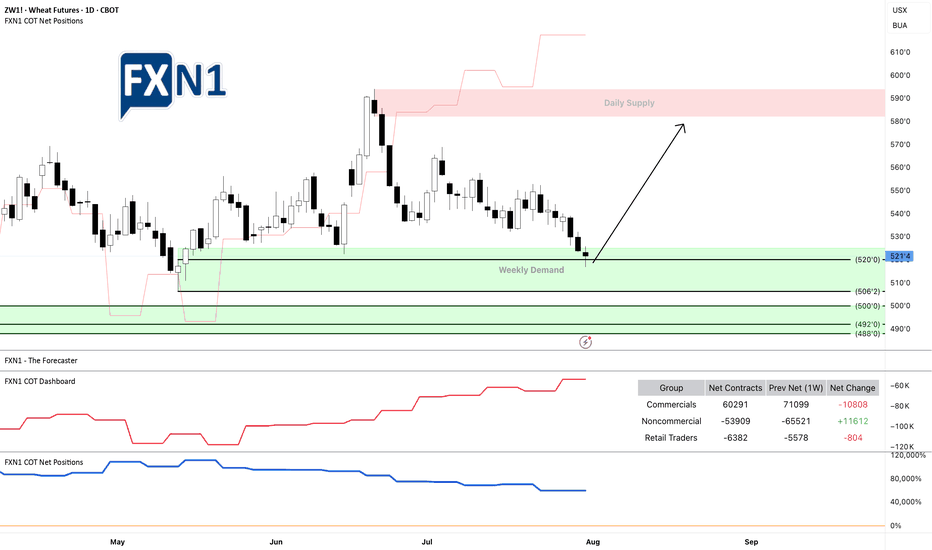

Is Wheat ZW1 Ready for a Long Trade? Key Demand Area InsightsThe futures of Wheat ZW1! are reaching a weekly demand zone, where we observe non-commercials going long and retail traders holding short positions. This could present a potential setup for a long trade. Note: There is another demand area below, but the positions of commercials are less clear compar

Contract highlights

Related commodities

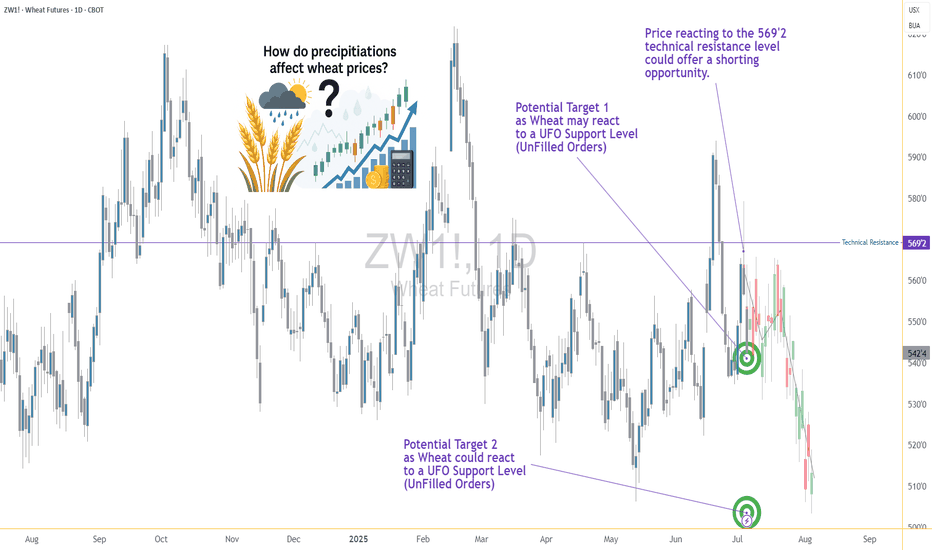

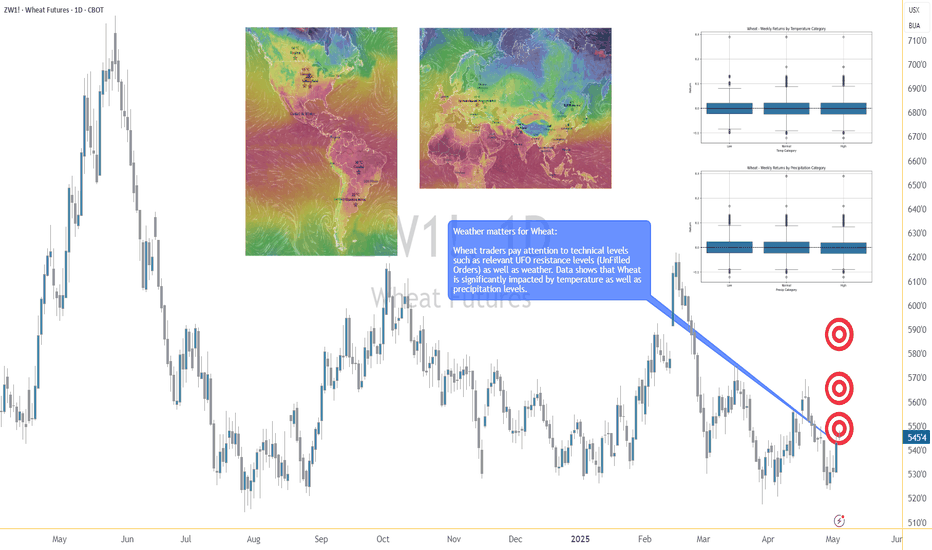

Rain or Ruin? Analyzing Wheat Prices During Precip Extremes1. Introduction: When Rain Means Risk for Wheat Traders

Rain is life for wheat crops—until it isn’t. In the world of agriculture, water is essential, but extremes in precipitation can cause just as much harm as droughts. For traders in the wheat futures market, understanding this relationship betw

WEAT making move?Wheat futures (ZW) have cleared a zone of resistance with a 4.6% one day move. As tracked by the WEAT ETF, current price seems to be heading for a retest of the 200 Daily SMA (currently at $4.90). The 200 Daily SMA has reversed previous attempts to break out in October 2024 and February 2025. Wi

Heatwaves and Wheat: How Temperature Shocks Hit Prices🌾 Section 1: The Wheat–Weather Connection—Or Is It?

If there’s one crop whose success is often tied to the weather forecast, it’s wheat. Or so we thought. For decades, traders and analysts have sounded the alarm at the mere mention of a heatwave in key wheat-producing regions. The logic? Excessive

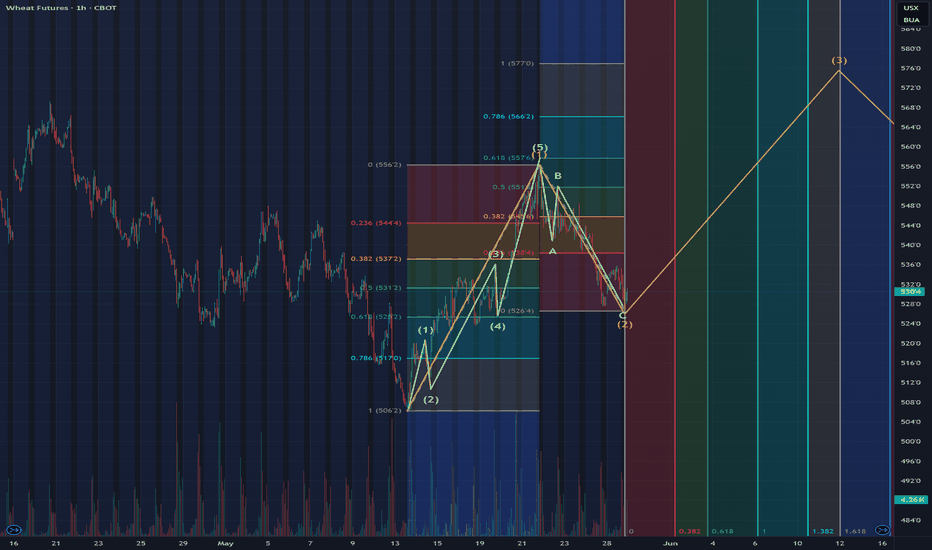

Wheat Futures – Quick Update | May 28, 2025Wheat Futures – Quick Update | May 28, 2025

---

📈 Overview

Swing low formed at $5.06 on May 13 (capitulation volume spike)

Pullback to $5.26–5.28 now likely completed Wave 2 of a new impulse

Indecision candles (daily spinning top, 4 h dragonfly doji) signal exhaustion of selling

---

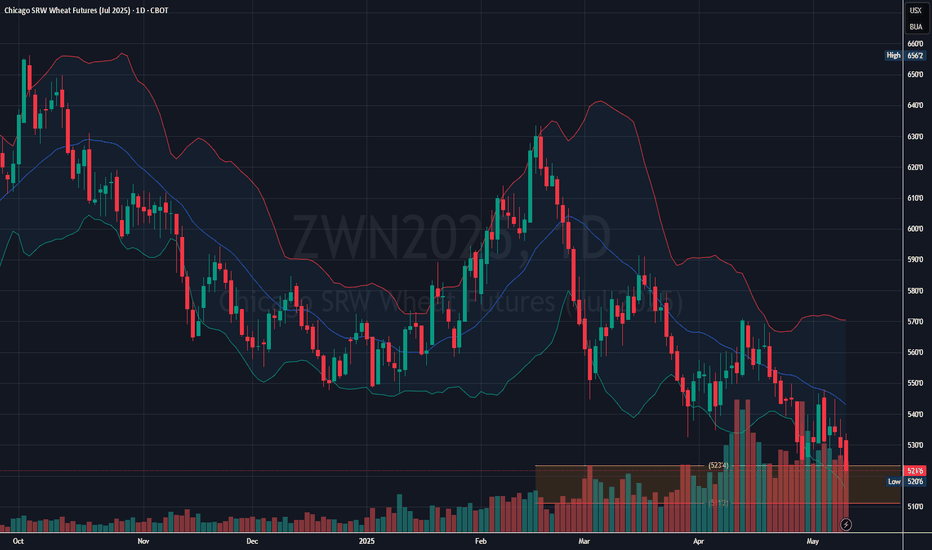

Wheat Futures Under Pressure: Breakdown Near Key Support

Short-term trend: Bearish. Price is consistently making lower highs and lower lows since late February.

Medium-term trend: Also bearish, as confirmed by price staying below the midline of the Bollinger Bands.

Price is near the lower Bollinger Band, suggesting it is oversold in the short term. Ho

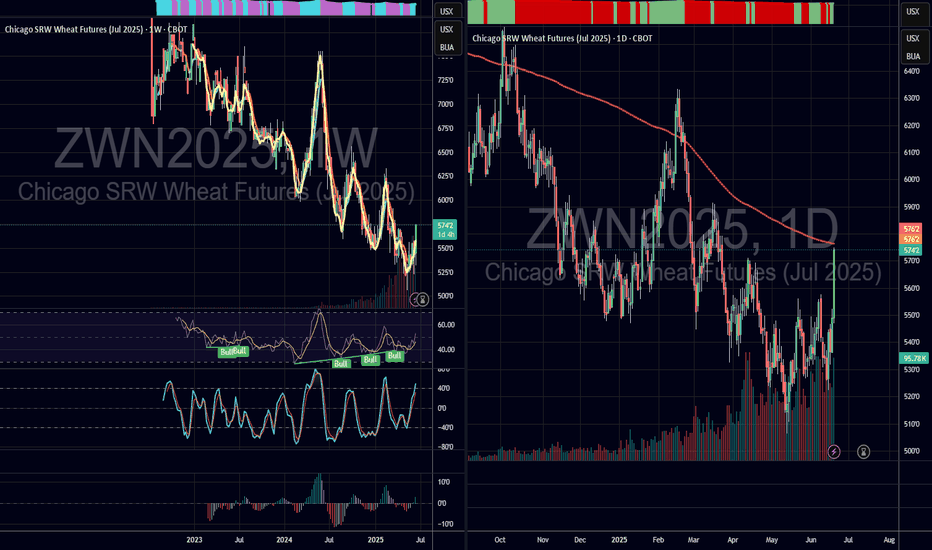

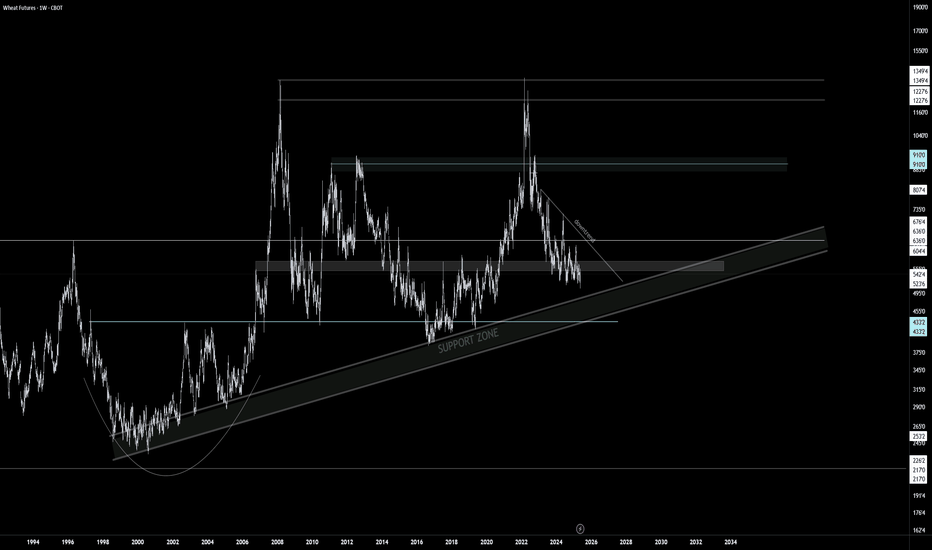

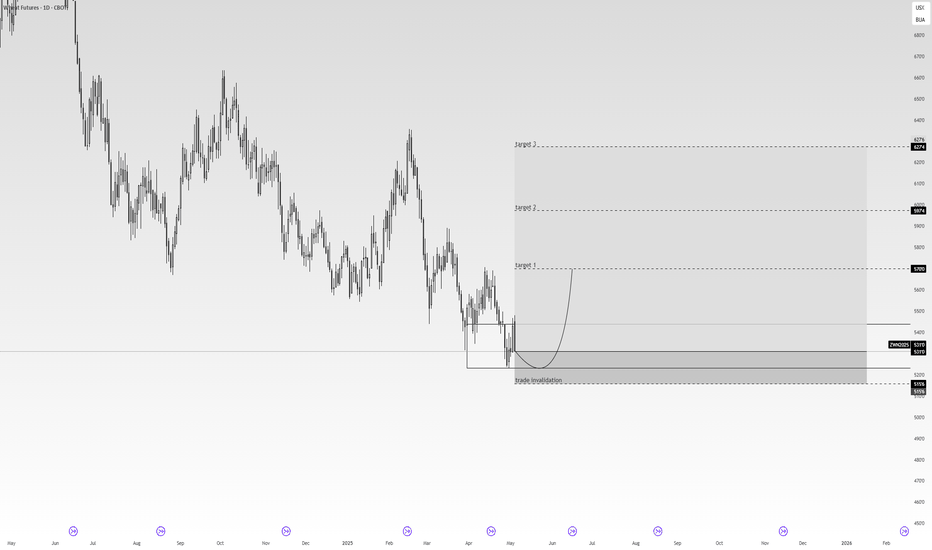

Wheat Trade ideaWheat has been in a downtrend for the past two years, but right now it’s sitting in a strong demand zone on the weekly chart for the year. Both the technicals and fundamentals are starting to look bullish, so this could be a solid setup for a long trade even if the overall trend is still down.

On T

Breadbasket Basics: Trading Wheat Futures🟡 1. Introduction

Wheat may be a breakfast-table staple, but for traders, it’s a globally sensitive asset — a commodity that reacts to geopolitics, climate patterns, and shifting demand from dozens of countries.

Despite its critical role in food security and its status as one of the most traded a

Wheat Poised for a Seasonal Breakout – Key TechnicalsWheat Futures Update –

Focus: Spring Setup + Multi-Timeframe Convergence

📈 RSI

RSI on both 1H and 4H charts bounced from oversold in March and continues to rise. This shows improving momentum with no signs of overbought stress yet. Bullish divergence at the lows confirms the current rebound.

⚡

See all ideas

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The nearest expiration date for Chicago SRW Wheat Futures (Jul 2025) is Jul 14, 2025.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Chicago SRW Wheat Futures (Jul 2025) before Jul 14, 2025.