly a leading candidate for the next Fed Chair.

③ U.S. Treasury Secretary Bensont stated that the interview process for the Fed Chair has begun.

④ Bostic stated that the July jobs report did change the Fed's outlook on its employment goals.

Technical Analysis:

Today's Buy/Sell Levels:

1.3746

Support and Resistance Levels:

1.3798

1.3778

1.3766

1.3726

1.3713

1.3694

Trading Strategy:

If the price breaks above 1.3746, consider a buy entry, with the first target price being 1.3766. If the price breaks below 1.3726, consider a sell entry, with the first target price being 1.3713.

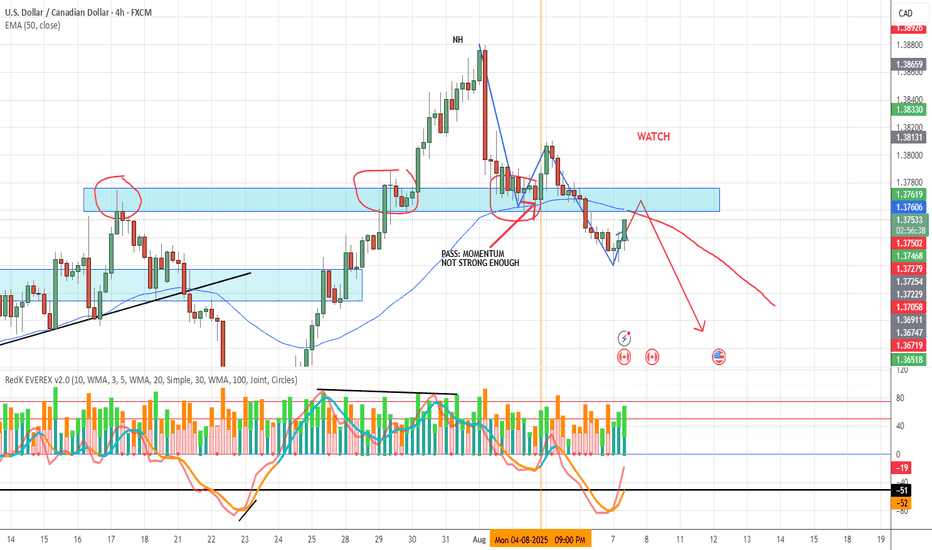

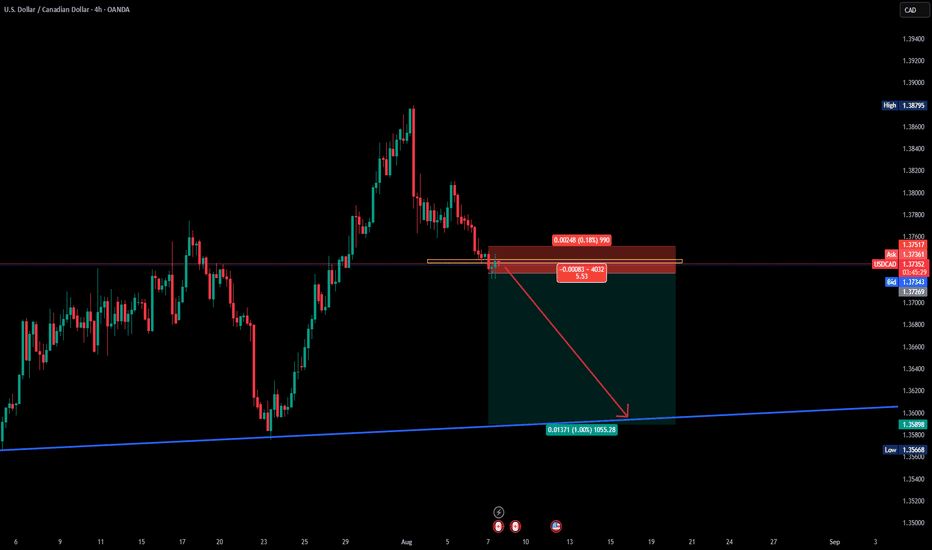

USD/CAD – Watchlist UpdateWe were watching USD/CAD for a possible pullback and long setup earlier this week. While we did get an engulfing candle, momentum was not strong enough to justify a trade — especially considering the subpar support/resistance zone.

Now, the market appears to be shifting direction, possibly forming a pullback into a stronger resistance zone that could set up a downtrend continuation.

We’ll continue to wait and watch with patience, only considering this a valid opportunity if all components of the VMS strategy align.

📌 Let the setup come to you. No alignment, no trade.

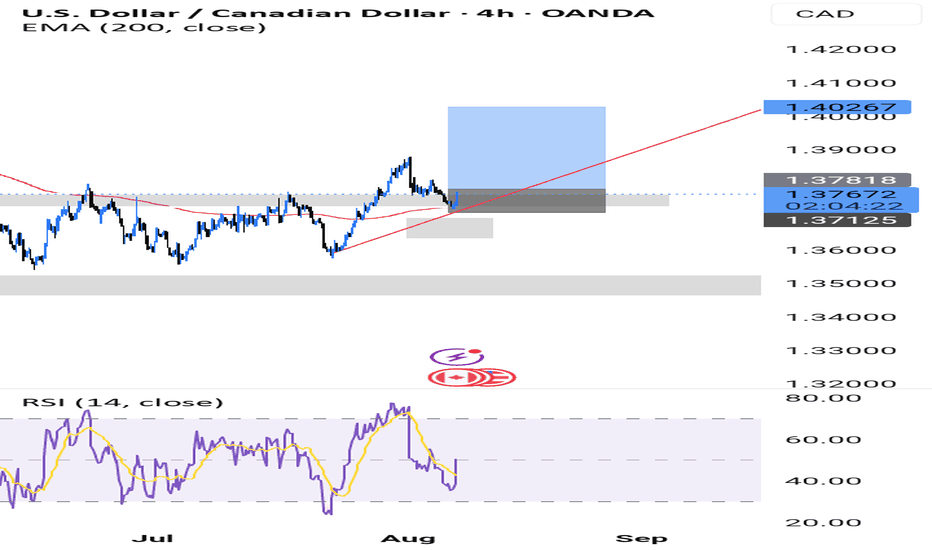

USDCAD - Big Picture and MomentumBig Picture and Momentum

USD/CAD is trading comfortably above the 50-day EMA (~1.3728) and above the 9-day EMA, indicating continued bullish momentum. The 14-day RSI is above the 50 level, confirming the positive market sentiment.

Key Support and Resistance

Resistance: 1.3770–1.3798 range is the current target, a break of which could open the way to the January high around 1.4016.

Support:

50-day EMA (~1.3728) is the first line of defense.

Next is the 9-day EMA (~1.3679).

A further weakening could see a decline to 1.3560, and a strong correction could see a decline to the February 2024 lows (~1.3420).

Market Behavior Scenarios

Bullish scenario: holding above EMA with RSI > 50 creates good conditions for a move up to 1.3770-1.3800, and then to 1.4016, with increasing momentum.

Bearish scenario: falling below EMA, especially below 1.3679, can lead to a deeper decline - to 1.3560 and then to 1.3420.

Recommendations for traders

Long position: can be considered for entry when holding above 1.3728, with a target of 1.3770-1.3800, and a stop just below the EMA.

Short position: justified when falling below 1.3728-1.3679, with a target of 1.3560, and a stop just above the EMA level.

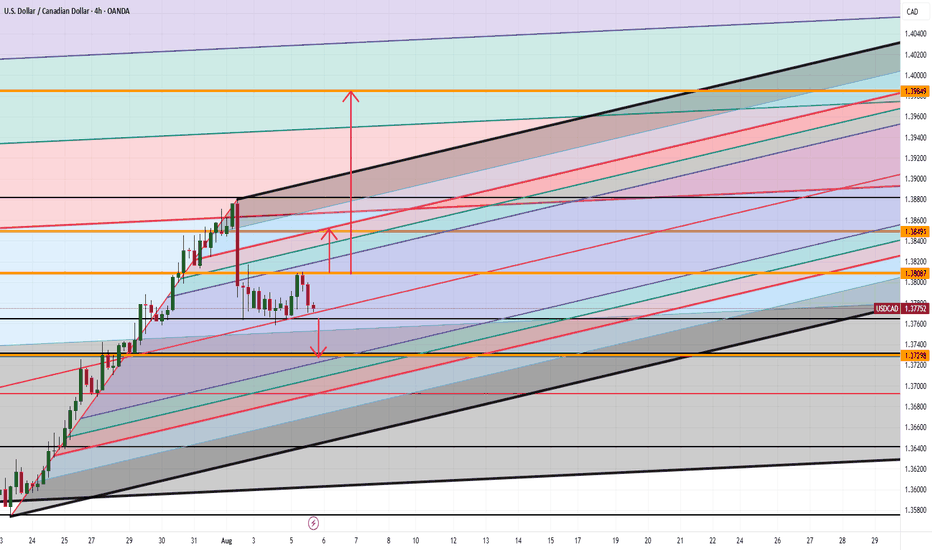

USDCAD support at 1.3730The USDCAD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 1.3730 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 1.3730 would confirm ongoing upside momentum, with potential targets at:

1.3830 – initial resistance

1.3860 – psychological and structural level

1.3890 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 1.3730 would weaken the bullish outlook and suggest deeper downside risk toward:

1.3716 – minor support

1.3690 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the WTI Crude holds above 1.3730. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

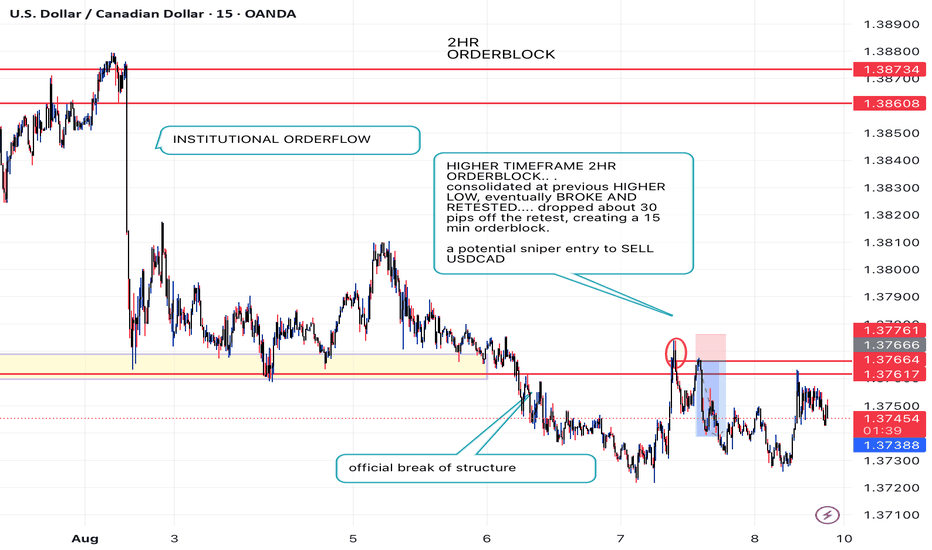

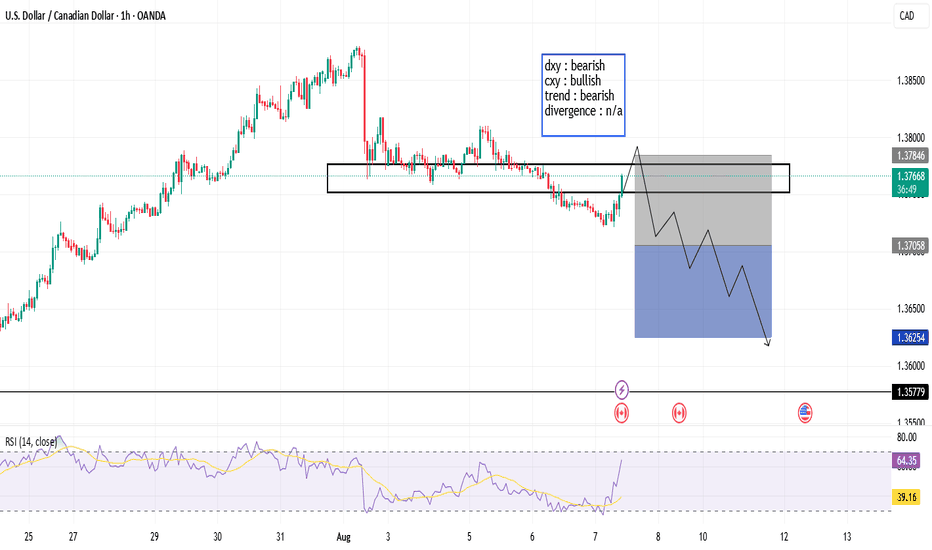

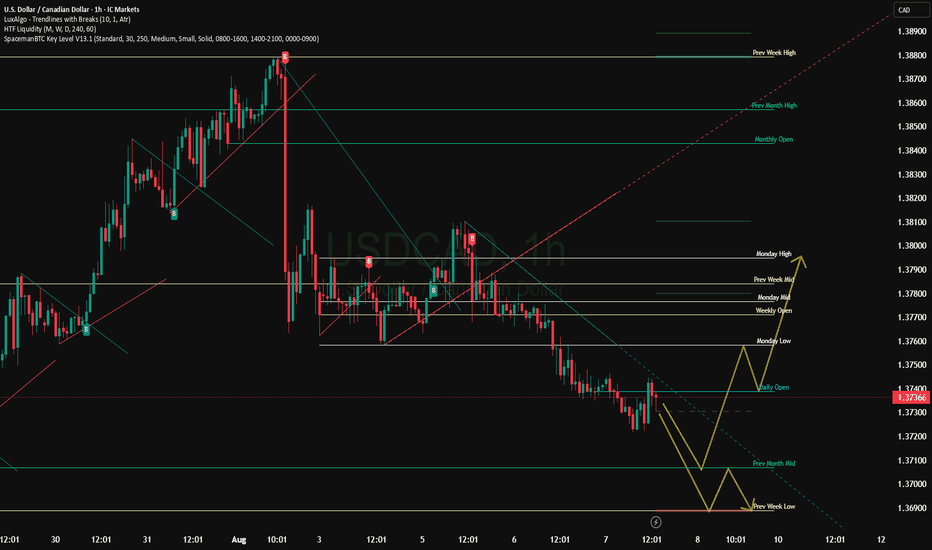

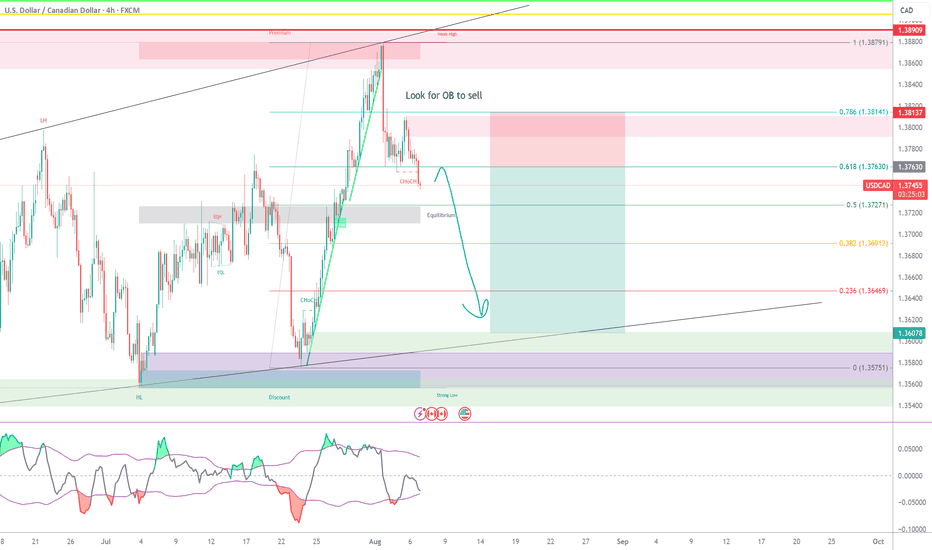

USDCAD (sell)USDCAD has broken a previous bullish trendline (green line) and started to fall.

My entry idea is to wait for a pullback and a bounce of the 61% fib level before heading back down to the previous low.

for added confluence you can wait for an overbought level on the stochastic oscillator indicator once it reaches the 61% fib level

USD/CAD(20250806)Today's AnalysisMarket News:

The US non-manufacturing PMI fell to 50.1 in July from 50.8 in June, below the expected 51.5. The ISM New Orders Index fell to 50.3 in July from 51.3 in June, with export orders contracting for the fourth time in five months.

Technical Analysis:

Today's Buy/Sell Levels:

1.3781

Support and Resistance Levels:

1.3828

1.3810

1.3799

1.3763

1.3751

1.3734

Trading Strategy:

On a breakout above 1.3781, consider a buy entry, with the first target at 1.3799. On a breakout above 1.3763, consider a sell entry, with the first target at 1.3751.

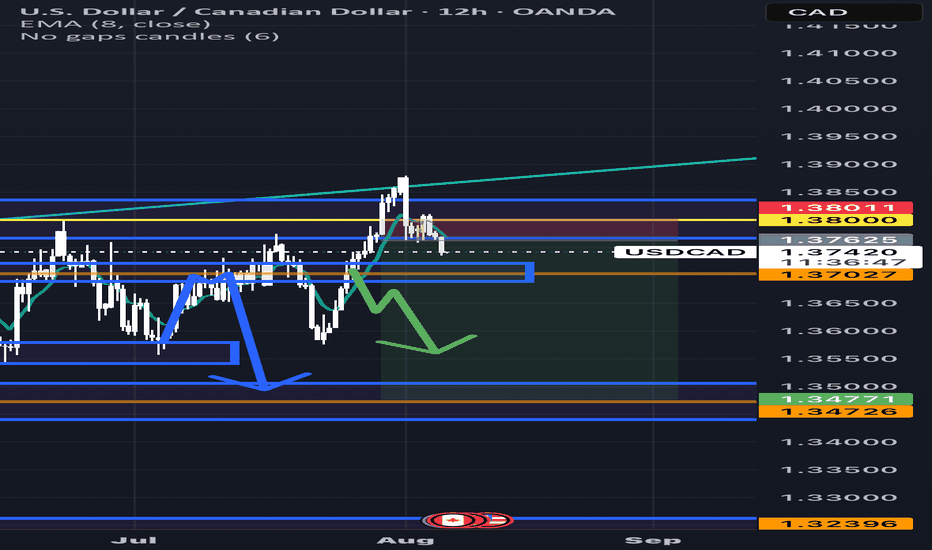

USD CAD Where Are We Heading DEEP ANALYSIS Hi Trading Fam

So with USD CAD this is what we are seeing:

Bearish:

If we stay under 1.38 then a drop down to the 1.37 range

Bullish:

If we can close above the high at 1.38 then we have levels of 1.3840 , and 1.3980 that could be hit

Trade Smarter Live Better

Kris

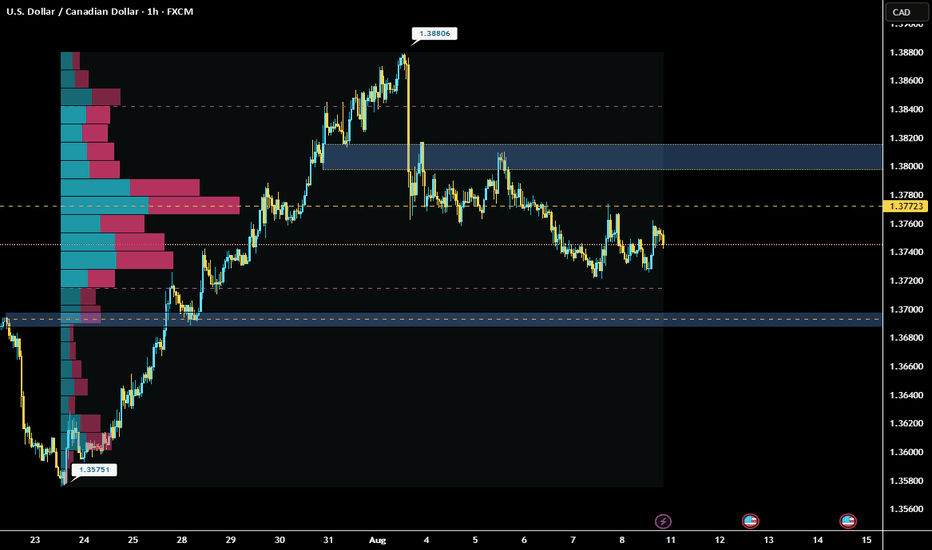

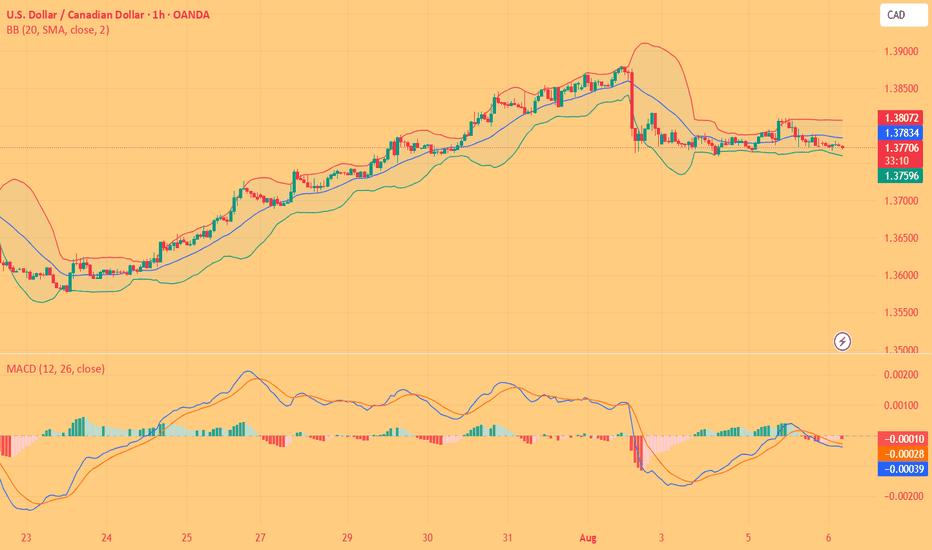

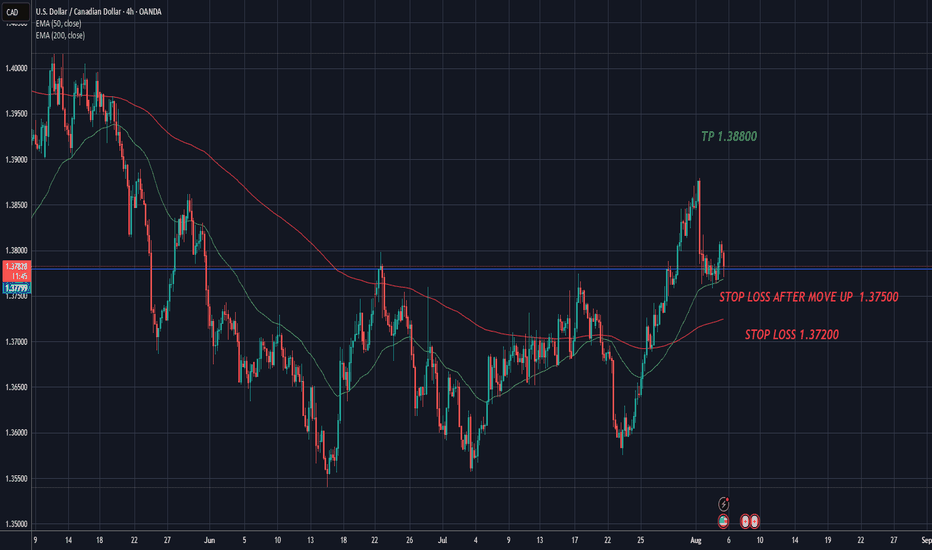

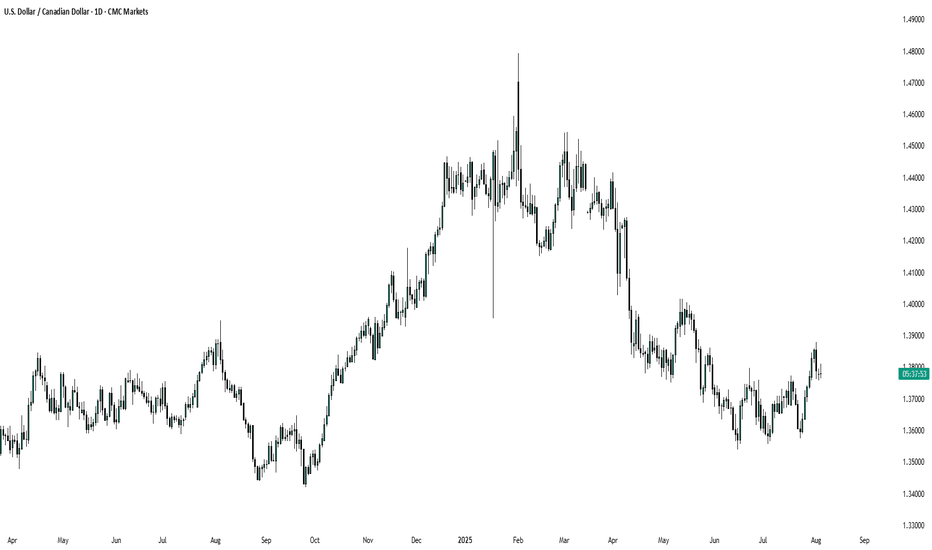

USD Could Gain Further Against CAD Despite Weak Jobs ReportThe weaker-than-expected US jobs report on 1 August, along with significant downward revisions, sent shockwaves through the market, and the US dollar was not spared. The stronger upward momentum observed over the past couple of weeks seemed to vanish almost instantly. Although the USDCAD has recently moved lower, it still maintains strong bullish momentum, indicating a potential move back toward higher levels.

The USDCAD formed a rather convincing triple-bottom pattern in June and even moved above a long-term downtrend. Additionally, the currency pair rose above the neckline of the triple bottom at 1.376, which now serves as a support level. Momentum, as measured by the Relative Strength Index, has turned upward and suggests that the USDCAD could move higher.

To further reinforce the bullish trend, the USDCAD remains above its 10-day exponential moving average. Therefore, while the prevailing market sentiment might lead one to believe the dollar will weaken, technical indicators suggest that the Canadian dollar will continue to weaken against the US dollar if support and the moving average around 1.37 hold. A break below this support area would indicate a trend reversal, potentially causing the USDCAD to fall back to lows around 1.358.

However, if the bullish trend persists and the USDCAD manages to hold above support at 1.37, the currency pair could head higher towards 1.397, retesting a resistance level established in mid-May.

Written by Michael J. Kramer, founder of Mott Capital Management.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed.

No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

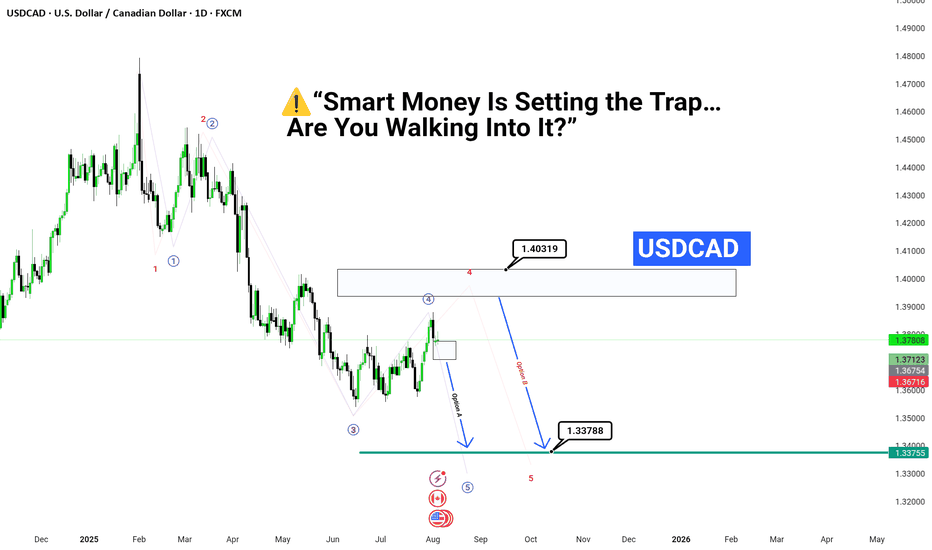

Smart Money Is Setting the Trap… Are You Walking Into It?”“💥USDCAD About to Explode — Final Wave Is Loading.

📉 If You Miss This Entry, You’ll Chase the Exit.

🧠 Wave 5 ≠ Just Another Move

It’s the final shot before the reversal storm.

✅ All signs point to liquidity being hunted

📍Stay sharp. 1.403 may be the bull trap of the year.

🎯 Make no mistake — the market is not random,

it’s engineered to fake you out before the real drop.

---

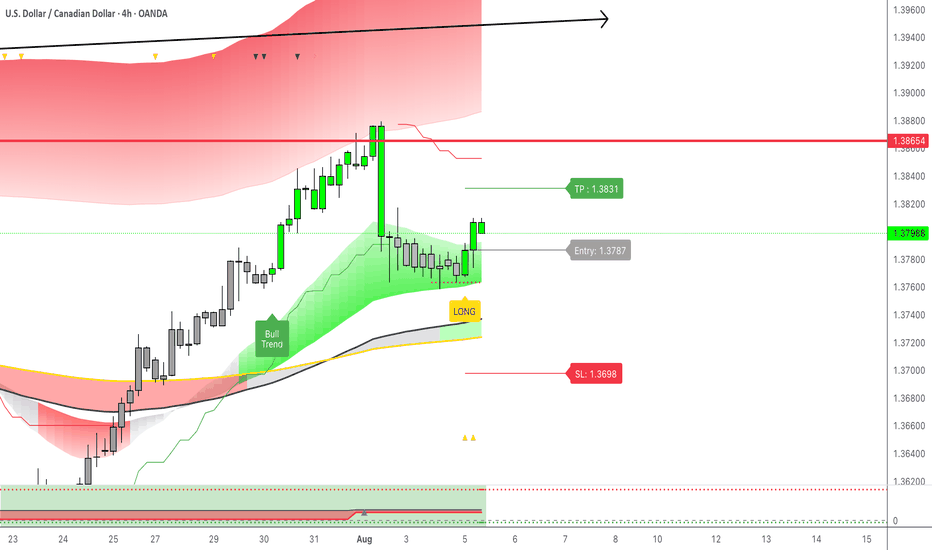

USDCAD: Long entry trigger on 4HGood morning everyone,

today I am sharing a Long signal received now via alert from the LuBot Ultimate indicator.

I will enter on correction (around 50% of the trigger candle).

TP slightly higher than suggested at 1.1850 e

SL on the suggested level.

The signal is confirmed by the positive structure (green candles) just started on the 4H and a bullish trend confirmed by the signal a few candles back.

The predictum also shows a rising signal, thus predicting a positive situation for the current month.

👍 If you want to see other similar posts, like/boost

🙋♂️ Remember to follow me so you don't miss my future analyses

⚠️ Disclaimer: This post is for informational purposes only and does not constitute financial advice. Always do your research before making investment decisions.

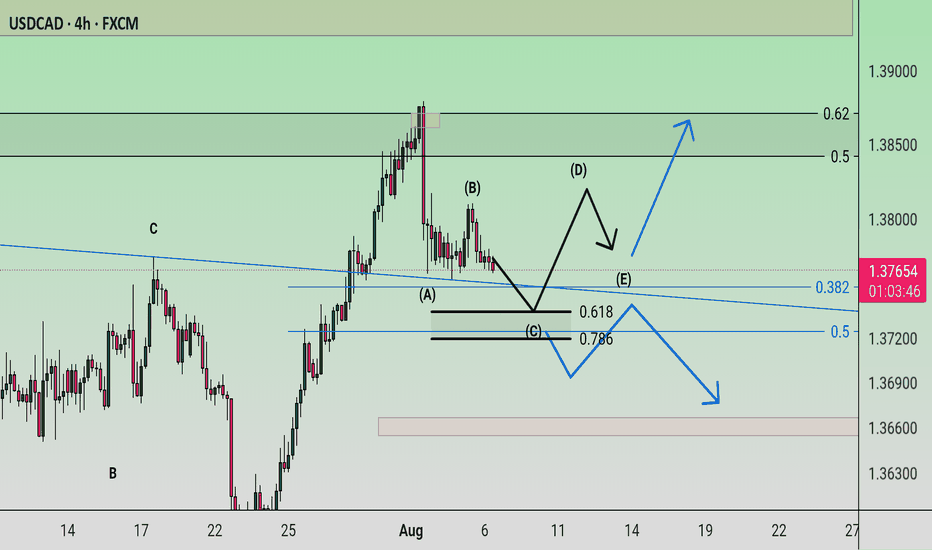

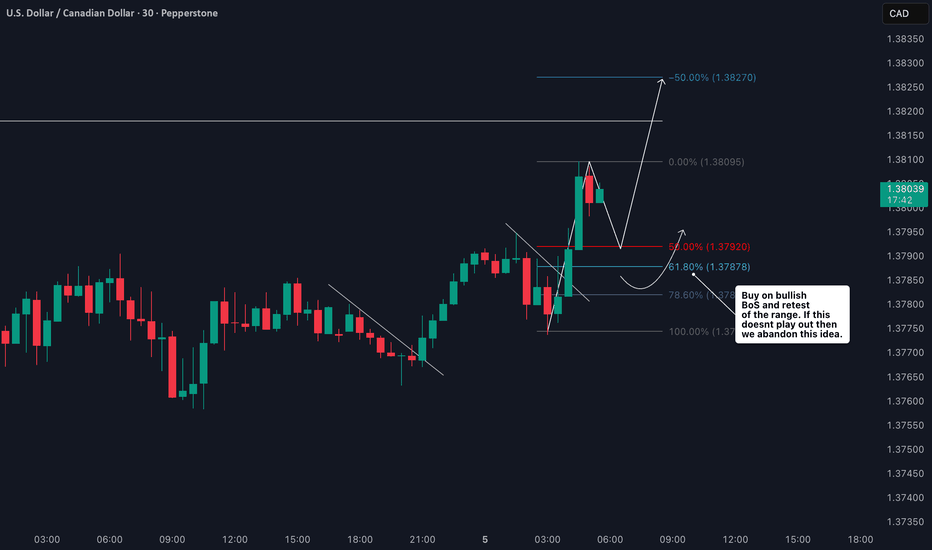

Watching Retracement Levels for Potential USDCAD Entry📈 The USDCAD remains firmly in a bullish trend following a sharp pullback on the 4-hour timeframe. Price continues to print higher highs and higher lows, showing sustained upward momentum. I’m watching for a retracement back into equilibrium of the previous price swing — if price dips and then breaks structure to the upside, I’ll be eyeing a potential long entry 🔍📊 (not financial advice).