Nasdaq 100 SPOT forum

Found time quickly to update you in the middle of crazy world I am in currently I swear lol between change children nappies or and always there is something to be done out there hehe

Wife and two kids in vacation believe me sth crazy lol

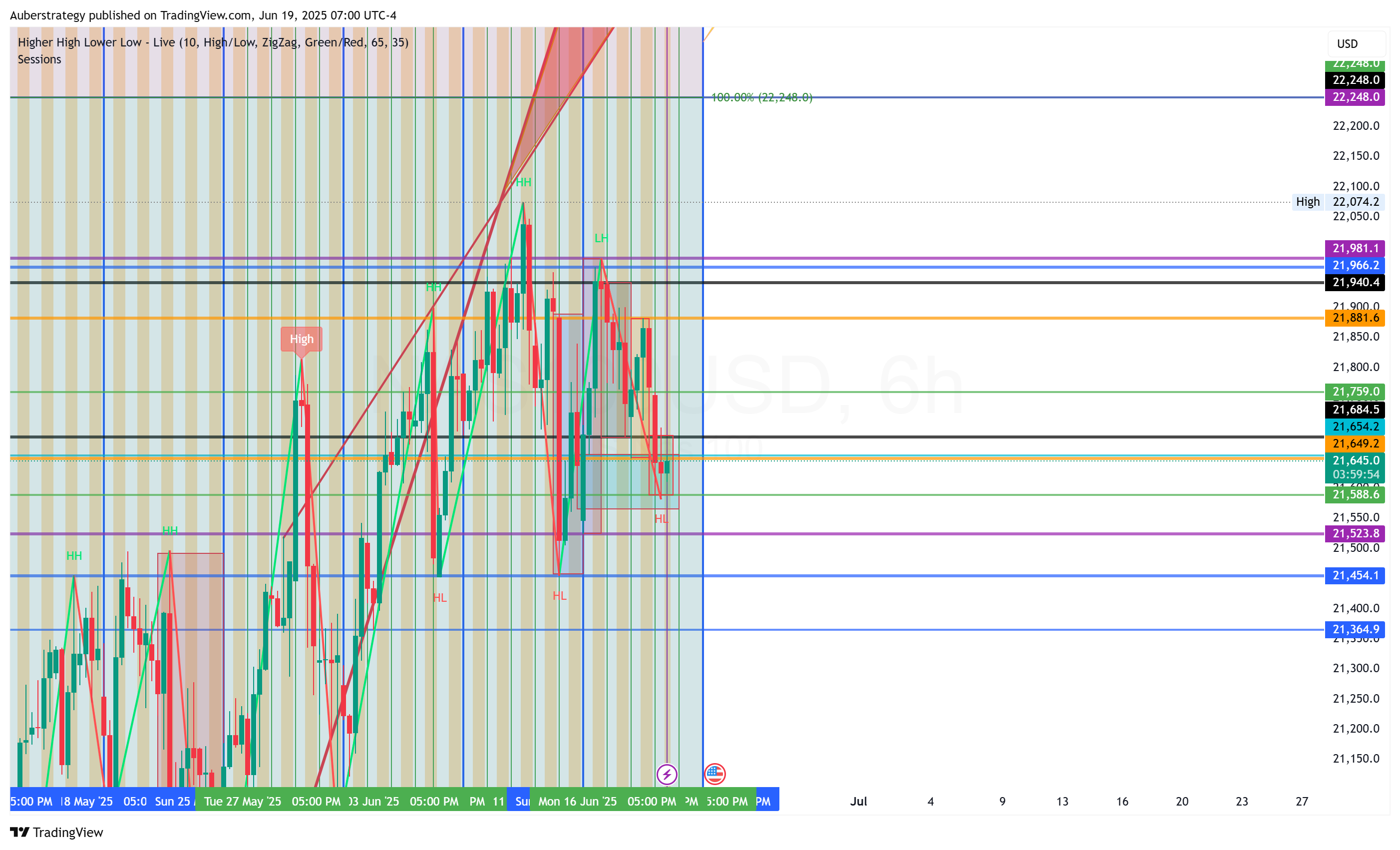

The reason of the bearish momentum which you started to see, is that current 3h candle opening price

The candle took the power from its opening price to generate a bearish momentum indeed enough to push the index lower (mainly to 21300)

So if the 3h candle will close in red, more likely like 99% we will be going there but anyway the momentum would make it easier to believe it as who went long recently will be stranded in a losing position then they will close their longs and open shorts and that what will make the momentum stronger

And if the current 3h candle will turn bullish, that will generate bullish momentum indeed but I would tell you that the bearish momentum of 21720 and 21800 was and still stronger and would act at a real bear trying to push his victim down!

Have a nice day guys!

The calendar shows a public holiday

This is from my personal experience:

1. A lot of times, there is nothing wrong with a traders analysis.

2. The trouble comes when you spend more time analyzing a retracement rather than the trend.

3. You start seeing levels where you would like the price to go instead of seeing the market and price for what it really is...just a retest to go higher.

4. The minute you change your mental bias is the day you will start seeing greater results from fewer trades and you will be able to spend less time on the charts watching your trades.

HL's to HH's guaranteed

#oneauberstrategy

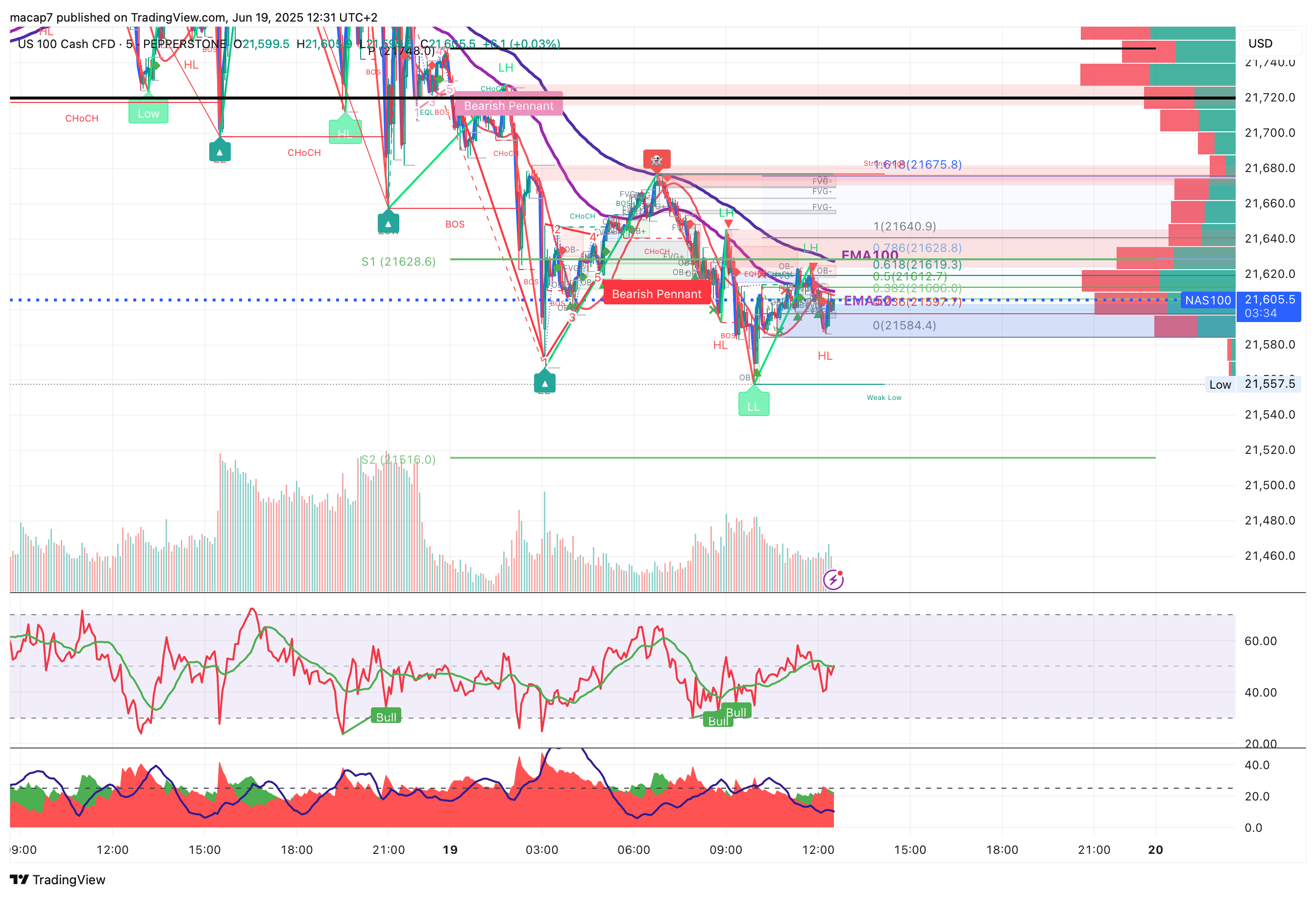

We had a dip in Asia… so expecting a bullish Judas Swing on NY Open….then THE REAL NY reaction to FOMC….

I truly believe that the ATH party is postponed until after Q3 at the earliest…

We are in the early phases of Wave 3…

First stop around 21k…

#onthewayto11k #unprecedentedbutnotimpossible

on 23H and 7H TF, with 21EMA on Scale, [Pivots, S&R, monthly on 23hr and weekly on 7hr]

the price bounced at S1 and signalled a new HL on the 7H.

i guess these are the right weekly pivots