Related funds

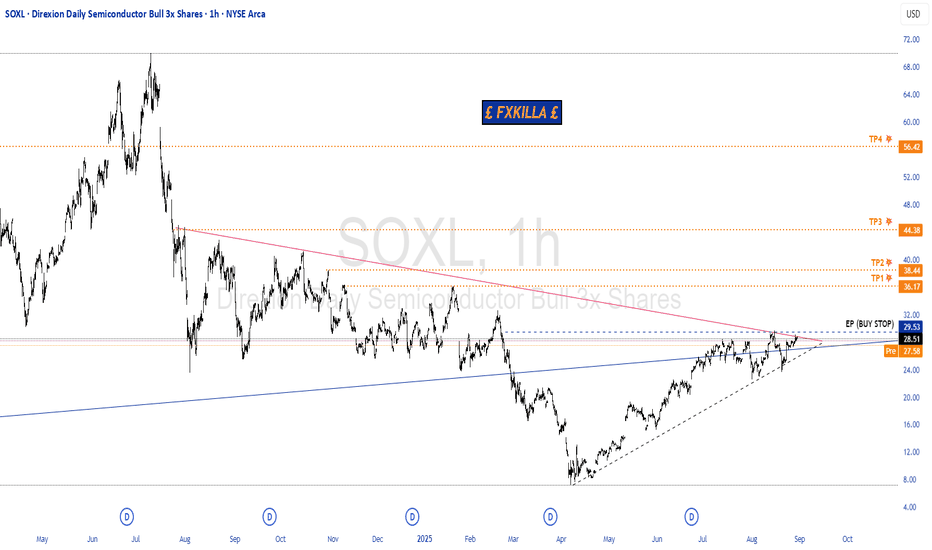

SOXL: A boring reaccumulation phase ahead!SOXL:

-Currently in a boring re-accumulation phase, with supply absorption swings happening within a narrow range and gradually declining volume. Watch for the completion of this process and time your entry when signals appear.

-Don’t forget a potential scenario: a clean shakeout breaking the Inside

Semiconductors & SOXL: A Bull ThesisWhy Semiconductors?

Virtually every single electronic device contains some form of a semiconductor unit within its components. The entire Bull theory on semiconductors as an industry could be reduced to this one sentence. The following, however, will introduce concepts contingent to the understand

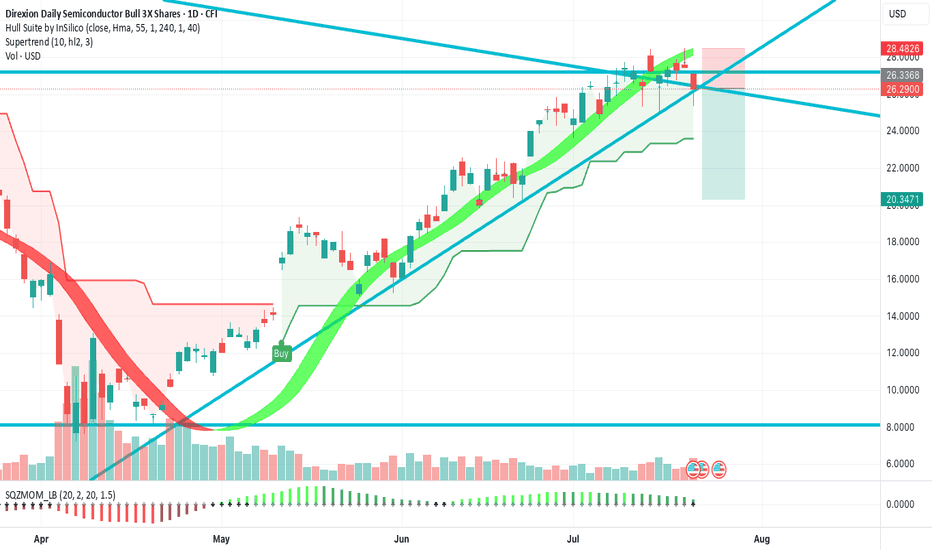

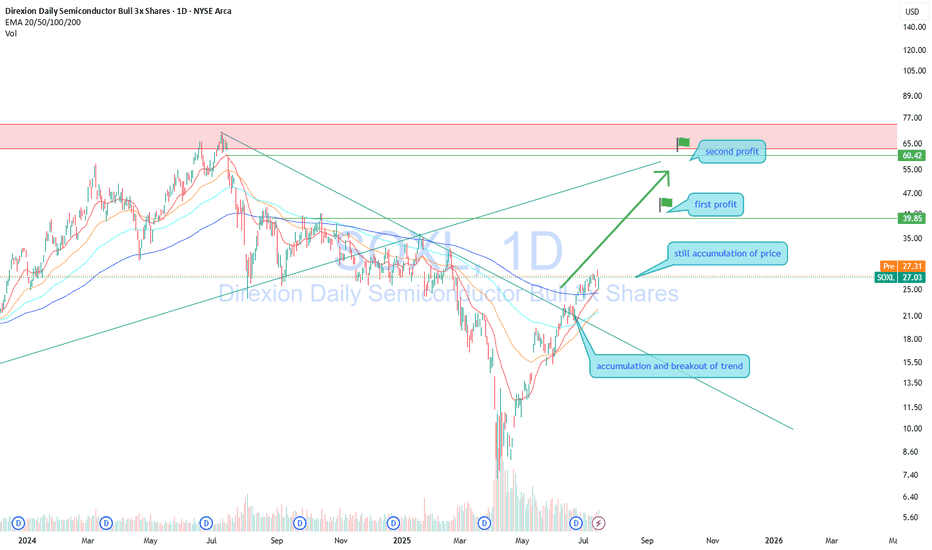

SOXL — Buying on a Strong Uptrend with 30%+ Profit PotentialDirexion Daily Semiconductor Bull 3x Shares (SOXL) continues to move in a clear uptrend after breaking long-term resistance. Price is consolidating above the breakout level, indicating sustained interest from major market participants.

Long positions remain valid.

Profit targets:

First target — 3

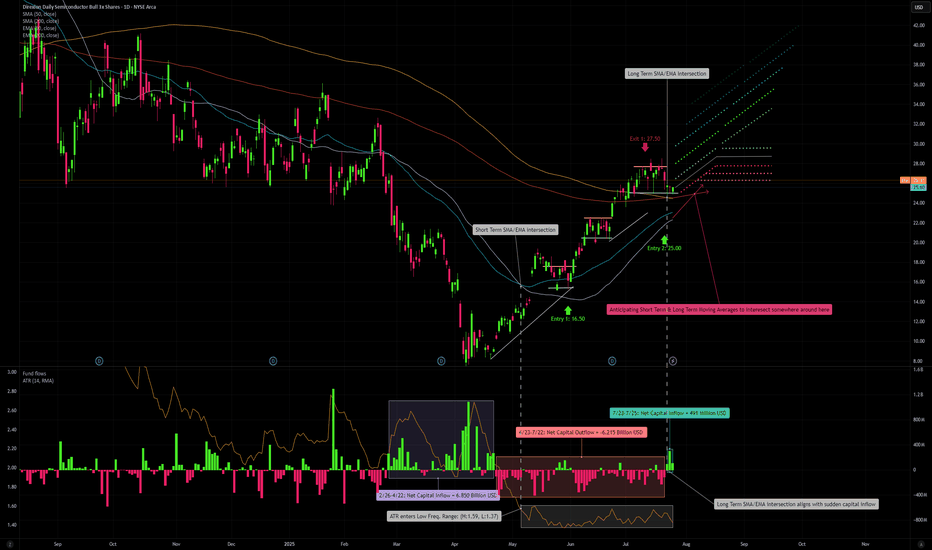

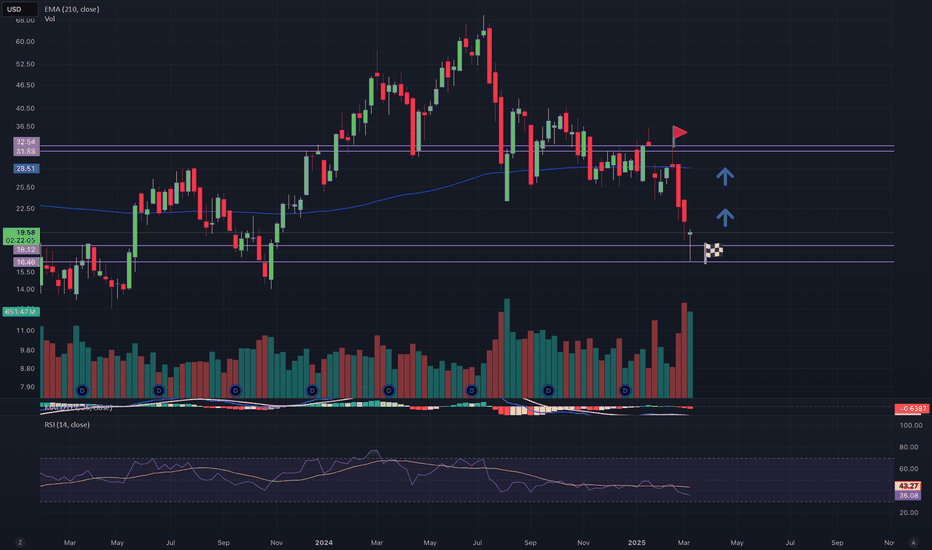

SOXL Will FLY!Just look at the AD line:

With its sharp V-shaped recovery, the A/D Line (middle area) shows that the recent price rise is being driven by significant capital inflows and strong buying interest.

The Accumulation/Distribution Oscillator (lower panel) underlines this with an exceptionally high green b

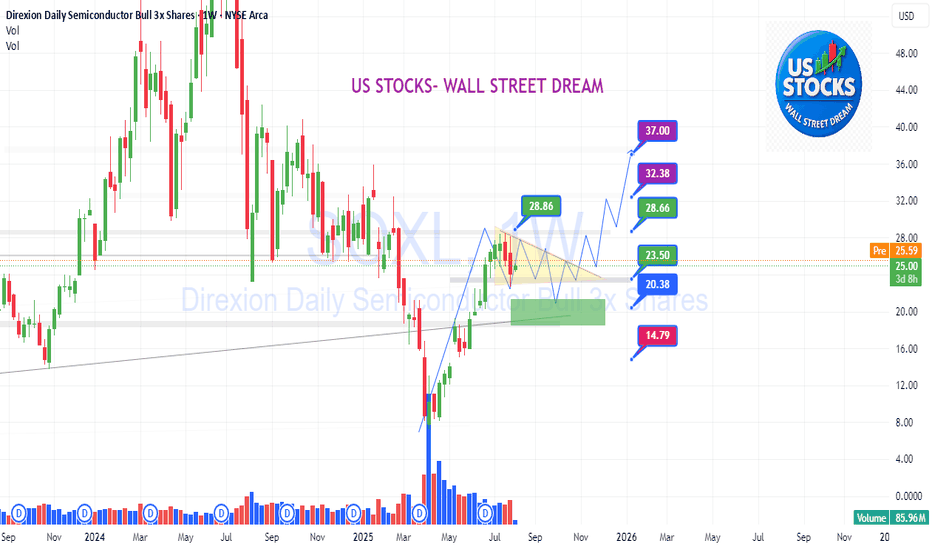

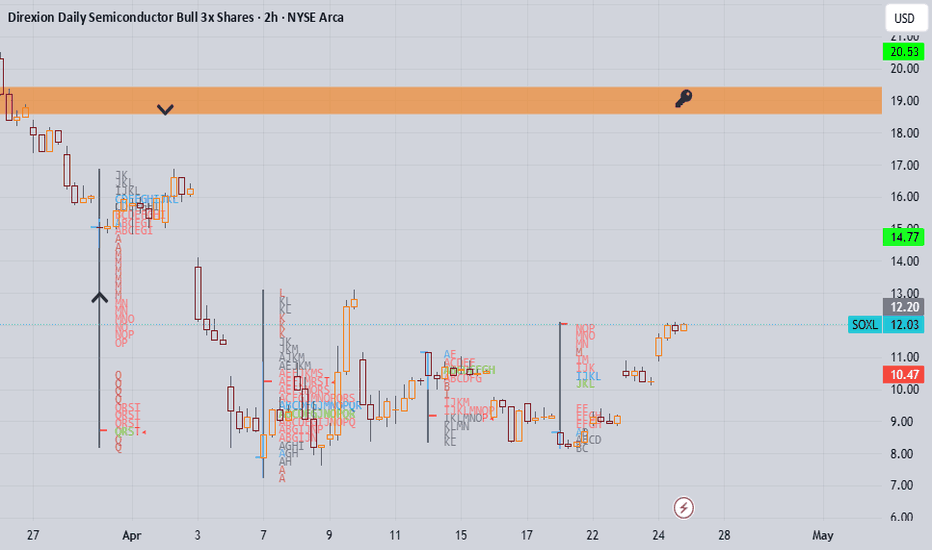

Bullish Swing Trade - SOXLHey all -

Sharing my mid-term analysis of SOXL. We've reached buy levels on the daily, weekly, and monthly charts.

Ideal entry between $16.46 - $18.12.

With patience, swing up to the $25-31 dollar area. Specifically for options, I'd suggest an August expiry, with an ITM or ATM strike price.

Ha

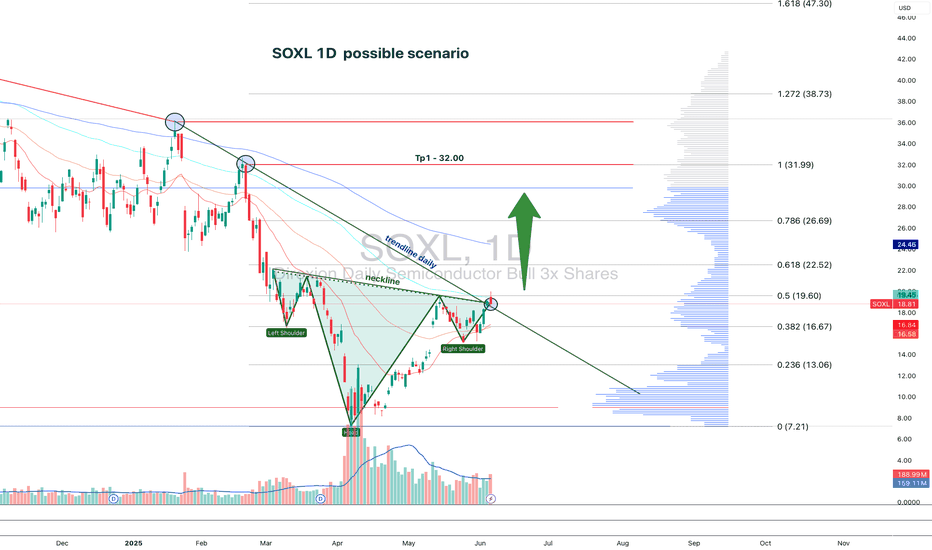

SOXL 1D — With a base like this, the ride’s worth itOn the daily chart of SOXL, since early March, a textbook inverse head and shoulders pattern has formed and is now in its activation phase. The left shoulder sits at $16.67, the head at $7.21, and the right shoulder at $15.11. The symmetry is classic, with volume stabilization and a narrowing range

SPY and SOXX...kinda a big issue of realitySo if the SPXL tracks the SPY and is pretty chuck at the ATH....

And the SOXL tracks the SOXX and is at the ATL....

What am i missing that others get....cause when your semiconductors are said to the AI backbone and its our future.....

Why is SOXS and SOXL relatively close in price...

I mean SPX

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

An exchange-traded fund (ETF) is a collection of assets (stocks, bonds, commodities, etc.) that track an underlying index and can be bought on an exchange like individual stocks.

Since ETFs work like an individual stock, they can be bought and sold on exchanges (e.g. NASDAQ, NYSE, EURONEXT). As it happens with stocks, you need to select a brokerage to access trading. Explore our list of available brokers to find the one to help execute your strategies. Don't forget to do your research before getting to trading. Explore ETFs metrics in our ETF screener to find a reliable opportunity.

No, SOXL doesn't pay dividends to its holders.