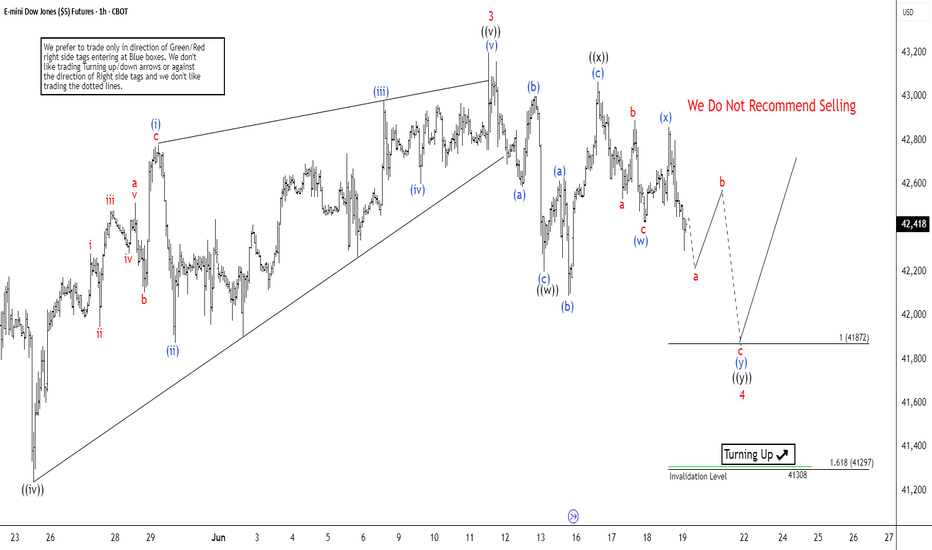

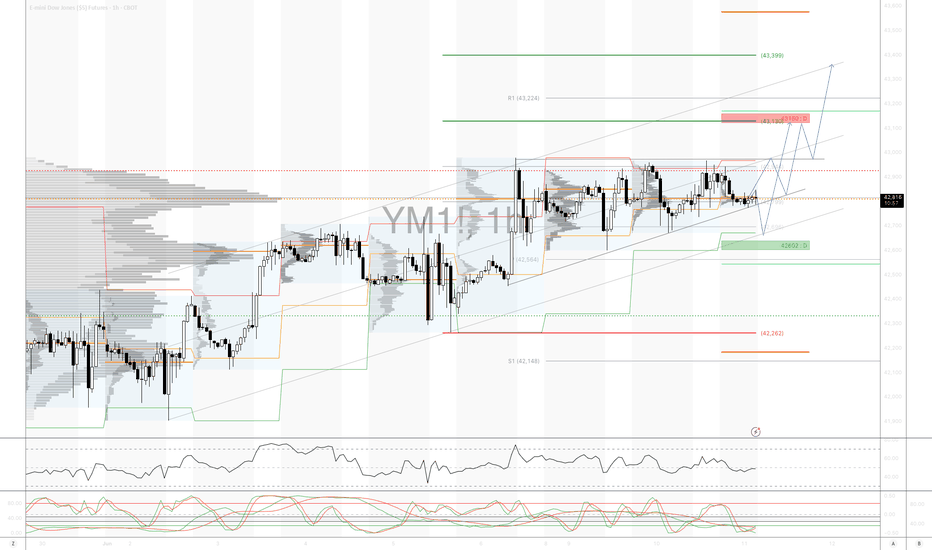

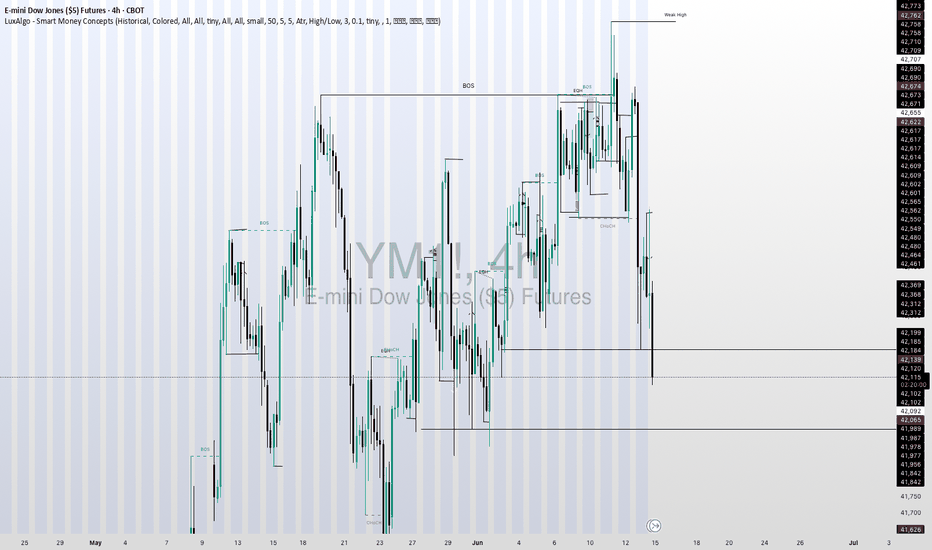

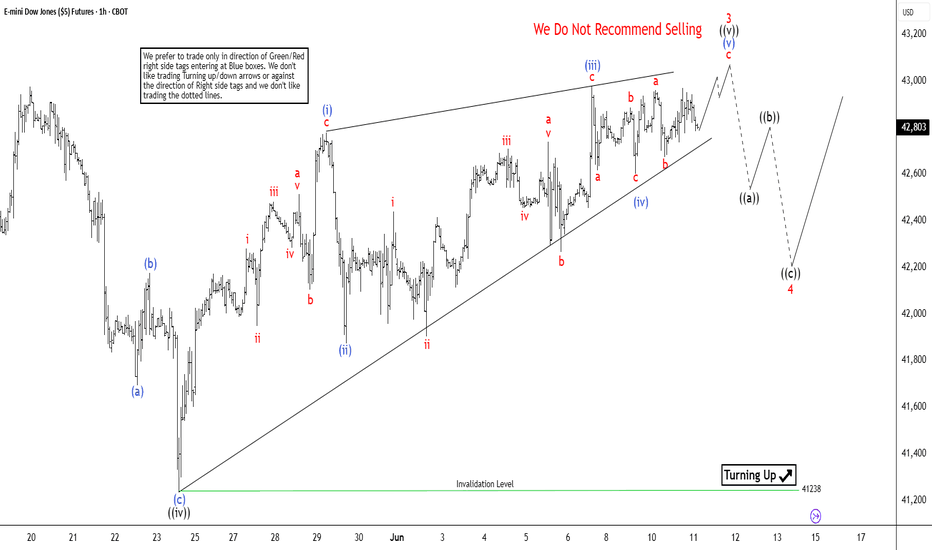

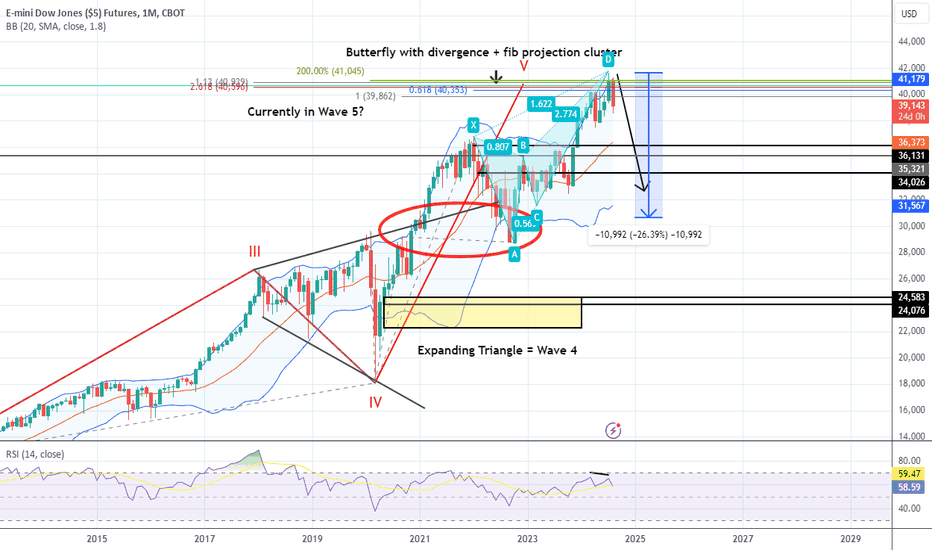

Dow Futures (YM) Elliott Wave View: Wave 4 Correction UnderwayThe rally in Dow Futures (YM) that began from the April 7, 2025 low remains intact. It is unfolding as a five-wave impulse pattern according to Elliott Wave analysis. Starting from that low, wave 1 peaked at 39,649. A corrective pullback in wave 2 followed which found support at 36,922. The Index th

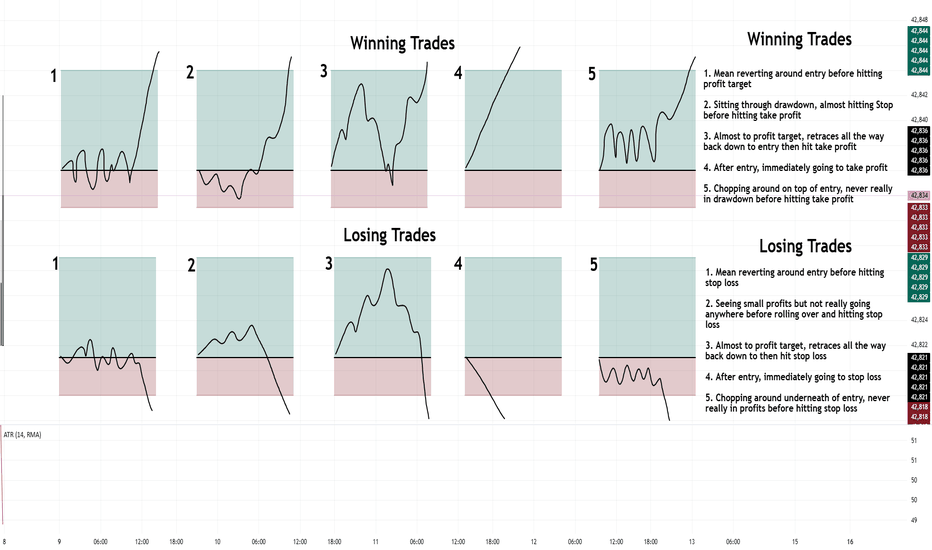

The 10 probabilistic outcomes of any given trade ideaOutlined below, I have come to the conclusion that there are 10, most probable trade outcomes of any given trade idea.

After seeing these outcomes, one can see what outcome is the most challenging for a trader to handle. Everyone is different and can tolerate different scenarios.

Dow Futures (YM) Set to Wrap Up Wave 3 SoonSince reaching its low on April 7, 2025, Dow Futures (YM) has shown signs of recovery. The Index has initiated a rally that requires further development to confirm whether the April 7 low will hold as a significant bottom. To establish this, the Index needs to either achieve a new all-time high or c

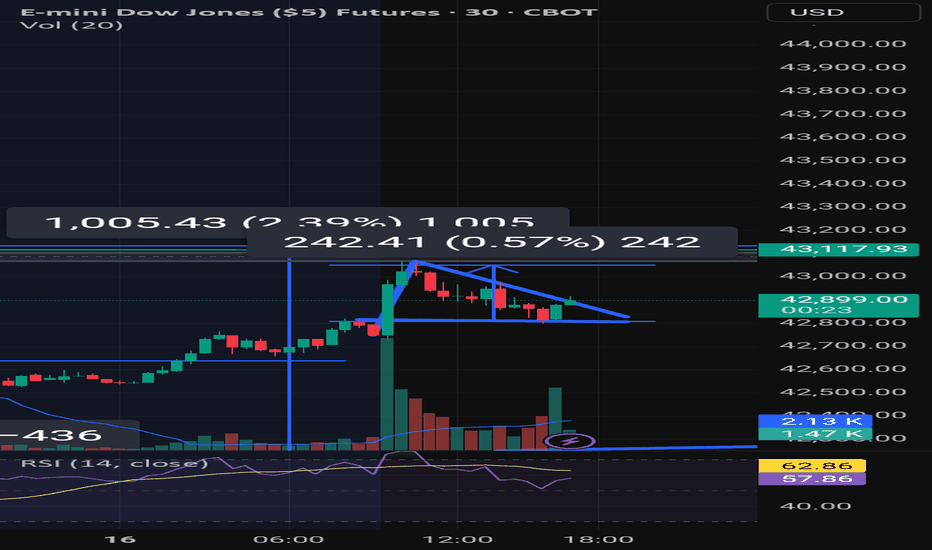

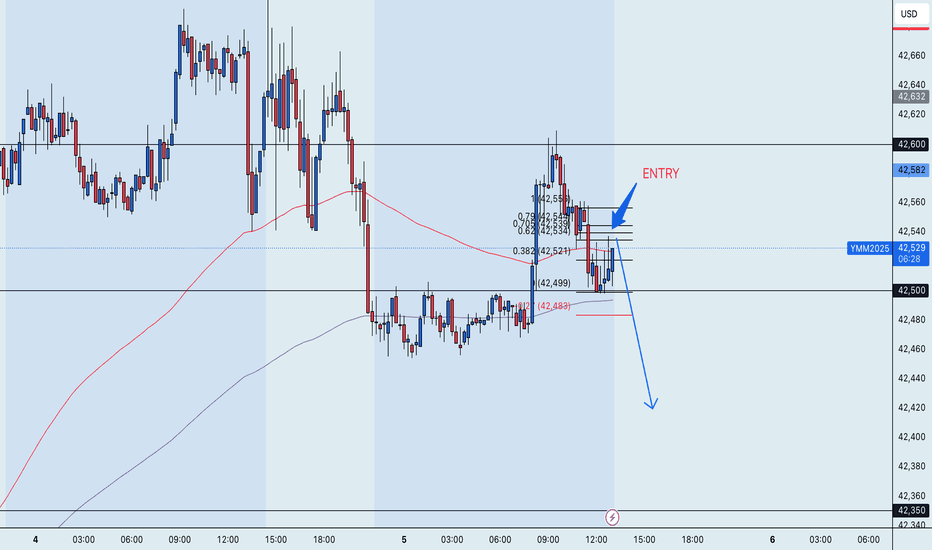

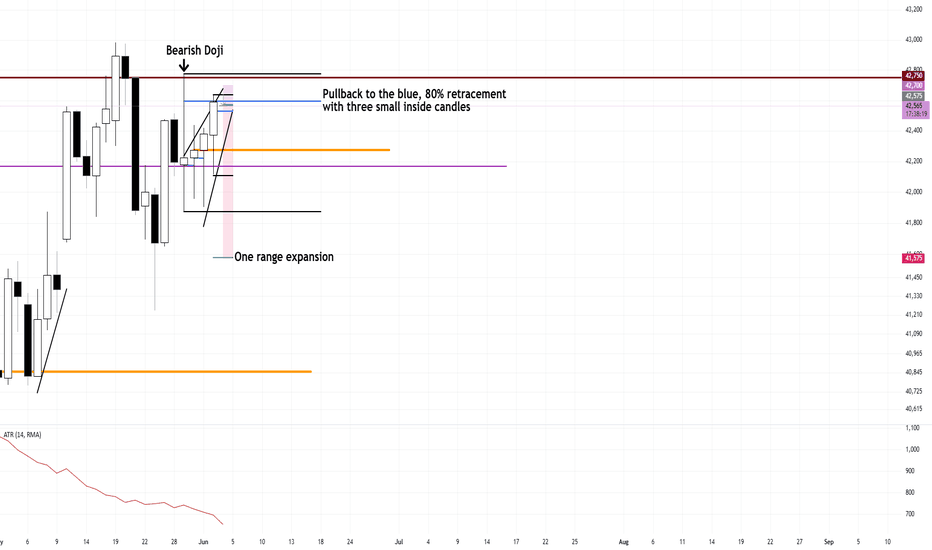

Dow Jones Short Trade Idea 8:1 1000 tick OpportunityI am currently short Dow Jones aiming for a home run trade that I have been waiting to set up for days now.

My thesis:

Rising wedge into the 80% pullback of the Daily Doji bar

Mean Reversion around March FOMC of 41,155

Break of the support zone of 42,000

If today will be the day it engulfs

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Related futures

Frequently Asked Questions

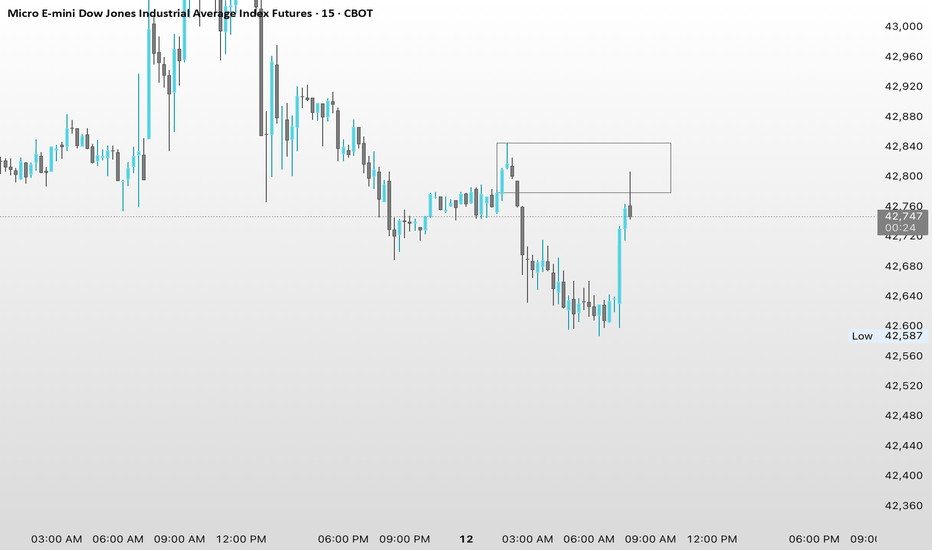

The current price of E-mini Dow Jones Industrial Average Index Futures (Dec 2025) is 42,667 USD — it has fallen −0.01% in the past 24 hours. Watch E-mini Dow Jones Industrial Average Index Futures (Dec 2025) price in more detail on the chart.

The volume of E-mini Dow Jones Industrial Average Index Futures (Dec 2025) is 3.00. Track more important stats on the E-mini Dow Jones Industrial Average Index Futures (Dec 2025) chart.

The nearest expiration date for E-mini Dow Jones Industrial Average Index Futures (Dec 2025) is Dec 19, 2025.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell E-mini Dow Jones Industrial Average Index Futures (Dec 2025) before Dec 19, 2025.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For E-mini Dow Jones Industrial Average Index Futures (Dec 2025) this number is 356.00. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for E-mini Dow Jones Industrial Average Index Futures (Dec 2025) shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for E-mini Dow Jones Industrial Average Index Futures (Dec 2025). Today its technical rating is sell, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of E-mini Dow Jones Industrial Average Index Futures (Dec 2025) technicals for a more comprehensive analysis.