XAU/USD: Today's Strategy AnalysisVerification of Support Level Effectiveness

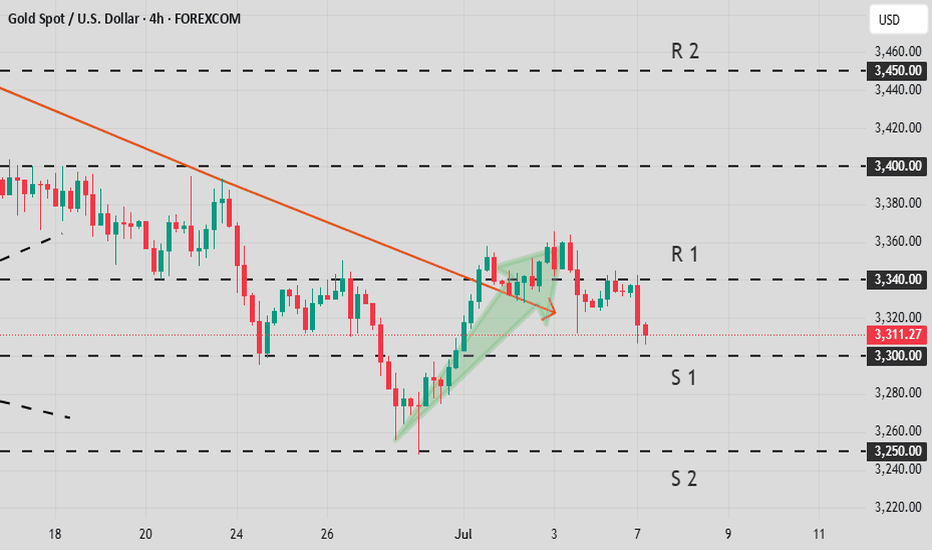

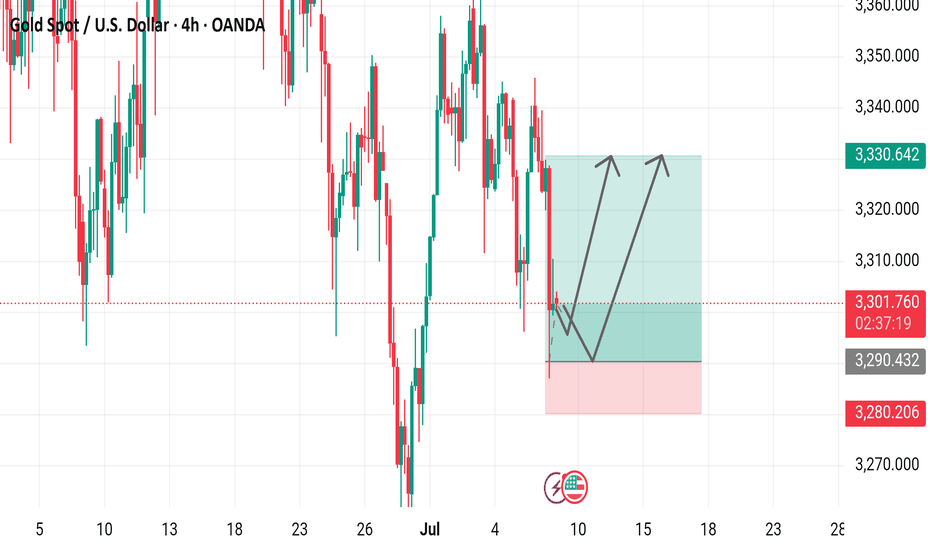

- $3306: As the 0.5 retracement level of the 3247-3365 band Fibonacci, it rebounded slightly after being first touched today. It is necessary to monitor whether a bullish candlestick stabilization signal forms at this level. If broken, the next target is $3290.

- $3290: Overlapping with the lower Bollinger Band support of the 4-hour chart, if a pullback signal with shrinking trading volume appears here, it can be regarded as a short-term long opportunity.

Suppression Effect of Resistance Level

- $3320-$3325: The suppression zone of the 5-day moving average at the 1-hour level, which is also near the early session rebound high. If the price is resisted and closes bearish when rebounding to this range, it confirms a short entry opportunity.

-

Operation Tips

Strictly set stop-loss orders to avoid capital drawdown caused by false breakouts of support/resistance levels.

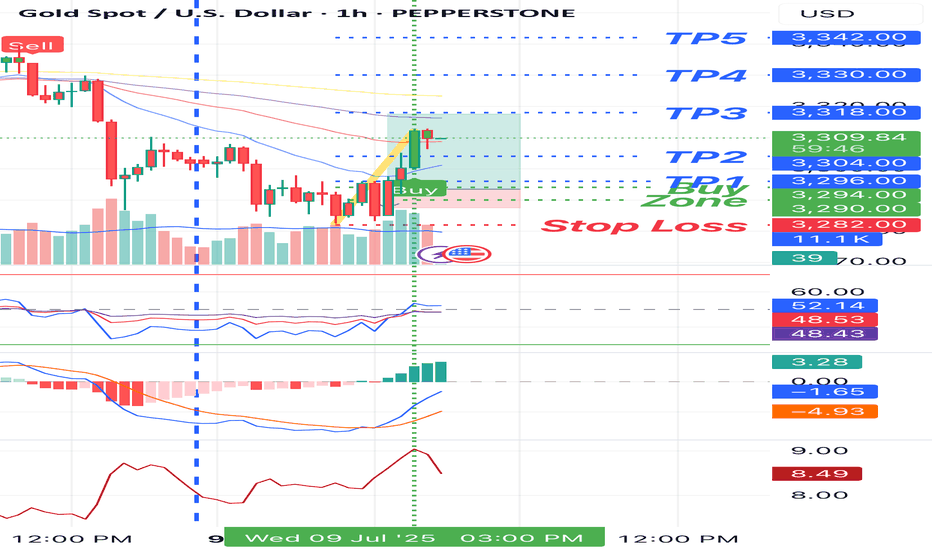

XAUUSD

buy@3285-3295

tp:3310-3320

sell@3315-3325

tp:3305-3295

I am committed to sharing trading signals every day. Among them, real-time signals will be flexibly pushed according to market dynamics. All the signals sent out last week accurately matched the market trends, helping numerous traders achieve substantial profits. Regardless of your previous investment performance, I believe that with the support of my professional strategies and timely signals, I will surely be able to assist you in breaking through investment bottlenecks and achieving new breakthroughs in the trading field.

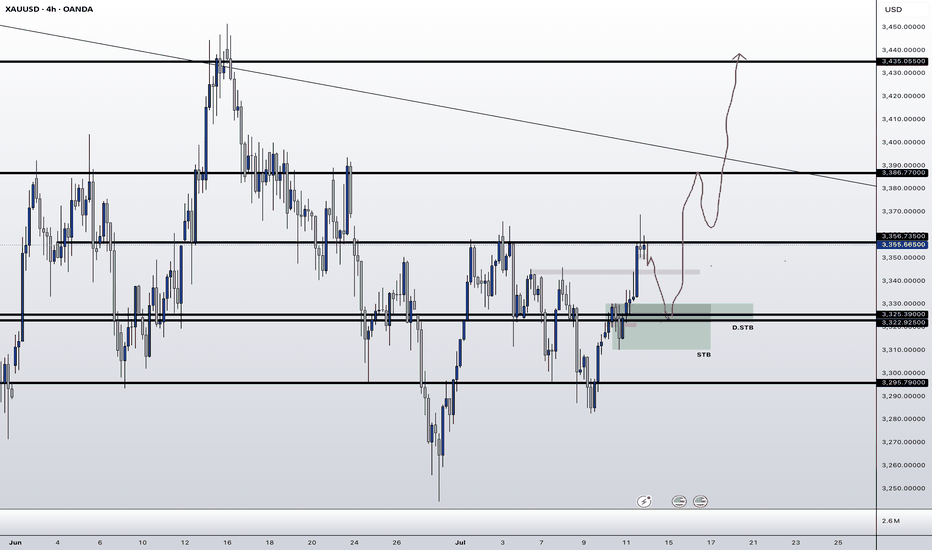

CFDGOLD trade ideas

The bill was introduced; the price did not rise but fell.Due to the implementation of the US bill, most traders in the market are bullish on gold and believe that gold will soar on Monday. As a result, it jumped up and fell sharply this morning. This is the uncertainty of the market. Although the short position given near 3340 last Friday was late, it fell to the low point of 3306 at the opening of the Asian market today.

In addition, the key to this sharp drop is the high point before the rebound, that is, the starting point or the position of the top and bottom conversion. Once it is broken, you have to change your mindset. The volatile market is like this, just get used to it. The turmoil caused by Trump's bill will not appear for a while. It takes a process and cannot be unilaterally considered as bullish or bearish.

In the early Asian market, the price fell all the way from 3342 US dollars to 3306. How to judge the end of the decline? It is to stare at the high point of the rebound before the last decline of 3320 US dollars. The loss of 3300 US dollars in the early trading indicates that the gap-up opening is a lure for more.

Today, I think that 3325 above 3320 can be used as the dividing point between long and short positions. You can short with a light position near 3315, and pay attention to the 3295-3290 line below. After the upward breakthrough is confirmed, consider adjusting the position and making other arrangements. For the time being, we will look at the weak adjustment during the day.

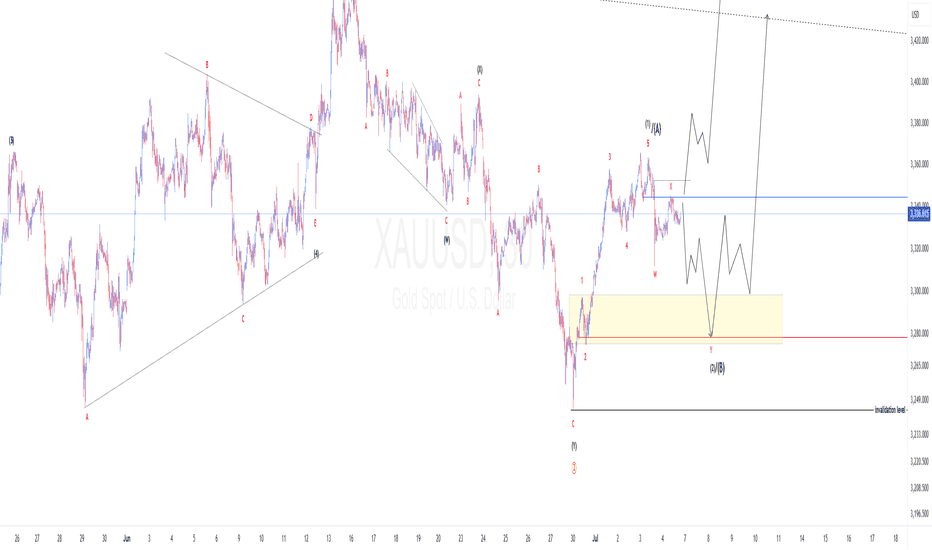

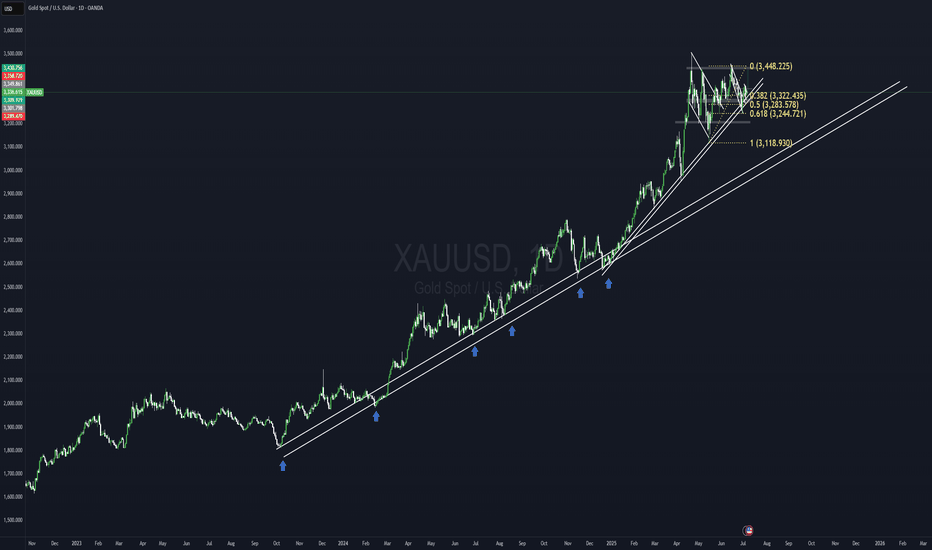

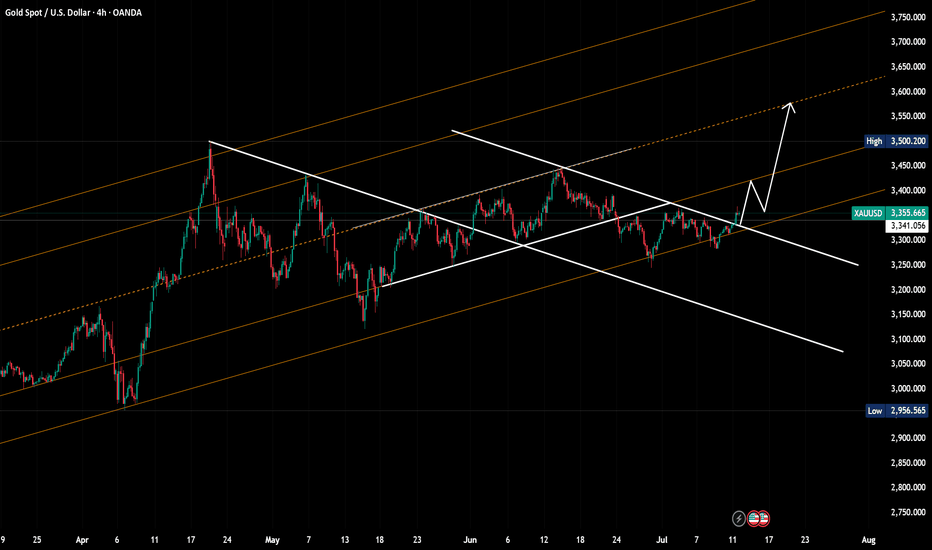

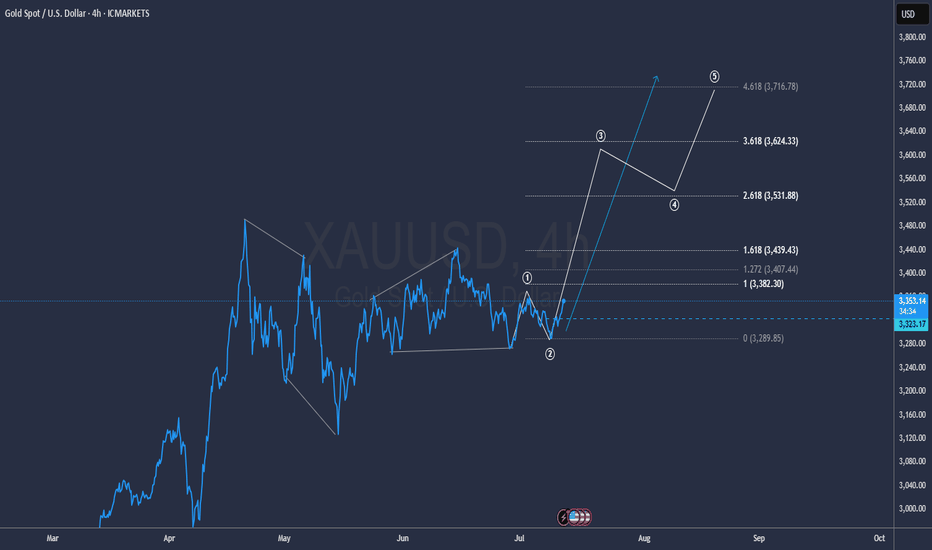

XAUUSD Elliotwaves update: Is wave 4 complete?The view we had in past three weeks was a possibility of complex 4th wave and our short term bias was bearish. But price reacted and closed above 61.8 Fibonacci retracement level and therefore changed our bias to bullish(Technically 4th wave is complete). Another confluence was a clear 5 waves after the reaction on the 61.8 fib. Now two possibilities, either wave 2 is complete and we should expect price to continue up from current price level or a possibility of double 3 to push price down to atleast 61.8 Fib before continuation to the upside. To take advantage of this anticipated move a trader should either wait for price to drop to the golden zone or wait for price to breach the immediate high and retest.

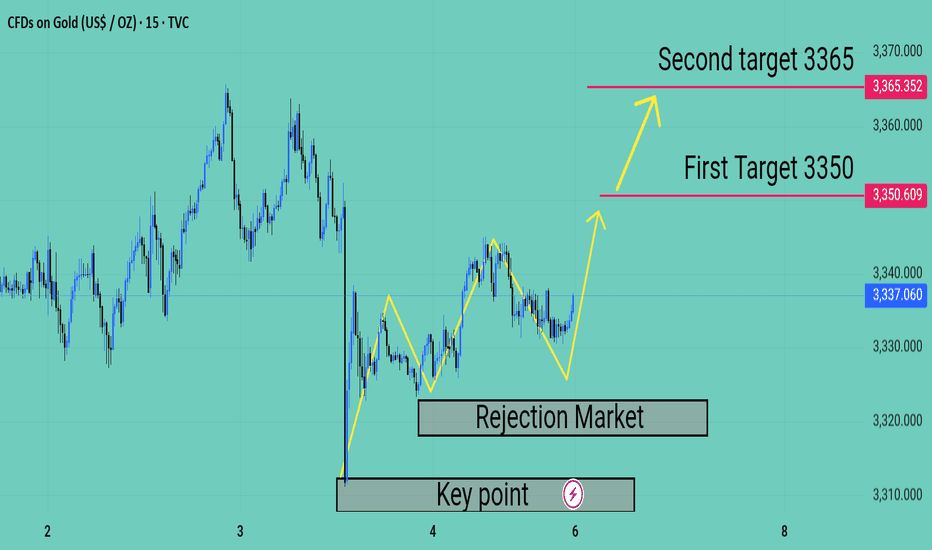

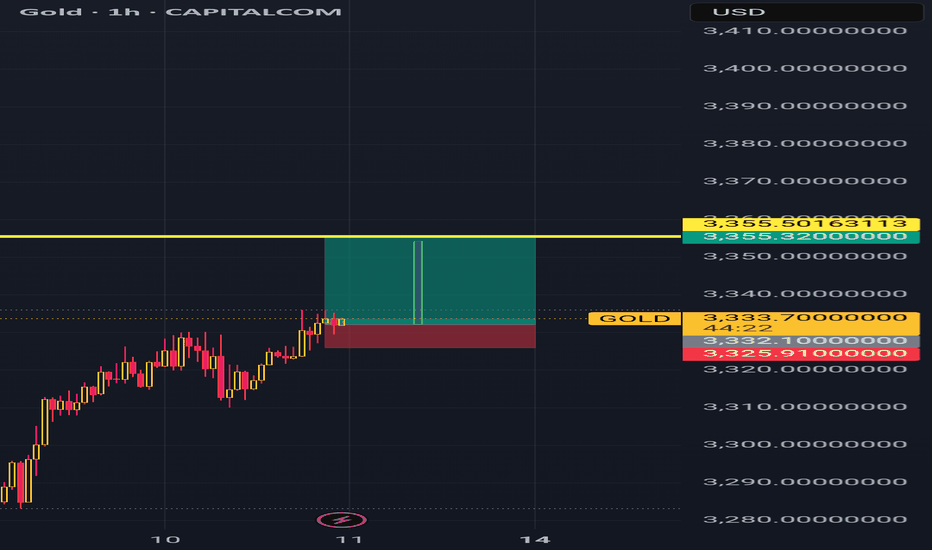

Xauusd Expecting bullish Movement Market I have identified a potential bullish setup based on key rejection zones and target levels

First Rejection Area 3325

Second Rejection Area 3310

First Target 3350

Second Target 3365

Price has shown strong support around the 3310–3325 zone, indicating possible buyer interest. If the market holds above this support range, we could see a move toward the 3350 and 3365 resistance levels

Gold will continue to sprint next Monday.

Recently, under the background of frequent tariff policies, which should be bearish for the US dollar, the US dollar unexpectedly rebounded and showed signs of turning bullish on the technical side. This may be because the Federal Reserve maintains high interest rates to prevent capital outflows, and at the same time increases the supply of US dollars by means such as issuing bonds. The US tax increase restricts the access of other countries to US dollars, while market demand has not decreased, prompting the rise of the US dollar. This trend is not good for precious metals, but gold has special safe-haven properties. In the long run, macro factors support gold, and in the short term, pay attention to the impact of the US dollar. Recently, it has been deployed at a low level.

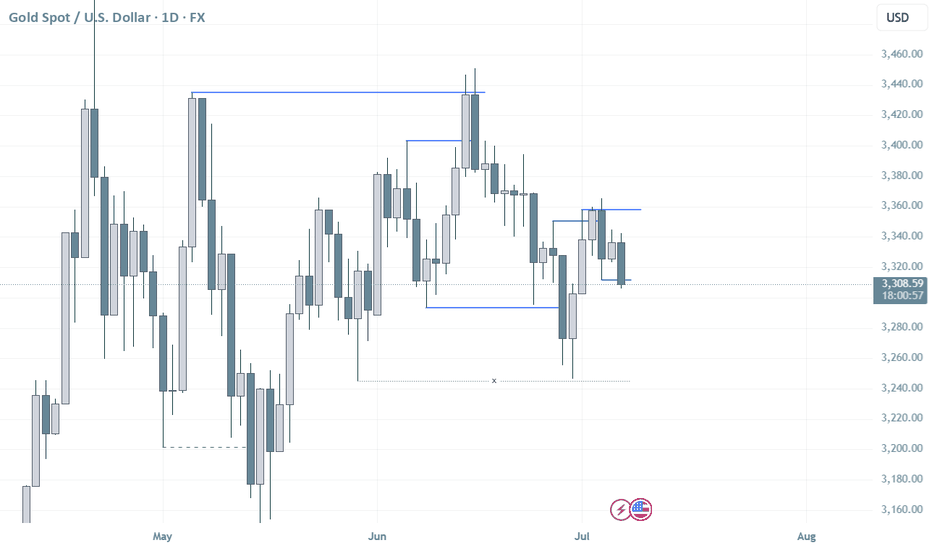

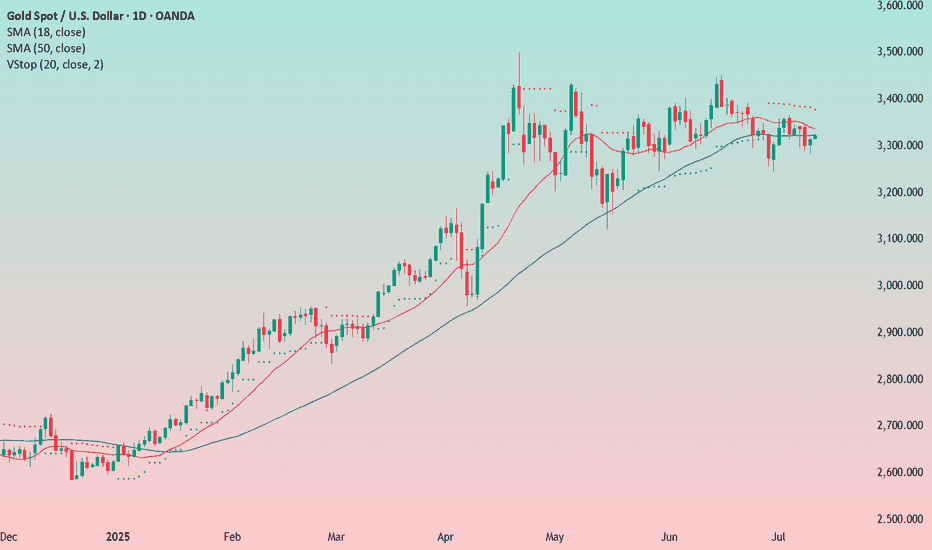

Looking back at the gold market, the previous high point near 3,500 points was mainly due to the safe-haven frenzy caused by Trump's tariff measures, and the influx of funds pushed the gold price to the top quickly. As the tariff negotiations progress, the impact of the news fades, and the gold price returns to the dominance of the technical side, and has been in a narrow range of fluctuations in the past two months. Extending the time dimension, the volatility characteristics of gold change, the volatility narrows, but the long-short conversion becomes more frequent. This week, gold stabilized and rebounded near 3,282. On the weekly chart, 3336 is a support level, which is also a key dividing line between long and short positions. 3393 is a resistance level, and after an effective breakthrough, it is expected to move towards the 3400-3410 area. The upper resistance is 3368-3373, and the lower support is 3345-3340.

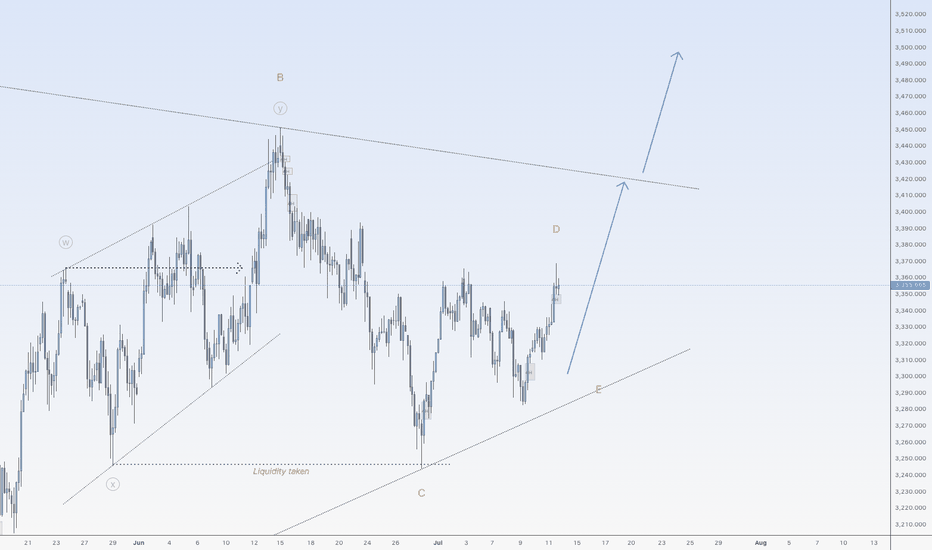

Gold is ready to go up againHi traders,

Last week gold went up again after a correction to finish (orange) Wave D just as I've said in my outlook.

Next week we could see another move down for Wave E and after that the next impulsive wave 5 up.

Or the last correction down was already wave E and gold started the next impulsive wave up.

In both cases gold will shoot up after a correction down.

Let's see what price does and react.

Trade idea: Wait for a small correction down on a lower timeframe and a change in orderflow to bullish to trade longs.

If you want to learn more about trading FVG's & liquidity sweeps with wave analysis, please make sure to follow me.

This shared post is only my point of view on what could be the next move in this pair based on my technical analysis.

Don't be emotional, just trade your plan!

Eduwave

Gold Weekly Report Conclusion: Continue to be bullishGold Weekly Report Conclusion: Continue to be bullish

I. Market Review This Week

Under pressure in the first half of the week: Affected by the strengthening of the US dollar, the gold price once fell below 3,300 points.

Rebound in the second half of the week: As the Trump administration announced new tariffs on Canada, market risk aversion increased, and the gold price rebounded to above 3,350 points and finally closed at 3,355 points.

Review of key influencing factors:

Federal Reserve policy expectations: The market still expects a possible rate cut in September, but some officials expressed hawkish views, resulting in short-term fluctuations in gold prices.

Geopolitical risks: US-Canada trade frictions and tensions in the Middle East support safe-haven demand.

Central bank gold purchases: The People's Bank of China has increased its gold holdings for eight consecutive months, and the global central bank's gold purchase trend has not changed.

II. Analysis of gold trend next week

1. Fundamental outlook

(1) Federal Reserve policy and US dollar trend

Next week, focus on the speech of Federal Reserve Chairman Powell (July 16) and US June retail sales data (July 17).

If retail data is weak, it may strengthen expectations of a rate cut in September, which is good for gold. On the contrary, if the data is strong, the US dollar may rebound, suppressing gold prices. The US dollar index (DXY) is currently around 104.5. If it falls below 104, gold may rise further. (2) Geopolitical risks: US-Canada trade friction: If the conflict escalates, safe-haven buying may continue to support gold prices. Middle East situation: Progress in Iran nuclear negotiations and Red Sea shipping safety are still potential catalysts. (3) Central bank gold purchases and institutional holdings: The global central bank's gold purchase trend has not changed. China, Poland and other countries are still increasing their holdings, which will support gold prices in the long term. ETF holdings: SPDR Gold ETF holdings increased by 5.3 tons last week, indicating that market sentiment has warmed up. Technical analysis: (1) Short-term trend (daily chart) Key support levels: 3300 (psychological support level), 3277 (trend line support level). Key resistance levels: 3373 (61.8% Fibonacci retracement level), 3400 (psychological barrier).

Moving average system: 50-day moving average (3330) provides support.

If it stands at 3350 points, it may challenge 3400 points.

MACD indicator: The fast and slow lines form a golden cross, the momentum column turns strong, and the short-term trend is bullish.

(2) Medium-term trend (weekly chart)

The rising channel is maintained, and the long-term trend is still bullish.

Key resistance: 3452 (previous high point), which may open up upward space after breaking through.

Key support: 3247 (61.8% retracement level), if it falls below, it may enter a macro adjustment.

III. Trading strategy for next week

1. Bullish scenario (breakthrough 3373 points)

Entry conditions: Stand firm at 3373 points, and the US dollar weakens.

Target: 3400→3452.

Stop loss: below 3340.

2. Bearish scenario (falling below 3300)

Entry conditions: falling below 3300 and the US dollar rebounding.

Target: 3277→3247.

Stop loss: above 3320.

3. Oscillating strategy (3300-3373 range)

Buy low and sell high, pay attention to the competition around 3350.

Conclusion

Short term (next week): Gold prices may fluctuate in the range of 3300-3373, pay attention to the speech of the Federal Reserve and retail data.

Breakout direction: If it stands at 3350, it is expected to test 3400; if it falls below 3300, it may fall to 3277.

Gold price summary: will continue to rise to $3,400Gold price summary: will continue to rise to $3,400

Analysis of the latest gold news (as of July 12, 2025)

1. Macroeconomics and monetary policy

The market generally pays attention to the interest rate meeting on July 29-30.

If the Fed sends a dovish signal, it may further enhance the attractiveness of gold as an anti-inflation asset.

However, the non-farm payrolls data in June showed that the labor market is still resilient, and the pressure to cut interest rates in the short term is limited.

The US dollar index continued to weaken, and the medium- and long-term depreciation trend has not changed, providing monetary support for gold.

2. Geopolitical risks are heating up

The situation in the Middle East has escalated

Israel arrested a special agent team of the Iranian "Quds Force" in southern Syria, triggering escalation of regional tensions.

At the same time, the Houthi armed forces used hypersonic missiles to attack Israel, resulting in obstruction of Red Sea shipping and a 300% surge in aviation insurance costs, further boosting the demand for gold as a safe-haven asset.

The conflict between Russia and Ukraine continues to ferment

The Russian army announced that it had completely controlled the entire territory of Luhansk, and the United States suspended some military aid to Ukraine, and the situation on the battlefield was stalemate.

Geopolitical risks and global central bank gold purchases (China has increased its holdings to 73.9 million ounces for eight consecutive months) highlight the value of gold as a "crisis hedge tool."

Technical Analysis

Key resistance: $3,370

Short-term support moves up to $3,330.

Macro support: 3300 (psychological support), 3277 (trend line support), 3247 (61.8% Fibonacci retracement level).

Macro resistance: 3370 (61.8% retracement level), 3400 (psychological barrier), 3452 (previous high).

Short-term trend:

Breaking through key resistance:

Gold price breaks through the upper track of the triangle pattern ($3327) and the $3350 resistance level (50% Fibonacci retracement level), and the short-term technical side is strong.

Operation strategy

Long position:

Pull back to 3320-3330 range to go long

Stop loss at $3310

Target at $3380-3400.

Be cautious about shorting

Oscillating range strategy:

If the price stabilizes at $3350-3365, it may further hit $3400; start a new round of rise.

If it falls below $3300, it may fall to the support level of 3277-3247.

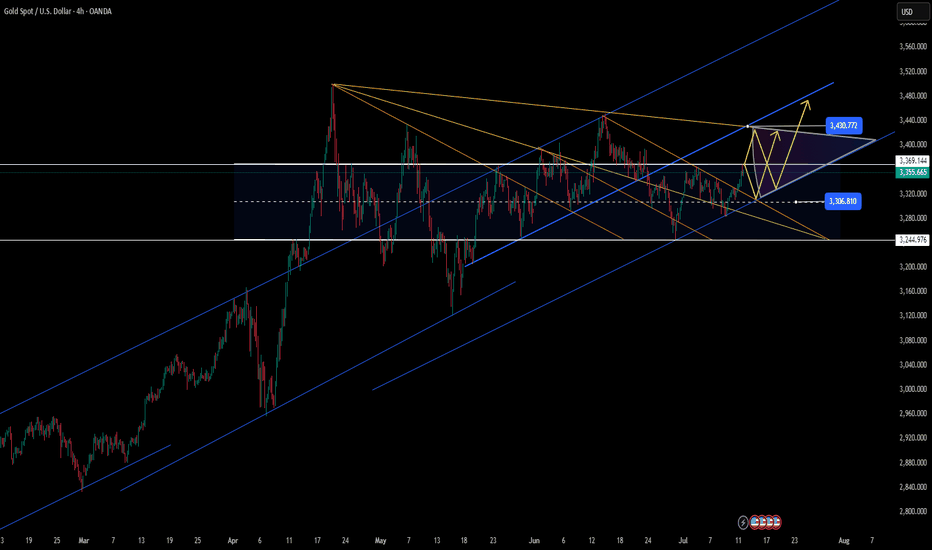

Gold will retest $3,451 in the coming week I my opinion that based on my 4H analysis, Gold will retest $3,451 in the coming week but we need to pay attention to those daily key support zones. Gold usually does deep retracement and that makes the unmitigated Bullish OB a good zone for patient buyers/ Play safe.

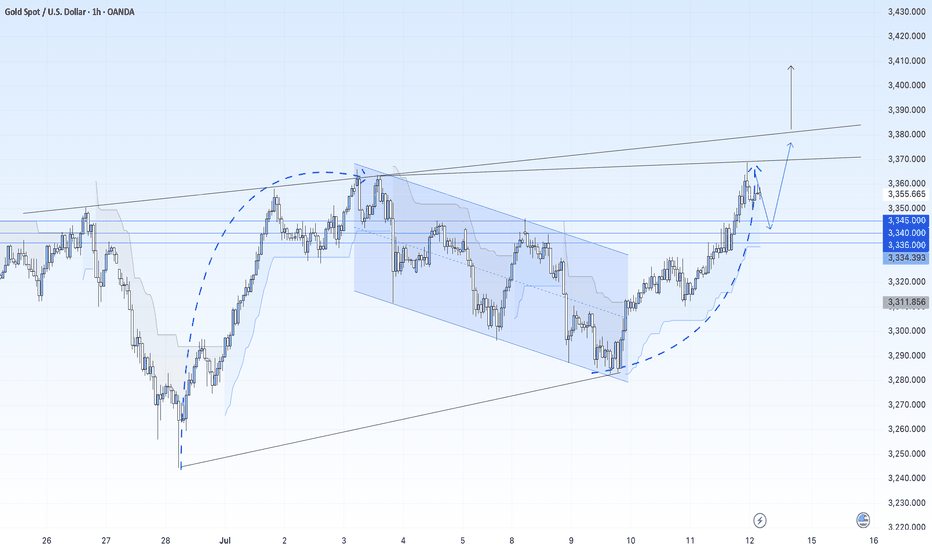

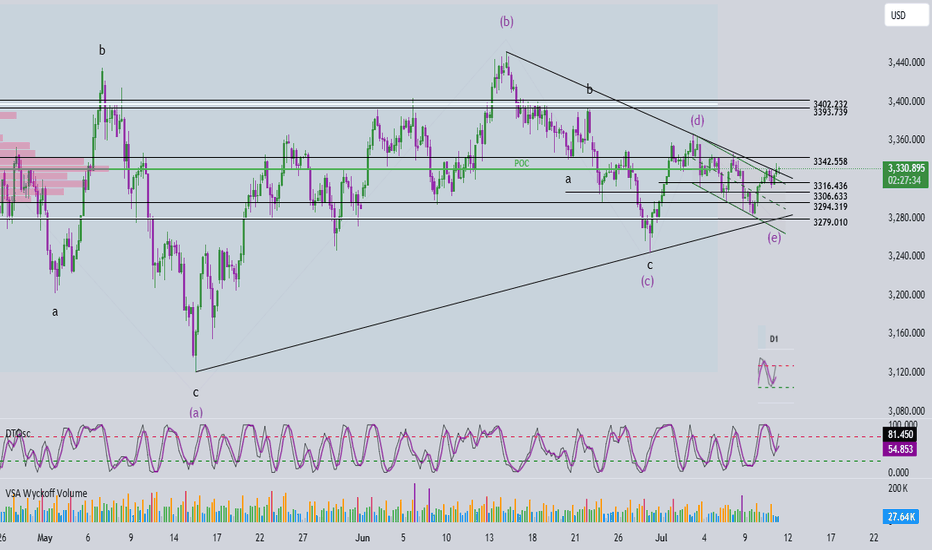

Elliott Wave Analysis – XAUUSD July 11, 2025

🔍 Momentum:

D1 timeframe: Momentum is currently rising, suggesting that the bullish trend is likely to continue for the next few days.

H4 timeframe: Momentum is also bullish, indicating that the uptrend is likely to dominate today.

🌀 Elliott Wave Pattern:

On the H4 chart, price action is in the final stage of a contracting triangle correction.

Price is now approaching the upper boundary of the triangle. With both D1 and H4 momentum in alignment, the probability of a breakout to the upside is high.

If this breakout occurs, we can expect a move toward the 3393 area, which is a key level to confirm whether the corrective phase has truly ended.

🎯 Price Targets:

Current area (3330–3332): A potential opportunity for a scalp BUY, supported by bullish momentum on H4.

Next support zone: 3315–3317 – a solid area for a mid-term BUY entry if there’s a pullback.

⚠️ If price breaks below 3279, the current wave count becomes invalid and a new analysis will be provided.

✅ Trade Plan:

🔹 SCALP BUY

Entry: 3332 – 3330

SL: 3327

TP1: 3363

TP2: 3390

🔹 MID-TERM BUY ZONE

Entry: 3317 – 3315

SL: 3307

TP1: 3342

TP2: 3363

TP3: 3390

The gold bull-bear game intensifiesThe gold bull-bear game intensifies: a breakthrough opportunity is hidden in the short-term shock

The gold market experienced violent fluctuations this week, and the core contradiction came from contradictory employment signals:

ADP cooling: The number of private sector jobs in the United States unexpectedly decreased in June, which once strengthened the expectation of a rate cut in September and pushed the gold price up

Non-farm counterattack: The subsequent non-farm employment announced exceeded expectations (206,000), which quickly extinguished the enthusiasm for rate cuts and gold prices gave up gains

Central bank support: Global central banks continue to buy gold (China increased its gold reserves in June), building a safety cushion for long-term prices

The essence of the "data fight" reflects that the resilience of the US economy remains, but cracks have appeared. The Federal Reserve dares neither cut interest rates too early (inflation risk) nor over-tighten (loosening of the employment market). This swing state will prolong the volatility cycle of gold, but every sharp drop is an opportunity for central banks and long-term investors to enter the market.

Technical aspect: Breakthrough signal of the four-hour chart

Current market characteristics:

Key position: 3344-3346 area has become the watershed between long and short positions. After three unsuccessful tests, the probability of this breakthrough has increased

Morphological structure: Breakthrough of the downward trend line of the four-hour chart + MACD golden cross, long arrangement of hourly moving average

Volume coordination: After yesterday's retracement to 3330 support, the volume rebounded, showing strong low-level support

Operation strategy:

Bull defense line: 3330-3325 (if broken, it will turn into shock)

Upward target:

▶ The first target is 3360 (previous high psychological position)

▶ The second target is 3380 (Fibonacci extension position)

▶ Ultimate target 3400 (option barrier)

Specific plan:

Conservatives:

Light long position at 3333-3335 (stop loss 3323)

After breaking through 3347, add more positions (stop loss 3335)

Radicals:

Batch layout above the current price of 3340, with 3325 as the ultimate defense

Risk warning:

⚠️ Beware of the volatility caused by Powell's speech on Friday night

⚠️ If 3320 is lost, beware of a deep correction to the 3300 mark

Currently, gold is in the "accumulation breakthrough" stage, with a bullish technical side but requiring fundamentals to cooperate. It is recommended to use the "small stop loss breakthrough" strategy, and it is better to miss it than to go against the trend. If it can stand firm at 3350 this week, it will no longer be a fantasy to look at 3400 in the third quarter.

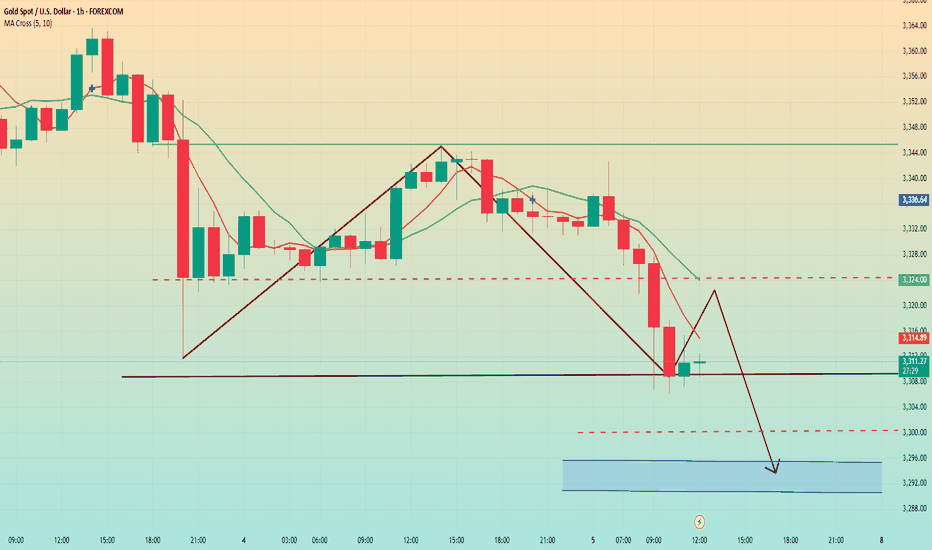

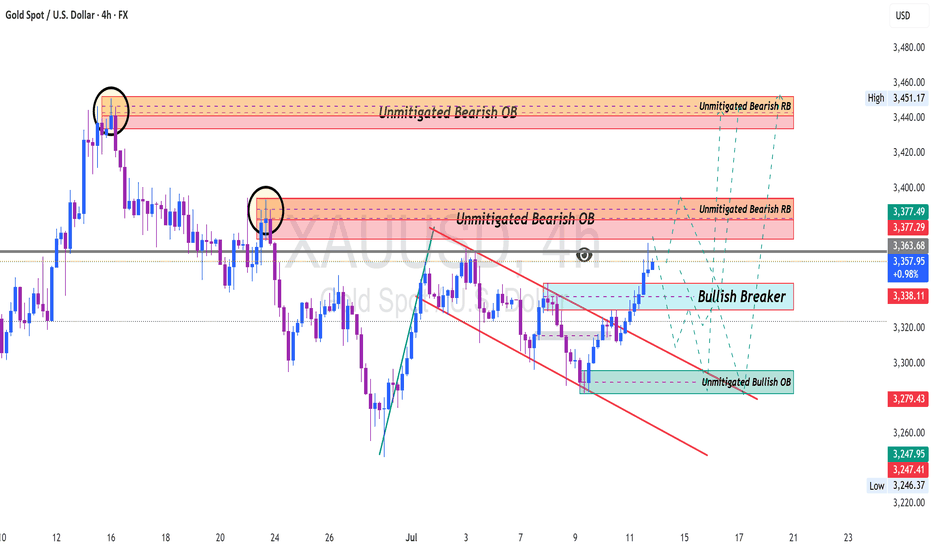

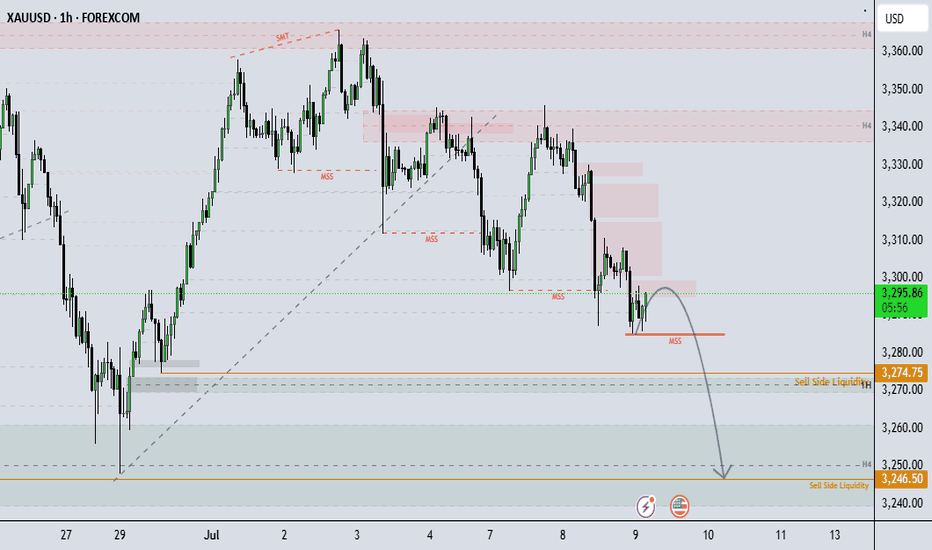

"Gold (XAUUSD) is moving down to grab liquidity."Looking for Impulse Down.

Gold/XauUsd: This chart shows a clear Market Structure Shift (MSS) following a liquidity sweep (SMT) near the highs. Price is now respecting a bearish order block and forming lower highs, indicating smart money distribution.

Targeting sell-side liquidity at 3274.75 and 3246.50. Until price reclaims the most recent supply (above 3,300), the bearish bias remains intact.

Educational Use Only: This breakdown is for study and informational purposes and is not financial advice.

Learn & Earn!

Wave Trader Pro

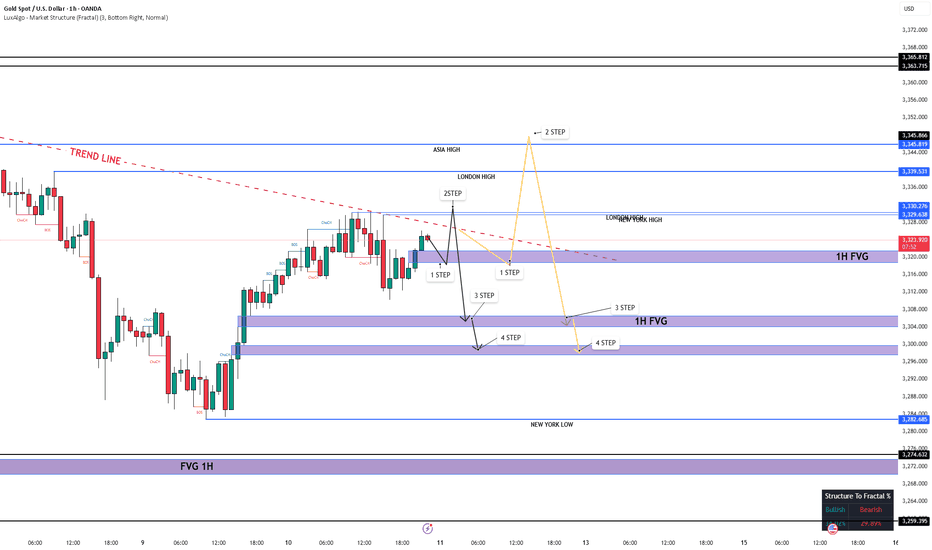

XAU/USD 1H Outlook

FVG Fill (3320–3318)

Price is expected to drop into the unfilled Fair Value Gap between 3320 and 3318.

London/NY Liquidity Hunt

After filling the FVG, look for a swift bullish impulse during the London and New York sessions to trigger stop-runs and collect liquidity.

Downward Correction to 3305 & 3298

Once the liquidity grab completes, expect a retracement:

First target: 3305

On a break below 3305, next target is the unfilled FVG at 3298

Summary:

Drop → FVG fill (3320–3318) → Bullish liquidity hunt (London/NY) → Retracement toward 3305 (then 3298)

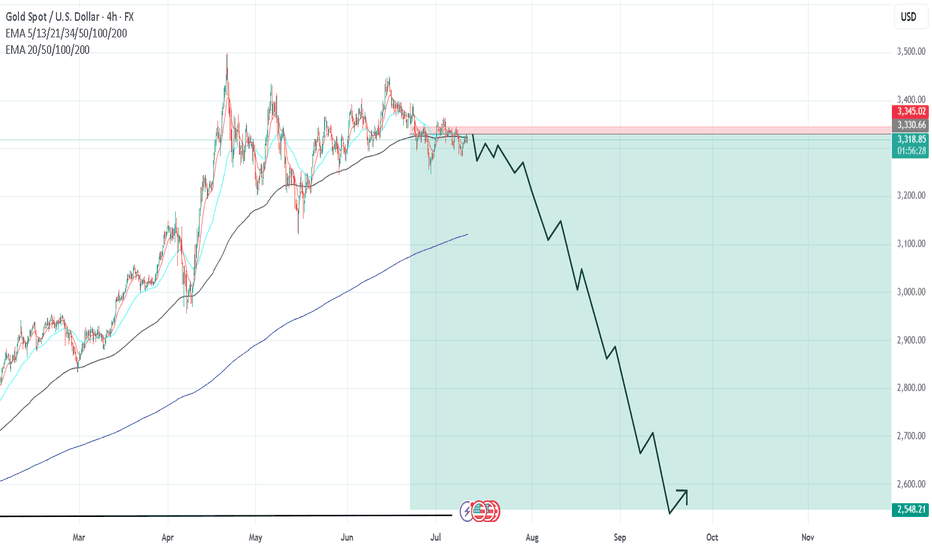

short gold week The market is at a point where we must sell, it's at a maximum of Elliott Waves, wave 5 is already extremely extended, so prepare for a mega drop of several weeks while everyone continues to buy at the lows, it will continue to go down. In summary, we have a bullish market on H4, now there will be a correction on H1, that is, a bearish trend on H1 for several weeks; it is not an ABC, but 5 bearish waves.

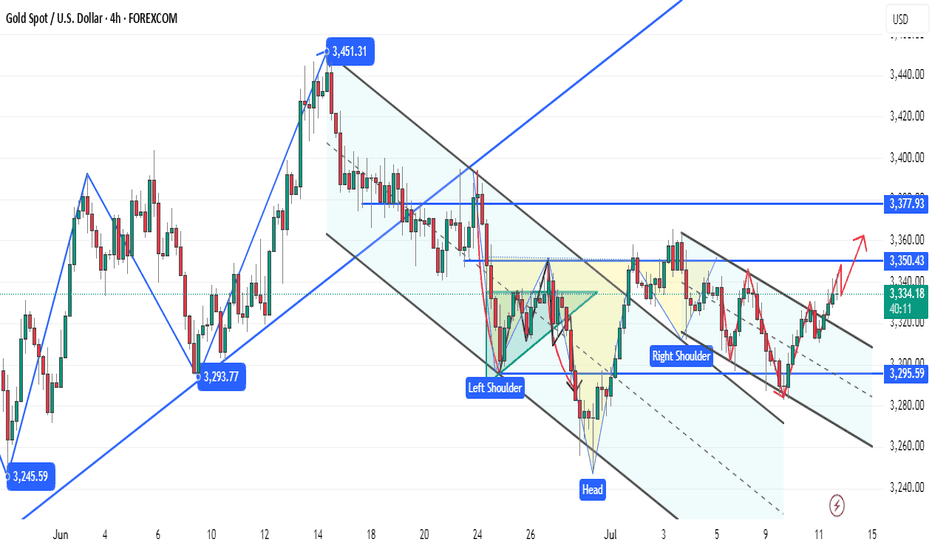

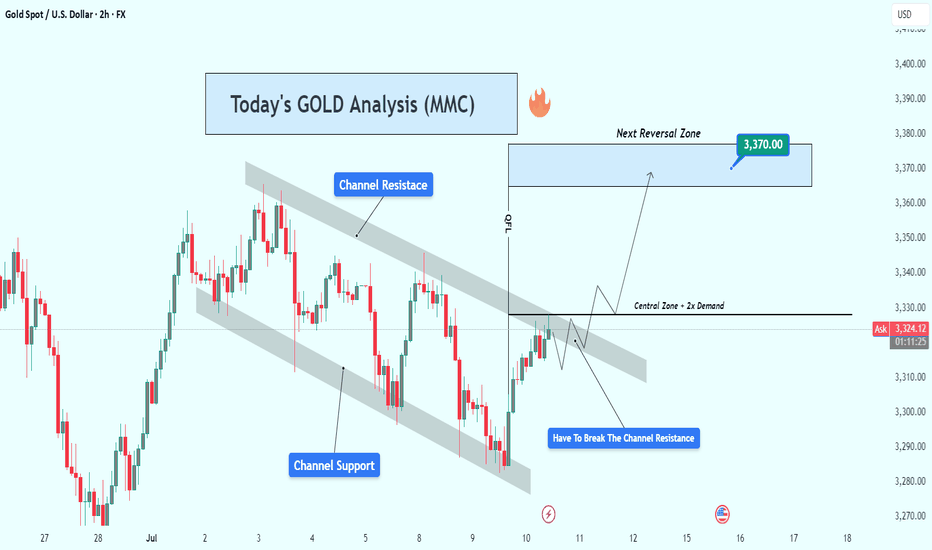

Gold (XAUUSD) Analysis : Bullish Structure Setup + Target🧠 Gold (XAUUSD) Technical Analysis

Gold has recently been trading within a clearly defined descending channel, which has governed price action over the past several sessions. This structure is characterized by a series of lower highs and lower lows, forming well-established channel resistance and channel support levels. However, recent bullish pressure has led price to aggressively test the upper boundary of this channel, signaling the potential for a structural breakout.

We are now at a technical inflection point, where a successful breakout and retest could mark the beginning of a significant trend reversal and short-to-medium term bullish move.

🔍 Key Technical Levels & Zones

🔷 Channel Resistance (~3,325)

The price is currently testing the descending trendline acting as channel resistance.

This area has previously rejected price several times, increasing its significance.

A confirmed break and close above this level may shift the market bias from bearish to bullish.

🔷 Central Zone – Dual Demand (~3,325–3,330)

This horizontal zone intersects with the channel resistance and aligns with two previous demand zones, now acting as a key decision area.

The market must validate this zone as new support before any sustained upward movement can occur.

🔷 Next Reversal Zone – Target (~3,370)

The next major area of interest lies around 3,370, a zone identified by previous swing highs and visible liquidity pools.

This level is likely to act as a magnet for price if bullish structure is confirmed.

📈 Price Structure Outlook

The potential breakout is supported by a strong bullish impulse off the channel support, followed by a series of higher lows suggesting growing bullish momentum. The projected movement scenario is as follows:

Break above the channel resistance

Retest and confirm the central zone as support

Continuation toward the 3,370 reversal zone

This would complete a classic break–retest–continuation pattern.

✅ Trade Considerations (Not Financial Advice)

Entry Type Entry Condition Target Stop Loss

Aggressive Break & 2H close above 3,330 3,370 Below 3,320

Conservative Retest & bullish confirmation above 3,325 3,370 Below 3,310

Risk Management:

Use position sizing aligned with your risk tolerance (max 1–2% per trade).

Monitor volume closely during breakout and retest for confirmation.

⚠️ Invalidation Scenario

If price fails to break above the channel and is rejected strongly, especially with a bearish engulfing or long upper wick, the downside could resume. In such a case, price may revisit the channel midline or even the lower boundary around 3,290.

📝 Summary

Gold is at a critical juncture, testing long-standing channel resistance.

A break above and successful retest of the 3,325–3,330 zone could lead to a rally toward 3,370.

This setup reflects a potential shift in structure from bearish to bullish on the 2H timeframe.

Gold on Hold: Consolidation Without a SignalGold is holding up well for now and consolidating at the current level. But there’s no clear opportunity to buy or sell. It’s just guesswork at this point. And why would I need that? I want to make money, not to be "right."

On a global, long-term horizon (up to a year), I believe the metal will go higher. On the daily and weekly charts, the trend is still upward, and both geopolitical factors and the Fed’s rate policy support the continuation of the trend. But when exactly will it happen? That’s unclear. For now, there are no setups for a trade.

Interestingly, gold and other precious metals might move in different directions. Gold could start a correction while other metals could rise, as they are undervalued. But undervaluation isn’t a direct reason to buy. It’s always better to follow this rule: the market knows better than all of us what the fair price should be right now. Still, when it comes to entering a position, my opinion that the metal is undervalued can be taken into account—and if there’s a proper setup, the entry can be made. It’s like a puzzle. One factor is one piece, then another, and another—and once the full picture comes together, that’s when we enter the position.

Gold Price Analysis - 4-Hour Chart4-hour candlestick chart for the Gold Spot price in U.S. Dollars (XAUUSD), sourced from OANDA. The chart displays the price movement over time, with green candles indicating an increase in price and red candles indicating a decrease. The chart also features various technical indicators and annotations, including a trend line and a support level.