ZB1! trade ideas

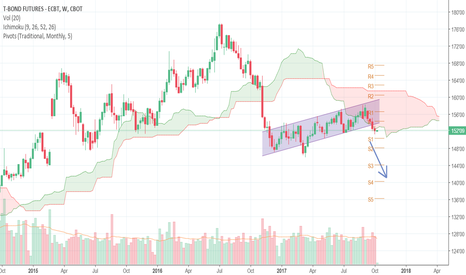

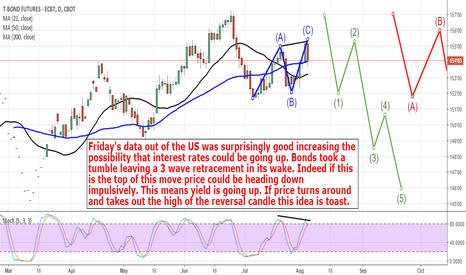

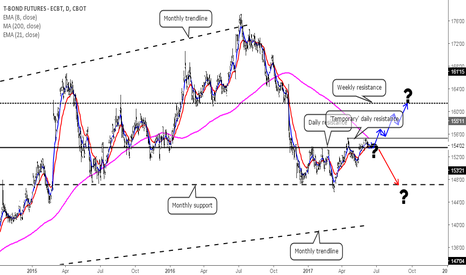

Caution for 30 year bondsThere are a number of things in play which could point to a possible sell off.

1. Volume spike blow off at recent high

2. Ascending triangle - bearing pattern

3. Break out failure/bull trap at recent high

4. Divergence on 3/10 Oscillator

It doesn't seem logical that bonds could sell off here, but on the basis of the above, there is only one thing to follow, and that is price.

Gold is displaying the same sort of behaviour. I will do another chart on that.

If bonds and gold fall, it would only give possible strength to the argument for more upside on the futures indices.

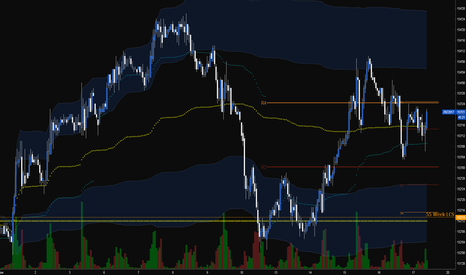

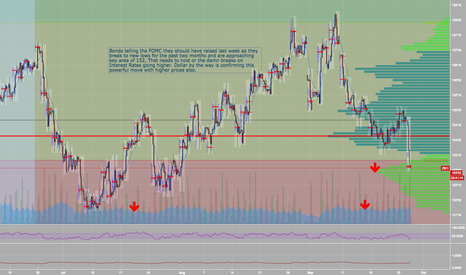

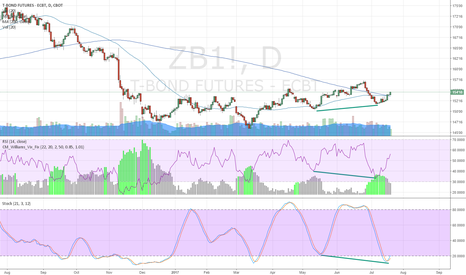

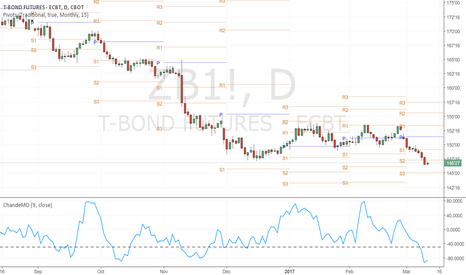

ZBU2017 - September T-Bond Futures - Daily and Weekly ReviewDAILY - Double NR7 is making T-Bonds look like there is a shorterm top in place. Trend is still up. Price > 20 (155'01),50,100,200 DMA, with all but the 200 in a positive slope. Strong moving average convergence in the 154'24-155'02 area. Looking to buy a pullback. Long end has been strong with the flattening of the yield curve, this is the current macro trend, anything here should be seen as an adjustment in the curve and profit taking.

WEEKLY - To the moon! Held the 200WkMA and have rallied nicely up from there. Above the 20WkMA as well. Also, the longterm RSI is above its moving average and crossed the 50 line with positive slope. First Resistance viewed at the 50/100WkMA area 158'08 and then the election drop point at 162'00. As in the daily, the macro economics of the flattening yield curve with even some pundits talking inverted should keep the trade in an up trend. As traders watch price action and keep an eye on the TLT as it has a projection point of 131 right now which would line up with the $ZB_F getting to the 160+ area.

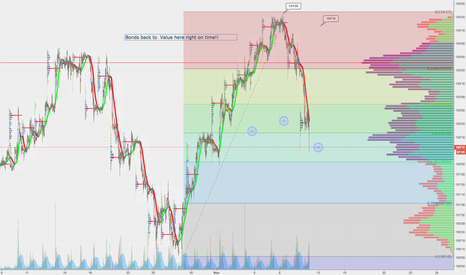

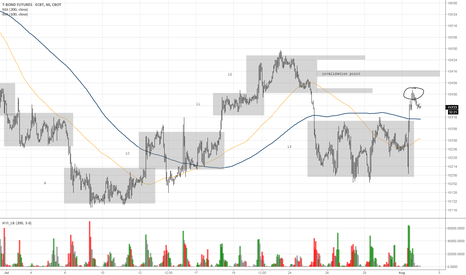

Guarded by a dragon?As one of my friends requested, I have made a graphical representation for him.

For several days, we can see that this Bond has been consolidating within the daily resistance and the monthly support. Just a few days ago, the Bond has broken above this consolidation mode. However, as seen on the graph, this may be a false breakout as this has occurred before thus making that area as the 'temporary' daily resistance.

Watch this pair closely!

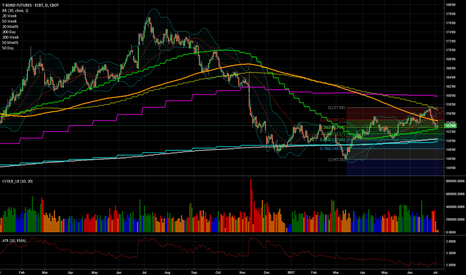

Trend-follow signals : ZB1! (60min)If you are a trend following trader, find instruments and timeframes that satisfy your trending criteria and just follow the signals. But remember:

consolidation period can be brutal to a trend following strategy. Also, the longer the trend, the greater the chance for a reversal.

With that in mind, make sure you apply proper money management.