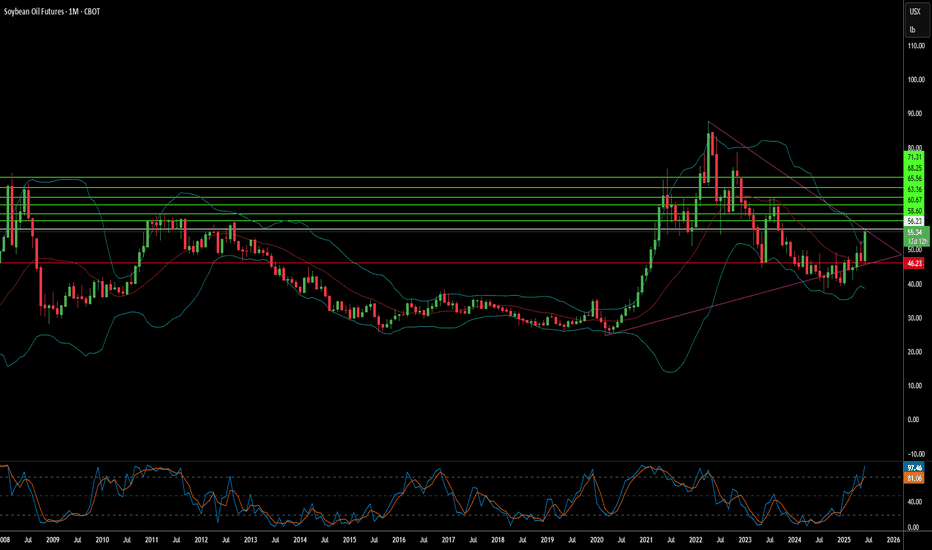

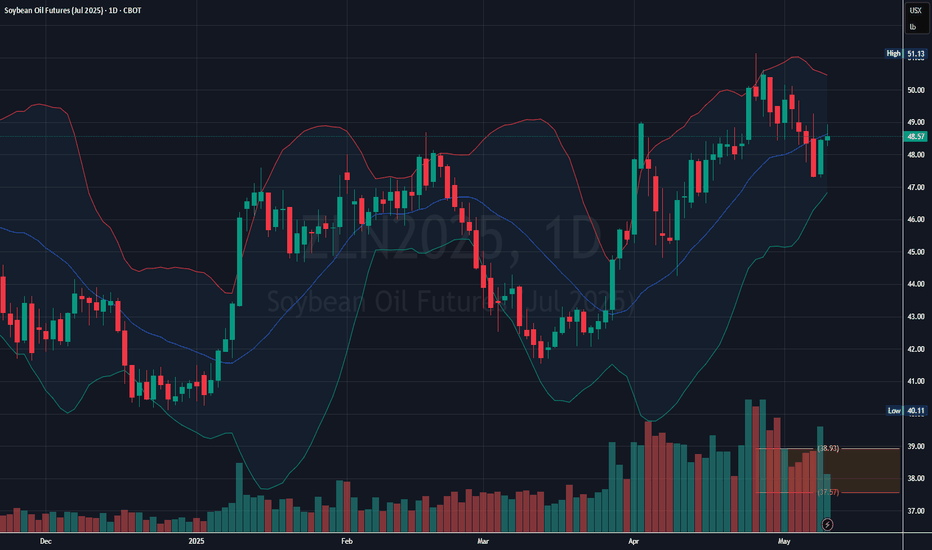

Why the Sudden Surge in Soybean Oil Prices?Recent sharp increases in Chicago soybean oil prices reflect a confluence of dynamic global and domestic factors. Geopolitical tensions, particularly those impacting crude oil markets, have played a significant role, as evidenced by the recent surge in Brent crude futures following events in the Mid

Contract highlights

Related commodities

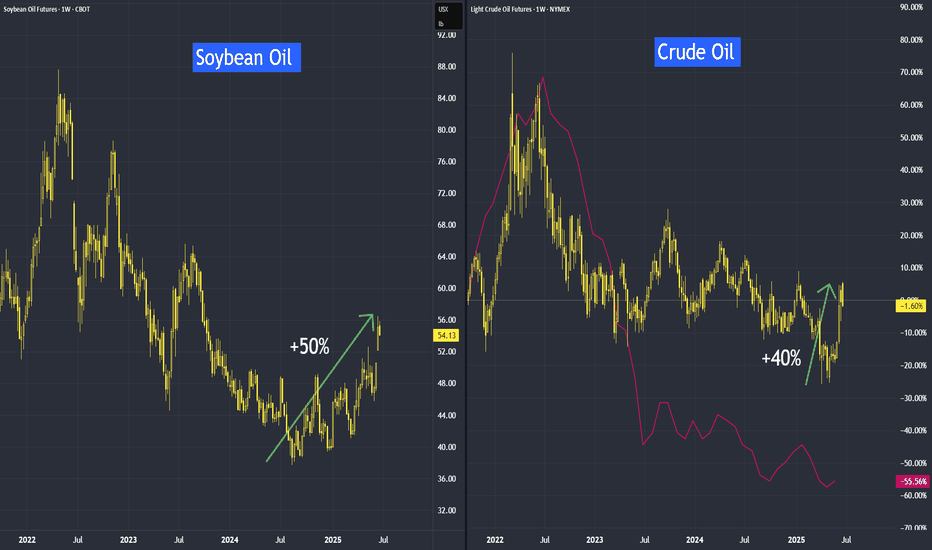

Why Soybean Oil Outperforms Crude Oil?From their recent lows, soybean oil has quietly crept up by 50%, while crude oil has risen by 40%. The reason goes beyond the recent renewal of tensions in the Middle East — it runs deeper than that.

Mirco SoybeanOil Futures

Ticker: MZL

Minimum fluctuation:

0.02 per pound = $1.20

Disclaimer:

•

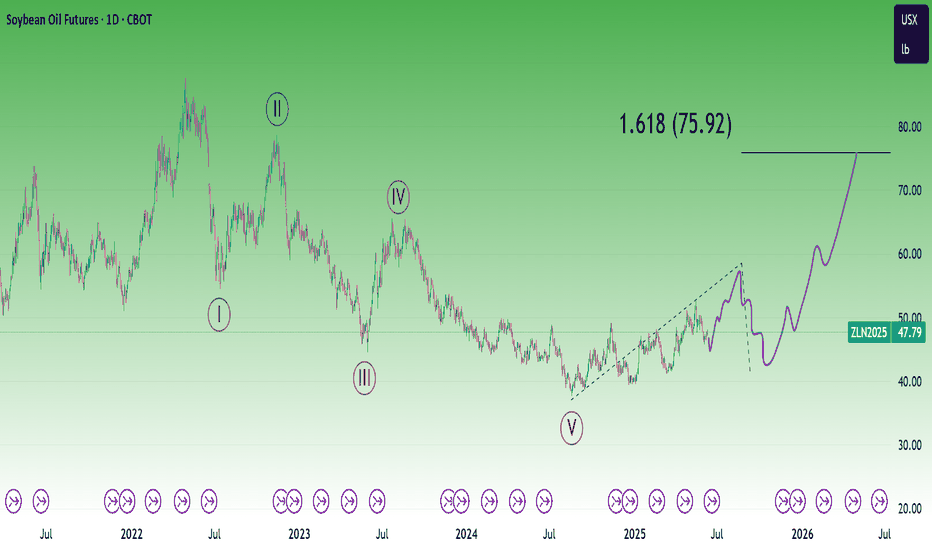

Soybean OilTo me the view is pretty clear. In 2026 we may see 75$

* The purpose of my graphic drawings is purely educational.

* What i write here is not an investment advice. Please do your own research before investing in any asset.

* Never take my personal opinions as investment advice, you may lose your m

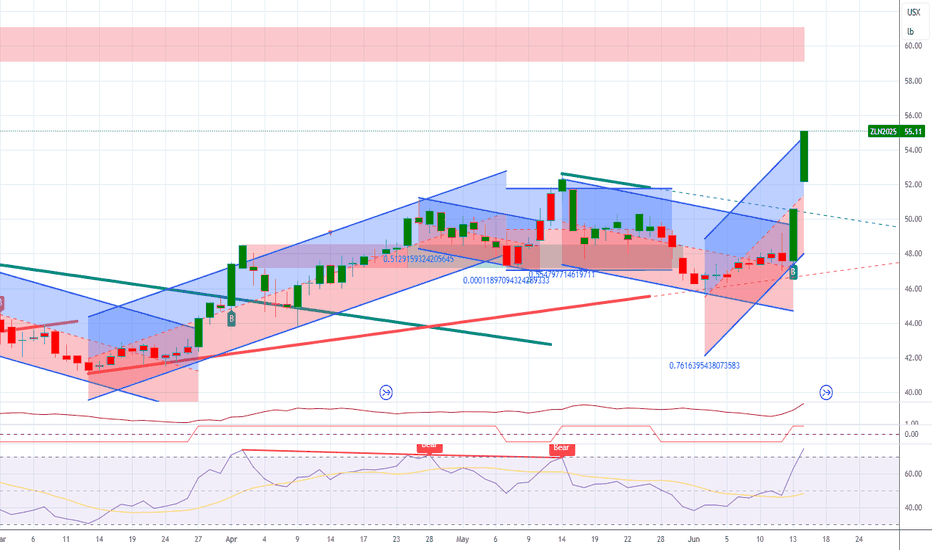

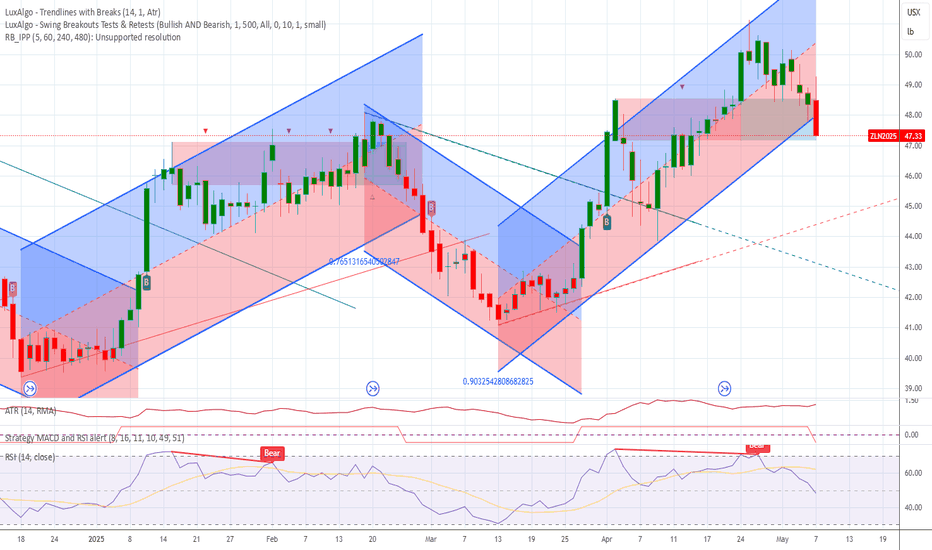

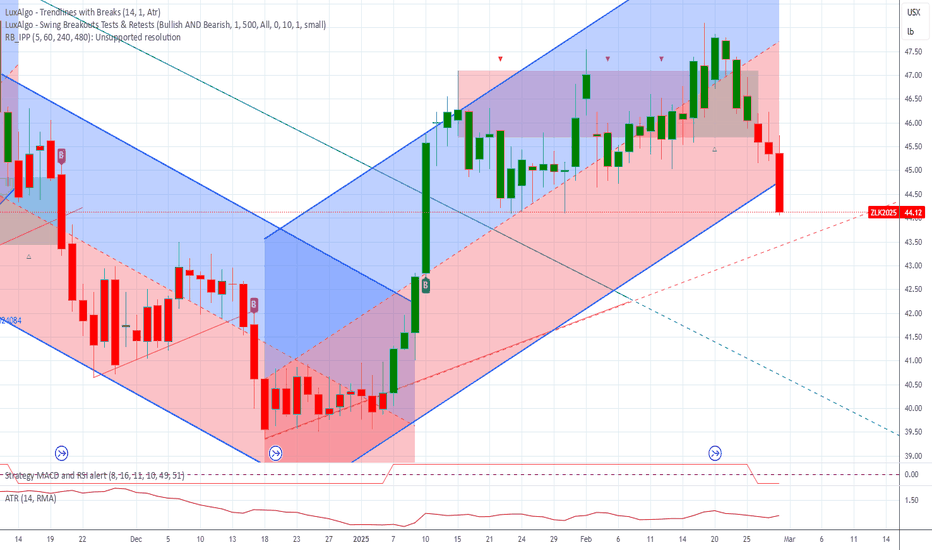

Soybean Oil Futures: Bearish Retest Signals Further Downside

The price is now failing to maintain above the short-term moving average, hinting at weak bullish follow-through.

ZLN2025 is showing signs of exhaustion after an uptrend, with bearish pressure increasing. If bulls fail to reclaim $49.00, the next leg could favor a continuation downward toward $46

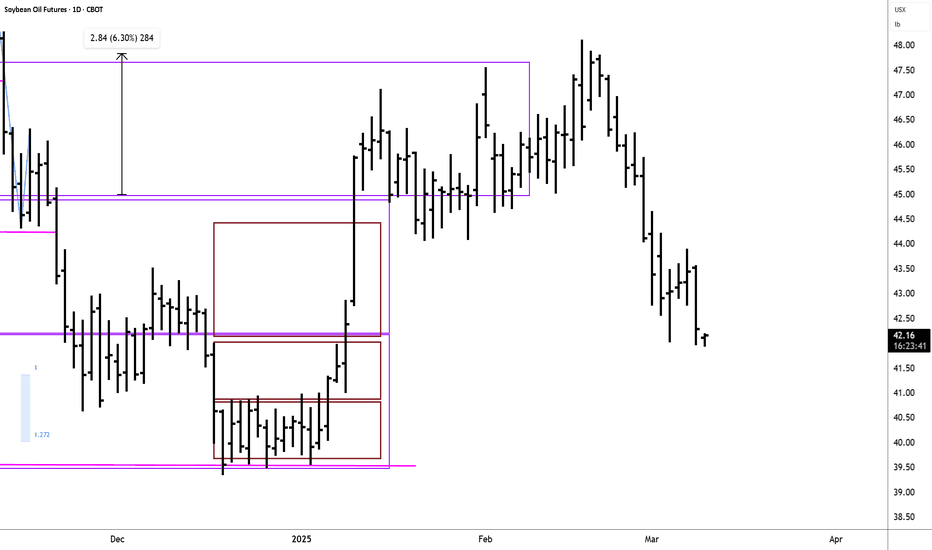

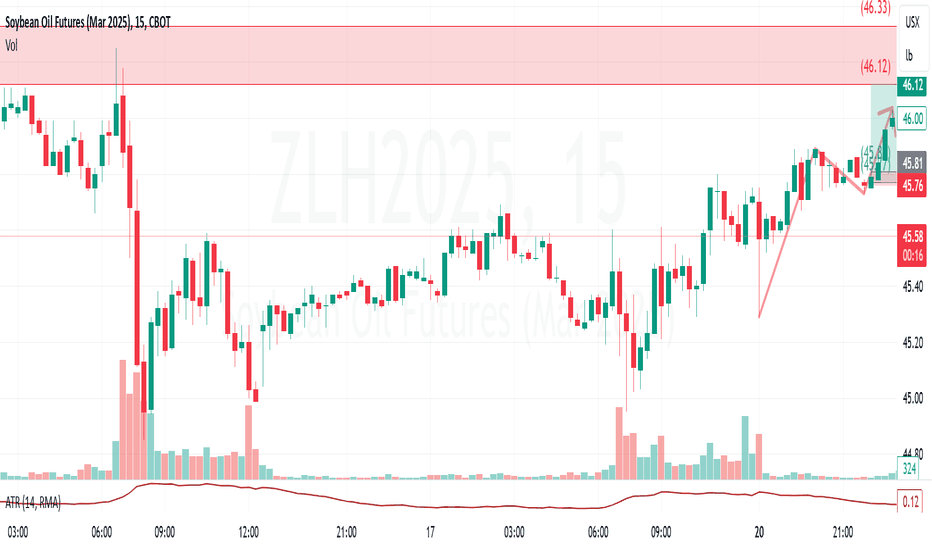

ZLH 15m Long 2025-01-20 10:50PM Maybe I should call this a 5m timeframe. I did my analysis on a 15m, but refined my zones on a 5m.

Also, I was doing my analysis late on the 20th, and was seeing my target as the upper curve. If I had taken that trade, I would have wanted to follow with my stop, but I was about to go to sl

See all ideas

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The nearest expiration date for Soybean Oil Futures (Mar 2017) is Mar 14, 2017.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Soybean Oil Futures (Mar 2017) before Mar 14, 2017.