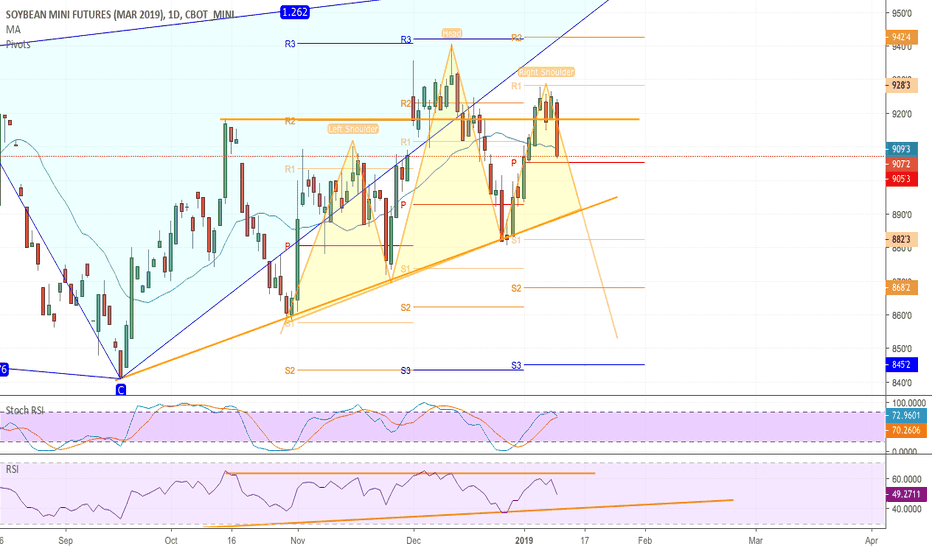

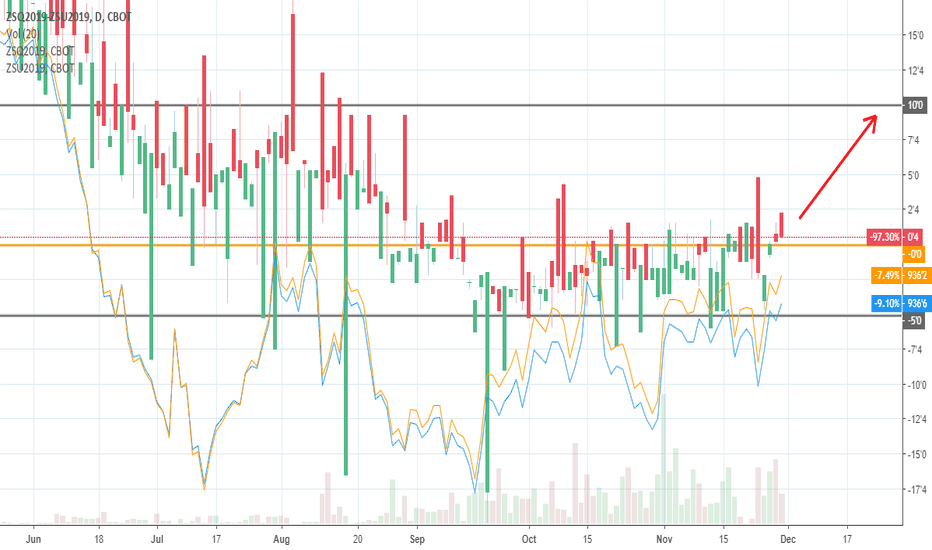

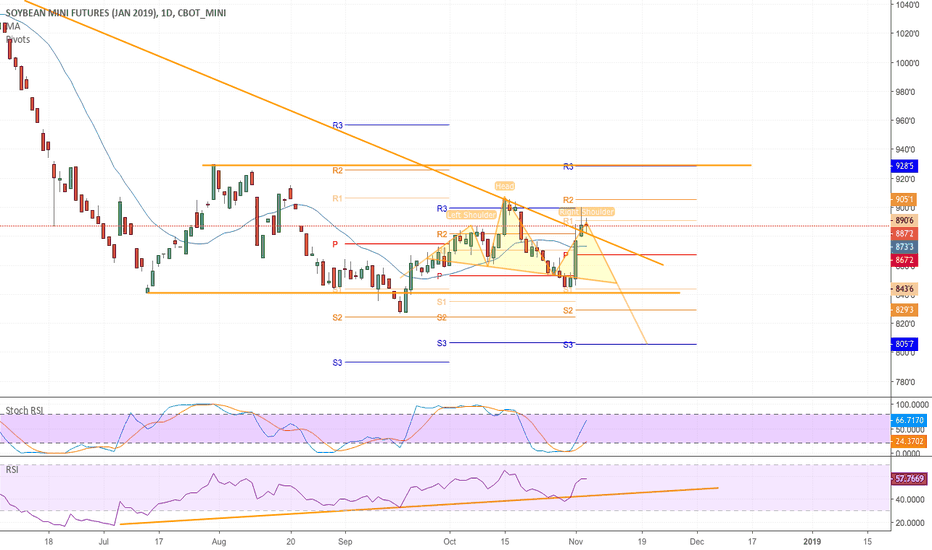

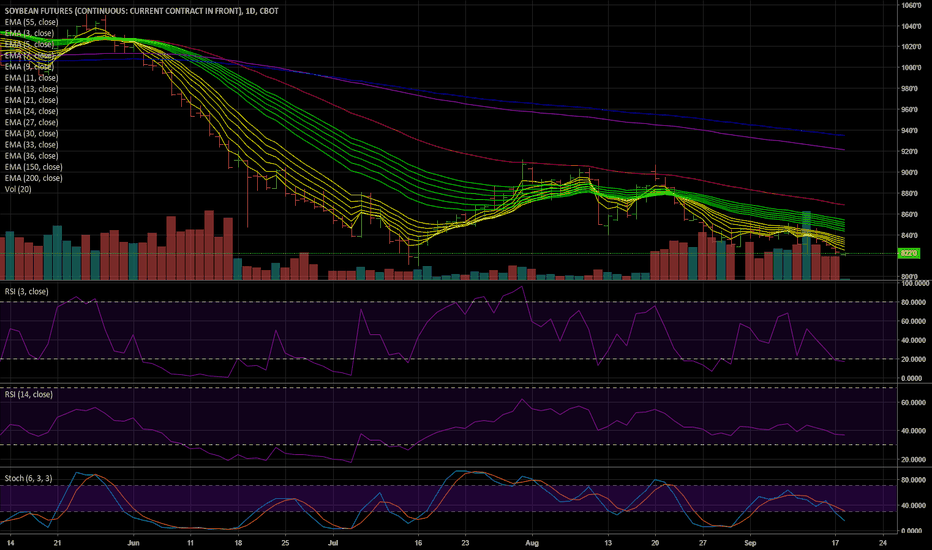

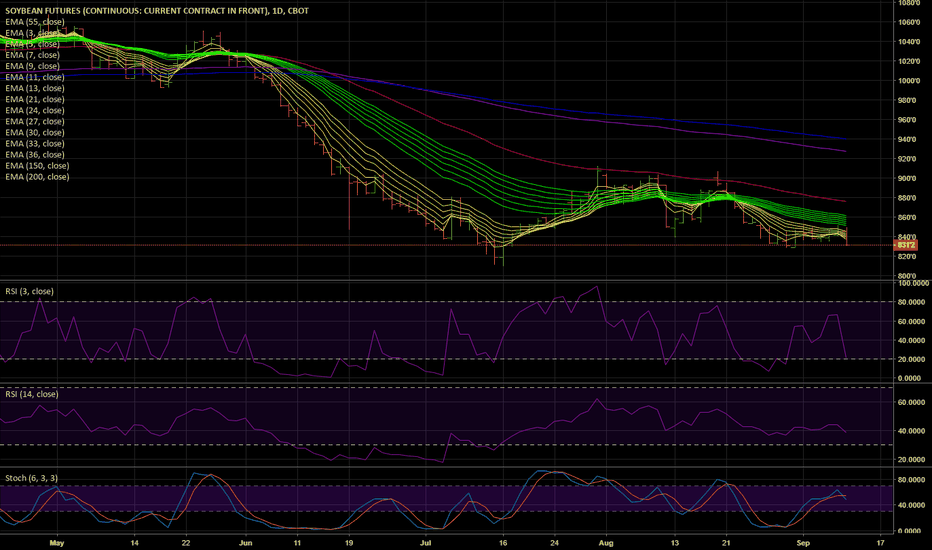

Soybeans Mar 2019 equilibrium patternDaily soybeans futures chart tightening up nicely and should give a good signal in either direction when it breaks. Purple line is 200MA; Yellow line is 100MA.

ZS1! trade ideas

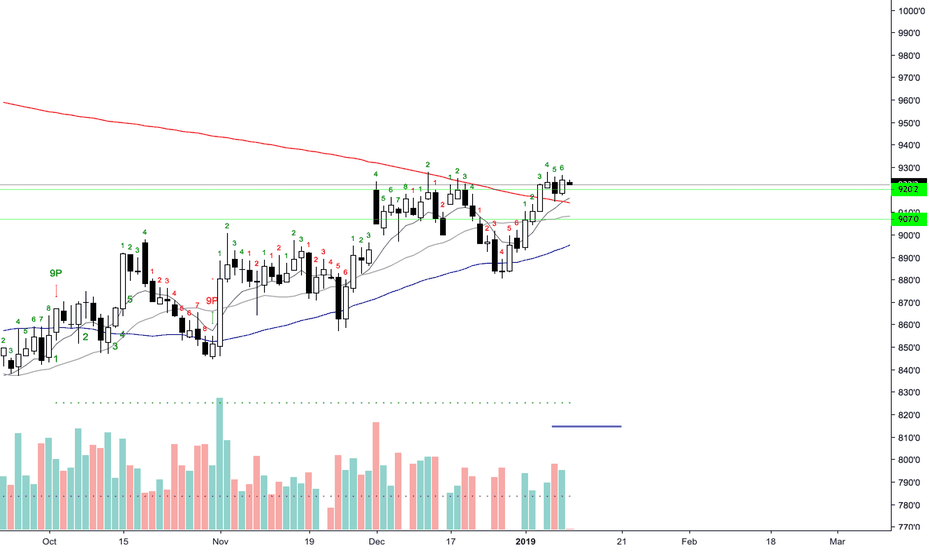

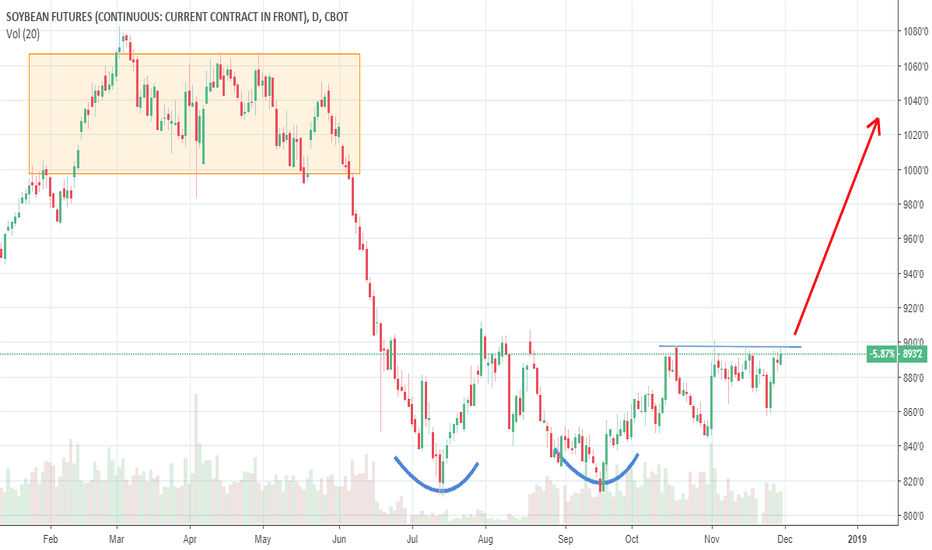

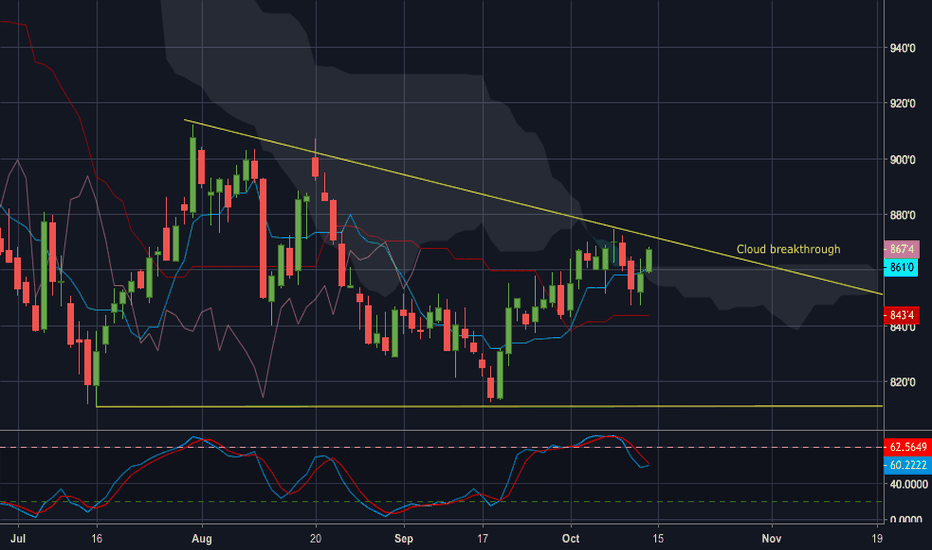

Nice Grain PlayI have been looking into different assets to play in these uncertain markets. The grains have etfs with options that track futures so here it is. SOYB tracks tracks front month soybeans so thats the play. I like that these have held the 200 day moving average and retested. The 50 ma is quickly heading higher as well for a golden cross forming in the near future. 920 was a significant resistance that was easily broken. With a weaker dollar coming into play these commodities will be boosted. Im looking for around 950 on beans, a hefty target, I know however they have not been good to this product in the last year.

Do these not look like the most bullish graphs of 2019?I see pure unadulterated gold when I look at these market bottoms. Dollar top soon, metals bottom already. I see ABC continuation pattern with huge accumulation of long positions at the bottom. I've been reading market wizards the past couple weeks. I do have a commodity bias, the dollar is going to collapse, our economy is not as healthy as major media outlets would have you believe. The federal reserve has fueled this market rally. Anytime you're feeling the economy looks good just analyze how low and long our interest rates had to remain to keep markets increasing.

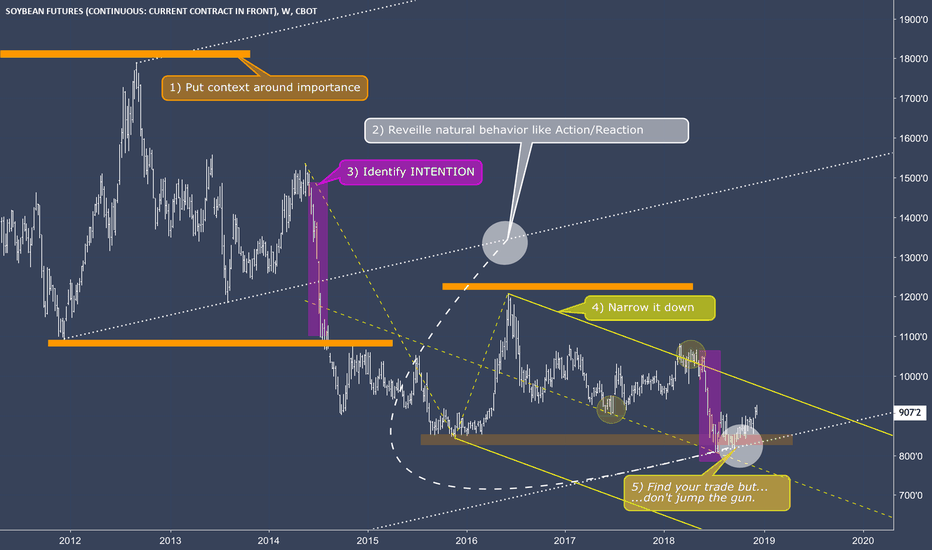

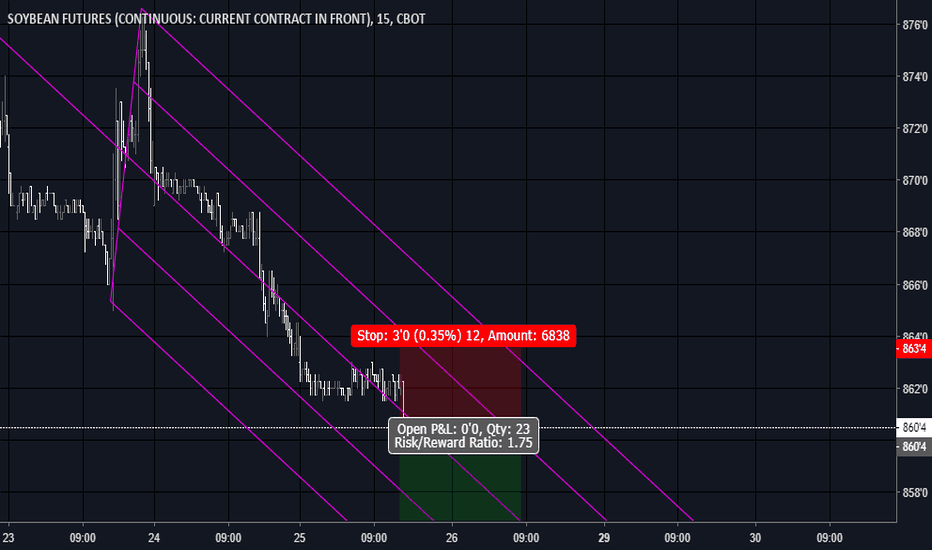

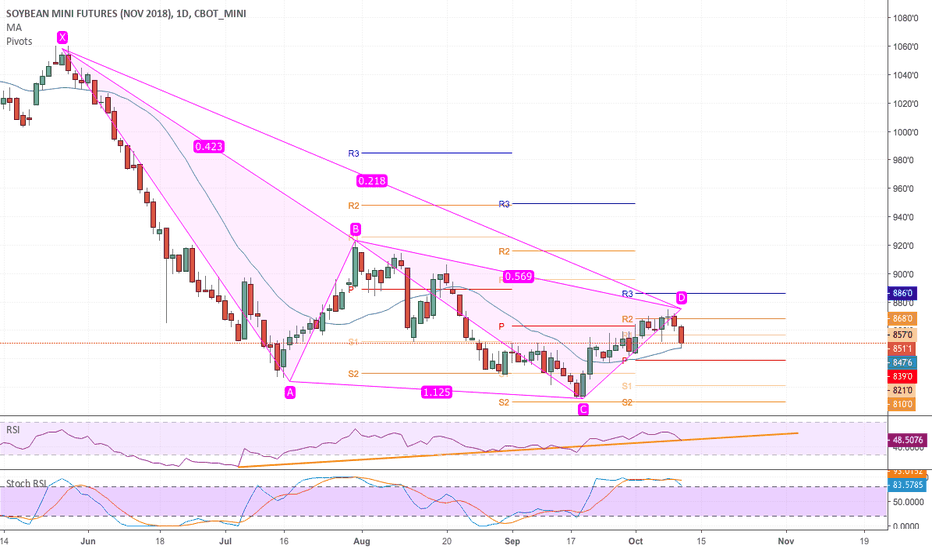

SOYBEANies - A simple approach to find hidden facts.Here's how I approach the beanies.

It's a simple concept and it "works" over and over again.

But...what do I mean by "work"?

I mean, that this concept (...go by the numbers on the chart) helps me to understand, and to reveille what's obviously, but hidden from my eyes at the first glance.

It's a simple plan what to analyze step by step...from top-down...exploring different types of facts and finally putting them together into a story that makes sense.

That's it...no magic, just pure crafting.

And you can do this too!

Seriously, just start...

P!

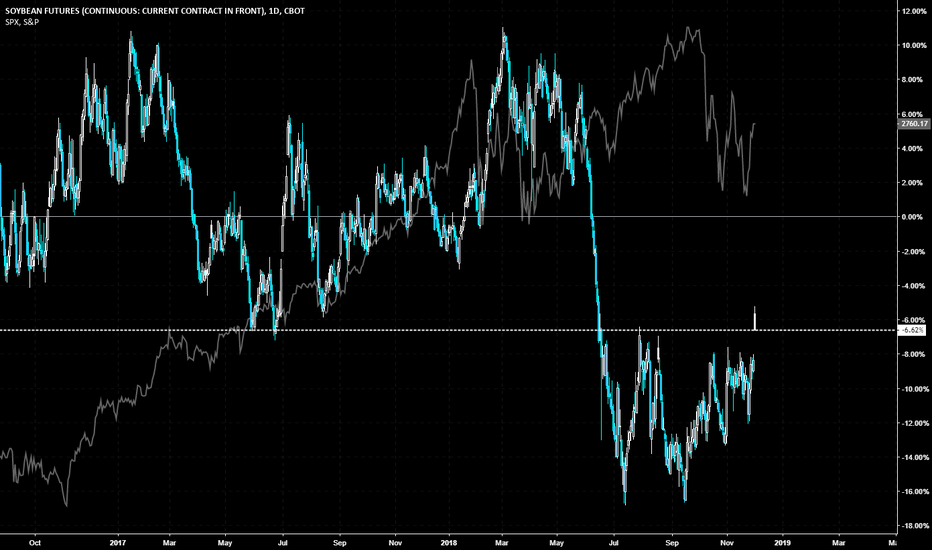

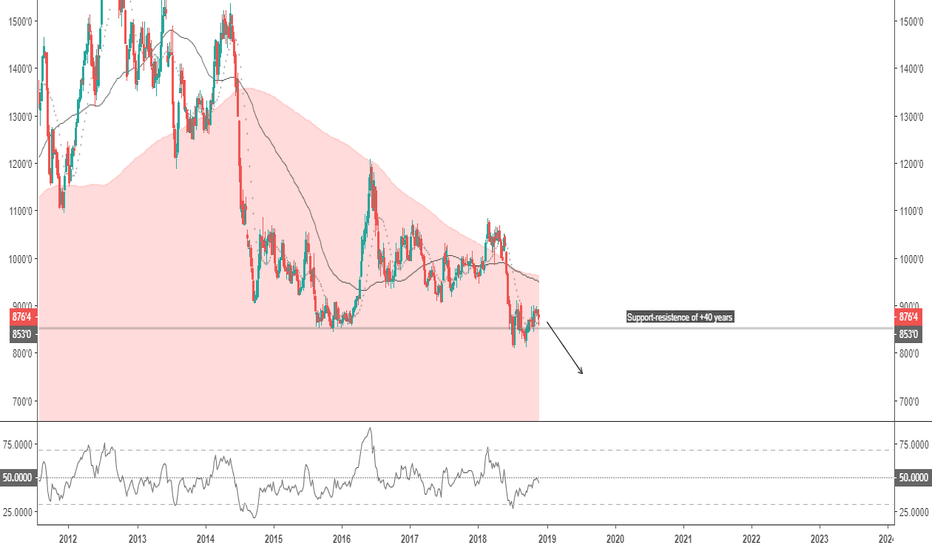

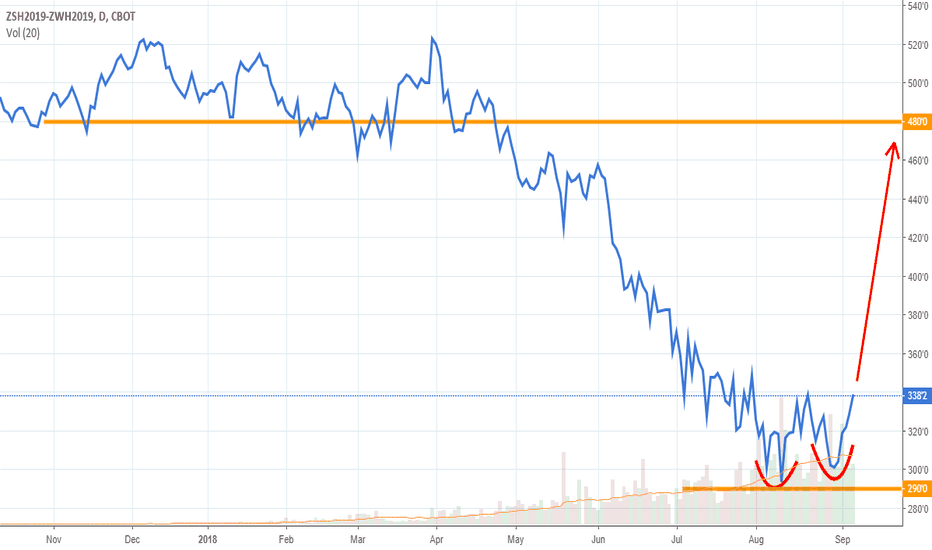

Soybean futures - Short to 700; Horizon: 6 monthsSoybean futures in the CBOT will approach the late 2015 levels of 800-850. The last time this downward support was crossed was in 2004 and it was a big downward trend of -35% with good short entry opportunities. This position is correlated with our medium-term view of bearish commodities in the next 6-7 months with a bullish USD and a bearish EUR. Our target is a drop of -18%, approximately at a price of 700.

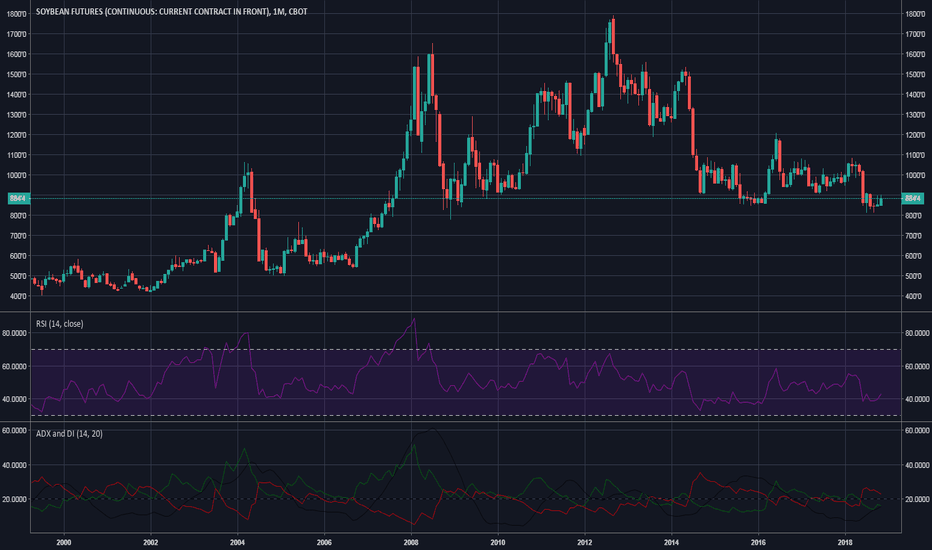

Long SoybeansHi guys ! I post a trading idea for long positions at ZS1! . Recent WASDE report had a price projection for soybeans for 2019 about 900-910. As wee see also in the recent political scene trade war talks at G20 there is a good possibility to go far beyond as from 910. From technical analysis view at the monthly chart is long with target 1056 , RSI is tend to swing to upper levels so I think is a good long signal and ADX now is tending to get a direction which is a further high price. Hope you find it usefull !

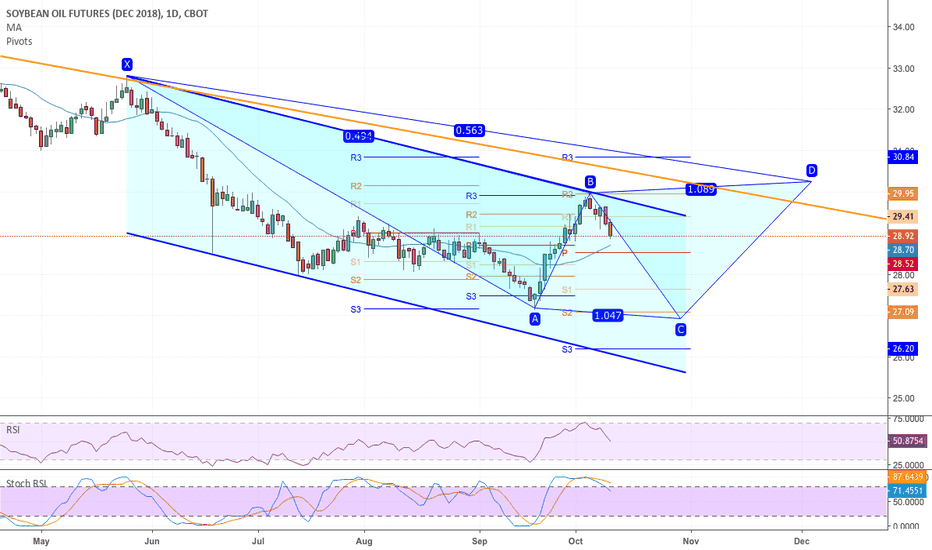

Soybean Oil Reverses Bearish CypherBO has moved lower today eyeing the 20 day MA and pivot at 28.52. RSI falling and Stochastic RSI has crossed over from high levels. If pivot holds increase move up to 29.95. Move under the 20 day MA and pivot would possibly send markets to S1 at 27.63. Overall market is in a downtrend.

Soybeans Future (ZS1) Long ViewHi guys ! I post my new trading idea for ZS1 (Soybeans Future). Soybeans are at a negative momentum with a price range 790-830 , in my view I see that this price is going to reach the level of 900-910 because of the hurricanes in U.S , also ADX and RSI are at ovesold levels and the trend in the next month i suppose is going to change upwards to the price levels of 900