Market Analysis: USD/CAD Consolidates GainsMarket Analysis: USD/CAD Consolidates Gains

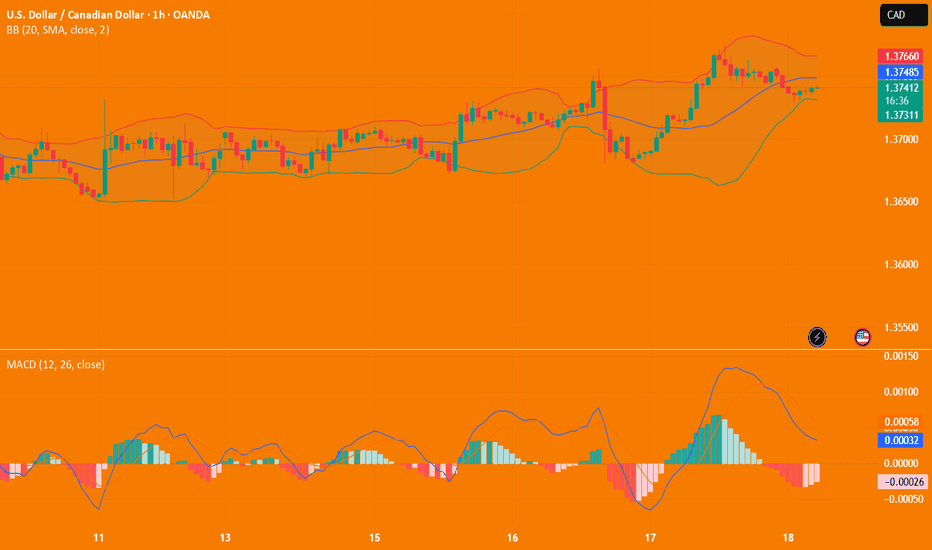

USD/CAD declined and now consolidates below the 1.3750 level.

Important Takeaways for USD/CAD Analysis Today

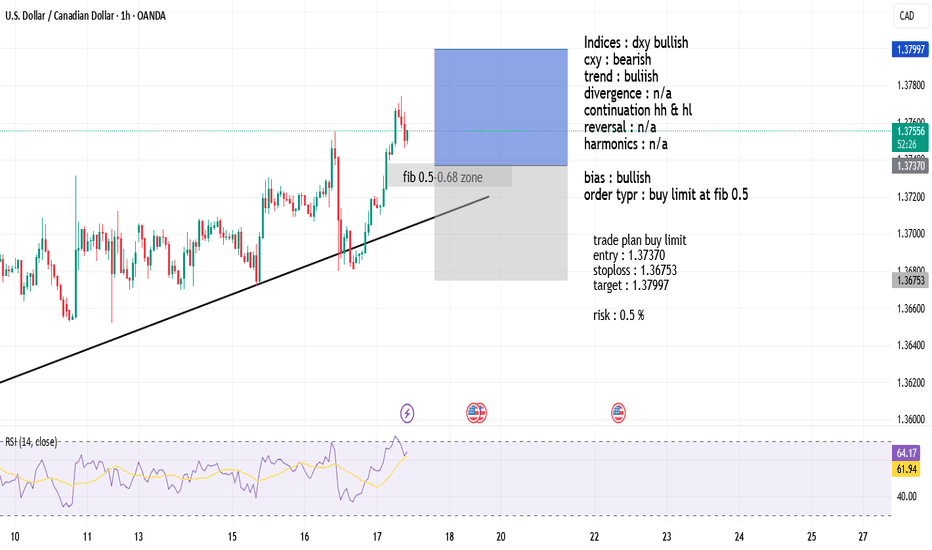

- USD/CAD started a fresh decline after it failed to clear the 1.3775 resistance.

- There is a key bullish trend line forming with support at 1.3715 on the hourly chart at FXOpen.

USD/CAD Technical Analysis

On the hourly chart of USD/CAD at FXOpen, the pair climbed toward the 1.3775 resistance zone before the bears appeared. The US Dollar formed a swing high near 1.3774 and recently declined below the 1.3750 support against the Canadian Dollar.

There was also a close below the 50-hour simple moving average and 1.3735. The pair is now consolidating losses below the 50% Fib retracement level of the downward move from the 1.3774 swing high to the 1.3695 low. But the bulls are active near the 1.3700 level.

If there is a fresh increase, the pair could face resistance near the 1.3735 level. The next key resistance on the USD/CAD chart is near the 1.3755 level or the 61.8% Fib retracement level.

If there is an upside break above 1.3755, the pair could rise toward 1.3775. The next major resistance is near the 1.3800 zone, above which it could rise steadily toward 1.3880.

Immediate support is near the 1.3715 level and a key bullish trend line. The first major support is near 1.3675. A close below the 1.3675 level might trigger a strong decline. In the stated case, USD/CAD might test 1.3650. Any more losses may possibly open the doors for a drop toward the 1.3620 support.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

CADUSD trade ideas

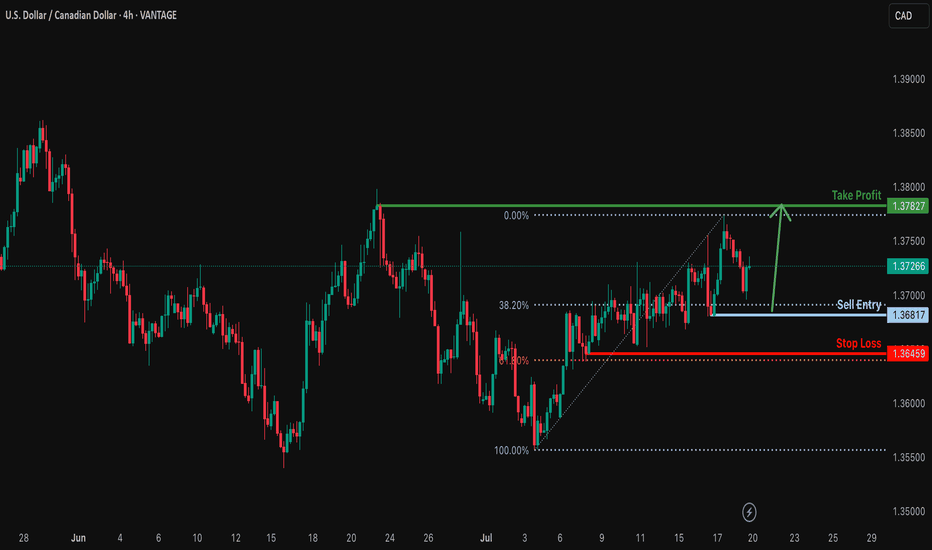

Bullish bounce off pullback support?USD/CAD is falling towards the support level which is a pullback support that lines up with the 38.2% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 1.3681

Why we like it:

There is a pullback support level that aligns with the 38.2% Fibonacci retracement.

Stop loss: 1.3645

Why we like it:

There is a pullback support that lines up with the 61.8% Fibonacci retracement.

Take profit: 1.3782

Why we like it:

There is a pullback resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

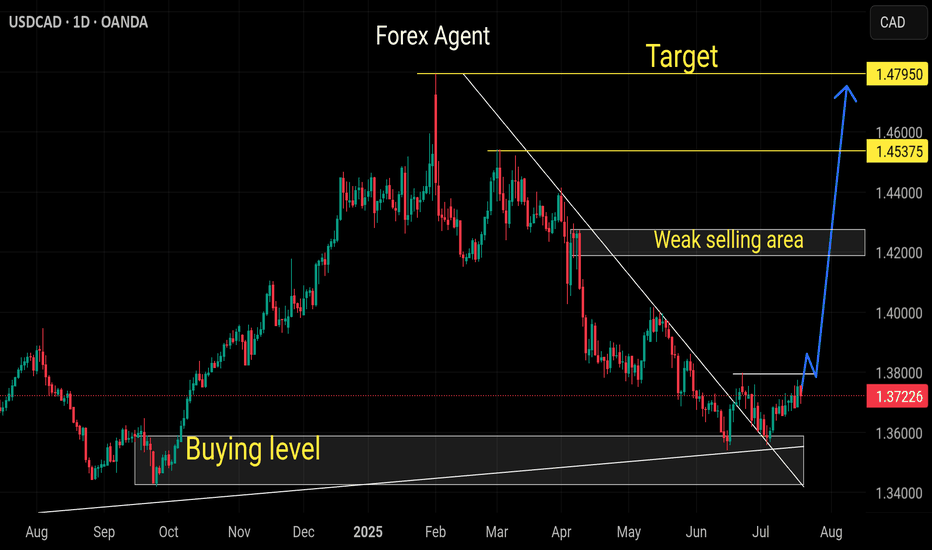

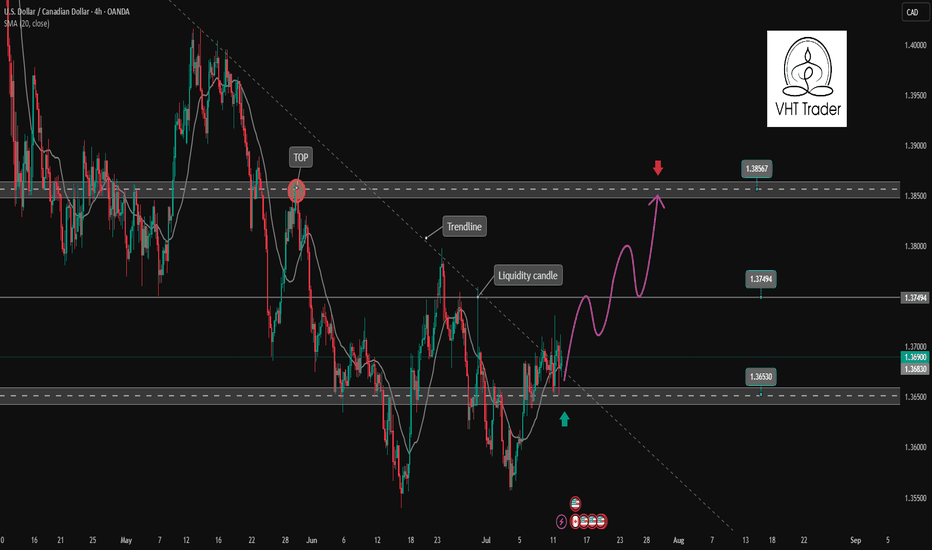

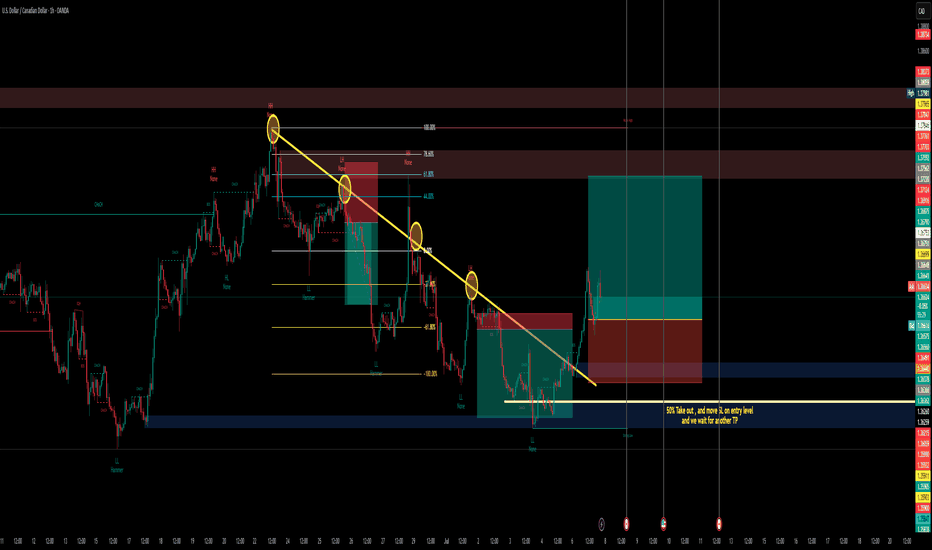

Tricky USDCAD . let the market decide - we follow Hello traders , here is the full multi time frame analysis for this pair, let me know in the comment section below if you have any questions , the entry will be taken only if all rules of the strategies will be satisfied. wait for more price action to develop before taking any position. I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied.

🧠💡 Share your unique analysis, thoughts, and ideas in the comments section below. I'm excited to hear your perspective on this pair .

💭🔍 Don't hesitate to comment if you have any questions or queries regarding this analysis.

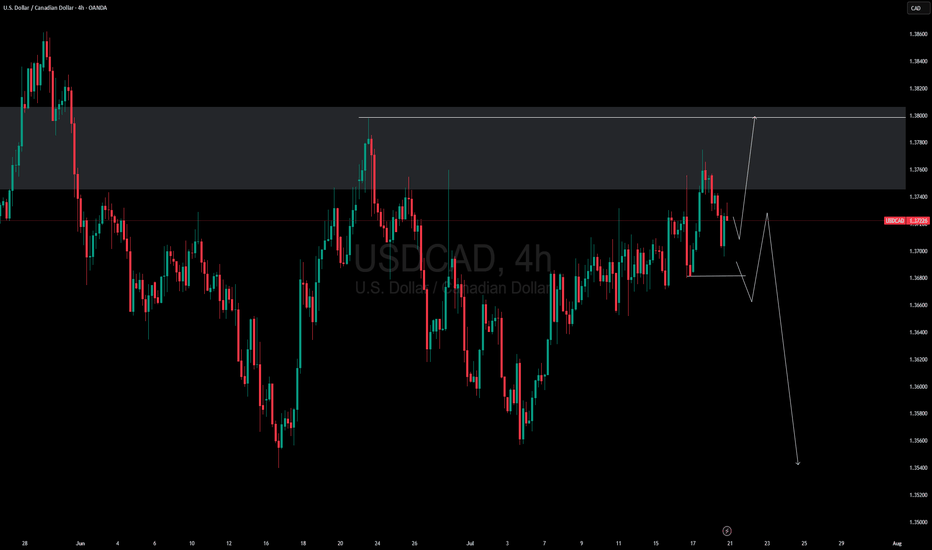

USDCAD bearish view

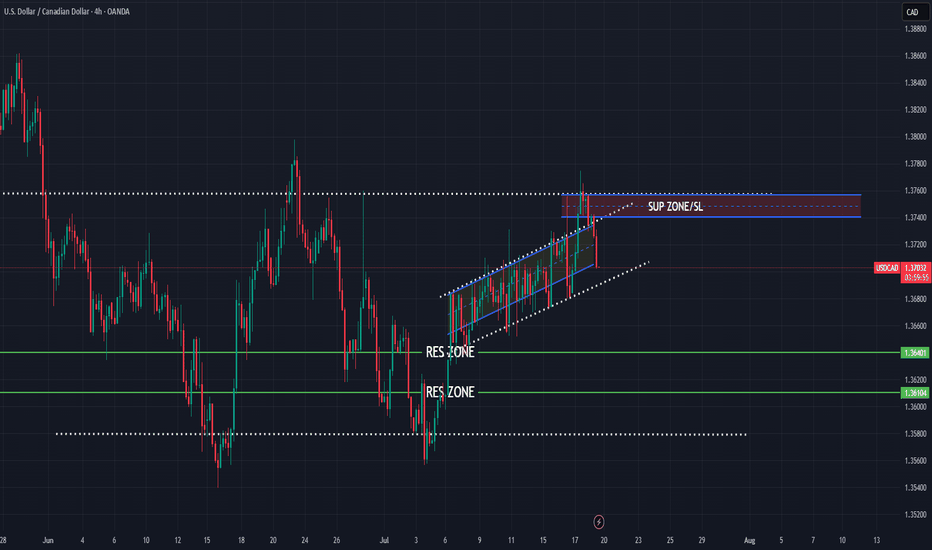

OANDA:USDCAD again on this pair, first analysis accurate, in new look having bearish view, price in PA moving, still we having nice structure, price is now come back in channel, looks like breaking first channel, which will take for confirmation and sign for bearish expectations.

SUP zone: 1.37400

RES zone: 1.36400, 1.36100

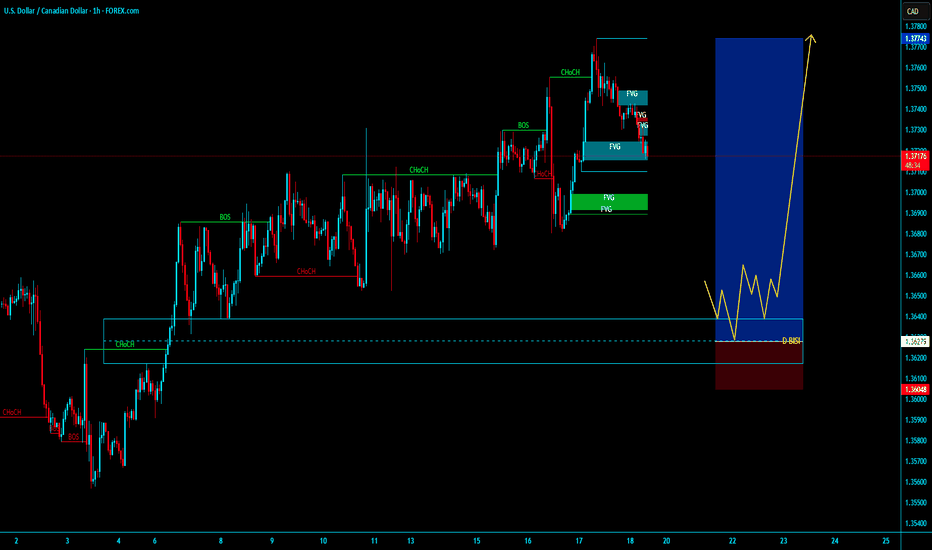

USDCAD BULLESH DAILY BISIUSDCAD BULLESH DAILY BISI

In daily TF market is bullesh market will creat trend line liquidity market first market will Run On Stop then tap daily BISI , going to LTF then valid mss with valid valid obi entry on this obi tight sl with 100 - 500 pips target holding over night , THANK YOU

KGB Priyabrat Behera

ICT TRADER & Advance mapping SMC trader

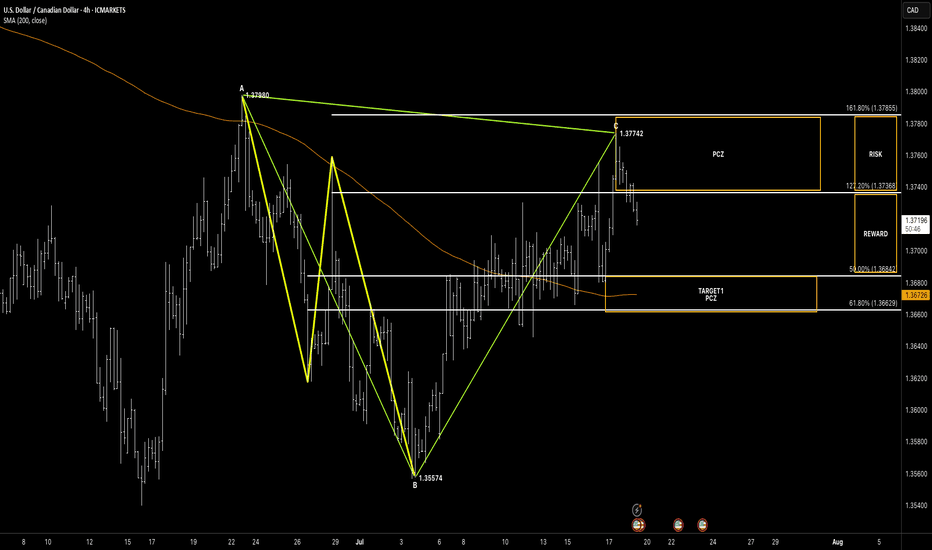

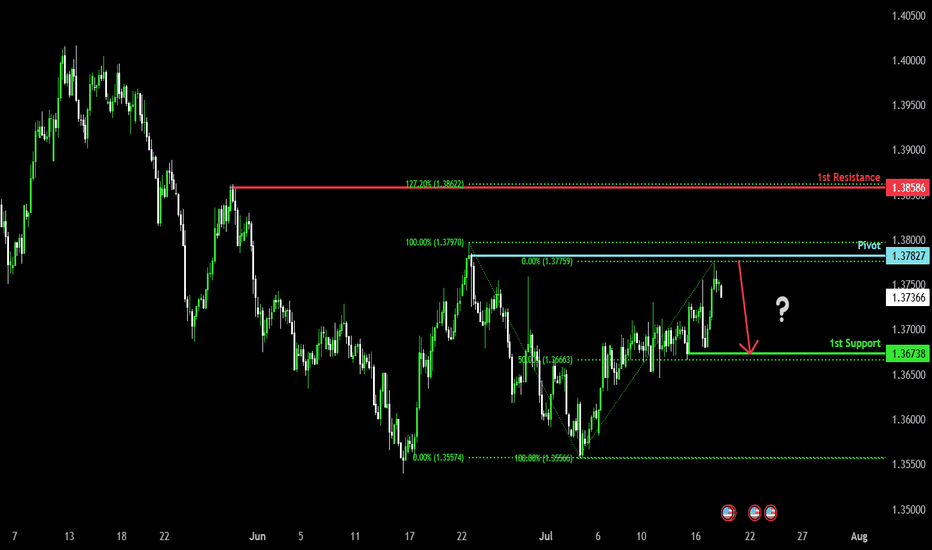

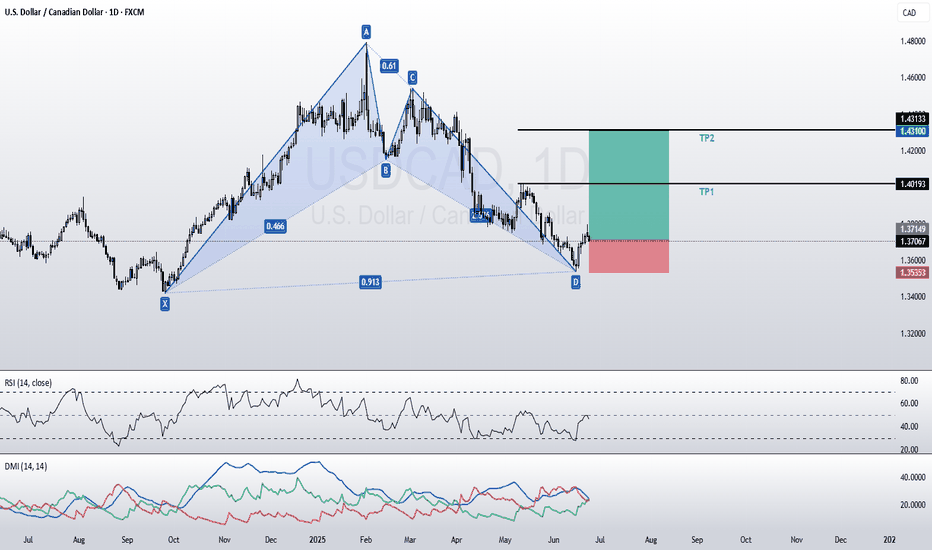

USDCAD / U.S. Dollar – Canadian Dollar (4H) – ABC Bearish PatterUSDCAD / U.S. Dollar – Canadian Dollar (4H) – ABC Bearish Pattern Completion at PCZ

Pattern Overview:

Pattern Type: ABC Bearish (Potential Reversal)

Asset: USDCAD

Timeframe: 4H

Trade Type: Short Bias – Rejection observed near PCZ zone

🔎 Key Levels

XA: 1.37880 → 1.35574

AB: 1.35574 → 1.37742

BC: Completed right into the PCZ, aligning with 127.2% and 161.8% projection zones

Rejection confirmed below 1.3774, entering pullback

📐 Fibonacci Extensions & Key Ratios

127.2% Projection: 1.37368

161.8% Extension: 1.37855

Retracement Target Zone (PCZ/Support):

50.0% = 1.36842

61.8% = 1.36629

💡 Price Action & Setup

The price has completed a textbook ABC structure into a confluence projection zone (PCZ), showing signs of exhaustion at 1.3774. This area aligns with a previous swing high and fib confluence, now acting as resistance.

The first leg of the pullback is underway, and momentum is favoring a deeper move toward the 1.3680 – 1.3660 PCZ, which aligns with key fibs and 200 SMA support.

🧠 Market Sentiment

DXY consolidating near highs – potential exhaustion

Crude oil stabilizing supports CAD

CAD correlation is enhancing bearish weight on this pair post-ABC

📊 Next Potential Movement

Targeting the 1.3680–1.3660 support cluster

If PCZ fails to hold on any retest → potential continuation down toward 1.3600 swing

Resistance to watch: 1.3737–1.3750 (any candle close above this weakens setup)

🛡 Risk Management

Short entries from the 1.3760–1.3770 area are valid

Stop-loss ideally above 1.3790 (beyond 161.8%)

Scaling out near 1.3680 and 1.3660, both technical targets and 200 SMA confluence

📌 Conclusion

Price completed a high-probability ABC Bearish structure and is now reacting from a strong confluence zone. While confirmation is still unfolding, momentum favors downside, and all eyes are on the next leg toward the PCZ support range.

“Bearish patterns are warnings, not guarantees. But confluence zones give them authority.”

USDCAD SELLUSD/CAD retakes 1.3700, eyes multi-week top amid a broadly firmer USD

The USD/CAD pair attracts some dip-buying during the Asian session on Thursday and climbs further beyond the 1.3700 mark amid a broadly firmer US Dollar. Spot prices have now reversed the previous day's retracement slide from a three-week high and seem poised to appreciate further

The year will be politically marked by Trump’s return to the White House. A Republican government is seen as positive for financial markets, but Trump’s pledge to cut taxes and impose tariffs on foreign goods and services may introduce uncertainty to both the political and economic landscape.

Canada’s political crisis peaked in late 2024 with a no-confidence vote against Prime Minister Justin Trudeau, leading to snap elections and a weakened Liberal minority government. Policy uncertainty and economic challenges dominate 2025’s outlook, raising concerns over market stability and investor confidence.

The BoC is set to continue easing interest rates through 2025, at least at a faster pace than the Fed is expected to, which could apply pressure on CAD’s already-rising rate differentia

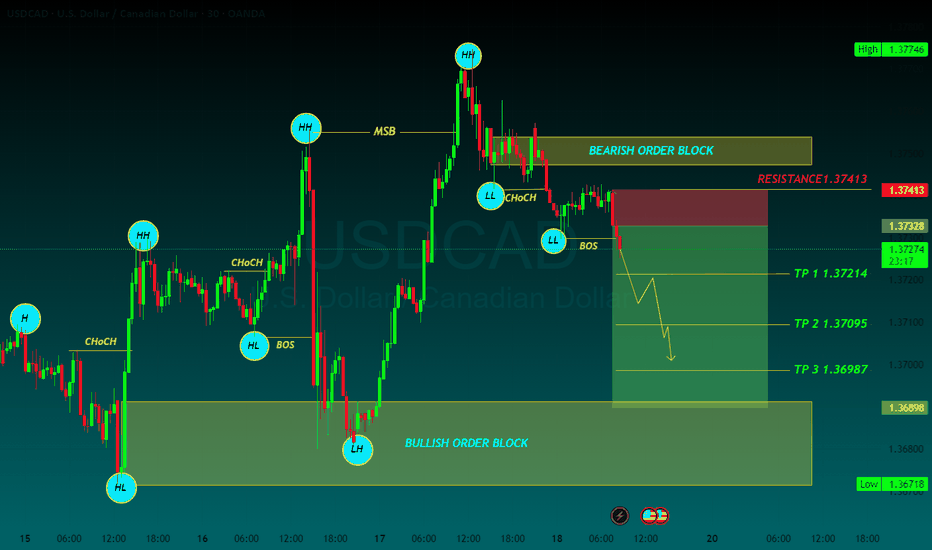

TP 1 1.37214

TP 2 1.37095

TP 3 1.36987

RESISTANCE 1.37413

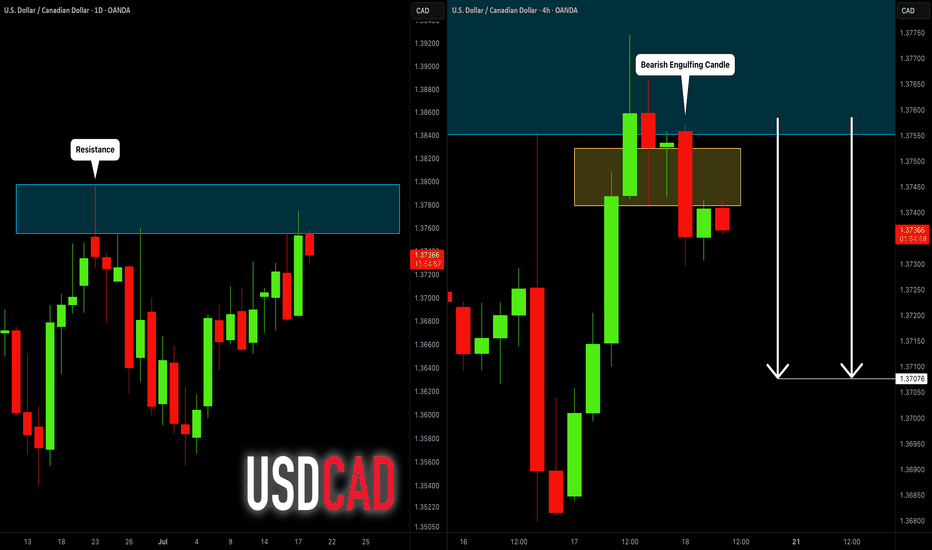

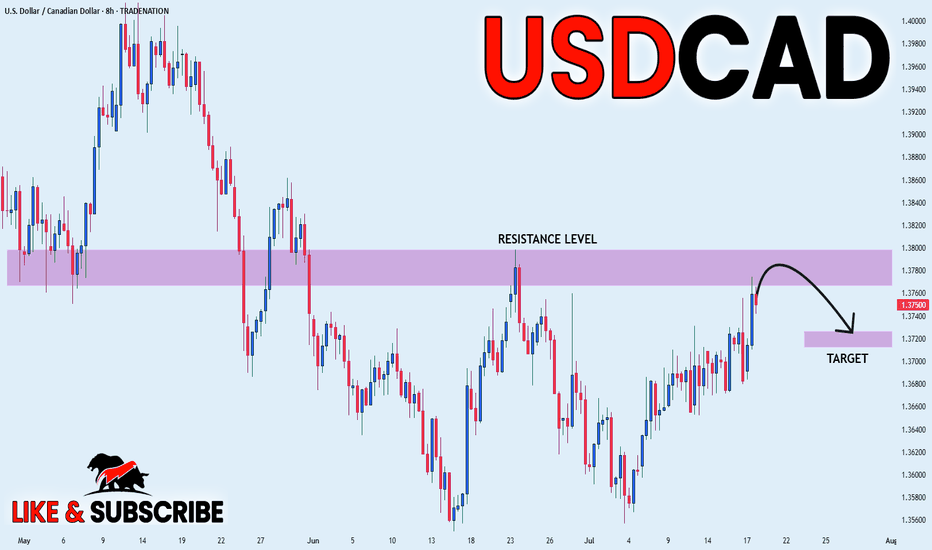

USDCAD: Bearish Move From Resistance 🇺🇸🇨🇦

USDCAD is going to retrace from a key daily resistance.

A bearish imbalance candle that the price formed after its test

during the Asian session provides a strong intraday bearish confirmation.

Goal - 1.3707

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

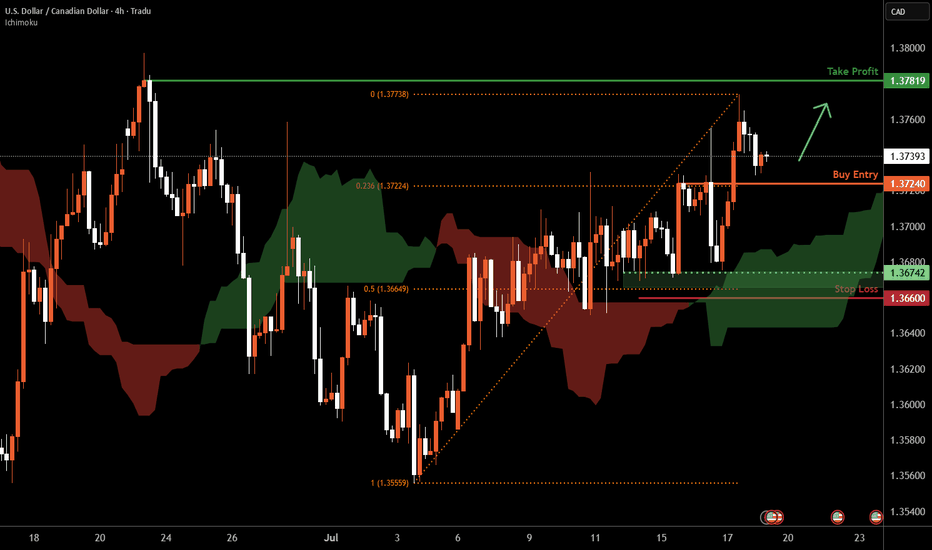

USD/CAD H4 | Potential bullish bounceUSD/CAD is falling towards a pullback support and could potentially bounce off this level to climb higher.

Buy entry is at 1.3724 which is a pullback support that aligns with the 23.6% Fibonacci retracement.

Stop loss is at 1.3660 which is a level that lies underneath a multi-swing-low support and the 50% Fibonacci retracement.

Take profit is at 1.3781 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

USD/CAD(20250718)Today's AnalysisMarket news:

① Kugler: It is appropriate to keep the interest rate policy stable for "a while".

② Daly: Whether to cut interest rates in July or September is not the most critical.

③ Bostic: It may be difficult to cut interest rates in the short term.

Technical analysis:

Today's buying and selling boundaries:

1.3735

Support and resistance levels:

1.3827

1.3792

1.3770

1.3700

1.3678

1.3644

Trading strategy:

If it breaks through 1.3770, consider buying in, the first target price is 1.3792

If it breaks through 1.3735, consider selling in, the first target price is 1.3700

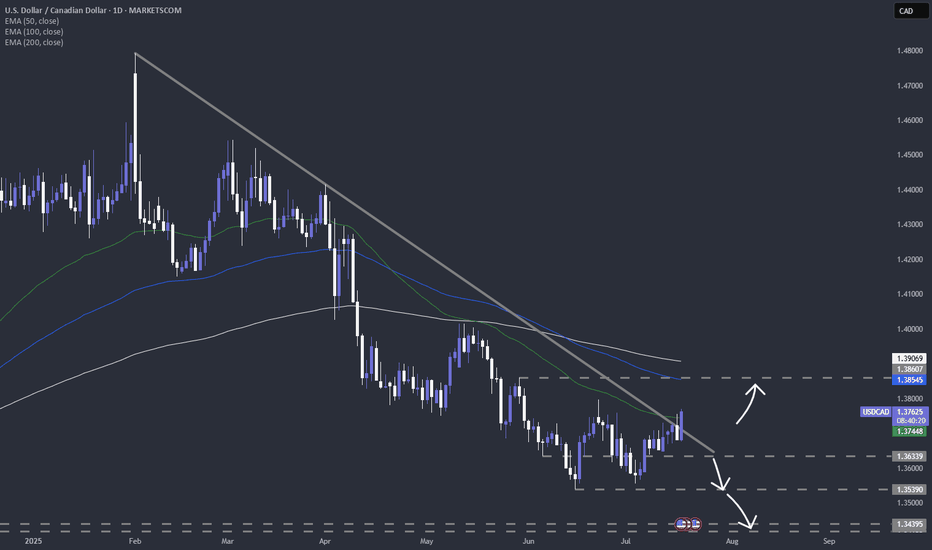

USDCAD is showing signs of bullish recovery✏️ OANDA:USDCAD has broken the Trendline structure to form a corrective uptrend. The price is still above the 20 SMA, indicating that the market's bullish momentum is still strong. The bullish wave may extend to 1.385. Pay attention to the reaction at the 1.375 liquidity candle wick zone for a positive DCA strategy.

📉 Key Levels

Support: 1.365

Resistance: 1.375-1.385

BUY Now: 1.365 (Strong support zone)

BUY Trigger: break and close above 1.375

Target: 1.385

Leave your comments on the idea. I am happy to read your views.

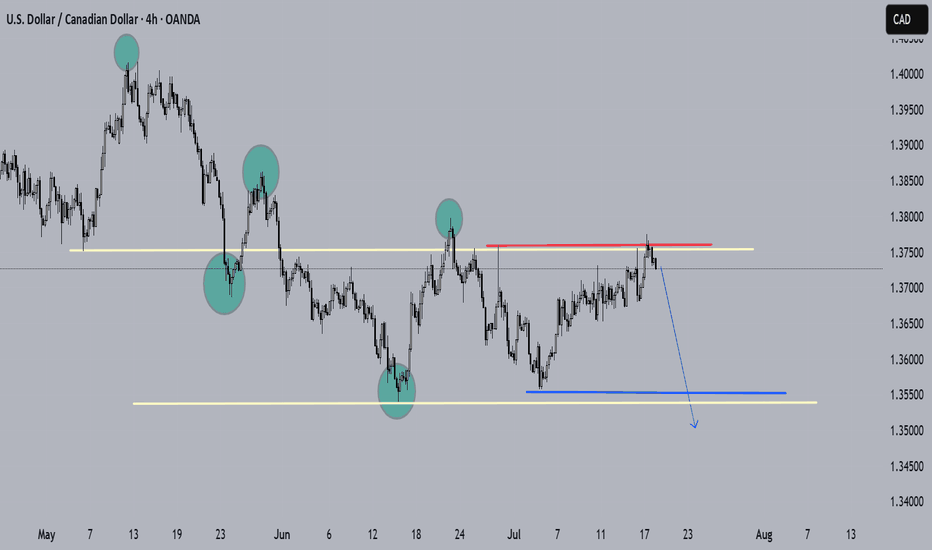

Heading into pullback resistance?The Loonie (USD/CAD) has rejected off the pivot which acts as a pullback resistance and could reverse to the pullback support that aligns with the 50% Fibonacci retracement.

Pivot: 1.3782

1st Support: 1.3673

1st Resistance: 1.3858

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

USD_CAD LOCAL SHORT|

✅USD_CAD is going up now

But a strong resistance level is ahead at 1.3800

Thus I am expecting a pullback

And a move down towards the target of 1.3720

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

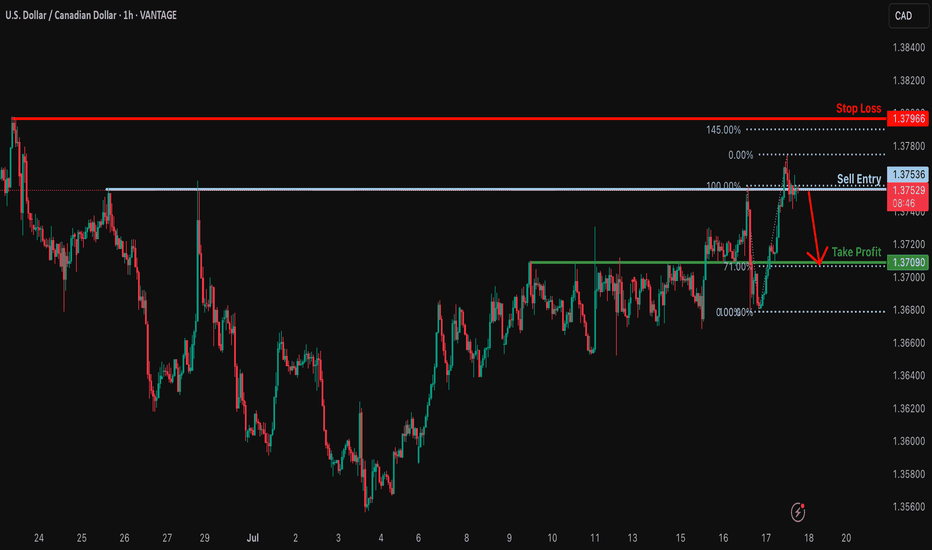

Bearish drop off pullback resistance?USD/CAD is reacting off the resistance level which is a pullback resistance and could reverse from this level to our take profit.

Entry: 1.3753

Why we like it:

There is a pullback resistance.

Stop loss: 1.3796

Why we like it:

There is a swing high resistance that is slightly above the 145% Fibonacci extension.

Take profit: 1.3709

Why we lik eit:

There is an overlap support that lines up with the 71% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

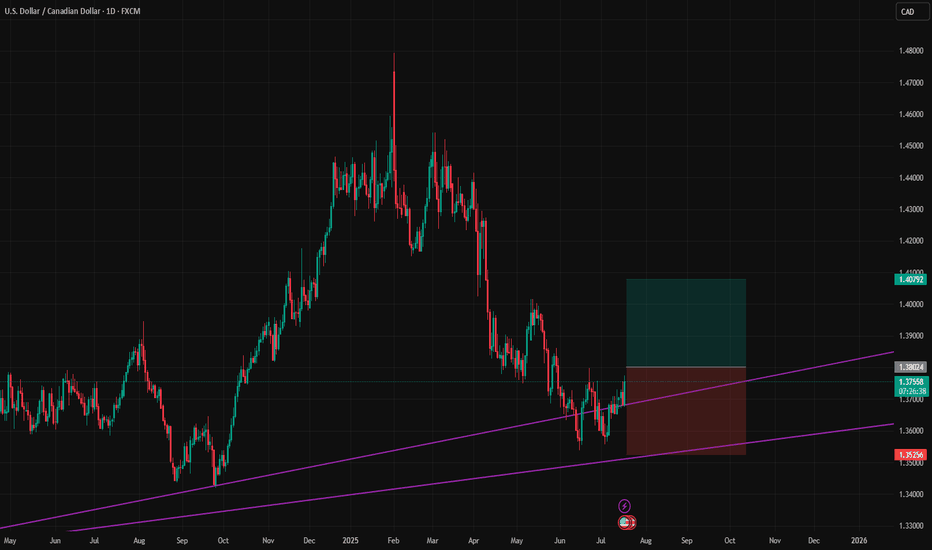

USDCAD is breaking the trendline againOnce again, FX_IDC:USDCAD is breaking its medium-term downside resistance line, drawn from the current highest point of this year. If the rate remains above it, we may see a few more bulls stepping in. Let's take a look.

MARKETSCOM:USDCAD

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

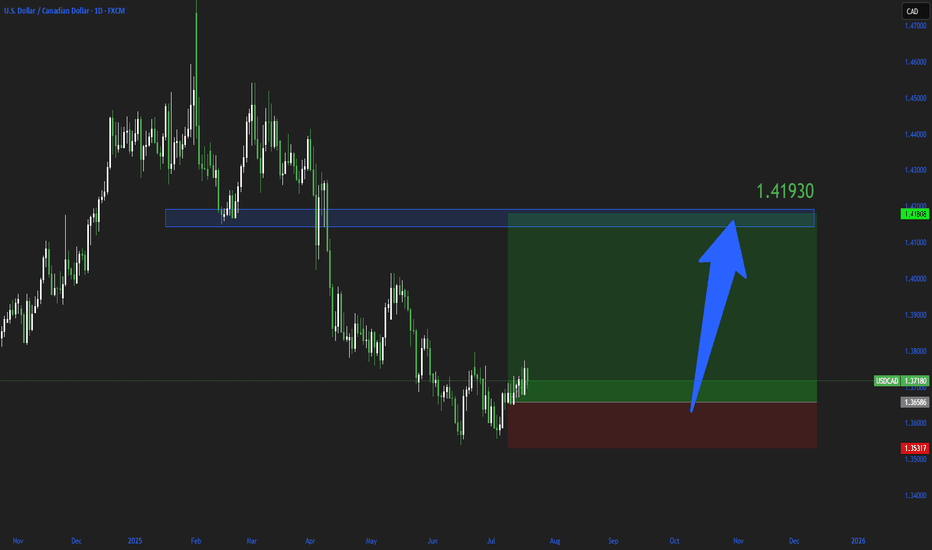

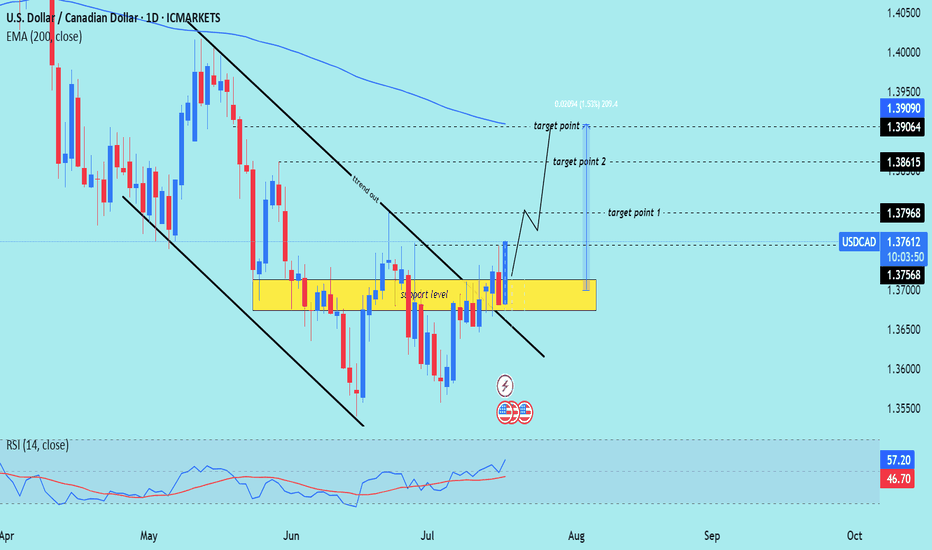

USD/CAD) strong bullish trend Read The captionSMC trading point update

Technical analysis of USD/CAD (U.S. Dollar vs Canadian Dollar) on the daily timeframe. Here's a breakdown of the trade

---

Technical Breakdown:

1. Breakout from Descending Channel:

Price has broken out above a descending trend channel (marked with black lines).

This breakout suggests a potential trend reversal or at least a bullish correction phase.

2. Key Support Zone (Yellow Box):

The yellow zone marked as “support level” was a strong consolidation area.

Price has bounced off this zone multiple times, forming a solid base for further upside.

3. Bullish Price Action:

Price has closed above the previous resistance (now support), signaling bullish intent.

Current candle structure confirms strength with bullish continuation patterns.

4. RSI Indicator:

RSI is at 56.38, indicating bullish momentum without being overbought.

Suggests there is room for further upside before exhaustion.

---

Target Levels:

Target Point 1: 1.37968 (near-term resistance)

Target Point 2: 1.38615 (intermediate target)

Target Point 3: 1.39064–1.39090 (longer-term resistance near the 200 EMA)

Mr SMC Trading point

---

Trade Idea Summary:

Bias: Bullish

Entry Zone: Break and retest of the yellow support area (~1.368–1.371)

Target Zone: 1.379 – 1.390

Invalidation: Break below the yellow support zone

Confluence: RSI strength + breakout of downtrend channel + structural support

plesse support boost 🚀 this analysis)