XW1! trade ideas

Long wheat!!Hello all

Let's take a look at wheat.

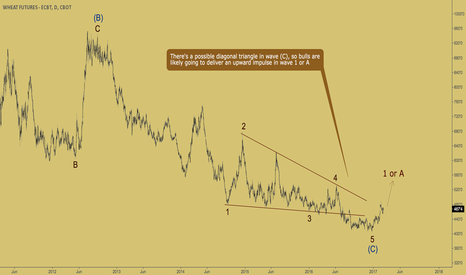

Weekly : Price broke LT trendline. Tested it and failed at kumo cloud top twice. This is third attempt and i expect a breakout. Weekly macd is above zero and crossed up.Chikou is above price and price above TK.

Daily: Price broke the triangle. Daily macd is above o and crossed up. Chikou is above price. Price above TK.

I am long and looking for a test of monthly kijun.

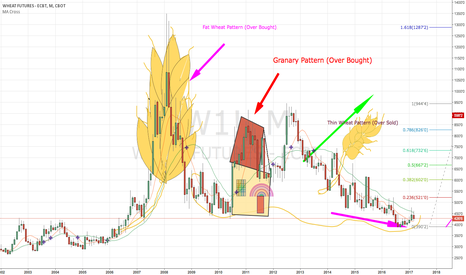

Big question is can this be starting of bigger multi year rally in corn and wheat?

Thanks

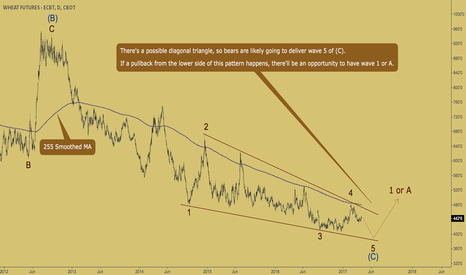

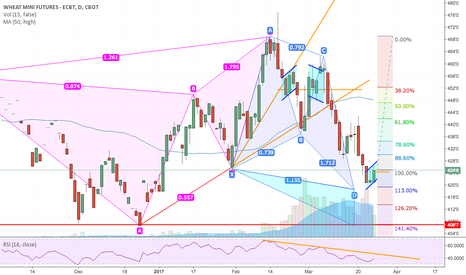

Wheat Turn Around? Cypher?Wheat RSI has floored. Elliot wave 1-5 complete, and wheat is still trying to sell itself off of a bearish flag. There is an outside chance of this becoming a Shark. More likelihood a Bearish Cypher. If up trend forms, looking at 430'4 and then 444'2. After 452. This could also fall more into extension in which case target numbers may change.

Wheat Still in DowntrendJuly Wheat has made a bullish flag and tried to escape it today. Wheat still in downtrend and market full of wheat right now, so still looking for further downside. Upside target reversal may come at 449 downtrend line if flag doesn't decay. If broken and stable we could see a short term turn around. RSI has come to downtrend line so caution should be taken.

Positive, but not there yet!I just adjusted the weekly multi-year bearish trendline to candle peaks.

Indication is bullish (see EWO, MACD and haDelta), but the break has not yet happened.

If price dips in coming weeks, then we will have to look for buy signals in 435-445 range, otherwise just buy the break and close above 475.