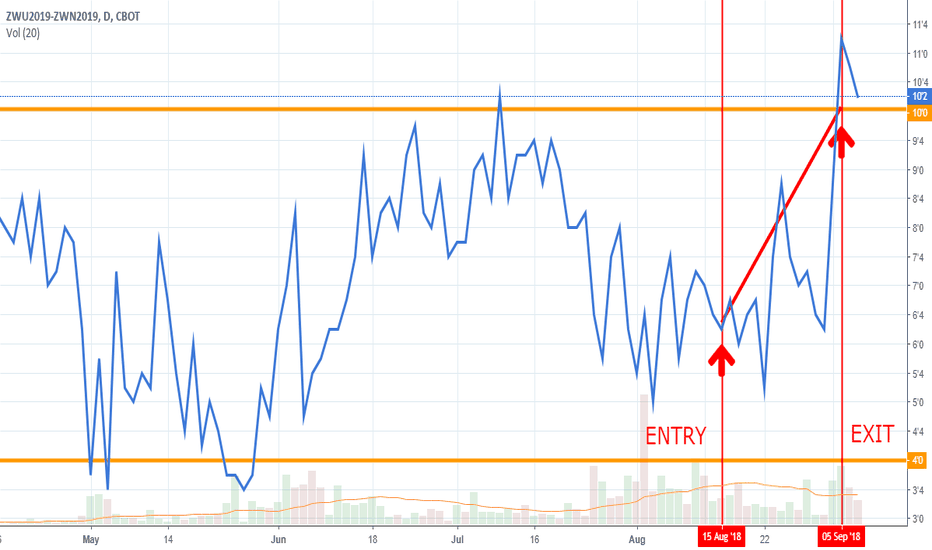

XW1! trade ideas

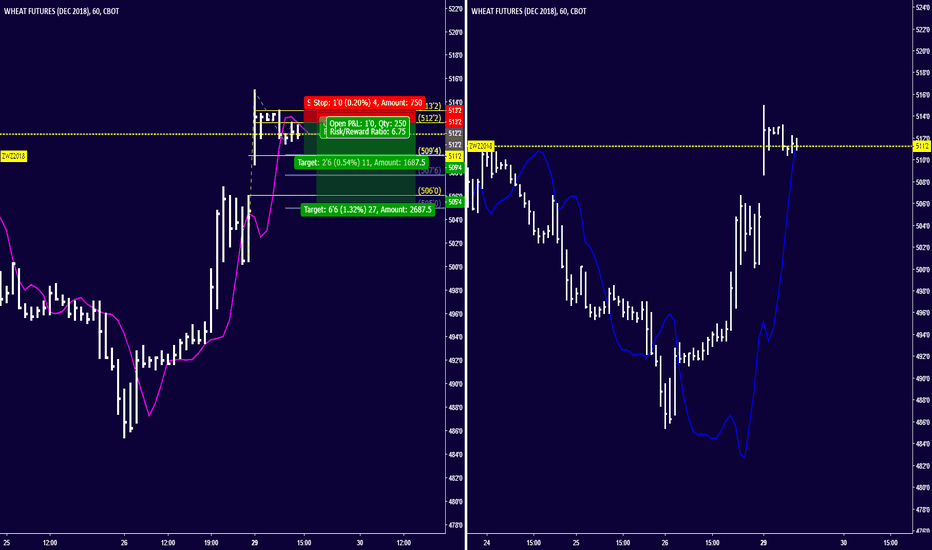

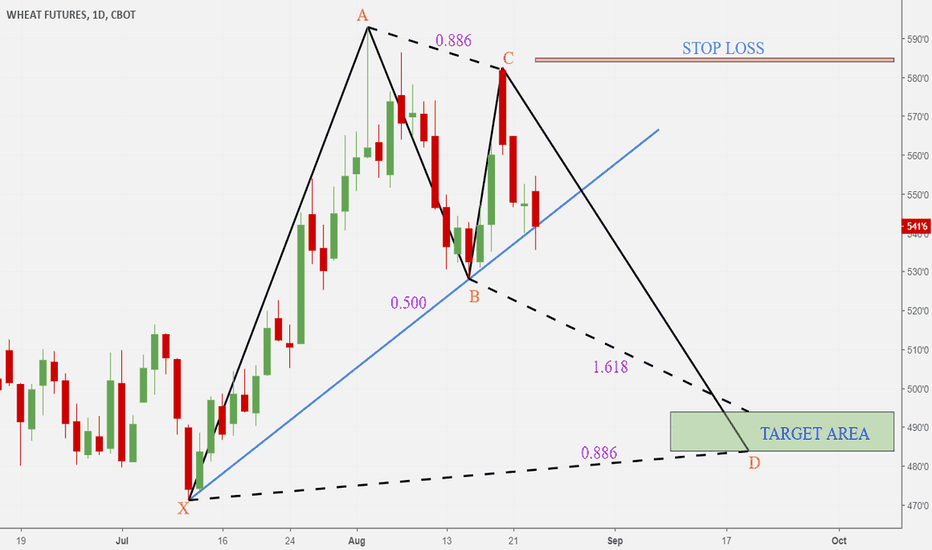

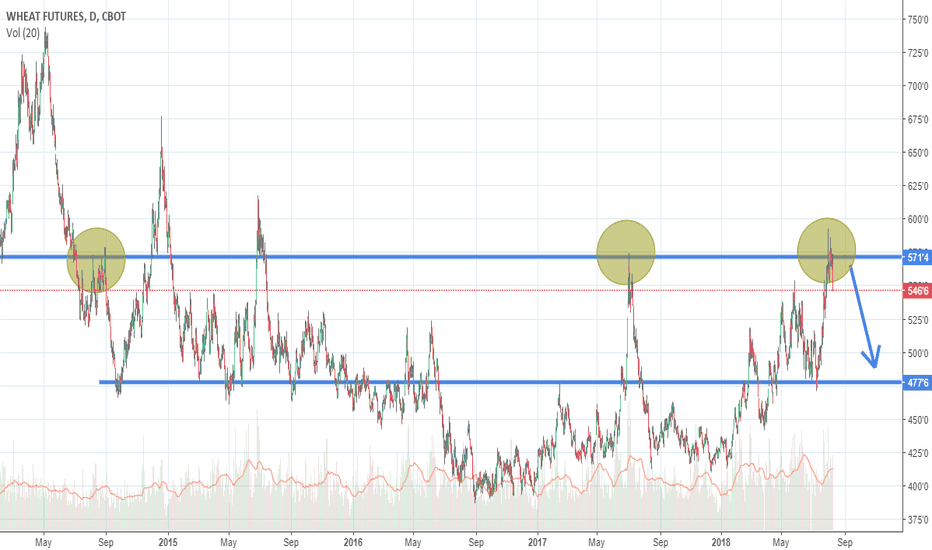

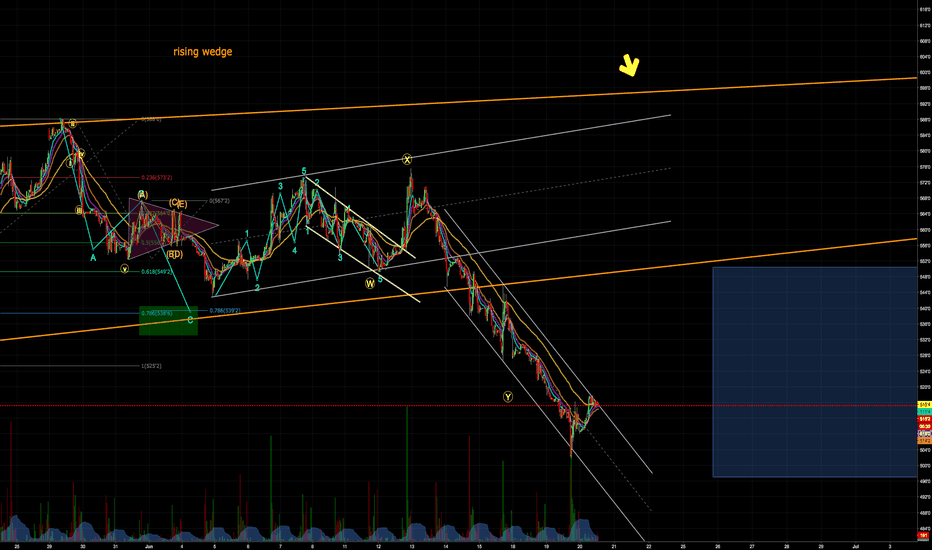

Wheat - Time for a choiceWheat has failed 4 weeks in a row to break the 525 price barrier - the weekly MA20 which is in negative direction! If we look at the shape it seems that we will head up, but there are several reasons why we should consider shorting:

Weekly MA 20 just above 525 with negative direction

Daily MA 50 just above 525 with negative direction

We are in decline on the monthly charts

1H, 2H and 4H chart overbought

Sell at 525 $

SL - 530

Target 485 $

Timeframe 2 weeks!

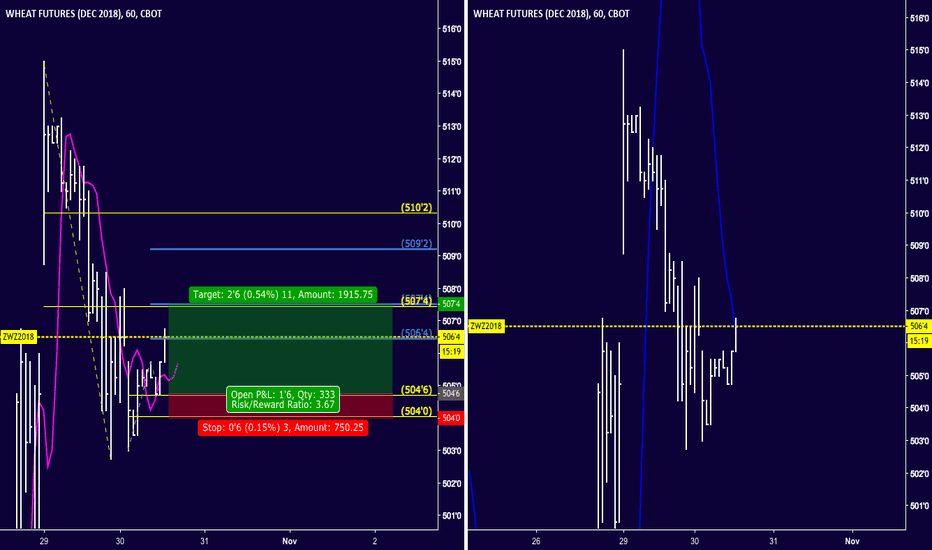

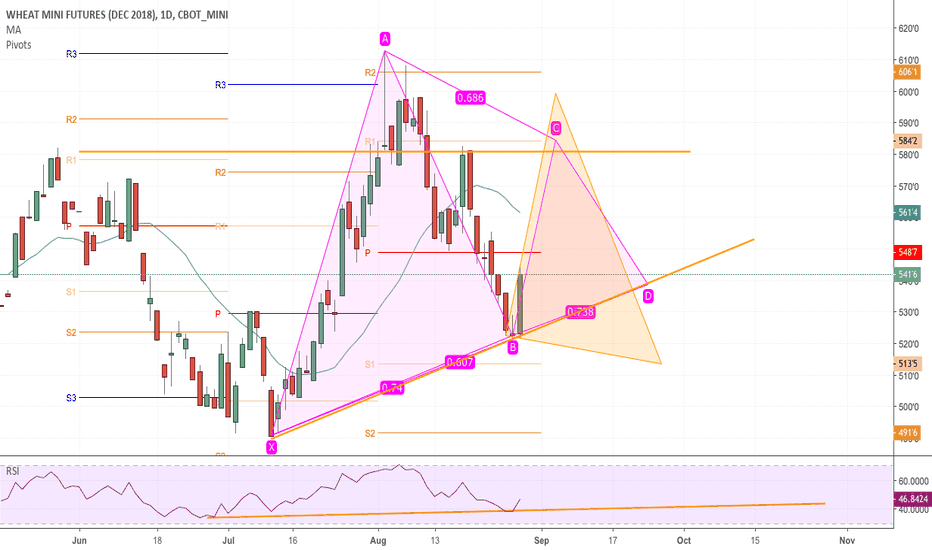

December Wheat Bullish Gartley?December Wheat may have found a reversal point just above the S1 pivot at 520. Upside target for bulls is crossing Pivot at 548'7 and heading for the 20 day moving average at 560. If this reverses then sell target for bears is double bottom at 491'6. Low world supplies may help this move up.

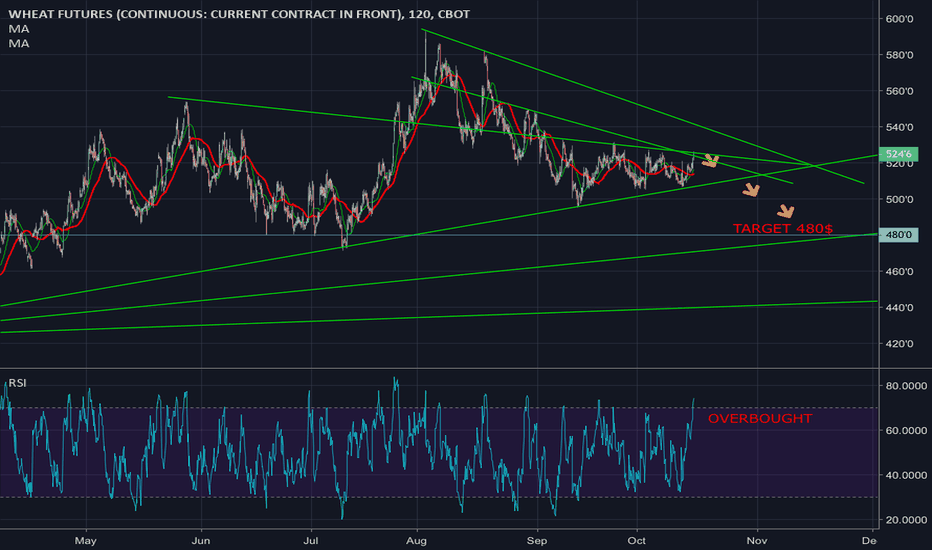

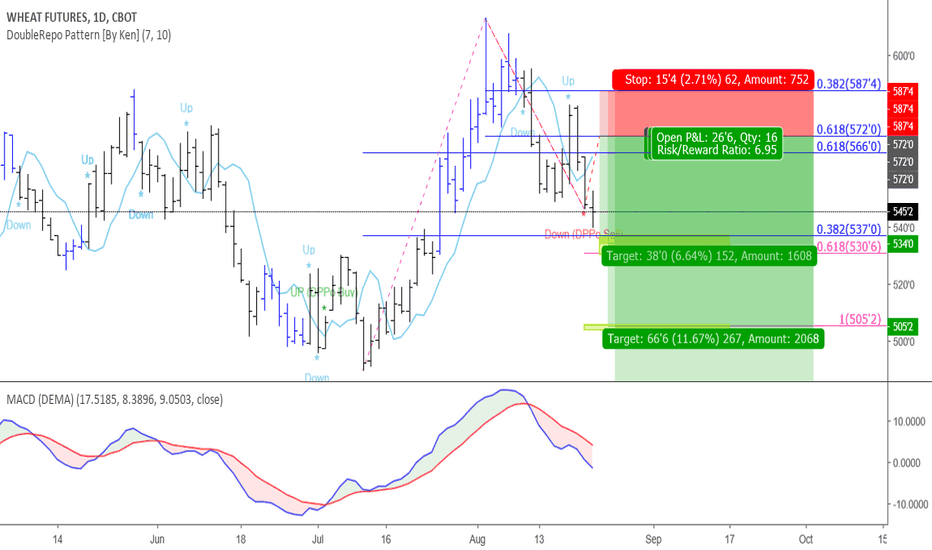

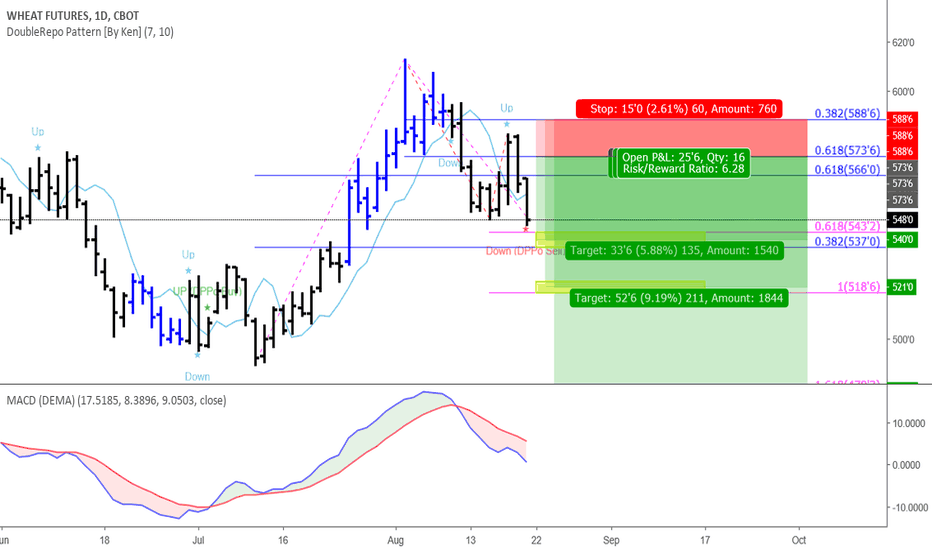

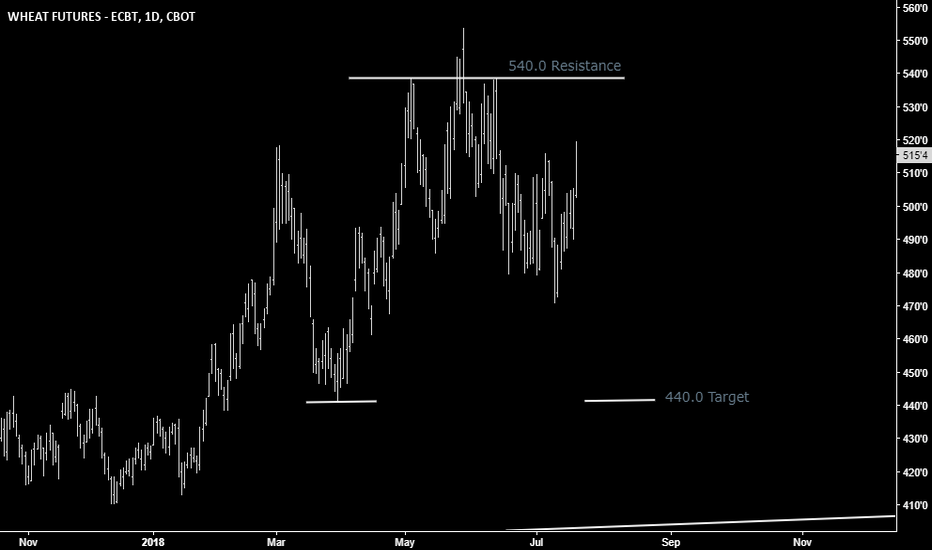

WHEAT FUTURES, 1D, CBOTTrading Signal

Short Position (EP) : 572

Stop Loss (SL) : 587.5

Take Profit (TP) : 534, 505.25

Description

ZW formed Double Repo Sell at 1d time frame. Trade setup with Sell Limit at 0.382 Level (572) and place stop after 0.618 level (587.5). Once the position was hit, place take profit before an agreement (534) and 505.25

Money Management

Money in portfolio : $48000

Risk Management (1%) : $480

Position Sizing

$0.25 = +-$ 12.50 (Standard)

Commission fee = -$2.82/contract (Standard)

EP to SL = $15.5 = -$775/contract (STD)

Contract size to open = 2 standard contracts

EP to TP#1 = $38 = +$1900 (STD)

EP to TP#2 = $66.75 = +$3337.5 (STD)

Expected Result

Commission Fee = -$3.61

Loss = -$496

Gain#1 = +$588

Gain#2 = +$912

Total Gain = +$1500

Risk/Reward Ratio = 3.35

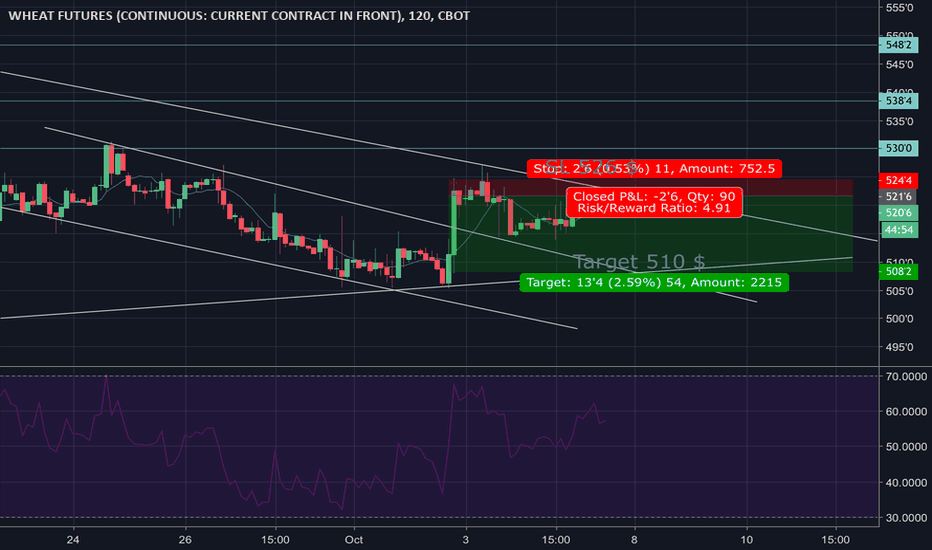

WHEAT FUTURES, 1D, CBOTTrading Signal

Short Position (EP) : 573.75 (573’6)

Stop Loss (SL) : 588.75 (588’6)

Take Profit (TP) : 521, 479.5 (521’0, 479’4)

Description

ZW formed Double Repo Sell at 1d time frame. Trade setup with Sell Limit at 0.382 Level (573.75) and place stop after 0.618 level (588.75). Once the position was hit, place take profit before an agreement (521) and 479.5

Money Management

Money in portfolio : $150000

Risk Management (1%) : $1500

Position Sizing

$0.25 = +-$ 12.50 (Standard)

Commission fee = -$2.82/contract (Standard)

EP to SL = $15 = -$750/contract (STD)

Contract size to open = 2 standard contracts

EP to TP#1 = $52.75 = +$2637.5 (STD)

EP to TP#2 = $94.25 = +$4712.5 (STD)

Expected Result

Commission Fee = -$3.61

Loss = -$480

Gain#1 = +$820

Gain#2 = +$1920

Total Gain = +$2740

Risk/Reward Ratio = 4.86

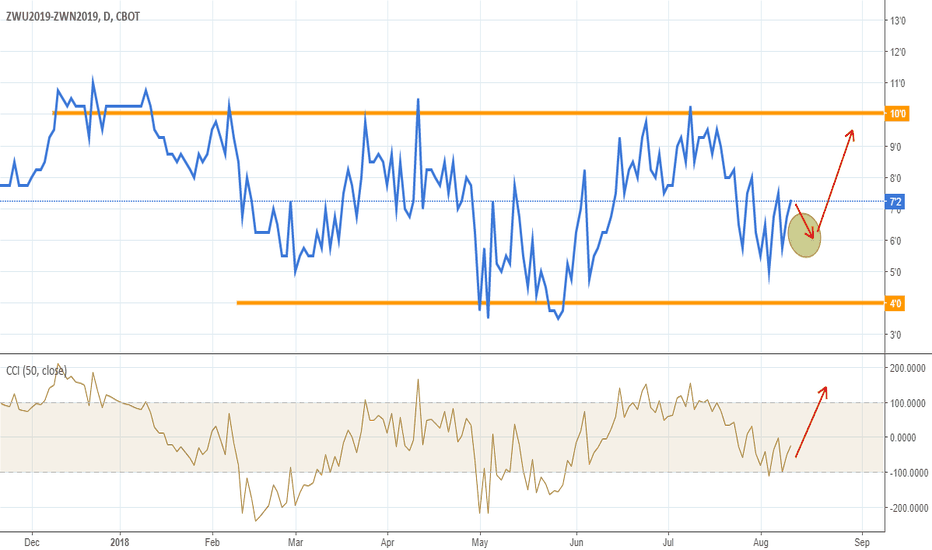

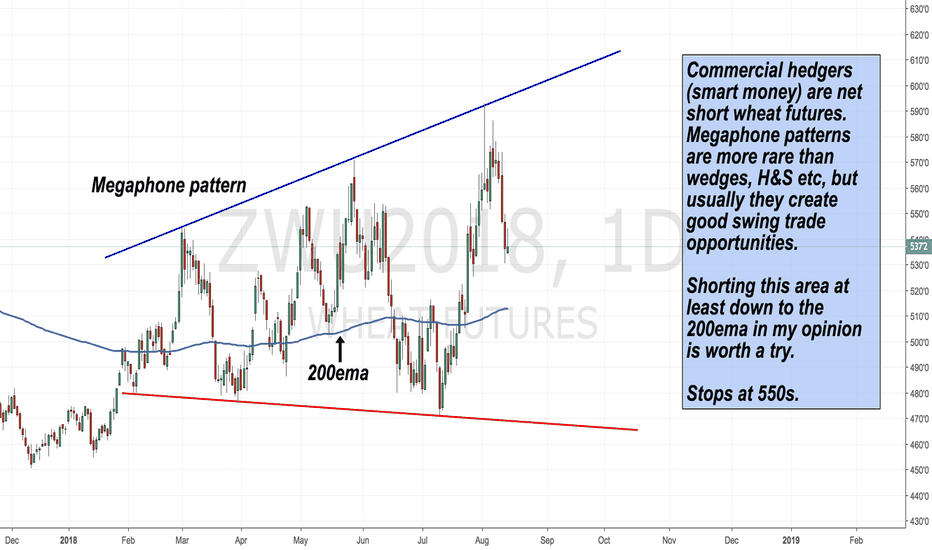

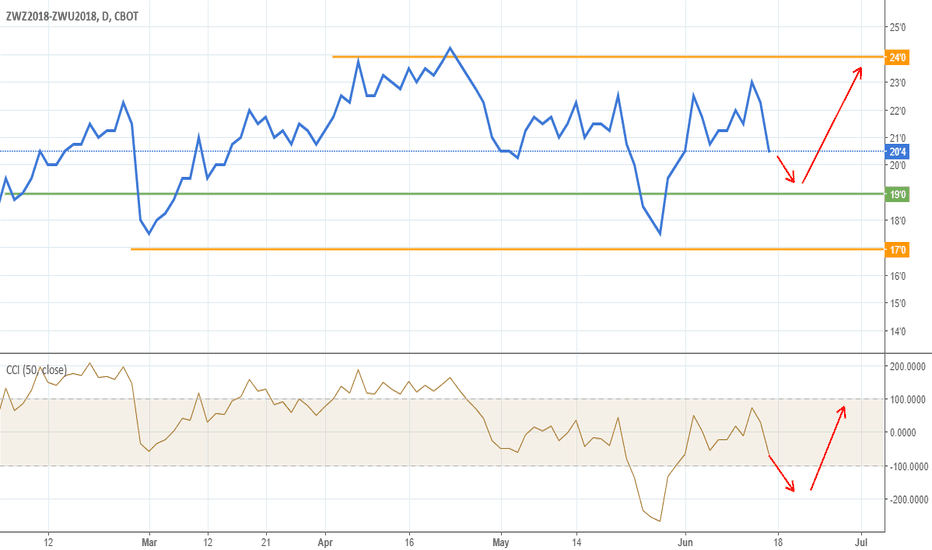

Wheat futures..Getting the timing right when attempting to trade alongside the commercial hedgers considered the smart money is no easy task, to say the least. When they are heavily short it can still take weeks for that asset to start falling in price and of course they do make mistakes, and vice versa when long.

And so assume nothing..Use stops !!